How is inventory taken and why is it needed?

Inventory of property listed on the balance sheet of an enterprise is the most important event in the company’s activities. Usually it is regulated by local acts of the organization with an eye to the requirements established by law. It allows you to track the availability of equipment, machinery, and other inventory items, their quantity and condition, as well as reconcile established indicators with accounting data and, ultimately, analyze the financial position of the company. Outdated, worn out, damaged property identified as a result of this inspection is transferred for repair or written off.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

Documentation of inspection results

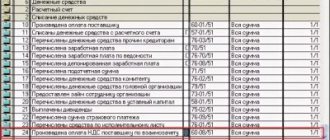

In the process of checking the actual existence of objects (obligations), control documents are drawn up, which differ depending on the object. The organization has the right to independently develop forms of control documents or use standardized forms approved by Resolution 88 of the State Statistics Committee.

The results are presented:

- inventory records, which reflect the actual availability and quantity;

- matching statements, where discrepancies between fact and accounting data are indicated.

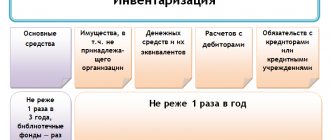

Control of inventory, fixed assets and cash

You can download a sample act of inventory of shipped inventory items and a sample act of inventory of fixed assets (unfinished repairs) at the end of the article.

It is recommended to inventory cash more often in case of significant movement of funds. To do this, use the form for checking funds at the cash desk.

- The cash register inventory report can be found in the appendix to the article. There is also a sample of filling out a cash inventory report.

Debt control

Verification of obligations is carried out to determine current, overdue debt, debt that is unrealistic for collection, among:

- buyers and suppliers;

- creditors (debtors) and other persons.

The results are documented in writing - see Sample of an inventory report of receivables and payables.

More information about the unrealistic debt of liquidated counterparties, as well as debt for which the statute of limitations has expired, can be read in the response of the Ministry of Finance.

Control of intangible assets

Occurs with the registration of INV 1-a form. If discrepancies are identified based on the results of the audit, a comparison sheet INV-18 is drawn up.

Completion

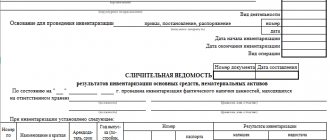

To record the results of control checks on the correctness of monitoring, a report on the results is drawn up. To find out the rules for filling it out, see Sample of filling out an act on inventory results.

Inventory order

Inventory report of shipped inventory items

Inventory report of fixed assets (unfinished repairs)

Cash inventory report (form)

Cash inventory report (filling sample)

Inventory report of receivables and payables

Form INV 1-a

Form INV-18

Statement of results (form)

Who conducts

To carry out the inventory, a special commission is appointed by order of the director of the company.

It consists of several specialists, including the chief accountant, the head of the structural unit whose property is being inventoried, as well as employees from other departments, such as a lawyer, chief engineer, etc.

At the same time, the commission should not include financially responsible employees, but they must be present during the inventory.

The commission’s tasks include inspecting the property, counting it, reconciling it with accounting papers and drawing up final documents, including a protocol, an inventory of inventory items and all necessary acts.

The procedure for conducting and registering inventory

The procedure for conducting an inventory (the number of inventories in the reporting year, the frequency of their conduct, the list of inventory items during each of them, etc.) is fixed in the accounting policy of the organization <*>.

The basis for conducting an inventory is the order of the manager.

The order determines:

— reason for inventory;

— start and end dates of inventory;

— place of inventory;

— inventory objects;

— creation and composition of an inventory commission (large organizations create a permanent central inventory commission and working inventory commissions);

— deadline for submitting inventory materials to the accounting department <*>.

The inventory commission determines the actual presence, as well as the condition and assessment of assets and liabilities verified in accordance with the order. The information received is entered into inventory records, inventory acts listed in table. 1, other industry forms approved by the relevant government bodies, as well as forms that organizations, in the event of a lack of information contained in the approved forms, developed independently and approved them in accordance with the law <*>.

To draw up an inventory of assets not owned by the organization that are listed on the balance sheet (leased, accepted for safekeeping, assets received for temporary use, etc.), separate inventories are compiled <*>.

Filling out inventory acts (inventory lists) is carried out in at least two copies using technical means or by hand with ink or a ballpoint pen clearly and clearly, without blots or erasures. If errors (misprints) are made when filling out inventory acts (inventory records) , then corrections are made to all copies of the inventories (acts): incorrect entries are crossed out and the correct ones are added above them. Corrections are negotiated and signed by all members of the inventory commission and financially responsible persons <*>.

Table 1

| Inventory object | Established forms of documents for registration of inventory | Form |

| Fixed assets | OS inventory | form 1-inv |

| Fixed assets held in safe custody and leased | Inventory list of assets accepted (handed over) for safekeeping | form 10-inv |

| Intangible assets | Inventory list of intangible assets | form 2-inv |

| Unfinished capital construction | Inventory report of unfinished capital construction | form 3-inv |

| Results of unfinished R&D work | Inventory report of unfinished R&D work | form 4-inv |

| Unfinished repairs of buildings, structures, machinery, equipment, installations and other objects | Inventory report of unfinished repairs | form 7-inv |

| Current assets | Inventory list of current assets | form 6-inv |

| Inventory label (attached to each current asset included in the inventory) | form 5-inv | |

| Materials and goods in transit | Act of inventory of materials and goods in transit | form 8-inv |

| Goods shipped and not paid for on time by buyers | Inventory report of goods shipped | form 9-inv |

| Current assets stored in warehouses of other organizations, accepted (handed over) for safekeeping | Inventory list of assets accepted (handed over) for safekeeping | form 10-inv |

| Cash | Cash inventory report | form 12-inv |

| Securities, strict reporting forms | Inventory list of securities, strict reporting forms | form 13-inv |

| Future expenses | Act of inventory of future expenses | form 11-inv |

| Obligations regarding settlements with debtors and creditors | Act of inventory of settlements with suppliers and contractors, buyers and customers, other debtors and creditors | form 14-inv |

| Help for the act of inventory of settlements with suppliers and contractors, buyers and customers, other debtors and creditors | Appendix to form 14-inv |

The actual availability data is compared with the accounting data entered into the inventory lists (inventory acts) <*>.

Deviations are reflected in the matching statements (forms 401, 15-inv, 16-inv), which are filled out using computer technology and by hand <*>.

Separate matching statements are drawn up for assets listed off-balance sheet <*>.

For each case of deviations, the commission takes explanatory notes from financially responsible persons <*>.

Documentation of the inventory results is carried out by the inventory commission <*>.

Thus, the obtained inventory results are considered by the inventory commission (the central inventory commission, if there is one) and are documented in a protocol, which is transferred to the head of the organization for making a decision based on the inventory results <*>.

The results of the inventory are summarized in a statement of results identified by the inventory , which includes data on all identified surpluses and shortages, established damage to valuables, and also indicates the procedure for regulating inventory differences in accordance with the decision made by the manager <*>.

We also note that, according to clause 11 of the Inventory Instructions, the preparation of an inventory of a number of assets should be carried out taking into account the features established by other regulatory legal acts, for example, the Instructions on the procedure for the use, accounting and storage of precious metals and precious stones, the Instructions on the procedure for inventory of industrial waste, etc. .

Read this material in ilex >>*

* following the link you will be taken to the paid content of the ilex service

Sample order based on inventory results

If you need to write an order based on the inventory results, and you have never done one before, apply the above recommendations and look at the sample document - with its help you can easily create the order you need.

- First, everything is as usual: write the name of the enterprise, the number and name of the order, put the date and place of its preparation.

- Below, enter a link to the documents in accordance with which the order is issued and enter the reason for its creation.

- Then comes the main block. Here, first of all, give an order to approve the results of the inventory, then, depending on the circumstances, include instructions on further actions, including, if shortages are identified, identifying the culprits, as well as measures to compensate for the damage incurred.

- It is imperative to include the need to enter inventory results into tax and accounting records and measures to prevent further theft and abuse.

- At the end, enterprise employees responsible for the execution of this order are appointed and all the necessary signatures are collected.

Nuances of inventory of goods and materials that are in transit

Inventory items in transit belong to the company after the transfer of ownership to it. The date of transfer of such right is determined by the contract. Since goods or other products have not yet arrived at the organization’s storage locations, measurements, calculations and weighing will not be possible. Therefore, all data in the form is entered on the basis of documents that indicate that the goods and materials have now become the property of the company.

For your information! The obligation to reflect inventory items in transit in the financial statements is outlined in PBU 5/01, which regulates the accounting of inventory items in organizations.