Where is page 210 on the property tax return?

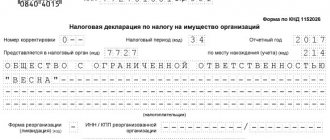

All legal entities that own property recognized as an object of taxation under property tax report to the fiscal authorities for 2021 using a declaration approved. By Order of the Federal Tax Service of the Russian Federation dated August 14, 2019 No. SA-7-21/ [email protected] (as amended by Department Order No. ED-7-21/ [email protected] ).

ATTENTION! As of March 14, 2021, the property tax declaration form has been updated. When should I report on the new form? Let's figure it out here.

The declaration form consists of a title page, sections 1, 2, 2.1, 3. The title page and section 1 are submitted by all taxpayers. The remaining sections of the report are presented depending on what kind of property the organization owns.

Line number 210 is located in the declaration in the 2nd section, where taxpayers calculate the tax base and the tax itself in terms of fixed assets owned by Russian and foreign enterprises, the cost of which is determined as the average annual value. As we already said, this line is used to indicate the tax rate.

Official site

18.12.2020 NEW YEAR WITHOUT TAX DEBT

09.12.2020 Interdistrict Inspectorate of the Federal Tax Service of Russia No. 4 for the Trans-Baikal Territory warns about the spread of false information about receiving a deduction for compulsory pension insurance

False information is being spread on the Internet about the possibility of receiving a social tax deduction for personal income tax for pension insurance expenses based on data from the Pension Fund of the Russian Federation. The corresponding instructions are distributed in instant messengers and social networks.

09.12.2020 WE FILL OUT THE TAX DECLARATION 3-NDFL IN THE TAXPAYER’S PERSONAL ACCOUNT FOR AN INDIVIDUALS

A tax return for personal income tax (form 3-NDFL) is a document by which individuals report the amount of income they receive and related expenses. The 3-NDFL declaration is also submitted to the tax authorities to receive a tax deduction.

09.11.2020 From January 1, 2021, the special tax regime for UTII is canceled

Which tax system should I switch to?

For more information on choosing the appropriate tax regime, you can go to www.nalog.ru (Qr code)

29.04.2020 Federal Tax Service of Russia for the Trans-Baikal Territory

Changes in the deadlines for submitting reports and paying taxes (contributions) in accordance with measures taken during the period of restrictions and a decrease in business activity in the context of the spread of coronavirus infection

29.04.2020 Federal Tax Service of Russia for the Trans-Baikal Territory

Business support measures implemented within the framework of tax administration during the period of restrictions and decline in business activity in the context of the spread of coronavirus infection

13.04.2020 On the issue of maintaining the Unified Register of Small and Medium Enterprises

According to clause 1 of part 5 of article 4.1 of the Federal Law of July 24, 2007 No. 209-FZ “On the development of small and medium-sized businesses in the Russian Federation”, the information about legal entities and individual entrepreneurs who meet the conditions for classification as small and medium-sized businesses established by Article 4 of the said Federal Law...

13.04.2020 The decision on the need for a round seal is made by the legal entity independently

The Federal Tax Service of Russia for the Trans-Baikal Territory reminds that the mandatory seal for business companies - limited liability companies and joint-stock companies has been abolished by Federal Law dated April 6, 2015 No. 82-FZ “On amendments to certain legislative acts of the Russian Federation regarding the abolition of the mandatory seal of business companies” .

13.04.2020 The Federal Tax Service informs

In accordance with Federal Law No. 97-FZ dated June 29, 2012, the taxation system in the form of a single tax on imputed income (UTII) is not applied from January 1, 2021.

13.04.2020 State registration of legal entities

Before submitting documents for state registration, we recommend signing up for training for beginning entrepreneurs, which is held at your tax office every Thursday from 14.00 to 15.00

13.04.2020 State registration of individual entrepreneurs (peasant farms)

Before submitting documents for state registration, we recommend signing up for training for beginning entrepreneurs, which is held at your tax office every Thursday from 14.00 to 15.00

13.04.2020 TO HELP THE MANAGER OF A LEGAL ENTITY What you need to pay special attention to when interacting with the tax service when conducting business!

Dear taxpayer! After receiving documents on state registration, we recommend that you sign up for training, which is held at your tax office every Thursday from 14.00 to 15.00, register in the “Personal Account of a Legal Entity” service, read the information below and decide on the applicable taxation system.

13.04.2020 TO HELP AN INDIVIDUAL ENTREPRENEUR What you need to pay special attention to when interacting with the tax service when conducting business!

Dear taxpayer! After receiving documents on state registration, we recommend that you sign up for training for beginning entrepreneurs, which is held at your tax office every Thursday from 14.00 to 15.00, register in the “Personal Account of an Individual Entrepreneur” service, read the information below and decide on the applicable taxation system.

30.07.2019 You can now apply for a second certificate from the Unified Civil Registry Office register through the public services portal

You can now apply for a repeated certificate of state registration of a civil status act (birth, marriage or divorce, establishment of paternity, adoption, change of name, death) through the Unified Portal of State and Municipal Services (EPGU).

15.02.2019 The deadline for the second stage of voluntary declaration of assets and accounts abroad ends on February 28, 2021

Interdistrict Inspectorate of the Federal Tax Service of Russia No. 4 for the Trans-Baikal Territory informs that there is less than a month left before the end of the second stage of voluntary declaration of assets and accounts abroad.

15.02.2019 Property tax benefits. Questions and answers

15.02.2019 The Tax Inspectorate calls for getting rid of property tax debts

Property taxes form a significant part of regional and local budgets.

The well-being of the population living in the territory of our settlement, district and region depends on the ability of local authorities to provide financing for socially significant programs, which depends on filling the revenue side of budgets and on the timely payment of taxes by citizens.

15.02.2019 Declaration Campaign 2019 has started

Interdistrict Inspectorate of the Federal Tax Service of Russia No. 4 for the Trans-Baikal Territory draws the attention of taxpayers obliged

provide a declaration of income.

On April 30, 2021, the deadline for submitting tax returns on personal income tax for certain categories of citizens expires.

06.11.2018 Dear taxpayers! Property taxes are due!

Interdistrict Inspectorate of the Federal Tax Service of Russia No. 4 for the Trans-Baikal Territory encourages individuals to receive tax notices and payment receipts for timely payment of taxes

06.11.2018 The Tax Service holds Open Days for individual taxpayers!

At the Interdistrict Inspectorate of the Federal Tax Service of Russia No. 4 for the Trans-Baikal Territory, Open Days will be held at the additional office of the inspectorate at the address: Stroiteley Ave., 19:

November 09 and November 23, 2021 (Friday) from 09:00 to 18:00;

November 10 and November 24, 2021 (Saturday) from 10:00 to 15:00.

News 1 - 20 of 196 Home |

Prev. | 1 | Track. | End | All

What regulatory documents regulate filling out line 210 of the declaration?

To accurately fill out line 210, the accountant of an organization that owns taxable property must refer to the Procedure for filling out the declaration, approved by the same order of the tax authorities as its form itself. And it says that the specified line shows the tax rate established by regional legislation for a certain category of taxpayers for a specific type of property. There is also an addition indicating a tax benefit, i.e. if a region provides a benefit in the form of a reduced tax rate, then line 210 must be filled out taking into account such a benefit.

ConsultantPlus experts explained step by step the procedure for calculating and paying property taxes. Get trial access to the system and upgrade to the Ready Solution for free.

As you can see, the filling procedure refers taxpayers to regional legislation. We will talk about which rates the regions have the right to set and which they do not.

On January 1, 2004, Chapter 30 “Organizational Property Tax” of the Tax Code came into force. The introduced tax differs significantly from the corporate property tax that was in force previously. The Ministry of Taxes and Taxes of Russia has released a declaration form (tax calculation for advance payment) for corporate property tax. For the first time it must be submitted by April 30, 2004. We will tell you about the rules for filling it out in the article.

The property tax of organizations is regional and is established by the Tax Code and the laws of the constituent entities of the Russian Federation.

Regional legislation establishes:

— the size of the tax rate;

— differentiated rates and their size depending on categories of taxpayers and (or) property;

— additional tax benefits;

— procedure and deadlines for tax payment;

— tax reporting form.

If the reporting form is not established by regional legislation, the form approved by the Ministry of Taxes of Russia is used.

How to draw up and submit a declaration

The form of the declaration on the property tax of organizations (tax calculation for advance payment) (hereinafter referred to as the declaration) and the Instructions for filling it out (hereinafter referred to as the Instructions) were approved by order of the Ministry of Taxes and Taxes of Russia dated March 23, 2004 No. SAE-3-21/224.

Taxpayers submit tax calculations for the advance payment for the reporting period (Q1, 1st half of the year and 9 months) no later than 30 days from the end of the reporting period (clause 2 of Article 386 of the Tax Code of the Russian Federation). Tax return based on the results of the tax period (year) - no later than March 30 of the year following the expired tax period.

The declaration is submitted to the tax authorities:

— at the location of the Russian organization;

— at the place of activity of the foreign organization through a permanent representative office;

— at the location of a separate division of a Russian organization that has a separate balance sheet;

- at the location of the real estate.

The tax is paid to the budget according to the appropriate OKATO code of the municipality in which the property is located. An exception is the tax on movable property of separate divisions that do not have a separate balance sheet. The residual value of movable property of separate divisions that do not have a separate balance sheet is taken into account when calculating the tax (advance payment of tax) at the location of the organization (if the specified property is on the balance sheet of the organization) or at the location of separate divisions that take this property into account on the balance sheet.

As a general rule, a separate declaration is submitted for each place of tax payment. One declaration is submitted to the tax authority, which oversees the territories of several municipalities with different OKATO codes, with the completion of sections indicating the amount of tax payable under the corresponding OKATO code to the budget of the municipalities.

Regional legislation may provide that the property tax of organizations is credited to the budget of a constituent entity of the Russian Federation without sending part of the tax amount to the budgets of municipalities. In this case, the organization can submit to the tax authority a single declaration for all property subject to this tax on the territory of a given subject of the Russian Federation.

If the legislation of a constituent entity of the Russian Federation establishes that the tax (advance payment of the tax) is credited to the budget of the constituent entity of the Russian Federation and to the budgets of municipalities, the organization has the right to submit a single declaration (single tax calculation for the advance payment) for everything subject to taxation in the territory of the given municipality. education property.

The declaration includes:

- title page;

— Section 1 “Amount of tax (amount of advance payment for tax)

, subject to payment to the budget according to the taxpayer”;

— Section 2 “Calculation of the tax base and the amount of tax (advance payment of tax) in relation to the taxable property of Russian organizations and foreign organizations operating in the Russian Federation through permanent representative offices”;

— Section 3 “Calculation of the tax base and the amount of tax (advance payment of tax) for the tax (reporting) period on a real estate property of a foreign organization not related to its activities in the Russian Federation through a permanent representative office”;

— section 4 “Calculation of the tax base and the amount of tax (advance tax payment) for real estate that is part of the Unified Gas Supply System, and for real estate objects of a Russian organization that are actually located on the territories of different constituent entities of the Russian Federation or on the territory of a constituent entity of the Russian Federation Federation and in the territorial sea of the Russian Federation (on the continental shelf of the Russian Federation or in the exclusive economic zone of the Russian Federation)";

— Section 5 “Calculation of the average annual (average) value of non-taxable (exempt) property.”

The composition of tax returns may vary among taxpayers. It varies depending on the taxpayer category, location of the property and other factors. Clause 1.3 of the Instructions provides all possible options for generating a declaration based on the composition of the sheets included in it. For convenience, we have summarized the possible options for the composition of the declaration in table. 1.

Table 1. Contents of the property tax return

| Presentation addresses | Composition of the declaration | |||||

| title page | section 1 | section 2 | section 3 | section 4* | section 5** | |

| At the location of the Russian organization | + | + | + | — | + | + |

| At the place where the foreign organization carries out its activities through a permanent representative office | + | + | + | — | — | + |

| At the location of a separate division of a Russian organization that has a separate balance sheet | + | + | + | — | + | + |

| At the location of the real estate, if it is located at the location of a separate division of a Russian organization that does not have a separate balance sheet | + | + | + | — | + | + |

| At the location of the real estate, if it is located outside the location of the Russian organization and separate divisions | + | + | + | — | + | + |

| At the location of the real estate, if it is owned by a foreign organization and does not relate to its activities through a permanent establishment | + | + | — | + | — | — |

| At the location of the real estate, if it is part of the Unified Gas Supply System and is located outside the location of the Russian organization | + | + | — | — | + | + |

* The section is completed if at the place of submission of the declaration there is real estate that is part of the Unified State Social System and is located outside the location of the organization (see last line). In other cases, this section is completed if at the place of submission of the declaration there is real estate that is actually located on the territories of different constituent entities of the Russian Federation or on the territory of a constituent entity of the Russian Federation and in the territorial sea of the Russian Federation (on the continental shelf of the Russian Federation or in the exclusive economic zone of the Russian Federation). ** The section is completed if there is property at the place of submission of the declaration that is not subject to property tax.

Filling out a tax return

Filling out a corporate property tax return begins with the title page. The title page, like other sections of the declaration, was developed taking into account the Uniform requirements for the preparation of tax returns, approved by order of the Ministry of Taxes of Russia dated December 31, 2002 No. BG-3-06/756.

We will tell you in detail about filling out sheets 2-5, which are included in the main calculation part of the declaration. The total amount of property tax paid to the budget is reflected in section 1. The calculation of the tax amount broken down by OKATO codes is carried out in several sections 2. But for these sections, data from sections 3, 4 and 5 can be used. Therefore, we will consider the procedure for filling out a tax return not from the first, but from the last section.

Filling out section 5

This section of the property tax return is filled out only by those taxpayers who have property that is not taxed in accordance with Article 381 of the Tax Code of the Russian Federation, and (or) property that is exempt in accordance with regional legislation.

Please note: for benefits established by the law of a constituent entity of the Russian Federation in the form of a reduction in the tax rate and in the form of a reduction in the amount of tax payable to the budget, section 5 is not completed.

Organizations that have property that is not subject to taxation and located on the territory of different municipalities fill out a separate section 5 for each OKATO code.

In addition, sections 5 are filled out separately:

— for real estate of the Unified Gas Supply System (USGS);

- for real estate of a Russian organization, which is actually located on the territories of different constituent entities of the Russian Federation;

— for real estate that is located on the territory of a constituent entity of the Russian Federation and in the territorial sea of the Russian Federation (on the continental shelf of the Russian Federation or in the exclusive economic zone of the Russian Federation);

- for other property.

In line 010, the taxpayer must indicate for which property this section 5 has been filled out. In this case, o.

By line 020

the benefit code is indicated according to the Tax Benefit Classifier given in paragraph 9 of the Instructions.

In column 3

The subsection “Calculation of the average annual (average) value of non-taxable (exempt) property for the tax (reporting) period” reflects the residual value of fixed assets. It is indicated on the 1st day of each month of the reporting period and on the 1st day of the month following the reporting period.

Based on the data in column 3, the average annual value of tax-free property is calculated. It is reflected on line 160

. The average annual cost is determined by dividing the sum of all indicators in column 3 by the number of months in the reporting period, increased by one. For example, when calculating the average annual value of property for the first quarter, the sum of the lines in column 3 must be divided by 4 (3 months plus 1).

On line 170

the tax rate established by regional legislation for this category of taxpayers for this property is indicated.

On line 180

the OKATO code of the municipality at the location of the non-taxable property is indicated.

Sections 3 and 4

Section 3 is filled out by foreign organizations with permanent representative offices for real estate not related to activities through these representative offices. In addition, this section is completed if the taxable real estate belongs to a foreign organization that does not have a permanent establishment.

Section 4 is completed if the real estate:

— is part of the Unified Gas Supply System (USGS);

— located on the territories of different constituent entities of the Russian Federation;

— is located on the territory of a constituent entity of the Russian Federation and in the territorial sea of the Russian Federation (on the continental shelf of the Russian Federation or in the exclusive economic zone of the Russian Federation).

Organizations that have different types of property must fill out Section 4 separately for each type.

Filling out section 2

This section is filled out by Russian and foreign organizations operating in Russia through their permanent representative offices. Foreign organizations fill out Section 2 only for property that relates to their activities through permanent missions. For real estate not used in this activity, Section 3 is completed.

Please note: if an organization in the territory of one municipality has property taxed at different rates, section 2 must be filled out separately for each tax rate.

Completing section 2 should begin with the subsection “Calculation of the average annual (average) value of property for the tax (reporting) period.” The corresponding lines in columns 3 and 4 reflect information about the residual value of fixed assets for the reporting (tax) period as of the 1st day of each month of the reporting period and as of the 1st day of the month following the reporting (tax) period.

Column 3 of this section indicates the residual value of fixed assets for the tax (reporting) period. Column 4 separately identifies the residual value of real estate. Please note: these columns do not indicate the residual value of fixed assets used in activities transferred to pay UTII.

On line 140

The indicator of the average annual (average) value of property for the tax (reporting) period is included. It is determined by dividing the sum of all lines in column 3 by the number of months in the reporting (tax) period plus one.

On line 150

the average annual (average) value of tax-free property for the tax (reporting) period is reflected. The meaning of this line is taken from line 160 of section 5. The following requirements must be met:

1. The OKATO code in line 180 of section 5 corresponds to the OKATO code in line 240 of section 2.

2. On line 010 in the “other property” cell of section 5 there is a mark. Please note: Section 2 only lists other non-taxable property. Data on other types of non-taxable property from the corresponding sections 5 are transferred to section 4.

3. The tax rate on line 170 of section 5 is equal to the rate specified in line 180 of section 2.

Next, fill in the subsection “Calculation of the tax amount (advance tax payment).”

In the declaration for the reporting period in this subsection of Section 2, lines 170, 180, 200, 220 and 230 and 240 are filled in, and in the annual declaration - all lines except line 200.

Line 160

must be completed only in the annual declaration. This line indicates the tax base indicator. It is calculated as the difference between the average annual value of taxable and non-taxable property (line 140 minus line 150 of this section).

On line 170

The code of the tax benefit established by regional legislation in the form of a reduction in the tax rate is reflected. As already noted, benefit codes can be taken from the Tax Benefit Classifier.

If a tax benefit in the form of a rate reduction is not established for the property indicated in Section 2, a dash is placed on line 170.

On line 180

reflects the tax rate established by the law of the constituent entity of the Russian Federation for the relevant types of property for this category of taxpayers.

If regional legislation establishes benefits for this property in the form of a reduced rate, line 180 reflects the tax rate taking into account the benefits provided.

On line 190

The annual tax amount is indicated. It is calculated as the product of the tax base calculated at the end of the year and the tax rate:

Line 190

=

Line 160

x

Line 180

:

100.

Line 190 is completed only if an annual declaration is submitted. If a tax calculation is submitted for an advance payment for the reporting period, a dash is placed on this line.

On line 200

The amount of the advance tax payment is entered. It is calculated as the product of one fourth of the base of the reporting period and the tax rate:

Line 200

= (

Line 140

-

Line 150

) x

1/4

x

Line 180

:

100.

Line 200 is filled in in the tax calculation for the advance payment. In the annual declaration, a dash is placed on this line.

Line 210

must be completed only in the annual declaration. The line reflects the amount of advance payments calculated at the end of the reporting periods (1st quarter, 1st half of the year, 9 months). It is defined as the sum of the values of lines 200 of sections 2 (with the corresponding OKATO codes and tax rates) of tax calculations for advance payments for the 1st quarter, 1st half of the year and 9 months.

By lines 220

and

230,

the code and amount of the tax benefit are recorded in the form of a reduction in the amount of tax paid to the budget. The benefit is established by regional legislation for the corresponding category of taxpayers. These lines are filled in based on the Tax Benefit Classifier. Please note: line 170 indicates the tax benefit code in the form of a reduction in the tax rate, and line 220 indicates the benefit code in the form of a reduction in the tax amount.

On line 240

The OKATO code is reflected, according to which the amount of tax (advance tax payment) is transferred.

Filling out section 1

The section is completed when submitting a declaration to any address. The section consists of blocks of lines 010-040. When filling out each block of lines, the amount to be paid is indicated according to the corresponding OKATO and KBK codes. If the declaration is filled out in relation to the amount of tax (advance tax payment) payable under one OKATO code and one KBK, then one block of lines 010-040 is filled in.

Each block of lines 010-040 of section 1 indicates:

- on line 010

— budget classification code (BCC), which is used to credit the amount of tax (advance tax payment) reflected on line 030 of this block;

- on line 020

— OKATO code according to which the tax amount indicated in line 030 of this block is paid;

- on line 030

- the amount of tax (advance tax payment) accrued as of the reporting date and paid to the budget at the place of submission of the declaration according to the corresponding KBK and OKATO codes.

When submitting a tax calculation for an advance payment for the reporting period (Q1, 1st half of the year, 9 months), the value of line 030 of section 1 with the corresponding codes for OKATO and KBK is calculated as the sum of the tax values for the tax period (advance payment for the reporting period) by sections 2, 3 and 4 (see formula 1). If the result obtained is less than zero, a dash is placed on line 030;

Formula 1.

Calculation of tax amount (advance tax payment)

| Line 030 section 1 | = | Section 2 line 200 | — | Section 2 line 230 | + | Line 090 section 3 | + | Section 4 line 220 | — | Section 4 line 250 |

- on line 040

indicates the amount of tax calculated for reduction based on the results of the tax period. It is filled out only when submitting an annual declaration. The value of this line is determined as the difference between the amount of tax calculated for the year and the amounts of advance tax payments accrued during the tax period.

If the result of this calculation is a negative number, then it must be entered in line 040 without the minus sign. If this number is positive, then a dash is placed in line 040.

Example

The Russian organization Repair Service LLC (TIN 4022128445, KPP 402201058) is engaged in the repair and maintenance of equipment (including agricultural equipment). The location of the organization is Borovsk, Kaluga region (OKATO code 29 206 501). The organization does not have separate divisions and territorially separate real estate. She has a gym at her location that is used for its intended purpose.

The data necessary for calculating the tax base on the residual value of the property of Repair-Service LLC, which is the object of taxation, on the 1st day of each month of the reporting period and on the 1st day of the month following the reporting period, is given in table. 2. The reporting period for which the tax calculation for the advance payment is submitted is the first quarter.

Table 2. Residual value of fixed assets (rub.)

| As of | Residual value | |||||

| fixed assets used for repair and maintenance of equipment (except agricultural) | fixed assets used for repair and maintenance of agricultural machinery | gym property (fixed assets) | ||||

| Total | including real estate | Total | including real estate | Total | including real estate | |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 01.01.2004 | 1 500 000 | 1 490 000 | 360 000 | 200 000 | 720 000 | 500 000 |

| 01.02.2004 | 1 470 000 | 1 460 000 | 345 000 | 192 000 | 700 000 | 490 000 |

| 01.03.2004 | 1 440 000 | 1 430 000 | 330 000 | 184 000 | 680 000 | 480 000 |

| 01.04.2004 | 1 410 000 | 1 400 000 | 315 000 | 176 000 | 660 000 | 470 000 |

Law of the Kaluga Region dated November 10, 2003 No. 263-OZ “On Organizational Property Tax” (hereinafter referred to as Law No. 263-OZ) sets the tax rate at 2.2%. For some categories of taxpayers and property listed in paragraph 2 of Article 1 of Law No. 263-OZ, a tax benefit has been introduced. In particular, for property used for the repair and maintenance of agricultural machinery, the tax rate is 1.1%.

Based on the conditions of the example, the tax calculation for the advance payment should include:

- title page;

- section 1;

— section 2, to be completed for property taxed at a rate of 2.2%;

— section 2, to be completed for property taxed at a rate of 1.1%. In our case, we need to fill out two sections 2, since there is property taxed at different rates;

— section 5, filled out for non-taxable (tax-exempt) property, since there is tax-free property.

We begin filling out the tax calculation for the advance payment in section 5.

On line 010 in the “other property” cell we put o, since the gym does not belong either to the real estate of the Unified State Social System or to real estate located in the territories of different regions.

The calculation of advance payments is presented for the first quarter, so you need to fill out lines 020-050 of column 3 of subsection “Calculation of the average annual (average) value of non-taxable (exempt) property for the tax (reporting) period” of section 5. We take the data for this column from columns 6 of table. 2.

On line 160 we indicate the average annual (average) value of tax-free property for the first quarter. The indicator of this line is calculated as follows:

(RUB 720,000 + RUB 700,000 + RUB 680,000 + RUB 660,000): 4 = RUB 690,000

In line 170 we enter the tax rate established in the region for this type of property for this category of taxpayers - 2.2%.

In line 180 we reflect the OKATO code at the location of the tax-free property.

Let's move on to filling out section 2.

First, we fill it out for property used for the repair and maintenance of non-agricultural equipment and for the property of a sports hall.

In lines 010-040, column 3, we indicate the residual value of fixed assets as of the 1st day of the month of the reporting period and the 1st day of the month following the reporting period. To do this, add up the values in columns 2 and 6 of the table. 2 for the corresponding dates. The residual value of fixed assets will be:

— as of January 1, 2004 — RUB 2,220,000. (RUB 1,500,000 + RUB 720,000);

— as of February 1, 2004 — RUB 2,170,000. (RUB 1,470,000 + RUB 700,000);

— as of March 1, 2004 — RUB 2,120,000. (RUB 1,440,000 + RUB 680,000);

— as of April 1, 2004 — RUB 2,070,000. (RUB 1,410,000 + RUB 660,000).

In column 4 we separately highlight the residual value of the property. To do this, add up the values of columns 3 and 7 of the table. 2. The residual value of the property will be:

— as of January 1, 2004 — RUB 1,990,000. (RUB 1,490,000 + RUB 500,000);

— as of February 1, 2004 — RUB 1,950,000. (RUB 1,460,000 + RUB 490,000);

— as of March 1, 2004 — RUB 1,910,000. (RUB 1,430,000 + RUB 480,000);

— as of April 1, 2004 — RUB 1,870,000. (RUB 1,400,000 + RUB 470,000).

Next, we calculate the average annual (average) value of the property. To do this, add up all the values in column 3 and divide by 4:

(RUB 2,220,000 + RUB 2,170,000 + RUB 2,120,000 + RUB 2,070,000): 4 = RUB 2,145,000

In line 150 we reflect the average annual (average) value of tax-free property. We take the value for this line from line 160 of section 5, since the content of this section meets all the necessary requirements:

— OKATO codes in section 2 and section 5 are the same;

- on line 010 in the “other property” cell of section 5 there is a mark;

— tax rates in both sections are the same.

In lines 160, 170, 190, 210, 220 and 230 of the section we put dashes.

All that remains is to calculate the amount of the advance payment. To do this, from the average annual (average) value of all property, subtract the average annual (average) value of tax-free property. We multiply the result by the tax rate and divide by 4:

(2,145,000 rubles - 690,000 rubles) x 1/4 x 2.2: 100 = 8002.5 rubles.

We round the amount of the advance payment to a whole number and reflect it on line 200.

In line 240 we indicate the OKATO code at the location of the organization.

We proceed to filling out section 2 on property used for repair and maintenance of agricultural machinery. It is taxed at a rate of 1.1%. The order of filling out sections 2 is the same, so we will only focus on filling out individual lines.

We take the values of residual values for lines 010–040 from columns 4 and 5 of the table. 2.

The average annual (average) value of property reflected on line 160 will be:

(RUB 360,000 + RUB 345,000 + RUB 330,000 + RUB 315,000): 4 = RUB 337,500

When filling out line 180, we indicate the rate established for this type of property - 1.1%.

The amount of the advance payment for the first quarter for this property will be:

(337,500 rub. - 0 rub.) x 1/4 x 1.1: 100 = 928 rub.

So, we have calculated the amounts of advance payments. Now let's complete section 1.

In our example, one block of lines 010-040 is filled in, since the entire tax is paid under one OKATO and one KBK.

We will calculate the amount of the advance payment for the entire property. To do this, add up the previously calculated amounts of advance payments for all sections 2:

8003 rub. + 928 rub. = 8931 rub.

Let's reflect this amount on line 030 of section 1 and put dashes in all unfilled lines.

The amount of the advance payment calculated in this way should be paid to the budget according to the deadlines established by regional legislation. For example, in our case, Article 3 of Law No. 263-OZ determines that advance payments at the end of the reporting period are paid no later than the 5th day of the second month following the reporting period. Advance payment for the first quarter of 2004 in the amount of 8931 rubles. must be paid no later than May 5, 2004.

What property tax rates can line 210 of the declaration contain?

Organizational property tax is a regional tax. That is why the constituent entities of the Russian Federation are vested with certain powers in establishing the principles and procedure for calculating this tax. The legislation of the constituent entities of the Russian Federation also approves the tax rate used to calculate the tax. It must be said that this rate is set in different amounts for property calculated at the average annual value, and for property for which the cadastral value is determined. We are interested in the first type of property, since we are talking about the 2nd section of the declaration.

At the federal level, a maximum of 2.2% has been approved for such property (clause 1 of Article 380 of the Tax Code of the Russian Federation). No region can exceed this percentage.

Based on the above, when calculating the property tax of organizations, a value not exceeding 2.2% may be indicated in line 210 of the declaration. Everything will depend:

- on the specifics of the property;

- taxpayer categories;

- features of regional legislation.

The contents of line 210 must be approached very responsibly, because the correctness of property tax calculations directly depends on it. If you enter incorrect data into it (especially if you indicate a lower rate than necessary), the tax amount will be underestimated, and this is fraught with claims from the tax authorities.

How to determine the indicator on line 210

With regard to rates on the tax base, which is represented by the book value of the property, the following general rules are established at the level of federal legislation:

- rates are established by the laws of the constituent entities of the Russian Federation and cannot exceed 2.2% (clause 1 of Article 380 of the Tax Code of the Russian Federation);

- if the rate is not determined by the law of the region, a rate of 2.2% is applied (clause 4 of article 380 of the Tax Code of the Russian Federation).

In most Russian regions, the maximum rate is 2.2%. But in the Republic of Crimea and Sevastopol it is noticeably lower - 1%.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

Cadastral rates listed in clause 1.1 of Art. 380 of the Tax Code of the Russian Federation, apply only to real estate objects specified in paragraph 1 of Art. 378.2 Tax Code of the Russian Federation.

In theory, a situation is possible when the same property will be located on the territory of two or more regions, each of which has different rates in relation to the balance tax base.

Filling out page 210 contained in the property tax return in such cases has a number of features.

Results

Line 210 in the property tax return, submitted by taxpayers once a year at the end of the year, is located in the 2nd section. It serves to indicate the tax rate at which the property tax is calculated, determined by the average annual value. The tax rate is set at the regional level in the same way as the benefit in the form of a lower interest rate. Therefore, in order to correctly fill out this line of the report and, accordingly, accurately calculate the tax, you need to use information from the laws adopted by the constituent entities of the Russian Federation.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated July 28, 2020 No. ED [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Letter dated January 16, 2018 No. BS-4-21/ [email protected]

The Federal Tax Service, in connection with numerous requests from tax authorities about the procedure for filling out sections 2.1 of tax reporting forms for property tax of organizations, recommends taking into account the following when conducting desk tax audits of the specified tax reporting forms.

According to clause 6.1 of the Procedure for filling out a tax return for property tax of organizations, approved by Order of the Federal Tax Service of Russia dated March 31, 2017 MMV-7-21/ [email protected] (hereinafter referred to as the Procedure), lines with codes 010 - 050 section. 2.1 of the tax return are filled out by Russian and foreign organizations in relation to real estate objects, the tax base in respect of which is recognized as the average annual cost, the amount of tax in respect of which is calculated in section. 2 tax returns.

At the same time, according to clause 6.2 of the Procedure when filling out section. 2.1 of the declaration indicates:

— on the line with code 010 — cadastral number of the real estate property (if any);

- on the line with code 020 - the conditional number of the real estate object (if any) in accordance with the information from the Unified State Register of Real Estate;

- on line with code 030, filled in if there is no information on line with code 010 or line with code 020, - inventory number of the real estate property;

- on line with code 050 - the residual value of the real estate property as of December 31 of the tax period.

Thus, the inventory number is indicated if there is no information about the cadastral number of the object or the conditional number of the object.

If there are cadastral numbers for each of several fixed asset objects recorded on the organization’s balance sheet in one inventory card with a common initial cost, the organization should fill out several blocks of lines 010 - 050, indicating the cadastral number of the property in each.

At the same time, taking into account the taxpayer’s obligation to indicate separate information for each object that has a separate cadastral number, in each of the blocks of lines 010-050 filled in with separate cadastral numbers, the corresponding residual value should be indicated in the corresponding line 050 of each block of lines.

In the case of the established procedure in the accounting of an organization for reflecting data in one inventory card (with the calculation of one residual value), we believe it is advisable to indicate in the line with code 050 of each block of lines the residual value of the corresponding property, calculated by calculation based on the share of the object’s area in the total area of all objects recorded in the inventory card, multiplied by the total residual value of all objects recorded in the inventory card according to accounting data.

Bring these clarifications to employees of lower tax authorities who administer the property tax of organizations, including conducting desk tax audits.

Acting State Advisor of the Russian Federation, 2nd class S.L. Bondarchuk

Declaration for 2021

- Victoria Vladimirovna!

Good afternoon In the new property tax declaration form, a special section 2.1 has appeared, in which you need to indicate information about real estate taxed at the average annual value. This innovation raises the most questions. — Indeed, despite the fact that it is for reference only, since it in no way affects the amount of the calculated tax, at seminars questions are asked specifically about this section. The fact is that already in 2021, many taxpayers submitted advance payment calculations using a new form and filled out a similar section 2.1. and encountered a number of technical issues, which the Federal Tax Service of Russia further clarified in its letters. We will discuss them in detail at the seminar.

— As we know, real estate includes engineering and technical support systems (for example, sewerage systems, communications, elevators, escalators, etc.), which, as a rule, are accounted for in accounting as separate inventory items. Do such objects need to be shown in section 2.1 of the Declaration?

— We can absolutely say that there is no need to fill out separate blocks of lines with codes 010 - 050 in relation to such inventory objects, since they themselves are not real estate. Similar explanations are given by the Federal Tax Service of the Russian Federation (Letter of the Federal Tax Service of Russia dated September 15, 2017 N BS-4-21/18425). In section 2.1. information about the property is indicated. Since engineering systems and networks are part of real estate (Federal Law of December 30, 2009 N 384-FZ), their average annual cost should be included in the total average annual cost of the property.

— From January 1, 2021, OKOF codes have changed. Which OKOF code should be indicated in section 2.1. declaration, if OKOF was assigned to real estate before 2021, i.e. Is it necessary to convert old OKOF codes to new ones to fill out a declaration?

— The Federal Tax Service clarifies that in line 040 “OKOF Code” of Section 2.1 you can reflect the “old” nine-digit OKOF code assigned to real estate when it was accepted for registration. In this case, you need to fill out the line from left to right. In unfilled spaces, a dash is placed on the right side of the field (clause 2 Letter of the Federal Tax Service of Russia dated 09/05/2017 N BS-4-21/ [email protected] ).

— In section 2.1. lines are provided to indicate the cadastral (line 010), conditional (line 020) and inventory number of the property (line 030). Do I need to fill out all these lines or is it enough to indicate only the cadastral number?

— If the property is assigned a cadastral number, then in section 2.1. it is enough to indicate only this in the declaration (on line 010). Accordingly, lines 020 and 030 do not need to be filled in (put a dash). Line 020 is filled in if there is no information on line with code 010, and line 030 (inventory number) must be filled out only if the number is not indicated in lines 010 and 020. Such clarifications are provided by the Federal Tax Service of the Russian Federation (Letter of the Federal Tax Service of Russia dated July 3, 2017 N BS-4 -21/ [email protected] ).