The net profit of Aktiv JSC for the last year amounted to 22,000 rubles. Aktiv has two shareholders.

By decision of the general meeting of shareholders of Aktiv JSC, dividends on shares are paid in the amount of:

A.N. Ivanov – 10,000 rubles;

S.S. Petrov – 12,000 rubles.

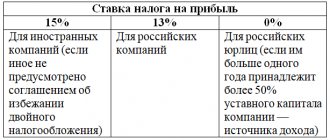

Personal income tax on Ivanov’s dividends will be:

10,000 rub. ? 13% = 1300 rub.

The personal income tax on Petrov’s dividends will be:

12,000 rub. ? 13% = 1560 rub.

The Aktiva accountant should pay dividends in the amount of:

A.N. Ivanov – 8,700 rubles. (10,000 ? 1300);

S.S. Petrov – 10,440 rubles. (12,000 ? 1560).

Who makes a decision on the payment of dividends to an LLC and how?

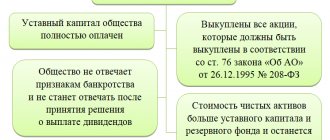

Legislative norms related to LLCs allow the profit received by it (all or part of it) to be used to issue income (dividends) to participants (Clause 1, Article 28 of the Law “On Limited Liability Companies” dated 02/08/1998 No. 14-FZ). The right to make decisions about this is reserved for the LLC participants themselves. To do this, they hold a general meeting. Convening a meeting becomes possible if a number of restrictions are met at the time of the meeting (Clause 1, Article 29 of Law No. 14-FZ):

- The management company is fully paid;

- the withdrawn participant was given the value of his share;

- net assets exceed the sum of the authorized capital and the reserve fund, and this ratio will remain after the issuance of dividends;

- There are no signs of bankruptcy and will not arise as a result of the issuance of dividends.

Compliance with the listed restrictions and the amount of profit that can be distributed are determined based on an analysis of the LLC’s financial statements prepared by the time the meeting is convened.

Analysis of reporting also applies to LLCs on the simplified tax system. For information on preparing reports under the simplified tax system, read the article “Maintaining accounting for an LLC using the simplified tax system: submitting reports .

Blog of a practicing accountant and legal analyst

Read the beginning: Payment of dividends in an LLC.

In accordance with Law No. 14-FZ, a company does not have the right to make a decision on the distribution of profits if, at the time of the general meeting of participants for the purpose of distributing profits, at least one of the following conditions is met (Article 29 of Law No. 14-FZ):

— the authorized capital of the company is not fully paid;

— there is an outstanding debt to pay the cost of shares (part of shares) to participants, which arose when the participant’s share was transferred to the company (in cases provided for by this law);

- the company meets the signs of insolvency (bankruptcy) or if the specified signs appear in the company as a result of such a decision;

— the value of the company’s net assets is less than its authorized capital and reserve fund or will become less than their size as a result of such a decision;

— in other cases provided for by federal laws.

About the date on which indicators are taken to analyze the presence/absence of the specified conditions

Analysis of the above conditions is possible only on the basis of one source, namely financial statements. From the provisions of PBU 4/99 it follows that the shortest period for preparing financial statements is a month (see section XI “Interim financial statements”). Therefore, it seems logical to analyze the presence/absence of conditions for the possibility of making a decision on the distribution of profit according to the interim financial statements for the previous month (i.e. on the last calendar day of the month preceding the month of the general meeting/decision of the sole founder).

On the signs of insolvency (bankruptcy)

In accordance with current legislation, a sign of bankruptcy of a legal entity is the inability to satisfy the claims of creditors for monetary obligations and (or) to fulfill the obligation to pay mandatory payments, if the corresponding obligations and (or) obligations are not fulfilled by it within three months from the date on which they were due be executed (Article 3 of the Federal Law of October 26, 2002 No. 127-FZ “On Insolvency (Bankruptcy)”). Clause 2 of Article 4 of the law indicates which types of obligations are taken into account and which are not taken into account when determining the presence of signs of bankruptcy. Thus, the following are taken into account as part of monetary liabilities:

— debts for goods transferred, work performed and services rendered;

- the loan amount, taking into account interest payable by the debtor;

- debt arising as a result of unjust enrichment;

- debt arising as a result of damage to the property of creditors, with the exception of obligations to citizens to whom the debtor is responsible for causing harm to life or health;

— obligations to pay severance pay and wages to persons working under an employment contract;

— obligations to pay remuneration to the authors of the results of intellectual activity;

- obligations to the founders (participants) of the debtor arising from such participation.

Mandatory payments are taken into account without fines (penalties) and other financial sanctions established by the legislation of the Russian Federation.

At the same time, when determining the presence of signs of bankruptcy of a legal entity, various property and financial sanctions are not taken into account, including: penalties (fines, penalties) for non-fulfillment or improper fulfillment of obligations, interest for late payment, damages in the form of lost profits subject to compensation for failure to fulfill or improper fulfillment of an obligation, other property and (or) financial sanctions, including for failure to fulfill the obligation to pay mandatory payments.

Article 6 of Law No. 127-FZ specifies the amount of aggregate claims at which a bankruptcy case can be initiated by an arbitration court - no less than one hundred thousand rubles.

Summarizing the above, when making a decision on the distribution of profit, it is necessary to confirm that the amount of total claims to the company that have not been fulfilled within three months from the date of their occurrence does not exceed one hundred thousand rubles.

To be honest, it is not entirely clear to me how to calculate whether, as a result of making a decision on the distribution of profits, signs of bankruptcy will appear in a society. The decision made to distribute profits means the formation of debt to the founders. But the appearance of this debt does not in any way affect the size of unfulfilled claims that arose more than three months ago. The new debt (to the founders) at the time of its occurrence will not be outstanding for three months from the date of its occurrence. Therefore, this legal requirement seems unnecessary. Maybe I'm wrong. I would love to hear readers' opinions on this matter.

About net assets

There are currently no special legal acts regulating the procedure for calculating the value of the net assets of an LLC. Courts and regulatory authorities indicate that in this case, the Procedure for assessing the value of net assets of joint-stock companies, approved by Order of the Ministry of Finance of the Russian Federation No. 10n, FCSM of the Russian Federation No. 03-6/pz dated January 29, 2003, is applied (hereinafter referred to as the Procedure for assessing the value of net assets). The calculation of net asset value itself is not difficult; any accounting program performs it automatically. Accordingly, it is necessary to make a calculation in an accounting program and attach it to the certificate (for particularly meticulous founders, and so that the accountant himself does not forget what initial figures led to the final result).

Considering that the debt to participants in the payment of income is included in the calculation of net assets (as part of liabilities subject to deduction from the assets participating in the calculation), the accountant can indicate for reference the amount of dividends at which the value of net assets will not be less than the sum of the authorized capital and reserve fund.

It is also necessary to take into account that clause 4 of Article 30 of Law No. 14-FZ contains a requirement to control the size of the company’s net assets. The law allows a company to have a net asset value less than its authorized capital at the end of the first and second financial years. But if, starting from the second financial year, this happens, the company is obliged to control the value of its net assets in the next year, and if their value again turns out to be less than the authorized capital, the company needs to make one of the following decisions:

— on reducing the authorized capital of the company to an amount not exceeding the value of its net assets;

- about the liquidation of the company.

A mandatory decision is made to liquidate the company if the value of its net assets in these cases is less than the minimum possible amount of the authorized capital.

Thus, an accountant’s certificate confirming the absence of financial indicators prohibiting a decision on the distribution of profit may look like this:

LLC “OUR FIRM” April 20, 2012 INN 0000000000/KPP 000000000

Accountant's certificate

about the lack of financial indicators,

prohibiting decisions on the distribution of profits,

as of March 31, 2012

(last calendar day of the month,

preceding the date of the general meeting)

1. In accordance with the Charter, the authorized capital of OUR FIRM LLC (hereinafter referred to as the Company) is 10,000 (Ten thousand) rubles. As of March 31, 2012, the authorized capital was paid in full.

2. Based on the results of the 2011 financial year, the value of the company's net assets is <sum>, which is greater than the authorized capital of the company.

3. As of March 31, 2012, there was no outstanding debt to pay the cost of shares (part of shares) to participants.

4. As of March 31, 2012, the Company has no signs of insolvency (bankruptcy). The amount of aggregate claims against the Company not fulfilled within three months from the date of their occurrence does not exceed one hundred thousand rubles. (Option: and amounts to <amount> rubles, including: <debt breakdown with a period of more than 3 months>).

5. As of March 31, 2012, the value of the Company's net assets (before distribution of profits among participants) is <amount>. The amount of the reserve fund is <amount>. Thus, the value of net assets is not less than the sum of the authorized capital and reserve fund. The maximum amount of profit, upon payment of which to participants, the value of net assets will not become less than the authorized capital and reserve fund, is <amount>.

Chief accountant signature full name

Clause 1 of Article 29 of Law No. 14-FZ does not define what to do if at the time of the general meeting of participants there are conditions (financial indicators) that prohibit making a decision on the distribution of profit. It turns out that even if at the end of the financial year (quarter/half-year/9 months) a profit is received, a more important condition for its distribution is the current financial condition of the company. Considering that the law does not contain restrictions on the frequency of holding a general meeting of participants, the general meeting can be postponed a month in advance so that the indicators are calculated as of another date. However, it is necessary to take into account the limitation on the date of holding the annual meeting of participants - no earlier than two months and no later than four months after the end of the financial year.

How to draw up a protocol on the payment of dividends in an LLC

The issue of profit distribution can be either one of several discussed at the meeting, or the subject of a separate meeting. Regardless of the number of issues on the agenda, the decision of the meeting is formalized by drawing up a protocol, the indispensable details of which will be:

- number, date and indication of whether the document belongs to the LLC;

- list of participants, distribution of shares between them;

- agenda;

- results of consideration and decision on each issue.

With regard to dividends, the meeting must determine:

- for what period they intend to pay them;

- the total amount allocated for this purpose;

- form and terms of issue.

The payment period can range from a quarter to a year. In this case, payments are also possible for the year preceding the previous one.

The total amount is distributed among the participants in proportion to the share of each, unless the charter provides for a different procedure (Clause 2, Article 28 of Law No. 14-FZ), therefore it is enough to establish its value. Although the protocol can also record specific amounts intended for distribution to each participant in accordance with the distribution rules.

The form of payment is most often monetary. However, the law does not prohibit payment in property.

Payment is made subject to tax withholding. Read about its calculation in the article “How to correctly calculate the tax on dividends?” .

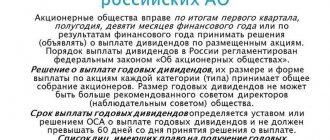

Payment is made no later than 60 days from the date of the decision (Clause 3, Article 28 of Law No. 14-FZ). If a period within this period is not established by the charter, the meeting has the right to set it by its decision for each specific payment. The period is considered equal to 60 days if it is not included in the decision and charter.

You can download a sample resolution of the founders on the payment of dividends (minutes of the meeting) on our website.

What to do if the founder did not receive dividends on time

Legislative norms related to LLCs allow the profit received by it (all or part of it) to be used to issue income (dividends) to participants (Clause 1, Article 28 of the Law “On Limited Liability Companies” dated 02/08/1998 No. 14-FZ). The right to make decisions about this is reserved for the LLC participants themselves.

- The management company is fully paid;

- the withdrawn participant was given the value of his share;

- net assets exceed the sum of the authorized capital and the reserve fund, and this ratio will remain after the issuance of dividends;

- There are no signs of bankruptcy and will not arise as a result of the issuance of dividends.

Compliance with the listed restrictions and the amount of profit that can be distributed are determined based on an analysis of the LLC’s financial statements prepared by the time the meeting is convened.

https://www..com/watch?v=upload

Analysis of reporting also applies to LLCs on the simplified tax system. For information on preparing reports under the simplified tax system, read the article “Maintaining accounting for an LLC using the simplified tax system: submitting reports.”

The sole founder has no one to hold the meeting with, so he simply makes his own decision on issuing dividends to himself. It is drawn up in the usual manner for such a document.

The procedure for using income must be enshrined in the organization’s statutory documentation. For an organization, this is indicated by Articles 4, 15, 41 and 59 of Law No. 1576. Typically, the division of income is done at a general meeting of shareholders, which is done after the end of the reporting year.

Participants at this meeting are required to approve the financial report provided to them, and therefore the amount of net income recorded in it. And after approval, they can allocate a specific amount of income to pay dividends.

Thus, the amount of dividends is determined at a general meeting of shareholders, which is held after the preparation of the financial report and no earlier than two months after the end of the reporting period.

If such a decision is stipulated by the charter or made due to various circumstances at a general meeting with changes to the charter papers, taxation of income from dividends is carried out at special rates, as with the proportional division of profits.

Decisions regarding the distribution of profit or its 100% shares between participants are always made at a general meeting of members corresponding to their share in the capital, unless other constituent agreements are specified in the charter and in accordance with Article 28 of the Federal Law No. 14-FZ “On Limited Liability Companies” .

Such mandatory compliance is determined by what, based on accounting analysis, is relevant at the time of the current convening of the meeting.

If all the conditions are met, then it is time to formalize the decision of those participating in the company to direct the net profit received in a certain period to pay dividends.

In this paragraph, we will consider the option when a limited liability company has only one founder member.

Two founders

In the case of two participants, paperwork is necessary as for a company with several participants. That is, first a decision made at a meeting of shareholders is drawn up, then the head of the LLC signs the order.

How the protocol is drawn up

If the organization has a single founder, then he draws up his resolution in the minutes, in free form, since there is no various form on this subject, but he will certainly write down the agenda of the adopted resolutions.

This is not always the only issue discussed at meetings. However, the quantitative issues on the agenda do not play a special role; the results of the meeting are formalized through the drawing up of a special protocol.

The main details of the protocol are:

- number, date and indication of the document’s affiliation with the LLC; listing of participants, distribution of their shares; agenda; results of the study and rendering of verdicts on all issues.

In order to solve the problem with dividend payments, the meeting must clearly define the amount of dividends to be paid, the period for which they are intended, as well as the form of payments, their order and date.

The main form of payment of dividends, as a rule, is cash, but there are no restrictions on property payments, which are now widespread.

Protocol example

The issue of dividends may not be the only one put forward for decision by the participants of the shareholders meeting.

Therefore, a special meeting protocol must be drawn up and approved, which includes the following aspects:

- the number of participants and their shares in the authorized capital of the company;

- an agenda consisting of the issues to be discussed;

- solutions to each of the issues listed on the agenda.

Let's bring an extraordinary meeting.

The issue of profit distribution can be either one of several discussed at the meeting, or the subject of a separate meeting. Regardless of the number of issues on the agenda, the decision of the meeting is formalized by drawing up a protocol, the indispensable details of which will be:

- number, date and indication of whether the document belongs to the LLC;

- list of participants, distribution of shares between them;

- agenda;

- results of consideration and decision on each issue.

With regard to dividends, the meeting must determine:

- for what period they intend to pay them;

- the total amount allocated for this purpose;

- form and terms of issue.

The payment period can range from a quarter to a year. In this case, payments are also possible for the year preceding the previous one.

The total amount is distributed among the participants in proportion to the share of each, unless the charter provides for a different procedure (Clause 2, Article 28 of Law No. 14-FZ), therefore it is enough to establish its value. Although the protocol can also record specific amounts intended for distribution to each participant in accordance with the distribution rules.

The form of payment is most often monetary. However, the law does not prohibit payment in property.

Payment is made subject to tax withholding. Read about its calculation in the article “How to correctly calculate the tax on dividends?”

Payment is made no later than 60 days from the date of the decision (Clause 3, Article 28 of Law No. 14-FZ). If a period within this period is not established by the charter, the meeting has the right to set it by its decision for each specific payment. The period is considered equal to 60 days if it is not included in the decision and charter.

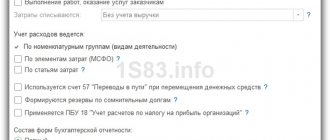

According to paragraph 1 of Art. 28 of the Federal Law of 02/08/1998 No. 14-FZ “On Limited Liability Companies” LLC has the right to make a decision quarterly, once every six months or once a year on the distribution of its net profit among the participants of the company. The decision to determine the part of the company's profit distributed among its participants is made by their general meeting.

The current legislation does not prohibit the payment of dividends based on the results of the current year, taking into account retained earnings of previous years.

At the same time, it is necessary to take into account that there are still restrictions regarding the distribution of the company’s profits between its participants - they are established by clause 1 of Art. 29 of Federal Law No. 14-FZ.

The company does not have the right to decide on the distribution of its profits among participants:

- until full payment of the entire authorized capital of the company;

- before payment of the actual value of a share or part of a share of a company participant in cases provided for by Federal Law No. 14-FZ;

- if at the time of making such a decision the company meets the signs of insolvency (bankruptcy) or if the specified signs appear in the company as a result of making such a decision. A legal entity is considered unable to satisfy the claims of creditors for monetary obligations, for the payment of severance pay and (or) for wages of persons working or who worked under an employment contract, and (or) to fulfill the obligation to make mandatory payments, if the corresponding obligations and (or) obligation not executed by him within three months from the date on which they should have been executed (clause 2 of article 3 of the Federal Law of October 26, 2002 No. 127-FZ “On Insolvency (Bankruptcy)”);

- if at the time such a decision is made, the value of the company’s net assets is less than its authorized capital and reserve fund or becomes less than their size as a result of such a decision. The value of the LLC's net assets is determined according to accounting data in the manner approved by Order of the Ministry of Finance of the Russian Federation dated August 28, 2014 No. 84n;

- in other cases provided for by federal laws.

If the listed restrictions do not work, the founder of the company has the right to decide on the distribution of profits from previous years, even if a loss was incurred at the end of 2021.

At the same time, the amount of distributed profit must be such that, as a result of distribution, the value of the LLC’s net assets does not become less than the authorized capital and reserve fund and the company does not develop signs of insolvency (bankruptcy).

It should also be taken into account that the profit for which a decision has been made to distribute between the participants of the LLC cannot be paid if (Clause 2 of Article 29 of Federal Law No. 14-FZ):

- at the time of payment, the company meets the signs of insolvency (bankruptcy) or the specified signs will appear in the company as a result of payment;

- at the time of payment, the value of the company’s net assets is less than its authorized capital and reserve fund or will become less than their size in connection with the payment.

Deadlines

https://www..com/watch?v=ytcopyrightru

Debit 70 (75), subaccount “Calculations for payment of income”, Credit 51

- Dividends are transferred to the founder - an employee of the company (a person who is not an employee).

At the time of payment of dividends, withhold personal income tax from the income of citizens or income tax from the amounts due to companies. And transfer taxes to the budget. We described in more detail how to create postings in this case on p. 40.

We also draw your attention to this point. In general, late payment of dividends does not have any negative consequences for the organization if the founders do not challenge the current situation in court.

If the owners go to court, the latter may oblige you to pay not only the dividends themselves, but also interest for late fulfillment of obligations and the use of other people's funds (Article 395 of the Civil Code of the Russian Federation, Resolution of the Federal Antimonopoly Service of the East Siberian District dated May 5, 2012 N A10-248 /2011).

How to decide on paying dividends to the sole founder

The sole founder has no one to hold the meeting with, so he simply makes his own decision on issuing dividends to himself. It is drawn up in the usual manner for such a document.

A sample decision on the payment of dividends to the sole founder can be viewed and downloaded on our website.

Find out which payments are not considered dividends from the article “Procedure for calculating dividends under the simplified tax system.”

How to register dividend payment?

It is very important to document the payment of dividends so that there are no later claims from offended participants.

Often, LLC participants, knowing that the company has a net profit, believe that they have been “passed over.” However, the courts refuse to satisfy such demands, since general meetings of LLC participants on the payment of dividends were not convened or held. And executed extracts from the preliminary protocol cannot be the basis for the payment of dividends, because in fact, the LLC participants did not make a decision on the actual payment of dividends (Resolution of the Central District Court of March 1, 2018 No. A62-2585/2014).

There are no mandatory requirements for formalizing decisions of a meeting of LLC participants on the payment of dividends.

However, there are details that must be indicated in the protocol. For example, the number, place and date of the LLC meeting, agenda items, as well as the signatures of the LLC participants.

Results

The law allows the profits received by the LLC to be used to pay dividends. The decision on payment is made by the sole founder or members of the company at a general meeting, subject to legally established restrictions (if the authorized capital is fully paid, there are no signs of bankruptcy, etc.).

The founders' decision to pay dividends is formalized in the form of minutes of the general meeting or a decision of the sole founder. Following the decision, an order to pay dividends is issued.

The decision of the sole participant of the LLC on the distribution of profits as dividends

But in general, LLC participants can distribute net profit not only once a year, but also once every six months or even once a quarter (Clause 1, Article 28 of the Law of 02/08/1998 N 14-FZ). And it may turn out that the amount of interim dividends paid exceeds the amount of profit received by the company at the end of the year. This will lead to the fact that for tax purposes the excess amount will turn into another “non-dividend income” of the participants (clause 1 of Article 43 of the Tax Code of the Russian Federation), which means that the procedure for its taxation may also change.

- incomplete payment of the company's authorized capital;

- non-payment (incomplete payment) of the actual value of a share or part of a share to a company participant who left the LLC;

- presence of signs of bankruptcy of the company or a high probability of such signs appearing after payment of dividends;

- the value of the company's net assets is less than the sum of the authorized capital and reserve fund (or a real threat that the value of the net assets will become less than the specified amount after the decision to pay dividends is made).

for free

When a foreign citizen (not a highly qualified specialist) temporarily staying in the territory of the Russian Federation receives income from a Russian employer for services rendered or work performed under a civil law contract, it is necessary to charge insurance premiums only for compulsory pension insurance.

The “deadline” is approaching for some individual entrepreneurs using PSN, as well as for organizations and individual entrepreneurs who are UTII payers and who are engaged in certain types of activities - trade and the provision of public catering services. From July 1, 2021, they must switch to online cash registers.

Accounting for dividends: postings, examples, accrual

Let's look at how dividends are accounted for and taxes are reflected. The payer must reflect all transactions related to the accrual and payment of dividends, withholding and accrual of taxes on such income. To account for such calculations, account 75 is used. In relation to accounting for dividends from individuals working at this enterprise, account 70 can be used.

In accordance with the law, this tax is withheld not only from those incomes received by an individual, but also from those for which he has the right to dispose. If a shareholder refuses income in favor of the organization, then the tax should be withheld on the day of refusal and transferred to the budget.

Determination of the amount and order of payments

Organizations can pay dividends to the founder from a portion of the profit every quarter, every six months or every year.

A shareholder receiving dividends must automatically pay personal income tax.

Residents who are not employees are also required to pay tax, only if the dividends are received from Russian organizations.

In this case, freelancers withhold tax at 15%, and full-time employees at 9%.

If the founder refuses dividends, for example, in favor of the enterprise, then the organization must still withhold personal income tax and pay it in accordance with the laws of the Russian Federation.

If dividend income is received from other companies, then a 0 percent rate may be applied to such payments.

Dividends can be accrued and paid to the founder no more than once a quarter.

Economists advise paying dividends once a year, because... only then can you accurately determine the amount of profit and payments

If the amount of accrued dividends is higher than net profit, then this payment will be considered as remuneration to an individual.

Then the organization will have to pay 13% personal income tax instead of 9%.

In addition to the tax increase, you will also have to pay additionally all insurance premiums and resubmit reports related to these payments to the Funds.

It turns out that quarterly dividends can be paid only if the founders are confident in the stability of their enterprise and its income.

After filling out the payment order, the period for paying dividends should not be more than 60 days. But sometimes, at the request of the founders, the deadline for paying dividends to an LLC can be reduced to 25 days.

What has changed when paying using a single payment document at the Pension Fund of Russia? What entries should an accountant make when writing off fixed assets? Article about postings for accrual of profit and income tax: https://buhguru.com/buhgalteria/kak-dolzhen-byt-nachislen-nalog-na-prib.html

Payments to all participants must be made simultaneously and according to their share or shares.

If the deadlines for receiving dividends are violated, the shareholder has the right to demand interest through the court for the use of other people's money. But he has such a right only on the condition that the delay was due to the fault of the owner.

Accounting entries for dividend payments

Accrual of dividends - entries from recipients (founders, participants) are reflected in the accounting records on the date when the meeting of shareholders (participants) decided to pay them (clause 7, subclause a-c, clause 12, clause 16 PBU 9/99 , approved by order of the Ministry of Finance of Russia dated 05/06/1999 No. 32n):

When the legal entity paying dividends is also their recipient, the tax paid by residents can be reduced by reducing the total tax base (the total amount of dividends allocated for distribution), which in this case will be calculated as the difference between the amounts intended for payment and received dividends (clause 2 of article 214 and clause 2 of article 275 of the Tax Code of the Russian Federation).

Certificate stating that dividends were not accrued or paid

Sample certificate of non-issuance of dividends

If a shareholder refuses income in favor of the organization, then the tax should be withheld on the day of refusal and transferred to the budget. Accrual of dividends - entries from recipients (founders, participants) are reflected in accounting on the date when the meeting of shareholders (participants) decided on them payment (clause 7, sub-clause a-c, clause 12, clause

16 PBU 9/99, approved by order of the Ministry of Finance of Russia dated 06.05.

1999 No. 32n): When the legal entity paying dividends is also their recipient, the tax paid by residents can be reduced by reducing the total tax base (the total amount of dividends allocated for distribution), which in this case will be calculated as the difference between the amounts dividends intended for issuance and received (clause

2 tbsp. 214 and paragraph 2 of Art. 275 of the Tax Code of the Russian Federation). In essence, dividends are part of the profit (or rather, net profit) that remains after paying taxes.

Sample certificate of dividend payment

We talked in more detail about the distribution of LLC profits for dividends in this material, where we also provided a sample memo on the distribution of profits and payment of dividends. We have provided the form for the decision on the payment of dividends to the LLC here. The deadline for paying dividends is usually specified in the resolution.

In an LLC, dividends must be paid within a period not exceeding 60 calendar days from the date of the decision on the distribution of profits. The order for the payment of dividends, confirming the will expressed by the owners, is aimed at its execution, and therefore must contain a reference to the corresponding decision on the distribution of profits.

If neither the charter nor the decision indicate the period for payment of dividends, when drawing up the order, it is necessary to check whether the 60-day period from the date of the decision has been exceeded. The order for the payment of dividends contains a list of persons to whom dividends are due, as well as the amount of payments . Indicates and

Organizations paying dividends to individuals do not have to report information about their income

Data on income in respect of which personal income tax is withheld are reflected in Appendix No. 2 to the said declaration.

It refers to persons recognized as tax agents when carrying out transactions with securities, with financial instruments of futures transactions, as well as when making payments on securities of Russian issuers. However, the authorized capital of limited liability companies consists of shares rather than shares.

In this regard, when paying dividends to its individual participants, the LLC is not recognized as a tax agent in accordance with.

Consequently, when paying dividends to individuals, a limited liability company, including one using the simplified tax system, should not comply with the requirement and submit to the inspectorate information about the income of these individuals as part of the “profitable” declaration.

Let us add that the organization as a tax agent for tax

Blog of a practicing accountant and legal analyst

From the provisions of PBU 4/99 it follows that the shortest period for preparing financial statements is a month (see section XI “Interim financial statements”).

On the signs of insolvency (bankruptcy) In accordance with the current legislation, a sign of bankruptcy of a legal entity is the inability to satisfy the claims of creditors for monetary obligations and (or) fulfill the obligation to pay mandatory payments, if the corresponding obligations and (or) obligations are not fulfilled by it within three months from the dates they were supposed to

Taxes and Law

At the same time, assigning a single number in relation to two forms of certificates (Certificate No. 2-NDFL and Appendix No. 2 to the Declaration) is not necessary.

2. Clause 17.4 of the Procedure for filling out the Declaration provides that if a tax agent paid an individual during the tax period income taxed at different tax rates, then information about income taxed at different tax rates is presented in the form of separate certificates.

In this case, each such certificate is assigned its own serial number by the tax agent. 3.

In accordance with the provisions of paragraph 3 of Article 230 of the Code, tax agents issue to individuals, upon their applications, certificates of income received by individuals and amounts of tax withheld.

With regard to information on income that tax agents submit to the tax authorities in accordance with paragraph 4 of Article 230 of the Code, upon application of the employee, he may be issued a certificate of such

How to pay dividends to LLC founders in 2019

At their core, dividends are part of the profit (or rather, net profit) that remains after taxes. Accordingly, if, for example, an LLC works for UTII, then this is the amount that remains after the single tax on imputed income has been paid.

An LLC has a number of advantages over an individual entrepreneur: in particular, this concerns the fact that the founders of a limited liability company are not liable for the company’s debts with their own property. In addition, this type of organization allows you to open branches and expand the scope of activity.

Rules for transferring dividends to the founder: payment order, order, protocol

- there is no single form for this document , it is drawn up arbitrarily with the obligatory designation of the share of payments of each founder or shareholder;

- if the company has a certain form according to which such documents are filled out, then it is necessary to follow it.

In the case when an organization is created on the basis of authorized capital, it must periodically share its income with those who founded it, as well as shareholders. Actually, dividends are those funds that remain after paying taxes, insurance premiums, salaries and other things. They are the income of shareholders who, through the purchase of shares, invested in the enterprise, and can now receive the part of the profit they deserve.

Salary certificate: form, contents and sample filling

If provided to an employment office, or otherwise to an employment center, for the calculation and assignment of unemployment benefits, a period of three months preceding the date of dismissal of the employee is taken. This takes into account the average earnings.

- Registration with the labor exchange - a document will be needed to calculate benefits for unemployed citizens while looking for a job.

- Obtaining credits and advances by citizens from financial and credit institutions.

- Receiving benefits and subsidies from the budget to pay for utility costs.

- Registration of pensions in the Pension Fund of the Russian Federation.

- Obtaining a visa to travel abroad of Russia.

Sample certificate of salary and other accruals

- Name;

- date of issue;

- registration number;

- details of the employee to whom the certificate is issued;

- information about the employee’s salary for at least the last six months;

- signature of the head of the organization;

- signature of the chief accountant;

- organization seal (if available).

The main difference between such certificates (depending on which specific authorized body it is submitted to) is the period for which payments from the employer in relation to a specific person are taken into account. Certificates submitted to social security authorities usually require information about income for the previous 3 months. For example, in order to recognize a citizen as low-income and provide him with appropriate state social support, such a citizen must submit to the authorized body a certificate of income for the last 3 calendar months (Article 4 of the Law “On the Procedure for Accounting for Income.” dated 04/05/2003 No. 44-FZ), etc. . P.

Purpose and procedure for issuing a certificate of income for 3 months

Certificates of income of family members for 3 months are provided to social security to recognize the family as low-income. Such families are entitled to various payments and benefits - monthly child benefits, compensation for kindergarten fees, travel benefits and others. Exactly what types of income are taken into account in this certificate are regulated by Federal Law No. 44 of 04/05/2003. “On the procedure for recording income and calculating the average per capita income of a family and the income of a citizen living alone in order to recognize them as low-income and provide them with state social assistance.”

A family is considered low-income if its average total income for the three months preceding the application for social security, divided by the number of family members, is below the subsistence level. When making your own calculations to determine whether you are included in this category of citizens, keep in mind the following: what is taken into account is not the amount that each working family member actually received in person, but the amount of wages before taxes and fees are deducted.

How to prepare a 3-month salary certificate for social security

Similar data is provided to receive benefits. A certificate from the social security system from the place of work for receiving benefits looks similar and contains the same list of information - about the position and length of service of the employee, about the income that has been received recently.

Every officially employed citizen has the right to demand from his employer a certificate stating that there are no wage arrears of any kind. It is possible to draw up the document in free form, since there is no unified form. There is a requirement that it be officially certified by the signatures of responsible persons - the general director, the accountant, the chief accountant.

2-NDFL reporting in the absence of payroll in 2021

Accountants have to face various difficulties at the time of filing reports. Every year they need to present form 2-NDFL to the tax service and thereby confirm the fact that employees receive income. But what if no one received a salary in 2021?

If the salary was not accrued, then you do not need to submit 2-NDFL. Organizations acting as tax agents for several employees should simply not submit certificates using this form for those who did not receive income during the reporting period. 2-NDFL with zeros in all columns is not provided for by law. Moreover, most accounting programs will generate an error when trying to draw up such a certificate.