In this article we will look at how to fill out a payment order for fines. Let's look at common mistakes.

If an LLC or individual entrepreneur made mistakes as a result of which a tax, fee or contribution was not paid, or the accountant missed the deadline for sending funds to pay taxes, the company will soon receive a request from the Federal Tax Service to transfer the underpaid amounts. In addition, a fine and penalties will be assessed.

And here you will need the ability to competently fill out payment orders for the payment of fines, otherwise the tax inspectorate will be forced to take more stringent measures against the willful defaulter.

Fines and penalties for taxes, fees and contributions

To transfer the amounts of a fine or penalty, the same details of the Federal Tax Service are entered in the payment order as when paying taxes and fees. The recipient of the payments will be the department of the tax service to which your company is assigned, and where you regularly send reports on payments transferred to the budget.

The line <Payment order> must contain the same value as when sending funds for taxes: <5>.

If the company has already received a notification from the Federal Tax Service that it has been fined or that a penalty has been charged, the document may indicate a unique accrual identifier (hereinafter referred to as UIN), this value will be useful for filling out the <Code> field. If the document from the Federal Tax Service does not contain a UIN, the value of this field remains zero.

OKTMO depends solely on the place of registration of the LLC or the registration of the individual entrepreneur, so its value coincides with that usually indicated when transferring tax amounts.

The line <Basis of payment> will contain one of two values:

- <TR> , if the company has already received an official request from the tax authorities to pay a fine;

- <ЗД> , if the accountant independently transfers funds to pay the fine, without waiting for notification from the Federal Tax Service, because knows that the deadlines for paying a tax or fee have been violated and a fine will be imposed.

Fields 108/109 will contain the value <0> if the company, on its own initiative, decided to pay the fine. And if it is paid at the insistence of the Federal Tax Service, the No and date from the request received from the Federal Tax Service are entered in these columns, respectively.

Line 107 <Tax period indicator> will also contain a zero if there is no official notification. If it was received, the payment deadline specified in the document will be recorded here.

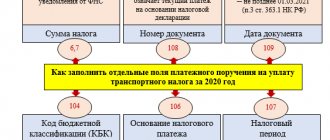

The most important thing is to correctly indicate the budget classification code (BCC). The main thing to remember here is that the code used is not the one that relates to the period in which there were violations that resulted in a fine. The BCC is the one that relates to the year during which the payment actually occurs.

The Federal Tax Service has the right to impose a fine based on the laws of not only the Tax Code of the Russian Federation, but also the Code of Administrative Offenses.

It is also important to know that the BCC for underpaid tax and the fine/penalty for it differ; for all three you will have to fill out your own payment documents.

Payment order for penalties in 2021 - 2021 - sample

Depending on what served as the basis for the payment, filling out this field will vary:

- In case of voluntary payment of penalties (the basis of the PP), there will be 0 here, because penalties do not have a frequency of payment, which is inherent in current payments. If you are listing penalties for one specific period (month, quarter), it is worth indicating it, for example, MS.08.2021 - penalties for August 2021.

- When paying at the request of tax authorities (basis of TR) - the period specified in the request.

- When repaying penalties according to the verification report (the basis of the AP), they also put 0.

Read about filling out field 107 in your personal income tax payment form here.

If you pay the fine yourself, enter 0 in fields 108 “Document number” and 109 “Document date”.

In all other cases, in field 108, provide the document number - the basis for the payment (for example, a claim), and do not put the “No” sign.

In field 109, indicate:

- date of requirement of the Federal Tax Service - for the basis of payment TR;

- the date of the decision to bring (refusal to bring) to tax liability - for the basis of an administrative agreement.

The main change concerns individual entrepreneurs, notaries, lawyers and heads of peasant farms. From October 1, 2021, payer status codes “09”, “10”, “11” and “12” will no longer be valid. Instead, the taxpayers listed above will indicate code “13,” which corresponds to individual taxpayers.

Also, some of the codes will be deleted or edited. New codes will be added:

- “29” - for politicians who transfer money to the budget from special election accounts and special referendum fund accounts (except for payments administered by the tax office);

- “30” - for foreign persons who are not registered with the Russian tax authorities, when paying payments administered by customs authorities.

From October 1, the list of payment basis codes will decrease. Codes will disappear:

- “TR” - repayment of debt at the request of the tax authorities;

- “AP” - repayment of debt according to the inspection report;

- “PR” - debt repayment based on a decision to suspend collection;

- "AR" - repayment of debt under a writ of execution.

Instead, you will need to indicate the code “ZD” - repayment of debt for expired periods, including voluntary. Previously, this code was used exclusively for voluntary debt closure.

Also, from October 1, the code “BF” will be removed - the current payment of an individual paid from his own account.

This field indicates the document number that is the basis for the payment. Its completion depends on how field 106 is filled in.

The new code for the basis of payment in the four invalid cases is “ZD”. But despite this, the deleted codes will appear as part of the document number - the first two characters. Fill out the field in the following order:

- “TR0000000000000”—number of the tax office’s request for payment of taxes, fees, and contributions;

- “AP0000000000000” - number of the decision to prosecute for committing a tax offense or to refuse to prosecute;

- “PR0000000000000” - number of the decision to suspend collection;

- “AR0000000000000” – number of the executive document.

For example, “TR0000000000237” - tax payment requirement No. 237.

The procedure for filling out field 109 changes to pay off debts for expired periods. When specifying the “ZD” code, you need to enter in the field the date of one of the documents that is the basis for the payment:

- tax requirements;

- decisions to prosecute for committing a tax offense or to refuse to prosecute;

- decisions to suspend collection;

- writ of execution and initiated enforcement proceedings.

Filling out a payment order to pay a fine

To correctly fill out a payment order, consider a sample payment order form:

Fields [62] and [71] are not filled in; they are needed for bank employee records.

The document No. is entered in field [3].

Field [4] is intended to indicate the day the payment order was issued in the format DD.MM.YY.

Field [5] must contain information about the type of payment. We write:

- [By mail], if the document is sent through a post office;

- [Urgent] if the contribution needs to be taken into account as soon as possible;

- [Electronically], if the money will be transferred by electronic payment;

- [___] if you pay in person.

Props [101]:

- <01> for LLC;

- <09> for individual entrepreneurs;

- <10> for a notary;

- <11> for a lawyer;

- <12> for the head of a peasant farm;

- <13> for individuals.

Field [6] must contain the amount to be paid in words, and [7] in numbers.

[60] – TIN (consists of ten digits for an LLC and twelve digits for an individual entrepreneur), [102] – KPP (entrepreneurs do not fill out), [8] – name of the paying enterprise (or initials of the entrepreneur), [9] – No accounts from which funds are debited; [10] – bank name, [11] – BIC, [12] – correspondent. account) of the payer. [13] – bank of your Federal Tax Service (recipient of the money), [14] – BIC, [15] – account. [16] – name of the Federal Tax Service, [17] – Account No., [61] – Taxpayer Identification Number, [103] – Checkpoint. [19], [20], [23] remain blank.

- In part [18]<Type of transaction> we put <01> (i.e. we indicate that this is a payment document);

- In [21] -<Payment order> – set <5>;

- <Code> [22] we have <0>, if we pay the penalties ourselves. Or enter the UIN from the Federal Tax Service notification.

[104] – KBK, [105] – OKTMO, [106] – Basis of payment:

- ZD (independent payment of penalties),

- TR (transfer of money at the request of the Federal Tax Service).

[107] – Payment period.

[108] – Document No. -<0>. [109] – Date of document execution, set <0> or the date of the document if the company received a request from the Federal Tax Service. Field [24] -<Purpose of payment>. The line must contain information that a fine or penalty is being paid.

In addition, you will see at the bottom of the document [43] “M.P.” (place of printing). It is needed if the payment order is submitted in paper form, but LLCs and individual entrepreneurs have the right to refuse to put it in then.

And finally, the area [44] contains handwritten or electronic signatures of people who have the right to sign such documents.

Area [45] is allocated for bank marks.

How penalties and fines on insurance premiums will change in 2021

From January 1, 2021, payments for insurance premiums will be placed under the control of the Federal Tax Service, which means penalties for late payments and arrears will now be imposed in a manner similar to taxes and fees.

Now organizations will not have to pay penalties for the day when they made payments on contributions; previously, penalties were assigned for this date as well. It follows that if payment is made one day later than the deadline, there will be no consequences in the form of penalties. The amount of the penalty for that day can be refunded as an excess payment. If the amount is insignificant, then it is not worth it.

The Federal Tax Service will fine an enterprise only when the company's accountant deliberately underestimated the base subject to insurance contributions.

Changes in details for paying fines and penalties in Moscow and the Moscow region

6.02.2017 Changes to the Federal Tax Service details in payment orders for the city of Moscow and the region have come into force:

- Account number for accounting for cash receipts divided by the Federal Treasury between the budgets of Russia within the borders of Moscow: 40101810045250010041

- bank name : Main Directorate of the Bank of Russia for the Central Federal District of Moscow

- BIC: 044525000

Changes in payment documents issued in the Moscow region are due to the fact that the accounts of the Fed. Treasuries for the Moscow Region in Branch 1 Moscow are sent for processing to the Main Directorate of the Bank of Russia for the Central Federal District:

- Account number: 40101810845250010102

- The bank and its BIC are the same as in payment cards in Moscow.

Directory of Payment Orders 2021

There are innovations for individuals who pay taxes, fees, insurance and other payments administered by the tax authorities. The changes concern field 101 (the status of the payment originator is entered in it).

Until October 2021, when filling out field 101, these individuals must select one of the following values:

- “09” - individual entrepreneur who pays taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “10” - a notary engaged in private practice, paying taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “11” - a lawyer who has established a law office that pays taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “12” is the head of a peasant (farm) enterprise who pays taxes, fees, insurance premiums and other payments administered by the tax authorities.

- “13” is an “ordinary” individual.

Starting in October 2021, the values "09", "10", "11" and "12" will be removed. Instead, the value remains, the same for all individuals (“ordinary”, individual entrepreneurs, lawyers, etc.) - “13”. Changes were made by order No. 199n.

- sells goods, provides services or performs work subject to VAT;

- transfers goods, provides work or services free of charge. The tax base for VAT in this case is the market value of goods or services;

- transfers goods (work, services) on the territory of our country for its own needs. These transactions are subject to VAT if the company did not take into account the costs for them when calculating income tax;

- performs construction and installation work for its own needs;

- imports goods.

Special rules will need to be followed in relation to penalties for injury contributions that are paid to the Social Insurance Fund (i.e., use the details of the relevant department of the fund and the KBK, starting with numbers different from the numbers in the KBK for tax payments). Fields 106–109 in such a payment document are always filled with zeros (clauses 5, 6 of Appendix No. 4 to Order of the Ministry of Finance of Russia dated November 12, 2021 No. 107n). If it is necessary to indicate the details of the document on the basis of which the payment is made, information about it is given in the purpose of the payment.

Also, in the 2021 sample payment slip for personal income tax penalties, in addition to the BCC, selected based on who exactly pays the tax, you need to pay attention to the code in field 101 in the upper right corner of the document, which reflects the status of the compiler. In relation to personal income tax, it can be like this:

When generating a sample payment order for 2021 for personal income tax penalties paid in response to a document issued by the Federal Tax Service, you will have to choose a different order of payment, use other codes for the reason for payment and be sure to fill out fields 107–109.

Everything we said above concerns payments for tax penalties. The payment order for penalties in 2021 for insurance premiums will be slightly different. When paying penalties on contributions, zeros are entered in fields 106 “Basis of payment”, 107 “Tax period”, 108 “Document number” and 109 “Document date”. If the payment is drawn up in accordance with a requirement or act, then the details of these documents should be given in the purpose of payment.

If the taxpayer made a mistake in indicating the KBK, Art. 78 and 79 of the Tax Code of the Russian Federation give the right either to return the amounts paid, or to offset them with other taxes if there is arrears on them. Also in paragraph 7 of Art. 45 of the Tax Code of the Russian Federation gives the opportunity to clarify the payment if an error was made in the BCC, but the money was received into the account of the Federal Treasury.

- A complete list of personal data and contacts of the entrepreneur. This includes: TIN, first name, last name and patronymic, contact phone number;

- In the necessary places, coding should be indicated, for example, a code for the type of business activity that the company is engaged in;

- The document must indicate the date when it was submitted to the required government agency, as well as the personal signature of the entrepreneur;

- All specified data is certified by a seal.

Legislative acts on the topic

This table describes the legislative acts of the Russian Federation.

| Appendix 6 to the order of the Ministry of Finance dated 07/01/2013 No. 65n | Current KBK |

| para. 7 p. 4 sec. II Order of the Ministry of Finance dated July 1, 2013 No. 65n | On the use of income subtype code 3000 (14-17 digits of the code) for fines |

| Appendix 2 to Order of the Ministry of Finance of the Russian Federation No. 107n | Rules for filling out payment order details for paying fines |

| clause 6 art. 32 Tax Code of the Russian Federation | On the obligation of the tax service to provide information to taxpayers about filling out payment orders for the purpose of paying taxes, fees, fines and penalties |

| Part 5 Art. 15 of the Law of July 24, 2009 No. 212-FZ | About the deadline for paying insurance premiums |

| Part 3 Art. 25 Federal Law of July 24, 2007 No. 212-FZ | On the accrual of penalties for late or partial payment of insurance premiums |

| Art. 47 of Law No. 212-FZ | About fines for incomplete payment of insurance premiums |

| Ruling of the Supreme Court of the Russian Federation dated March 13, 2015. No. 310-KG15-1761, Resolutions of the Federal Antimonopoly Service of the Central District dated December 19, 2014 No. A64-8264/2013 and dated November 27, 2014 No. A64-8265/2013 | About the absence of grounds for imposing a fine on an enterprise if the calculation of insurance premiums contained errors, but payment for the year was made in full |

| Letter of the Federal Tax Service dated November 7, 2016 No. ZN-4-1/21026 | About the transition period of payment orders with old details to new ones (in Moscow and Moscow Region) |

Sample pp for payment of VAT penalties in 2021

The number of days can be calculated from the day following the date of the last payment of tax to the budget. The end of accrual of penalties by the tax inspectorate occurs on the day when the arrears were actually paid and their execution occurred. If arrears arise after October 1, 2021, the above formula is applied in the first 30 days. And then (on the 31st day and in the subsequent period), a new increased coefficient is used - 1/150 of the bet.

- Rent property from government agencies and local governments.

- Purchase GWS from foreign companies that sell products on the Russian market, but are not taxpayers to the budget system of the Russian Federation.

- Purchase government-owned property within the territory of the Russian Federation. An exception is objects leased by SMP, starting from 04/01/2021.

- Realize Russian property assets in accordance with a court decision. The owner of such property must be the taxpayer. The exception is the property assets of the bankrupt.

- Intermediate in trade with foreign companies that are not tax residents of the Russian Federation.

Field What is indicated How to fill in 101 Payer status 01 (if the taxpayer is an organization); 09 (if the taxpayer is an individual entrepreneur); 02 (for tax agent) 104 KBK 18210301000011000110 (tax, except for imports from the EAEU); 18210301000012100110 (penalties); 18210301000013000110 (fine) 105 OKTMO OKTMO at the location of the organization (place of residence of the individual entrepreneur) 106 Basis of payment TP - current year payments; ZD – voluntary repayment of debt for expired tax periods in the absence of a requirement for payment; TR – repayment of debt at the request of the tax authority; etc.

The value of the tax period indicator for which tax is paid or additionally paid. Consists of 10 characters. Eight of them have semantic meaning, and two are delimiters and are filled with a dot (“.”).

From January 1, 2021, a change is provided for individual payers who are not individual entrepreneurs. Order of the Ministry of Finance dated September 14, 2021 No. 199n updated the rules approved by Order of the Ministry of Finance dated November 12, 2013 No. 107n.

Previously, in order for inspectors to be able to determine who the payment came from, an individual had to indicate his TIN. Instead of the TIN, you could fill out field 108 “Number of the document that is the basis for the payment”, or enter the UIN in field 22 “Code” (in the absence of a UIN, it was possible to indicate the address of residence or stay).

Now, if you do not have a TIN and UIN, you can indicate the series and number of your passport or SNILS.

From January 1, 2021, new BCCs were introduced for personal income tax calculated on a progressive scale.

By Order No. 236n dated October 12, 2021, the Ministry of Finance added new codes to the KBK list for transferring personal income tax on income exceeding 5 million rubles. in year:

- for tax: 182 1 0100 110

- for stumps: 182 1 0100 110

- for fines: 182 1 0100 110.

Common mistakes

Error No. 1: In the payment order, a zero value was entered in the “Code” field, when the debt on penalties was repaid by the enterprise independently, without waiting for a request from the Federal Tax Service. The next time the tax office received a notice of payment of a fine, the accountant automatically entered “0” in the “Code” column.

Comment: When a company receives a document requesting the Federal Tax Service to pay penalties or fines, a unique accrual identifier specified in the request is entered in the “Code” field of the payment. And only if it is not specified there, you can leave a zero value.

Error No. 2: Indication by the organization that received a request from the tax service to pay penalties, the code “ZD” in the “Base of payment” field.

Comment: When an official request from the Federal Tax Service has already been received, the payment is considered to have been made not on a voluntary basis, but at the insistence of the tax inspectorate, therefore the code “TP” must be indicated in the “Base of payment” field.

Error No. 3: Indication in the KBK payment order of the tax period in which the tax arrears arose and when penalties were accrued.

Comment: The BCC is indicated as current as of the date of actual repayment of the debt.

Where to find KBK for correctly filling out payment slips

Before filling out a payment slip for penalties or fines, check the KBK. In case of an error, the debt owed to the company will remain outstanding, and the amount of financial sanctions will increase. The current codes are contained in the order of the Ministry of Finance on the approval of the BCC for the current year. For 2021, this is order No. 99n dated 06/08/20.

If you receive a request from the Federal Tax Service, then sometimes it indicates only the main BCC for the tax, without any indication of a penalty or fine. The code itself consists of 20 digits, values 14 to 17 indicate the type of payment. The value “2100” indicates payment of a penalty, “3000” - a fine.

Thus, penalties for transport tax are paid from KBK 182 1 06 04011 02 2100 110, and the fine is paid from KBK 182 1 0600 110.

If you have any doubts about how to fill out a payment order for the fine KBK 39211607090060000140 for late submission of a report to the Pension Fund, then this code is contained in the section “Other fines, penalties, penalties paid in accordance with the law or agreement in case of non-fulfillment or improper fulfillment of obligations before the Pension Fund of the Russian Federation" of the KBK list. The basis for accrual is Art. 17 of Law No. 27-FZ of 04/01/1996 (as amended on 07/20/2020).