Payroll

Settlements with company personnel for wages are accumulated in account 70. This account is passive, since all calculated amounts of employee earnings are taken into account on a loan. This is done on the last date of the month. And on the 1st day of each next month, the credit balance is reported to employees.

Account analytics is carried out for each employee using personal accounts (cards) in the T-54(a) form.

You will find the current form and the procedure for filling it out in the article “Unified form No. T-54a (personal account (SVT)).”

The amount of accrued salary is posted to the appropriate expense accounts depending on the department in which the employee is registered. Postings in each specific case can be as follows: Dt 20 (23, 26, 44) Kt 70.

If an employee was engaged in the construction or repair of fixed assets, then his earnings should be reflected in the entry: Dt 08 (07) Kt 70.

When calculating sick leave, the calculated amount should be included in debit 69, since it is not an expense of the enterprise and is reimbursed from the budget using the social insurance fund: Dt 69 Kt 70.

Important! The employer pays for the first 3 days of illness of the employee.

An example of a shortage with the definition of MOL

For example, during a quarterly inventory of the Teplitsa LLC warehouse, a shortage of tangerines in the amount of 14,000 rubles was discovered. Damage within the limits of natural loss - 7,000 rubles. The accountant applied the calculation formula to find out how many tangerines need to be written off in excess of the required standard:

- 14,000 - 7,000 = 7,000 rubles.

Now you need to reflect the deficiency in the program:

- Dt 94 Kt 41 “Goods in warehouses” - 14,000 rubles.

The storekeeper admitted his guilt and agreed to compensate for material damage from his wages. Operations need to be recorded:

- Dt 44 Kt 94 - the account is closed for the amount of natural loss in the amount of 7,000 rubles;

- Dt 73 Kt 94 - the amount of the shortage of 7,000 rubles was transferred to the storekeeper;

- Dt 70 Kt 73 - a deduction of 7,000 rubles was made from the salary of the official responsible for the shortage.

It remains to generate an analysis of the account to see whether the account has been closed:

Table 1. Analysis of account 94 for July 2021 Limited Liability Company "Teplitsa"

| Cor. Check | Debit | Credit | |

| Opening balance | |||

| 41 | 14.000,00 | ||

| 44 | 7.000,00 | ||

| 73 | 7.000,00 | ||

| Turnover | 14.000,00 | 14.000,00 | |

| Closing balance | 0,00 | ||

Output data: BU (accounting data)

There should be no balance on account 94. It may remain at the end of the year only if the investigation has not been completed and the person responsible has not been identified.

What is account 70 used for in accounting?

Account 70 “settlements with personnel for wages” is used according to the Chart of Accounts to reflect on it all wage settlements for both employees carrying out activities under employment contracts, and under contracts for the provision of services with individuals.

This account accumulates information on salary calculation in all its components:

- salary payment;

- bonuses;

- additional payments;

- vacations;

- compensation;

- payment of benefits and financial assistance, etc.

With the help of this information, the administration can make the necessary decisions on labor costs. This account summarizes the salaries of employees in all departments of the company. On the other hand, depending on the corresponding account, it is possible to establish labor costs for each structural unit.

This reflects information about the existence of existing debts, both of the employee for overpaid wages, and of the enterprise itself for wages that were not paid on time.

Attention! Account 70 also reflects settlements with the founders, who are also employees of the company, for dividends accrued to them.

Normative base

Shortages and spoilage within the limits of natural loss norms depend on many factors (type of goods and materials, method of transportation, storage methods and periods, etc.). This indicator is calculated in each specific situation:

- To establish standards for natural loss during the transportation (delivery) of inventory items, it is necessary to take into account either the cost of each product or the total weight of inventory items. Shortages or damage are identified upon acceptance, then they are documented (notes in accompanying documents, acts).

- To establish norms of natural loss during the storage or sale of inventory items, it is necessary to apply the calculation formula:

| EU = T x Well x 100% where: T – mass or cost of goods and materials; Well, there is a regulated rate of loss for a specific inventory item (the legislation provides reference books and classifiers of various inventory items with their rates of natural loss). |

- To establish norms of natural loss for the storage of goods, norms are calculated for the balances of goods, for their receipts and disposals during inter-inventory periods

Calculations relating to the formation of the authorized capital of JSC and LLC

For settlements on deposits, subaccount 1 is created to account 75. The size of the authorized capital and the debts of the founders on deposits are reflected by this posting: DT75/1 KT80.

How to take into account assistance from the founder when calculating income tax ?

Posting is carried out on the basis of information from the constituent documents. Within 90 days from the date of registration, the founders must make at least half of the capital contributions. The remaining 50% is due within 12 months from the date of registration. The memorandum of association may stipulate a shorter period. If the founders of the organization did not meet the deadline, the posting above must be recorded in accounting.

When a contribution is made in the form of money to capital, this posting is made: DT50, 51, 52 KT75/1. Money has been contributed to the capital.

Question: How to reflect in the accounting of an organization (borrower) the receipt and repayment of an interest-bearing loan from an individual - the founder (lender), if the terms of the agreement provide for the calculation of interest using the compound interest formula? An individual is a tax resident of the Russian Federation. The organization received an interest-bearing loan in the amount of RUB 2,000,000. According to the agreement, interest is accrued (capitalized) daily according to the compound interest formula at a rate of 18% per annum on a monthly basis, based on the number of days the agreement is valid in the current month, from the day following the day the loan was issued until the day the loan is repaid inclusive. The loan was received on February 19 and repaid on April 24. Interest accrued for the period of validity of the loan agreement (64 days) is paid on the day of repayment of the loan in non-cash form. Borrowed funds were used to finance current activities. The lender's share of participation in the organization is more than 25%. At the same time, the transaction between the borrower and the lender for the purposes of applying the Tax Code of the Russian Federation is not controlled. View answer

If the contribution is made in the form of property, these entries are needed:

- DT08, 10, 41, 58 KT75/1. Capital includes intangible or tangible assets, products, shares or other objects.

- DT19 KT75/1. Fixation of VAT on the deposit made.

Accounting involves performing an assessment of deposits. This is not always easy to do. For example, it is difficult to value an intangible asset. The evaluation is carried out on the basis of mutual consent of the creators. The corresponding agreement is recorded in the constituent documents. If the asset is not in cash form, the valuation is carried out by an independent appraiser. The amount received as a result of a professional assessment may be reduced by the founders. However, it cannot be increased on the basis of paragraph 2 of Article 66 of the Civil Code of the Russian Federation.

Example

The capital amount is 200 thousand rubles. It is divided into four parts:

- JSC Luna owns three shares. This is 75% of the authorized capital. That is 150 thousand rubles.

- Ivan Ivanov owns one share. This is 25% of capital. That is, it is 50 thousand rubles.

To record deposits, these sub-accounts are opened:

- The score is 75/1/1. Settlements on deposits with JSC Luna.

- The score is 75/1/2. Settlements on deposits with Ivan Ivanov.

JSC Luna contributed materials worth 150 thousand rubles. The VAT amount was 22,882 rubles. Ivan Ivanov contributed money. The following transactions are performed:

- DT75/1/1 KT80. Luna's debt amounted to 150 thousand rubles.

- DT75/1/2 KT80. Ivanov's debt amounted to 50 thousand rubles.

- DT08 KT75/1/1. Luna contributed materials in the amount of 140,880 rubles.

- DT19 KT75/1/1. Recovered VAT on contributed materials in the amount of 22,992 rubles.

- DT50 KT75/1/2. Ivanov made a contribution in the amount of 50,000 rubles.

Upon completion of all calculations, the balance of the open subaccount should be equal to zero. A zero value indicates that the capital is fully formed.

D 70 to 73

Quick navigation: Catalog of articlesGeneral issues of entrepreneurial activityEntrepreneurial activity and labor relations Compensation for damage by an employee (Semushkin V.)

Compensation for damage by the employee (Semushkin V.)

Article posted date: 12/06/2014

How to reflect in the accounting records of an organization compensation by an employee for direct actual damage caused to him?

The employee is obliged to compensate the employer for direct actual damage caused to him. In this case, this is understood as a real decrease in the employer’s available property or a deterioration in its condition.

This also applies to the property of third parties that is in the possession of the employer, if he is responsible for its safety.

Finally, direct actual damage is recognized as the need for the employer to make expenses or excessive payments for the acquisition, restoration of property, or for compensation for damage caused by the employee to third parties.

Lost income (lost profit) is not considered direct actual damage and cannot be recovered from the employee (Article 238 of the Labor Code). In this case, the obligation to compensate for damage is assigned to the employee, regardless of whether he is brought to disciplinary, administrative or criminal liability for actions or inactions that caused damage to the employer (Article 248 of the Labor Code).

Limits of liability

In this case, as a general rule, an employee bears financial liability for damage caused within the limits of his average monthly earnings. The employee is obliged to compensate the direct actual damage caused to the employer in full only in the cases specified in Art.

243 of the Labor Code, or when provided for by other federal laws.

https://www.youtube.com/watch?v=h5OOL0dUlDk

At the same time, written agreements on full individual or collective (team) financial responsibility for the shortage of property entrusted to employees can only be concluded with employees who have reached the age of eighteen and directly service or use monetary, commodity valuables or other property (Article 244 of the Labor Code). Lists of relevant works and categories of workers, as well as standard forms of these contracts, were approved by Resolution of the Ministry of Labor of Russia of December 31, 2002 No. 85.

In addition, full financial responsibility can be established by an employment contract with the deputy heads of the organization and the chief accountant (Article 243 of the Labor Code).

Establishment of damage

Before making a decision on compensation for damage by a specific employee, the employer is obliged to conduct an inspection to establish the amount of damage caused and the reasons for its occurrence. For this purpose, he has the right to create a commission with the participation of relevant specialists.

In this case, written explanations are required from the employee to establish the cause of the damage. In case of refusal or evasion of the employee from providing the specified explanation, a corresponding act is drawn up.

In turn, the employee and (or) his representative have the right to familiarize himself with all inspection materials and appeal them in the manner established by the Labor Code.

The amount of damage caused to the employer in the event of loss and damage to property is generally determined by actual losses, calculated on the basis of market prices prevailing in the area on the day the damage was caused, but not lower than the value of the property according to accounting data, taking into account the degree of wear and tear (Art. 246 TK). A special procedure may be provided for by federal law.

Collection procedure

Recovery from the guilty employee of an amount of damage not exceeding the average monthly salary, no later than one month from the date of final determination of the amount of damage caused, is carried out by order of the employer.

After this period has expired or in the case where the employee does not agree to voluntarily compensate for the damage, and its amount exceeds the employee’s average monthly earnings, recovery can only be carried out by the court.

The employee can also compensate the damage in full or in part on a voluntary basis, including by installment payment, unless, of course, the employer is against it.

In this case, the employee must provide the employer with a written obligation to compensate for damages, indicating specific payment terms. But in the event of his dismissal and refusal, despite the obligation to compensate for damages, the outstanding debt can only be recovered through legal proceedings.

With the consent of the employer, in order to compensate for the damage caused, the employee can transfer to him an equivalent property or repair the damaged property (Article 248 of the Labor Code).

Accounting

If facts of theft, abuse or damage to property are detected, the organization is obliged to conduct an inventory of inventory assets, during which their presence, condition and valuation are checked and documented (Part 3 of Article 11 of the Law of December 6, 2011 N 402-FZ; clause 27 of the Regulations on accounting and reporting, approved.

By Order of the Ministry of Finance of Russia dated July 29, 1998 N 34n, clause 22 of the Methodological Guidelines for the Accounting of Inventory Plants).

The shortage identified as a result of the inventory is written off to the debit of account 94 “Shortages and losses from damage to valuables” from the account of the corresponding property (03 “Profitable investments in material assets”, 10 “Materials”, 41 “Goods”, 43 “Finished products”, 50 “Cash desk”, etc.).

In turn, from the credit of account 94, the shortage of property (its damage) within the limits of natural loss norms is attributed to production or distribution costs (expenses), that is, to the debit of the cost accounting account (20 “Production”, 26 “General business expenses”, 44 “ Selling expenses"). Shortage of property (its damage) in excess of such norms is written off at the expense of the guilty parties to the debit of account 73 “Settlements with personnel for other operations”, subaccount 73-2 “Calculations for compensation of material damage”.

Payroll

Labor costs are included in the cost of production. Therefore, accounting account 70 is debited with the accounts “Main production” (20) and “Sales expenses” (44). The posting is made for the entire salary amount. For calculations, a time sheet (form T12, T13) and a statement (T51) are used.

Example

A production employee received a monthly salary of 25 thousand rubles. Personal income tax is withheld from it in the amount of: 25 x 0.13 = 3.25 thousand rubles. Total payable – 21.75 thousand rubles. Accounting entries (account 70):

- DT20 KT70 – 25 thousand rubles. – the employee’s salary is accrued;

- DT70 KT68 – 3.25 thousand rubles. – personal income tax withheld;

- DT70 KT50 – 21.75 thousand rubles. - wages were paid from the cash register.

Account 94 Shortages and losses from damage to valuables

VAT 18% - 762.71). During the year, all goods were sold (40 units).

In addition, the company pays for bank services, which amounted to 890 rubles.

Accounting entries for completed business transactions:

- Dt41 Kt60: 101,694.20 rubles – receipt of office furniture to the warehouse for further sale;

- Dt19.03 Kt60: 18,305.80 rub. – VAT from the supplier;

- Dt51 Kt90.01: 200,000 rubles – proceeds from the sale of chairs;

- Dt91.02 Kt41: 101,694.20 rub. – write-off of the cost of chairs (the cost of Kolosok LLC includes only the purchase price of suppliers);

- Dt90.03 Kt68.02: RUB 30,508.47 – calculation of VAT payable to the tax authorities;

- Dt91.02 Kt51: 890 rub. – bank commissions.

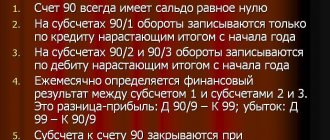

Results for account 90 at the end of the month:

Dt: RUB 101,694.20 + 30,508.47 rub. = 132,202.67 rub.

Kt: 200,000 rub.

Final balance: 67,797.33 rubles - profit received from the sale.

Results for 91 accounts at the end of the month:

Dt91.09 Kt91.02: 890 rub. - loss.

Closing of the year:

Dt90.09 Kt99: 67,797.33 rub. – profit from ordinary types of business activities is displayed.

Dt91.09 Kt99: 890 rub. – loss from non-operating activities.

At the end of the reporting year, Kolosok LLC received profit, which will be included in undistributed profit:

Dt84 Kt99: 66,907.33 rub. – determination of the financial results of the company’s economic life at the end of the year, as of December 31.

Victor Stepanov, 2018-06-22

Account characteristics

To record payroll calculations, account 70 is used. When asked which account 70 is active or passive, you can clearly answer that it is an active-passive account.

Depending on the situation, it can have two balances at once. The debit balance reflects the debt of persons working at the enterprise for the wages paid to them by the enterprise. The loan balance, on the contrary, reflects the employer’s debt to the employees working in the company.

When determining the final account balance, it matters which side the balance is on. If by debit, then the debit turnover reflects the increase in debt, and the credit turnover reflects its repayment.

The opening balance is added to the debit turnover, after which the resulting result must be compared with the credit balance. If the final value of the difference with the loan turnover turns out to be positive, then the final balance is a debit.

When the initial balance of account 70 is on credit, then the increase in debt is reflected on the credit side, and its repayment on the debit side. If the difference between the amount of the opening balance and the turnover on the credit account with the debit turnover is positive, then the ending balance is in credit. Otherwise, at the end of the period, a debit balance of account 70 is obtained.

Attention! The turnover sheet for account 70 can reflect two balances at once. This is due to the fact that subaccounts within it can be either debit or credit, and the synthetic account has a folded double balance.

In the balance sheet, account 70 balances are reflected as follows:

- In the asset as part of current assets on line 1230 as accounts receivable.

- In liabilities as part of short-term liabilities on line 1520 as accounts payable.

Should I expect help from the program?

Software products designed for accounting provide various opportunities for identifying shortages and closing turnover.

In 1C version 8.3, you can reflect the amount of shortages found during inventory using the document “Inventory of goods in the warehouse” by department and MOL.

After filling it out and posting it, you can “create based on” this document “Write-off of goods”. Here you need to manually select the product range, enter the quantity, and the program will enter the amount. You can learn this process using a video.

Write-offs within the norms and above, regardless of the presence of the culprit, will have to be done in any version of 1C in manual operations. In versions 8.2 and 8.3, to do this, you need to go to the “Accounting, Taxes and Reporting” menu, select the “Accounting” section and go to the “Manual Transactions” subsection. When creating an operation yourself, you need to register all the transactions and fill out all the required subaccounts.

For the 1C UPP 94 configuration, the account is closed by writing off the goods, but it is necessary to specify in the settings the cost estimation method “At planned cost”. Otherwise, the cost price may be calculated incorrectly due to skewed registers.

What are the subaccounts?

Each employee of the company creates his own sub-account, which will account for all accruals, payments and deductions for the entire period of his work in the organization. For ease of work, they are combined by department and divided into the following groups:

- payments to employees included in the company's staff;

- payments to employees with whom a contract has been concluded;

- payments to employees working part-time;

- payments to employees with a confirmed disability group.

Each organization itself has the right to create and approve the analytics it needs, but taking into account the requirements of Order of the Ministry of Finance No. 94n dated October 31, 2000.

The following subaccounts are most common at enterprises of different levels:

- 70.1 - used for payroll;

- 70.2 - serves to reflect deposited amounts;

- 70.3 - salary debts are reflected;

- 70.4 - shows the amounts to be issued;

- 70.5 - amounts transferred to deposits are entered;

- 70.6 - reflects the rounding amounts used when calculating wages.

Corresponds with accounts

Account 70 can correspond with the following accounts:

From the debit of account 70 to the credit of accounts:

- Account 50 - when paying wages in cash from the cash register;

- Account 51 – when paying wages by transfer from a current account;

- Account 52 – when paying wages by transfer from a foreign currency account;

- Account 55 – when paying wages by transfer from a special account;

- Account 68 - regarding tax withholding from wages;

- Account 69 - when withholding funds not covered by the social insurance fund (for example, when paying for a voucher);

- Account 71 - when withholding unpaid accountable amounts;

- Account 73 - when withholding funds in favor of the company (for example, when covering damage or defects);

- Account 76 - when depositing unpaid wages, or deductions under writs of execution;

- Account 79 - for settlements between the parent company and the branch;

- Account 94 - for a one-time recovery of the deficiency from the guilty person.

According to the credit of the account, it corresponds with the debit of the following accounts:

- Account 08 - regarding the calculation of wages to employees involved in the creation or preparation for operation of a non-current asset;

- Account 20 - when calculating wages to the main employees of the workshop;

- Account 23 – when calculating wages for employees of the auxiliary workshop;

- Account 25 – when calculating salaries for managerial or technical personnel;

- Account 26 - when calculating salaries for administrative staff;

- Account 28 - when calculating wages for employees who are constantly engaged in correcting defects;

- Account 29 – when calculating wages to employees of service farms;

- Account 44 - when calculating wages for employees engaged in trade;

- Account 69 - when calculating payments made from social funds;

- Account 76 - when calculating payments from third parties in favor of a specific employee;

- Account 79 – for settlements between the parent company and the branch;

- Account 84 - when accruing income based on the results of activities to the founders, members of the company, etc.;

- Account 91 - when calculating wages to employees who are not engaged in their main activities;

- Account 96 - in case of accrual of payments made at the expense of a previously created reserve;

- Account 97 - when calculating payments that will actually be taken into account in the following periods;

- Account 99 - when calculating payment for work to eliminate the consequences of force majeure.

Postings to subaccount 73.1

73 account may have several sub-accounts, the use of which is regulated by the accounting policy of the organization.

Conventionally, we assume that the company uses subaccount 73.1 to account for settlements with employees for loans provided to them. Account assignments using subaccount 73.1

| Dt | CT | Characteristics of a business transaction |

| 73.1 | 50 | The employee was given a loan from the cash register to purchase livestock |

| 73.1 | 51 | A loan for building a house was transferred from the current account to the employee's account |

| 73.1 | 10 | The employee was provided with a loan in the form of construction materials |

| 73.1 | 91 | Interest is accrued on the loan amount for use |

| 50 | 73.1 | The organization's cash desk received the amount to repay the loan debt |

| 51 | 73.1 | Funds to pay for the loan were transferred to the company's bank account |

| 70 | 73.1 | The loan amount and interest are deducted from the employee's salary. |

| 91.2 | 73.1 | The amount of unrepaid debt is written off as expenses of the organization |

As can be seen from the table, the organization has the right to withhold the amount of debt from the employee’s salary. If the retained funds are still not enough to repay the loan amount, the balance is written off to the financial result (account 91.2).

Which accounts does account 70 correspond to?

Account 70 corresponds with many expense accounts. For convenience, we have collected everything in a table.

| Account 70 corresponds by debit with | Account 70 corresponds for the loan with |

|

|

Calculation of wages for personnel in the 1C system

You can correctly calculate your salary in the 1C: Salary and Personnel program if you follow a certain sequence of arrangement of all the required data in the information base. The calculation results are entered into the payroll sheet. Some organizations issue wages using cash receipts issued for each worker. To avoid mistakes, users of the 1C system are recommended to calculate all the numbers in the payslip and issue money according to the required documents.

To draw up a payslip in the 1C program, you need to open the “Reports” menu and select the appropriate item. The document can be compiled for the enterprise as a whole or for a specific division, as well as for a group of employees. The procedure for reflecting data in the pay slip:

- The serial number of the entry is entered in column No. 1.

- Columns No. 2-5 contain information about the employee. It can be viewed from the “Directories” section (personnel number, last name and initials, position or profession, tariff rate or salary).

- Based on the working time sheet, data on the number of days actually worked in the period is entered in column No. 6, and data on the number of days worked on holidays and weekends is entered in Column No. 7.

- Information about accruals for the current month by type of payment is displayed (section No. 8-12), as well as the calculation of deductions from the amount.

- Column No. 13 indicates the amount of tax payable this month.

- Data is entered on other deductions from the worker’s salary (column No. 14): loan repayment, alimony, union membership dues, etc.

- Column 15 sums it up.

- Column No. 16 shows the company’s debt (employee’s debt) based on the results of previous calculations.

- If there is a difference between the totals of columns No. 12 and No. 15, it is shown in column No. 18 “Amount to be paid.”

The article examined in detail account 70 “Settlements with employees for wages”. Knowing its features, young specialists will be able to correctly perform the required financial transactions.

Postings to account credit 73

73 account is credited when the employee makes a payment for previously billed amounts or when compensation payments are calculated.

Account assignments for the loan account. 73

| Dt | CT | Characteristics of a business transaction |

| 50 | 73 | The amount of funds deposited into the cash register to repay the debt for the purchase of specialized clothing is reflected. |

| 51 | The employee transferred the amount of debt for the purchased apartment to the organization’s current account | |

| 76 | The employee received the amount of insurance compensation | |

| 92 | The amount of the employee's outstanding receivables was written off after the expiration of the claim period | |

| 10 | Compensation was awarded for purchased fuel for a personal car used at work | |

| 19 | The amount of input VAT on purchased fuel is reflected |

Accounting account 73 is one of the ways to reflect settlements with employees. Not all payments and collections can be reflected on accounts 70 and 71, which explains the use of an additional account that simplifies accounting.