Account 62 is intended to reflect settlements with customers. Sales debt owed to the buyer is reflected in the debit of this account. It is still included in the accounts receivable department.

Determination of debt to suppliers

In the business world, there is a common accounts payable for suppliers in invoice number 60.

Let's look at two main players:

- A supplier is a company that provides finished products for sale.

- A customer is a company that purchases something from a supplier.

A debt will arise if payment is not made immediately or there is an error in the calculations.

The loan must be repaid after:

- Agreement to payment is accepted by the customer.

- Goods were accepted that did not have the necessary documents.

- Excesses or inconsistencies are detected.

Debt may arise if payment for products or other work is not made on time.

Full repayment of debts to suppliers

In order for the amount of debt to be transferred to the supplier, the bank must document the fact of the required transfer. For confirmation, you will need to provide bank account statements and all relevant receipts.

Difficulties may arise if the terms of the contract or mutual agreement are not observed. The supplier may offer payment in installments with interest if it is impossible to repay the debt to the partner. The terms and interest rate are determined on the basis of a bilateral agreement.

For example, a creditor company gives the customer a certain time to return the money. During this time, the debtor is obliged to return the funds, covering the costs of caring for the safety of the products instead of interest.

Settlement of mutual claims

Contractual obligations are the amount of creditor or debtor arrears, formed based on the results of settlements, delivery of goods, budget allocations, etc. Debts are accounted for by the accounting department in the following accounts: 60, 62, 66, 67, 68, 69, 70, 71, 73, 76 ,58.

The procedure for terminating mutual arrears through offset is regulated by Art. 410 of the Civil Code of the Russian Federation, involves repaying loan turnover with a debit balance. That is, neither party to the relationship makes an actual payment of funds, and the debt ceases to exist.

This event has many subtleties, legal nuances, and requires detailed study, consideration and agreement with qualified specialists. It is important to understand that unilateral manipulations are unacceptable; the transaction must be concluded in writing by mutual agreement of the parties. An additional aspect can be noted that the main contracts contain no conditions prohibiting similar actions by counterparties.

To repay the debt, two basic rules must be observed: the parties do not dispute the existence and size of the arrears, the claims are uniform. The creditor and debtor must have on hand primary documents drawn up in accordance with accounting standards. A signed bilateral reconciliation report without objections will indicate the consistency of the settlement status of both companies.

The parties to the relationship may agree to terminate the existence of debts

To assess the legality and correctness of the transaction, the debts to be offset must be of the same nature. For example, a company has a payable for electricity to a supplier, and the counterparty leases transport from this organization, for which money has not yet been transferred. Debt settlement will be the best option for resolving the dispute and continuing productive cooperation.

Based on Art. 411 of the Civil Code of the Russian Federation, it is impossible to repay arrears according to the following requirements:

- Compensation for damage caused to the life, health, and property of an individual.

- Expenses for the lifelong provision of a certain citizen.

- Cash payments for the maintenance of children and disabled relatives.

- If the debt has expired, etc.

Documenting

Any party to contractual obligations may initiate the procedure by sending a letter to the counterparty. To do this, it is enough to wait until the arrears repayment deadlines specified in the basic contract are missed.

The addressee of the application considers the intention and enters into negotiations. If the outcome of the case is positive, the parties to the relationship sign the agreement in duplicate. To eliminate potential risks and unfounded claims, it is recommended to indicate the following details on the form:

- Name of the form.

- Date and place of compilation.

- Name of the parties' authorized representatives.

- Identification data of the main contracts (number, date, subject).

- The amount of claims to be paid.

- The essence of the agreement.

- Details of the parties.

- Signatures, seals (for legal entities).

Proper documentation of the procedure will avoid various problems in the future.

Business transaction in accounting

The accountant of each party must reflect the entries for closing debts on the basis of the form signed by the parties. The procedure is formalized by a certificate or adjustment of the debt. The accounting registers reflect correspondence postings of accounts 60, 62,76.

Transactions must be reflected on the day of the offset. For an enterprise under the general taxation regime, such measures do not in any way affect the tax base for personal income or profit. Companies using the simplified tax system are required to increase income, and the amount of receivables for purchased goods and materials must be included in costs.

Here is a typical entry when a short-term loan debt to a bank is repaid using the debtor's contribution: D-66, K-51.

Types of debt to suppliers

The conditions described above apply to any outstanding loan. Adjustments are possible only in individual cases. Accounts payable to suppliers, reflected in the balance sheet account in line 60, can be of the following types:

- supply of products and services;

- financial loan;

- commercial bills;

- advance and prepaid;

- payment of claims;

- obligations on other loans.

Uninvoiced deliveries are quite common. They are transferred to the company as a debt, since they do not have the necessary documents to make the payment. There are no problems if the customer has the means to pay. It all depends on the type of debt, its short-term nature and duration.

You definitely need to clarify whether the goods were paid for without documents or not, so as not to create unnecessary problems for yourself and your partner. It can be accounted for as being on the way, or it has already been added to accounts receivable. The cost of such supplies can be determined using other documents.

BIT.Business Analysis - a modern analytical tool of the Business Intelligence class

Monitor the work of all company personnel using numerous real-time reports.

You can order a ready-made Cash Flow Report dashboard or develop your own together with our specialists.

- Access to ALL information about controlled processes;

- Squeezing key information into convenient charts;

- Instant identification of problem situations;

- The effect of the “all-seeing eye” from anywhere in the world.

More details Order

Payments to suppliers: postings and reflection on accounts

In the bay. In accounting documents, this position is reflected in account No. 60. When compiling the organization’s balance sheet, this indicator is necessarily reflected. By its structure, it is both a passive and an active account. It includes both debit receipts (advances and prepayments) and credit funds.

Entries in it are made on the basis of documents sent by the supplier:

- packing list;

- certificate of work done;

- invoice, etc.

All numbers that are entered into the account must be displayed on time, doing this regardless of any events. The amounts should be indicated in accordance with the available settlement documentation.

All debts are written off according to the conditions specified in PBU No. 34. The maximum limitation period is 3 years. In parallel with the sixtieth account, you can control monetary and material transactions with counterparties in reporting journal No. 6. It includes analytical and synthetic types of accounting.

Working with accounts receivable

The accrual of debt for value added tax on shipped products is reflected as follows D-t 90 Sales The planned standard cost of products shipped to customers is 150,000 rubles, and the contract price is 240,500 rubles. on

Depending on the terms of payments established in contracts with buyers for products sold (work, services), the debit balance of account 62 “Settlements with buyers and customers” can be reflected as part of either short-term or long-term receivables.

Regulatory acts Accounting entries when writing off accounts receivable. Creditor 3. Accounting upon expiration of the statute of limitations on a claim related to the return of the transferred advance payment.

Draw up the opening balance of the organization as of 10/01/20__. based on the initial data below.

Covering debt in cash

When performing such operations, the following posting should be made: D 60 K 50. In this case, the following subaccounts can be used for account No. 50:

- from the main cash register of the organization;

- from commodity checkouts;

- bills, other financial documents.

Based on the cash order, in addition to the accounts and balance sheet, all money transfers made should be additionally entered into the cash book.

From personal account

Posting D60 K51 is carried out if the payment was made by bank transfer and is recorded in 51 accounts. The company can create a separate column for each counterparty. The basis in this case is a bank statement, receipt or other supporting document.

Despite the fact that different types of repayment of incurred accounts payable are recorded in different accounts, the link for all of them is No. 60, where the final indicators are entered. It is in accordance with it that all operations are carried out.

In order to avoid large losses, you need to know how much was transferred from the current account to repay debts to suppliers for materials, goods and services; it is important to track all these numbers.

If the letter of credit has been received and the money has reached the addressee, the debt is considered fully repaid. All payment documents after each transfer of money, as well as data on transactions, must be displayed in the relevant sections of the balance sheet, in the case when the loan is being paid in installments.

SOUTH URAL STATE UNIVERSITY

On the balance sheet, the asset is on the left and the liability is on the right. Active-passive accounts can be displayed at a time in the balance sheet.

VAT 18%. VAT allocated - 45.7 thousand rubles. Debit 10 – 254.2 thousand rubles. Debit 19 – 45.7 thousand rubles. Credit 60 (Payment for contractor services) – 300 thousand rubles.

Several departments worked together: the registration department and the accounting department. They worked clearly and harmoniously.

In other cases, in order to receive your money, you will have to prepare a claim against the debtor, since now in order to go to court in this category of cases, a mandatory claim procedure is required. If the balance is on credit, then the debt must be repaid. If it's debit, then claim it. If an act of services was made, but it was not signed, and the contract was terminated, then it is reversed with an explanatory note.

VAT is considered and payable on advances received. Then, when goods, works or services are transferred to the buyer, VAT is charged again, this time on the proceeds.

How to smartly remove 62-hour debt. if mastiff terminated... so as not to dangle before your eyes...

The obligations of other legal entities and individuals for settlements in relation to an enterprise or organization are called accounts receivable, and these persons themselves are called debtors.

Analytical accounting for accounting account 60 is carried out separately, in the context of each presented invoice.

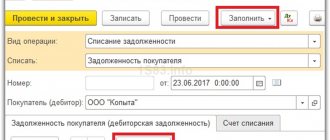

How to prepare a report on debts to suppliers by debt terms in “1C: Accounting 8” (rev. 3.0)?

In order to divide accounts payable by periods of occurrence, as well as display the amount of overdue debt, you need to prepare a report “Debt to suppliers by debt period”.

Section: For the manager – Debt to suppliers by debt terms.

Select an organization if the program maintains accounting for several organizations, and set the date on which the report will be generated.

Click the “Show settings” button to specify report generation parameters.

On the “Setting Intervals” tab, you can configure the number and duration of periods (intervals) according to debt terms.

On the “Grouping” tab, select indicators for grouping data in the report: “Supplier”, “Contract”, “Document”. Additional indicators can be added using the “Add” button.

On the “Selection” tab, select the indicators for selecting data for the report and specify the type of comparison and selection value. You can add indicators by clicking the “Add” button. For example, a report can be generated for a specific supplier (comparison type – “Equal”). In addition, at the bottom, using the link “Set up accounts payable,” you can exclude individual accounting accounts from the analysis.

On the “Sorting” tab, configure the data sorting parameters for output to the report. You can add indicators by clicking the “Add” button.

On the “Design” tab, configure the font, color, and borders of report fields according to certain conditions (add new parameters using the “Add” button).

"Generate" button.

The payment period for determining overdue debt is taken into account as follows:

- the date on which the report is generated is compared with the date on which payment must be made to the supplier (the “Payment due date” field in the “Calculations” form, which is opened by clicking on the link in the field of the same name in the receipt document).

- the date on which payment must be made to the supplier is indicated in the “Settlements” form in the receipt document automatically according to the payment deadline specified in the contract. If it is not specified, then according to the default payment period to suppliers (section “Purchases – Supplier Payment Period”) and can be changed manually;

- the debt is considered overdue if the date of generation of the report is greater than the deadline for payment to the supplier according to the receipt document.

The debt to the creditor was repaid from the current account by posting

Accounts receivable are reflected in accounting in the amounts determined by the parties in the relevant agreements and recorded in primary accounting documents (acts, invoices, etc.).

However, if debtors violate contractual obligations regarding the procedure and timing of payments, the initially recognized actual amount of receivables as of certain reporting dates may not reflect the real assessment of the organization’s assets.

Any information about actions performed on accounts is marked with a double entry, i.e. in the debit of one account and in the credit of another, for an identical amount.

It must contain information about each debtor, the amount of the debt, the reason for its occurrence, as well as documents regarding the receipt of funds to repay the receivables. In your accounting, you must reflect the following entries: Receipts from debtors to repay the debt. what wiring should I make? One main D 51 K 76/62 It’s great when they pay money.

Accepted for payment is the invoice of a) the transport organization for the delivery of materials to the enterprise (16 invoice) D16 K60 b) VAT on transport services (20 D18 K60 10.

The amount of the reserve is determined separately for each doubtful amount of debt. Formation of the reserve since 2011. became the responsibility of enterprises. How to reflect in the accounting records of an educational institution the receipt of receivables to a personal account opened with the Federal Treasury?