Taxation of travel expenses: general rules

For an employee sent on a business trip, the employer is obliged to:

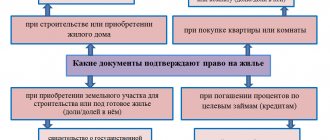

1. Pay the average salary for the period of the trip. You can find out how it is calculated in the article “How the average monthly salary is calculated.” Personal income tax on an average travel salary is calculated in the same way as on a regular salary while a person is at work. In general, according to the same principles, travel and regular salaries are reflected in tax reporting (but there are nuances here - we will look at them later in the article).

2. Pay for travel and accommodation where the person is sent. Such expenses are not subject to tax, since they are not the employee’s income (Clause 3, Article 217 of the Tax Code of the Russian Federation). Information about them after a business trip is not reflected in 6-NDFL.

3. Issue daily allowances. These are amounts that an employee can use for personal purposes - usually associated with paying for food, public transport and taxis within the locality to which he left. You can find out more about the amount of daily allowance that an employee is entitled to receive on a business trip in the article “What is the amount of daily allowance for business trips.” In the manner prescribed by law, daily allowances are subject to personal income tax and are subject to reflection in tax reporting. Let's take a closer look at the features of calculating and reflecting in form 6-NDFL those components of travel payments that are subject to personal income tax - the average salary and partially daily allowances.

For reporting for the 1st quarter of 2021, the calculation of 6-NDFL must be submitted using a new form. How to fill out the updated form is described in the ready-made solution “ConsultantPlus”. You will receive even more relevant materials if you sign up for a free trial access to K+.

Reflection of daily allowances in the calculation of 6-personal income tax (features of compensation) – Accounting

Add to favoritesSend by email Daily allowances in excess of the 6-NDFL norm (hereinafter referred to as the calculation) are included in accrued income only in the amount of their excess over the limit. Read our article about how to show excess daily allowances in the main calculation lines.

We reflect daily allowances in 6-NDFL. Daily allowances in excess of the norm in 6-NDFL: examples. Results. We reflect daily allowances in 6-NDFL. Clause 3 of Art. 217 of the Tax Code of the Russian Federation states that there is a limit for daily allowances, from which personal income tax is not paid. This is 700 rubles. per day for business trips around the country and 2,500 rubles.

per day for foreign business trips. If, according to internal regulations, the employer issues large amounts of daily allowance, then everything issued in excess of the limit is subject to personal income tax. Accordingly, taxable income must be reflected in 6-NDFL.

Read more about the rules for paying daily allowances in the article “Amount of daily allowances for business trips in 2021 (nuances).” Amount of income per page

Important

Question No. 2: How to draw up section 2 if there is income in kind? Income is not calculated here. You need to enter information in two positions - “100” (date of receipt of income) and “130” (amount of income). In other positions "0" is written. Question No. 3: Is it possible to withhold tax on excess daily allowances until the end of the month (on the date of the advance payment)? The advance report has been agreed upon by this time.

If the estimated tax withholding date is before the last day of the month, then no. Even if there is an agreed expense report. Personal income tax is not withheld from an advance paid to a business traveler.

For example, a business trip lasted from October 9 to October 14, 2021, the advance report was approved on October 16, 2021. On the day the report is approved (October 16), personal income tax cannot be transferred.

The tax must be transferred to the paycheck, which will be issued next month.

Is it necessary to reflect daily payments for a business trip in 6 personal income taxes?

Instead, Section 32 appeared in the Tax Code of the Russian Federation. It says that employers can no longer independently determine the amount of daily expenses per employee. Article 422 establishes an updated procedure, according to which daily allowances are now subject to insurance premiums if they exceed the limit allowed for personal income tax.

How to correctly reflect daily allowances in excess of the norm in 6-personal income tax?

When an employee is sent on a business trip, the accounting department of the company in which he works must correctly calculate the daily allowance for the entire time the employee is absent.

The amount of daily allowances, the period of their payment, the necessary calculations of employee income that they receive from business trips, insurance premiums - all these are single-digit numbers that must be accurately and accurately calculated.

The employer may be held liable for ignorance of these issues.

Online magazine for accountants

Date of income transfer) The period is affected by the type of income: sickness benefits and vacation pay are issued before the end of the month; in some cases, the information is reflected the next day after receiving the money. Usually the date is recorded here, no later than which personal income tax is deducted Page.

“130” (Amount of income received) The following is written here: the exact amount of the total actual income without deduction of withholding tax; amount of excess travel allowances Page.

“140” (Value of withheld personal income tax) The summed personal income tax that was withheld as of the date recorded in position “110.” If the beginning of the operation belongs to one reporting period and the end to another, then section 2 of this form records information on the final period. Example 1.

Display and calculation of excess travel expenses, income tax, income in 6-NDFL Employee of Project LLC Tsarev N.

M.

Daily allowance above the norm: 6-NDFL

Attention

The amount of tax withheld is indicated. The amount in lines 040 and 070 may not match. This situation may arise if the employee’s income was indicated and tax was calculated on him, but the actual payment was not made. The Federal Tax Service decided that line 070 will only include the tax that was withheld at the time of reporting.

How to fill out section 2? This section describes only those actions that were carried out during the last three months of the reporting period: Line 100 The dates of actual receipt of wages are indicated. 110 The dates when the tax was withheld are indicated.

120 The date when the tax should be remitted is written, usually this is the next working day after receiving wages. 130 The amount of income received as of the date indicated in line 100 is displayed.

140 The amount withheld at the time of date is indicated in line 110.

Business trip to 6 personal income taxes from 2021 example of filling

Thus, the Social Insurance Fund believes that daily allowances should be paid in all cases. The opinion of the Supreme Arbitration Court is exactly the opposite. It is based on the fact that payments received by an employee during a business trip do not act as his additional income.

They only compensate him for the inconvenience caused by the employer’s instructions. Features of filling out the form An example of filling out a report in Form 6-NDFL can be viewed on the website of the Federal Tax Service. It is sent there every reporting period, that is, quarter.

The calculation includes a title page and two sections. The first section is called “Generalized Indicators”, and the second section indicates the dates and amount of income received and tax withheld. The document must be completely filled out.

How to fill out the title page? At the top of the first sheet is the individual taxpayer number and the company checkpoint.

8 questions about 6-personal income tax removed: prizes, business trips, civil servants, vacation pay, benefits, errors

Dates for excess daily allowance To reflect the amount of excess daily allowance in form 6-NDFL, it is necessary to determine the dates that will be indicated in Section 2 of the Calculation.

The date of actual receipt of income for daily allowances subject to personal income tax is the last day of the month in which the advance report is approved after the employee returns from a business trip (clause 6, clause 1, article 223 of the Tax Code of the Russian Federation).

Thus, this date must be indicated on line 100 “Date of actual receipt of income” of form 6-NDFL.

The date of tax withholding (line 110) will be the date of actual payment of income from which personal income tax was withheld (clause 4 of Article 226 of the Tax Code of the Russian Federation). It is important to keep in mind that this date cannot be earlier than the last day of the month, because personal income tax cannot be withheld if income is not received.

The Federal Tax Service explained how to reflect average earnings in 6-personal income tax

But if the prizes received by the same individual exceed 4,000 rubles per year in total, then this income must be reflected in the calculation using Form 6-NDFL.

Based on paragraph 8 of Article 217 of the Tax Code, amounts of one-time payments (including in the form of financial assistance) at the birth (adoption) of a child paid during the first year after birth (adoption), but not more than 50,000, are not subject to personal income tax. rubles for each child. So the employer has the right not to reflect these payments in 6-NDFL.

Characteristics of excess daily allowance in 6-personal income tax

A civil contract was concluded with an individual in February to carry out construction work. The work acceptance certificate was signed in March 2021, and the remuneration was paid in April. In this case, the date of actual receipt of income is considered the day the income is paid, including the transfer of income to the individual’s accounts.

Source:

Characteristics of excess daily allowance in 6-NDFL

When an employee is sent on a business trip, the accounting department of the company in which he works must correctly calculate the daily allowance for the entire time the employee is absent.

The amount of daily allowances, the period of their payment, the necessary calculations of employee income that they receive from business trips, insurance premiums - all these are single-digit numbers that must be accurately and accurately calculated. The employer may be held liable for ignorance of these issues.

Daily allowances, the amount of which is higher than the standards, are subject to taxation. Therefore, the tax return must indicate their size and the amount of tax withheld. It is important to know that the Calculation indicates only the amount of daily allowance that exceeds 700 rubles per day for domestic business trips and 2,500 rubles per day for foreign ones.

Personal income tax transfer must be made on the next business day after the tax is withheld.

Main details of the description

To understand the taxation process, you first need to understand what a per diem is. Per diem is the cost that an employer has to incur to pay for an employee’s accommodation during a business trip.

If the payment of “one-day” daily allowances is prescribed in collective agreements and local regulations, then this is a direct violation of Russian legislation.

An exception is the situation when an employee is sent on a one-day business trip abroad. According to the regulations on business trips, payment in this case is made in the amount of fifty percent of the established daily allowance in foreign money.

What it is

Daily allowance is compensation for the material costs of employees sent on a business trip both in Russia and abroad, for accommodation. This compensation is expressed in monetary terms and is paid every day.

The head of the organization is obliged to pay daily allowances in the following situations:

- a company employee was sent on a business trip;

- the employee was sent on a business trip of a traveling nature;

- the employee carries out his activities in extreme conditions or participates in an expedition.

Payment refers to the calculation of funds for an employee. The payment may be in excess of the norm.

Source: //buchgalterman.ru/normativy/otrazhenie-sutochnyh-v-raschete-6-ndfl-osobennosti-kompensatsij.html

Salary on a business trip: payment terms

Having information about the timing of transferring taxable payments to an individual is the most important condition for correctly filling out Form 6-NDFL.

The travel salary (which is calculated, as we noted above, on the basis of average earnings) is paid to the employee in the same time frame as the main salary, since it is one of the options for remuneration, part of the salary as such (Articles 167, 139 of the Labor Code of the Russian Federation) .

If the salary is transferred to the employee’s card, then, as a rule, there are no practical difficulties in meeting the deadlines for its payment (an exception is if, for example, in the locality where the business traveler went, there are no ATMs and acquiring services due to the fact that it is remote from communication networks).

If salaries are traditionally issued through the organization’s cash desk (or there are noted technical difficulties in using the card), then the employer should use available alternatives so that the employee on a business trip receives his salary on time. In this case, federal legislation proposes making a money transfer at the expense of the employer (clause 11 of the Regulations according to Decree of the Government of Russia dated October 13, 2008 No. 749).

In practice, the travel portion of the salary can be included in the calculation:

- advance payment (salaries for the first half month);

- basic salary (for the second half of the month).

Depending on which part of the salary includes its “travel” component, the procedure for reflecting this component in 6-NDFL is determined. Let's look at the options here.

How to calculate average earnings for a business trip - formulas

The procedure for calculating average earnings to pay for travel expenses includes several successive stages, each of them is characterized by a specific action.

- Step 1. The billing period is determined.

In this case, this will be the year - 12 months preceding the one in which the employee goes on a business trip.

For example, if an employee goes on a business trip in April 2021, the billing period will be the time period from March 1, 2020 to March 31, 2021.

If necessary, the employer has the right to change the pay period. He can do this only on the condition that this action does not infringe on the rights of the worker. This rule is regulated by the Labor Code of the Russian Federation. In particular, Article 169 of the Labor Code of the Russian Federation.

In a situation where an employee has worked for the company for less than a year, the calculation is based on the actual number of months worked.

If less than a month has passed from the moment of employment to the date of departure on a business trip, the average daily salary of a specialist is calculated for the actual time of his work in the organization.

Rarely, there may be cases when an employee’s first working day is also the first day of a business trip. In such a situation, travel allowances are paid in accordance with the salary/tariff rate.

- Step 2. The number of days worked during the billing period is calculated.

It is important to understand that not all days are included in the calculation. The exceptions include periods of temporary disability (sick leave), an employee being on vacation (any kind), and time of forced downtime due to the fault of the enterprise management.

- Step 3. The total amount of money earned during the billing period is calculated.

The calculation includes amounts of money received during the period for which the average salary is considered. Only certain types of payments are subject to accounting.

- Step 4. Average daily earnings are calculated.

This step involves using the following formula:

Average daily earnings = Amount of funds received in the billing period / Number of days worked in the same time period.

- Step 5. The amount of travel allowances to be paid is calculated.

At this stage, the indicator obtained in the previous paragraph is multiplied by the number of business trip days. All working days are taken into account, including the day of departure and arrival.

The formula for determining average earnings for a business trip is as follows:

Travel allowance = Average daily earnings * Business trip days.

What is included?

When calculating the average daily earnings for business travel, not all payments received by the employee during the pay period are taken into account.

The calculation does not include:

- payment for the period of temporary disability;

- payment of annual paid and other types of leave;

- social benefits - financial assistance, payment for travel and food, etc.

Only the days during which the employee was actually at work are taken into account. Therefore, payments received exclusively during this time are taken into account.

The topic of business trips is reflected in articles 167-169 of the Labor Code of the Russian Federation.

According to regulatory documentation, during the trip the employee is assigned the following rights:

- maintaining a job;

- maintaining average wages;

- compensation for travel expenses - not only to the place of business trip and back, but also for moving around the area;

- reimbursement of living expenses;

- compensation for other expenses related to production needs.

Calculation example for 2021

A clear example will help you understand in more detail the topic of determining average earnings for a business trip.

Initial data:

Specialist Smirnov A.V. opens from November 2021. The employee's business trip is scheduled for April 2021. Therefore, the calculation period will be 12 months preceding the month of the business trip - from 03/01/2020 to 03/31/2021.

There were 248 working days in the specified time period. Of these, 5 employees were on sick leave, 19 were on vacation. The number of days used in calculating average earnings is determined as follows:

- Days worked = 248 – 5 – 19 = 224 days.

The total amount received during the year by Smirnov A.V. cash amounted to 500 thousand rubles. Of these, 10 thousand rubles. – payment for a certificate of temporary incapacity for work, 30 thousand rubles. – vacation pay. The following amount will be used for calculation:

- Earned = 500,000 – 10,000 – 30,000 = 460,000 rubles.

Knowing the number of days worked in the billing period and the amount received during this time, you can calculate the average earnings to pay for the business trip period. In this case, its calculation will look like this:

- Average earnings = 460,000 / 224 = 2,054 rubles.

The number of working days that the employee will spend on a business trip is 5. The total amount of travel allowances will be:

- Payment for the business trip period = 2,054 * 5 = 10,268 rubles.

Please remember that travel allowances are taxable. Of the amount of 10,268, 13% will be withheld.

In each case, the calculation is individual. The size of the average value is mainly influenced by the number of days worked in the billing period and the amount earned by the employee during this time.

How to reflect travel salary in 6-NDFL

Wages are recognized as income of an individual as of the last day of the month for which they are calculated. And the tax on it is withheld from the next nearest payment (usually until the 15th of the next month).

That is, personal income tax on the travel component of the salary will be:

- Calculated (based on the recognition of an individual’s income as received) - at the end of the month (regardless of whether travel allowances are included in the advance or the basic salary).

- Withheld - simultaneously with the payment of the main part of the salary.

- Transferred to the budget - the next day after deduction.

Thus, the 6-NDFL report shows (in terms of the amount of average earnings during the business trip and the personal income tax accrued on it):

1. In section 2 of the report:

- on pages 110 and 112 - the amount of travel allowances;

- on pages 140 and 160 - the tax calculated and withheld from this amount.

2. In section 1 of the report:

- on page 021 - the next working day after the day of dismissal;

- on page 022 - the amount of personal income tax withheld.

Next, we will tell you how to reflect travel payments in terms of daily allowances in 6-NDFL.

We answer popular questions about 6-NDFL

New quarterly reporting form 6-NDFL (calculation of personal income tax amounts calculated and withheld by a tax agent approved by order of the Federal Tax Service of the Russian Federation dated October 14, 2015 No. ММВ-7-11/ [email protected] ) when submitting a report for the first quarter 2021 has raised a huge number of questions. Let's look at the most popular of them.

– How to fill out the indicators of lines 070 and 080 of section 1 for transitional payments, if the salary accrued for the second quarter of 2021 was actually paid in the third quarter of 2016?

– Line 070 is the total amount of tax withheld on an accrual basis from the beginning of the tax period, line 080 is the total amount of tax not withheld by the tax agent on an accrual basis from the beginning of the tax period. When filling out these lines, the accountant has a choice.

The first option is to show the June salary only in section 1 when filling out the calculation on form 6-NDFL for the second quarter. And when preparing a report for 9 months, the payment of the June salary should go into section 2.

The second option is to show the June salary calculated for the second quarter in both sections: the calculation of wages for the month is reflected in section 1, and the payment with July dates is reflected in section 2.

When choosing the first option, an additional question may arise: what amounts to indicate in section 1 in lines 070 and 080.

Someone may think that in this case, the tax on the June salary should be reflected in line 080 “Amount of tax not withheld by the tax agent.” However, line 080 is intended for amounts that cannot be withheld and which must be shown in the 2-NDFL certificate with attribute 2 (taking into account the provisions of clause 5 of Article 226 of the Tax Code of the Russian Federation and clause 14 of Article 226.1 of the Tax Code of the Russian Federation, when the tax agent is not may fulfill the obligation to withhold personal income tax).

For example, a company gave a former employee a gift worth 10,000 rubles. The accountant assessed personal income tax in the amount of 780 rubles. ((RUB 10,000 – RUB 4,000) x 13%).

It is impossible to withhold tax in this situation, since the employee does not receive income from the company.

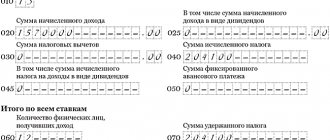

The following indicators must be indicated in the lines of form 6-NDFL:

- in line 020 “Amount of accrued income” - 10,000 rubles,

- in line 030 “Amount of tax deductions” - 4000 rubles,

- in line 040 “Amount of calculated tax” - 780 rubles,

- in line 070 “Amount of tax withheld” - 0 rub.,

- in line 080 “Amount of tax not withheld by the tax agent” - 780 rubles.

- At the end of 2021, the company will submit a 2-NDFL certificate with attribute 2, where in the line “Tax amount not withheld by the tax agent” the number 780 will be reflected.

Therefore, when choosing the first option, in both lines 070 and 080 of section 1 of the 6-NDFL calculation for the second quarter of 2021, the personal income tax amounts from the June salary are not indicated. They are reflected only in line 040 “Amount of calculated tax” of section 1.

– How to fill out the 6-personal income tax calculation if the salary is issued before the end of the month, while the last day of the month is a day off, and the personal income tax payment deadline also falls on a weekend?

– This situation can be observed quite often, for example, when an organization’s accounting policy states that the day of payment of salaries is the last day of the month for which they are accrued. And, as was the case in April 2021, the last day may be a day off. That is, the accountant had to calculate and issue wages for April at least on April 29. What dates, in this case, should be reflected in section 2?

Unfortunately, the current edition of the Tax Code of the Russian Federation does not cover this practice of settlements with employees. According to paragraph 2 of Art. 223 of the Tax Code of the Russian Federation, the date of actual receipt of wages (line 100) is the last day of the month for which income is accrued (regardless of whether this day falls on a weekend or a non-working holiday or not). That is, in line 100 of section 2, in this case, for the salary for April 2021, we must put 04/30/2016. And since the organization actually pays its employees on the 29th, it will also withhold personal income tax from wages on the 29th. It follows that in line 110 we show 04/29/2016, in line 120 05/04/2016.

But until recently, specialists from the Federal Tax Service and the Ministry of Finance argued that it was impossible to determine the tax base before the date of actual receipt of income. And this meant that it was impossible to calculate, let alone withhold, personal income tax until the end of the month (for example, letter from the Ministry of Finance dated July 10, 2014 No. 03-04-06/33737). Therefore, it was believed that personal income tax amounts withheld before the end of the month are not taxable (for example, letter of the Federal Tax Service dated July 25, 2014 No. BS-4-11/14507). And many companies had to prove that it was a tax that was withheld from the taxpayer’s income. At the moment, judicial practice has developed entirely in favor of tax agents. It is important that with regard to form 6-NDFL, the Federal Tax Service changed its point of view in letter dated March 24, 2016 No. BS-4-11/5106. And in accordance with the latest changes, the April dates indicated in the example above are legally correct.

The question may arise why the date 05/04/2016 is indicated in line 120. After all, line 120 is the date no later than which the tax amount must be transferred. And from 2021, a single deadline for paying personal income tax has been established - no later than the day following the day of payment of income (with the exception of sick leave and vacation pay). Following this logic, line 120 should indicate the date 04/30/2016. But since April 30, 2016 is a day off, the deadline is moved to the next working day, in our example - to May 4.

– Is an organization required to submit a zero calculation 6-NDFL?

– Tax agents are obligated to provide the tax authorities with calculations in Form 6-NDFL. In accordance with the Tax Code of the Russian Federation, tax agents for personal income tax are Russian organizations and individual entrepreneurs who pay individuals the income listed in clause 2 of Art. 226 of the Tax Code of the Russian Federation (clause 1 of Article 226 of the Tax Code of the Russian Federation), as well as persons paying citizens income from transactions with securities and financial instruments of futures transactions (clause 2 of Article 226.1 of the Tax Code of the Russian Federation).

Thus, if an organization does not pay income to individuals, then it is not a tax agent and is not obliged to submit a calculation in Form 6-NDFL (letter of the Federal Tax Service of the Russian Federation dated May 4, 2016 No. BS-4-11/7928).

However, such an organization has the right to submit tax calculations in Form 6-NDFL with zero values. And then section 1 will need to be completed at one rate equal to 13%. And in section 2, fill out only one block: on lines 100, 110, 120, indicate a conditional date (for example, 01/01/2016), and in lines 130, 140, enter zeros.

– How to fill out section 1 of the 6-NDFL calculation when recalculating vacation pay?

– In a letter dated May 24, 2016 No. BS-4-11/9248, the Federal Tax Service of the Russian Federation explained how to fill out this section 1 if the organization recalculated the amount of vacation pay and, accordingly, the amount of personal income tax.

The Tax Department reminds that section 1 of the 6-NDFL calculation is filled out with an accrual total for the first quarter, half a year, 9 months and a year. Therefore, when recalculating vacation pay, this section reflects the total amounts taking into account the recalculation made.

In cases where an organization (tax agent) recalculates the amount of vacation pay and, accordingly, the amount of personal income tax, then in section 1 of the calculation in Form 6-NDFL the total amounts are reflected taking into account the recalculation made.

– How to fill out section 2 if the company is late in paying wages?

– Let’s look at this question using a clear example.

The company pays salaries to its employees in the second quarter of 2016 monthly, as expected, on the last day of the month, and calculates personal income tax also on the last day of the month, that is, April 30, May 31 and June 30, respectively. But due to financial difficulties, the company is delaying salary payments. So income for April was actually paid on June 20, for May - on July 20, for June - on August 20. When filling out section 2, you must indicate only the amounts paid in the second quarter of 2021, that is, in line 100 indicate the date 04/30/2016 (the last day of the month for which income was accrued), in line 110 - 06/20/2016 (the actual day of payment income and tax withholding), in line 120 – 06/21/2016 (the next business day after payment of income). As for the salaries for May and June, we will reflect them in the calculation of 6-personal income tax for 9 months, since in fact the salaries were paid already in the third quarter. But in section 1 for the second quarter it is necessary to reflect all accrued wages for April-July.

– Do I need to show the advance separately in 6-NDFL?

– Let’s look at a practical example.

In the company, the advance payment is due on April 27, and the salary is due on May 13. Should blocks 100-140 be duplicated in section 2, where first the date 04/27/2016 will be indicated on line 100, and then 05/13/2016. According to Art. 223 of the Tax Code of the Russian Federation, the advance should not be indicated as a separate payment, since for wages the date of actual receipt of income is the last day of the month for which income is accrued. It follows that to fill out line 100, it doesn’t matter to us when the income was paid. In the case of payment of wages for the month, in line 100 it is always necessary to indicate the last day of the month for which it was accrued. In our example, this is 04/30/2016. And on line 130 you should indicate the full amount of the accrued salary for the month, without allocating a separate advance.

– Is it necessary to reflect income exempt from tax in the calculation of 6-NDFL?

– Many accountants in practice have more than once encountered a situation where an employee needs to accrue income that is not subject to taxation, for example, state benefits. In general, the list of income exempt from personal income tax is very large. Therefore, in order to correctly withhold personal income tax from the income of individuals, every accountant should familiarize themselves with Art. 217 Tax Code of the Russian Federation.

The Procedure for filling out the calculation in Form 6-NDFL (approved by order of the Federal Tax Service of the Russian Federation dated October 14, 2015 No. ММВ-7-11/ [email protected] ) does not specify whether such income needs to be indicated in the calculation. In this regard, the Federal Tax Service of the Russian Federation issued letters dated March 23, 2016 No. BS-4-11/ [email protected] and No. BS-4-11/4901, where it explained that income exempt from personal income tax in accordance with Art. 217 of the Tax Code of the Russian Federation, are not reflected in the calculation using Form 6-NDFL.

But there is a small nuance in this issue, when part of the income may not be taxed. And the question arises: should you indicate only the part of the income that is taxable or the entire amount of income?

Let's look at an example. In accordance with the collective agreement on June 1, 2016, the employee was accrued and paid financial assistance in the amount of 10,000 rubles. (income code 2760). The personal income tax deduction is 4,000 rubles. (deduction code 503). That is, personal income tax, taking into account the deduction, was calculated and withheld upon payment of 780 rubles.

This operation in section 1 of Calculation 6-NDFL for the second quarter of 2021 should be reflected as follows:

- line 020 – 10,000 rub.,

- line 030 – 4000 rub.,

- line 040 – 780 rub.,

- line 070 – 780 rub.

Payment of financial assistance in section 2 of Calculation 6-NDFL for the second quarter of 2021 should be reflected as follows:

- in line 100 – 06/01/2016;

- in line 110 – 06/01/2016;

- in line 120 – 06/02/2016;

- in line 130 – 10,000 rub.,

- in line 140 – 780 rub.

Taxation of excess daily allowances: general points

Daily allowances are not taxed within the limits of amounts per employee (clause 3 of Article 217 of the Tax Code of the Russian Federation):

- 700 rubles per day - for business trips around Russia;

- 2500 rubles per day - for foreign business trips.

Amounts falling within the specified limit should not be reflected in any way in the 6-NDFL report.

This is the fundamental difference between daily allowances and tax deductions, which, in cases provided for by law, reducing personal income tax to zero, are nevertheless subject to reflection in reporting.

Taxable daily allowances, like wages, are subject to inclusion in tax reporting. In this case, daily allowances are recognized as income at the end of the month in which the accounting department approves the advance report of the employee returning from a business trip (subclause 6, clause 1, article 223 of the Tax Code of the Russian Federation).

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

The employee submits the report within 3 days after returning to work. The deadline for approval of the accepted report is determined by the employer himself (clause 6.3 of Bank of Russia Directive No. 3210-U dated March 11, 2014). By analogy with salaries, tax on excess daily allowances, which are recognized as income at the end of the month, is withheld from the next next salary (in practice, from one of its parts, an advance or the principal amount). It doesn’t matter when the employee actually received the daily allowance; the moment they were received is not reflected in the reporting in any way and does not affect the procedure for its preparation.

Let's look at an example of how travel allowances are recorded in 6-NDFL if they are presented in excess of the limit.

Rolling leave

This is another difficult moment for an accountant - if an employee’s vacation began in one month and ended in another, how to reflect it in the calculation?

And here it is necessary to take into account not the duration of the vacation, but the month in which he was paid vacation pay.

Example:

The employee goes on vacation from March 15 to April 11, vacation pay was accrued in the amount of 29,000 and paid on March 10, personal income tax was withheld at 13%. Let’s assume there were no other payments or accruals in the organization.

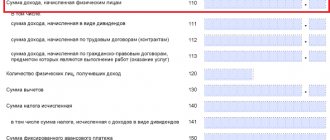

In the report, Section 1 will look like this:

Section 2:

How to reflect above-limit daily allowances in 6-NDFL: example

Ivanov A.A. On July 8, 2021, he went on a business trip for 15 days, receiving a daily allowance in the amount of 15,000 rubles. Upon his return, he prepared an advance report and submitted it to the accounting department on July 23. For July, Ivanov received his salary on August 6.

Accountants will need:

1. Calculate the taxable amount of excess daily allowance.

It's simple: divide 15,000 by 15 days of business trip - it turns out 1,000 rubles per day. Of these, 300 rubles. (1,000 – 700) is the employee’s taxable income. Total taxable income for a business trip is 4,500 rubles (300 × 15 days).

2. Reflect in the 6-NDFL report for 9 months (in terms of taxable amounts for excess daily allowance):

1. In section 2:

- in columns 110 and 112 - 4,500 rubles of income;

- in columns 140 and 160 - 585 rubles each (calculated and withheld tax).

2. In section 1:

- in column 021 - 08/09/2021 (personal income tax is transferred to the budget);

- in column 022 - 585 rubles (personal income tax on daily allowance).

The terms we considered for calculating and reflecting travel payments in the 6-NDFL report are determined in relation to the status of an individual as an employee of an organization. But what about these procedures if, at the time the daily allowance is recognized as received and taxable income, the employee is fired? This scenario can be classified as a special one - let’s get acquainted with the accounting procedure in this case.

Reports for the 1st quarter of 2021 should be submitted on the new form 6-NDFL, approved by order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11/753. How to fill out the calculation on the new form? The answer is given in the ready-made solution ConsultantPlus. You will find even more useful materials if you sign up for a free trial access to K+

Registration

Section 1 indicates the amounts of accrued income, calculated and withheld tax, aggregated for all individuals, on an accrual basis from the beginning of the tax period at the appropriate tax rate.

If the employer paid individuals during the tax period (presentation period) income taxed at different rates, section 1, with the exception of lines 060 - 090, is completed for each tax rate.

If the indicators of the corresponding lines of Section 1 cannot be placed on one page, then the required number of pages is filled in.

The totals for all rates on lines 060 - 090 are filled out on the first page of Section 1.

On line 010 you need to indicate the appropriate tax rate using which the tax amounts are calculated.

Line 020 is the cumulative amount of accrued income for all individuals from the beginning of the tax period. This line indicates all income the date of receipt of which falls within the period of submission of the calculation. For example, if this is the first quarter, then you should indicate the entire salary accrued for January - March, including part of the salary for March paid in April (clause 2 of article 223 of the Tax Code of the Russian Federation, letters of the Federal Tax Service dated March 18, 2021 No. BS-4 -11/ [email protected] , dated February 25, 2021 No. BS-4-11/ [email protected] ).

If temporary disability benefits are accrued in one reporting period and paid in another, then both the amount of income (line 020) and the amount of personal income tax calculated from it (line 040) must be reflected in the report prepared for the period in which the period falls benefit payments. This clarification was given in the letter of the Federal Tax Service of Russia dated August 1, 2021 No. BS-4-11/13984. Let us recall that for personal income tax purposes, the date of receipt of cash income (including income in the form of temporary disability benefits) is considered the day of its payment.

On line 025 - the amount of accrued income in the form of dividends, cumulative for all individuals, on an accrual basis from the beginning of the tax period.

Line 030 is the sum of tax deductions generalized for all individuals that reduce income subject to taxation on an accrual basis from the beginning of the tax period. If the amount of personal income tax deductions provided to an employee exceeds his accrued salary, line 030 “Amount of tax deductions” indicates only the offset amount of the deduction, which is equal to the amount of accrued income indicated on line 020 (letter of the Federal Tax Service of Russia dated August 5, 2016 No. BS-4 -11/14373).

On line 040 - the amount of calculated tax generalized for all individuals on an accrual basis from the beginning of the tax period at the appropriate rate. This amount is calculated as follows: (total income (line 020) – total deduction (line 030) x personal income tax rate (line 010).

On line 045 - the amount of calculated tax on income in the form of dividends, aggregated for all individuals, on an accrual basis from the beginning of the tax period.

On line 050 - the amount of fixed advance payments generalized for all foreign employees working under patents, accepted to reduce the amount of calculated tax from the beginning of the tax period.

Below are the summary figures for all tax rates.

On line 060, indicate the total number of individuals who received taxable income during the tax period. In case of dismissal and hiring of the same individual during the same tax period, the number of individuals is not adjusted.

How one person is counted:

- a person who received income under different contracts during one period;

- a person who has received income subject to personal income tax at different rates.

On line 070 - the total amount of tax withheld on an accrual basis from the beginning of the tax period.

On line 080 - the total amount of tax not withheld by the tax agent, cumulatively from the beginning of the tax period (for example, in the case when an individual receives income in kind or in the form of material benefits). The total amount of personal income tax not withheld by the tax agent from this income is reflected in line 080 if there is no other income in cash (letter of the Federal Tax Service of the Russian Federation dated July 19, 2016 No. BS-4-11 / [email protected] ).

Special scenarios: reporting per diem upon dismissal of an employee

For clarity, let's consider another example.

Ivanov A.A. submitted a report on the business trip on July 5, 2021, then, after working in the company until the 16th, he wrote a letter of resignation. The parties agreed to terminate labor relations on July 19 and make all payments.

The question arises - how to withhold personal income tax (and reflect it in reporting) if the day on which the excess daily allowance is recognized as income - July 31, 2021 - comes later than the day the employee is dismissed?

In this case, personal income tax is subject to withholding simultaneously with calculations upon dismissal. In form 6-NDFL the following are recorded (in section 1):

- in column 022 - 07/20/2021 (date of transfer of tax to the budget).