For 2021, Rosstat approved a new form P-4 - reporting, which is used to monitor the number of employed persons and the amount of wages paid to them.

With this article we complement the series of reviews about the new forms of statistical reports that have been introduced by Rosstat for this year, and we explain the main issues - what has changed in the updated form, how to correctly fill out the P-4 form, for whom this report is mandatory, and in what time frame it must be submitted to avoid penalties for violating reporting deadlines.

Form P-4: what kind of report is this and who submits it?

For the last few years, employers have been submitting information on the number and wages of employees in the P-4 form to Rosstat. Respondents provide report form P-4 according to the new OKUD form 0606010 in 2021 - from Order No. 412 dated July 24, 2020.

IMPORTANT!

Regulatory instructions for filling out Form P-4 in 2021 are contained in Order No. 412 dated July 24, 2020 and Order No. 711 dated November 27, 2019.

Reporting on the number of employees and their wages is submitted by:

- legal entities involved in medium and large businesses, including each branch of the company;

- state organizations;

- temporarily non-working organizations - on a general basis, indicating from what time they have not been working;

- bankrupt organizations until a liquidation entry is made in the Unified State Register of Legal Entities.

There are organizations that do not need the P-4 statistical form. The document is not submitted to the statistical accounting service:

- firms engaged in small business;

- public organizations;

- cooperatives;

- IP.

IMPORTANT!

The possibility of not submitting a report must first be agreed upon with Rosstat.

Who should submit a statistical report?

Form P-4 must be submitted to Rosstat departments. The report contains data on the number and salary of employees. Form No. P-4 was approved by Rosstat order No. 566 dated September 1, 2017. It is filled out in accordance with the instructions approved. by order of Rosstat dated November 22, 2017 No. 772.

All organizations are required to submit Form No. P-4, regardless of the taxation system. The exception is small businesses. Individual entrepreneurs do not submit reports at all.

All separate divisions of organizations and branches of foreign companies are required to report. The report is submitted even if wages and other payments were not accrued during the reporting period (clause 74.3 of the instructions, approved by Rosstat order No. 772 dated November 22, 2017).

When and where does the P-4 go?

The letter of the Ministry of Digital Development No. EK-P14-070-39442 dated December 29, 2020 explains that the P-4 report to statistics is information about the number and wages of employees. The form is submitted at the following intervals:

- If the organization employs less than 15 employees, then P-4 is submitted quarterly, before the 15th day of the month following the previous quarter.

- If the company has 15 or more workers, then the personnel report to Rosstat in form P-4 is submitted monthly, before the 15th day of the month following the previous one. Every month, information is expected from legal entities that hold a license for the extraction of minerals, and companies registered (reorganized) in the current or previous year. For subsoil users and newly registered organizations, the frequency of delivery is not affected by the average number of employees.

| P-4 delivery dates in 2021 | |

| Number of employees more than 15 | Number of employees less than 15 |

| January 15 | |

| February, 15 | They don't rent |

| March 15th | They don't rent |

| April 15 | |

| May 17 | They don't rent |

| June 15 | They don't rent |

| July 15 | |

| August 16 | They don't rent |

| September 15th | They don't rent |

| October 15 | |

| 15th of November | They don't rent |

| December 15 | They don't rent |

What has changed in the reporting form

Form P-4, which you can download in the current version at the end of our review, does not contain any special innovations. Almost all changes made to the P-4 report form for 2021 are of a technical nature. So, in particular:

- In the “Provide” section of the form title, Rosstat specified the list of respondents for whom submission of the report is mandatory;

- In the first part of the table “Number of employees, accrued wages and hours worked,” the definition of “with up to 15 people” is replaced by the definition of “providing information quarterly”;

- The comment to group 4 regarding the format of the indicated values has been changed. If previously the average number was calculated and indicated exclusively in whole units, now this information is calculated and indicated in values with one decimal place;

- The second part of the table now does not contain instructions on the use of OKEI codes. In addition, it also changes the definition of legal entities with up to 15 employees, now they are designated as “providing information quarterly.”

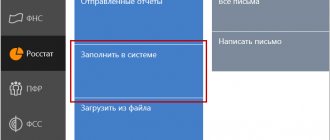

How to send

In 2021, all reports to Rosstat are submitted electronically (500-FZ dated December 30, 2020). The file is signed with an electronic signature and sent to the territorial statistics department. If the respondent sends information in an incorrect form, he will receive a warning on the P-4 report on headcount and wages.

IMPORTANT!

Until the changes to the RF Regulation No. 620 dated 08.18.2008 come into force, organizations have the right to submit reports both electronically and on paper.

Report formatting rules

Employers use only a unified form to submit reports. The use of forms independently developed by the enterprise is not permitted. Let's look at how to fill out the P-4 report.

Title page

The first - the title page of the P-4 statistics form contains:

- the reporting period for which information is submitted;

- full and short name of the enterprise. On the form containing information on a separate division of a legal entity, the names of the separate division and the legal entity to which it belongs are indicated;

- actual and postal addresses of the organization;

- OKPO code;

- identification number - for the head and separate divisions of the legal entity.

Filling out the tables

The content part (2nd and 3rd pages) of the document contains two tables that reflect information about the number of employees, the salary accrued to them and the time they worked.

First table by columns:

- A (lines 02 to 11) is intended to indicate the types of activities of the enterprise;

- B - code according to OKVED2;

- 1 is the sum of the values of columns 2, 3 and 4;

- 2 - average number of workers. To calculate this indicator, we add up the number of employees for each calendar day of the month and divide by the number of days in the month. When submitting a report for the fourth quarter, we first count the number of employees for each of the 12 months (information is transmitted to Rosstat from the beginning of the year), then we divide the result by 12, and write down the final figure. If the report is submitted for the second quarter, calculate the number of employees for each of the 6 months and divide by 6. In our example, the report is for a month, so we do not enter anything;

- 3 - average number of external part-time workers (use the calculation method described in the Rosstat instructions);

- 4 - the average number of employees who performed work under civil contracts (a similar algorithm is used for calculation).

Second table of the form:

- 5, 6 - the number of man-hours actually worked by payroll employees and external part-time workers. This does not take into account the time a worker is on vacation, on off-the-job training courses, or during periods of illness, but it is necessary to take into account employees who perform job duties remotely (see Rosstat letter No. 07-07-2/3061-TO dated 07/08/2020);

- 7-10 - data on the accrued salary fund, which is taken from accounting documents. Include in columns 7, 8 and 9 incentive payments that employees are paid for special working conditions in the fight against coronavirus (see Rosstat letter No. 1540/OG dated 07/08/2020);

- 11 - social payments.

There are small exceptions to the rules. Companies employing more than 15 people and which are not small businesses:

- monthly reports are made in columns 1, 2, 3, 4, 7, 8, 9, 10, columns 5, 6, 11 are omitted;

- in the quarterly P-4, all columns are filled in, but the indicators in columns 5, 6, 11 must reflect data for the period from the beginning of the year.

Even if the company is not a small business, but it employs less than 15 people, all fields must be filled out. But the data in columns 5-11 is needed not for the quarter, but for the period from the beginning of the year.

Preparation of report P-4: step-by-step instructions for filling out

In form P-4 the following are filled in sequentially:

- Title page on which you need to indicate:

- reporting period;

- name of the company, its address, OKPO code.

- Statistical table (pages 2 and 3 of the form).

It consists of 14 columns. Of these, 3 are alphabetic:

- A - it reflects the types of activities for which economic indicators are disclosed;

- B - contain line numbers in order;

- B - reflect codes according to OKVED-2, corresponding to the types of activities indicated in column A.

The remaining columns are numeric:

- 1 - total average number of employees, the sum of values in columns 2, 3 and 4;

- 2 - average number of employees on the payroll;

- 3 — average number of external part-time workers;

- 4 - average number of individual contractors;

- 5 — man-hours worked by full-time employees;

- 6 — man-hours worked by external part-time workers;

- 7 - total wage fund, sum of values in columns 8, 9, 10;

- 8 - wage fund for full-time employees;

- 9 — fund for external part-time workers;

- 10 - fund for contractors;

- 11 - social payments.

Social payments include severance pay, compensation for the use of transport, financial assistance and other methods of financial support for employees. Their expanded list can be found, for example, in the Instructions approved by Rosstat Order No. 22 dated January 23, 2019 (they relate to another form - but are also applicable in the case under consideration).

Indicators in the Rosstat P-4 form cannot have a negative value.

Let us now consider the deadlines for submitting the document (and what, therefore, the reporting period is indicated on the title page).

How to make changes to reporting

In order to clarify the data previously submitted to the territorial department of Rosstat for January-December of the reporting year, you should send changes in an official letter no later than January 15 of the year following the reporting year to generate final data on the number and salaries of employees.

If you need to change information for a specific month, you should officially notify the territorial department of Rosstat. This can be done no later than the 15th day of the month following the reporting month.

ConsultantPlus experts discussed how to fill out the federal statistical observation form No. P-4, starting with the report for January 2021. Use these instructions for free.

Form P-4 (NZ)

In contrast to the procedure for filling out P-4, which is submitted both monthly and quarterly, the new instructions for filling out form P-4 (NZ) in statistics states that it should be submitted once a quarter. The report form on underemployment and movement of workers for 2021 was approved by Rosstat order No. 412 dated July 24, 2020.

Information is submitted by commercial and non-profit organizations (except for small companies included in the Unified Register of Small and Medium-Sized Enterprises) whose average number of employees exceeds 15 people, including those who perform part-time work or under GPC agreements. The type of activity and form of ownership do not play a role. Information is expected from all organizations created in the reporting year (except for small businesses), regardless of the number of employees.

Companies report quarterly, and the deadlines for submitting P-4 (NZ) to statistics in 2021 are as follows:

- for the fourth quarter of 2021 - until 01/11/2021;

- for the first quarter of 2021 - until 04/08/2021;

- for the second quarter of 2021—until 07/08/2021;

- for the third quarter of 2021 - until 08.10.2021;

- for the fourth quarter of 2021 - until 01/10/2022.

What is the deadline for submitting the new form?

Form P-4 is due (from 2021):

- Monthly:

- companies employing more than 15 people;

- enterprises holding a license for the extraction of mineral resources (regardless of the number of employees and revenue);

- organizations that were registered or reorganized in the current or previous year (regardless of the number of employees and revenue).

- For companies employing no more than 15 people - quarterly.

In both cases - until the 15th day of the month that follows the reporting period (month, quarter).

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

For 2021, we rent according to the old rules: monthly - those companies that employ more than 15 people, quarterly - those with less than 15 people.

Taking into account weekends and holidays in 2019-2020, the form is submitted:

- for November 2021 - until December 16, 2019;

- for December 2021 - until 01/15/2020;

- for January 2021 - until 02/17/2020;

- for February 2021 - until 03/16/2020;

- for March and the 1st quarter of 2021 - until 04/15/2020;

- for April 2021 - until May 15, 2020;

- for May 2021 - until June 15, 2020;

- for June and the 2nd quarter of 2021 - until July 15, 2020;

- for July 2021 - until 08/17/2020;

- for August 2021 - until September 15, 2020;

- for September and the 3rd quarter of 2021 - until 10/15/2020;

- for October 2021 - until November 16, 2020;

- for November 2021 - until December 15, 2020;

- for December and the 4th quarter of 2021 - until 01/15/2021.

Please note that Form P-4 is drawn up on the form introduced by Rosstat Order No. 404 dated July 15, 2019 (until the law provides otherwise). But there is no reason to say that Rosstat has changed the procedure for filling out form P-4 and its structure significantly. The rules for preparing the report remain the same.

If the P-4 report, like any other mandatory form of statistical reporting, is not submitted, sanctions in the form of a fine may be initiated against the company (Article 13.19 of the Code of Administrative Offenses of the Russian Federation):

- 20–70 thousand rubles. — on the organization;

- 10–20 thousand rubles. - on officials.

The specified sanctions also apply if the form is submitted, but it contains inaccurate information.

One of the criteria for establishing unreliability may be a discrepancy between the data in form and those given in other statistical reports. Thus, the most important nuance in the preparation of statistical reporting is the comparison of information in its different forms. Let's consider which reports need to be verified with form P-4 and what other nuances there are in filling out the document in question.

How to fill out form P-4 (NZ)

The same Rosstat instructions from Order No. 412 contain instructions on how to fill out the P-4 (NZ) report in 2021. Officials did not develop any other recommendations.

Form P-4 (NZ) consists of two pages - the title page and the main section.

Title page

Here they indicate:

- the reporting period for which information is submitted;

- full and short name of the enterprise;

- actual and postal addresses of the organization;

- OKPO code.

Table

The table consists of three columns and 22 numbered lines; they record information about employees who:

- work part time;

- are involved in the watch;

- scheduled to be released;

- are on leave without pay;

- are on parental leave for children up to 1.5 years and from 1.5 to 3 years.

ConsultantPlus experts discussed how to fill out form P-4 (NZ) for the first quarter of 2021. Use these instructions for free.

How to fill out

Separate instructions have not been prepared for employers on how to fill out the P-4 (NZ) report in 2021, but general instructions are contained in Rosstat Order No. 412. The form is simple, and no special comments are needed: all the necessary explanations are given in the form itself.

The report consists of two pages, the first of which is the title page. As in the previous form, the title page indicates:

- reporting period;

- Business name;

- mailing address;

- code for the 2nd quarter of the year for P-4 (NZ);

- OKPO code.

On the second page of P-4 (NZ) there is a table. It contains data on underemployment and movement of workers. The table consists of three columns and almost 30 numbered rows.

IMPORTANT!

Starting with the quarterly report for the first quarter of 2021, Rosstat Order No. 412 dated July 24, 2020 approved a new report form P-4 (NZ).

If there are no indicators

Rosstat emphasizes that everyone is required to submit reports. If the company has not worked for some time or there is no data to be entered (there are no employees who work part-time), it is permissible to submit reports with zeros. It is also possible to submit a blank report if the organization did not operate during the reporting period.

IMPORTANT!

The rules from Federal Law 500-FZ also apply to how to submit a P-4 (NZ) report - electronically. Before the innovations in RF PP No. 620 come into force, it is allowed to submit reports in both electronic and paper format.

Responsibility for violation of deadlines for submitting statistical reports

Based on Part 1 of Art. 13.19 of the Code of Administrative Offenses of the Russian Federation imposes a fine for late submission of a report or failure to provide it. This also applies to reports P-4 and P-4 (NZ):

- for officials - from 10,000 to 20,000 rubles;

- for organizations - from 20,000 to 70,000 rubles.

Repeated offenses are punished more severely:

- for officials the fine will be from 30,000 to 50,000 rubles;

- for organizations - from 100,000 to 150,000 rubles.