Concept and features of a budget organization

Budgetary institutions are organizations that are financed from budgetary funds and on the basis of approved estimates. The affiliation of an organization with a budgetary institution is determined by the relevant financial authorities and is recorded in the constituent documents.

The Federal Treasury of the Russian Federation is responsible for accounting for operations on the movement of budgetary funds. This body also draws up and approves the accounting methodology in budgetary institutions, as well as the reporting procedure.

Accounting in budgetary organizations has a number of features that differ from the accounting procedure in industrial and commercial enterprises. These include the availability of approved cost estimates and control of their execution, and the use of budget classification, which is the basis for organizing accounting in the institution.

Funding of budgetary institutions is carried out in compliance with the following basic principles:

- Irrevocability. Non-production organizations that are financed from budget funds do not have their own income, so returning funds to the budget is impossible.

- Intended use. When approving expenses provided for in the organization’s activity plan, their amount must be used strictly for their intended purpose.

- Actual execution. Funds received by a budgetary institution are issued not in accordance with the plan, but according to actual use as the funds are disbursed.

Compliance by budgetary institutions with the basic principles of financing is controlled by law.

Hello student

Accounting in educational institutions

0 Economics of Education

“Accounting in Educational Institutions”

(OZO 2nd year 4th semester) Computer Science

Completed by: Zyukova A.V.

Checked by: Makukha N.A.

year 2013

Features of accounting in educational institutions Responsibility for the organization of accounting, for compliance with the norms of current legislation when performing financial and business transactions and storage of accounting documentation lies with the heads of educational institutions in accordance with the provisions of the Federal Law of the Russian Federation of November 21, 1996 No. 129-FZ “On Accounting” "(Article 6)1. · Depending on the volume of accounting work, heads of educational institutions have the right to: o organize an accounting service in the form of a structural unit headed by a chief accountant; o introduce the required number of accounting positions into the institution’s staffing table; o transfer, under the terms of the contract, accounting to a centralized accounting department, a specialized organization or a specialist accountant; o maintain accounting records personally. If an accounting service is created in an educational institution, the chief accountant is responsible for ensuring compliance of ongoing financial and economic transactions with current legislation, control over the movement of property of the educational institution and the fulfillment of various obligations of the institution. The chief accountant reports directly to the head of the institution and is responsible for maintaining accounting records, as well as the timely submission of complete and reliable financial statements. The requirements of the chief accountant for documenting business transactions and providing the necessary documents and information to the accounting department are mandatory for all employees of an educational institution. Without the signature of the chief accountant, monetary and settlement documents, financial and credit obligations are considered invalid and should not be accepted for execution. If the head of an educational institution decides to centralize accounting, the head of the serviced institution retains the rights of the recipients. · In particular, within the limits of the allocations provided for by the estimate of income and expenses approved by the manager, the following rights may be granted: o to receive advances for economic and other needs in the prescribed manner; o allow the issuance of advances and wages to employees of the institution; o spend materials, food and other material assets for the needs of the institution in accordance with established standards; o approve advance reports of accountable persons, inventory documents, acts on the write-off of fixed assets and other material assets that have become dilapidated and unusable in accordance with current legislation; o resolve other issues related to the financial and economic activities of the institution. The centralized accounting department provides the heads of the educational institutions served with the information they need on the execution of income and expense estimates within the time limits established by the chief accountant of the centralized accounting department in agreement with the heads of these institutions. In the case of transferring the accounting of an educational institution under a service agreement to a specialized organization or an accounting specialist acting as an entrepreneur without forming a legal entity, the specific functions and responsibilities of the parties are determined by the terms of the agreement. The requirements of the chief accountant or the person performing his functions in a specialized organization regarding the procedure for registration and submission to the accounting service or specialized organization of the necessary documents and information are mandatory for all employees of the educational institution, and in case of centralization of accounting - for all serviced institutions. Accounting in an educational institution must ensure systematic control over the progress of execution of income and expense estimates, the status of settlements with legal entities and individuals, and the safety of funds and material assets. Accounting is maintained by an educational institution continuously from the moment of its registration as a legal entity until the moment of reorganization or liquidation in the manner established by current legislation. · The documents that provide normative and legislative regulation of accounting in educational institutions are: o The Civil Code of the Russian Federation, the first and second parts of which were adopted by the Federal Laws of the Russian Federation dated November 30, 1994 No. 51-FZ and dated January 26, 1996 No. 14-FZ, respectively. o Federal Law of November 21, 1996 No. 129-FZ “On Accounting”. o Order of the Ministry of Finance of the Russian Federation dated March 30, 2001 No. 26n “On approval of the Accounting Regulations “Accounting for Fixed Assets” PBU 6/01″2; · and for state or municipal educational institutions financed from budgets of various levels, additionally: o Budget classification introduced by the Federal Law of the Russian Federation of August 15, 1996 No. 115-FZ; o Budget Code of the Russian Federation, adopted by Federal Law of the Russian Federation dated July 31, 1998 No. 145-FZ, which came into force on January 1, 2000 by Federal Law of the Russian Federation dated July 9, 1999 No. 159-FZ3 o Instructions on the procedure for applying the budget classification of the Russian Federation, approved by order of the Ministry of Finance of the Russian Federation dated May 25, 1999 No. 38n4 (lost force on January 1, 2003 due to the issuance of order of the Ministry of Finance of the Russian Federation dated December 11, 2002 No. 127n5); o Instructions for accounting in budgetary institutions, approved by order of the Ministry of Finance of the Russian Federation dated December 30, 1999 No. 107n; o Changes and additions to the Instructions for accounting in budgetary institutions, introduced by order of the Ministry of Finance of the Russian Federation dated July 10, 2000 No. 65n6; o Changes and additions to the Instructions on the procedure for applying the budget classification of the Russian Federation, approved by order of the Ministry of Finance of the Russian Federation dated May 25, 1999 No. 38n, introduced by order of the Ministry of Finance of the Russian Federation dated December 28, 2001 No. 118n, which extended the validity period of the above mentioned Instructions7 (lost force from January 1, 2003 in connection with the issuance of Order No. 127n of the Ministry of Finance of the Russian Federation dated December 11, 2002); o Instructions on the procedure for applying the budget classification of the Russian Federation, approved by order of the Ministry of Finance of the Russian Federation on December 11, 2002 No. 127n8; o Instructions for budget accounting, approved by order of the Ministry of Finance of the Russian Federation dated August 26, 2004 No. 70n9, which came into force on January 1, 2005. As can be seen from the above chronology of the formation and enactment of regulations governing the accounting system in budgetary educational institutions, various changes to the rules occur on average 2 times during the calendar year, while for non-state educational institutions the situation with accounting rules is more stable . Taking into account the need to additionally maintain tax accounting in educational institutions with the adoption of part one and part two of the Tax Code of the Russian Federation by Federal Laws of the Russian Federation dated July 31, 1998 No. 146-FZ and dated August 5, 2000 No. 117-FZ, some conclusions can be drawn. Fig. 8.0.1. Main objectives of the accounting system of educational institutions First of all, the conclusion is that the accounting system in state educational institutions, which is quite conservative in nature, is in the sphere of continuous innovative changes, which do not always have a positive effect on the activities of the education system in in general. The tasks solved when organizing an accounting system in educational institutions are presented in Figure 8.0.1. · The main objectives of accounting of educational institutions are: o the formation of complete and reliable information about the state of the assets and liabilities of the educational institution, as well as about the property status and financial results of its activities necessary both for the managers, founders and owners of the property of the educational institution, and for external investors and other users of financial statements; o ensuring control over the compliance of operations carried out during the execution of income and expense estimates with the legislation of the Russian Federation, their feasibility, the availability and movement of property, the use of material, labor and financial resources in accordance with approved norms, standards and estimates; o generation of the necessary reporting for executive authorities, founders and property owners; o preventing negative results from the economic activities of an educational institution and identifying internal reserves to ensure its financial stability. The formation of modern accounting systems in educational institutions is based on the principles and methodology that were enshrined in the Regulations on Accounting and Reporting in the Russian Federation, approved more than a decade ago by order of the Ministry of Finance of the Russian Federation dated March 20, 1992 No. 1010. This Regulation has now lost force due to the issuance of Order No. 17011 of the Ministry of Finance of the Russian Federation dated 2612.1994, which in turn was canceled due to the issuance of Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n12. The latest Regulation is currently in effect. We outline the content of the basic accounting principles and methodology in Figure 8.0.2. based on the use of materials from the author of the textbook13, which, in our opinion, deserves serious attention from specialists in the field of economics of education, as well as management, financial, accounting and tax accounting in educational institutions. Rice. 8.0.2. Basic principles of accounting and reporting of educational institutions The accounting method is usually understood as a set of methods and techniques that provide accounting control functions, functions of analysis and management of the economic activities of an enterprise. The accounting method has a complex structure and consists of a number of elements that form the basis of the method. The elements of the accounting method are presented in Figure 8.0.3. Fig.8.0.3. Structure and elements of the accounting method Documentation in the accounting method is usually understood as a written certificate of a business transaction that gives legal force to accounting data. Each business transaction to be reflected in accounting must be documented. The documents provide a description of the transactions performed, their exact quantitative expression and monetary value. The accuracy of the information provided in the documents is confirmed by the signature of the persons responsible for the transactions performed. The current reflection of economic assets, liabilities and transactions on qualitatively homogeneous grounds is carried out by grouping by accounts, using double entry. Double entry is a method of recording business transactions in business accounts. The peculiarity of double entry is that the amount of each business transaction is recorded in two accounts - the debit of one account and the credit of another account. Double entry provides the ability to control the correctness of recording business transactions. The basic principle of creating a separate account is based on the homogeneity of the objects taken into account. If account data makes it possible to analyze the state of affairs of the organization as a whole, then it is called a synthetic account. However, more detailed metrics and information are often required. For more detailed accounting, analytical accounts are used. Analytical accounts are opened as a development of each synthetic account. Accounting also uses subaccounts, which are intermediate elements between synthetic and analytical accounts. Their purpose is to provide additional grouping of some analytical accounts. They are used in reporting and analysis of business activities to obtain summary indicators in addition to the information contained in synthetic accounts. When accounting on synthetic accounts and sub-accounts, only the monetary meter is used; and on analytical accounts - as labor, natural; so are monetary meters. Valuation is the way in which economic assets receive monetary value. The assessment of various economic assets of each business entity is based on their actual cost. This ensures reality and adequacy of the assessment. The method of grouping costs and determining the cost of acquired material assets, manufactured products, work performed, services rendered, used in the assessment and accounting of business transactions, is called costing. Inventory is a check of the availability of property listed on the balance sheet of enterprises, organizations and institutions, which is carried out by counting, describing, weighing, mutual reconciliation, evaluation of identified funds, and comparison of the obtained data with accounting data. The inventory is carried out both within the established planned periods and when financially responsible persons change, as well as at the request of auditors or investigative authorities. The scheme for recording business transactions on active and passive accounts using double entry is presented in Figure 8.0.4. Rice. 8.0.4. A scheme for accounting for business transactions on active and passive accounts using double entry · Back in the 15th century, the Franciscan monk Luca Pacioli described a method in accordance with which accounting is carried out on business accounts today. In accordance with this method, several rules are used in accounting: 1. Any account in which accounting is carried out is divided into two parts. The left side of the account is conventionally called debit (Latin debet - he must), the right side is credit (Latin credit - he believes). 2. Each business transaction is recorded twice: in the debit of one account and in the credit of another (double entry). The debit amount is equal to the credit amount, i.e. the sum must be balanced, therefore balance is understood as equilibrium (French balance - scales). If the debit and credit amounts are not equal, the business transaction is reflected incorrectly. 3. Based on the basic accounting equation, all accounts are divided into active (Latin aktivus - active) and passive (Latin passivus - inactive). 4. The rules for reflecting the movement of funds on active and passive accounts are opposite. In an active account, an increase in funds is accounted for as a debit, and a decrease as a credit. In a passive account, an increase in funds is reflected in its credit, and a decrease is reflected in its debit. The account balance for an active account (account balance) can only be debit, for a passive account - credit. Active accounts account for the funds of the educational institution, and passive accounts account for the sources of funds. Active-passive accounts are used to record settlements. · For an active-liability account, the balance can be: o debit or credit; o simultaneously debit and credit, i.e. expanded. A double entry that records a business transaction and affects two accounts, reflecting the debit of one of them and the credit of the other, is called a simple entry. If one account is debited (credited) and several others are credited (debited), complex postings occur. The relationship between two or more accounts reflecting a completed business transaction is called correspondence of accounts. The accounts are said to correspond with each other or to be corresponding. · The objects of continuous, continuous and documentary accounting in educational institutions are property, as well as their obligations and business transactions carried out in the course of activity, namely: o property on the balance sheet under the rights of operational management or economic management of the institution; o budget income and expenses, income and expenses from extra-budgetary funds; o budgetary and extra-budgetary funds in accounts in institutions of the Central Bank of the Russian Federation, in personal accounts in treasury authorities, in credit institutions; o financial assets and liabilities of the institution; o calculations arising during budget execution; o other business transactions carried out in the course of the activities of the educational institution. The set of accounting objects in educational institutions and a description of their features are shown in Figure 8.0.5 Figure 8.0.5. Objects of the accounting system for the economic activities of an educational institution Let us provide a list of the totality of objects for supporting the economic activities of an educational institution, constituting economic assets: Fixed assets are buildings, machines, laboratory and technological equipment, vehicles, inventory, textbooks and teaching aids. They act and are used in the economic activities of the educational institution for a long time, wear out gradually, which allows their cost to include in the costs of production (organization of the educational process and the provision of educational services) in parts, as depreciation is worn out. Intangible assets are various kinds of rights (for the use of land, water, real estate, deposits of natural fossils), patents, inventions, intellectual property. Fixed assets and intangible assets, as a rule, are used for more than one year and wear out gradually. The standard life of fixed assets and intangible assets is established by the state in accordance with their types. If in a document confirming the availability of an intangible asset, its service life is not established, then the wear of this type of asset is accrued for ten years, starting from the date of its acquisition. Currently, a number of economic issues of intangible assets of educational institutions have not yet been resolved at the level of normative and enforcement support, since the registration of an intangible asset and reflect it in the balance of an educational institution in modern conditions will lead to a certain increase in the educational institution of taxes. Revivalry is raw materials, materials, fuel, component products, low -value and rapidly significant objects and other accounting objects. They are used in one production cycle, so their cost immediately refers to the costs of an educational institution. The composition of this group includes finished products and incomplete production. Cash funds are cash at the cash desk of an educational institution, funds on personal accounts in the treasury bodies, on settlement accounts (ruble, foreign currency) in banks, investments in securities (shares, bonds, savings certificates, bills). The funds in the calculations are the amount of the debts of third -party legal and individuals, as well as the owners and employees of this educational institution in front of it, i.e. Accounts debt for work, services rendered, goods, for issued advances received bills, as well as amounts of funds listed behind accountable persons. The abstract funds are funds distracted by the budget in the form of taxes, as well as funds used to the formation of special funds of the educational institution. Economic means (assets) of an educational institution to ensure activities are formed at the expense of various sources (liabilities): own sources: the authorized capital (if such is provided for by constituent documents), the depreciation fund, the development fund of the educational institution, the insurance fund, the wage fund, etc. Funds from temporarily attracted sources are the bank loans, debt to suppliers, debt to employees (accrued but unpaid wages), debt to the budget, social insurance and other organizations and persons. The totality of accounting objects that determine the composition of the economic activity of an educational institution combines economic processes and results of activity. The economic processes include the process of procurement, production and implementation. In addition, the number of economic processes may include the processes of developing educational activities and improving the material base of the educational process implemented by an educational institution. They are performed simultaneously and consist of separate business transactions. The result of the processes of procurement and production may be the savings or overrun of resources, and the process of implementation is income or loss. The result of the process of development and improvement may be stabilization or improving the quality of educational processes (production activities) implemented by an educational institution. Profit from the activities of the educational institution is a cash amount for which the organization’s income exceeds its costs (for the sale of products, works, services and non -operating operations) for a certain accounting period if they are not directed to the development and improvement of the educational process in this educational institution in this educational institution Relations with the implementation of its authorized tasks. The business transaction means reflection in accounting using a double entry (debit and corresponding account credit), the movement of funds of the educational institution, which is carried out in cash. The business transaction is each documented fact that has been completed in the activities of the educational institution. References: 1. https://www......rudn.ru/open/econom/8.htm 2. Economics and finance in the structure. Topic 8

Download: You do not have access to download files from our server. HOW TO DOWNLOAD HERE

Category: Coursework / Coursework in accounting

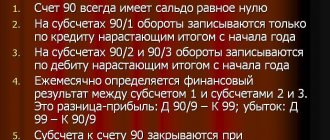

Keeping records in budgetary organizations

Let's look at the postings for typical transactions carried out in budgetary institutions using examples.

Mutual settlements with the supplier

Let’s imagine that a budgetary institution “Hospital” and LLC “Magnit” entered into an agreement for the supply of materials in the amount of 64,000 rubles, VAT 9,762 rubles. The contract provides for an advance payment of 20% of the cost of the goods, which was paid by the Hospital (RUB 12,800). The remaining part (200 rubles) was transferred to Slavutich LLC upon delivery of the goods.

In the accounting of the budgetary institution “Hospital”, these operations were reflected as follows:

| Dt | CT | Description | Sum | Document |

| 2.206.34.560 | 2.201..610 | An advance payment of 20% was transferred in favor of Magnit LLC | 12,800 rub. | Payment order |

| 2.303.04.830 | 2.210.01.660 | Accepted for deduction of VAT 18% of the amount of the transferred advance | RUB 1,952 | Invoice |

| 2.105.36.340 | 2.302.34.730 | Received materials were capitalized (64,000 rubles - VAT 9,762 rubles) | RUR 54,238 | Packing list |

| 2.210.01.560 | 2.302.34.730 | Input VAT on the amount of materials received is taken into account | RUB 9,762 | Packing list |

| 2.210.01.560 | 2.303.04.730 | Recovered VAT from advance payment | RUB 1,952 | Invoice |

| 2.303.04.830 | 2.210.01.660 | Input VAT accepted for deduction | RUB 9,762 | Invoice |

| 2.302.34.830 | 2.206.34.660 | The amount of the prepayment transferred in favor of Magnit LLC is credited | 12,800 rub. | Payment order |

| 2.302.34.830 | 2.201..610 | The final payment amount for materials has been transferred (RUB 64,000 - RUB 12,800) | 200 rub. | Payment order |

| 2.302.34.830 | 18 (KOSGU code 340) | The outflow of funds from the account of a budgetary institution is reflected | 200 rub. | Payment order |

Settlements with the lessor

Let’s say that the budgetary institution “University” and LLC “Status” entered into a lease agreement, according to which the tenant of LLC “Status” pays a monthly rent of 74,000 rubles, VAT of 288 rubles, and also reimburses the cost of utilities. In May 2015, the University account received funds for rent, as well as reimbursement of utilities in the amount of 000 rubles, VAT 3966 rubles. The utility service provider issued a total invoice for RUB 115,00, VAT RUB 17,542. "University" distributes input VAT on utilities in accordance with the proportion of rented area. Specific gravity - 10%.

The following entries were made in the University’s accounting:

| Dt | CT | Description | Sum | Document |

| 2.205..560 | 2.401.10.120 | The tenant of Status LLC was presented with rent | 74,000 rub. | Invoice, certificate of completion of work |

| 2.401.10.120 | 2.303.04.730 | VAT is charged on the rental amount | 288 rub. | Invoice |

| 4.401.20.223 | 4.302..730 | The cost of utilities is taken into account in terms of activities to fulfill the state task | 115,000 rub. | Invoice |

| 2.205.31.560 | 2.401.10.130 | The tenant, Status LLC, was presented with the cost of utilities for reimbursement | 000 rub. | Invoice, certificate of completion of work |

| 4.210.01.560 | 4.302..730 | VAT from utility service provider included | RUB 17,542 | Invoice |

| 2.303.04.830 | 4.210.01.660 | VAT deduction included (RUB 17,542 * 10%) | RUB 1,754 | Calculation |

| 4.401.20.223 | 4.210.01.660 | VAT is included in expenses for core activities | RUB 15,788 | Invoice, calculation |

| 2.303.04.830 | 2.201..660 | The VAT amount was transferred to the budget | RUB 15,788 | Payment order |

| 2.201..550 | 2.205..660 | Funds were received from Status LLC to pay for rent | 74,000 rub. | Bank statement |

| 2.201..550 | 2.205..660 | Funds were received from Status LLC to pay for utilities | 000 rub. | Bank statement |