Who are recognized as related parties?

Interdependent persons are several subjects of legal relations (citizens or legal entities), among which there is at least one subject that can influence (Clause 1 of Article 105.1 of the Tax Code of the Russian Federation):

- participation of at least one other entity in certain transactions;

- on the results of economic activities carried out by at least one other entity.

Read more about the criteria for classifying individuals as interdependent here.

One of the common types of relationships between interdependent persons is a transaction. Typically in the form of a commercial contract.

In cases provided by law, a transaction between related parties may be classified as controlled. But what could be the reasons for this?

Establishment of commercial or financial terms for tax purposes

If a transaction involves interdependent companies, and the transaction is recognized as comparable to a transaction that could be between ordinary companies that do not have mutual dependence on each other, then the income from the transaction is also taken into account for tax purposes.

Tax authorities need to monitor the price of a transaction between persons who are mutually dependent on each other, as if this transaction were carried out between ordinary companies or persons, since as a result of such transactions, as a rule, additional amounts are charged that do not correspond to market prices. It is they who are taken into account in taxation matters, and as a result, the replenishment of the state budget after such transactions.

Commercial terms in beneficial transactions are those conditions that result in a company or person being mutually dependent on each other in matters of capital or economic activity, resulting in a benefit for both parties to the transaction. But at the same time, the conditions are considered comparable to those that may arise in a transaction between persons or companies that are not interdependent.

In this case, only conditions that lead to a reduction in the percentage tax that companies must pay after the transaction to the state budget will be taken into account for tax purposes.

There is another condition - if the amount of loss of the company or person as a result of the transaction increases. Moreover, if one of the payers participating in the transaction applies the norm of corrective symmetry, then the conditions under which the transaction was carried out are not taken into account.

What are controlled transactions?

A controlled transaction is considered to be a transaction between interdependent persons, which is subject to verification by the Federal Tax Service for an unjustified decrease or increase in the tax base.

The Federal Tax Service may control transactions between related parties that:

- form amounts subject to personal income tax, profit tax, mineral extraction tax, VAT;

- fall under the criteria established in paragraphs. 1–3, 5–7 tbsp. 105.14 Tax Code of the Russian Federation;

- do not fall under the criteria given in paragraph 4 of Art. 105.14 Tax Code of the Russian Federation.

Having checked the transaction between interdependent persons, the Federal Tax Service may fine the participants and assess additional tax for the payer if it considers that the base for it was unreasonably reduced. Recognition of parties to a transaction as interdependent is carried out solely for tax purposes.

You can learn more about controlled transactions in the article: “Criteria for controlled transactions - table for 2021” .

Analytics Publications

Rule 1 (clause 1 of the Review)

Control of the compliance of prices applied in controlled transactions is carried out by the Federal Tax Service of Russia and cannot be the subject of on-site and desk audits of lower tax authorities (1.

This rule contains two important exceptions.

Exception 1 (clause 2 of the Review):

methods for determining income using market prices (according to Chapter 14.3 of the Tax Code of the Russian Federation) can be used during a regular tax audit, if this is provided for in chapters of Part 2 of the Tax Code of the Russian Federation. This conclusion is illustrated by the reference norms of the Tax Code of the Russian Federation, which provide for the possibility of determining the tax base for VAT and income tax, taking into account Art. 105.3 of the Tax Code of the Russian Federation when:

– sales of goods (work, services) through barter transactions or free of charge, when transferring ownership of the pledged item to the pledgee in the event of failure to fulfill the obligation secured by the pledge, when transferring goods (results of work, provision of services) when paying for labor in kind (clause 2 Article 154 of the Tax Code of the Russian Federation);

– upon gratuitous receipt of property (work, services), property rights (clause 8 of Article 250 of the Tax Code of the Russian Federation);

– receipt by the taxpayer of income in kind (clauses 4–6 of Article 274 of the Tax Code of the Russian Federation).

However, even within the chapters on income tax and VAT, the Review lists a far from complete list of cases. Reference to Art. 105.3 of the Tax Code of the Russian Federation is also contained when determining the tax base for other taxes/fees. Therefore, the above enumeration of the RF Armed Forces can be safely supplemented - for the purposes of:

– calculation of personal income tax (2 – receipt by the taxpayer of income from organizations and individual entrepreneurs in kind in the form of goods (work, services) and other property, determination of the value of securities, determination of the value of assets (clause 1 of article 211, clause 13.2 of art. 214.1, Article 220 of the Tax Code of the Russian Federation);

– calculation of mineral extraction tax (3 – determination of revenue from the sale of extracted minerals (clauses 2–3 of Article 340 of the Tax Code of the Russian Federation);

– application of the simplified tax system (4 – receipt of income in kind (clause 4 of article 346.18 of the Tax Code of the Russian Federation);

– application of the patent taxation system – receipt of income in kind (clause 5 of article 346.53);

– determining the basis for calculating insurance premiums – making payments and other remuneration in kind in the form of goods (work, services), other property (clause 7 of Article 421 of the Tax Code of the Russian Federation).

Moreover, the general rule for determining the tax base for value added tax when selling goods, works, and services provides for the calculation of their value based on prices determined in accordance with Art. 105.3 of the Tax Code of the Russian Federation (clause 1 of Article 154 of the Tax Code of the Russian Federation). The Ministry of Finance of the Russian Federation also drew attention to this in its Letter dated February 15, 2017 No. 03-07-11/8356.

The guarantee of protecting the rights of the taxpayer from unjustified tax control in the above cases is the provision of paragraph. 3 p. 1 art. 105.3 of the Tax Code of the Russian Federation, according to which prices used in transactions in which parties are persons who are not recognized as interdependent, as well as income received by persons who are parties to such transactions, are recognized as market prices for the purposes of the Tax Code.

Exception 2 (clause 3 of the Review):

As part of tax audits by regional inspectorates, it is permissible to monitor the compliance of the transaction price with market prices to identify cases of receiving unjustified tax benefits. In this case, the discrepancy between the transaction price and market prices must be multiple, and the receipt of an unjustified tax benefit must be confirmed by other evidence discrediting the business purpose of the transaction (5.

For example, when conducting an audit of a taxpayer, the tax authority considered the price of purchase and sale transactions to be underestimated and determined the tax base based on the market value of the alienated property.

When considering the dispute, the court found that the tax authority did not prove the mutual dependence of the parties to the transaction; the parties to the contractual relationship confirmed the presence of a commercial interest when concluding contracts.

Analyzing judicial acts, the Supreme Court of the Russian Federation noted that multiple deviations of the transaction price from the market level can be taken into account as one of the signs of obtaining an unjustified tax benefit only in the aggregate and in conjunction with other circumstances that discredit the business purpose of the transaction (interdependence of the parties to the transaction, the creation of an organization shortly before business transaction, the use of special forms of payment and payment terms, etc.). The final judicial act was rendered in favor of the taxpayer (Determination of the Supreme Court of the Russian Federation dated December 1, 2016 No. 308-KG16-10862 in case No. A32-2277/2015).

Here's another example. When conducting an audit of the taxpayer, the tax authority considered the price of purchase and sale transactions to be underestimated and determined the tax base based on the market value of the alienated property.

During the consideration of the case, it was established that the parties to the transaction are interdependent persons, the transaction price deviates many times from the market price, and the actual purpose of the transaction was to obtain an unjustified tax benefit.

When considering this dispute, the Supreme Court of the Russian Federation noted that the materiality and severity of the deviation of the price applied by the taxpayer from the market level, together with other circumstances of the disputable transactions, may have legal significance if, during a desk or field tax audit, signs of obtaining an unjustified tax benefit are established.

The final judicial act was rendered in favor of the tax authority (Determination of the Supreme Court of the Russian Federation dated July 22, 2016 No. 305-KG16-4920 in case No. A40-63374/2015).

Thus, the formal non-compliance of a transaction with the characteristics of a controlled one does not guarantee the taxpayer’s safety from additional tax charges based on the market price of the transaction.

Our advice:

When entering into transactions that deviate from the market, it is necessary to understand what business purpose the agreement serves. Try to record your commercial interest in correspondence, protocols, memorandums and other documents, the decision to provide which during an audit or in court can be made by the taxpayer on a case-by-case basis. When protecting your interests in a tax dispute, you must pay due attention to the collection and analysis of the evidence base, which will be assessed by the court.

Rule 2 (clause 4 of the Review)

The court has the right to recognize persons as interdependent for tax purposes in cases not specified in paragraph 2 of Art. 105.1 of the Tax Code of the Russian Federation, if the taxpayer’s counterparty (interdependent persons of the counterparty) had the opportunity to influence decisions made by the taxpayer in the field of its financial and economic activities. The burden of proving these circumstances rests with the tax authority.

The purpose of applying this rule is to identify transactions whose financial content differs from the conditions that the parties would determine when interacting as independent counterparties acting in their own economic interests.

The court included some signs of mutual dependence in the Review:

– another person (including the counterparty to the transaction) has the opportunity to determine the decisions made by the taxpayer;

– the taxpayer acted in the general economic interests of the group to which he belongs (for the benefit of third parties);

– lack of freedom in decision-making should have affected the conditions and results of the execution of the relevant transactions.

The last sign is especially worth noting, since often the tax authority does not even try to prove that the mutual dependence of the parties directly affected the results of the transaction.

Exception:

influence exerted for economic reasons, for example due to the preferential market position of one of the parties to the transaction, should not be taken into account when deciding on the issue of recognizing persons as interdependent (clause 4 of Article 105.1 of the Tax Code of the Russian Federation).

Our advice:

when concluding a transfer transaction, justify your own economic interests as a party to the agreement.

Rule 3 (clause 5 of the Review)

The interdependence of the parties to a transaction may be the basis for adjusting their income (profit, revenue) according to the rules of Section V.1 of the Tax Code of the Russian Federation, if in relation to this transaction the entire set of conditions is met, in the presence of which it is recognized as controlled.

Apparently, the Review sets out the essence of the dispute in case No. A53-30653/2014 with the participation of Flash Energy LLC. However, in the Ruling of the Supreme Court of the Russian Federation dated April 11, 2016 No. 308-KG15-16651, the court also drew attention to the fact that the Tax Code excluded from the number of transactions between related parties subject to control in the manner provided for in Section V.1 of the Tax Code of the Russian Federation, transactions that do not comply the criterion of controlled transactions, as well as transactions for which the amount of income does not exceed those established by Art. 105.14 of the Tax Code of the Russian Federation, amount criteria.

Classifying a transaction as controlled on the basis of clause 1 of Art. 105.14 of the Tax Code of the Russian Federation without taking into account the criteria reflected in paragraphs 2 and 3 of Art. 105.14 of the Tax Code of the Russian Federation is not legal.

For example, during an audit, the tax authority identified a set of transactions by the taxpayer for the purchase of goods and materials from an interdependent party involving a chain of intermediaries, falling under the criteria of sub. 1 clause 1 art. 105.14 Tax Code of the Russian Federation. In this connection, the company was held liable under Art. 129.4 of the Tax Code of the Russian Federation for failure to provide notification of a controlled transaction.

When considering the dispute, the court found that the amount of income from the transaction was below the established amount threshold provided for in paragraph 2 of Art. 105.14 of the Tax Code of the Russian Federation, while the inspection did not provide evidence of compliance of any party with other conditions provided for by this paragraph of the article.

In addition, the court drew attention to the fact that the tax authority did not prove that the transaction does not fall under the criteria of agreements, which, by virtue of clause 4 of Art. 105.14 of the Tax Code of the Russian Federation are not recognized as controlled (for example, it did not reveal that the parties to the transaction have separate branches in the territory of other constituent entities of the Russian Federation or pay taxes there). The dispute was resolved in favor of the taxpayer (Resolution of the Arbitration Court of the PA dated 02.02.2016 in case No. A55-6922/2015).

Do not forget that from 01/01/2017 new norms sub-clause came into force. 6–7 paragraph 4 art. 105.14 of the Tax Code of the Russian Federation, according to which transactions for the provision of sureties/guarantees between Russian organizations (with the exception of banks (subclause 6, clause 4, Article 105.14 of the Tax Code of the Russian Federation), as well as transactions for the issuance of interest-free loans between Russian interdependent persons are excluded from the list of controlled ones. This significantly facilitates intra-corporate financing and reduces the administrative burden on business.

Our advice:

when protecting your interests within the framework of a tax dispute, check the compliance of the transaction with all the criteria established by Art. 105.14 Tax Code of the Russian Federation. Please take into account that even if the terms of the transaction formally comply with the characteristics provided for in paragraphs 1–3 of Art. 105.14 of the Tax Code of the Russian Federation, the agreement will not be controlled in the cases listed in paragraph 4 of this article.

Rule 4 (clause 6 of the Review)

Provided for in paragraph 11 of Art. 105.7 of the Tax Code of the Russian Federation, the right of the court to take into account any circumstances relevant to determining whether the price applied by the taxpayer corresponds to the market level cannot serve as a basis for deviation from the rules established by law for calculating taxes on controlled transactions.

The court drew attention to the fact that the provisions of section V.1 contain not only the rules that should guide the inspectorate, but also the rules for calculating taxes that taxpayers must follow when carrying out controlled transactions. The rules applied by tax authorities and taxpayers should not differ due to the principle of legal certainty of taxation (Clause 6, Article 3 of the Tax Code of the Russian Federation).

Prior to this, the position of the Constitutional Court of the Russian Federation, reflected in the rulings of December 4, 2003 No. 442-O and of September 18, 2014 No. 1822-O (when considering a similar norm of paragraph 12 of Article 40 of the Tax Code of the Russian Federation), on the possibility of the court to take into account any circumstances when determining market price was often interpreted broadly. For example, the courts considered it possible to accept as evidence a calculation of the market price carried out in violation of the rules of paragraphs 4–11 of Art. 40 of the Tax Code of the Russian Federation (Resolution of the Arbitration Court of the Northern Territory of March 10, 2016 in case No. A13-17750/2014).

Now the Review directly states that when using clause 11 of Art. 105.7 of the Tax Code of the Russian Federation, the court should not facilitate deviations from the rules:

– determining the comparability of commercial and financial terms of transactions (Article 105.5 of the Tax Code of the Russian Federation);

– selection of information to determine the comparability of transactions (Article 105.6 of the Tax Code of the Russian Federation);

– choosing a priority method for determining income (profit, revenue) (clause 3 of Article 105.7 of the Tax Code of the Russian Federation);

– the procedure for applying calculation methods (Articles 105.8–105.13 of the Tax Code of the Russian Federation).

What to pay attention to:

on the basis of clause 11 of Art. 105.7 of the Tax Code of the Russian Federation, the taxpayer has the right to provide evidence that the non-application of the market price was not a consequence of the mutual dependence of the parties to the controlled transaction, but had other economic reasons, referring to the accounting of imputed economic benefits for tax purposes when performing other transactions, etc.

Rule 5 (clauses 7, 8 of the Review)

A report on the assessment of market value may be accepted as evidence in disputes related to adjustment of the tax base in accordance with Section V.1 of the Tax Code of the Russian Federation only in the cases established in this section.

Namely:

– in the absence or insufficiency of the sources of information listed in paragraph 1 of Art. 105.6 of the Tax Code of the Russian Federation (subclause 3 of clause 2 of Article 105.6 of the Tax Code of the Russian Federation);

– when making one-time transactions, if the methods provided for in Ch. 14.3 of the Tax Code of the Russian Federation do not allow determining whether the price corresponds to the market level (clause 9 of Article 105.7 of the Tax Code of the Russian Federation);

– when making transactions when an assessment is mandatory (clause 10 of Article 105.3 of the Tax Code of the Russian Federation).

The court also focused on the conditions for accepting the appraiser’s report in terms of its admissibility and reliability:

– the report must allow one to draw a conclusion about the level of income that could actually be received by the taxpayer;

– the conclusion must be prepared by a person who meets the requirements for subjects of professional assessment activities;

– the expert should not deviate from the principles of identity and comparability of analogous objects.

For example, based on the results of a tax audit, the company was assessed taxes based on the market value of the rent determined by the appraiser hired by the inspection, and not on the basis of the prices applied by the taxpayer.

Having examined the valuation document, the court came to the conclusion that the concept of “market value”, defined in accordance with Federal Law No. 135-FZ of July 29, 1998 “On Valuation Activities in the Russian Federation,” has a probabilistic nature. The expert's conclusion did not take into account all the factors influencing the determination of the market value of the rent in relation to the above premises. Under such circumstances, an expert opinion cannot be an unconditional confirmation of the established deviation in the amount of rent.

As a result, the dispute was resolved in favor of the taxpayer (Resolution of the Arbitration Court of the UO dated May 19, 2015 in case No. A07-5319/2014).

The court also noted some principles for appointing a forensic examination in this category of disputes:

– the examination should not be appointed to compensate for the shortcomings of the tax audit;

– an examination may be appointed in order to resolve irreconcilable disagreements about the correct application of methods for determining income or in order to eliminate doubts about the reliability of conflicting evidence.

Our advice:

To avoid mistakes regarding the examination, we recommend that you pay attention to the Ruling of the RF Armed Forces dated July 22, 2016 No. 305-KG16-4920 in case No. A40-63374/2015.

Rule 6 (paragraphs 9–11 of the Review)

Prosecution under Art. 129.4 of the Tax Code of the Russian Federation for unlawful failure to provide notification of controlled transactions or reflection of false information in them must be carried out taking into account the following circumstances:

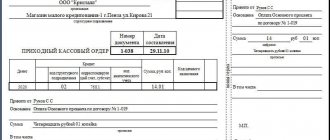

– the amount of the fine does not depend on the number of transactions that must be indicated in the notification (that is, 5,000 rubles regardless of the number of transactions) (6;

– inaccurate completion of certain details of the notification is not grounds for prosecution if this does not impede the identification of a controlled transaction;

– resolving the issue of bringing to tax liability under Art. 129.4 of the Tax Code of the Russian Federation falls within the competence of the tax inspectorate, to which the taxpayer was or should submit such a notification (7.

The specified clarifications on the application of Art. 129.4 of the Tax Code of the Russian Federation significantly simplify the interaction between tax authorities and taxpayers regarding the submission of notifications about controlled transactions.

In conclusion, I would like to note that 2021 is an important era for transfer pricing regulation. In addition to the Review of Judicial Practice of the Supreme Court of the Russian Federation, which is of exceptional importance in law enforcement, the norms of Sub. 6–7 paragraph 4 art. 105.14 of the Tax Code of the Russian Federation, reducing the number of controlled transactions, and the possibility of introducing cross-country reporting is also being considered. In order to minimize tax risks, taxpayers should conduct an audit of completed transactions, and when implementing current transactions, do not forget to adapt them to dynamically changing realities.

1. Ruling of the Supreme Court of the Russian Federation dated February 26, 2016 No. 308-KG15-16651 in case No. A63-11506/2014.

2. Tax on personal income.

3. Mineral extraction tax.

4. Simplified taxation system.

5. The main signs of receiving an unjustified tax benefit are reflected in the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated October 12, 2006 No. 53.

6. Letter of the Ministry of Finance of the Russian Federation dated October 15, 2012 No. 03-01-18/7-142.

7. Resolution of the Arbitration Court of the Moscow Region dated January 26, 2016 in case No. A40-71494/2015.

Transactions between affiliates: consequences

Interdependence is a concept very close to another, affiliation. At the same time, the fact of affiliation (established based on the criteria defined in Article 4 of the RSFSR Law “On Competition” dated March 22, 1991 No. 948-1) of the parties to a transaction in the general case does not predetermine legal consequences similar to those that characterize controlled transactions between interdependent persons .

At the same time, the legislation can highlight a number of the following responsibilities:

- for all legal entities - on the disclosure of information about affiliated entities in the financial statements (subparagraph “a”, paragraph 4, paragraphs 6, 10–15 PBU 11/2008);

- for LLCs - to ensure the storage of data on affiliated entities (Clause 1, Article 50 of the Law “On LLCs” dated 02/08/1998 No. 14-FZ);

- for JSCs - on the publication of information about affiliated entities on the Internet (clause 73.3 of the Regulations of the Central Bank of the Russian Federation dated December 30, 2014 No. 454-P).

Failure to fulfill these obligations can lead to large fines, which, in principle, are comparable to the economic risks in transactions between related parties. For example, if a JSC has not published information about affiliated entities in accordance with Regulation 454-P, it may be fined up to 1 million rubles (an official - up to 50,000 rubles) on the basis of clause 2 of Art. 15.19 Code of Administrative Offenses of the Russian Federation.

Accounting for income tax purposes

Federal executive authorities determine the income received (including revenue and profit) that was formed as a result of a transaction between mutually dependent companies or persons, provided that these incomes were not received.

The condition for accounting is the non-receipt of income as a result of differences in the commercial terms of the transaction from a similar one conducted between companies or persons that are not recognized as mutually dependent on each other.

Tax authorities (should be understood as federal executive authorities) conduct a comparative analysis, studying all the terms of transactions.

Transactions between persons recognized as interdependent are always characterized by the presence of special conditions, which, as a rule, result in an increase in the income of one organization or company at the expense of another.

Tax authorities carefully study and take control of such transactions to apply tax standards, and the transactions receive controlled status.

At the same time, there are also the concepts of an analyzed transaction and a comparable transaction, where the analyzed transaction is the one that compares the conditions of a market transaction and a transaction between interdependent companies.

Comparable is a specific transaction that is compared with the analyzed one for compliance with market conditions and those that are carried out when concluding a transaction between companies or persons recognized as mutually dependent.

Who are the stakeholders?

Affiliation is one of the possible criteria for recognizing a person as an interested party (in the context of the provisions of paragraph 1 of Article 19 of the Law “On Bankruptcy” dated October 26, 2002 No. 127-FZ). At the same time, the concept of “interest” in different legal contexts is disclosed in more than a dozen federal regulations. For example, in such as:

- Customs Code of the EAEU (came into force on July 1, 2017);

- Civil Code of the Russian Federation;

- Code of Administrative Offenses of the Russian Federation;

- Housing Code of the Russian Federation;

- Law 14-FZ;

- Law “On Credit Cooperation” dated July 18, 2009 No. 190-FZ;

- Law “On Self-Regulatory Organizations” dated December 1, 2007 No. 315-FZ;

- Law “On Anti-Dumping Measures” dated December 8, 2003 No. 165-FZ.

It may be noted that a transaction between related parties can be concluded by parties who also have the status of interested parties.

Let us consider, as an example, the features of the status of an interested party in an LLC.

The tax base

The tax base for calculating the tax applied to the company is determined taking into account the transaction price, and this price is recognized as the market price. The recognition of the price for compliance with the market price is carried out either by the tax authorities, or the original price is adjusted by the payer party to the transaction to the market value.

For example, two interdependent companies enter into a transaction, the terms of which do not differ significantly from market ones, and then independently adjust the resulting income to market income.

In this case, the tax base will be the final income and profit, taking into account adjustments or taking into account the recognition by tax authorities of income comparable to income from a regular market transaction.

Where can I download a sample approval with an interest in an LLC?

Unlike transactions between related parties, interested party agreements are not subject to control by the Federal Tax Service.

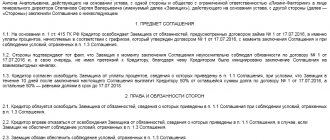

A transaction with an interest in a company that is registered as an LLC is a legal relationship in the establishment of which there is an interest of certain persons specified in paragraph 1 of Art. 45 of Law 14-FZ. For example, a director of an organization or a member of its board of directors.

In general, no one’s approval is required to enter into an interested party transaction. However, if it is not properly received, then members of the board of directors or participants of the LLC will have the right to challenge such a transaction in court if they prove that its completion caused damage to the company (clause 6 of Article 45 of Law 14-FZ).

Therefore, it is advisable to formalize this consent. You can download its sample on our website.

Interdependence doesn't count

Arbitration practice shows that there is another side to interdependence. In some cases it does not affect the price. Courts may turn a blind eye to the possible interdependence of the parties to the transaction and to the likely non-market price. They base their conclusions solely on the evidence collected and presented by the inspectorate. This turns out to be sufficient to make a decision on the merits, even if the inspectors did not delve into the issues of pricing in disputed transactions.

Arbitrage practice

Based on the resolution of the Federal Antimonopoly Service of the Ural District dated August 3, 2012 No. F09-6240/12 . According to the court, the inspectorate did not investigate the issue of the relationship between the price of transactions made by the company and the market price for the goods (work, services) purchased by it. That is, it did not prove that there are deviations from the market price. Therefore, the court did not accept the controllers’ arguments about receiving an unjustified tax benefit. The payer’s victory was also facilitated by the fact that the court of first instance, when ruling in favor of the inspectorate, did not establish the company’s ability to control the actions of its counterparties and influence relationships with them. Although, judging by the plot of the case, the tax authority’s claims did not arise out of nowhere.

In some cases, arbitrators agree that the payer and the counterparty are interdependent. At the same time, they conclude that this did not affect the price of the transactions they completed, as well as the results of business transactions, preparation of primary accounting documents, good faith in VAT reimbursement (Resolution of the Federal Antimonopoly Service of the North Caucasus District dated December 5, 2007 No. A53-1034/ 06-С6-22).

It also happens that the court establishes interdependence with counterparties; the payer does not dispute this, but declares that he did not cooperate with them during the period examined by the inspection. This is confirmed by invoices, delivery notes, payment orders, purchase books, and sales books for the period. It turns out that interdependence could not influence the terms and results of transactions at all (Resolution of the Federal Antimonopoly Service of the Moscow District dated July 2, 2013 No. A40-73621/12-91-408).

It should be noted that tax practice has not established a more or less uniform mechanism for the inspectorate to prove that interdependence has moved the price away from the market average.

Results

A transaction concluded between interdependent persons may be controlled. It can actually be concluded by interested parties, affiliates, and beneficiaries. A transaction between interdependent persons in which the tax base is underestimated may, upon inspection by the Federal Tax Service, lead to fines and additional taxes.

You can learn more about the features of legal relations involving interdependent persons in the articles:

- “Criteria for controlled transactions - table for 2019”;

- “Interdependent persons in tax legal relations - 2018-2019”.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

The concept of interdependent persons in tax legislation

To recognize mutual dependence, one must take into account the influence that one firm or person has by participating in the capital of others. Establishing interdependence is possible by concluding an agreement between persons, or in another way that allows one person to influence the decisions made by other persons.

The following are recognized as interdependent persons for tax purposes (clause 2 of Article 105.1 of the Tax Code of the Russian Federation):

- organizations when one of them has a share of more than 25% in the capital of the other;

- legal entity and individual, with the participation of the individual in the capital of the organization more than 25%;

- several legal entities and a legal entity (or individual), with the participation of one person in several organizations, when his share in each of them exceeds 25%;

- the organization and the person authorized to appoint a director, or 50% of the management of the organization;

- the person and all organizations in which they are appointed directors, or 50% of the management team;

- different organizations in which more than half of the management or board of directors are the same individuals;

- organization and its leader;

- several organizations in which the head is one individual;

- several organizations or individuals in which the first person owns more than 50% of the capital of the second, the second owns more than 50% of the capital of the third, etc.;

- individuals are recognized as interdependent persons when one individual is officially subordinate to another;

- individuals related by kinship: spouses, parents, adoptive parents, children, brothers, sisters, guardians, trustees, wards.

The share of participation of an individual in an organization is the total share of participation of the individual himself and his relatives - interdependent persons (clause 3 of Article 105.1 of the Tax Code of the Russian Federation).

Interdependent persons in tax legal relations in 2021 may be recognized as such by the court on other grounds, and not only on those provided for in paragraph 2 of Art. 105.1 Tax Code of the Russian Federation. Similarly, organizations and individuals themselves can, for tax purposes, call themselves interdependent for other reasons if their relations meet the definition of interdependence (clauses 6 and 7 of Article 105.1 of the Tax Code of the Russian Federation).

It is important to take into account that while the concepts of “affiliated” and “interdependent” persons are similar, there are differences between them, so they should not be confused. Affiliated individuals include individuals and organizations that can influence the activities of other organizations and entrepreneurs, but at the same time, affiliation is more necessary in accounting reporting, while the concept of “interdependent persons” is in tax legal relations. Also, to recognize the interdependence of persons, more than 25% participation in capital is required, and for affiliated persons only 20% of such participation is sufficient.

Interdependent structures and market prices

Transactions with related parties always mean potential risks for the participating companies. There is a high probability that the prices of goods or services specified in the agreements will seem non-market to the controllers, and the organization will have unnecessary problems and hassles.

Article 105.3 stipulates the so-called “presumption of market prices”. It is indicated that the cost of goods and services sold between non-interdependent persons a priori corresponds to the current market situation.

How, then, should we interpret the prices that arise between interdependent structures? Do tax authorities recognize them a priori as undervalued and unfair? No, in Art. 105.3 stipulates that the value is recognized as market value if the following conditions are met:

- prices comply with the provisions of antimonopoly legislation;

- the transaction was concluded on a domestic or foreign exchange during trading;

- the object of sale has undergone a preliminary independent assessment;

- the company, which has the status of the largest taxpayer, determined the cost based on an agreement with the tax service.

Important! Transactions concluded between interdependent structures during auctions and electronic trading are not recognized as obviously market ones. Tax authorities have every reason to check the pricing mechanism.

The given list of grounds for recognizing prices as market prices is not subject to broad interpretation. Obviously, it does not include most operations performed by interconnected structures. Each of them may become the object of increased interest from the Federal Tax Service.