Features of the financial result according to UTII

According to Art. 346.30 of the Tax Code of the Russian Federation, the tax period for UTII is a quarter, and therefore the imputed tax must be calculated and paid quarterly.

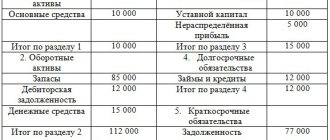

Unlike many other taxes, UTII transactions do not affect the cost of products and goods. That is, neither the 20th account “Main production” nor the 44th account “Sales expenses” is involved in the imputation. This is stated in the letter of the Ministry of Finance of the Russian Federation dated August 18, 2004 No. 07-05-14/215, which states that the final financial result on the balance sheet is taken into account without taking into account income tax and other similar payments, such as UTII.

UTII when combined with OSN

For expenses that cannot be unambiguously attributed to specific types of activities, a basis for the distribution of expenses by type of activity is established. To do this, in the “Setting up taxes and reports” form, section “Income tax - Base for distribution of income by type of activity”, you should select one of the indicators: “Only income from sales” or “Income from sales and non-operating”.

Fig.8 UTII when combined with OSN

When combining activities on OSN and activities on UTII, the organization has the obligation to keep separate VAT records, which is necessary in the VAT section.

Fig.9 Setting up taxes and reports

The “1C: Accounting 8” configuration also provides for setting up cost items used when writing off UTII expenses, or expenses that cannot be attributed to a specific type of activity at the time of their commission. You can set up cost items from the section “Directories - Income and Expenses - Cost Items”.

If a cost item can be unambiguously attributed to activities on OSNO or UTII, then the item is set up for each type of activity. For example, the cost item “Payment”. The attribution of costs to a particular activity is regulated by the switch in the “Item for accounting expenses of the organization” section.

Posting the transaction “UTII Paid”

The posting of payment of tax on imputation is reflected by an entry in the accounts:

Dt 68 – Kt 51 (50), where:

account 51 (50) - current account of the organization or cash desk.

Tax payment is made until the 25th (inclusive) day of the month after the end of the tax period.

Read more about paying tax in the “Payment of UTII” section.

At the end of the year, the amount accumulated in account 99 “Profits and losses” will be attributed to account 84 “Retained earnings”. Thus, at the end of the reporting period, the following entries may be made for the amount of UTII accrued for the 4th quarter, possible income received or losses incurred:

- Dt 84 - Kt 99 - will reflect the uncovered loss of the reporting year: or

- Kt 99 - Dt 84 - will show net profit based on the results of the past year.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Calculation of UTII: postings

The use of UTII presupposes the exemption of the “imputed” organization from paying income tax. Instead, he pays an “imputed” tax.

Let us remind you that income tax is accrued on the debit of account 99 “Profits and losses” and the credit of account 68 “Calculations for taxes and fees”.

Considering that UTII is essentially an analogue of income tax, the accrual of tax on imputed income is reflected in the same way as the accrual of income tax.

This means that every quarter when a single tax is calculated, an accounting entry is made in the accounting records of the “imputed person” (Order of the Ministry of Finance dated October 31, 2000 No. 94n):

Debit of account 99 – Credit of account 68, subaccount “UTII”

This procedure for calculating UTII is also confirmed by Letter of the Ministry of Finance of the Russian Federation dated December 16, 2004 No. 09-01-07.

The type of business entity has a significant impact on accounting for UTII. If the taxpayer is a legal entity, then accounting can be organized in full or in a simplified format. Individual entrepreneurs may not keep accounting records on UTII. This norm is confirmed by clause 2 of Art. 6 of the Law of 06.12.2011 No. 402-FZ and Letter of the Ministry of Finance of 08.08.2012 No. 03-11-11/233. You can learn more about accounting for individual entrepreneurs on UTII.

The right to use a simplified method of organizing accounting arises for a company provided that it meets the criteria of a small business entity:

- by volume of income;

- by the number of hired personnel;

- by capital structure.

UTII accounting and taxation

UTII is a specialized taxation system that provides for the calculation and payment of “presumptive” tax, and its calculation does not depend in any way on the actual income received. Let's look at how to reflect the accrual and payment of UTII tax in transactions.

Basic requirements for calculating UTII

The use of this taxation system exempts the payer from paying income and property taxes, except for non-current assets that already have their own cadastral value, as well as VAT and personal income tax - personal income tax.

Payment of UTII must be made no later than the 25th day of the month following the reporting quarter. The posting of UTII accrual must be done on the last day of the quarter.

Important! The amount of UTII tax can be reduced by the amount of insurance premiums that the entrepreneur pays for himself.

In addition, please note that the amount of UTII tax must be accrued and paid even during periods of business downtime or losses.

The use of the special UTII regime is provided only in several areas of activity on the basis of Article 346.27 of the Tax Code of the Russian Federation:

- Household services;

- Veterinary services;

- Hotel services;

- Vehicle washing and repair services;

- Retail;

- catering establishments;

- Outdoor advertising placement;

- Providing housing and commercial properties for rent:

Get 267 video lessons on 1C for free:

Only those enterprises that meet the requirements established by Article 346.26 of the Tax Code can apply this UTII system, namely:

- The number of hired employees does not exceed 100 people;

- Equity contributions to the authorized capital of other enterprises do not exceed 25%;

- The area of the sales area is no more than 150 square meters;

- The organization is not one of the largest taxpayers.

Formula for calculating UTII

The UTII tax is calculated based on the level of basic profitability, adjusted by the deflator coefficient K1 and the adjustment coefficient K2. The amount of basic profitability and the types of physical indicators K1 and K2 are established for each type of activity separately, which is prescribed in Article 346, paragraph 29.

The K1 coefficient is set at the federal level for 2021. it is 1.798, and the size of the K2 coefficient is set by local authorities at the place of registration of the company.

Calculation and accrual of UTII tax is carried out quarterly. Calculation formula:

Tax base = Profitability base * physical indicators for 3 months * K1 * K2, where:

- K1 – deflator coefficient;

- K2 – correction factor;

- UTII tax = Tax base * 15%.

If an enterprise has started its work or is deregistered as UTII without having worked the full reporting period, then the tax amount will be calculated for the period actually worked.

For example, a private enterprise is engaged in retail trade. Enterprise registration date: February 05, 2021 Find the amount of UTII tax for the 1st quarter.

- The sales area is 25 square meters;

- The level of basic profitability for this type of activity is 1,800 rubles / square meter;

- K1 for 2021 equal to 1.798;

- K2 is equal to 1.

Postings for accrual and payment of UTII

To ensure that the amount of UTII tax does not affect the cost of production work, goods and services sold, its accrual is carried out in the following correspondence:

- Debit 99 - Profit and loss;

- Credit 68 - UTII.

By the end of the year, the amount of tax accrued by UTII, which is collected in the Debit account 99, must be closed to account 84 - Retained earnings.

In total, although the amount of UTII does not have a direct impact on the cost of products manufactured or services provided, it nevertheless takes part in the formation of the final financial result of the enterprise.

Calculation of UTII transaction:

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| 99-01 | 68-UTII | 22 539,21 | UTII tax was accrued for the 1st quarter. | Accounting information |

| 68-UTII | 50, 51 | 22 539,21 | The amount of accrued UTII tax has been paid to the budget | Payment order, bank statement |

| 84 | 99-01 | 131 767,21 | Write-off of the annual amount of accrued UTII at the end of the year ((80,910.00 * 9 months) * 15%) + 22,539.21 = 131,767.71 rubles. | Accounting information |

Basic requirements for calculating UTII

The use of this taxation system exempts the payer from paying income and property taxes, except for non-current assets that already have their own cadastral value, as well as VAT and personal income tax - personal income tax.

Payment of UTII must be made no later than the 25th day of the month following the reporting quarter. The posting of UTII accrual must be done on the last day of the quarter.

Important! The amount of UTII tax can be reduced by the amount of insurance premiums that the entrepreneur pays for himself.

In addition, please note that the amount of UTII tax must be accrued and paid even during periods of business downtime or losses.

The use of the special UTII regime is provided only in several areas of activity on the basis of Article 346.27 of the Tax Code of the Russian Federation:

- Household services;

- Veterinary services;

- Hotel services;

- Vehicle washing and repair services;

- Retail;

- Maintenance of catering establishments;

- Outdoor advertising placement;

- Providing housing and commercial properties for rent:

Only those enterprises that meet the requirements established by Article 346.26 of the Tax Code can apply this UTII system, namely:

- The number of hired employees does not exceed 100 people;

- Equity contributions to the authorized capital of other enterprises do not exceed 25%;

- The area of the sales area is no more than 150 square meters;

- The organization is not one of the largest taxpayers.

Accounting for UTII

UTII acts as a basic mandatory payment made to the budget for small organizations in which up to 100 people work and perform their direct duties. This is stated in Art. 346.26 of the Tax Code of the Russian Federation.

For individual entrepreneurs, the fee replaces personal income tax, VAT and property contributions, and for LLCs it becomes a replacement for income tax and VAT. Using the mode brings convenience from the point of view of reducing costly areas and from the point of view of simplicity in general.

The use of UTII is available only to those organizations that ensure the implementation of their activities strictly in certain areas. This is described in the norms of the current legislation - Art. 346.27 Tax Code of the Russian Federation. This also includes the following common areas:

- provision of veterinary services;

- consumer services;

- hotel service;

- repair work on automatic telephone exchange;

- retail sales of products and goods;

- running a restaurant business;

- advertising placement;

- leasing of commercial and residential real estate.

Moreover, the organization has the right to apply UTII not in relation to all activities, but within the framework of individual areas together with other regimes such as the simplified tax system, OSNO.

Detailed correspondence with examples

As part of the process of calculating and accruing this fee, entrepreneurs use a whole system of entries, which are subsequently subject to entry into the Income and Expense Book, as well as into the Accounting Journal. As in the execution of other operations, the principle of double entry is relevant and applied here:

- The loan is recorded as a disposal. In modern accounting, this means using only one transaction in an organization and for individual entrepreneurs. This is credit 68, which is associated with settlement transactions for taxes and fees.

- By debit we are talking about receipts, so the main account that appears here is 99 “Profits and losses”. Here the accumulation of all income received by the organization within a certain period of time occurs.

If we take into account the fact that UTII is an analogue of a “profitable” tax, the accrual is reflected in the same way as the accrual of income tax. This indicates that every quarter, when UTII is calculated, a corresponding accounting entry is made in the report, as stated in Order No. 94n of the Ministry of Finance of Russia.

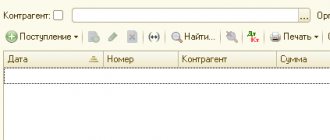

Working in 1C: features and nuances

A large proportion of individual entrepreneurs and LLCs are engaged in non-manual tax and accounting activities. They use specialized computer programs that automate this process and reduce the cost of services from financial sector specialists. The most common mechanism is 1C, which facilitates the calculation and accounting of this tax.

In the process of setting up the software, it is necessary to choose the single tax system, which will lead to the prompt distribution of household goods. transactions on the necessary accounting accounts.

It is worth taking into account the features of the version used and looking at the type of operations, for example, “manually carried out”, “AC and NU actions”, “UTII tax”, etc.

In this case, the declaration must be drawn up as of the end date of the last month relating to the reporting quarter.

Thus, this tax system is widespread, but not suitable for all enterprises and organizations. This is evidenced by the norms of current legislation.

Features of calculating UTII in 1C are presented below in the instructions.

General information

Tax on imputed income is the main mandatory payment to the budget for small enterprises that employ no more than 100 people (Article 346.26 of the Tax Code of the Russian Federation).

Wherein:

| For individual entrepreneurs | It replaces personal income tax, VAT and property tax |

| For LLC | Income tax and VAT |

The use of such a regime is convenient, both from the point of view of reducing the cost of paying taxes, and from the point of view of convenience and ease of maintaining tax and accounting records.

It is important to note that the use of UTII is available only to those companies that operate in certain areas, including (Article 346.27 of the Tax Code of the Russian Federation):

- Providing veterinary services and household services.

- Provision of hotel services.

- Carrying out repairs and washing of vehicles.

- Retail sales of products.

- catering establishments.

- Placement of outdoor advertising.

- Renting residential and commercial properties.

At the same time, the company has the right to use UTII not in relation to all of its activities as a whole, but within the framework of certain areas of operation, along with other tax regimes (STS, OSN).

Basic elements of taxation

The Tax Code of the Russian Federation clearly defines the elements of taxation of entrepreneurs with UTII. They determine the principles of operation, structure and procedure for collecting this mandatory payment.

| Item name | Description |

| Tax payers | LLCs and private entrepreneurs are acting in the area that is considered acceptable within the framework of UTII and do not violate the limits on the number of personnel (100 people), the size of the retail space (150 square meters), the number of cars (20 pieces), and also do not have shares in other companies, exceeding 25% (Article 346.28 of the Tax Code of the Russian Federation). |

| Tax rate | Set at 15%. It is accrued on the so-called imputed income: basic profitability adjusted by the value of the coefficients (Article 346.31 of the Tax Code of the Russian Federation) |

| Taxable period | The calculation and payment of UTII by organizations and entrepreneurs is carried out once a month (Article 346.30 of the Tax Code of the Russian Federation) |

| Single tax object | This is the income that the payer can potentially receive in the presence of a certain set of conditions. In the legislation it is conventionally called imputed income (Article 346.29 of the Tax Code of the Russian Federation) |

| The tax base | Calculated according to the formula prescribed in tax legislation |

Namely:

In this case, the basic profitability is predetermined by the state in the form of a nominal value, which differs for different types of activities.

As for the correction factors, then:

| K1 | Recalculates the tax base based on the level of inflation that has established in the economy |

| K2 | Determined at the regional level and characterizes seasonality, order and other features of conducting a particular type of business |

The physical indicator is a unit in which the result of the company’s activities is measured in terms of UTII, and the number of months demonstrates exactly how many full months in a year the entrepreneur worked, paying a single tax (Article 346.29 of the Tax Code of the Russian Federation).

The transition to UTII is carried out at the voluntary request of the taxpayer himself. To do this, he will need to prepare an application to the Federal Tax Service. After this, the right to charge a single tax will begin to apply from the new financial year.

An automatic transition from UTII to the main mode at any time of the year occurs if the entrepreneur (Article 346.36 of the Tax Code of the Russian Federation):

| Begins to engage in activities | Not falling under UTII |

| Expanding your staff | Exceeds the 100 employee limit |

| Increases the share of participation in other companies | More than 25% |

It is worth noting that in order to register for taxation under the single tax system, a company fills out an application for UTII-1 (for LLC) or UTII-2 (for individual entrepreneurs), and when deregistering - UTII-3 (for LLC) or UTII-4 ( for individual entrepreneurs).

Consideration of any applications to the Federal Tax Service from entrepreneurs and organizations regarding tax on imputed income takes no more than 5 days.

Payment deadlines

Both LLCs and individual entrepreneurs pay a single tax based on the results of the quarter, as mentioned above.

In this case, filling out the declaration and making payment to the treasury must be made no later than the 25th day of the month following the reporting quarter (Article 346.32 of the Tax Code of the Russian Federation).

It is worth noting that submitting documents and making payments is carried out by the Federal Tax Service:

| By place of registration | For individual entrepreneurs |

| At the place of registration | For LLC |

When filling out the declaration, payers must remember that they have the right to reduce the amount of UTII by the amount:

- Contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund, the Social Insurance Fund, if the company uses the labor of hired workers. A private entrepreneur has no right to make similar deductions for himself.

- Costs incurred as a result of paying temporary disability benefits to the company's employees. Such payments can be deducted if the employee’s absence from work is confirmed by sick leave.

According to legal restrictions, all of the above deductions cannot reduce the tax base by more than 50%.

When UTII will be cancelled, see the article: UTII cancellation.

Do I need a cash register for individual entrepreneurs with UTII?

Private entrepreneurs carrying out their activities without hiring employees cannot use the right to deductions.

The main regulatory act regulating the issues of calculation and collection of UTII in Russia is the Tax Code.

It devotes an entire chapter 23.6 to issues of the single tax, the articles of which cover:

| Article | |

| 346.26 | Main characteristics and features of this form of taxation of small enterprises, such as UTII |

| 346.27 | Concepts, terms and definitions used in matters of taxation of individual entrepreneurs and LLCs with a single tax, as well as types of activities that fall under this regime and are not recognized within its framework |

| 346.28 | General characteristics of tax payers and the possibility of replacing other mandatory payments with a single tax |

| 346.29 | Description of the taxable object, the procedure for its determination and the process of calculating the tax base |

| 346.30 | The time that is taken into account when calculating the single tax |

| 346.31 | Establishing the exact tax rate |

| 346.32 | The period during which the tax must be calculated, the declaration must be filled out and paid into the treasury |

More detailed issues are regulated by regulations and instructions of specialized government departments, including the Federal Tax Service, the Ministry of Finance and extra-budgetary funds.

Certain issues regarding the procedure for calculating and accounting for UTII are described in Federal Law-402 “On Accounting”, as well as instructions for maintaining documentation for companies using a simplified system of accounting and tax accounting.

Which accounting entry to accrue UTII

When calculating UTII, entrepreneurs use a system of entries that are entered in the Book of Accounting for Cash Receipts and Expenses or in the General Journal.

It should be noted that a posting is a special entry in an account book, journal or computer program that reflects a particular business transaction.

When making entries, entrepreneurs usually use the double entry rule - one and the same amount is reflected in two interconnected accounts:

| By debit | Admission |

| By loan | Disposal |

Currently, accounting uses only one key entry for calculating UTII for organizations and private entrepreneurs if this process is done manually, namely:

| D 99 | "Profit and loss" |

| K 68 | "Calculations for taxes and fees" |

In fact, it is in account 99 that all the income that the company received for a certain period from temporary activities is accumulated, which must be transferred to the treasury in the form of a tax (taking into account the established rate).

: calculation of UTII in 1C Accounting 8

At the end of the quarter (reporting period for UTII), this amount is debited to account 84 in the form of a payment. The above method is now considered as the simplest and most universal method of calculating UTII for LLCs and private entrepreneurs.

Working in the 1C program

Many individual entrepreneurs and LLCs do not carry out tax and accounting manually.

Through special computer programs that allow not only to automate this process, but also to reduce the costs of financial services.

The most common mechanism in this case is the 1C program, which also allows entrepreneurs to calculate and account for UTII.

Find out everything about the transition to UTII with the simplified tax system from the article:.

Where can I get an application form for withdrawal from UTII in 2021?

How to keep separate records for UTII and OSNO.

Even when setting up the software, a single tax system should be selected - this will allow you to quickly distribute business transactions to the necessary accounting accounts.

It is also important to take into account the version of 1C used, namely:

| In 1C 8.2 | To record the operation, use the “Manual Operations” tab |

| In 1C 8.3 | Postings are taken into account thanks to the tab “Operation BU and NU” |

After the operation parameters are set, you should post its amounts into two accounts:

| D 99 | "Profit and loss" |

| K 68.11 | "UTII tax" |

The preparation of the declaration is timed to coincide with the end date of the last month of the reporting quarter.

Thus, as part of tax accounting in small enterprises operating under UTII conditions, a specific system for tax accounting and its reflection in accounting documentation is used.

This procedure applies to both individual entrepreneurs and LLCs. It is important to emphasize that the possibility of calculating and subsequently reflecting a single tax in the declaration also exists within 1C, regardless of the version of the program used.

Cancellation of UTII Form UTII 2

Transition from UTII to a general taxation system

Situation 1. Income from the sale of goods, performance of work, provision of services acquired (performed, provided) during the period of application of UTII was received during the period of application of the SST.

When applying the general taxation system for income tax, you can choose the method of recognizing income and expenses: cash method or accrual method.

To apply the cash method, revenue from the sale of goods (work, services) on average over the previous four quarters should not exceed 1,000,000 rubles. for each quarter (clause 1 of article 273 of the Tax Code of the Russian Federation). Proceeds for calculations are applied excluding value added tax. When applying the cash method, income is taken into account in the tax base when it is actually received into the current account or into the cash register.

In other cases, the taxpayer uses the accrual method. This means that income is taken into account in the base in the period in which the transfer of ownership of goods, results of work performed, and provision of services occurred. The date of actual receipt of funds does not matter with this method.

Thus, regardless of the applied method of recognizing income and expenses in the general taxation system (cash method or accrual method), income from the sale of goods on UTII, actually received during the period of application of the SST, is not taken into account in the tax base for income tax.

Situation 2. During the period of application of UTII, an advance was received (payment, partial payment for upcoming deliveries of goods). Is subsequent income from the sale of these goods taken into account in the income tax base?

When applying the accrual method of income tax, revenue that is received as an advance payment is not taken into account as income (clause 1, clause 1, article 251 of the Tax Code of the Russian Federation).

Consequently, when applying the accrual method, the advance payment for the upcoming sale of goods (work, services) is not included in the tax base for income tax. However, when these goods are shipped already during the period of application of the OSN, revenue will be included in income using the accrual method.

When applying the cash method in such a situation, the advance received during the period of application of UTII is not included in the income tax base.

Situation 3. Goods for resale were purchased on UTII, but were sold already during the period of application of the SST. Is it possible to take into account the costs associated with the acquisition in the income tax base?

The procedure for accounting for income tax expenses is provided for in Article 268 of the Tax Code of the Russian Federation. In paragraphs 3 p. 1 art. 268 of the Tax Code states that the taxpayer has the right to reduce income by the cost of purchasing goods sold using one of the following methods for valuing purchased goods:

- at the cost of the first in time of acquisition (FIFO);

- at average cost;

- at the cost of a unit of goods.

The chosen method for recognizing expenses must be specified in the organization’s accounting policies for tax purposes.

Consequently, the cost of remaining goods not sold during the period of application of UTII can be taken into account as part of income tax expenses during the period of application of the SST.

Situation 4. How to calculate VAT when switching from UTII to OSN from 01/01/2021? According to paragraph 1 of Art. 146 of the Tax Code of the Russian Federation in this situation, the taxpayer becomes a payer of value added tax from 01/01/2021, that is, he has an obligation to calculate VAT.

If an advance payment for future deliveries is received during the period of application of UTII before 12/31/2020, and the shipment will be made after 01/01/2021, then VAT will not be charged on such advance payment. However, on the cost of the shipment itself, which will be carried out in the period from 01/01/2021, VAT must be charged in the general manner.

Situation 5. Is it possible to get VAT deductions when switching from UTII to OSN?

In the event that a taxpayer has balances of unsold goods purchased during the period of application of the taxation system in the form of a single tax on imputed income, VAT on such goods can be deducted in the manner prescribed by Art. 172 of the Tax Code of the Russian Federation. It is important that these goods are used in transactions subject to value added tax. The right to deduction arises during the period when the transition from UTII to OSN is made, that is, starting from the first quarter of 2021.

The possibility of obtaining a VAT deduction on fixed assets will depend on the period in which the fixed assets were put into operation.

If a fixed asset was acquired and put into operation during the period of application of UTII, then the deduction of value added tax on the residual value of such objects after the transition to the general taxation system of the Tax Code of the Russian Federation is not provided.

If the fixed asset was purchased during the period of application of UTII, and was put into operation already during the period of application of the SST, then the amounts of VAT are accepted for deduction in accordance with Article 172 of the Tax Code of the Russian Federation. A prerequisite is that the fixed asset must be used in activities subject to VAT. The right to deduct VAT arises from the first quarter of 2021.

Clarifications on all the issues discussed above were issued by the Federal Tax Service until 2021, which means that taxpayers could take them into account when deciding whether to switch to one regime or another.

Postings according to UTII

UTII acts as a basic mandatory payment made to the budget for small organizations in which up to 100 people work and perform their direct duties. This is stated in Art. 346.26 of the Tax Code of the Russian Federation.

For individual entrepreneurs, the fee replaces personal income tax, VAT and property contributions, and for LLCs it becomes a replacement for income tax and VAT. Using the mode brings convenience from the point of view of reducing costly areas and from the point of view of simplicity in general.

The use of UTII is available only to those organizations that ensure the implementation of their activities strictly in certain areas. This is described in the norms of the current legislation - Art. 346.27 Tax Code of the Russian Federation. This also includes the following common areas:

- provision of veterinary services;

- consumer services;

- hotel service;

- repair work on automatic telephone exchange;

- retail sales of products and goods;

- running a restaurant business;

- advertising placement;

- leasing of commercial and residential real estate.

Moreover, the organization has the right to apply UTII not in relation to all activities, but within the framework of individual areas together with other regimes such as the simplified tax system, OSNO.

How to calculate UTII

UTII is calculated based on the basic profitability, the sum of physical indicators for the quarter, and the established coefficients K1 and K2. Each type of business activity has its own basic profitability and type of physical indicator. They are spelled out in Art. 346..

The K1 coefficient is annually indexed and published by tax legislation (currently it is equal to 1.798). The K2 coefficient is established by the legislative bodies of the constituent entities. Its meaning can be found at the Federal Tax Service where the company is registered.

The formula for calculation is:

NB = BD x (FZ1+FZ2+FZ3) x K1 x K2

UTII = NB x 15

Where NB is the tax base;

FZ1,2,3 – physical indicator for each of three months;

K1 and K2 are coefficients.

When registering or deregistering UTII, it is not uncommon that the reporting period has not been fully worked out. In this situation, tax must be calculated and paid only for the time actually worked.

Example. The Alpha organization is engaged in retail trade. The sales area is 12 m2. “Alpha” has been registered as a payer since 02/2015. You need to calculate UTII for the 1st quarter.

The basic profitability for retail of this type is 1800 rubles. per meter K2 will be equal to 1. You need to calculate the tax base for partial February:

NB = 1800 x (12/28 x 20) x 1.798 x 1 = 27741

Tax base for March:

NB = 1800 x 12 x 1.798 x 1 = 38837

UTII = (27741 + 38837) x 15% = 9986,

It must be taken into account that tax must be calculated and paid even when the activity is not actually carried out, but the taxpayer is not deregistered.

Macro

Enterprises that operate on UTII must not only calculate it, but also reflect the accrual of UTII tax on their accounting accounts. The single tax on imputed income is charged to the account where the final financial result is formed, that is, to account 99 “Profits and losses”.

In the 1C Accounting program 8th edition. 3.0 the accrual of UTII tax is reflected using the accounting and NU operation, located on the “Accounting, taxes and reporting” tab. A posting is drawn up Dt 99.01.2 Kt 68.11, which is entered into the program manually.

This posting can also be made using the “Account Correspondence” assistant. All you need to do is find the required entry in the assistant, and then fill out the transaction that opens, indicate the subaccount and the tax amount.

The debit indicates the sub-account “Income tax and similar payments”, and the credit “Tax (contributions): accrued/paid”.

Payment of a single tax on imputed income in the 1C Accounting program 8 ed. 3.0 is reflected using the document “Write-off from current account”, type of operation “Tax transfer”. The document is located on the “Bank and Cash Desk” tab, or it can also be entered using “Correspondence of Accounts”.

If payment orders are drawn up in the program, you must first make a payment.

According to the document, a posting is generated: Dt 68.11 Kt 51

The UTII tax is calculated, as well as the preparation and submission of a tax return, once a quarter.

The deadline for submitting the declaration is no later than the 20th day of the month following the reporting month. That is, for the 1st quarter of 2014, the declaration is due by April 20, 2014.

Tax payment is made no later than the 25th day of the month following the reporting month. Therefore, tax for the 1st quarter of 2014 must be paid no later than April 25, 2014.

The tax return for the single tax on imputed income for certain types of activities was approved by order of the Federal Tax Service of Russia dated January 23, 2012 No. ММВ-7-3/ [email protected] Since 2014, the declaration has indicated new OKTMO codes instead of OKATO codes.

This is how UTII tax is calculated and paid in 1C Accounting 8th edition. 3.0, about the calculation of the simplified tax system in the program. Also, since 2016, automatic tax calculation is available with the program. See more about this.

UTII is a specialized taxation system that provides for the calculation and payment of “presumptive” tax, and its calculation does not depend in any way on the actual income received. Let's look at how to reflect the accrual and payment of UTII tax in transactions.

Calculation of UTII: postings

The use of UTII presupposes the exemption of the “imputed” organization from paying income tax. Instead, he pays an “imputed” tax.

Let us remind you that income tax is accrued on the debit of account 99 “Profits and losses” and the credit of account 68 “Calculations for taxes and fees”.

Considering that UTII is essentially an analogue of income tax, the accrual of tax on imputed income is reflected in the same way as the accrual of income tax.

This means that every quarter when a single tax is calculated, an accounting entry is made in the accounting records of the “imputed person” (Order of the Ministry of Finance dated October 31, 2000 No. 94n):

Debit of account 99 – Credit of account 68, subaccount “UTII”

Postings for calculating UTII tax

UTII is a specialized taxation system that provides for the calculation and payment of “presumptive” tax, and its calculation does not depend in any way on the actual income received. Let's look at how to reflect the accrual and payment of UTII tax in transactions.

Basic requirements for calculating UTII

The use of this taxation system exempts the payer from paying income and property taxes, except for non-current assets that already have their own cadastral value, as well as VAT and personal income tax - personal income tax.

Payment of UTII must be made no later than the 25th day of the month following the reporting quarter. The posting of UTII accrual must be done on the last day of the quarter.

Important! The amount of UTII tax can be reduced by the amount of insurance premiums that the entrepreneur pays for himself.

In addition, please note that the amount of UTII tax must be accrued and paid even during periods of business downtime or losses.

The use of the special UTII regime is provided only in several areas of activity on the basis of Article 346.27 of the Tax Code of the Russian Federation:

- Household services;

- Veterinary services;

- Hotel services;

- Vehicle washing and repair services;

- Retail;

- catering establishments;

- Outdoor advertising placement;

- Providing housing and commercial properties for rent:

Get 267 video lessons on 1C for free:

Only those enterprises that meet the requirements established by Article 346.26 of the Tax Code can apply this UTII system, namely:

- The number of hired employees does not exceed 100 people;

- Equity contributions to the authorized capital of other enterprises do not exceed 25%;

- The area of the sales area is no more than 150 square meters;

- The organization is not one of the largest taxpayers.

Formula for calculating UTII

The UTII tax is calculated based on the level of basic profitability, adjusted by the deflator coefficient K1 and the adjustment coefficient K2. The amount of basic profitability and the types of physical indicators K1 and K2 are established for each type of activity separately, which is prescribed in Article 346, paragraph 29.

The K1 coefficient is set at the federal level for 2021. it is 1.798, and the size of the K2 coefficient is set by local authorities at the place of registration of the company.

Calculation and accrual of UTII tax is carried out quarterly. Calculation formula:

Tax base = Profitability base * physical indicators for 3 months * K1 * K2, where:

- K1 – deflator coefficient;

- K2 – correction factor;

- UTII tax = Tax base * 15%.

If an enterprise has started its work or is deregistered as UTII without having worked the full reporting period, then the tax amount will be calculated for the period actually worked.

For example, a private enterprise is engaged in retail trade. Enterprise registration date: February 05, 2021 Find the amount of UTII tax for the 1st quarter.

Initial data:

- The sales area is 25 square meters;

- The level of basic profitability for this type of activity is 1,800 rubles / square meter;

- K1 for 2021 equal to 1.798;

- K2 is equal to 1.

Calculation:

- The size of the tax base for February = 1800 rubles / sq. m. m * (25 sq. m/28 days * 24 days) * 1,798 * 1 = 69,351.43 rubles;

- The size of the tax base for March = 1,800 rubles/sq. m * 25 sq. m * 1.798 * 1 = 80,910.00 rub.;

- Amount of UTII tax for the 1st quarter = (69351.43 + 80910.00) * 15% = 22,539.21 rubles.

Postings for accrual and payment of UTII

To ensure that the amount of UTII tax does not affect the cost of production work, goods and services sold, its accrual is carried out in the following correspondence:

- Debit 99 - Profit and loss;

- Credit 68 - UTII.

By the end of the year, the amount of tax accrued by UTII, which is collected in the Debit account 99, must be closed to account 84 - Retained earnings.

In total, although the amount of UTII does not have a direct impact on the cost of products manufactured or services provided, it nevertheless takes part in the formation of the final financial result of the enterprise.

Calculation of UTII transaction:

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| 99-01 | 68-UTII | 22 539,21 | UTII tax was accrued for the 1st quarter. | Accounting information |

| 68-UTII | 50, 51 | 22 539,21 | The amount of accrued UTII tax has been paid to the budget | Payment order, bank statement |

| 84 | 99-01 | 131 767,21 | Write-off of the annual amount of accrued UTII at the end of the year ((80,910.00 * 9 months) * 15%) + 22,539.21 = 131,767.71 rubles. | Accounting information |

Source: //BuhSpravka46.ru/buhgalterskie-provodki/provodki-po-nachisleniyu-envd.html

UTII

The single tax on imputed income or UTII is a taxation regime in which tax is paid on imputed income. Imputed income does not depend on the profit received by a company or individual entrepreneur; it is established by current legislation. This tax is not charged on actual income received.

Basic profitability is established for certain types of activities for which UTII can be applied. It is necessarily tied to physical indicators. For example, if the activity is related to cargo transportation services, then the basic profitability is established for each individual unit of transport. As for retail trade, the basic profitability is tied to 1 sq.m of area used in work.

Important! A company and an entrepreneur can influence the tax burden under UTII only by changing the physical indicator.

Formula for calculating UTII

The UTII tax is calculated based on the level of basic profitability, adjusted by the deflator coefficient K1 and the adjustment coefficient K2. The amount of basic profitability and the types of physical indicators K1 and K2 are established for each type of activity separately, which is prescribed in Article 346, paragraph 29.

The K1 coefficient is set at the federal level for 2021. it is 1.798, and the size of the K2 coefficient is set by local authorities at the place of registration of the company.

Calculation and accrual of UTII tax is carried out quarterly. Calculation formula:

Tax base = Profitability base * physical indicators for 3 months * K1 * K2, where:

- K1 – deflator coefficient;

- K2 – correction factor;

- UTII tax = Tax base * 15%.

If an enterprise has started its work or is deregistered as UTII without having worked the full reporting period, then the tax amount will be calculated for the period actually worked.

For example, a private enterprise is engaged in retail trade. Enterprise registration date: February 05, 2021 Find the amount of UTII tax for the 1st quarter.

Initial data:

- The sales area is 25 square meters;

- The level of basic profitability for this type of activity is 1,800 rubles / square meter;

- K1 for 2021 equal to 1.798;

- K2 is equal to 1.

Calculation:

- The size of the tax base for February = 1800 rubles / sq. m. m * (25 sq. m/28 days * 24 days) * 1,798 * 1 = 69,351.43 rubles;

- The size of the tax base for March = 1,800 rubles/sq. m * 25 sq. m * 1.798 * 1 = 80,910.00 rub.;

- Amount of UTII tax for the 1st quarter = (69351.43 + 80910.00) * 15% = 22,539.21 rubles.

Who can switch to UTII

Until recently, all organizations that conducted certain types of activities specified in the Tax Code of the Russian Federation had to switch to UTII. In 2013, a voluntary transition to this taxation regime was introduced. Today, this tax can be paid starting at any time, regardless of when the taxpayer’s activities actually began (346.26 of the Tax Code of the Russian Federation). UTII in the constituent entities of the Russian Federation is put into effect by separate regulations. This tax regime does not exist in all regions of Russia, and from 2021 it will be completely abolished.

Important! The right of taxpayers to apply such a regime as UTII is confirmed by a notification to the taxpayer, which is issued upon the application of a company or individual entrepreneur if all the conditions necessary for the application of this tax regime are met.

If a company is a UTII payer, then it is exempt from paying taxes such as VAT, income tax, and property tax. But this applies only to transactions related to the types of activities for which the company pays UTII. And objects not used in activities falling under the imputation are subject to taxation according to general requirements.

Why keep separate records when combining simplified taxation system and UTII

Taxpayers who apply both “simplified taxation” and “imputation taxation” must keep records of income and expenses for each tax regime separately. If this condition is not met, problems may arise with calculating the tax base according to the simplified tax system and the amount of tax according to UTII.

Keeping separate records makes it possible to figure out which costs incurred during the tax period can be used to reduce the tax base for the simplified tax system or UTII. If you do not have proof of expenses, then you are deprived of this right.

Another important task of maintaining separate accounting is establishing a system for separate accounting of wages for employees of the organization who work in different sections of your business under different tax regimes.

Modern programs or services help to establish separate accounting, payment of taxes and reporting when combining modes without much difficulty.

Taxation under UTII

This special regime cannot be used by companies and individual entrepreneurs if their workforce is more than 100 people. To switch to UTII, a corresponding application is submitted to the Federal Tax Service at the place of registration or business. Having examined it, the Federal Tax Service will issue a notification that will confirm the right to apply this type of taxation.

Tax payment is made quarterly. In addition, it is also the responsibility of taxpayers to file a UTII return. A declaration is also provided every quarter.

| Taxpayer action | Deadlines |

| Submitting a declaration to the Federal Tax Service | Until the 20th day of the month following the quarter |

| Paying tax | Until the 25th day of the month following the quarter |

Payments through a current account with UTII

The taxation regime in the form of UTII applies only to the types of business activities listed in clause 2 of Art. 346.26 Tax Code of the Russian Federation. For types of activities not specified in this paragraph, other taxation regimes must be applied. UTII can only be applied to retail trade, which means the sale of goods for personal, family, household and other use not related to business activities (Clause 1, Article 11 of the Tax Code of the Russian Federation, Article 492 of the Civil Code of the Russian Federation). In Letters of the Ministry of Finance of the Russian Federation dated November 23, 2012 N 03-11-11/355, dated May 21, 2012 N 03-11-11/165, it is said: The defining feature of a retail purchase and sale agreement is the purpose for which the taxpayer sells goods to organizations and to individuals: for personal, family, home or other use not related to business activities, or for the use of these goods for the purpose of conducting business activities. At the same time, the individual entrepreneur is not obliged to control the further use of the purchased product. Letter of the Federal Tax Service of the Russian Federation dated January 18, 2006 N GI-6-22/31

If an individual entrepreneur sells goods to legal entities and these goods are used by buyers to conduct business, then this activity is recognized as wholesale trade, which, as a rule, is accompanied by the conclusion of an agreement for the supply of goods. If an individual entrepreneur sells goods to legal entities for other uses not related to business activities, then this is recognized as retail trade. At the same time, a retail purchase and sale agreement (NOT delivery!) can be concluded with a legal entity, which states that the goods are not purchased for business activities.

A similar position on the possibility of applying UTII in relation to the services of a service that deals with maintenance and sale of spare parts is set out in Letter of the Ministry of Finance of the Russian Federation dated 05.08.2014 N 03-11-11/38552: If the contract (work order) for the provision of repair services and maintenance involves the replacement (installation) of spare parts, and their cost is included in the total cost of services provided, then the service applies UTII to all its activities as a whole. If the sale of spare parts is carried out under a separate purchase and sale agreement, then such activity should be considered as an independent type of entrepreneurial activity in the field of retail trade, which may also be subject to UTII.

Sincerely, A. Greshkina

Features of accounting for UTII

Such a special taxation regime as UTII provides for tax calculation based on the basic profitability for the quarter, a certain value of the physical indicator, as well as adjustment factors. The magnitude of the latter depends on the degree of influence of certain conditions on the final result of activities covered by the Unified Tax Fund. The amount of tax payable does not depend in any way on what specific profit the organization received during the reporting period.

The procedure by which accounting is organized in a company is contained in Law 402-FZ “On Accounting”. When carrying out accounting, companies on UTII are faced with the need to perform the following activities:

- Preparation and approval of the company's accounting policies.

- Development of a working chart of accounts.

- Development and approval of the necessary forms of registers, as well as statements (used to reflect business transactions).

- Approval of primary documentation forms (the company can develop document forms independently or use standardized forms).

- Reflection of transactions on expenses and income in accordance with PBU 9/99 and 10/99.

- Reflection of settlement transactions.

- Reflection of cash transactions.

Important! Organizations on UTII have the right to keep accounting in full, or keep simplified accounting if they meet the criteria of a small business. As a rule, companies that are imputed are classified as small enterprises.

Transition from UTII to a simplified taxation system

Situation 1. Income from the sale of goods, performance of work, provision of services purchased (performed, provided) during the period of application of UTII was received during the period of application of the simplified tax system.

When applying the simplified tax system, income includes income from sales (Article 249 of the Tax Code of the Russian Federation) and non-operating income (Article 250 of the Tax Code of the Russian Federation). According to paragraph 1 of Art. 249 of the Tax Code of the Russian Federation, income from sales is recognized as proceeds from the sale of goods (work, services) both of one’s own production and those previously purchased.

According to paragraph 1 of Art. 346.17 of the Tax Code of the Russian Federation, the date of receipt of income on the simplified tax system is the day of receipt of funds to the current account or to the cash desk of an organization or individual entrepreneur. That is, the cash method of accounting for income is used.

Thus, in the event of a transition from UTII to the simplified tax system, the tax base under the simplified tax system must include income from sales received during the period of application of the simplified tax system for goods sold during the period of application of the simplified tax system.

In a situation where goods (work, services) were sold (performed, provided) during the period of application of UTII, and income from this sale was received already during the period of application of the simplified tax system, such amounts are not included in the tax base under the simplified tax system.

Situation 2. The advance payment for the sale of goods was received on UTII, and the shipment of the goods itself occurred during the period of application of the simplified tax system.

Similar to the previous situation, such income belongs to the taxation system in the form of a single tax on imputed income; it does not need to be taken into account in the tax base under the simplified taxation system.

A different situation arises with respect to the final payment for such a delivery. If the shipment and final payments were made already during the period of application of the simplified tax system, then such income will be included in the tax base under the simplified tax system.

Situation 3. Goods for resale were purchased on UTII, but were sold already during the period of application of the simplified tax system. Is it possible to take into account the costs associated with the acquisition in the tax base under the simplified tax system?

It should be immediately noted that this option concerns only a simplified system with the object “income reduced by the amount of expenses.”

According to clause 2.2 of Art. 346.25 of the Tax Code of the Russian Federation, taxpayers who used UTII before the transition to the simplified tax system have the right to take into account expenses incurred before the transition to the simplified tax system related to the acquisition of goods for further sale. Let us remind you that such expenses can be taken into account in the tax base as goods are sold (clause 2, clause 1, article 346.17 of the Tax Code of the Russian Federation).

To account for expenses on the simplified tax system with the object “income reduced by the amount of expenses,” it is necessary to have primary documents confirming the expenses incurred.

The remaining expenses directly related to the sale of these goods (for example, storage, maintenance and transportation), when applying the simplified tax system, are taken into account in the period in which their actual payment was made after the transition to this taxation system.

Situation 4. Fixed assets and intangible assets were used in activities subject to UTII. Is it possible to take into account their residual value in expenses when switching to the simplified tax system?

It should be immediately noted that this situation is considered only for a simplified system with the object “income reduced by the amount of expenses.”

In the case of a transition from UTII to the simplified tax system, the residual value of fixed assets and intangible assets will be determined as the difference between the price of acquisition (creation) of fixed assets and intangible assets and the amount of depreciation accrued in accordance with accounting legislation during the period of application of UTII (clause 2.1 of article 346.25 of the Tax Code ).

Thus, the residual value of fixed assets and intangible assets is included in the tax base as part of the expenses for the simplified tax system in equal shares for the reporting periods.

The procedure is established by paragraphs. 3 p. 3 art. 346.16 Tax Code of the Russian Federation (Table 1). Table 1. Procedure for accounting for fixed assets and intangible assets in expenses

| Useful life of fixed assets and intangible assets | Procedure for accounting for expenses |

| up to 3 years inclusive | during the first calendar year of application of the simplified tax system |

| from 3 to 15 years inclusive | during the 1st calendar year - 50% 2nd calendar year - 30% 3rd calendar year - 20% |

| over 15 years | during the first 10 years of application of the simplified tax system |

Simplified way of accounting

As noted above, for companies on UTII it is possible to maintain accounting records in a simplified form.

Criteria for classifying companies as micro and small enterprises:

| Criteria | Limit |

| Number of employees | 15 people for micro-enterprises 16-100 people for small enterprises |

| Income for the year | 120 million rubles for micro-enterprises 800 million rubles for small enterprises |

If the above criteria are met, the company is considered a small enterprise and has the right to conduct accounting in a simplified form. This allows companies not to disclose information in detail in accounting reports, but to indicate it in a generalized form.

Responsibility for organizing accounting rests with the head of the company. A company must keep accounting records on UTII from the moment of its registration. The main feature of accounting operations on UTII is the constant recording of values that are the basis for calculating tax. They are physical indicators.

Important! If UTII is combined with other tax regimes, accounting for income and expenses for each regime must be kept separately. This is required for the correct formation of the tax base for each tax within a particular regime.

Tax and accounting under UTII for LLC

Despite the fact that the tax base for UTII does not depend on actual income, legal entities on the “imputation” need to organize the reflection of accounting transactions in accounting according to a standard algorithm. Differences with other tax regimes will manifest themselves in the content of accounting policies and the composition of reporting documentation. When organizing accounting, enterprises must:

- develop an accounting policy that will indicate the type of activity of the company and the chosen taxation regime;

- use a complete set of primary documentation of a unified type and created using arbitrary templates;

- systematize information about the work of the company in accounting registers (for a small volume of transactions, the registers can be replaced by a journal of business transactions);

- prepare and submit reports.

In the accounting policy in one of the appendices it is necessary to provide a working chart of accounts. Accounting for UTII allows you to make the working chart of accounts more enlarged - for this purpose several synthetic accounts are combined into one. For example, instead of a set of cost accounts (23, 26, 25, 28, 20 and 29), only account 20 can be used. The justification is information from the Ministry of Finance dated July 19, 2011, No. PZ-3/2010. The norm is relevant for small businesses.

Responsibility for organizing accounting for all segments rests with the management of the company. LLC accounting on UTII must be carried out from the moment of registration of the legal entity. Enterprises account for income and costs using the accrual method according to the rules of PBU 9/99 and PBU 10/99.

A feature of accounting operations on “imputed income” is the need to constantly take into account the values that form the basis for calculating tax on imputed income - physical indicators. The formula for calculating tax liability involves multiplying the current value of profitability with a physical indicator (Article 346.29 of the Tax Code of the Russian Federation).

If the tax accrual is shown not on the last day of the quarter, but earlier, then the regulatory authorities will regard this fact as a deliberate concealment of income receipts. When combining imputation with other tax regimes, accounting for income and costs must be kept separately. This is necessary for the correct derivation of the tax base for each of the taxes within the framework of special regimes.