What fines do companies face if they fail to pay dividends to participants or shareholders on time? For what period can a shareholder or participant recover dividends from the company?

The timing of dividend payments is different for LLC participants or JSC shareholders. Thus, dividends must be paid to an LLC participant no later than 60 days from the date of the decision on the distribution of profits, unless a different period is determined by the charter or decision of the LLC (Clause 3, Article 28 of Law No. 14-FZ).

For shareholders, the timing of dividend payments is different. Thus, the period for paying dividends should not exceed 25 working days from the date on which the persons entitled to receive dividends are determined. Such a date is indicated in the decision on the payment of dividends to shareholders (clause 6 of Article 42 of Law No. 208-FZ).

Concept of distributable income

Distribution of dividends is the prerogative of commercial organizations whose purpose of existence is to make a profit.

A dividend is a profit received for a certain period intended for distribution among the participants of this organization. Profit can be distributed in full or in part. In the Russian Federation, commercial firms are usually created in one of 2 forms:

- in the form of a joint-stock company (JSC), guided by the Federal Law “On Joint-Stock Companies” dated December 26, 1995 No. 208-FZ;

- in the form of an LLC, applying the Federal Law “On Limited Liability Companies” dated 02/08/1998 No. 14-FZ.

In the 1st of these laws, the concept of dividends is used in relation to the payment of income (Chapter V), and in the 2nd law there is no such concept, although the issue of profit distribution is discussed in it (Articles 28, 29 of Law No. 14-FZ) .

Both of these concepts (dividend and profit distribution) are united by Art. 43 of the Tax Code of the Russian Federation, which classifies as dividends any income received by a participant or shareholder as a result of the distribution of net profit in proportion to his share of participation.

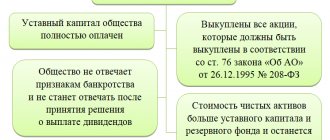

Restrictions on dividend payments

In order to distribute dividends, the mere fact of profit is not enough. Both of the above laws contain lists of very similar restrictions (Article 43 of Law No. 208-FZ and Article 29 of Law No. 14-FZ), which apply not only to the date of the decision on payment, but also to the date of payment (if the situation has changed by the time of payment ).

Limitations common to both organizational forms:

- The management company must be paid in full.

- Net assets must exceed the sum of the authorized capital and reserve fund even after payment of dividends. For a joint-stock company, the amount of the excess of the value of preferred shares over their par value is also added to the amount of the authorized capital and reserve fund.

- Signs of bankruptcy must not occur or arise as a consequence of the payment of dividends.

A special restriction for an LLC: a decision on payment is not made until the actual value of the share (or part thereof) has been paid to the retiring participant.

According to the AO, a decision cannot arise:

- until the completion of the repurchase from shareholders of shares in respect of which there is a right to demand their repurchase (Clause 1, Article 75 of Law No. 208-FZ);

- without observing the correct sequence of making a decision on the payment of dividends: first in relation to those preferred shares that have special advantages, then on other preferred shares and only then on ordinary shares.

Both laws contain a clause that under an existing payment decision that has not been implemented due to restrictions that arose at the time of payment, the issuance of dividends is mandatory after the disappearance of these restrictions.

Postings for payment of dividends to the founder

| Methods of transferring income to founders | Wiring |

| By offsetting the founder's debt on the loan received | Dt 75 Kt 73 |

| By transferring materials to the organization | Dt 75 Kt 10 |

| Goods owned by the organization | Dt 75 Kt 41 |

| The organization's own products | Dt 75 Kt 43 |

| Cash | Dt 75 Kt 50 |

| Via current account | Dt 75 Kt 51 |

When issuing dividends through the cash register, a cash receipt must be punched, in accordance with Federal Law No. 54-FZ dated May 22, 2003 “On the use of cash register equipment when making payments in the Russian Federation.”

When issuing dividends on its own products, goods, services, materials, all taxes paid by the organization upon the sale of these assets are paid from their value. In particular, organizations under the general tax regime pay VAT and income tax (Letter of the Ministry of Finance dated August 25, 2017 No. 03-03-06/1/54596).

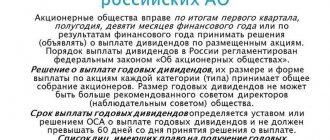

Frequency and methods of payment

In both forms (JSC and LLC), it is allowed to make a decision on the payment of dividends with a frequency of 1 time:

- per quarter;

- half year;

- year.

Quarterly and semi-annual distributions will be considered interim. The payment of such dividends is assessed accordingly.

IMPORTANT! Interim dividends remain dividends even if the profit at the end of the year is less than the amounts already paid in the form of dividends. There is no need to reclassify them as other income. This is important for tax purposes. Read more here.

A legal entity is not necessarily required to make a decision on the payment of income. There may also be a decision on non-distribution of profits, usually made at the end of the year.

Law No. 208-FZ directly lists the methods of paying dividends (in money or property), while Law No. 14-FZ does not indicate either the methods of payment or any restrictions on them. Thus, it is possible to pay dividends regardless of the form of the legal entity:

- cash from the cash register.

- by non-cash transfer to the participant’s bank account;

- property.

From the amount of accrued income, personal income tax (for an individual) or income tax (for a legal entity) must be withheld. For the calculation, a rate of 13% is used for residents (clause 1 of Article 224 and subclause 2 of clause 3 of Article 284 of the Tax Code of the Russian Federation) and 15% for non-residents, as well as for residents in case of payment of dividends in an amount exceeding 5 million rubles . in year. (clause 3 of article 224 and subclause 3 of clause 3 of article 284 of the Tax Code of the Russian Federation). The question of paying tax when paying dividends to a legal entity arises regardless of what taxation regime is applied by the organization that decided to issue them.

To learn how the tax on dividends paid to a legal entity is calculated, read the article “How to correctly calculate the tax on dividends?” .

For information on the taxation of dividends from individuals, see the material “Is personal income tax levied on dividends?”

ConsultantPlus experts explained in detail what tax reporting needs to be submitted on dividends paid. Get trial access to the legal system for free and go to the K+ Guide.

The specified rates are used in relation to dividends paid in 2021, regardless of the year for which they are paid and what rate was in effect in the year for which they were accrued. For an individual, this income is taken into account separately from other income taxed at the same rate. In the case of payment of dividends to a legal entity that owns more than 50% of the capital, the rate may be 0% (subclause 1, clause 3, article 284 of the Tax Code of the Russian Federation).

For information on what needs to be done to apply a 0% rate on dividends, read the article “How to justify a zero tax rate on dividend income”

The situation of issuing dividends with property is regarded as a sale (letter of the Ministry of Finance of Russia dated December 17, 2009 No. 03-11-09/405), entailing the payment of VAT and income tax from the transferring party. At the same time, the obligation to pay tax for the recipient of dividends is not relieved. Taxes are calculated based on the market value of the property. If there is no interdependence, this value is equal to the contractual value of the transfer. The issue of establishing the market value will be significantly complicated in the case of interdependence of persons (participation share of more than 20%) and the presence of constituent entities of the Russian Federation among the participants.

Accrual and payment of dividends: postings

According to the instructions for using the chart of accounts (approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n), the payment of dividends to an LLC is documented with the following entries:

- Credit 75.02 “Calculations for income” Debit 84.01 “Profit to be distributed” for the amount to be transferred to a company participant according to the decision of the general meeting of founders;

- Debit 75.02 “Calculations on income” Credit 68.34 “Income tax when performing the duties of a tax agent” for the amount of income tax withheld from the founding organization;

- Credit 51 “Current accounts” Debit 75.02 “Calculations for income” for the amount paid.

Postings for the accrual and payment of dividends at the end of the year to the founder - an individual not an employee of the organization differ only in the correspondence for the calculation of tax on the founder’s income:

Debit 75.02 “Income calculations” Credit 68.01 “Income tax for individuals when performing the duties of a tax agent” for the amount of personal income tax on dividends paid.

The payment of dividends to the founder - an individual working in the organization, is formalized by the following transactions:

- Credit 70 “Payroll calculations” Debit 84.01 “Profit to be distributed” for the amount due to the employee member of the company;

- Debit 70 “Payroll calculations” Credit 68.01 “Personal income tax when performing the duties of a tax agent” for the amount of tax on remuneration in the form of dividends.

Postings for dividends to non-residents differ from postings in the case of participation in the distribution of profits by residents:

- Credit 75.02 “Income calculations” Debit 84 “Retained earnings (uncovered loss)” - accrual of dividends to a non-resident shareholder

- Debit 75.02 “Calculations for income” Credit 68 “Calculations for taxes and fees” - withholding personal income tax from non-resident dividends

The procedure for paying dividends to the sole founder of an LLC does not have any special features and is formalized by the same decision of the founder on the payment of dividends, only to a single person. An order for the payment of dividends to the sole founder (sample) answers the question of who exactly they are paid to, how much money is to be transferred and how they will be transferred.

The purpose of payment when paying dividends to the founder is drawn up with reference to the number and date of the corresponding order.

How is the payment decision made?

This decision is made by the general meeting:

- shareholders in the joint-stock company (clause 3 of article 42 of law No. 208-FZ).

- participants in an LLC (Clause 1, Article 28 of Law No. 14-FZ).

The financial statements for the relevant period must be ready for the meeting, their data must be analyzed to ensure compliance with the restrictions established for making a decision on payment, and the amount of profit that can be used to pay dividends must be determined.

The result of the meeting is a protocol, which, when executed by the JSC, must contain (clause 2 of Article 63 of Law No. 208-FZ) the following:

- time and place of the meeting;

- the total number of votes and votes of meeting participants;

- information on the election of the chairman and secretary;

- agenda;

- the results of consideration of each of the issues;

- final decision.

The listed data will not be superfluous in the protocol drawn up by the LLC.

With regard to dividends, the meeting of the joint-stock company must decide on the following points:

- for what period they are paid;

- total payment amount and size for each type of shares;

- the date on which the composition of shareholders will be determined;

- form and time of payment.

For LLCs, the following are excluded from this list:

- the amount of dividends for each type of shares;

- the date on which the composition of shareholders will be determined.

The distribution of the total amount between specific persons is carried out:

- in JSC - according to the algorithm laid down in the charter, depending on the types and number of shares;

- in an LLC - in proportion to shares, unless the charter contains a different order.

The general meeting is not held by the sole founder. It is enough for him to make a decision on the payment of dividends, formalizing it as any of his decisions, indicating the date of preparation and the essence of the issue on which the decision is being made.

How to reflect dividend payments on the balance sheet

The decision to distribute the net profit received by the organization for the reporting year among the founders is recognized in accounting as an event after the reporting date (clause 3 of PBU 7/98). During the reporting period, accounting entries on the distribution of net profit between them are not made. The explanations to the balance sheet and the financial results report for the reporting year disclose the fact of distribution of net profit between the founders as an event after the reporting date (clause 10 of PBU 7/98), if the decision was made before the submission of the annual financial statements.

In accounting, the accrual of dividends to the founders from net profit is reflected on the date of adoption of the corresponding decision (paragraph 4, paragraph 10 of PBU 7/98). The amount of distributed profit is not an expense of the organization, and is reflected in the balance sheet as a decrease in capital (retained earnings).

Terms of payment of dividends in LLC

For an LLC, the period for issuing dividends is limited to 60 days from the date of the decision (Clause 3, Article 28 of Law No. 14-FZ). A specific period within these 60 days may be established by the charter or a meeting of participants. If such a period is not recorded in the LLC documents, it is equivalent to 60 days.

Important! “ConsultantPlus” warns that if you violate the deadline for paying dividends, as well as if you do not pay them, the consequences may be different depending on whose fault the violation occurred. Read more about the consequences in K+ by getting trial demo access to the system.

Payment of interest on shares

Income from shares of public companies is received by their owners within 30 days after the publication of the decision of the general meeting of shareholders. Payments of dividends on shares in 2021 are made to shareholders recorded in the register and in accordance with the policy of the company that issued the shares. For example, Sberbank makes transfers on shares not once, but twice a year.

If there are a large number of shareholders and different timing of transfers, it is advisable for the payer to draw up a payment calendar for 2020.

The calendar for transferring income from shares to the paying organization should be approved by order.

Director's order

Founder's decision

Consequences of failure to pay dividends on time

Both laws provide the same procedure for situations of non-payment of dividends on time. They can be claimed by the participant within 3 years (or 5 years if this is stated in the charter) from the date:

- making a decision on payment to the JSC (clause 9 of Article 42 of Law No. 208-FZ).

- completion of the 60-day period in the LLC (Clause 4, Article 28 of Law No. 14-FZ).

If dividends are unclaimed at the end of these periods, they are returned to profit and claims for them are no longer accepted.

The legislation does not provide for any sanctions for exceeding the deadline for paying dividends. The consequences may be that the participants go to court demanding the payment of not only dividends, but also interest for the delay in their transfer. If it is proven that the JSC that accrued the dividends opposes their payment, then a fine is possible under Art. 15.20 of the Code of Administrative Offenses of the Russian Federation in the amount of:

- from 20,000 to 30,000 rub. for officials;

- from 500,000 to 700,000 rubles. for legal entities.

For information on the rules for reporting dividends in the 6-NDFL report, read the material “How to correctly reflect dividends in the 6-NDFL form?”

Dividend calculation

The calculation of dividends in a joint-stock company is carried out in several stages.

First of all, the total amount that the company can allocate for payment is determined, taking into account the conditions listed in the previous section and the recommendations of the Board of Directors.

First, the amount to be paid on preferred shares is determined. They pay a fixed dividend - this is the amount specified in the company's charter for each type of such shares. This can be a percentage of the par value of the stock or a fixed amount of money:

- Dp = Kp1 x Dp1 + Kp2 x Dp2 + ... + Kpi x Dpi, where Kp1 ... Kpi is the number of preferred shares of each type

- Dp1 ... Dpi - the amount of dividends per type of share

Next, the remaining portion of the allocated funds is distributed among the holders of ordinary shares. How to calculate dividends per 1 ordinary share can be seen from the formula:

- To = (D – Dp) / Ko, where D is the total amount allocated by the company for the payment of dividends

- Ko - number of ordinary shares

In LLC everything is much simpler. How dividends are calculated in this case depends only on the distribution of shares between participants. The formula shows how to calculate dividends per founder:

- Di = D x DLi, where D is the total amount of distributed profit

- DLi - participant’s share in the authorized capital of the company

Let's look at an example of calculating dividends for a joint stock company.

The authorized capital of the company is 1 million rubles. and divided into 1000 shares with a par value of 1 thousand rubles. Of these, 200 pcs. are privileged, and 800 pcs. – ordinary. Based on the results of the year, a decision was made to pay dividends in the amount of 120 thousand rubles. According to the charter, dividends in the amount of 20% of the par value must be paid for each preferred share.

Payments on preferred shares will be:

- Dp = 200 pcs. x (20% x 1000 rub.) = 200 pcs. x 200 rub. = 40,000 rub.

Payment amount per one ordinary share:

- Up to = (120 tr. - 40 tr.) / 800 pcs. = 80 t.r. / 800 pcs. = 100 rub.

The dividend rate is the ratio of the annual payment to the par value (or current market price) of the stock. In this case, for preferred shares it will be 20%, and for ordinary shares – 10%.

Results

The period for paying dividends in an LLC is 60 days from the date of the decision to pay them, unless a different period is established by the charter or meeting of the company’s participants. In a JSC, the period for paying dividends depends on the recipient: 10 days from the date of the decision for payment to nominee holders and trustees, and 25 days for payment of dividends to other shareholders.

Sources:

- Tax Code of the Russian Federation

- Law of 02/08/1998 N 14-FZ “On Limited Liability Companies”

- Law of December 26, 1995 N 208-FZ “On Joint Stock Companies”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.