Accounting account 79 is “Internal business settlements”, it is intended to reflect and summarize economic information in organizations that have branches, representative offices or separate divisions. If these structural units have a dedicated balance sheet, but are not separate legal entities, an inter-business settlement scheme is used. This scheme is optimal when consolidating individual balances of all departments, since turnover on account 79 is excluded during consolidation.

Table of types of structural divisions

Settlements with divisions

A legally approved feature of a separate unit is a remote workplace.

That is, a branch (representative office) has means and tools of labor and carries out business transactions. Effective management of an enterprise as a complex and monitoring the economic situation of structural units require the creation of localized accounting in remote offices with the subsequent transfer of information to the parent company. Control of financial indicators is organized in two directions:

- Inventory, current and non-current assets;

- Current activity.

To collect and analyze information on each item, account 79 provides for the opening of sub-accounts.

“Calculations for allocated property”

The transfer of material assets between the main organization and the branch (representative office) is formalized by an act on the basis of which the transferring and receiving parties register account assignments in the transaction journals.

Examples of typical operations:

| Debit | Credit | Type of property |

| 79 | 01 | Fixed assets |

| 02 | 79 | |

| 79 | 04 | Intangible assets |

| 05 | 79 | |

| 79 | 41 | Retail goods (wholesale products are reflected in the same way, excluding the entry for reversing the markup) |

| 42 | 79 | |

| 79 | 10 | Inventory, workwear listed in the warehouse |

| 012 | Low-value items (up to RUB 40,000.00), written off as expenses in accordance with the law | |

| 07, 08 | Equipment, capital investments | |

| 20 | Unfinished products | |

| 41 | Finished products | |

| 50, 51, 52, 55 | Cash provided that a bank account is opened for an additional office | |

| 62 | Letter to debtors about changing the payment procedure - the rights to claim the debt have been transferred to the branch |

In remote divisions, transactions will be entered into account 79 “Intra-business settlements” in the same way as those carried out by centralized accounting, but debits and credits will be swapped.

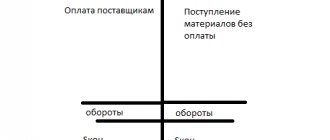

"Calculations for current operations"

In the process of conducting business, branches notify the head office of completed transactions by sending an advice note - a primary document that serves as the basis for processing transactions.

An example of reflecting in management accounting the purchase of goods by a wholesale warehouse that does not have its own bank account:

| Debit | Credit | Amount, rub. | |

| 60 | 51 | 25 000,00 | Money transferred to the supplier |

| 79 | 60 | 25 000,00 | The wholesale warehouse sent a notification about the receipt of products |

The separate division will formalize the transaction as follows:

| Debit | Credit | Amount, rub. | |

| 41 | 60 | 25 000,00 | Products have arrived |

| 60 | 79 | 25 000,00 | Payment reflected |

From the tables it can be seen that after the department transfers the turnover balance sheet for reporting, the enterprise’s balance sheet will remain a balance for goods, but account 79 does not have balances, and there is no line for it.

Typical wiring with examples

After accepting the advice note, the recipient and sender of the notice create accounting records in the accounting registers of their department. As an example, let's look at several of the most common transactions with postings to account 79.

Transfer of property from the head enterprise to the division

The April furniture factory transferred the following property to the Naberezhny branch:

- Woodworking machine. The original cost is 120,000 rubles, accrued depreciation is 16,000 rubles.

- Lumber worth 85,000 rubles.

| Debit | Credit | the name of the operation | Sum |

| Postings in the accounting department of the April factory: | |||

| 79-1 | 01 | Transfer of the initial cost of a woodworking machine | 120000,00 |

| 02 | 79-1 | Write-off of wear and tear on a woodworking machine | 16000,00 |

| 79-1 | 10 | Write-off of lumber cost | 85000,00 |

| Postings in the branch accounting department | |||

| 01 | 79-1 | Registration of a woodworking machine (initial cost) | 120000,00 |

| 79-1 | 02 | Reflection in the accounting of wear of a woodworking machine | 16000,00 |

| 10 | 79-1 | Arrival at the lumber yard | 85000,00 |

Transfer of branch income to the central organization

Income from the main activities of the branch for the month in the amount of 12,580,000 rubles was transferred by the branch to the central office for inclusion in the consolidated statements.

| Debit | Credit | Contents of operation | Sum |

| Postings in the accounting department of the Naberezhny branch: | |||

| 90 | 79-2 | Transfer of income | 12580000,00 |

| Postings in the accounting department of the April factory: | |||

| 79-2 | 90 | Revenue receipt | 12580000,00 |

Settlements under trust management agreements

The Zarya furniture factory transferred the building under a trust management agreement. The initial cost of the building is 1,820,000 rubles, accrued depreciation is 300,000 rubles.

transferred the monthly amount of profit under the contract in the amount of 45,000 rubles to the settlement account of a furniture factory.

| Debit | Credit | Business transaction | Sum |

| Postings in the accounting department of the April factory: | |||

| 79-3 | 01 | Transfer of the original cost of the building | 1820000,00 |

| 02 | 79-3 | Write-off of accrued depreciation of a building | 300000,00 |

| 50 | 79-3 | Receipt of payment under the contract to the bank account | 45000,00 |

| 79-3 | 91 | Reflection of profit under the contract in financial results | 45000,00 |

| Postings in accounting: | |||

| 01 | 79-3 | Registration of the initial cost of the building | 1820000,00 |

| 79-3 | 02 | Reflection of accrued depreciation of the building | 300000,00 |

| 79-3 | 50 | Transfer of payment under the agreement | 45000,00 |

| 84 | 79-3 | Reflection in the financial results of the profit due to the furniture factory "April" | 45000,00 |

To prevent overlap of turns when generating consolidated financial statements, the postings of the transmitting and receiving parties must be mirror opposite. Another prerequisite is the creation of transactions in one reporting period.

Subaccounts 79 accounts and reflection of transactions in the head department

79 account is active-passive. Receipts are reflected according to Kt, write-offs - according to Dt of the account. A subaccount is created for each type of transferred assets. The number of these sub-accounts is not limited by law, but it is more logical to arrange transactions according to the scheme proposed by the Chart of Accounts.

- 79.01 Settlements for allocated property. This reflects operations on the movement of property, current and non-current assets between the “singles” and the head office;

- 79.02 Settlements for current transactions. Movements of cash and non-cash funds and intangible assets;

- 79.03 Settlements under trust management agreements. That is, settlements for property and intangible assets located in the trust.

Example: transfer of a fixed asset from a branch to the head office

The head division of Progress JSC transferred the garage premises to Delta LLC. The initial cost of the premises is 200,000 rubles, the amount of accrued depreciation is 60,000 rubles.

The accountant of the head division (JSC Progress) made the following entries:

Postings reflecting the transfer to the department:

| Dt | CT | Sum | Type of operation | Document |

| 79.1 | 01 | 200000 | OS transfer | Interbranch advice note1 |

| 02 | 79.1 | 60000 | Write-off of depreciation | Interbranch advice note |

The postings show the disposal of a fixed asset from account 01 of the head department and the write-off of the amount of accumulated depreciation on this fixed asset in correspondence with the intercompany settlements account.

Postings to account 89 reflecting acceptance from the branch

Suppose the branch transfers another fixed asset to the “head”:

| Dt | CT | Sum | Type of operation | Document |

| 01 | 79.01 | 10000 | OS transferred from branch | Interbranch advice note |

| 79.1 | 02 | 2000 | Depreciation cost written off | Interbranch advice note |

Property and assets received from the branch are reflected in the main division on the corresponding accounting accounts. That is, for active accounts it will be a debit, and for passive accounts it will be a credit, in correspondence with the corresponding analytical account 79.

Subaccounts and analytics

For the convenience of systematizing information, the following sub-accounts can be opened for account 79:

- 79.01 “On allocated property”;

- 79.02 “For current operations.”;

- 79.03 “Under a property trust management agreement.”

Account 79 reflects the mutual settlements of the organization with its branches, divisions, subsidiaries, etc. Analytical accounting is carried out separately for each division/agreement, which implies the opening of additional sub-accounts, the number and nature of which are determined by the specifics of the company’s accounting policy.

Closing 79 accounts in the balance sheet

When forming a consolidated balance sheet for the entire enterprise, account 79 should be equal to zero. Inequality means an accounting error. If inter-branch accounting of business transactions is carried out correctly, the debit balance of account 79 at the branch is equal to the credit balance of account 79 at the head office (of course, in the Civil Defense, these calculations are taken by branch).

Likewise for the credit balance.

To identify this error, you need to reconcile all transactions on account 79 in the branch and the head office.

A zero balance on account 79 in a division is possible only in the event of liquidation (closure) of this division.

1 Depending on the information system used for accounting, it can exist either in the form of a regular accounting certificate or in the form of a separate document (for example, in 1C).

Account 79 of accounting is an active-passive account “Intra-business settlements”, serves to summarize information on all types of settlements with separate divisions that are on a separate balance sheet of companies: branches, representative offices, departments and others, namely on:

- allocated property,

- mutual release of material assets;

- sale of goods, works and services;

- transfer of expenses of general management activities;

- remuneration of department employees, etc.

Definition and characteristics

Each division keeps records of business transactions and forms a balance sheet.

But it is not an independent report; its indicators are only part of the consolidated balance sheet for a legal entity. In the process of work between individual departments, as well as between a higher organization and departments, the need to carry out calculations may arise.

They are associated with the transfer of fixed assets, materials, and general business expenses. On-farm settlements are carried out when transferring receivables or payables, profits and losses. It is possible to transfer funds between bank accounts of a legal entity, which must also be reflected in the accounting records.

To prevent such calculations from leading to the formation of income and expenses, an accounting account is used to summarize them, reflecting transactions within one farm. In addition, using account 79, the central organization has the opportunity to exercise control over the activities of each of its divisions.

Registration of business transactions under account 79 is carried out on the basis of notices (advice notes). The form of the document is not established by law, therefore each enterprise has the right to create its own form. The procedure for drawing up an advice note can be chosen by a legal entity independently. In practice, the following methods are used:

- creating a notice in the centralized accounting department and sending it to the accountant of the structural unit for posting;

- creating a notice in a structural unit and sending it to the head office for centralized accounting;

- registration of the notice by the accountant who was the first to receive the primary documentation;

- simultaneous generation of counter advice notes.

The party that received the notice checks it, accepts it and sends one copy of the signed document to the sender. There are cases when acceptance of an advice note is not required. This could be when transmitting:

- general management costs;

- accrued taxes for inclusion by the parent organization in a single declaration;

- calculations for capital investments;

- other operations.

The basic principles of on-farm settlements are:

- Equality of turnover and balances in divisions. They must be identical in terms of account, subaccount and analytical accounting characteristics.

- Documentation of operations for conducting intra-business settlements. After the notice is signed by both parties, the amounts reflected in it must be paid in full to both the sender and the recipient of the document.

- Completeness of information. When generating a notice, it includes tax accounting information in addition to accounting data.

- Equality of parties involved in settlements. If controversial situations arise, the problem is resolved by a higher division.

At the end of the reporting year 79, the account is subject to reformation. With this operation, the accounts of the divisions are closed to the head office. The next reporting period begins with a zero balance. If the activity of the division ends in the middle of the year, the reformation is carried out on the last day of the month in which the reporting is generated.

Postings to account 79 “Intra-business settlements”

Correspondence and main postings to the “Internal business settlements” account are presented in the table:

| Account Dt | Kt account | Wiring Description |

| 79 | 01/04/05/07/ 43/58, etc. | Transfer of property to a separate division (hereinafter referred to as the SB) and a trustee (from the parent organization and the founder of the management). Acceptance of property by the OP and the trustee – reverse posting. Return of property upon closure of the OP/termination of the trust management agreement (in the OP). The property is accounted for in the parent organization - reverse posting. |

| 79 | 02 | Accumulated depreciation on property received from the OP. Reflection of amounts - reverse posting. |

| 79 | 20/23/29 | Reflection of the provision of EP services |

| 79 | 25/26 | Write-off of part of management expenses for OP |

| 79 | 50/51/52/55 | Reflection of the transfer of funds to the OP |

| 79 | 60 | Acceptance of invoices from suppliers/contractors for assets, works/services for the OP. Repayment of debt at the expense of the OP - reverse posting. |

| 79 | 70 | Calculation of payments to employees of the OP. When an employee is transferred from an EP, arrears of wages are reflected. Transfer of debt - reverse posting. |

| 79 | 71 | Reflection of payment to accountable persons of the EP's debts When transferring an employee from the EP, re-registration of accountable amounts is a reverse entry. |

| 79 | 76 | Insurance of the property of the OP (accrual of payments) and charges to various organizations for services for the OP. Payment of debt at the expense of the OP - reverse posting. |

| 79 | 84 | Write-off of losses at the expense of the OP and the trustee. Accrual of income to employees of the OP - reverse posting. |

| 79 | 90/91 | Reflection of income from the activities of the OP. Reflection of OP expenses - reverse posting. |

| 79 | 99 | Reflection of losses from emergency circumstances at the expense of the OP. Disposal costs – reverse entry. |

| 05 | 79 | Reflection of the amount of accumulated depreciation on intangible assets. |

| 23/25/26/ | 79 | Costs transferred by internal departments (according to advice notes) are taken into account. |

Examples of transactions and postings on account 79

Let’s assume that JSC Fonet, Moscow, opened its branch in Samara on a separate balance sheet and transferred to it:

- technological equipment - 130,000 rubles, depreciation - 35,000 rubles;

- batch of materials - 25,000 rubles.

The transfer of property to a separate division in Samara is reflected by the following entries in account 79:

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| Moscow | ||||

| 79.01 | 01 | 130 000 | Equipment written off (initial cost) for the branch | Interbranch advice note |

| 02 | 79.01 | 35 000 | The amount of depreciation on it is written off | Interbranch advice note |

| 79.01 | 10 | 25 000 | Written off materials (cost) | Interbranch advice note |

| Samara | ||||

| 01 | 79.01 | 130 000 | Capitalization of equipment | Interbranch advice note |

| 79.01 | 02 | 35 000 | Depreciation has been taken into account | Interbranch advice note |

| 10 | 79.01 | 25 000 | Materials have been capitalized | Interbranch advice note |

Account 79 “Intra-business settlements” is used by organizations to display settlements carried out with all divisions of the company (branches, representative offices, etc.), the accounting of which is carried out independently (they are allocated to a separate balance sheet).

Account 79 in accounting is used by enterprises to consolidate available data on settlements made with separate divisions of the company that maintain independent accounting records, for example, for allocated equipment, remuneration of branch employees, etc.

In addition to the account 79 provides for the opening of sub-accounts:

- Control of settlements with separate divisions (branches and representative offices) is carried out, maintaining an independent balance sheet in terms of non-current assets and working capital transferred for use.

The debit of the head office shows the transfer of property to the company's branches in correspondence with asset accounts (for example, 01).

Accounting: account 79 “Intra-business settlements”

Credit of subaccounts of separate divisions – display of accepted assets.

Trust management is understood as a type of agreement in which one participant (the management founder) transfers his assets to another participant (the manager) for an agreed period. The trustee, in turn, assumes the responsibility to manage the received assets in the interests of the founder or a person designated by him (the beneficiary). As a rule, the objects of the agreement are securities, real estate or other assets (except for cash).

The debit of the subaccount displays the value of the transferred property in correspondence with the asset accounts (for example, 01, 04.).

At the same time, the operation of accounting for depreciation charges is carried out.

Subaccount credit – display of accepted assets from the trustee.

Upon termination of the agreement, a reverse entry is made in the accounting records of both parties.

Transfer of funds - income of the founder of the management: the sub-account is credited from the manager, debited from the founder in correspondence with the cash accounts (cash payment or non-cash transfer).

The costs of trust management arising from damage to assets or their loss, subject to compensation from the manager, are displayed according to Dt76 and Kt91. Upon receipt of this compensation, the amount is written off according to Kt76.

Questions and answers on the topic

No questions have been asked about the material yet, you have the opportunity to be the first to do so

Save the article to social networks:

Dt 79 Kt 441

The procedure for generating accounting information on financial results

To record financial results, active-passive account 79 is intended, in the subaccounts of which income and expenses are compared by type of activity. To do this, all expenses are written off to the debit of account 79, and all income to the credit.

Scheme of correspondence of accounts for accounting for the formation of financial results from ordinary activities (see below).

Account 79 is closed with active-passive account 44 “Retained earnings” (uncovered loss).

If the company received more income than expenses in the reporting period, then the credit turnover of account 79 exceeds the debit turnover and when it is written off, the following entry is made:

If the company was unable to cover expenses with income, then the debit turnover is greater than the credit turnover. The difference between them is the uncovered loss, which is written off:

All transactions on account 79 do not require documentary justification. They are accounting transactions.

An enterprise can calculate the preliminary balance for the subaccounts of account 79 to identify the final financial result for the enterprise as a whole and by type of activity. If the financial result of ordinary and extraordinary activities is profit, then according to standard 17 “Income Tax” the enterprise is obliged to calculate income tax. Its amount is calculated at the rate in accordance with the Law on Taxation of Enterprise Profits and is considered as expenses of the enterprise.

Account 79 “Intra-economic settlements”

For this purpose, active account 98 “Income Tax” was introduced into the Chart of Accounts. Its debit reflects the amount of tax calculated in accordance with P(S)BU No. 17, and from the credit this amount is written off to the debit of account 79. Account 98 has two sub-accounts for separately reflecting income tax calculated on profits from ordinary activities and from extraordinary events . Thus, the final financial result for account 79 is revealed only after income tax is reflected in the debit of this account.

ACCOUNT CORRESPONDENCE SCHEME

ON ACCOUNTING THE FORMATION OF FINANCIAL RESULTS

The amount of accounting profit underlying the calculation of income tax according to P(S)BU No. 17 may differ significantly from the amount of taxable profit calculated in the enterprise’s income statement. The reason for this is the differences in the economic nature of the two profits, in the methodology for calculating them, despite the same tax rate (30%). The presence of temporary differences between the amounts of accounting and income tax explains the purpose of accounts 17 “Deferred tax assets” (A) and 54 “Deferred tax liabilities” (P). If the accounting income tax exceeds the tax tax, then the difference is reflected in the credit of account 54, and if vice versa, then in the debit of account 17. The following entries are made in accounting:

Example 1. Accounting income tax - 400 UAH, tax - 350 UAH.

1) Profit tax is calculated taking into account financial and tax calculations

Date added: 2015-03-31; ; Copyright infringement?;

Recommended pages:

Account 79 “Intra-business settlements” is used by organizations to display settlements carried out with all divisions of the company (branches, representative offices, etc.), the accounting of which is carried out independently (they are allocated to a separate balance sheet).

Account 79 in accounting is used by enterprises to consolidate available data on settlements made with separate divisions of the company that maintain independent accounting records, for example, for allocated equipment, remuneration of branch employees, etc.

In addition to the account

>Questions and answers on the topic

No questions have been asked about the material yet, you have the opportunity to be the first to do so

Save the article to social networks:

Question - answer No. 1

Question: Which balance sheet item does the debit amount in account 79 belong to? (Yurla)

Answer:

According to the Instructions for the use of the Chart of Accounts, approved. By Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n, account 79 “Intra-business expenses” is used to summarize information on settlements with separate divisions allocated to a separate balance sheet.

Sub-accounts can be opened to account 79 “Intra-business settlements”:

79-1 “Calculations for allocated property”,

79-2 “Calculations for current operations”,

79-3 “Settlements under a property trust management agreement”, etc.

Analytical accounting for account 79 “Intra-business settlements”, depending on the specifics of the enterprise’s activities and the nature of the transactions performed, must be kept for each branch, representative office, division or other separate division of the organization, allocated to a separate balance sheet, and settlements under property trust management agreements - for every contract.

As a rule, in a branch (division) allocated to a separate balance sheet, all business transactions are accounted for separately from the operations of the head unit, in a separate General Ledger. Operations for the movement of property and liabilities between the head office and the branch are documented by drawing up a notice (advice note).

Reporting is prepared:

— for the head division of the organization (without taking into account the branch’s indicators);

— by branch;

— consolidated (by summing similar indicators of the head unit and branch).

The founders (shareholders) approve the consolidated financial statements for the organization as a whole, which must include performance indicators of all branches, representative offices and other divisions (including those allocated to separate balance sheets) (clause 8 of the Accounting Regulations “Accounting statements of the organization” PBU 4/ 99, approved by Order of the Ministry of Finance of Russia dated July 6, 1999 N 43n).

In this case, the balances listed in the accounting records of the head office on account 79 must be fully covered by the total corresponding balances on this account of the separate divisions. Consequently, data on account 79 “Intra-business settlements” is not reflected in the preparation of the organization’s consolidated financial statements.

Lack of data comparability leads to the formation of a balance on account 79 and indicates incomplete (untimely) reflection of individual transactions in the accounting of separate divisions or the head office or other errors.

In consolidated statements, the balance of account 79 is usually reflected as part of accounts receivable or payable, which leads to distortion of data in the balance sheet. Since this debt is not an obligation of the organization or to the organization, the statute of limitations does not apply to it: the debt cannot be written off, but must be settled.

For reference.

Regulatory documents on accounting do not contain requirements for conducting a mandatory inventory of the balance of account 79. In particular, clause 1 of Art. 12 of the Federal Law of November 21, 1996 N 129-FZ “On Accounting” and clause 26 of the Regulations on Accounting and Financial Reporting in the Russian Federation require an inventory of the property and liabilities of organizations. Since the organization that created them bears responsibility for the transactions of branches, the branch itself has no obligations. The Methodological Instructions for Inventorying Property and Financial Liabilities do not provide for the need to take inventory of this account.

Meanwhile, the need to control the correctness of the formation of the balance on account 79 entails at least a reconciliation of calculations between the head office and branches.

Taking into account the above, before resolving the reasons for the occurrence of the debit balance of account 79, in my opinion, it is more correct to reflect in the balance sheet on line 270 “Other current assets” as assets that are not reflected in other articles of section. II balance sheet. In any case, until the reasons for the balance are resolved, the organization remains at risk of presenting distorted reporting.

For reference.

Article 120 of the Tax Code of the Russian Federation establishes the responsibility of the taxpayer for systematic (twice or more times during a calendar year) untimely or incorrect reflection in the accounting accounts and financial statements of business transactions, cash, tangible assets, intangible assets and financial investments:

- if these acts are committed during one tax period - a fine of 5,000 rubles is levied. (clause 1 of article 120 of the Tax Code of the Russian Federation);

- if these acts are committed during more than one tax period - a fine of 15,000 rubles is levied. (clause 2 of article 120 of the Tax Code of the Russian Federation);

- if these actions resulted in an underestimation of the tax base, a fine of 10% of the amount of unpaid tax is levied, but not less than 15,000 rubles.

Article 146 of the Tax Code of the Russian Federation, clause 1 - there are no exchange rate differences.

Anonymous

, Article 146 of the Tax Code of the Russian Federation, clause 1 - there are no exchange rate differences. Another thing is that you need to understand when to determine the base if the calculations are expressed in currency.

Tax Code of the Russian Federation, VAT, article 153. Tax base

3. When determining the tax base, the taxpayer’s proceeds (expenses) in foreign currency are recalculated into rubles at the rate of the Central Bank of the Russian Federation, respectively, on the date corresponding to the moment of determining the tax base for the sale (transfer) of goods (work, services), property rights, established by Article 167 of this Code, or on the date of actual expenditure.

Article 167. Moment of determination of the tax base 1. For the purposes of this chapter, the moment of determination of the tax base, unless otherwise provided by “clauses 3”, “7” - “11”, “13” - “15” of this article, is the earliest of the following dates

: 1) day of shipment (transfer) of goods (work, services), property rights; 2) the day of payment, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights.

That is, at the time of shipment (or receipt of an advance), you determine the base at the Central Bank rate and that’s it. You do not make any “additional charges” of VAT even if you receive income (expense) for the IR.

Account 79 in accounting: intra-business calculations

(clause 3 of article 120 of the Tax Code of the Russian Federation).

In addition, Art. 15.11 of the Code of the Russian Federation on Administrative Offenses establishes liability for officials of an organization in the form of a fine in the amount of 2000 rubles. up to 3000 rub. for gross violation of the rules of accounting and presentation of financial statements, which means:

— distortion of the amounts of accrued taxes and fees by at least 10%;

— distortion of any article (line) of the financial statements by at least 10%.

Failure to submit financial reporting forms (including an audit report in cases where an audit is mandatory) to the tax authority within the prescribed period will result in a fine of 50 rubles being imposed on the organization. for each unsubmitted form, and for officials of the organization - from 300 rubles. up to 500 rub. (Clause 5, Clause 1, Article 23, Clause 1, Article 126 of the Tax Code of the Russian Federation, Clause 1, Article 15.6 of the Code of Administrative Offenses of the Russian Federation). Moreover, payment of these fines does not relieve one from the need to submit financial statements to the tax office (Clause 4, Article 4.1 of the Code of Administrative Offenses of the Russian Federation).

Return to “Our Consultations” section

Account 79 “Intra-balance sheet settlements” is intended to summarize information on all types of settlements with branches, representative offices, divisions and other separate divisions of the organization, allocated to separate balance sheets (intra-balance sheet settlements), in particular, settlements for allocated property, for mutual release of material assets, for sale of products, works, services, transfer of expenses for general management activities, remuneration of department employees, etc.

Sub-accounts can be opened to account 79 “Intra-business settlements”:

79-1 “Calculations for allocated property”;

79-2 “Calculations for current operations”;

79-3 “Settlements under a property trust management agreement”, etc.

Subaccount 79-1 “Settlements for allocated property” takes into account the status of settlements with branches, representative offices, departments and other separate divisions of the organization, allocated to separate balance sheets, for non-current and current assets transferred to them.

The property allocated to the specified divisions is written off by the organization from account 01 “Fixed assets”, etc.

The rest of 2015 was formed or was already hanging in 2014

Write off this amount as instructed by PBU 22/2010 - in December 2015 from undistributed profits.

Was the rest of 2015 formed or was it already hanging in 2014?

knp said: 02/25/2016 23:51

Anonymous said: 02/28/2016 12:26

knp said: 02/28/2016 17:14

Anonymous

, Article 146 of the Tax Code of the Russian Federation, clause 1 - there are no exchange rate differences. Another thing is that you need to understand when to determine the base if the calculations are expressed in currency.

Tax Code of the Russian Federation, VAT, article 153. Tax base

3. When determining the tax base, the taxpayer’s proceeds (expenses) in foreign currency are recalculated into rubles at the rate of the Central Bank of the Russian Federation, respectively, on the date corresponding to the moment of determining the tax base for the sale (transfer) of goods (work, services), property rights, established by Article 167 of this Code, or on the date of actual expenditure.

Article 167. Moment of determination of the tax base 1. For the purposes of this chapter, the moment of determination of the tax base, unless otherwise provided by “clauses 3”, “7” - “11”, “13” - “15” of this article, is the earliest of the following dates

: 1) day of shipment (transfer) of goods (work, services), property rights; 2) the day of payment, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights.

That is, at the time of shipment (or receipt of an advance), you determine the base at the Central Bank rate and that’s it. You do not make any “additional charges” of VAT even if you receive income (expense) for the IR.

Account 79 in accounting: On-farm calculations

to the debit of account 79 “On-farm settlements”.

The property allocated by the organization to the specified divisions is registered by these divisions from the credit of account 79 “Intra-business settlements” to the debit of account 01 “Fixed assets”, etc.

Subaccount 79-2 “Settlements for current operations” takes into account the status of all other settlements of the organization with branches, representative offices, departments and other separate divisions allocated to separate balance sheets.

Subaccount 79-3 “Settlements under property trust management agreements” takes into account the status of settlements related to the execution of property trust management agreements. This sub-account is used to account for settlements with the management founder, trustee, as well as settlements for property transferred to trust management, which is accounted for on a separate balance sheet.

The property transferred to trust management is written off by the founder of the management from accounts 01 “Fixed Assets”, 04 “Intangible Assets”, 58 “Financial Investments”, etc. to the debit of account 79 “Intra-business settlements” (at the same time, a debit entry is made for the amount of accrued depreciation accounts 02 “Depreciation of fixed assets”, 05 “Depreciation of intangible assets” and the credit of account 79 “Intra-business settlements”). The property accepted by the trustee on a separate balance sheet is reflected in the debit of accounts 01 “Fixed assets”, 04 “Intangible assets”, 58 “Financial investments”, etc. and the credit of account 79 “Intra-business settlements” (at the same time, an entry is made for the amount of accrued depreciation on the credit of the accounts 02 “Depreciation of fixed assets”, 05 “Depreciation of intangible assets” and credit account 79 “Intra-business settlements”).

When the property trust management agreement is terminated and the property is returned to the management founder, reverse entries are made. If the property trust management agreement provides for other operations with the property transferred to trust management, then accounting for these operations is carried out in accordance with the general procedure.

The transfer of funds on account of the profit (income) due to the founder of the management in a separate balance sheet is reflected in the credit of cash accounting accounts and the debit of account 79 “On-farm settlements”. The funds received by the founder of the management on account of this profit (income) are credited to the debit of cash accounts in correspondence with account 79 “On-farm settlements”.

The amounts due from the trustee for compensation for losses caused by loss or damage to property transferred to trust management, as well as lost profits, are reflected in the debit of account 76 “Settlements with various debtors and creditors” in correspondence with the credit of account 91 “Other income and expenses” . When the founder receives control of these funds, cash accounting accounts are debited and account 76 “Settlements with various debtors and creditors” is credited.

Analytical accounting for account 79 “Intra-business settlements” is carried out for each branch, representative office, division or other separate division of the organization, allocated to a separate balance sheet, and settlements under property trust management agreements are carried out for each agreement.

Account 79 “Intra-economic settlements” corresponds with the accounts:

| by debit | on loan |

| 01 Fixed assets 02 Depreciation of fixed assets 04 Intangible assets 05 Depreciation of intangible assets 07 Equipment for installation 08 Investments in non-current assets 10 Materials 11 Animals for growing and fattening 15 Procurement and acquisition of material assets 16 Deviation in the cost of material assets 20 Main production 21 Semi-finished products of own production 23 Auxiliary production 25 General production expenses 26 General business expenses 29 Servicing production and facilities 40 Output of products (works, services) 41 Goods 43 Finished products 44 Selling expenses 45 Goods shipped 50 Cash 51 Current accounts 52 Currency accounts 55 Special bank accounts 60 Settlements with suppliers and contractors 62 Settlements with buyers and customers 70 Settlements with personnel for wages 71 Settlements with accountable persons 76 Settlements with various debtors and creditors 84 Retained earnings (uncovered loss) 90 Sales 91 Other income and expenses 97 Deferred expenses 99 Profits and losses | 01 Fixed assets 02 Depreciation of fixed assets 04 Intangible assets 05 Depreciation of intangible assets 07 Equipment for installation 08 Investments in non-current assets 10 Materials 11 Animals for growing and fattening 15 Procurement and acquisition of material assets 16 Deviation in the cost of material assets 20 Main production 21 Semi-finished products of own production 23 Auxiliary production 25 General production expenses 26 General business expenses 29 Servicing production and facilities 40 Output of products (works, services) 41 Goods 43 Finished products 44 Selling expenses 45 Goods shipped 50 Cash 51 Current accounts 52 Currency accounts 55 Special bank accounts 57 Transfers to ways 60 Settlements with suppliers and contractors 62 Settlements with buyers and customers 70 Settlements with personnel for wages 71 Settlements with accountable persons 73 Settlements with personnel for other operations 76 Settlements with various debtors and creditors 84 Retained earnings (uncovered loss) 90 Sales 91 Other income and expenses 97 Deferred expenses 99 Profits and losses |

Balance lines 2018/2019: explanation

The current form of the balance sheet, which is submitted to the tax office, was approved by Order of the Ministry of Finance dated July 2, 2010 No. 66n. Its basis is the balance sheet lines, which reflect the balances transferred from the accounting accounts. Therefore, for correct preparation, it is important not only to keep accounting records correctly and completely, but also to understand the information from which accounts each line of the balance sheet reflects. Our consultation will help you figure this out.

What's behind the balance sheets?

Below is a complete breakdown of the balance sheet lines for 2018/2019. Moreover, each line is specified according to the most characteristic accounts for it, which are reflected in it. Of course, the specifics of economic activity in practice may leave their mark on this correspondence.

Also, the order of formation of accounting reports, as well as the reflection of certain indicators, is influenced by the accounting policy for accounting purposes adopted by the company.

The following is a breakdown of the balance sheet lines for the accounts in two tables - by asset and liability of the balance sheet.

Explanation of lines for balance sheet assets

Name of the indicator Code Data from which accounts are used Algorithm for calculating the indicator

| Intangible assets | 1110 | 04 “Intangible assets”, 05 “Amortization of intangible assets” | Dt 04 (excluding R&D expenses) – Kt 05 |

| Research and development results | 1120 | 04 | Dt 04 (in terms of R&D expenses) |

| Intangible search assets | 1130 | 08 “Investments in non-current assets”, 05 | Dt 08 – Kt 05 (all regarding intangible exploration assets) |

| Material prospecting assets | 1140 | 08, 02 “Depreciation of fixed assets” | Dt 08 – Kt 02 (all regarding material exploration assets) |

| Fixed assets | 1150 | 01 “Fixed assets”, 02 | Dt 01 – Kt 02 (except for depreciation of fixed assets accounted for in account 03 “Income-generating investments in tangible assets” |

| Profitable investments in material assets | 1160 | 03, 02 | Dt 03 – Kt 02 (except for depreciation of fixed assets accounted for on account 01) |

| Financial investments | 1170 | 58 “Financial investments”, 55-3 “Deposit accounts”, 59 “Provisions for impairment of financial investments”, 73-1 “Settlements on loans provided” | Dt 58 – Kt 59 (regarding long-term financial investments) + Dt 73-1 (regarding long-term interest-bearing loans) |

| Deferred tax assets | 1180 | 09 “Deferred tax assets” | Dt 09 |

| Other noncurrent assets | 1190 | 07 “Equipment for installation”, 08, 97 “Deferred expenses” | Dt 07 + Dt 08 (except for exploration assets) + Dt 97 (in terms of expenses with a write-off period of more than 12 months after the reporting date) |

| Reserves | 1210 | 10 “Materials”, 11 “Animals for growing and fattening”, 14 “Reserves for reducing the cost of material assets”, 15 “Procurement and acquisition of material assets”, 16 “Deviation in the cost of material assets”, 20 “Main production”, 21 “Semi-finished products own production”, 23 “Auxiliary production”, 28 “Defects in production”, 29 “Service production and facilities”, 41 “Goods”, 42 “Trade margin”, 43 “Finished products”, 44 “Sales expenses”, 45 “Goods shipped”, 97 | Dt 10 + Dt 11 – Kt 14 + Dt 15 + Dt 16 + Dt 20 + Dt 21 + Dt 23 + Dt 28 + Dt 29 + Dt 41 – Kt 42 + Dt 43 + Dt 44 + Dt 45 + Dt 97 (in part expenses with a write-off period of no more than 12 months after the reporting date) |

| Value added tax on purchased assets | 1220 | 19 “Value added tax on acquired assets” | Dt 19 |

| Accounts receivable | 1230 | 46 “Completed stages of work in progress”, 60 “Settlements with suppliers and contractors”, 62 “Settlements with buyers and customers”, 63 “Provisions for doubtful debts”, 68 “Settlements for taxes and duties”, 69 “Settlements for social insurance and security", 70 "Settlements with personnel for wages", 71 "Settlements with accountable persons", 73 "Settlements with personnel for other operations", 75 "Settlements with founders", 76 "Settlements with various debtors and creditors" | Dt 46 + Dt 60 + Dt 62 – Kt 63 + Dt 68 + Dt 69 + Dt 70 + Dt 71 + Dt 73 (except for interest-bearing loans accounted for in subaccount 73-1) + Dt 75 + Dt 76 (less reflected in accounts for VAT calculations on advances issued and received) |

| Financial investments (excluding cash equivalents) | 1240 | 58, 55-3, 59, 73-1 | Dt 58 – Kt 59 (in terms of short-term financial investments) + Dt 55-3 + Dt 73-1 (in terms of short-term interest-bearing loans) |

| Cash and cash equivalents | 1250 | 50 “Cash”, 51 “Current accounts”, 52 “Currency accounts”, 55 “Special bank accounts”, 57 “Transfers in transit”, | Dt 50 (except for subaccount 50-3) + Dt 51 + Dt 52 + Dt 55 (except for the balance of subaccount 55-3) + Dt 57 |

| Other current assets | 1260 | 50-3 “Money documents”, 94 “Shortages and losses from damage to valuables” | Dt 50-3 + Dt 94 |

On the topic of the article! Is a seal required on the liquidation balance sheet?

Decoding lines for balance sheet liabilities

Indicator Code Data from which accounts is used Algorithm for calculating the indicator

| Authorized capital (share capital, authorized capital, contributions of partners) | 1310 | 80 “Authorized capital” | Kt 80 |

| Own shares purchased from shareholders | 1320 | 81 “Own shares (shares)” | Dt 81 (in parentheses) |

| Revaluation of non-current assets | 1340 | 83 “Additional capital” | Kt 83 (regarding the amounts of additional valuation of non-current assets) |

| Additional capital (without revaluation) | 1350 | 83 | Kt 83 (except for amounts of additional valuation of non-current assets) |

| Reserve capital | 1360 | 82 “Reserve capital” | Kt 82 |

| Retained earnings (uncovered loss) | 1370 | 99 “Profits and losses”, 84 “Retained earnings (uncovered loss)” | Or Kt 99 + Kt 84 Or Dt 99 + Dt 84 (the result is reflected in parentheses) Or Kt 84 - Dt 99 (if the value is negative, reflected in parentheses) Or Kt 99 - Dt 84 (the same) |

| Borrowed funds | 1410 | 67 “Calculations for long-term loans and borrowings” | Kt 67 (regarding debts with a maturity date of more than 12 months at the reporting date) |

| Deferred tax liabilities | 1420 | 77 “Deferred tax liabilities” | Kt 77 |

| Estimated liabilities | 1430 | 96 “Reserves for future expenses” | Kt 96 (regarding estimated liabilities with a maturity period of more than 12 months after the reporting date) |

| Other obligations | 1450 | 60, 62, 68, 69, 76, 86 “Targeted financing” | Kt 60 + Kt 62 + Kt 68 + Kt 69 + Kt 76 + K86 (all in terms of long-term debt) |

| Borrowed funds | 1510 | 66 “Calculations for short-term loans and borrowings”, 67 | Kt 66 + Kt 67 (in terms of debt with a repayment period of no more than 12 months as of the reporting date) |

| Accounts payable | 1520 | 60, 62, 68, 69, 70, 71, 73, 75, 76 | Kt 60 + Kt 62 + Kt 68 + Kt 69 + Kt 70 + Kt 71 + Kt 73 + Kt 75 + Kt 76 (in terms of short-term debt, minus VAT calculations reflected in the accounts on advances issued and received) |

| revenue of the future periods | 1530 | 98 “Deferred income” | Kt 98 |

| Estimated liabilities | 1540 | 96 | Kt 96 (regarding estimated liabilities with a maturity period of no more than 12 months after the reporting date) |

| Other obligations | 1550 | 86 | Kt 86 (regarding short-term liabilities) |

, please select a piece of text and press Ctrl+Enter.

Account 79 “Intra-economic settlements”

Account 79 “Intra-balance sheet settlements” is intended to summarize information on all types of settlements with branches, representative offices, divisions and other separate divisions of the organization, allocated to separate balance sheets (intra-balance sheet settlements), in particular, settlements for allocated property, for mutual release of material assets, for sale of products, works, services, transfer of expenses for general management activities, remuneration of department employees, etc. Subaccounts can be opened to account 79 “Intra-business settlements”: 79-1 “Settlements for allocated property”, 79-2 “Settlements for current operations”, 79-3 “Settlements under a property trust management agreement”, etc. On subaccount 79- 1 “Settlements for allocated property” takes into account the status of settlements with branches, representative offices, divisions and other separate divisions of the organization, allocated to separate balance sheets, for non-current and current assets transferred to them. The property allocated to the indicated divisions is written off by the organization from account 01 “Fixed assets”, etc. to the debit of account 79 “Intra-business settlements”. The property allocated by the organization to the specified divisions is taken into account by these divisions from the credit of account 79 “Intra-business settlements” to the debit of account 01 “Fixed assets”, etc. Sub-account 79-2 “Settlements for current operations” takes into account the status of all other settlements of the organization with its branches , representative offices, branches and other separate divisions allocated to separate balance sheets. Subaccount 79-3 “Settlements under property trust management agreements” takes into account the status of settlements related to the execution of property trust management agreements. This sub-account is used to account for settlements with the management founder, trustee, as well as settlements for property transferred to trust management, which is accounted for on a separate balance sheet. The property transferred to trust management is written off by the founder of the management from accounts 01 “Fixed Assets”, 04 “Intangible Assets”, 58 “Financial Investments”, etc. to the debit of account 79 “Intra-business settlements” (at the same time, a debit entry is made for the amount of accrued depreciation accounts 02 “Depreciation of fixed assets”, 05 “Depreciation of intangible assets” and the credit of account 79 “Intra-business settlements”). The property accepted by the trustee on a separate balance sheet is reflected in the debit of accounts 01 “Fixed assets”, 04 “Intangible assets”, 58 “Financial investments”, etc. and the credit of account 79 “Intra-business settlements” (at the same time, an entry is made for the amount of accrued depreciation on the credit of the accounts 02 “Depreciation of fixed assets”, 05 “Depreciation of intangible assets” and credit account 79 “Intra-business settlements”). When the property trust management agreement is terminated and the property is returned to the management founder, reverse entries are made. If the property trust management agreement provides for other operations with the property transferred to trust management, then accounting for these operations is carried out in accordance with the general procedure. The transfer of funds on account of the profit (income) due to the founder of the management in a separate balance sheet is reflected in the credit of cash accounting accounts and the debit of account 79 “On-farm settlements”. The funds received by the founder of the management on account of this profit (income) are credited to the debit of cash accounts in correspondence with account 79 “On-farm settlements”. The amounts due from the trustee for compensation for losses caused by loss or damage to property transferred to trust management, as well as lost profits, are reflected in the debit of account 76 “Settlements with various debtors and creditors” in correspondence with the credit of account 91 “Other income and expenses” . When the founder receives control of these funds, cash accounting accounts are debited and account 76 “Settlements with various debtors and creditors” is credited. Analytical accounting for account 79 “Intra-business settlements” is carried out for each branch, representative office, division or other separate division of the organization, allocated to a separate balance sheet, and settlements under property trust management agreements are carried out for each agreement. Account 79 “Intra-business settlements” corresponds with the accounts: debit to credit 01 Fixed assets 01 Fixed assets 02 Depreciation of fixed assets 02 Depreciation of fixed assets 04 Intangible assets 04 Intangible assets 05 Amortization of intangibles 05 Amortization of intangible assets assets 07 Equipment for installation 07 Equipment for installation 08 Investments in non-current assets 08 Investments in non-current assets assets 10 Materials 10 Materials 11 Animals in cultivation 11 Animals in cultivation and fattening 15 Procurement and acquisition 15 Procurement and acquisition of material assets of material assets 16 Deviation in value 16 Deviation in the cost of material assets of material assets 20 Main production 20 Main production 21 Semi-finished products 21 Semi-finished products of own production of own production 23 Auxiliary 23 Auxiliary production production 25 General production 25 General production expenses expenses 26 General expenses 26 General expenses 29 Servicing 29 Servicing production and economy production and economy 40 Output of products (works, 40 Output products (works, services) services) 41 Goods 41 Goods 43 Finished products 43 Finished products 44 Selling expenses 44 Selling expenses 45 Goods shipped 45 Goods shipped 50 Cash register 50 Cash desk 51 Current accounts 51 Current accounts 52 Currency accounts 52 Currency accounts 55 Special bank accounts 55 Special bank accounts 60 Settlements with suppliers and 57 Transfers in transit by contractors 60 Settlements with suppliers and 62 Settlements with buyers and contractors by customers 62 Settlements with buyers and 70 Settlements with personnel for customers' wages 70 Settlements with personnel for 71 Settlements with persons accountable for wages 71 Settlements with accountable persons 76 Settlements with various persons, debtors and creditors 73 Settlements with personnel for 84 Retained earnings from other operations (uncovered loss) 76 Settlements with various 90 Sales to debtors and creditors 91 Other income and expenses 84 Retained earnings 97 Expenses future periods (uncovered loss) 99 Profit and loss 90 Sales 91 Other income and expenses 97 Deferred expenses 99 Profit and loss