Accounting for payment of the actual value of a share

May 19, 2011

Question:

How to reflect in accounting the payment to an LLC participant of the actual value of the share, as well as the transfer of the share to the remaining LLC participant?

Answer:

Legal certificate.

Any participant in an LLC has the right to leave the company by alienating his share, regardless of the consent of other participants or the company, if this is provided for by the company’s charter (clause 1 of article 94 of the Civil Code of the Russian Federation, clause 1 of article 8, clause 1 of article 26 of the Law of 08.02 .1998 N 14-FZ “On Limited Liability Companies”).

In this case, the participant’s share passes to the company, and the company, in turn, within three months from the date of receipt of the participant’s application to leave the company is obliged to pay this participant the actual value of his share in the authorized capital of the company, determined on the basis of the company’s financial statements for the last the reporting period preceding the day of filing an application to leave the company, or with the consent of this company participant, give him in kind property of the same value (clause 6.1, subclause 2, clause 7, article 23 of Federal Law No. 14-FZ). The actual value of a share in the company's authorized capital is paid out of the difference between the value of the company's net assets and the size of its authorized capital. If such a difference is not enough, the company is obliged to reduce its authorized capital by the missing amount (Clause 8, Article 23 of Federal Law No. 14-FZ). When a participant leaves the LLC, his share transferred to the company is distributed among the remaining participants while maintaining the ratio of their shares in the authorized capital of the LLC. Withdrawal of a participant from the company

On the date of receipt of an application from an LLC participant about his withdrawal from the company, the debit of account 81 “Own shares (shares)” in correspondence with the credit of account 75 “Settlements with founders” reflects the debt to this participant

in the amount of the actual value of his share .

Payment to the retiring participant of the actual value of the share

is not recognized as an expense

in accounting and is reflected in the debit of account 75 and the credit of account 50 “Cash” or 51 “Settlement accounts”.

According to paragraphs. 3 p. 1 art. 251 of the Tax Code of the Russian Federation, the value of property received as a contribution to the authorized capital is not recognized as income. Thus, based on the norm of paragraph 1 of Art. 252 of the Tax Code of the Russian Federation, payment to an LLC participant upon his withdrawal from the company of the actual value of the share within the limits of its nominal value is not taken into account as expenses. As for the amount of excess of the actual value of the share over its nominal value, these expenses are also not recognized in tax accounting, since they are not related to the implementation of activities aimed at generating income (paragraph 4, clause 1, article 252 of the Tax Code of the Russian Federation). The actual value of the share paid to the participant who left the LLC is the income of this participant, subject to personal income tax (clause 1 of article 209, clause 1 of article 210 of the Tax Code of the Russian Federation). The organization paying the income is recognized as a tax agent. In this case, the withdrawing participant does not have the right to a property tax deduction, since passes to the company not on the basis of a purchase and sale agreement (clause 6 of Article 226 of the Tax Code of the Russian Federation). The date of receipt of income is considered the day of actual payment of the actual value of the share (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation). Taxation is carried out at a rate of 13%. Acquisition of a share by the remaining participant.

The distribution between the participants of the specified share is reflected by an entry in the debit of account 75 and the credit of account 81. Since the remaining participant does not pay for the shares distributed in his favor, the amount reflected in account 75 is written off, in our opinion, from the appropriate sources to the debit of accounts 84 “Retained earnings (uncovered loss)”, 83 “Additional capital”, 82 “Reserve capital”.

In our opinion, in this situation it is advisable to use account 84 “Retained earnings”. That is, when paying the actual value of a share to a participant who left the LLC, and when distributing this share among the participants who remained in the company, expenses are not reflected in accounting. A participant in the company, in whose favor the share in the authorized capital transferred to the company is distributed, receives income in kind, subject to personal income tax (clause 1 of article 210, clause 2 of clause 2 of article 211 of the Tax Code of the Russian Federation). The tax base, in accordance with paragraph 1 of Art. 211, art. 41 of the Tax Code of the Russian Federation is determined based on the actual value of the distributed shares. An organization as a tax agent is obliged to calculate and withhold the amount of personal income tax for any cash payment of income to participants (clause 6 of Article 226 of the Tax Code of the Russian Federation). If the LLC does not make payments to the participant, then it is obliged, no later than one month from the end of the tax period in which the relevant circumstances arose, to notify in writing the LLC participant (taxpayers) and the tax authority at the place of its registration about the impossibility of withholding personal income tax and the amount of tax (clause 5 Article 226 of the Tax Code of the Russian Federation). Conclusions:

The following entries must be made in accounting:

| Debit | Credit | Contents of operations |

| Operations for the withdrawal of a participant from the LLC | ||

| 81 "Own shares" | 75 “Settlements with a participant who left the LLC” | The debt to pay the actual value of the share to the participant who left the LLC is reflected |

| 75 “Settlements with a participant who left the LLC” | 68 "NDFL" | Personal income tax is withheld when paying the actual value of the share to a participant who left the LLC |

| 75 “Settlements with a participant who left the LLC” | 50 (51) | The actual value of the share was paid to the participant who left the LLC |

| Operations to transfer a share to a new participant | ||

| 75 “Settlements with the participant to whom the share has been transferred” | 81 "Own shares" | The debt of the participant to repurchase the share in the LLC is reflected |

| 84 | 75 “Settlements with the participant to whom the share has been transferred” | The cost of the share distributed between the participants is written off at the expense of the sources of formation of the property of the LLC |

Change of participants - accounting features

Describe why you are complaining about this answer

Complaint

Cancel

The new composition of the organization's participants must be reflected in the list of company participants. In addition to information about each participant, this document must contain information about the size of his share, its payment, the size of shares belonging to the company itself, the dates of their transfer to the company, etc. (Article 31.1 of the Federal Law of 02/08/1998 N 14-FZ "On limited liability companies"). In your case, the data of only one founder will be reflected, because complete transfer occurs (100%).

In connection with the withdrawal of the founder (participant) from the company, the organization needs to make changes to the Unified State Register of Legal Entities (clause “d”, paragraph 1, article 5 of the Federal Law of 08.08.2001 N 129-FZ “On State Registration of Legal Entities and Individual Entrepreneurs”).

ACCOUNTING

You can reflect a change in the composition of participants in accounting by posting:

Debit 80 subaccount “Owner 1” Credit 80 subaccount “Owner 2” – reflects the change in the composition of the company’s participants.

Or do not make any entries in the organization’s accounting records. In this case, on the date of making changes to the constituent documents of the company regarding the change of founder, the organization will have to “correct” the analytical accounting data to account 80 “Authorized capital”.

If an organization decides to reflect the change of founder in accounting, then keep in mind: First of all, let us recall that transactions recognize the actions of citizens and legal entities aimed at establishing, changing or terminating civil rights and obligations (Article 153 of the Civil Code of the Russian Federation). A two- or multilateral transaction is called an agreement (clause 1 of Article 154 of the Civil Code of the Russian Federation). Moreover, in the situation under consideration, the company itself is not a party to the transaction: the subject of the transaction is a share in the LLC, i.e. property right owned by a member of the company. A participant in an LLC can alienate only the paid share (Clause 3, Article 21 of the LLC Law), i.e. the seller of the share or its original owner has already made a contribution to the authorized capital of this company. It is obvious that the cost of the share paid by the buyer to the seller under the purchase and sale agreement is not a contribution to the authorized capital of the company; the authorized capital of the company does not change as a result of the transaction.

Thus, the company itself does not have any rights or obligations (liabilities) that must be reflected on the balance sheet of the LLC from the sale and purchase transaction of the share.

As a general rule, transactions aimed at alienating a share or part of a share in the authorized capital of an LLC are subject to notarization (Clause 11, Article 21 of the LLC Law). Clause 12 of Art. 21 of the Law on LLC establishes that a share in the authorized capital of the company passes to its acquirer from the moment of notarization of a transaction aimed at alienating a share in the authorized capital of the LLC, or from the moment of making appropriate changes to the Unified State Register of Legal Entities on the basis of title documents (in cases that do not require notarization certificates).

In accordance with the Instructions for the application of the Chart of Accounts for accounting the financial and economic activities of organizations (approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n, hereinafter referred to as the Instructions), account 80 “Authorized Capital” is intended to summarize information on the state and movement of the authorized capital of an organization. The balance of account 80 must correspond to the amount of the authorized capital recorded in the constituent documents of the organization. Entries in account 80 are made when forming the authorized capital, as well as in cases of increasing and decreasing capital, only after making appropriate changes to the constituent documents of the organization.

The Instructions do not mention entries in account 80 in cases of changes in the composition of the organization’s founders. However, it has been established that analytical accounting for account 80 is organized in such a way as to ensure the generation of information (including) on the founders of the organization.

We believe that, by analogy with the reflection on account 80 of information on the formation and change of the authorized capital, data on the change of founders (members of the LLC) are also reflected after making appropriate changes to the constituent documents. Accordingly, a change of founders can be reflected in accounting on analytical accounts to account 80 by internal accounting entries, for example:

Debit 80 subaccount “Owner 1” Credit 80 subaccount “Owner 2” – reflects the change in the composition of the company’s participants.

We also note that since the company itself does not make any settlements with participants under the agreement on the alienation of shares in the LLC, balance sheet account 75 “Settlements with founders” is not used in this case.

Let's move on to accounting for notary expenses. According to clause 5 of PBU 10/99 “Expenses of the organization” (hereinafter referred to as PBU 10/99), expenses for ordinary activities are expenses associated with the manufacture of products and the sale of products, the acquisition and sale of goods. Such expenses also include expenses the implementation of which is associated with the performance of work or provision of services.

From clause 7 of PBU 10/99 it follows that the totality of expenses for ordinary activities is formed taking into account administrative expenses. We believe that these may include, for example, the cost of paying state duties in connection with changes made to the constituent documents, including in relation to the composition of the LLC’s participants. However, the fee for notarization of a transaction made between individuals, i.e. a transaction to which the LLC itself is not a party cannot be recognized as expenses for managing the company.

Expenses other than expenses for ordinary activities are considered other expenses (clause 4 of PBU 10/99). The list of other expenses given in paragraphs. 11, 12 PBU 10/99, is not exhaustive.

Thus, if the final decision is made that the expenses for notary services are incurred at the expense of the LLC itself, then the payment for notarization of the transaction can be reflected as part of other expenses, i.e. on the debit of account 91, subaccount 91-2 “Other expenses”.

REPORTING

A change in the owner of an LLC will not affect the tax accounting of the organization. A legal entity is a payer of the simplified tax system and owes taxes in accordance with the general procedure. The tax return must be submitted only at the end of the year no later than March 31 of the following year (clause 1, clause 1, article 346.23 of the Tax Code of the Russian Federation). The organization must submit the declaration for 2021 no later than March 31, 2017. There are no quarterly reports on the simplified tax system.

If the founders (“new” and “old”) received income from the organization from the LLC, then the LLC is required to file 6-NDFL and 2-NDFL in relation to them. The calculation and certificate are submitted in the general manner.

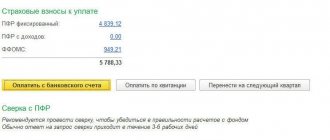

In relation to the founders who are directors of the organization, it is also necessary to submit a calculation of insurance premiums. The calculation must be submitted even if no payments were made to him.

If an employment contract with the director - the sole founder - has been concluded and the company conducts financial and economic activities, then the company definitely needs to submit SZV-M and individual information for the director.

How to reflect the accrual and payment of dividends to the founder in 1C with reflection in the form of 200.00?

Dividends can be accrued to the founder in the 1C program in two ways:

1) the “Operations” document, which generates accounting entries:

- for calculating dividends

Debit 5610 “Retained earnings (uncovered loss) of the reporting year” or

Debit 5620 “Retained earnings (uncovered loss) of previous years”

Loan 3040 “Short-term accounts payable for dividends and participants’ income”

- for the calculation of personal income tax (in case of holding a participation interest for less than 3 years and non-compliance with paragraph

1 of Article 341 of the Tax Code of the Republic of Kazakhstan)

1 of Article 341 of the Tax Code of the Republic of Kazakhstan)

Debit 3040 “Short-term accounts payable for dividends and participant income”

Credit 3120 “Individual Income Tax”

This document reflects the founder (individual) and the amount of dividends to be accrued in the analytics.

Depending on the version of the 1C program used, in order to be correctly reflected in the “Declaration of Personal Income Tax and Social Tax” in Form 200.00, it is necessary to adjust the entries in the accumulation registers.

To do this, you can add a new tab in the “Operations” document “Income Information IIT” through the “Select Registers” and reflect data on the calculation of dividends, IIT and IIT payment. You can also create a document “Registration of other income for tax purposes” with the type of calculation “Dividends”, the card of which indicates the necessary data (reflection in accounting, line code in the declaration for personal income tax and personal tax) or use the document “Adjustment of entries in accumulation registers”, in which to reflect data on the registers “IPN settlements with the budget” and “IPN information on income”.

2) documents “Payroll” with the type of calculation “Dividends”, “Calculation of deductions for employees of organizations”, “Reflection of salaries in regulated accounting”.

In the “Dividends” accrual card, you must indicate the calculation method “Fixed amount”, do not indicate the value “Counted as time worked”, in the “Accounting” tab create a new “Reflection in accounting” - “Dividends” indicating the accounting and tax entries for the accrual dividends (Debit 5610/5620 Credit 3040), as well as in the case of calculating personal income tax in the “Taxation accounting” column, you must indicate “Full taxable”. For correct reflection in the “Declaration of Personal Income Tax and Social Tax” in form 200.00, it is necessary to indicate line code 200.01.001.B in the payment card. When carrying out the “Calculation of employee retention of an organization”, it is necessary to adjust the IPN (5%).

The payment of dividends is reflected by the documents “Cash expenditure order” (if the payment is made through the cash register) or “Payment order (outgoing” (if the payment is made by transfer from the organization’s current account):

- payment of dividends minus withheld personal income tax

Debit 3040 “Short-term accounts payable for dividends and participant income”

Credit 1010 “Cash on hand” or

Credit 1030 “Cash in current bank accounts”

- transfer of withheld personal income tax to the budget

Debit 3120 “Individual income tax”

Credit 1030 “Cash in current bank accounts”

Thus, if the details and analytics of the necessary documents are correctly filled out in the 1C program, the data on the accrual and payment of dividends should be correctly reflected in form 200.00 and its annexes.