This review is devoted to the procedure for calculating income tax and filling out the corresponding declaration in 1C 8.3, 1C: Accounting program. It is assumed that the reader is already familiar with the principles of PBU 18/02. It is impossible to cover the entire Chapter 25 of the Tax Code of the Russian Federation in one article; we will focus on the main points. Also, providing comprehensive automation services for accounting on 1C:Enterprise since 2003, we have developed an algorithm for calculating income tax using the 1C program.

The income tax return in 1C reflects income and expenses accepted for calculating the tax base for income tax. The procedure for filling it out is described in detail in the Order of the Federal Tax Service MMV-7-3 / [email protected] dated 10/19/2016.

The tax period for all companies is a calendar year, the deadline for submitting the annual return is March 28. If the last day for submitting the declaration falls on a weekend, it is postponed to the next working day.

There are some nuances regarding reporting periods and advance payments:

Organizations with small turnover submit reports during the year based on the following results:

- 1 quarter until April 28;

- Semester until July 28;

- 9 months until October 28th.

At the same time, payments are made on accrued profits, which are considered advance payments, because The full tax amount will be generated only at the end of the year. Sometimes situations are possible when the amount of advance payments paid during the year exceeds the tax accrued at the end of the year, then the organization has an overpayment of tax.

If an organization’s average quarterly revenue for the last 4 quarters is equal to or exceeds 15 million rubles, then they pay monthly advance payments of income tax until the 28th, formed by calculation (an example of the calculation will be later). The deadline for submitting reports is similar to that given in the previous paragraph. If at the end of the quarter the amount of advance payments is less than the amount of actually accrued tax, the delta will have to be paid additionally.

The procedure for making an advance payment of income tax every month is not always beneficial for the organization. There are situations when there is no profit, but you have to pay advances. In this case, the organization can switch to the calculation procedure based on the actual profit received: at the end of each month it will be necessary to submit reports to the tax authorities.

To switch to this regime, you must submit the appropriate application before the start of the calendar year, then you will not be able to change the regime until the end of the tax period.

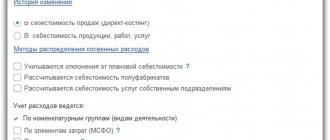

Preliminary program setup

In the 1C 8.3 Accounting 3.0 program, income tax is calculated completely automatically. To calculate it correctly, it is necessary to make a number of preliminary settings.

Go to the “Main” - “Accounting Policies” section. In the window that opens, check the box “PBU 18 “Accounting for calculations of corporate income tax” is applied.

In the latest versions of the 1C: Accounting 3.0 release, tax and reporting settings are made separately. You can access them using the appropriate hyperlink from the bottom of this form. For this example, we do not need to configure anything additional.

Reflection of salaries in financial accounting

At this stage, the program checks and, if necessary, offers to generate a document “Reflection of salaries in financial accounting.”

Next, the program checks for the presence of the document “Reflection of wages in financial accounting” for the period being closed. If it is, then the operation is considered completed. If the posted document is missing, the item is marked as problematic.

By clicking on the reflect button, if a document has not been generated previously, the program will create and post it.

If it gives an error, you can click on the More details link and check the completion of the document.

Figure 8 – Reflection of salaries in financial accounting

Primary documents in 1C for calculating income tax

Receipts (acts, invoices)

Let's reflect the arrival of boards in 1C 8.3. They are the materials from which products will be manufactured in the future.

There were no differences in the postings of this document, so the values of PR and VR remained empty. Please also note that the VAT amount of 1260 rubles was not reflected in the debit. This happened due to the fact that in the program, VAT accounts are not included in the list of tax accounts in the chart of accounts.

Receipt of equipment

Let us reflect in 1C the receipt and acceptance of the lathe for accounting. In new versions of the 1C: Accounting 3.0 release, this can be done in one document. It is located in the section “Fixed assets and intangible assets” - “Receipt of fixed assets”.

In the document of acceptance for accounting, we will add a depreciation bonus in the amount of 30% to reduce the tax.

The amount of this premium will be reflected in the movements of the document on the “KV” debit and will be 105 thousand rubles.

Reflection of wages in accounting

We will also include wages for employees. This can be done using the document of the same name.

As a result, movements will be created, both in payroll itself and in taxes.

Request-invoice

At this stage, we need to write off materials for production. Let's write off the boards that we bought in our example earlier.

Sale of finished products

The first step is to reflect the output of finished products with a production report for the shift. Let's assume that from ten discarded boards we produced ten pallets.

To reflect the fact of sale of our pallets in 1C, we will use the document “Sales (acts, invoices)”. The price of the pallet will be 150 rubles. We'll sell them all.

Entering data for the declaration

It is recommended to use standard documents to record income and expenses.

Fig.4

The second rule is that it is important not to make mistakes when filling out income and expense analytics (cost accounts, cost items, item groups, divisions).

For example, in the document “Production Report for a Shift”, the product groups on the “Products” and “Materials” tabs must correspond to each other (Fig. 5), and the cost item must be present in the register “Methods for determining direct production costs of NU”

Fig.5

Depreciation

The last step before calculating income tax will be the calculation of depreciation of the machine previously accepted for accounting. Due to the fact that we accepted it for accounting in July 2021, depreciation will only be accrued at the close of August.

Based on the formed movements, it is clear that the program took into account the depreciation bonus, which amounts to 105 thousand rubles for a lathe.

Registration of employee output

When performing this operation, the turnover in the accumulation register “Labor costs for registration” for the month is analyzed. If there is turnover, then the program shows the operation “Registration of employee output” in the list of operations.

Turnovers in this register appear in the system if the “production stage” or the document “Production without an order” or the “Repair Order” reflected the completion of work (on the “Labor Costs” tab).

Unfinished documents can be seen and processed through a special workplace “Employee Production”, which is called directly from the closing form and from the “Production Documents” Journal.

Figure 7 – Transition to registration of employee output

Income tax calculation

To view deferred tax liabilities and assets at the end of the month, generate a certificate-calculation “Tax assets and liabilities”. You can find this report, for example, in the “Month Closing” processing.

From the same processing, you can generate a certificate - the “Calculation of income tax” calculation. It will display not only the financial result of the organization’s activities, but also income tax for the current month, year and for the previous months of the current year.

This report shows that the amount of income tax for the current month is 20 percent of the profit for the current month:

- 1,271.19 rubles * 20% = 254.24 rubles

Revaluation of cash and financial instruments

At this stage, the program analyzes the information register “Tasks for closing the month” with the type of operation “Revaluation of cash and financial instruments”. If there is an entry, then the step is recorded as requiring execution.

As a result, a regulatory document with the type Calculation of exchange rate differences is generated (section Financial results and controlling – Month-end closing – Regulatory documents

):

Figure 6 – Calculation of exchange rate differences

We connect an external 1C report, using the example of a profit declaration

So, you have in your hands the current version of the income statement. A couple of days before the reporting deadline, you received a regulated report file and can now fill out a declaration based on accounting data neatly saved in the program for the quarterly period.

How can you connect an external report to the program and get started?

The file with the regulated report can be downloaded from the user website. Free access to the site is provided to all users of 1C:Enterprise programs with a valid subscription to ITS (information technology support). In the private part of this site, in the section where software updates are posted, you can download the report like this:

Select the menu item “Save link as...” and a dialog box will appear asking you to save the file on your computer’s hard drive with an external 1C report. The file is an archive with an external report attached to it, so before connecting the report itself to the program, you will need to unzip it.

After you receive a report file with the extension “.erf” from the archive, for example, “Regulated ReportProfit Declaration.erf”, run the program and open the list of regulated reports in it. (Menu "Reports - Regulated reporting - Regulated reports (built-in)". In the upper left corner of the form that opens, click on the "Reports Directory" button: a list of regulated reports will appear on the screen, grouped into sections "Tax reporting", "Reporting to funds" etc. It is recommended to follow the sequence of actions as shown in the figure:

Now select a section and within the selected section find the desired report. In the example under consideration, the required section is “Tax reporting”, and within the section is “Profit statement”. Open the "Profit Report" help item for editing. Set the “Use:” switch to the “file” position - now the field for selecting a file is available to you.

In the dialog box, select the external report file. This is an archive of the file that you saved to your hard drive earlier:

Having selected the file, write the changes to the directory of regulated reports using the “OK” or “Write” button and close the program. Restart the application to work with the changed data (new report form).

The new version will be available to you when you select this regulated report from the list. You can find out which version is being used from the information label:

The form with the inscription always opens before the start of generating a new report.

Repayment of the cost of inventory items in operation

At this step, the system checks the status of inventory items in operation. If there is an entry in the information register in the month of closing (or earlier), then the step about Repayment of cost appears in the list of operations, which requires execution. If there is no entry in the information register, but there is a posted “Repayment of Cost” document, then the operation in the list is shown as completed.

When starting the closing procedure, the system will create a document “Repayment of the cost of inventory items in operation” automatically.

Distribution of production costs. Setting up cost distribution

During this step, the distribution of material and intangible costs between costs and manufactured products is configured. Documents “Distribution of expenses for production costs” are created.

Processing the creation of documents can also be called from the section “Production” - Intra-shop accounting - “Cost distribution”.

If not all documents have been created or a distribution error is detected based on previously entered documents, the operation is marked as requiring execution.

When you start the procedure, the missing documents will be generated. In this case, the distribution itself occurs at the next stage.

Documents are created with the settings that are set for the expense item by default.

Figure 10 – Setting up cost distribution

Calculation of exchange rate differences

The need for this step is determined by the system based on the balances of the revalued foreign currency accounts.

In this case, the system makes a preliminary calculation of the exchange rate difference at the rate at the end of the closing period. If the amount differs from what is currently in the transaction balances, then the need for routine calculation is recorded.

As a result, the documents Regular transaction with the transaction type Calculation of exchange rate differences for regulated accounting

.

VAT distribution

The program analyzes the information register “Tasks for closing the month” with the type of operation “VAT distribution”. If there is an entry, then the step is recorded as requiring execution. If there are no entries in the information register for the required period (or earlier), but there is a posted “VAT Distribution” document, then the step is marked as completed.

As a result, the “VAT Allocation” document is automatically created and posted.

Figure 11 – VAT distribution