The topic of the note sounds like - what is personal income tax in simple words and its decoding. There is a lot of information on this issue, since taxation is one of the important points in the life of Russians. It is especially important to have an idea of this concept due to the fact that many citizens in Russia will receive wages or another type of income.

This article will address various issues regarding the procedure for deducting personal income tax, the tax rate, who fills out the declaration and where it must subsequently be submitted. At the beginning of the material we will provide a decoding of the abbreviation personal income tax.

Payers and object of taxation

The personal income tax payer is the person who actually receives the income. Legislatively, such entities are divided into two categories:

- entities recognized as tax residents of Russia;

- entities that are not tax residents. In other words, non-residents.

Both categories pay personal income tax, but only at different rates. As a rule, higher rates apply to non-residents than to Russian citizens.

The object of taxation is income received by these categories of payers. At the same time, income under the Tax Code is recognized as both monetary and material forms. For example, when receiving an expensive gift, you must also pay personal income tax.

Income can be received from sources that are located both within the state and outside it (the rule is relevant for residents). If we are talking about non-residents, then they pay the fee only from sources of income located in Russia.

What type of income is subject to personal income tax:

- from the sale of property;

- from leasing assets;

- various kinds of winnings;

- other types of income received from sources outside the state. For example, dividends from shares owned by a foreign company;

- other types of income. For example, salary, remuneration, etc.

IMPORTANT: tax on the sale of property is paid only if it has been owned for less than 3 years. If real estate and other assets were owned for more than the specified period, then the subject is exempt from personal income tax.

Who is a resident and why do you need to know it?

A completely logical question arises: who is recognized as a resident and who is not? According to the law, a resident is a subject who resides in the territory of the state for more than 183 days a year. It does not matter whether such a subject is a citizen of Russia or not. For example, an individual with Russian citizenship, but living outside of Russia, will be recognized as a non-resident.

The advantage of residence is that the state has developed a list of tax deductions for such persons that reduce the base for calculating personal income tax. These are social, property and other types of deductions.

IMPORTANT: the category of the subject (resident or non-resident) affects the list of income to which personal income tax will be applied.

Tax calculation procedure

In order to calculate personal income tax yourself, you need to know two parameters:

- tax base;

- tax rate.

The first indicator is actually the amount of income received by a resident or non-resident.

The rate is a fixed amount prescribed in the Tax Code. It can be from 9 to 35%.

Having determined two indicators, you should multiply them and divide by 100.

It looks something like this: income (rubles)*rate (%)/100.

Now all that remains is to decide on the bet sizes. Most situations that happen to residents require a base rate of 13%. For example, with a salary of 10,000 rubles, the personal income tax deduction will be exactly 1,300 rubles.

A rate of 9% is used:

- dividends that were paid to shareholders before the beginning of 2015;

- interest payments on mortgage-backed bonds (the main conditions are that such bonds were issued before the beginning of 2007).

A rate of 13% is used:

- wages and other payments under the employment contract;

- payments for civil law relations;

- dividends (received after January 1, 2015);

- income from the sale of property, its rental.

Only a single type of income is taxed at a rate of 15% - dividend payments received by non-residents of Russia from domestic companies.

All income of non-residents, except those taxed at 13%, is subject to tax at 30%.

35% applies to the following types of income:

- all types of prize payments that were made as part of advertising;

- interest savings when processing loans;

- income from interest payments from deposits that exceed the established amounts.

Based on these values, we can conclude: the average resident of Russia in most cases must pay personal income tax at a rate of 13%. An exception is the winnings received, when up to 35% of the received gift or sum of money will have to be given to the state.

Tax rate in Russia

Income tax in Russia is calculated based on interest rates established by tax legislation. Indicators may vary depending on who is the taxpayer:

- 13% is the main rate at which: wages, rent, money from the sale of property and dividends are taxed;

- 9% – the indicator established for non-residents recognized as specialists or holding a patent;

- 15% – dividends received by non-residents from Russian companies;

- 30% – income of other non-residents;

- 35% - lottery winnings or competition prizes, accruals on deposits, if the refinancing rate is exceeded by 5%.

The tax code decides how much interest to charge on the payer’s income, but the tax is registered and paid by the citizen’s employer or himself.

Income not subject to personal income tax

Not all income is subject to personal income tax. This is important to know. The Tax Code has approved a complete list of cases when the fee is not withheld:

- income received by the successor on the basis of the right of inheritance;

- income under a gift agreement in cases provided for by law. These cases include a gift from a close family member: spouses, children, parents, sisters and brothers, grandparents, adoptive parents. If, by deed of gift, a certain object, a sum of money, is donated, not from a close family member, the gifted person is also obliged to pay personal income tax;

- income received from the sale of property owned for more than three years.

What income is subject to personal income tax?

Tax is paid on income received in cash and in kind. It can be:

- any payment for work - salary, fees, etc.;

- income from the sale of securities and property;

- income from property rental;

- lottery winnings, prizes and gifts from individual entrepreneurs and organizations more than 4 thousand rubles;

- real estate, car or securities received as a gift not from close relatives.

Some income is exempt from personal income tax. First of all, these are various social payments, subsidies and benefits that should improve the financial situation of the recipient, as well as pensions, scholarships, repaid debt, property and shares received as a gift from close relatives or by inheritance. In addition, you do not have to pay tax on income from the sale of an apartment and car that you have owned for more than three years. There is an additional condition for housing: it must be the only one. If you have several apartments, you can sell any of them without taxes after five years of ownership.

Who pays tax for you

According to the Tax Code, there is such a category as a tax agent. This is an individual or legal entity who is legally entrusted with the function of withholding and transferring personal income tax to the budget. The most popular tax agent representative is the employer. It is obliged to withhold income tax from wages and other accruals from all its officially registered employees.

For example, a company pays its employee a salary of 20,000 rubles. Of this, 13% will be withheld. This is 20000 * 0.13 = 2600 rubles. The company will transfer the indicated 2600 to the budget.

Important: the calculation was made without the use of tax deductions, which can also reduce the tax base even when calculating personal income tax from wages.

Also, tax agents are often organizations that hold drawings for valuable prizes. They are entrusted with the obligation to collect income tax from the subject and transfer it to the budget. This issue is especially controlled by the Federal Tax Service in case of cash prizes.

My contract states that the salary includes personal income tax - this means what amount

You will be paid your salary minus personal income tax. But, in accordance with paragraph 1 of Art. 24 of the Tax Code, tax agents are persons who, in accordance with the law, are entrusted with the responsibility for calculating, withholding and remitting taxes. In particular, these are Russian organizations, individual entrepreneurs, notaries engaged in private practice, lawyers who have established law offices, as well as separate divisions of foreign organizations in the Russian Federation from which (or as a result of relations with which) the individual received income. From this point, by virtue of clause 2 of Art. 226 of the Code, the tax agent is obliged to calculate, withhold and pay the appropriate amount of personal income tax. The exception is income for which the calculation and payment of tax are carried out in accordance with Art. Art. 214.3, 214.4, 214.5, 214.6, 226.1, 227 and 228 of this Code.

Meanwhile, it is not entirely correct to indicate wages taking into account personal income tax, since it is not possible to determine in advance the specific amount of personal income tax that will be withheld and transferred to the budget from the employee’s salary. Therefore, there is no need to fix it in the employment contract. Moreover, in accordance with Part 1 of Art. 136 of the Labor Code, when paying wages, the employer is still obliged to notify each employee in writing about the components of the wages due to him for the relevant period, about the size and grounds of deductions made, as well as about the total amount of money to be paid.

Who is obliged to pay personal income tax on their own and when?

When it comes to an employee, the employer pays the fee for him. But there are situations that oblige the subject to independently calculate and pay income tax. In case of violation of payment discipline, administrative liability is applied to an individual.

When you need to pay personal income tax yourself:

- renting out property to others. At the same time, for residents it makes no fundamental difference where such property is located - in Russia or abroad;

- sale of real estate and other objects if they have been owned for less than 3 years;

- receipt by citizens of various kinds of gifts from persons who are not recognized as close relatives. True, the main condition is the official nature of the gift;

- remuneration from others. As an option, payment of monetary compensation to the teacher-tutor. True, you need documentary evidence that the teacher received the money;

- winnings received as a result of a lottery, drawing, etc.;

- royalties from copyrights and other intellectual property;

- interest payments on deposits, but provided that such income exceeds the Central Bank discount rate + 5% (if the deposit is in rubles) or + 9% if the funds are kept in foreign currency.

Also, do not forget that all persons who carry out private practice are also required to pay the specified fee. That is, private lawyers, attorneys, and notaries are required to independently carry out calculations and pay personal income tax. The same obligation is assigned to individual entrepreneurs, who pay for themselves, as well as for employees.

The evolution of scientific thought about the criteria for tax classification. Personal income tax (NDFL)

The classification of taxes means their grouping, determined by certain goals and objectives. Today, there are a considerable number of different tax classification characteristics [6, p. 142]. When scientists began to find out what underlies the division of taxes, it turned out to be very difficult to establish a criterion for such division. In financial science, the division into direct and indirect taxes was first given by D. Locke at the end of the 17th century. The division was based on the criterion of tax transferability. The classification of taxes, which was based on the principle of transferability or non-transferability, lasted throughout the 17th-19th centuries.

The second way of dividing taxes into direct and indirect was the differentiation of taxes according to the method of taxation and collection. Direct taxes are based on phenomena and signs of a permanent nature and are therefore predeterminable (ownership or use of property). They are collected according to personal, periodically compiled lists of payers based on the cadastre (land, houses) and within certain periods. Indirect taxes come from changing phenomena, from individual actions, facts, such as, for example, from various acts of consumption, transactions, services, taxed on the basis of certain tariffs [5, p.32].

In the third way, when determining solvency directly, direct taxes were levied, and when indirectly, indirect taxes were levied. This position was concretized by the German economist Haeckel, who divided all taxation into income taxation and taxation of consumption expenses. According to Haeckel, the taxpayer's economy is divided into income and expenses. Income and property taxes (land, house, trade, cash capital and personal labor) were classified as direct, and taxes on expenses, i.e. on consumer goods - to indirect taxes. This division of taxes was based on the solvency of a person, determined by his income and property, as well as on the connection between the payer’s income and his consumption.

The division of taxes into direct and indirect based on the income-expenditure principle, established by financiers at the beginning of the 20th century, did not lose its significance at the end of the 20th - beginning of the 21st century. In the Russian Federation, division was introduced by the tax reform of 1991. Imperfect classification of taxes led to a reduction in the number of taxes. In the 20s XX century A turnover tax was introduced, thanks to which excise taxes on consumer goods were abandoned, for which the tax was called a universal excise tax. The trade tax was eliminated, which was transformed into a profit tax and a turnover tax. The income tax was adjusted taking into account world practice [3, p.54].

As a result of transformations in the 1990s. Tax legislation was simplified and now began to consist of a small number of taxes, which eliminates the need to divide taxes in the budget into direct and indirect. The simplicity of taxation makes it possible to provide the treasury with revenues at minimal costs; it makes it understandable to the taxpayer and develops a sense of responsibility, forcing them to refuse the temptation to evade paying taxes. The division of a single budget into appropriate levels in modern conditions has led to the fact that taxes began to be divided into levels - federal, regional and local taxes.

In the tax system of the Russian Federation, reformed taking into account international practice, taxes are for the first time divided into three types and enshrined in part one of the Tax Code of the Russian Federation, which came into force on January 1, 1999 [2, p. 162]:

- federal taxes and fees (value added tax, excise taxes, personal income tax, unified social tax, corporate income tax, mineral extraction tax, water tax, fees for the use of wildlife and aquatic biological resources, state duty) ;

- regional taxes (organizational property tax, gambling tax, transport tax);

- local taxes (land tax, property tax for individuals).

In modern economic literature, tax classifications are understood as their groupings, determined by certain goals and objectives. Since the goals and objectives of legislators are different, there are a large number of different classifications, but the most common are the following. The traditional tax system is based on the division of taxes into several classes: direct taxes; indirect taxes; fees and duties. The international classification of taxes and fees is based on the criterion of dividing taxes by object of taxation. Within groups formed based on the object of taxation, taxes are further subdivided according to various classification criteria (for example, based on the subject of taxation: levied on individuals and legal entities, etc.).

The main classification characteristics of taxes are presented in Table 1 [5, p.65].

Table 1 – Classification characteristics of taxes

| Classification feature | Types of taxes | Characteristics of species |

| By method of collection | Direct | Taxes levied on the property or income of individuals or legal entities. |

| Indirect | Taxes on goods and services included in the price of a product, that is, these are taxes paid by consumers | |

| By object of taxation | Property taxes | Taxes the object of taxation of which is property (organizational property tax) |

| Income taxes | Taxes, the object of which is income (personal income tax) | |

| Resource taxes | Taxes that are subject to taxation of any resources | |

| By sources of payment | Action taxes | Taxes, the object of which are any actions in the monetary sphere (VAT) |

| Taxes paid on revenue | VAT, excise taxes | |

| Taxes expensed | Transport tax, property tax |

Continuation of Table 1

| Classification feature | Types of taxes | Characteristics of species |

| Taxes paid from taxable income | Income tax | |

| Taxes paid on income | Personal income tax | |

| By target orientation | General (budget) taxes | Taxes intended to generate revenue for the budget as a whole, used for national purposes |

| Special (targeted) taxes | Taxes that have a strict target orientation and are assigned to certain types of expenses (for example, transport tax) | |

| By subject of taxation | Taxes levied on individuals | Personal income tax |

| Taxes levied on legal entities | Income tax | |

| Mixed taxes | Transport tax | |

| By budget level | Sticky taxes | Taxes that go entirely to a particular budget (land tax) |

| Regulatory taxes | Multi-level taxes, that is, taxes the proceeds of which are distributed between the corresponding budgets | |

| By management level | Federal | First-level taxes, which are established by the Tax Code of the Russian Federation and are obligatory for payment throughout Russia (VAT, excise taxes, personal income tax, income tax, etc.) |

| Regional | Second-level taxes, which are established by the Tax Code of the Russian Federation and the laws of the constituent entities of the Russian Federation on taxes and are obligatory for payment in the territories of the relevant constituent entities of the Russian Federation (transport tax, property tax of organizations) | |

| Local | Third-level taxes, which are established by the Tax Code of the Russian Federation and regulatory legal acts of representative bodies of municipalities and are obligatory for payment in the territories of the corresponding municipalities (land tax). | |

| By tax rates | Solid | Taxes in which the tax rate is set as a fixed value (transport tax) |

| interest | Taxes in which the tax rate is set as a percentage of any indicator (VAT, personal income tax) | |

| Combined | Taxes in which the tax rate is set as a fixed value and as a percentage (excise tax) | |

| By the nature of interest rates | Proportional | Taxes with a fixed rate |

| Progressive | Taxes, the rate of which increases when the tax base reaches a certain value | |

| Degressive | Taxes, the rate of which decreases when the tax base reaches a certain value. |

Of course, the list given in Table 1 is not exhaustive. However, it reflects the main classification criteria given in various economic literature.

Personal income tax (NDFL) is a federal direct (income) tax. This tax is provided for in Ch. 23 of the Tax Code of the Russian Federation, which has been in force since January 1, 2001.

According to paragraph 1 of Art. 207 of the Tax Code of the Russian Federation the following are recognized as personal income tax payers [8]:

- individuals who are tax residents of the Russian Federation;

- individuals receiving income from sources in the Russian Federation who are not tax residents of the Russian Federation.

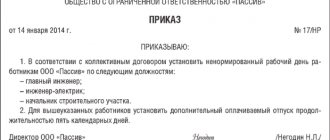

All organizations that are tax agents for personal income tax must submit to their Federal Tax Service:

- quarterly - calculation according to form 6-NDFL. Read about how to fill it out here;

- annually - certificates in form 2-NDFL. Read about how to fill it out here.

In addition, JSCs that paid dividends to individuals must reflect them in Appendix No. 2 to the income tax return for the year of payment of dividends (clause 4 of Article 230 of the Tax Code of the Russian Federation, clause 1.8 of the Procedure for filling out the declaration, Letter of the Federal Tax Service dated June 20, 2014 N GD-4-3/ [email protected] ).

The basic tax interest rate is 13%. But the rate for some types of income differs from the standard one.

Such income includes: prizes and winnings in an amount exceeding 4 thousand rubles (35%); interest income received from deposits in banks, if the amount of interest received exceeds the amount of accrued interest on a deposit in rubles, calculated at the refinancing rate of the Central Bank of the Russian Federation plus 5%; if the deposit is in foreign currency, then from an amount of interest exceeding 9% per annum (35%); dividends received by non-residents of the Russian Federation from equity participation in the activities of Russian organizations (15%); direct income of non-residents of the Russian Federation (30%). 6-NDFL calculations and 2-NDFL certificates for individuals who received income from the organization itself (its head division) must be submitted to the Federal Tax Service at the place of registration of the organization.

And calculations and certificates for individuals who received income from a separate division (SU) of the organization are submitted:

- by the largest taxpayers (TTPs) - at the choice of the organization in the Federal Tax Service Inspectorate at the place of registration of the EP or in the Federal Tax Service Inspectorate at the place of registration as a Taxpayer;

- other organizations - to the Federal Tax Service at the place of registration of the OP.

Calculation of 6-NDFL must be submitted within the following deadlines (clause 2 of Article 230 of the Tax Code of the Russian Federation):

- for the first quarter, half a year and 9 months - no later than the last day of the month following the reporting period;

- for the year - no later than April 1 of the following year.

For the first time, the 6-NDFL calculation must be submitted for the first quarter of 2021. The deadlines for submitting the 6-NDFL calculation in 2021 are as follows [8]: for the first quarter of 2016 - no later than 05/04/2016; for the first half of 2021 – no later than 08/01/2016; for 9 months of 2021 – no later than October 31, 2016; for 2016 – no later than 04/03/2017.

If you do not submit the 6-NDFL calculation on time, then two fines may be imposed simultaneously [8]:

- per organization - in the amount of 1000 rubles. for each full or partial month of delay;

- for an official of the organization - in the amount of 300 to 500 rubles.

In addition, if the 6-NDFL calculation is not submitted within 10 working days from the deadline for its submission, the Federal Tax Service will be able to block the organization’s bank accounts.

Thus, the tax system of a modern state is an effective and universal mechanism for regulating macroeconomic processes occurring in society. With the help of taxes, the state can stimulate investment activity, implement financial and economic policies, support economic development, carry out social regulation and even solve political problems.

How to pay tax yourself

The main thing to understand is that the responsibility for calculation and payment rests with the payer who received the profit. Therefore, even if the tax office does not send a notification with the amount due, the entity must independently calculate and pay the money.

This process can be divided into two stages:

- filing a personal income tax return. This paragraph applies to those persons who have not received any notifications from the Federal Tax Service. They are required to submit a declaration to the Federal Tax Service by April 30 of the year following the one in which the operation was performed. For example, if an apartment was sold in 2019, then the declaration must be submitted by April 30, 2021.

IMPORTANT: if April 30 is a holiday or day off, the payment deadline is postponed to the next first working day.

- payment of the tax calculated in the declaration. A person must pay his debts by July 15 of the following year.

The difference between the deadline for filing a declaration and payment is created purposefully. Federal Tax Service employees will be able to conduct a desk check of documents and, if necessary, inform the payer about the mistake.

How is tax calculated?

The formula was already presented in the article earlier. The principle is simple: the amount of income is multiplied by the rate.

Important: it is not the income that is actually taxed, but the payer’s profit. Therefore, if a person can prove previously incurred expenses, then he does so. Otherwise, he can use various tax deductions. They reduce the tax base and, accordingly, the personal income tax itself.

Example: a car owner sells a car for 1 million rubles. He owned it for 1 year. How much should he pay?

There are two calculation options here:

- if the owner has documents confirming the purchase of the car. For example, a purchase and sale agreement, which states that the car was purchased for 500,000 rubles;

- if there are no documents.

First option:

- The actual profit from the transaction is 1,000,000-500,000 = 500,000 rubles - this is the basis for calculation.

- Personal income tax will be 500,000 * 13/100 = 65,000 rubles.

Second option:

- The income is 1,000,000 rubles, but the Tax Code provides the citizen with the opportunity to use a deduction - a maximum of 250,000 rubles. Therefore, the base will be equal to 1,000,000-250,000 = 750,000 rubles.

- Personal income tax = 750,000*13/10 = 97,500 rubles.

Conclusion: the first option is more profitable than the second. Therefore, you should always keep papers confirming the costs of purchasing valuables.

What tax breaks are there for personal income tax?

These are different types of deductions. For example, if you sold an apartment or car that you owned for less than three years, you must pay 13% on the money received. But you can reduce your taxable income by an amount specified by law. For housing this is 1 Article 220. Property tax deductions are million, for a car - 250 thousand. So, if you bought an apartment for 2 million, you can take advantage of the deduction and pay tax on only 1 million.

There is another relaxation for housing: if you sold an apartment for 2 million and bought it for 1.5 million, then the income is equal to the difference between these figures. Tax is paid on only 500 thousand. If you sell it cheaper than you bought it, you won’t have to pay tax at all. It is only important that you have documents that confirm the expenses - a check from the developer or a receipt from the seller.

In addition, there are deductions related to your life circumstances that allow you to return your personal income tax in part or in full. Here's what they are like:

- Property - when buying a home, building a house, paying off interest on a mortgage loan, buying property from you for municipal and state needs.

- Standard - for parents and adoptive parents, disabled people, Heroes of Russia, liquidators of the Chernobyl nuclear power plant accident.

- Social - for training, treatment, charity, insurance, including non-state pension.

- Investment - if you transferred money to an individual investment account.

- When carrying forward losses from transactions with securities, derivative financial instruments, and from participation in an investment partnership.

To find out more, read Lifehacker's great article on tax deductions.

Personal income tax payment deadline

If a tax agent is involved in the payment process, then the payment deadline is considered to be the day following the payment day. For example, if the salary was paid on August 5, then on August 6 the employer must transfer the tax to the budget.

If a person is obliged to pay the payment on his own, then the deadline is until July 15 of the year following the year in which the income was received.

INTERESTING: now every citizen of the Russian Federation has the opportunity to pay taxes, fines and other fees both for themselves and for their relatives. In this case, payment can be made from one card.

You can pay personal income tax yourself in several ways:

- Through the official website of the Federal Tax Service. To do this, you need to have a personal account on the website.

- Through the portal "State Services". Likewise, an authorized profile is required.

- In any bank, using a mobile application, Internet banking or simply by coming to the branch. The main thing is to have a payment order for payment, since it indicates the necessary details of the specific Federal Tax Service. You can also generate a payment document on the Federal Tax Service website or the State Services portal.

Where does personal income tax go?

All taxes go to the budget. The only difference is what level of budget. All taxes of individuals and legal entities form first the budget of the constituent entities of the Russian Federation, and then the general federal budget.

Regarding personal income tax, the proportion is somewhere like this: 85% of all deductions go to the regional budget of the constituent entity of the Russian Federation, and the rest is already distributed between local budgets. This is an approximate distribution. Each year this proportion can be adjusted, but not significantly.

What is it for?

Having figured out how personal income tax is deciphered, it’s worth saying a few words about its purpose. The money received from the earnings of each citizen goes to the federal budget and is subsequently distributed in various social areas:

- payment of benefits to pregnant women;

- reimbursement to students paying tuition fees;

- refund when purchasing real estate;

- payments for child care.

These options for spending the received tax are not limited, but are carried out within the framework of existing state programs that provide assistance to the population in the event of certain cases.

Tax deductions

A tax deduction is a kind of fixed discount from the state for its citizens. Its size and possibility of application depend on the specific situation. In general, the algorithm of use is simple:

NFDL = (Income – Deduction amount)*13%/100.

In addition, the deduction allows the taxpayer, under certain circumstances, when expenses are incurred, to return some part of them.

There are these types of deductions:

- standard;

- social;

- investment;

- property;

- professional;

- deductions for transactions with the Central Bank.

Deductions

For personal income tax, decoding is extremely simple. But it cannot be said that in some cases taxpayers can receive a tax deduction. That is, return 13% from the completed transaction. This opportunity applies only to those who pay income tax.

You can get your money back for real estate transactions (including mortgages), as well as for treatment, training and the purchase of any goods. If you have minor children, you have the right to a special deduction. It's called "For Children." Due to it, the tax base from which you pay personal income tax is reduced. A very useful thing.

All deductions are processed by the tax authorities if there is an application, evidence of expenses, income subject to income taxes, as well as other important documents. This includes: TIN, SNILS, marriage/divorce/birth certificates, accreditations and licenses, certificates of ownership of something. The declaration is also mandatory. So remember: if you pay personal income tax, in some cases you can get a tax deduction for yourself. It's not that difficult really!

The procedure for obtaining a tax deduction

In order to apply a deduction when paying personal income tax, it is enough to indicate it in the declaration itself. In some cases, papers confirming the right to use it may be required.

If we are talking about deductions that are compensated from the budget, then there is a slightly different algorithm. The subject actually collects documents confirming his expenses, for example, for medical care, fills out the same 3-NDFL declaration and submits it to the Federal Tax Service. The tax office checks the papers and transfers the due refund to the bank account.

What happens if you don’t pay personal income tax?

What happens if you don't pay? This is the question that interests many citizens. There are several options for the development of events:

- First, additional fines and penalties are assessed. We remember that the penalty is charged for each day of delay and depends on the key rate of the Central Bank - 1/300 of the key rate per day. The fine will be up to 40% of the debt amount. At the same time, they are fined not only for non-payment, but even for failure to submit a declaration;

- then representatives of the Federal Tax Service will go to court and involve bailiffs in the work. Then seizure of property, blocking of accounts, and a ban on traveling abroad may be applied.

In exceptional cases, not administrative, but criminal liability may arise. True, it arises only if the total tax debt for three years amounts to 900 thousand rubles. or 2.7 million for the entire period.

What is a 2-NDFL certificate?

Certificate 2-NDFL is a document that also contains information about the tax in question. But this is a paper that is generated by the employer and provides information about the actual accrued and received income of an individual for a specific period of time.

The document may be needed in various situations:

- when applying for social benefits;

- when applying for a visa, traveling abroad;

- when receiving a loan;

- when receiving a tax deduction.

IMPORTANT : 2-NDFL and 3-NDFL are completely different documents.

Declaration 3-NDFL - terms and procedure for tax payment

Subjects who are independently required to calculate and pay the fee fill out the 3-NDFL declaration. This is a unified form. Other forms are not accepted. available on the Federal Tax Service website. The declaration can be filled out manually or on a PC. There are many free services that help you fill out a document automatically.

The deadline for filing the declaration is April 30 of the following year.

What information is indicated in 3-NDFL:

- personal data;

- the type of income and its amount that was received last year;

- type and amount of tax deduction, if any;

- calculation of personal income tax itself.

You can submit a declaration in paper form, directly visiting the Federal Tax Service office or sending it by mail, as well as through your personal account of the Federal Tax Service, by email. But if the subject uses a tax deduction in the calculation, then he is additionally obliged to provide documents confirming this right. Such documents are not always required, since Federal Tax Service employees have access to various databases, but upon request, the citizen must submit them (if he did not submit them by photocopier during the initial application).

How to calculate personal income tax from salary: calculation formula

Employers calculate the tax base for employee income, taxed at a rate of 13%, based on the results of each month on an accrual basis from the beginning of the year (clause 3 of Article 226 of the Tax Code of the Russian Federation). The amount of income the employee receives must be reduced by the personal income tax deductions provided to him (clause 3 of Article 210 of the Tax Code of the Russian Federation). That is, the tax base is calculated using the formula:

Once the tax base for personal income tax has been determined, you can proceed to calculating the tax itself using the formula:

To calculate personal income tax, which must be withheld from the employee’s income for the current month, you need to use another formula:

Do not forget that personal income tax is calculated in full rubles. This means that the calculated tax amount must be rounded: amounts less than 50 kopecks are discarded, amounts 50 or more kopecks are rounded to the nearest ruble (Clause 6 of Article 52 of the Tax Code of the Russian Federation).

Electronic services

The most popular services for calculating and paying personal income tax are:

- taxpayer account on the official website of the Federal Tax Service;

- portal "Government Services".

Here you can not only download the declaration form, find out your tax debts, but also even pay your independently calculated personal income tax liability.

Thus, personal income tax is a mandatory tax on personal income, which is paid by all persons who received income both in Russia and abroad. Rates are ranked by population, although the most popular rate is 13%. Concealing income and non-payment of fees may result in administrative and even criminal liability.

Procedure for calculating personal income tax: calculation example

/ condition / Salary E.O. Ivanova is 36,000 rubles. per month. She has a daughter aged 12, due to which E.O. Ivanova is provided with a standard deduction for a child in the amount of 1,400 rubles. per month. In addition, in April she was paid an additional bonus of 12,000 rubles. Let's determine the amount of personal income tax withheld from the employee's income for the month of April.

/ decision / The tax base for personal income tax for January-April will be:

36,000 rub. x 4 months + 12,000 rub. – (1400 rub. x 4 months) = 150,400 rub.

Personal income tax amount for January-April: 150,400 rubles. x 13% = 19,552 rub.

Personal income tax withheld from the employee’s income for January-March:

(36,000 rub. x 3 months – (1,400 rub. x 3 months)) x 13% = 13,494 rub.

Personal income tax withheld from income for April: RUB 19,552. – 13,494 rub. = 6,058 rub.