All organizations and individual entrepreneurs paying income to individuals are required to withhold personal income tax from this income, since according to paragraphs 1 and 2 of Art. 226 of the Tax Code of the Russian Federation they are recognized as tax agents.

But there are situations when it is not possible to withhold tax on income.

For example, when paying a salary in kind or generating income in the form of material benefits (debt forgiveness, giving a gift worth more than 4 thousand rubles). Personal income tax may not be withheld as a result of an error in calculation.

The impossibility of withholding tax and the amount of debt must be reported no later than March 1 of the next year (clause 5 of Article 226 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of the Russian Federation dated March 24, 2017 No. 03-04-06/17225, Federal Tax Service of the Russian Federation dated March 30, 2016 No. BS- 4-11/5443).

A message about the impossibility of withholding tax is Form 2-NDFL with sign “2”.

From the moment of notification, the obligation to pay tax is assigned to the individual, and the organization ceases to perform the functions of a tax agent (letter of the Federal Tax Service of the Russian Federation dated December 2, 2010 No. ШС-37-3/ [email protected] ). The tax must be paid by the taxpayer himself when submitting a personal income tax return to the Federal Tax Service at his location (letter of the Federal Tax Service of the Russian Federation dated August 22, 2014 No. SA-4-7/16692).

Since the deadline is approaching, we decided to talk in more detail about the rules for filling out the 2-NDFL certificate in case of impossibility of withholding tax.

Failure to withhold personal income tax as a result of a calculation error

In case of an error with the calculation, you must withhold tax until the end of the year from the next cash payments to an individual.

If there is no such possibility before the end of the year (for example, an error in the calculations was discovered in December), the individual must be informed about the impossibility of withholding tax and his tax office (Article 216, paragraph 5 of Article 226 of the Tax Code of the Russian Federation).

At the same time, they can be fined for failure to withhold only if the individual had the opportunity to withhold tax when paying income. If there was no such opportunity (for example, the income was paid in kind), then it cannot be held accountable. But if such an opportunity arose before the end of the year, and the tax agent still did not withhold the tax, in this case he also faces a fine (Article 123 of the Tax Code of the Russian Federation, paragraph 21 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57).

If personal income tax is not withheld from payments to a dismissed employee upon final settlement with him and no payments were made to him by the end of the year, the organization should also send a message about the impossibility of withholding personal income tax to the inspectorate and this employee (Article 216, paragraph 5 of Article 226 of the Tax Code of the Russian Federation ).

Actions of a tax agent in case of non-withholding of personal income tax

Most of the income paid by a company to employees during the year is subject to personal income tax (NDFL). This tax applies to salaries, bonuses, allowances, additional payments and other payments.

Tax is withheld directly from the amount of income the employee receives. In this case, income can be received both from sources in the Russian Federation and from sources outside its borders.

About the deadlines for paying personal income tax

It should be noted that different types of income have different deadlines for transferring personal income tax to the budget.

The withheld personal income tax must be transferred to the budget within the following terms (clauses 1, 2 of Article 223, clause 6 of Article 226 of the Tax Code of the Russian Federation):

- from wages, including the advance paid for the first half of the month - no later than the day following the day of payment of wages for the month (final payment);

- from salary upon dismissal - no later than the day following the day of payment of salary upon dismissal;

- from vacation pay and sick leave (including child care benefits) - no later than the last day of the month in which vacation pay or sick pay were paid;

- any other income, including income in kind - no later than the day following the day of payment of any other income.

When they couldn't withhold tax

In cases where you paid income to one of your employees, but were unable to withhold tax from this income and did not transfer it to the budget, you will have to report this to the inspectorate - until March 1.

They report to the Federal Tax Service in the prescribed form - in the form of a 2-NDFL certificate, in which the sign “2” is indicated. It indicates the amount of income from which tax was not withheld and the amount of tax not withheld.

The employee will have to pay the tax not withheld from him by the employer himself no later than December 1.

Please note: failure to submit documents and (or) other information provided for by the Tax Code by a tax agent within the prescribed period entails a fine of 200 rubles for each unsubmitted document (Clause 1 of Article 126 of the Tax Code of the Russian Federation).

How can they be punished for non-payment?

If you were supposed to withhold and transfer personal income tax to the budget, but did not withhold and (or) transfer it, then the tax authority will fine you. The fine is established by Part 1 of Article 123 of the Tax Code, which establishes the responsibility of the tax agent:

- for failure to withhold tax or incomplete withholding of tax;

- non-transfer of tax, i.e. tax was withheld but not transferred;

- late payment of tax, i.e. withheld, but did not transfer the tax on time);

- incomplete transfer of tax, i.e. They withheld, but did not transfer the entire amount of tax.

The fine is 20% of the amount of tax that you did not withhold and (or) transfer to the budget.

However, the tax agent can avoid liability under Part 1 of Art. 123 Tax Code of the Russian Federation. The condition is the simultaneous fulfillment of the following points:

- the tax calculation is submitted to the Federal Tax Service on time;

- in the tax calculation there are no facts of non-reflection or incomplete reflection of information and (or) errors leading to an underestimation of the amount of tax to be transferred to the budget;

- the tax agent independently transferred the amount of tax not transferred on time and the corresponding penalties until the moment when he became aware of the discovery of the fact of untimely transfer of tax or the appointment of an on-site audit.

Deductions from employee income

It is mandatory to make deductions according to executive documents. The Ministry of Finance of Russia reminds us of this in letter dated December 23, 2019 No. 03-04-06/100331.

Executive documents are:

- writs of execution issued by courts on the basis of their decisions;

- court orders;

- notarized agreements on payment of alimony;

- orders of the bailiff.

As a rule, the amount that must be withheld under enforcement documents cannot exceed 50% of the employee’s earnings.

However, there are cases of collection in which up to 70% of earnings can be withheld. The list of such cases is given in Part 3 of Article 99 of the Federal Law of October 2, 2007 No. 229-FZ “On Enforcement Proceedings”.

Thus, deductions in the amount of 70% of an employee’s earnings are possible:

- when collecting alimony for minor children;

- when compensating for damage caused to health;

- when compensating for damage to persons who suffered damage as a result of the death of the breadwinner;

- when compensating for damage caused by a crime.

Remember that the amount of deduction from wages and other income of the debtor is calculated from the amount remaining after withholding taxes.

Who and how to send a message about the impossibility of retention

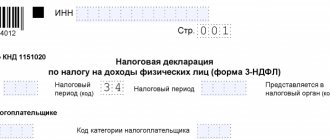

The peculiarity of issuing a 2-NDFL certificate when it is impossible to withhold tax is only that:

- in the “Sign” field, code 2 is indicated instead of the usual code 1. Sign “2” means that the 2-NDFL certificate is submitted as a message to the tax office about that income has been paid to an individual, but tax has not been withheld from it (clause 5 of Article 226 of the Tax Code of the Russian Federation);

— in the Appendix “Information on income and corresponding deductions by month of the tax period” the amount of income actually paid, from which tax was not withheld, is reflected in a separate line according to the corresponding income codes;

Section 2 “Total amounts of income and tax based on the results of the tax period” indicates:

- in the “Total amount of income” field - the total amount of income from which tax is not withheld;

- in the “Amount of tax calculated” field - the amount of tax accrued but not withheld;

- in the fields “Tax amount withheld”, “Tax amount transferred”, “Tax amount excessively withheld by the tax agent” - zeros;

- in the field “Amount of tax not withheld by the tax agent” - once again the amount of tax accrued but not withheld.

The form must be sent to:

- an individual from whose income personal income tax is not withheld;

- to the tax authority (clause 5 of article 226 of the Tax Code of the Russian Federation).

A message can be sent to an individual in any way that can confirm the fact and date of sending the message.

The specific method is not defined by tax legislation. We recommend sending it by a valuable letter with a description of the attachment, or handing it in person and receiving a receipt on a copy of the document indicating the date of delivery. The message is sent to the tax authority (clause 5 of Article 226, clause 2 of Article 230, clause 1 of Article 83 of the Tax Code of the Russian Federation):

- organization - at its location, and if the message is submitted in relation to a person working in its separate division - at the location of this division;

- individual entrepreneurs - to the inspectorate at their place of residence, and in relation to employees engaged in activities subject to UTII or PSN - to the tax authority at the place of registration in connection with the implementation of such activities.

The message can be submitted in the form of a paper document (in person or by post with a list of attachments) or in electronic form via telecommunication channels (clause 3 of the Procedure approved by Order of the Federal Tax Service of the Russian Federation dated September 16, 2011 No. ММВ-7-3 / [email protected] ) .

After sending a message to the tax authority in form 2-NDFL with attribute “2”, at the end of the year, in general order, it is necessary to submit a certificate 2-NDFL with attribute “1” (Article 216, paragraph 2 of Article 230 of the Tax Code of the Russian Federation, paragraphs 1.1 clause 1 of the Order of the Federal Tax Service of the Russian Federation dated October 30, 2015 No. ММВ-7-11/ [email protected] , section II of the Procedure for filling out the 2-NDFL certificate, letter of the Federal Tax Service of the Russian Federation dated March 30, 2016 No. BS-4-11/5443).

If the 2-NDFL certificate will be submitted by the successor for the reorganized organization, then in accordance with the changes made by Order of the Federal Tax Service of the Russian Federation dated January 17, 2018 No. ММВ-7-11 / [email protected] , in the “Sign” field he should indicate “4” ( Chapter II of the Procedure for filling out the 2-NDFL certificate).

As a result of a technical error, the calculated personal income tax was not fully withheld from the income of an employee who quit in 2021. At the end of the tax period, should an organization submit to the tax authority at its place of registration a certificate in Form 2-NDFL for 2016 for the specified employee twice:

— with sign “2” no later than March 1, 2017;

— with sign “1” no later than April 3, 2017?

Russian organizations from which or as a result of relations with which the taxpayer received the income specified in clause 2 of Art. 226 of the Tax Code of the Russian Federation are recognized as tax agents in relation to such income paid to an individual, and are obliged to calculate, withhold from the taxpayer and pay the amount of tax calculated in accordance with Art. 224 of the Tax Code of the Russian Federation (clause 1 of Article 226 of the Tax Code of the Russian Federation).

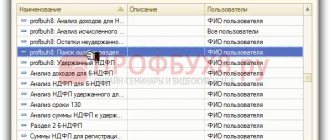

In accordance with paragraph 2 of Art. 230 of the Tax Code of the Russian Federation, a tax agent is obliged to provide to the tax authority information on the income of individuals for the expired tax period and the amounts accrued, withheld and transferred to the budget system of the Russian Federation for this tax period of taxes annually no later than April 1 of the year following the expired tax period, in the form , formats and in the manner approved by the federal executive body authorized for control and supervision in the field of taxes and fees.

As follows from paragraph 5 of Art. 226 of the Tax Code of the Russian Federation, if it is impossible to withhold the calculated amount of tax from the taxpayer, the tax agent is obliged, no later than March 1 of the year following the expired tax period in which the relevant circumstances arose, to notify in writing the taxpayer and the tax authority at the place of his registration about the impossibility of withholding the tax and the amount of tax .

The tax period for personal income tax is the calendar year (Article 216 of the Tax Code of the Russian Federation).

According to clause 1, Order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11/ [email protected] information on the income of individuals for the past tax period and the amounts accrued, withheld and transferred to the budget system of the Russian Federation for this tax period taxes, as well as a message about the impossibility of withholding tax and the amount of tax are submitted by the tax agent in form 2-NDFL “Certificate of income of an individual for the year 20_” (hereinafter referred to as the certificate).

By virtue of section II of Appendix No. 2 to this Order - The procedure for filling out the title of the Certificate form - in the title of the certificate it is indicated: in the “Characteristic” field, enter the number 1 - if the certificate is submitted in accordance with clause 2 of Art. 230 Tax Code of the Russian Federation; number 2 - if the certificate is submitted in accordance with clause 5 of Art. 226 Tax Code of the Russian Federation.

Responsibility for failure by a tax agent to submit documents and (or) other information provided for by the Tax Code of the Russian Federation and other acts of legislation on taxes and fees to the tax authorities within the prescribed period is provided for in paragraph 1 of Art. 126 of the Tax Code of the Russian Federation.

The Letter of the Federal Tax Service of Russia for Moscow dated 03/07/2014 No. 20-15/021334 states that certificates submitted annually for the entire organization with attribute “1” indicate the total amounts of income and calculated tax, including income and the calculated amount of tax reflected in the certificate with attribute “2”, the amount of tax withheld and transferred, as well as the amount of tax not withheld by the tax agent, which was previously reflected in the certificate with attribute “2”.

From the Letter of the Federal Tax Service of Russia dated March 30, 2016 No. BS-4-11/5443, it follows that the organization’s fulfillment of the obligation to report the impossibility of withholding tax and the amount of tax in accordance with clause 5 of Art. 226 of the Tax Code of the Russian Federation does not relieve an organization from the obligation to provide information on the income of individuals of the expired tax period and the amounts of taxes accrued, withheld and transferred to the budget system of the Russian Federation in accordance with art. 2 tbsp. 230 Tax Code of the Russian Federation.

The judges do not agree with this. In the Resolution of the Federal Antimonopoly Service of the Ural District dated September 24, 2013 No. F09-9209/13 in case No. A60-52670/2012, the judges decided that the tax agent was unlawfully held accountable by the tax authority for failure to submit certificates in Form 2-NDFL with the attribute “ 1". According to the judges, the tax agent, having submitted to the tax authority certificates in form 2-NDFL with sign “2”, containing all the necessary information to be indicated in certificates in form 2-NDFL with sign “1”, fulfilled the duties regulated by clause 5 Art. 226 and paragraph 2 of Art. 230 Tax Code of the Russian Federation.

We believe that an organization that does not want to bring the case to court should have been guided by the official position of the regulatory authorities and, at the end of the tax period, for an employee who resigned in 2021 and from whose income the organization did not withhold the entire amount of calculated personal income tax, submit to the tax authority a certificate of form 2-NDFL for 2021 with sign “2” no later than March 1, 2021, and a certificate in form 2-NDFL for 2021 with sign “1” no later than April 3, 2021.

An example of filling out a 2-NDFL certificate with sign 2

Alliance LLC in October 2021 rewarded former employee Petr Petrovich Ivanov (resident of the Russian Federation).

The price of the gift is 9,500 rubles. Income code - 2720. Deduction amount - 4,000 rubles. Deduction code - 501. Tax base: 5,500 rubles (9,500 rubles - 4,000 rubles).

Personal income tax: 715 rubles (5,500 rubles x 13 percent).

For the same person, you must also submit a 2-NDFL certificate with attribute “1” (letter of the Federal Tax Service of the Russian Federation dated March 30, 2016 No. BS-4-11/5443).

Certificate 2-NDFL will look like this:

Moreover, even if the tax agent did not pay other income, he will need to submit to the inspectorate two identical certificates for the same person, the difference will only be in the indication of presentation (letter of the Ministry of Finance of the Russian Federation dated October 27, 2011 No. 03-04-06/8- 290).

Failure to provide a certificate will entail the same fine in the amount of 200 rubles.

True, there are court decisions in which arbitrators recognize such fines as illegal. They indicate that there is no point in duplicating information (resolutions of the Federal Antimonopoly Service of the Ural District dated September 24, 2013 No. F09-9209/13, dated September 10, 2014 No. F09-5625/14, dated May 23, 2014 No. F09-2820/14, FAS East Siberian District dated 04/09/2013 No. A19-16467/2012), and add that, in accordance with clause 7 of Art. 3 of the Tax Code of the Russian Federation, all irremovable doubts, contradictions and ambiguities in acts of legislation on taxes and fees are interpreted in favor of the taxpayer.

But it is advisable not to lead to such proceedings. It is better to resend a document, the completion of which does not pose any particular difficulties, than to resolve such issues in court. After all, if you lose, in addition to the fine, you will also have to pay legal costs.

Sanctions

Failure to provide information about the impossibility of withholding is punishable in accordance with paragraph 1 of Art.

126 of the Tax Code of the Russian Federation with a fine of 200 rubles for each unsubmitted document. If the company or individual entrepreneur informed in time about the impossibility of withholding tax, no penalties will be charged. If you do not report the fact of non-withholding, penalties will be charged under Art. 75 of the Tax Code of the Russian Federation.

In addition, officials of the organization may be held administratively liable (clause 1 of Article 126 of the Tax Code of the Russian Federation, note to Articles 2.4, 15.6 of the Code of Administrative Offenses of the Russian Federation).

A tax agent can also be fined for submitting a 2-NDFL certificate with false information (clause 1 of Article 126.1 of the Tax Code of the Russian Federation).