In what cases is count 67 applied?

The account “Settlements for long-term loans and borrowings” is maintained by the organization receiving the credit (loan). In some cases, an enterprise needs to make expensive acquisitions, for example, equipment, but there is no free working capital at the moment. In such cases, it makes sense to take a long-term loan - that is, with a repayment period exceeding one tax period.

The account reflects information about counterparties (creditors) and loan agreements.

After the loan repayment period is reduced to 365 days, it can be transferred from 67 to 66 account “Short-term loans and borrowings”, or left on account 67. The chosen accounting method is fixed in the accounting policy of the organization.

Typical correspondence

Transferring a liability to a short-term liability

| Dt | CT | Operation description | Sum | Document |

| 67 | 66 | The amount was transferred to short-term | 680000 | Accounting information |

General information

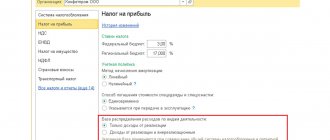

Account 67 is used to collect and process data on loans and borrowings whose repayment period exceeds one year. Among them:

- amounts of loans and borrowings by their types;

- percentage part;

- repayment transactions;

- fines for late payments.

Information on account 67 is recorded according to:

- loans and credits;

- credit institutions;

- institutions that issued the loan;

- specific funds issued at interest;

- credit institutions that purchased securities, and other credit obligations on bills.

From a structure point of view, account 67 is similar to account 66. Their main and only difference is the duration of the credit period. Account 66 is intended to record information about short-term credit relationships, the payment period of which is less than one year.

Account 67 reflects the financial balance of the enterprise, expressed in its debt obligations and income for the current period. This allows the designated account to be considered passive - its balances for a specific period are included in the organization’s sources of profit for this period.

If the loan repayment period is reduced to a year or less, the debt can be transferred to short-term status.

Getting a loan

Example

The organization Quadrum LLC received a loan from the bank in the amount of 1,578,000 rubles for a period of 3 years. Principal and interest are paid monthly in equal amounts.

Postings

| Dt | CT | Operation description | Sum | Document |

| 67 | Credit transferred to the organization's account | 1578000 | Bank statement | |

| 91.2 | 67 | Monthly interest accrued (payable) | 15122,50 | Accounting information |

| 67 | Monthly debt payment | 43833,33 | Payment order | |

| 67 | Monthly interest on loan | 15122,50 | Payment order |

Postings to account “67.04”

By debit

| Debit | Credit | Content | Document |

| 67.04 | 50.01 | Expense of cash from the organization's cash desk to pay off interest debt on previously received long-term loans in rubles. | Cash withdrawal |

| 67.04 | 51 | Transfer of funds from the organization's current account to pay off interest debt on previously received long-term loans in rubles. | Debiting from current account |

| 67.04 | 55.04 | Transfer of funds from special bank accounts (except for letters of credit, check books, deposit accounts) to repay interest debt on previously received long-term loans in rubles. | Debiting from current account |

By loan

| Debit | Credit | Content | Document |

| 000 | 67.04 | Entering initial balances: interest on long-term loans in rubles. | Entering balances |

| 07 | 67.04 | Accrual of debt for interest payments under a long-term loan agreement in rubles. The interest amount is included in the cost of equipment requiring installation | Operation |

| 07 | 67.04 | Reflection of debt for payment of interest under a loan agreement (long-term) in rubles. The interest amount is included in the cost of equipment requiring installation | Receipts (acts, invoices) |

| 08.01 | 67.04 | Accrual of interest under a long-term loan agreement in rubles. The amount of interest is included in the cost of the land plot | Operation |

| 08.02 | 67.04 | Accrual of interest under a long-term loan agreement in rubles. The amount of interest is included in the cost of the environmental management facility | Operation |

| 08.03 | 67.04 | Accrual of interest under a long-term loan agreement in rubles. The amount of interest is included in the cost of the construction project | Operation |

| 08.04 | 67.04 | Accrual of interest under a long-term loan agreement in rubles. The interest amount is included in the cost of the non-current asset (equipment) | Operation |

| 08.05 | 67.04 | Accrual of interest under a long-term loan agreement in rubles. The amount of interest is included in the value of the intangible asset | Operation |

| 91.02 | 67.04 | Accrual of interest under a long-term loan agreement in rubles. | Operation |

Obtaining a loan by issuing bonds

The bond determines the right of its owner to receive from the issuer (the one who issued this security) its nominal value within a specified period, as well as, in some cases, a fixed percentage of the nominal value or other property rights.

Expenses for the issue (issue) of bonds are included by the organization in non-operating expenses.

Bonds can be placed at par value, above par value or below par value. In the first case, accounting is carried out only on account 67, in the second case, the difference is taken into account on account 98 “Deferred income”. In the second case, the difference is reflected by entries Dt 91.2 - Kt 67 evenly over the write-off period.

Example of placement above par

Mercury LLC placed a bond on the secondary market worth 15,000 rubles, with a par value of 10,000 rubles. The repayment period is 24 months.

Postings

| Dt | CT | Operation description | Sum | Document |

| 67 | The amount of the bond's par value is reflected | 10000 | Bank statement | |

| 98 | DS received above the nominal value are reflected | 5000 | Bank statement | |

| 98 | 91.1 | Monthly: 5000/24 | 208,33 | Accounting information |

Below par placement example

Saturn LLC placed bonds at a price of 8,000 rubles with a par value of 10,000 rubles. The repayment period is 18 months.

Postings

| Dt | CT | Operation description | Sum | Document |

| 67 | Reflects the amount of funds received from the placement of bonds | 8000 | Bank statement | |

| 91.2 | 67 | Monthly: 2000/18 - price deviation from nominal | 111, | Accounting information |

Types of borrowed funds

The legislation provides for two methods of legal registration of provided borrowed funds. This is a credit agreement and a loan agreement. When concluding them, two parties are involved - the lender and the borrower. A legally fixed transaction is made, according to which the lender provides the borrower with a certain amount of material assets for a specified period. Upon its expiration, the borrower undertakes to return the original amount of funds provided and pay interest (if provided for in the agreement). After the transfer of valuables from the lender to the borrower, the agreement is considered active.

Depending on the terms of the agreement and the categories of persons who take part in it, there are two main types of borrowed funds: credits and borrowings. Taken together, they form one of the most important elements in the formation of enterprise sources. Borrowed funds, along with own funds, significantly influence the well-being and development of the economic activity of a legal entity.

Types of loans and borrowings

Account 67 contains information about different types of borrowed funds. The only thing they have in common is the commitment period, which is at least 12 months from the reporting date. Loans can be in the form of earmarked funds, promissory notes or bonds. The main difference between this method of attracting assets is that a bank cannot act as a lender. A loan is a legally formalized transaction, according to which the parties agree to transfer funds or property into ownership on the terms of return with or without payment of interest for use. Individuals and legal entities can enter into such an agreement, with the exception, as already mentioned, of banks. One of the ways to attract loans is to issue securities (bills, bonds, shares).

A loan is a relationship between parties in which funds are transferred on loan on the terms of urgency, payment and repayment. The procedure for granting and repaying loans is regulated by law. The rights and obligations of the parties are specified in the loan agreement. Account 67 contains information about long-term loans and interest on them.

Characteristics of account 67

This account is included in section VI of the Standard Plan, in which the accounts of the settlement group are located. They are created to characterize relationships with different debtors and creditors. In the modern economy, it is difficult for the average enterprise to manage without borrowing funds. Often this step becomes a “breakthrough” in the development of entrepreneurship.

Accounts 66 and 67 were created specifically to record transactions on loans and credits issued to the company. The procedure for organizing accounting for them is similar, but has one significant difference - the duration of the relationship between the lender and the borrower. Account 66 describes the relationship of the parties to short-term loans, i.e. those that last less than 12 months. Account 67 is intended to account for longer-term transactions occurring over 12 months or more.

It has a passive structure, since account balances at the end of the month are reflected as part of the company's sources. For a loan, there is an increase in borrowed funds (an increase in accounts payable), and for a debit, there is a decrease in debt obligations.

Accounting and postings on bills received

If an organization has shipped goods or products to a buyer and received a bill of exchange from him to secure the debt, then it must be accounted for in a separate subaccount 62.3 “Bills received.” Upon receipt of the bill of exchange, posting D62.3 K62.1 is performed.

After a certain period stipulated in the contract, the buyer pays the bill, and entry D51 K62.3 is reflected, which will mean that the bill has been repaid.

Correspondence

Accounting for short-term loans

Short-term loans are issued for a period of up to 1 year. The funds received are accounted for on the loan account 66 in correspondence with account 50 "Cash" (if the loan is issued in cash), 51 "Current account" and 52 "Currency account" (corresponding entries D50 K66, D51 K66, D52 K66 ) .

When receiving loans, the organization incurs certain costs. These can be the so-called basic costs, which include interest on the loan, exchange rates, and amount of interest differences. Basic costs are included in operating expenses, and the accounting entry is D91/2 K66 .

In addition to the main expenses, there are also additional expenses associated with obtaining credit money, these include payment for legal and consulting services, copying costs, taxes, examinations, and communication services. These expenses are reflected by posting D91/2 K60.

Repayment of the loan is reflected in the debit of account 66 in correspondence with the accounts for cash and non-cash funds, and accounting for foreign currency funds, depending on how the loan debt is repaid (entries D66 K50, D66 K51, D66 K52).