Is count 69 active or passive?

To answer the question whether account 69 is active or passive, you must first understand what it is used for. In accounting, account 69 is used to display calculations for various types of compulsory social insurance:

- pension;

- medical;

- in case of occupational diseases/injuries at work;

- in case of temporary disability.

Account 69, as a rule, corresponds with cost accounts, and in the case of calculating benefits at the expense of the employer, with accounts related to the accrual and payment of wages. It also reflects penalties for late payments made to government funds through the tax office. The debit reflects payments made in the form of mandatory insurance contributions. Based on this, we can conclude that this accounting account is active-passive.

What does account credit 69 show?

The loan reflects business transactions related to the calculation of mandatory insurance contributions, including fines and penalties. That is, the credit of account 69 shows what the current debt of the employer-insurer to state funds and the tax office related to insurance and social security is.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

At the same time, the amount of transferred insurance premiums is reflected in the debit of the account. A debit balance means that the company has overpaid insurance premiums.

To better understand what type of mandatory insurance premiums the overpayment or debt arose for, you should study account 69 for subaccounts. For this purpose, analytical accounting must be maintained.

Case Study

- Limited Liability Company "Podsolnukh" entered into an agreement to insure its main warehouse against flooding. The terms of the agreement with the insurance company provide for the payment of an annual insurance premium in the amount of 30 thousand rubles, and also determine the maximum amount of compensation - 600 thousand rubles.

Accounting entries for business transactions:Dt20 Kt76.01 30 thousand rubles – calculation of insurance premium under the contract

Dt76.01 Kt51 30 thousand rubles. – payment for insurance was made by bank transfer.

- Podsolnukh LLC purchased a large batch of goods from Zvezda LLC. The purchase amount was 750 thousand rubles (VAT is not assessed); according to the purchase and sale agreement, the delivery of assets is carried out after full payment. When receiving the goods at the warehouse, some products were found to be defective. Podsolnukh LLC submitted a claim to Zvezda LLC for the cost of defective products (150 thousand rubles), but the supplier satisfied the claim only for 90 thousand rubles, stating that the rest of the products were not defective.

Accounting entries for business transactions:Dt60 Kt51 750 thousand rubles - delivery of goods has been paid in full.

Dt76.02 Kt60 150 thousand rub. – a complaint to the supplier for the quality of the product is displayed.

Dt51 Kt76.02 90 thousand rubles - part of the claim was satisfied.

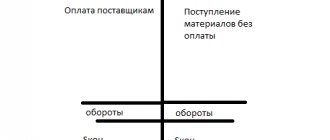

Balance sheet for account 76 for 2021

| Check | Balance at the beginning of the period | Period transactions | balance at the end of period | ||||||||

| Counterparties | Debit | Credit | Debit | Credit | Debit | Credit | |||||

| 76 | 180000,00 | 120000,00 | 60000,00 | ||||||||

| Insurance company | 30000,00 | 30000,00 | |||||||||

| Star | 150000,00 | 90000,00 | 60000,00 | ||||||||

| Total | 180000,00 | 120000,00 | 60000,00 | ||||||||

Output data: BU (accounting data)

Analytics of account 69 by subaccounts

Analytical accounting according to recommendations from the Chart of Accounts, approved. By order of the Ministry of Finance dated October 31, 2000 No. 94n, it is advisable to conduct information in the context of each type of compulsory social insurance. Thus, it is recommended to open sub-accounts to accounting account 69 with the following numbering after the dot:

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

- 1 - for social insurance (social insurance contributions payable to tax are reflected);

- 2 - for pension (contributions are made in favor of the Pension Fund, but they are administered by the Federal Tax Service);

- 3 - for medical, which is mandatory (accounting for accruals and payment of contributions to the Federal Compulsory Medical Insurance Fund, the administrator of these insurance contributions is the tax office).

In addition, subaccounts can also be opened for other types of social security and compulsory insurance that are used at the enterprise, for example, subaccount 11 for accounting for settlements with the Social Insurance Fund for “accidental” contributions.

How to use regulatory documents?

Without regulatory documents, not a single object can be designed, so one of the main components in design is the ability to use regulatory documents. Today I will share my experience in reading regulatory documents.

The ideal option is when you always have printed regulatory documents at hand, and you also have all these documents in electronic form. I think most designers have problems with printed copies, but today it’s much easier with electronic copies. Almost any document can be found on the Internet. Printed documents are easy to read, and electronic documents are easy to find the information you need.

First of all, I advise everyone to subscribe to my articles and receive as a gift a set of basic regulatory documents for the designer. This is my personal selection of regulatory documents, which will allow you to find answers to 80% of your questions. You can find them on other sites without any problems, but you will spend a lot of time on it.

It is worth keeping in mind that regulatory documents can be divided into two classes: basic and additional. The main ones include documents that set requirements only for our design area, i.e. to power supply (PUE, TKP 45-4.04-149-2009 (RB), SP 31-110-2003 (RF)). I conditionally classify the regulatory documents used by related departments as additional. In these documents, the requirements for power supply are usually presented in the section “power supply and automation” (SNiP II-35-76).

How to read regulatory documents?

Regulatory documentation is not fiction that can be read in one sitting. When reading regulatory documents, sometimes you have to re-read the paragraph several times to catch the essence. So you've just started your design career. Each object, depending on its purpose, has its own regulatory documents.

I would advise you to read at your leisure all the regulatory documents and lists of TNLA (RB) or TNLA (RF), first of all, read those documents that apply to your current facility. In any case, some information will be stored in your memory, and information is best absorbed when you find the answer to a question during design.

It is better to read printed documents with a colored pencil in your hands. Mark key phrases in the margins. Don’t be afraid to spoil the regulatory document, remember your childhood, how you painted books with felt-tip pens

How to find the right regulatory requirements?

This is where electronic documents will come to our aid. The bulk of documents can be found in doc format. Such documents have a very convenient “FIND” function. We enter a keyword and quickly find where in the text this word or phrase occurs. As I already said, when reading printed documents, key phrases can be marked, which will speed up the search for the desired text in the future. If you still haven’t found the answer to your question, you can always ask

What can you recommend?

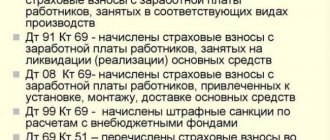

Typical transactions for account 69

Since this is an active-passive account 69, the postings will be in correspondence with other accounting accounts, both in debit and credit. Let's get acquainted with the typical ones:

- Dt 69 Kt 50 - payment of contributions in cash; vouchers paid for from social insurance funds were issued from the cash desk;

- Dt 69 Kt 51—payment of social contributions from a bank account was made;

- Dt 69 Kt 55 - an operation was carried out to transfer contributions from special bank accounts;

- Dt 69 Kt 70 - the employee was accrued temporary disability benefits, paid from the Fund;

- Dt 08 (20, 23, 25–26, 28–29, 44, 91) Kt 69 - insurance premiums were calculated for personnel from different areas of work;

- Dt 51 Kt 69 - overpayment of insurance premiums was returned to the company’s accounts;

- Dt 70 (73) Kt 69 - funds were withheld from personnel for vouchers paid for from social insurance funds;

- Dt 96 Kt 69 - a vacation reserve has been created in the part that is subject to transfer in favor of state funds;

- Dt 97 Kt 69 - insurance premiums are accrued from vacation pay in the part relating to future reporting periods;

- Dt 99 Kt 69 - financial sanctions were accrued for the delay in paying insurance premiums.

Chart of accounts: structure and subaccounts

Account 69 corresponds with the following debits:

- 50 – cash transactions;

- 51 – actions on the company’s current accounts;

- 52 – operations are carried out in currency terms;

- 54 – special purpose current account in a bank;

- 70 – display of payment of wages to workers.

By loan:

- 08 – funds received as a contribution to non-current assets;

- 20 – actions related to the fixed asset are displayed;

- 23 – additional production operations;

- 25 – expenses spent in total on production;

- 26 – general business expenses;

- 28 – amount of defective goods and products;

- 29 – costs of servicing the production sector and the economy as a whole;

- 44 – display of the amount of funds spent on the sale of goods;

- 69 – contributions to the VNF for social insurance;

- 76 – repayment of receivables and payables;

- 79 – identification of costs in the on-farm sphere;

- 84 – display of immediate profit or unwritten off or uncovered loss;

- 91 – costs and income shown in the accounting report;

- 96 – the amount of funds held in reserve to cover losses of upcoming periods;

- 97 – deferred costs;

- 99 – the amount of profit received and losses incurred.

Types of subaccounts:

- 69.01 – for social insurance;

- 69.02.1 – for the insured share of the labor pension;

- 02/69/02 – to the funded part of the pension;

- 69.02.3 – as an additional payment to pension payments to members of flight groups;

- 69.02.4 – for coal industry workers;

- 69.02.5 – to employees in hazardous work;

- 69.02.6 – workers at work with difficult conditions;

- 69.02.7 – for compulsory type of pension insurance;

- 03/69/01 – to the Compulsory Medical Insurance Fund;

- 69.03.2 – Compulsory medical insurance of territorial significance;

- 69.04 – the amount of the UST accrued to the federal budget;

- 69.05.1 – funds in the VNF from the employer’s account;

- 69.05.2 – from the amount of the employee’s salary;

- 69.06.1 – transferred to the Pension Fund for the insurance part;

- 69.06.2 – the accumulative part of insurance funds in the Pension Fund of Russia;

- 69.06.3 – to the Compulsory Medical Insurance Fund;

- 69.06.4 – in the FSS;

- 69.06.5 – compulsory type insurance for entrepreneurs;

- 69.11 – calculation according to OSS in case of injuries, accidents and diseases associated with professional activities;

- 69.12 – implementation of voluntary insurance in case of sick leave for an employee;

- 69.13.1 – contribution of funds to the Social Insurance Fund to organizations that pay UTII;

- 69.13.2 – settlements with enterprises using the simplified tax system.

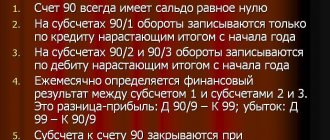

How is the balance sheet prepared for account 69

To draw up a balance sheet for accounting account 69, transfer the final balance based on the results of the previous reporting period to a new spreadsheet document. Enter the debit and credit turnover that occurred during the reporting period and display the final balance.

The balance sheet for account 69 will clearly demonstrate the presence of debt or overpayment for each of the social insurance funds. It is important to analyze the initial and final turnover figures. If at the beginning of the reporting period there is a balance on the loan, it means that the company has arrears on insurance premiums.

Due to the fact that information is entered into the statement in the context of subaccounts, it is clearly visible for which of the payments the debt arose. At the end of the reporting period, the final information from the turnover is transferred to the balance sheet (liability).

***

Account 69 is used in accounting to reflect information on accruals and payments of mandatory insurance contributions in favor of state funds and the Federal Tax Service. Analytical records must be kept for the account to make it easier to navigate the status of settlements for a particular type of social security or compulsory insurance. Enter information on all transactions performed during the reporting period into the turnover balance sheet - use the final balance from it to fill out the balance sheet.

Reports on accounts payable and receivable in the 1 C system

A company using the 1C: Enterprise 8 system must maintain a report on the amount of receivables from counterparties. You can get acquainted with the information if, after starting the program, you enter the “Counterparties” section. In the field that opens there is a list of organizations and individual entrepreneurs. Among them there are debtors and creditors. Contact information, invoices and contracts, work schedules - all this can always be viewed. It is from this menu that you can register a new organization that is part of the holding.

Finding out the exact debt of enterprises is not difficult. To do this, go to the “Debt under contracts” section, in the “Output debt” panel, select “Receivable” and set the required date. The user will see a list of all counterparties, from which you can select specific enterprises (with large debts). If there are many organizations and the entire list does not fit on one page, the information can be presented in a visual form. To do this, you will need to go to the “Diagram” section. Work with accounts payable is carried out in a similar way.

That's all you need to know about account 76, which reflects settlement transactions with debtors (creditors). Since the legislation of the Russian Federation is systematically changing, you should regularly use legal reference systems, which always have an up-to-date chart of accounts and PBUs. Then specialists will always be aware of any changes affecting their professional activities and will be able to make the right decisions when maintaining accounting records.

15 Cancer Symptoms Women Most Often Ignore Many signs of cancer are similar to symptoms of other diseases or conditions, which is why they are often ignored. Pay attention to your body. If you notice.

13 signs that you have the best husband Husbands are truly great people. What a pity that good spouses don't grow on trees. If your significant other does these 13 things, then you can s.

Why are some babies born with an “angel's kiss”? Angels, as we all know, are kind to people and their health. If your child has the so-called angel's kiss, then you are out of luck.

How to look younger: the best haircuts for those over 30, 40, 50, 60 Girls in their 20s don’t worry about the shape and length of their hair. It seems that youth is created for experiments with appearance and daring curls. However, already last.

What does your nose shape say about your personality? Many experts believe that you can tell a lot about a person's personality by looking at their nose. Therefore, when you first meet, pay attention to the stranger’s nose.

11 Weird Signs That You're Good in Bed Do you also want to believe that you please your romantic partner in bed? At least you don't want to blush and apologize.