Two cases of “restoring” VAT in 1C 8.3 are shown in this illustration:

In the first case, the VAT previously paid to the budget is “restored”, i.e. The VAT amount is returned to us.

In the second case, we must pay the tax previously claimed for reimbursement.

In both cases the same term is used, but in practice it has two directly opposite meanings.

This is especially clearly seen when analyzing VAT on advances received and paid.

When we receive an advance from a buyer, an obligation arises to pay VAT on this amount. After selling the goods, we are also required to pay VAT. In order not to pay the same tax twice, we can submit the first payment for reimbursement, i.e. "restore".

A similar situation, but with the opposite sign, occurs when we pay an advance to the supplier. We have the right to claim VAT on the advance payment for reimbursement, thereby reducing the total amount of tax. But in the future, after receiving the goods, the VAT amount will have to be returned to the budget (so as not to submit the same amount for reimbursement twice).

Both situations are automated in the 1C 8.3 program.

Recovering VAT on advances to suppliers

Example: an organization made an advance payment to a supplier for goods. At this point, you can deduct VAT. After receipt of goods, the advance payment is offset, and VAT is deducted again. As a result, VAT needs to be restored.

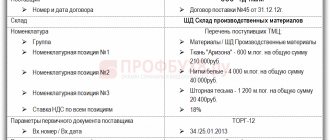

We created the document “Write-off from the current account”, transactions:

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

We see that there is an advance payment to the supplier.

Based on the write-off, we create the document “Invoice received for advance payment”:

VAT was deducted in the document entries:

Next, upon receipt of goods, we will create the document “Receipt (acts, invoices)”:

We also generate an invoice.

Now, when filling out the document “Creating purchase ledger entries,” VAT will again be deducted:

Postings:

Accordingly, in the Purchase Book there will be two lines with invoices:

To recover VAT, you need to create the document “Creating sales ledger entries”:

When posting the document, there will be a posting of Dt 76.VA Kt 68.02 for the amount of VAT:

This information will be reflected in the Sales Book:

The first recovery option in 1C

It is necessary to consider the situation in which the organization receives an advance from the buyer

The system independently classifies the funds received as “advance” and generates the corresponding accounting entries.

The posting to the VAT account triggers the creation of an advance invoice. In this case, an invoice can optionally be generated at the time of crediting funds or at the end of the reporting month.

After the sale of goods, the advance received is reversed

The sales invoice does not provide for the formation of any transactions, but its data is used for entering into the registers necessary for working with VAT.

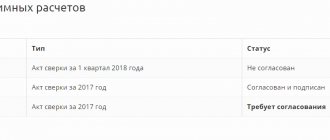

VAT recovery is carried out through the document “Creating purchase ledger entries”

All data in the “Received advances” tab is filled in automatically by the system, including all information on VAT accrued on previously received advances.

The final results of the work are reflected in the “Sales Book” and “Purchases Book”

For example, a couple of entries are made in the sales book. The first is to receive an advance payment, and the second is to carry out the sale of goods.

There is also an entry for this counterparty in the Purchase Book. It acts as a compensating agent for the advance receipts reflected in the Sales Book. At the same time, it is easy to notice that each of the entries made provides for an amount of 7627.12 rubles.

Despite the presence of three entries, tax payment to the budget will be made only once.

It is also necessary to check the closure of account 76. It is closed.

VAT taxation of subsidized transactions

If a company's costs are somehow compensated from the budget, should it pay VAT on subsidized activities? Let's turn to Chapter 21 of the Tax Code. In accordance with Article 146, this tax is imposed on the sale of goods, works or services. However, the source of their payment is not taken into account. Moreover, the VAT base arises even when the sale occurs free of charge. Consequently, receiving subsidies from the state in no way affects the company’s obligation to calculate and pay VAT.

In accordance with paragraph 2 of Article 154 of the Tax Code of the Russian Federation, income from subsidized activities for the purpose of calculating VAT is taken into account at the actual sales price. How should the VAT base be formed - taking into account the received government support or not? The answer to this question depends on what exactly the subsidies are for.

If subsidies are received to compensate for expenses or to cover losses from the sale of subsidized goods, works or services, then they should not be included in the VAT tax base. This is the general opinion of the Ministry of Finance, the Federal Tax Service and arbitration courts (clarifications of the Ministry of Finance in letters dated 03.06.13 No. 03-03-06/4/20240, dated 26.07.11 No. 03-03-06/4/83 and others, letter of the Federal Tax Service of Russia on Moscow dated 06/23/09 No. 16–15/63905, resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated 03/07/13 in case No. A38-6048/2011).

A completely different situation arises when subsidies have other purposes, such as covering price differences. In this case, they represent amounts associated with payments for goods, and on the basis of subparagraph 2 of paragraph 1 of Article 162 of the Tax Code of the Russian Federation, are included in the VAT base. An explanation of this position is in the letter of the Ministry of Finance dated 08.17.11 No. 03-07-11/227, as well as in the letter of the Federal Tax Service of Russia for Moscow dated 12.18.07 No. 19–11/120978.

In what case should VAT be charged when receiving a subsidy?

According to paragraph 1 of Art. 146 of the Tax Code of the Russian Federation, transactions for the sale of goods (work, services) on the territory of the Russian Federation are recognized as subject to VAT, regardless of the source of financing. In accordance with paragraphs. 2 p. 1 art. 162 of the Tax Code of the Russian Federation, the VAT tax base is increased by the amount of money received for goods (work, services) sold in the form of financial assistance, to replenish special-purpose funds, to increase income or otherwise related to payment for goods (work, services) sold.

Thus, if subsidies provided by the budget are essentially a payment for goods (work, services) sold by the organization that are subject to taxation, then VAT in relation to these subsidies is calculated in the generally established manner. In this case, VAT amounts presented by suppliers of goods (works, services) are accepted for deduction in the generally established manner.

If subsidies were received by an organization from the budget to reimburse costs associated with payment for purchased goods (works, services), including VAT, then these subsidy amounts are not included in the tax base.

The explanations given concern subsidies provided by both regional (local) and federal budgets ( letters of the Federal Tax Service of the Russian Federation dated February 28, 2013 No. ED -19-3/26 ( clause 1 ), the Ministry of Finance of the Russian Federation dated April 18, 2013 No. 03‑07‑11 /13330 , dated 04/18/2013 No. 03‑07‑11/13370 , dated 06/09/2011 No. 03‑03‑06/1/337 , dated 02/08/2013 No. 03‑07‑11/3144 , dated 02/01/2013 No. 0 3 ‑07‑11/2142 , dated 05/27/2011 No. 03‑03‑06/1/313 (relates to the situation with the provision of subsidies from the federal budget for the purchase of chemical agents, diesel fuel, and for reimbursement of part of the cost of paying interest on loans)).

The invoice is issued in a single copy “for yourself”

In this case, it is advisable to use special processing Registration of invoices for advance payments (Bank and cash desk - Registration of invoices - Invoices for advance payments)

, which will automatically create invoices for all outstanding advances according to the established statement rules*.

*The procedure for issuing invoices for advances received is established in the accounting policies of organizations (), as well as in the agreement with the counterparty. By the way, we strongly advise you not to neglect the latest provision of the law and issue invoices for all advances that are not paid by the end of the day. One of our acquaintances, an accountant, has been reprinting books of purchases and sales since 2011, due to the fact that he wrote out advances that were not accounted for within 5 days.

The most important limitation of this method is that before registering advance invoices, we must be sure that:

- The sequence of settlements with customers is relevant

- Duplicate counterparties and contracts were reconciled

- All debt balances are as of 62.01

- All balances of advances are at 62.02

- At 62.02 there are no balances for which the advance should have already been closed

- the registration of advance invoices

has already been processed , it is necessary to restart

Let's briefly consider each of the above restrictions separately:

Restoring the sequence of settlements with customers

In enterprise accounting

There are two ways to transfer documents:

- re-posting of documents in Closing the month

(

Operations - Closing of the month - Re-posting of documents

)

- using the VAT Accounting Assistant

(

Reports - VAT - VAT Reporting

).

Its main task is to correctly perform all regulatory operations for calculating VAT.

Before generating a declaration, you must complete Regulatory Operations

.

These operations allow you to avoid errors. They allow you to restore the sequence of documents, make entries in the purchase book, and also a tool such as Express Accounting Check

allows you not only to see errors, but also to receive recommendations on how to eliminate them.

Each organization should develop regulations for the re-processing of documents and setting a date for prohibiting editing, but this is the topic of a separate independent article.

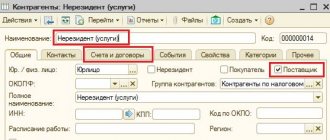

Checking for duplicate counterparties and contracts

This topic is also quite extensive and, of course, it is better to reconcile doubled counterparties not during reporting, but constantly, in accordance with the developed regulations. Some points can be gleaned from the article Effective work with the directory of counterparties, and to search for duplicate elements of directories, use special universal processing.

We also recommend that you familiarize yourself with the service for checking the details of counterparties and the service for establishing counterparties by TIN.

Checking the correctness of mutual settlement balances on accounts 62.01 and 62.02

To check account balances 62, you can use the Turnover Balance Sheet

with the settings

Expanded balance

and

By subaccounts

.

Let me draw your attention to the fact that many accountants, when analyzing account balances 62, do not enable the Expanded balance

and disable grouping by

Documents of settlements with counterparties

and see approximately the following picture (Figure 1)

Figure 1 - Checking account 62 without an expanded balance and settlement documents

Looking at this table, the accountant makes the following conclusions: at the beginning of the year there are “minuses” in the balance sheet, but during the period they leveled out, and at the end of the quarter the balances are correct - all balances 62.01 are debit, 62.02 are credit.

Let's look at the same report with the expanded balance setting enabled (Figure 2)

Figure 2 – Checking account 62 with setting up the expanded balance

We see that in fact the program considers the amount of 207606.73 for the counterparty “Buyer 6” on account 62.01 as an unclosed advance. On the contrary, the program considers account 62.02 for counterparty “Buyer 6” to be an outstanding debt. Let's consider this situation in more detail, expanding the turnover for the counterparty “Buyer 6” according to the settlement documents (Figure 3).

Figure 3 – Turnover 62.02 for counterparty “Buyer 8” according to settlement documents

We see that the debit turnover according to the document Receipt to current account 16 dated 02/27/2019

is incorrect, since there was no advance balance on this document (there was no loan). To correct this error, it is enough to decipher the turnover with the account card, find the document that made the incorrect turnover and re-post it.

The procedure for correcting identified erroneous movements and balances in mutual settlements is worthy of a separate full-fledged article. For the purposes of this article, we will limit ourselves to the fact that the closure of advances and debts must necessarily take into account settlement documents. Disabling the grouping Documents for settlements with the counterparty

when analyzing mutual settlements - a common and significant mistake.

As a result, after all the corrections, the following picture should be obtained: balances 62.01 - only in the debit of 62 accounts, balances 62.02 - only in credit (Figure 4).

Figure 4 – SALT for account 62 with expanded balance for subaccounts

Checking unclosed (unaccounted) advances

The general essence of checking unclosed advances is that, subject to the previous point, we just need to remove the “By subaccounts” setting and check whether there are simultaneous debit and credit balances for one counterparty/agreement as a whole on account 62. Grouping by settlement documents can be disabled (Figure 5).

Figure 5 – SALT for account 62 with expanded balance

Analyzing this report, we see that “Buyer 2” under contract “No. 2” simultaneously has a debt of 3,399,275.50 and an advance of 3,559,642.50. This situation suggests that advances under this agreement were offset incorrectly. If this error is not corrected, then when automatic registration of invoices for advance payments is made, an advance invoice will be issued for the credit balance of 3,559,642.50 and VAT will be charged.

Let us separately consider the counterparty “Buyer 8”. In general, for the counterparty we see that there is both a credit and a debit balance on account 62, but when detailing the agreements, it is clear that the debit balance is on “agreement 8”, and the credit balance is on “agreement 8.2”. This situation really can happen. We must pay attention to it, but we will not correct anything in this case.

After correcting all unaccounted advances, the picture in the report will change as follows (Figure 6).

Figure 6 – SALT for account 62 with expanded balance after corrections

Registration of invoices for advance payments

Finally, when we are sure that:

- The sequence of settlements with customers is relevant

- Duplicate counterparties and contracts were reconciled

- All debt balances are as of 62.01

- All balances of advances are at 62.02

- At 62.02 there are no balances for which the advance should have already been closed

Only now we can use the automatic issuance of invoices for advances ( Sales - Maintaining a sales book - Registration of invoices for advances

).

Document Invoice

issued with the sign

For advance

registration registers the following movements in the system:

- Accounting entry Dt 76.AV Kt 68.02 for the amount of VAT on the advance

- Entry into the sales VAT

- it is on the basis of the data in this register that

the Sales Book

I repeat, in case of changes in mutual settlements in the period for which processing has already been performed Registration of invoices for advance payment

, it is necessary to re-perform processing, and the program implements the ability not to renumber previously generated documents (this is important if we have already printed previously issued invoices).

Deduction of VAT on advances received

Previously accrued amounts of VAT on advances are subject to deduction in the period in which the advance was offset (debit turnover on account 62.02). To register VAT deductions from advances received, you must create a document Creating purchase ledger entries

(

Operations – Regular operations for VAT – Creation of purchase ledger entries

) and fill out the tab

Deduction of VAT from advances received

.

Document Formation of purchase ledger entries

registers the following VAT movements from received advances in the system:

- Accounting entry Dt 68.02 Kt 76.AV - for the amount of VAT credited in advances during this period

- Entry into the VAT Purchases

– it is on the basis of the data in this register that

the Purchase Book

Comparison of balances 62.02 and 76.AB

If VAT on advances received was calculated correctly, and was also correctly accepted for deduction of VAT on offset advances, then the credit balance of 62.02 * VAT rate should be equal to the debit balance of 76.AB.

To compare balances 62.02 and 76.AB, you can use the Turnover balance sheet

for each of the accounts and compare the amounts of balances 76.AB with those obtained by manually calculating VAT based on account 62.02. For more detailed information on how to check the correctness of VAT calculation on advances, our article Checking VAT on advances on accounts 62.02 and 76.AB for sales for VAT 18% using Excel will help.

Do not hesitate, contact us for help and we will help you set up VAT accounting on advances, correct all errors, resubmit VAT for previous periods, we really have extensive experience in correcting VAT errors.

Support and assistance

Receive articles by email

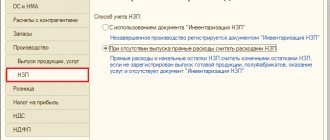

In the 1C: Enterprise Accounting program version 3.0, there are two ways to write off VAT. The choice of method depends on how the goods or materials were purchased.

Method 1

If the goods were purchased by an accountable person, then when filling out the advance report, VAT will be written off automatically.

Let's go to “Bank and cash desk” - “Advance reports” (see Fig. 1).

Rice. 1. Advance reports

When filling out the “Advance report” document, you must indicate the VAT highlighted in the documents in the “VAT” column (rate and amount) (see Fig. 2). In the column “Invoice” (invoice) we do not check the box.

Rice. 2. Indication of VAT

We check the transactions made by the document using the “DT/CT” button. The written-off VAT is reflected in account 91.02. The article “Write off allocated VAT for other expenses” is set automatically.

In addition, the written-off VAT accumulates in the off-balance sheet account HE.01.9 during the calendar year (see Fig. 3).

Of course, there is a constant difference, but it is calculated automatically.

Rice. 3. Document movements: expense report

You can check the correctness of the reflection of this operation by generating a balance sheet for account 19.03 (see Fig. 4).

Rice. 4. Balance sheet

Method 2

The second option for writing off VAT is not automated in the 1C: Enterprise Accounting program ed. 3.0 and requires the execution of an additional special document.

In this case, the receipt of goods or materials is documented using the document “Receipt of Goods”. You can find it by going to “Purchases” - “Receipts (acts, invoices, UPD)” (see Fig. 1).

Rice. 1. Document “Receipt of goods”

When filling out the “Receipt of Goods” document, indicate the VAT highlighted in the supplier’s documents in the “VAT” column (see Fig. 2). We do not register the invoice.

Rice. 2. Filling out the document “Receipt of goods”

We check the transactions made by the document using the “DT/CT” button (see Fig. 3). We see that VAT was not automatically written off.

Rice. 3. Document movements: Receipt

To write off VAT in the 1C: Enterprise Accounting program version 3.0, a document “Write off VAT” is provided.

The easiest way to write off VAT based on the “Receipt of Goods” document is to generate the “Write off VAT” document using the “Create based on” button (see Fig. 4).

Rice. 4. Formation of the document “Write-off of VAT”

The “Purchased Assets” tab will be filled in automatically (see Fig. 5).

Rice. 5. Tab “Purchased Values”

On the “Write-off account” tab, you can specify the account and also select the required analytics (see Fig. 6).

Rice. 6. Tab “Write-off account”

We check the transactions made by the document using the “DT/CT” button. The written off VAT was reflected in account 91.02.

Also, the written-off VAT is accounted for in the off-balance sheet account HE.01.9 (see Fig. 7).

Rice. 7. Reflection of written off VAT

Having generated the balance sheet for account HE.01.9, we can analyze how much VAT was written off during the reporting period.

It is important not to forget to check the “NU” checkbox in the report settings. To do this, select “Show settings” - “Indicators” - “NU” (see Fig. 8-9).

Rice. 8. Report settings

Rice. 9. Balance sheet

In this way, VAT is written off in the 1C: Enterprise Accounting program, edition 3.0, depending on the methods of purchasing goods or materials.

Subsidies from the federal budget

As you know, VAT refers to federal taxes and is credited to the federal budget at the rate of 100% ( Article 13 of the Tax Code of the Russian Federation , Article 50 of the Budget Code of the Russian Federation ). Financiers point out that VAT is not deductible if goods (work, services) are paid for from the federal budget (subsidy), since this leads to a repeated refund of the tax from the budget ( letters dated 02/08/2013 No. 03‑07‑11/3144 , dated 02/01/2013 No. 03‑07‑11/2142 , dated 08/08/2011 No. 03‑03‑06/4/92 , dated 06/09/2011 No. 03‑03‑06/1/337 , dated 05/31/2011 No. 03 ‑07‑15/55 , dated 05/27/2011 No. 03‑03‑06/1/313 ( clause 2 ), dated 03/18/2011 No. 03‑07‑11/61 , dated 12/10/2010 No. 03‑07‑11 /486 , dated 08/31/2009 No. 03‑07‑14/91 ). In addition, in the Letter of the Ministry of Finance of the Russian Federation dated December 23, 2013 No. 03‑03‑06/4/56546 with reference to paragraphs. 6 clause 3 art. 170 of the Tax Code of the Russian Federation clarifies that VAT amounts presented to the taxpayer by contractors for work performed to modernize depreciable property, paid for from the federal budget, are not accepted for deduction.

It should be said that the Federal Tax Service, giving explanations regarding the possibility of applying VAT deductions on goods (works, services) paid for with subsidies from the federal budget, although it quotes the position of the Ministry of Finance verbatim, at the same time notes that in the current judicial practice ( resolutions of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 01.04.2008 No. 13419/07 , dated 01.04.2008 No. 12611/07 ) expresses the position that the Tax Code does not provide for restrictions on the right to tax deductions for organizations selling goods (work, services) at regulated prices and receiving in connection with these are subsidies in case of purchasing goods from budget funds. Therefore, the Federal Tax Service instructs the tax authorities, in order to reduce the number of court disputes lost to taxpayers and to exclude court decisions not in favor of the tax authorities, when making decisions based on the results of tax audits and participating in legal proceedings with taxpayers, to be guided by established judicial practice ( letters of the Federal Tax Service of the Russian Federation dated March 30 .2011 No. KE -4-3/5012 , dated July 28, 2009 No. 3‑1‑11/ [email protected] ). That is, in essence, the Federal Tax Service agreed with the Ministry of Finance, but suggested that local tax authorities act with an eye on arbitration practice in order to exclude decisions not being made in favor of the tax inspectorates.

If a deduction in the indicated case cannot be applied, then does the taxpayer have the right to attribute the amount of “input” VAT on goods (work, services) paid for with a subsidy to expenses for profit tax purposes? In Letter dated March 19, 2012 No. 03‑03‑06/4/20, the Ministry of Finance indicates that this cannot be done. Here's the thing. Clause 1 of Art. 170 of the Tax Code of the Russian Federation establishes that VAT amounts presented to the taxpayer when purchasing goods (work, services, property rights) are not included in expenses when calculating corporate income tax, except for the cases provided for in paragraph 2 of Art. 170 Tax Code of the Russian Federation . In turn, in paragraph 2 of Art. 170 of the Tax Code of the Russian Federation contains an exhaustive list of transactions in which the amounts of VAT presented to the buyer when purchasing goods (work, services) are taken into account in the cost of these goods (work, services). Operations related to payment for goods (works, services) from the federal budget are not mentioned in the specified list. Thus, when paying for goods (work, services) at the expense of the federal budget, the VAT amounts charged to the buyer when purchasing goods (work, services) cannot be taken into account by the buyer as expenses for profit tax purposes.

The taxpayer must develop a separate accounting methodology independently and necessarily consolidate it in the accounting policy for tax purposes.

Example 2. Let's use the conditions of example 1 with the only difference that in May fertilizers were purchased in the amount of 1,500,000 rubles. (i.e. 1,000,000 rubles from subsidies, 500,000 rubles from own funds), incl. VAT 18% - RUB 228,813. In this case, the organization has the right to deduct only part of the VAT attributable to the purchase of fertilizers from its own funds (500,000 rubles * 18/118 = 76,271 rubles), the rest of the tax is 152,542 rubles. is not accepted for deduction, is taken into account in the cost of materials, and is taken into account as expenses for tax purposes.

The accountant of the organization, in order to maintain separate accounting and comply with the law, opened a separate sub-account for accounting for such VAT - 19-2 “VAT on values (expenses), not accepted for deduction.” Based on this, the following entries were made in accounting:

1) in February 2021, a subsidy was received for the purchase of fertilizers in the amount of 1,000,000 rubles:

Dt 51 – Kt 98 – 1,000,000 rub.

2) in May 2021, the Company purchased fertilizers, partially financed from the budget in the amount of 1,500,000 rubles. (including VAT - 228,813 rubles), the expenditure of funds received is reflected:

Dt 10 - Kt 60 - RUB 1,271,187.

Dt 19-1 - Kt 60 - 76,271 rub.

Dt 19-2 - Kt 60 - 152,542 rubles.

Dt 98 - Kt 91 - 1,000,000 rub.

3) in May, transactions for accounting for VAT on purchased fertilizers are reflected:

Dt 68 – Kt 19-1 – 76,271 rub. – VAT has been accepted for deduction regarding the amount of own funds spent on the purchase of fertilizers;

Dt 10 - Kt 19-2 - 152,542 rubles. – VAT on financed costs is included in the cost of fertilizers.

The second option is more common, since the main part of the organization’s expenses already incurred is financed after the accountant collects all the necessary supporting documents as part of the subsidy program.

In this case, by virtue of sub. 6 clause 3 art. 170 of the Tax Code of the Russian Federation, tax amounts are subject to restoration in the amount previously accepted for deduction. No difficulties arise when applying this rule if specific purchases (goods, works, services) are known for which a subsidy was paid to reimburse the costs.

If subsidies only partially compensate for the costs incurred, then, knowing the cost of goods (work, services) excluding VAT, purchased through subsidies for cost recovery, it is necessary to determine the share for restoring the tax amounts. This will be the same proportion as subsidies finance costs. The fact is that in sub. 6 clause 3 art. 170 of the Tax Code of the Russian Federation refers exclusively to purchased goods (works, services), for which a deduction of “input” VAT was applied. If subsidies are allocated to compensate for the costs of purchasing goods, works, services, the suppliers of which did not submit VAT, or to compensate for the costs of paying wages, the norm in question does not apply (we will talk about this a little later in this article).

The amounts of VAT on purchases accepted for deduction during the tax period should be restored in a certain proportion in the tax period in which the subsidies were received:

| Share of VAT that is subject to recovery | = | Cost of goods (works, services), the costs of which are reimbursed through subsidies (investments) from the budgets of the budget system of the Russian Federation, excluding tax | / | Total cost of purchased goods (works, services) excluding tax |

Recovered VAT amounts are not included in the cost of goods (work, services). They are taken into account as part of other expenses in accordance with Art. 264 Tax Code of the Russian Federation. Please note that this procedure is not directly described in the Tax Code of the Russian Federation, so it must be enshrined in the accounting policy.

Example 3. The company received a subsidy of 1,000,000 rubles in April 2021. (excluding VAT) to finance the costs of previously purchased fuel and lubricants for RUB 2,200,000. (including VAT RUB 335,593). As a result, the cost of fuel and lubricants excluding VAT is RUB 1,864,407. Based on the requirements of tax legislation, the amount of VAT in terms of budget financing is subject to restoration. The organization's accountant calculated the share of recoverable VAT, since costs are only partially subsidized.

VAT share = 1 00 0000/1 864 407 = 0.54636

Consequently, the VAT previously accepted for deduction in the amount of RUB 179,999.86 is subject to restoration. (RUB 335,593 * 0.54636). The amount of restored VAT is subject to reflection in accounting and in the VAT return during the period of receiving the subsidy, i.e. in April.

The organization's accountant reflects the VAT restoration operation as follows: Dt 91 - Kt 68. This amount is included in expenses in tax accounting.

It should be noted that this norm of the Tax Code of the Russian Federation applies regardless of the period for which expenses are reimbursed. If an organization in 2018 receives subsidies to reimburse costs associated with payment for goods (work, services) purchased before 2021, including fixed assets and intangible assets, then the amounts of VAT previously accepted for deduction are subject to restoration ( Letter of the Department of Tax and Customs Policy of the Ministry of Finance of the Russian Federation dated February 5, 2021 No. 03-07-11/6382).

When restoring VAT in the sales book, you should register the invoice on the basis of which the tax was previously accepted for deduction. It is registered for the restored amount, this is stated in clause 14 of the Rules for maintaining the sales book, approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137. In this case, there is no need to make changes to the purchase book.

Once again we would like to draw your attention to the fact that only those tax amounts that were previously accepted for deduction are subject to restoration. If your organization purchased subsidized goods, works, services and other property without VAT, then when receiving budget funds you do not need to restore anything.

Example 4. Let us use the conditions of the previous example with the only difference that the Company purchased fuel and lubricants that were subsequently subsidized without VAT, i.e. total cost of fuel is RUB 2,200,000. Since VAT was not previously deductible when receiving subsidies of 1,000,000 rubles. in April, the organization’s accounting department does not legally restore VAT.

Additionally, a problem arises with taking into account input and output VAT, because often the subsidy covers costs only partially, and the costs are of different orders, and it is very difficult to allocate part of the VAT for recovery from all costs. In this case, it will be easier for the organization to recover VAT on the entire amount of subsidies, which will lead to double taxation of some expenses.

Next, let's move on to the most difficult and frequently asked question about the restoration of VAT on subsidies such as: to support the production of milk and meat or on unrelated state support in crop production and other “impersonal” costs. The Tax Code of the Russian Federation does not say anything about how to allocate and restore VAT on such costs and whether it needs to be restored at all. Let's figure it out together.

It appears that the first step is to determine the value of the purchases for which the subsidy was provided. The basis for the calculation is, as a rule, reports submitted to the funding source to determine the amount of the subsidy and confirm its intended use. From the total amount of costs for the type of activity, the share compensated by the subsidy should be allocated in proportion to the share of the subsidy in the amount of all revenues for the type of activity in connection with which the subsidy is provided. This share determines the amount of tax to be restored. In this case, the actual restoration is carried out in the tax period when the subsidy was actually received by the taxpayer. This procedure must also be reflected in the accounting policy for tax accounting.

Example 5. The company received a subsidy in the amount of 5,000,000 rubles in May 2021. to reimburse part of the costs for the construction of complexes for the slaughter of pigs and the production of offal, storage of meat and offal, including the purchase of equipment.

According to the certificates and calculations submitted by the accountant for obtaining financing, the total amount of costs for the construction of complexes for the slaughter of pigs and the production of by-products, storage of meat and by-products amounted to 20,000,000 rubles, which represent:

— costs for construction materials – 8,000,000 rubles. (including VAT and without VAT);

— expenses for wages and insurance premiums – 7,000,000 rubles;

— services of a contracting organization – RUB 1,500,000. (without VAT);

— services of other third-party organizations – RUB 2,000,000. (including VAT and without VAT);

- expenses of auxiliary production and general business expenses - 1,000,000 rubles;

- expenses for other materials - 500,000 rubles. (including VAT and without VAT).

As a result, the accountant cannot determine with exact certainty the specific amount of tax to be restored, since materials, work, and services were purchased both with and without VAT. It is not possible to “single out” the tax that should be restored. For this, the above calculation is applied.

We determine the share of subsidized costs: 5,000,000/20,00,0000 rubles. = 0.25%.

We apply this share to the amount of budget funds received: 5,000,000 rubles. * 0.25% = 1,250,000 rub.

As a result, VAT in the amount of RUB 1,250,000 is subject to restoration.

Agricultural producers and organizations of the agro-industrial complex can be provided with subsidies not only for reimbursement of specific expenses, but also based on:

- per 1 hectare of crop area;

per 1 liter (kilogram) of milk sold;

The question arises: should organizations and entrepreneurs who received subsidies “per 1 kg”, “per 1 hectare”, “per 1 conventional head”, etc. restore the VAT charged by counterparties on goods (works, services)? We believe that if such subsidies are received, there is no need to restore VAT. The fact is that the rules for the provision and distribution of these subsidies do not contain a specific list of costs for the reimbursement of which subsidies are provided, and this is their fundamental difference from subsidies that are provided for the costs of acquiring certain material resources (young cattle, mineral fertilizers, seeds and etc.). This difference is clearly visible when comparing certificates and calculations for the provision of subsidies.

For example, a calculation certificate for the provision of a subsidy to support the production of commercial milk of the highest and first grade for an organization or individual entrepreneur - the recipient of the subsidy contains the following data for the quarter:

| Milk consignee | Number and date of the document confirming the sale of products | Volume of milk produced during the reporting period (t) | Volume of sold and (or) own milk processing for the reporting period (t) | Subsidy rate | Subsidy requirement (RUB) | Amount of subsidy to be transferred (RUB) |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

The certificate looks similar - a calculation for the provision of subsidies for unrelated support in the field of crop production - to reimburse part of the costs of carrying out a set of agrotechnological works, increasing the level of fertility and soil quality per 1 hectare of sown area.

At the same time, for example, a certificate of calculation for the provision of subsidies for the purchase of equipment looks completely different and contains information about specific equipment and its cost:

| Name of purchased equipment | Quantity (units) | Equipment cost (RUB) | Subsidy rate (% of actual costs incurred) | Need for subsidies (RUB) (gr. 3 * gr. 4) | Amount of subsidy to be transferred (RUB) |

| 1 | 2 | 3 | 4 | 5 | 6 |

Based on this, by virtue of sub. 6 clause 3 art. 170 of the Tax Code of the Russian Federation, the taxpayer is obliged to restore VAT only in cases where the subsidy is allocated to reimburse specific costs (property, work, services), because the restoration of VAT is due to the need to exclude double VAT refunds from the budget (Letters of the Ministry of Finance of the Russian Federation dated September 19, 2013 No. 03-07 -11/38839, dated 02/01/2013 No. 03-07-11/2142).

However, it must be taken into account that following this position is associated with the risk of claims from the tax authorities. Thus, the Letter of the Ministry of Finance of the Russian Federation dated February 11, 2014 No. 030711/5427 directly states that when paying for goods (works, services) using subsidies provided within the framework of the Rules for the provision and distribution of subsidies from the federal budget to the budgets of constituent entities of the Russian Federation for the provision of unrelated support to agricultural producers in the field of crop production, the “input” VAT on them is subject to restoration in accordance with sub-clause. 6 clause 3 art. 170 Tax Code of the Russian Federation.

However, in the same letter there is also confirmation of our position that there is no need to restore the tax: the requirement to restore VAT applies only to those situations where subsidies are allocated specifically to pay for purchased goods (works, services).

If we are talking about state support within the framework of the implementation of targeted programs that provide for the allocation of funds for certain work (events), then the provisions of sub-clause. 6 clause 3 art. 170 of the Tax Code of the Russian Federation are not applied; as a result, VAT on such subsidies is not required to be restored.

Next, we will consider this type of subsidy as compensation for part of the cost of paying interest on loans. On October 16, 2012, the Ministry of Finance of the Russian Federation, in Letter No. 03-07-11/430, provided clarification on the issue of restoration (payment) of VAT to the budget on subsidies to reimburse part of the cost of paying interest on credits (loans).

The received credits (loans) are used to purchase goods, works, services, but this type of subsidy is provided not to pay for goods, but to compensate for part of the cost of paying interest on borrowed credits (loans). Based on this, the requirements of sub. 6 clause 3 art. 170 of the Tax Code of the Russian Federation does not apply to targeted funds aimed at compensating the costs of interest paid; VAT is not subject to recovery.

And finally, let’s return to the third option for providing subsidies, discussed in Letter of the Ministry of Finance of the Russian Federation dated 04/02/2018 No. 03-07-15/20870.

In a situation where subsidies provided to an organization that is an agricultural producer are payment for the goods (work, services) sold to it, subject to taxation, VAT in relation to these subsidies is calculated in the generally established manner. Such a subsidy should be treated as ordinary revenue of the organization and, accordingly, subject to VAT.

But in practice, such types of subsidies specifically in relation to agricultural producers have not been encountered. Typically, subsidies in the form of price differences are used by housing and communal services, the prices of which are regulated by the state.

To summarize the above, I would like to say that changes in the Tax Code of the Russian Federation regarding the restoration of VAT on received earmarked funds will not only significantly increase the work of the accounting department, but will also generally lead to a deterioration in the financial condition of agricultural producers in the form of lost financial assistance from the state.