The concept of “adjustment” itself implies a change in some data. We will look at changing data in VAT accounting in 1C 8.3 using the “Enterprise Accounting” configuration as an example.

There are two options here: using an “Adjustment Invoice” (CAI) or correcting erroneously entered data. In many ways, the user actions in these cases are similar, but we will look in detail at working in 1C with KSF, as well as how to reflect the direct correction of VAT errors.

CSFs are issued by the seller to the buyer in the event of a change in the price and (or) quantity of goods (works, services). An important condition is that such changes must be agreed upon between the parties to the transaction. Then there is no need to submit updated VAT returns, and CSF (for example, adjustment documents for shipment) are reflected in accounting for the period when they were compiled (from the seller) and received (from the buyer).

There are two types of adjustments – increasing or decreasing the cost of sales. An accountant more often has to deal with a situation of decreasing value, for example, when applying retro discounts.

The accounting treatment is as follows:

From the buyer:

- Decrease in value - in the sales book;

- The increase in value is in the purchase book.

From the seller:

- Reducing the cost - in the purchase book;

- The increase in value is in the sales book.

Before the advent of Russian Government Decree No. 952 dated October 24, 2013, the Seller, when the cost of shipment increased, had to submit an updated declaration for the shipment period. Many sources on the Internet still advise this procedure, but it is no longer relevant. “Clarifications” on VAT are submitted if errors are discovered, and the agreed price change is now not an error.

Let's consider the process of reflecting CSF in the 1C accounting program, first from the buyer, then from the seller. If you still have questions, please contact our 1C system user support service, we will be happy to answer them.

•2. Additional sheets for the purchase book must be printed

We create the document “Creating purchase book entries” (as usual), fill it out using the “fill” button. In this case, in the tabular section “Deduction of VAT on purchased valuables”, in addition to all purchases for the current period, there will be a line with our Invoice. All we have to do is indicate the period to be adjusted (June 15, 2009) and set o (pictures are available in the pdf version of the article at the bottom of the document).

To print an additional sheet, go to the “Purchase Book” report, indicate in the settings the period June 2009, the “generate additional sheets” checkbox “for the current period”, the “output only additional sheets” checkbox and get the required result (pictures are available in the pdf version of the article at the bottom of the document)

Adjustment of input VAT to reduce value

First, we will generate incoming and outgoing invoices, which we will later make adjustments to.

Fig.1

In Fig. 1 we see the receipt of goods under invoice No. 00BP-000003 (supplier Aquilon). Invoice No. 123 was issued (Fig. 2).

Fig.2

Suppose that when purchasing a batch of goods of 1000 or more pieces, the supplier provided a discount, as a result of which both the total cost and VAT decreased. To reflect the decrease in value, based on the invoice No. 00BP-000003, we will create an adjustment to receipt No. 1 dated January 23, 2017 (Fig. 3)

Fig.3

On the “Products” page it is possible to specify a new price (Fig. 4). Amounts in the columns “Cost”, “VAT”, “Total” are calculated automatically.

Fig.4

Just like in the invoice, it is possible to register an invoice in the adjustment document (Fig. 5). This invoice will be an adjustment invoice.

Fig.5

The adjustment invoice in 1C 8.3 is slightly different from the usual one. It contains fields that indicate the change in value. In our example, the fields to reduce the amount are filled in.

Now let's create a purchase book and a sales book. Let's analyze both reports at once, since when the cost decreases, the adjustment invoice should go into the sales book, and the primary invoice should go into the purchase book.

Fig.6

Let’s generate the “Purchases Book” report (Fig. 6). A line appeared in it for the counterparty “Aquilon”

Let's check the sales book (Fig. 7). This report contains an entry about adjustment invoice No. 1 dated 01/23/2017, created on the basis of invoice No. 123 dated 01/16/2017. That's right!

Fig.7

•3. The half-year VAT return must take into account the new Invoice

It would seem that everything is simple here: go to the existing declaration, click “fill out” and the report is ready. But there is a small nuance: when filling out the declaration, 1C takes into account data and changes up to the date of signature of the document. This field is filled in automatically with the current date when a new report is generated and, as a rule, no one pays attention to it. Therefore, if we simply click “fill out” in the previously created declaration, our invoice will not be included in it. Therefore, it is better to create a new report and fill it out (you can change the signature date in the existing one and refill it, but then you will lose the history of submitting reports). Please note: the signature date must be August 25, 2009.

This completes the procedure for reflecting an invoice for the past period; you can safely go to the tax office.

Adjustment of implementation of 1C:Accounting 3.0 (seller position)

This type of document is used to register changes to those already issued to the buyer. Such situations may include situations where the seller has identified errors in shipping documents or an agreed change in the terms of sale for goods, services or work already sold.

Implementation adjustments are introduced based on:

1. Sales (deed, invoice)

2. Provision of production services

3. Report of the commission agent (principal) on sales

4. Implementation adjustments.

Based on the entered Sales of goods, Sales Adjustments document .

In the Create based on , select Adjustment of implementation .

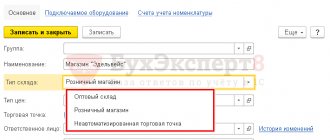

The Adjustments form opens, Operation type:

1. Adjustment by agreement of the parties - performed when conditions (price or volume) change as agreed.

2. Correction in primary documents - correction of an identified error in the primary documentation.

In the Products tabular section, change the row after the change , enter new data on quantity or price.

There is a convenient printed form in the printed forms called Cost Change Agreement , this document is used to agree on changes to the terms of the contract with the buyer, that is, this document confirms the consent of both parties to the adjustment.

The printed form contains all the necessary data to agree on a Change in Value Agreement. The header is filled in with the details of the seller and the buyer, the tabular part contains the goods, services or work for which changes are being made, and the footer has places for the signature of the buyer’s and seller’s employees.

All created adjustments are stored in a journal.

Located in the Sales section - Adjustment of sales .

If you need to make an adjustment for an adjustment, then this possibility is also included in the program. To do this, let's go to the Sales journal - Adjustment of sales and, based on the already created document, we will introduce a new one.

Quite simple operations for generating adjustment documents that will allow you to protect your interests and comply with the law. And also show your customers a high culture of working with programs and knowledge of accounting.

How to correct a receipt in a closed period

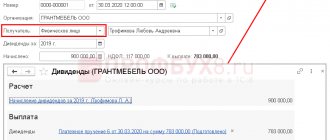

It is always easier to study any question that concerns you with examples. That's what we'll do. Let's say the company made a mistake and overstated its expenses due to a technical glitch. Received services from external suppliers were registered using the receipt option (acts, invoices) from the purchase section. At the same time, the accountant registered the invoice:

The supplier issued an invoice for its services, the VAT amount was accepted for deduction.

For the accepted services, the accountant created a corrective document for adjustment of receipts. The important point is to understand and identify the reason why the accounting data was adjusted. I decided to present the reasons in the form of a table.

| No. | Type of action | Description |

| 1 | Primary correction | What is listed in your accounting and what is indicated in the incoming primary statement may not coincide. The supplier himself may simply make a mistake by incorrectly indicating the item in the invoice |

| 2 | Correcting your mistake | You received the correct primary product, but you made a mistake yourself or there was a technical failure, but it’s already in your company and the counterparty has nothing to do with it |

Display of sales of the previous period

Instead of having banal errors, the accountant may, for various reasons, fail to record the sale. Paper that is lost and not posted must be reflected through the use of the implementation command (acts, invoices) on the date when you discovered it. At the same time, mark the date of the adjustment on the invoice and enter it in the line issued (transferred to the counterparty).

Along with the forgotten primary item, it is also worth reflecting the amount of tax. Why put yes in the additional list entry, and in the period being adjusted, put the date of the original paper. The VAT Sales team will help you enter information manually.

You have the opportunity and the right to send an update on the income tax for the previous period to your Federal Tax Service, but this is only possible if there is no fact that the tax amount has been understated. However, before that, you will have to correct your tax records in manual format.

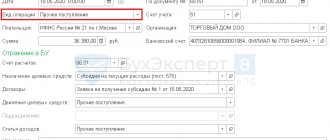

How to fix the error

Let's consider a situation where the user mistakenly deposited an incorrect amount and for this you will need to use the command to correct your own error. When it is still necessary to correct a closed period, refer to the item of other income and expenses and mark here the line of corrective entries for transactions of previous years. This applies to an income/expense item with the item type profit (loss) of previous years. The services field requires entering new correct information.

After you finish posting the option, the machine will reverse it downwards in a situation where the final amount is less than the corrected amount. And additional wiring for lack of funds in the opposite situation. Then the machine will independently generate profit or loss entries. As a result of the actions taken, the corrected VAT will be reflected in the Purchase Book.

After you have resorted to the closed period adjustment command, you must perform a Reformation of last year’s balance sheet. To do this, in the transactions section, go to month closing in December.

Deleting an entered document

No one is immune from duplicates of the same paper, or there was no need to reflect something in accounting at all. It may happen that you found in the list of incoming primary documents a paper that in fact does not exist and should not exist. It can only be deleted by manually posting a reversal transaction in the transactions section. There you will see the reversal document and mark what needs to be deleted. As a result, everything that was entered incorrectly will be lost, that is, the primary and tax reflection will also be canceled. The purchase ledger reflects this reversal by recording VAT for deduction in the transactions field. To complete the procedure, do the following:

- Mark everything with flags;

- Enter the date for adding the line to the additional list.

Don’t forget to work with the products and services tab and here you will be required to:

- Check the presence of VAT claimed for deduction in the events field;

- Enter the information from the calculation paper and set a minus value.

I repeatedly advise you to double-check the automatically corrected information and this can be done in the Purchase Book of the purchase section.

Adjustment of previous periods in 1C: basic parameters

The machine gives you the opportunity to simply adjust whatever you need. Adjustment of previous periods in 1C depends primarily on how the error affected the tax paid and there are two possible scenarios:

- When the tax amount is not underestimated, this period is subject to correction.

- Otherwise, if the tax amount is underestimated, the closed period will have to be corrected.

The last scenario will oblige the accountant to do manual accounting entries.

Adjustment of Receipts 1C:Accounting 3.0 (buyer’s position)

This type of document is used to register changes in documents received from the supplier. As with implementation, this could be a bug or a negotiated change.

The document is generated based on the document Receipt of goods and services .

There are 3 types of operations in adjusting receipts:

Adjustments can be of several types:

1. Adjustment by agreement of the parties - an agreed change in the price or volume of services, works or goods supplied. An adjustment invoice is issued (clause 3 of Article 168 of the Tax Code of the Russian Federation)

2. Correction in primary documents - correction of errors made by the supplier when generating the Act or Invoice.

3. Correcting your own error - this type of operation is intended to correct incorrect data in a document, such as incoming number, tax identification number, checkpoint, invoice date...

Fill out the header and go to the Products tab.

In the products tab we make changes to the Price or Quantity of products.

As a result, when processing the documents, we see that the 1C: Accounting program has made changes to the amount of the receipt adjustment.

We can also open a list of documents already created and posted.

Purchases - Adjustment of receipts .

To generate a receipt adjustment for an adjustment document, you need to go to Purchases - Receipt Adjustment and enter a new one based on the already created document.

Generating adjustment documents is very simple and publicly available in the 1C: Accounting 8.3 program. This type of operation will greatly simplify your accounting, especially if you work with VAT; adjustment invoices are a mandatory element of any adjustment.