UTII or single tax on imputed income is a preferential tax regime for certain types of business activities. Exactly which types are subject to tax calculation under this system are determined by local authorities within the list approved by Russian tax legislation (Tax Code of the Russian Federation, Art. 346.26, clause 2).

Each entrepreneur engaged in an “imputed” type of activity independently decides whether it is beneficial for him to use this regime or whether it is more advisable to use a different tax scheme.

Main characteristics

On the territory of the Russian Federation, UTII was planned to be completely discontinued. But the government of the Russian Federation decided, because UTII is recognized as a comfortable tax for small firms, to extend the mentioned tax system, but to make changes to UTII in 2021 for individual entrepreneurs.

UTII is considered an optional regime; legal entities or individual entrepreneurs have the right to choose taxation systems at their own discretion. For a new type of activity, there is no need to wait until the end of the year to change the regime to imputation; you can submit an application five days from the start of work in this activity.

Thanks to Internet resources, there are special online services where a sample of filling out UTII 2 for individual entrepreneurs 2021 is available, you can submit a declaration or calculate the tax.

The UTII rate in 2021 for individual entrepreneurs is 15% of imputed income. Municipal authorities have the authority to reduce the tax rate to 7.5%, taking into account the category of the taxpayer and his type of activity.

The deadline for paying UTII in 2021 for individual entrepreneurs, like the frequency of reporting, is quarterly.

The single tax on imputed income replaces a series of large taxes on the full taxation system, namely:

- value added tax (excluding export);

- tax on personal income (for individual entrepreneurs, but not for employees);

- income tax;

- property tax.

When calculating this tax, it is possible to take into account funds paid into insurance funds. By correctly indicating the budget classification code (BCC), the entrepreneur receives the right to reduce the amount of imputation. Often the funds transferred to the budget cover the lion's share of UTII. Paid insurance premiums can be taken into account only when they were transferred within the period for which the tax is calculated.

The forced use of online cash registers has been postponed until July 1, 2019, which makes it possible to thoroughly prepare and study this state requirement. Business entities not involved in retail trade and public catering with hired assistants have the right not to install cash registers.

Individual entrepreneurs on UTII should not be involved in accounting - for them, accounting for physical numbers is more relevant. With a combined taxation system, revenues and expenses are taken into account under other tax regimes.

Individual entrepreneurs who have registered certain types of activities for the first time have the opportunity to apply a 0% tax rate. It is possible to take advantage of tax holidays only for up to two years. The 0% rate can be used for specifically designated types of activities, which are announced by law of local authorities.

When imputed, it is allowed to apply other tax regimes simultaneously, but it is prohibited to conduct one type of activity under several taxation systems.

UTII does not have a threshold income level, above which this form of taxation cannot be applied.

Procedure and deadlines for tax payment

Firms and entrepreneurs must make quarterly advance payments for the single tax. Advance payments must be transferred no later than the 25th day of the month following the reporting quarter.

At the end of the year, you need to calculate the total amount of single tax payable to the budget. The tax for the year must be paid no later than March 31. For individual entrepreneurs, this period has been extended until April 30.

The single tax is paid at the location of the company or the place of residence of the entrepreneur to the accounts of the federal treasury authorities. Find out the details of the account to which the tax should be transferred from your tax office.

Who is allowed to use UTII

This tax regime is not available to all businessmen.

In order to switch to UTII, you must meet a number of conditions:

- In the locality where individual entrepreneurs are registered, the use of UTII is permissible.

- The type of activity is placed on the list of those permitted for the use of UTII.

- The individual entrepreneur did not sign partnership agreements or trust disposition of property.

- The average number of employees is no more than 100 people.

- The individual entrepreneur does not have a patent.

- When trading retail, the area of the retail premises cannot be more than 150 square meters.

The permitted types of activities for the application of imputation are described in Article 346.26, paragraph 2 of the NKRF.

Also in the Tax Code in Art. 346.26 clause 2.2 lists taxpayers who, under no circumstances, can take advantage of such a taxation system. Individual entrepreneurs who work in the following areas are allowed to switch to UTII:

- general household services indicated in the list of codes of household services allowed for imputation (hairdressers, dry cleaners, and so on);

- veterinary service;

- car service and car wash;

- rental of parking spaces for vehicles, including car security;

- transportation of goods and passengers (the number of vehicles involved in the business activities of an individual entrepreneur cannot exceed 20 units);

- retail sales through retail premises with an area of up to 150 sq. m.;

- trade in stationary and non-stationary sales facilities (STS and NTS);

- Catering;

- placement of external advertising on individual structures, internal and external advertising in transport;

- leasing to business entities premises with an area of up to 500 square meters, retail space, and land for retail facilities;

- hotel business.

Local authorities consider each specific type of activity for UTII in the territory of their management.

Taxpayer documentation for UTII

It is not necessary to keep books and generate reports for individual entrepreneurs, but the documentation should be kept in order. While on imputation, you need to have a number of documents that may be requested to confirm that all conditions for the UTII regime have been met. Among them:

- Tax returns.

- Reporting for employees.

- Data on physical indicators.

- Cash data.

- Additional required documents.

Individual entrepreneurs who pay clients both in cash and by non-cash payments are required to work with online cash registers from 2021.

UTII reforms in 2019

IN

There are quite a few changes to tax legislation in 2021 to keep taxpayers on their toes. The changes also affected the single tax on imputed income.

The time for using imputation has been extended. It was planned to abolish this tax system from January 1, 2021 or significantly reduce the list of activities for this tax, but, on the contrary, they extended its existence until January 1, 2021, and in paragraph 2 of Art. 346.26 of the Tax Code of the Russian Federation specifies many imputed types of activities.

We recommend you study! Follow the link:

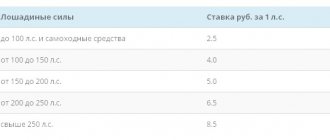

Tax rate for individual entrepreneurs on UTII in 2021

The deflator coefficient (K1) increased from 1.798 to 1.868, which is due to Order of the Ministry of Economic Development No. 579. The K1 coefficient is annually reviewed and approved by the Ministry of Economic Development of the Russian Federation.

Mandatory use of online cash registers has been postponed. Until July 2019, certain categories of imputed people are allowed not to use online cash registers.

These include:

- Individual entrepreneurs who are engaged in permitted activities for UTII, with the exception of the field of public catering and retail trade;

- Individual entrepreneurs who personally conduct business in retail trade or public catering, without hiring hired help;

- Individual entrepreneurs who engage in vending activities independently, without additional employees.

When calculating the imputed tax, it has become permissible to take into account the costs of purchasing cash register equipment (CCT). The amount of UTII in 2019 for individual entrepreneurs is significantly reduced.

You can take into account not only equipment, but also the cost of software for cash registers, the cost of installation services, and the cost of a fiscal drive.

It is permissible to deduct 18 thousand rubles. There is no need to bring any certificates or applications for benefits to the tax service. To have the legal right to deduct expenses, you need to register an online cash register from 02/01/2017 to 07/01/2019, and expenses should be taken into account exclusively according to UTII (when using several taxation systems at the same time). Businessmen involved in retail trade or public catering can apply the benefit only if the KKM is registered before July 2021. Fixed contributions to funds and the procedure for their calculation have changed.

The method for calculating the entrepreneur's contributions for himself has changed. From 01/01/2018, the amount of contributions is indicated in the Tax Code. Now indexation is not expected every year.

Dimensions installed:

- for compulsory pension insurance the figure in 2021 is 26,545 rubles;

- for compulsory health insurance, the amount of contributions for 2019 is 5,840 rubles.

An individual entrepreneur, at his own discretion, can transfer contributions to social insurance.

OPS and compulsory medical insurance should be transferred not to the Pension Fund of the Russian Federation, but to the Federal Tax Service of the Russian Federation.

The maximum amount and deadline for payment of contributions for income over 300 thousand rubles have changed.

Entrepreneurs must transfer to the budget 1% of the amount exceeding the limit of 300 thousand.

Imputation takes into account the imputed income for the year, not the real one. 1% must be paid on the amount of excess income over the limit of 300 thousand. The state has designated the maximum amount of contributions when paying for exceeding the limit. In 2021, this figure will be 212,360 rubles. The deadline for payment under the overlimit is until July 1 of the following reporting year. The income limit has increased, after which employee contributions are calculated at a reduced rate.

An individual entrepreneur has the right to reduce the rate of payments to the funds in the event that the wages of a particular employee exceed the maximum wage for the year established by the state.

This amount equals:

- 1021 thousand rubles. for transfers to a pension fund (anything higher is subject to a rate of 10%);

- 815 thousand rubles. to pay social insurance contributions (exceeding this amount is not taxed).

Contributions for health insurance have no restrictions; they are calculated on the entire amount of the employee’s income.

The declaration form has been changed. Lines have been added to the form for deducting the amount of expenses for CCP. The amended form is planned to be introduced in April of this year.

UTII payers have the opportunity to be VAT payers in accordance with Articles 161 and 174.1 of the Tax Code of the Russian Federation.

New declaration form for 2021

The Federal Tax Service has introduced changes regarding tax returns for those who work for UTII. Now a separate section has appeared regarding the amount spent on the purchase of cash register equipment (cash register equipment), which reduces the tax for the period of purchase. The section must include the following information:

- serial and serial numbers of the cash register, as well as the one assigned to it by the tax authority;

- name and date of registration with the tax office;

- the amount of money spent on the purchase.

The form is only valid for certain types of activities. Their list can be found in the Order of the Federal Tax Service dated June 26, 2018 No. ММВ-7-3/ [email protected] The form must be submitted starting from the 4th quarter of 2018. For the 1st quarter of 2021, the declaration must be submitted by 22.04 .2019 The following dates are set:

- 2nd quarter – until 22.07;

- 3rd quarter – until 21.10;

- 4th quarter – until 01/20/2020

If the end date falls on a holiday or weekend, the last workday will be the next working day.

Transition to a single tax on imputed income

The decision to change the taxation system to UTII is made voluntarily by individual entrepreneurs. In order to change the tax regime, a standard application is submitted to the tax service department - form UTII-2 in two copies. The application can be submitted at the time of registration of an individual as an individual entrepreneur or already in the process of activity. The document is submitted in accordance with the general procedure at the place of business.

For the following types of activities, an application must be submitted at the place of registration:

- retail sales with delivery;

- distribution of advertising in transport;

- transportation of passengers and cargo.

According to Article 346.28, paragraph 3 of the NKRF, an entrepreneur must submit an application to the tax office within five days from the introduction of a new type of activity into the business process, which is permitted upon imputation. The Code does not provide for methods of transition to UTII for previously introduced types of activity. The application indicates a convenient date for the individual entrepreneur to switch to the simplified system. If the application is completed correctly and on time, tax officials will need to receive notification of the legality of the transition to UTII.

We recommend you study! Follow the link:

How to calculate UTII for individual entrepreneurs and what information is needed for the tax calculator

The current application form has not changed since 2013. On the title page you should provide information about the individual entrepreneur and when exactly it is planned to change the taxation system to UTII. The reverse side indicates the type of activity code and legal address.

The legislation does not provide for requiring from an individual entrepreneur, when submitting an application, physical indicators (number of employees, store area, etc.) and information that this entrepreneur meets all the requirements for transferring to UTII.

An entrepreneur is not required to submit any other documents other than the application, and tax officials do not have the right to request them.

Advantages and disadvantages of imputation

Among the advantages of switching individual entrepreneurs to this tax regime are:

- Low tax burden for many types of activities. The most popular are retail trade, cargo transportation, and repairs.

- The tax amount is not tied to income.

- Possibility of tax reduction by installing online cash registers and deducting insurance premiums.

- No need to submit financial statements.

- It is possible to reduce the tax rate to 0% for certain types of activities and for registering a business for the first time.

- Can be combined with other tax regimes.

- It is possible to switch at any time during the tax period.

This system has many advantages, but there are also negative aspects:

- There is no connection to income. This is an advantage, but it can turn against the UTII payer in the absence of profit or large losses.

- Not valid throughout the country. This is more common in the regions. For example, in Moscow the UTII system does not work, unlike the Moscow region.

- Reporting is submitted quarterly.

- The area of sales floors and the number of employees, that is, the values for the physical indicator when calculating, are strictly limited.

How to calculate UTII

It will be easy for an individual entrepreneur to calculate taxes without the help of an accountant.

The formula is as follows: Tax base x tax rate (15%) = UTII amount in 2021 for individual entrepreneurs

Tax base = basic profitability x physical indicator for 1 month x K1 x K2

K1 and K2 are coefficients established by the state. Indicator K1 is a deflator specified by the Ministry of Economy, K2 is determined by local authorities. In 2021, the K1 coefficient is equal to 1.868; its increase in 2021 increased the amount of tax compared to the previous year.

The K2 coefficient has a limitation. It can be from 0.005 to 1. This indicator reduces or leaves the tax amount unchanged. If at the end of the year the authorities did not change the K2 coefficient, then for the next year it remains the same as in the outgoing year. K2 may include subcoefficients, the value of which depends on various nuances in the work of an individual entrepreneur - work schedule, seasonality, etc. The multiplied subcoefficients make up the K2 coefficient.

In cases where local authorities have not established the K2 indicator, it is taken as one by default.

You can find out the values of K1 and K2 on the websites of the Federal Tax Service of the Russian Federation or contact the Federal Tax Service of the Russian Federation at the place of registration.

The amount of UTII can be reduced by reducing the number of employees working on temporary duty, reassigning them to another activity. You can use part of the sales area as utility rooms. It is also possible to significantly reduce the tax by combining it with a simplified taxation system.

Features of payment of insurance premiums

In 2021, the amounts that must be paid as mandatory contributions have increased. The law established a new value for pension insurance - it will be 29,354 rubles. For compulsory health insurance you need to allocate 6884 rubles.

The changes also affected those individual entrepreneurs whose income exceeds 300 thousand rubles. Now to pay pension insurance to the established amount of 29,354 rubles. it is necessary to add 1% of profits exceeding 300,000 rubles. Otherwise the system remains the same.

Combining UTII with other tax regimes

Russian legislation does not establish restrictions on the combination of tax regimes when carrying out various types of activities. Thus, an entrepreneur or company can easily engage in retail trade using UTII and provide consulting services on the general taxation system.

The key condition is separate accounting of income and expenses for each regime.

If there are no problems with comparing income, some expenses are a little more difficult to clearly identify. For example, the director’s salary cannot be attributed to UTII or another regime, since he controls the entire operation of the company.

What activities can you do on UTII?

UTII is a taxation system aimed at specific types of activities. Thus, individual entrepreneurs and legal entities engaged in:

- provision of various types of household services;

- retail trade;

- provision of catering services;

- provision of veterinary services;

- provision of services for washing cars and other vehicles, as well as repair and maintenance;

- placement and distribution of advertising materials;

- transportation: freight and passenger;

- provision of temporary accommodation places;

- transfer of land plots and other places for temporary possession, etc.

IMPORTANT The specific list of activities in a particular municipality is determined by local authorities. For example, in Moscow UTII is not used. You can find information on the official portal of the Federal Tax Service of Russia in the “Unified tax on imputed income” section, indicating in the top panel the region in which the activity is carried out.

Let's sum it up

The UTII tax regime is suitable for both individual entrepreneurs and individuals engaged in trade, the provision of household and veterinary services, transportation, activities in the field of public catering and some others.

The special regime provides for the payment of a single tax, which replaces three main taxes: VAT, profit, and property. The amount of tax does not depend on the amount of revenue, which is why UTII has many advantages over other tax regimes.

Video for dessert: If you pull out a gold bar, it's yours!

Deregistration of UTII

If an entrepreneur or legal entity plans to terminate its activities or switch to another tax regime, a mandatory requirement is to deregister UTII taxpayers.

So, in order to be deregistered, the taxpayer must submit a written application to the tax authority within five days after completing the activity or switching to another tax regime.

PLEASE NOTE: if an individual entrepreneur or legal entity is engaged in trading activities in several retail outlets located at the same address, but closes one of them, he may not submit an application to the tax authority for deregistration. You will still have to notify the tax authorities: the official portal of the Federal Tax Service of Russia indicates that in this case the taxpayer will need to provide a completed form No. UTII-3.

IMPORTANT, when filling out UTII forms, the taxpayer must indicate the value “4” - “other” in the “reasons for deregistration” column. If the value “1” is indicated – “termination of activity”, all retail outlets will be immediately removed from the tax regime. This is a fairly common mistake among Russian entrepreneurs.

Questions and answers

How should changes in a physical indicator be taken into account when filling out reports?

When reporting, changes in a physical indicator must be taken into account from the beginning of the month in which such change was registered. Let's say the number of grocery store employees increases from 5 to 9 people as of September 6, 2021. The new indicator is taken into account from September 1, 2021.

Are there any restrictions on annual revenue in the UTII mode?

No, such limits are not established by law.

What date is officially considered the day of commencement of activities under UTII?

The official start of activities under UTII coincides with the day the first revenue is received.

Is it possible to lose the right to carry out activities under UTII?

An entrepreneur or legal entity cannot work under UTII if the number of employees exceeds 100 people or the share of other companies in the authorized capital exceeds the established value of 25%.

If this happens, the taxpayer is automatically transferred to the general taxation system from the beginning of the quarter in which the indicator changed.

Please note : if a taxpayer works in several modes at once, for example, UTII and simplified tax system, in case of violations he will automatically switch to the “simplified” system.