06.06.2018

| no comments

The first months of the year are the time to take stock. It is worth thinking about the fate of retained earnings. Let's consider who has the right to use it and what it can be spent on.

With the final entry in December, the amount of net profit (loss) of the reporting year is written off from account 99 “Profits and losses” to the credit (debit) of account 84 “Retained earnings (uncovered loss)”. Thus, on account 84, after the balance sheet reformation, the financial result is formed, which will be announced at the general meeting of shareholders (participants). If, as a result, the organization has a debit balance on account 84, this, unfortunately, indicates that the main goal of entrepreneurial activity has not been achieved: the organization has incurred a loss. If account 84 has a credit balance, this indicates that the organization has retained earnings that can be used.

What is retained earnings?

Firstly, it is part of the organization's capital. It is not for nothing that it is reflected in Sect. III “Capital and reserves” balance sheet. And capital is nothing more than the difference between an organization's assets and its liabilities.

But if assets and liabilities are associated with real objects, then capital is a kind of abstract financial quantity that shows from what sources the organization exists: authorized, additional or reserve capital, retained earnings. For example, in the Chart of Accounts for accounting the financial and economic activities of organizations (hereinafter referred to as the Chart of Accounts), approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n, in the commentary to account 84, retained earnings are directly named as a source of financial support for the production development of the organization.

Accordingly, if the organization’s capital contains such a component as retained earnings, this is a very good sign and indicates that the organization earns more than it spends.

Secondly, the credit of account 84 shows the amount of net profit received for the entire period of the organization’s activities, and not just for the last year. This value represents the final result of the company’s activities over the entire period of its existence, and the owners have the right to dispose of this accumulated profit at their own discretion.

Thirdly, the credit balance of account 84 indicates that the organization’s profit was not used to withdraw funds from the company’s turnover . What this means will be explained below.

Who has the right to use retained earnings?

Only the owners of organizations: shareholders or participants have the right to distribute earned profit and decide what expenses should be incurred at its expense. It’s not for nothing that accountants call account 84 “the owner’s account.” In accordance with the current legislation, the decision on its distribution is made by the general meeting of shareholders (participants) (clause 3, clause 2, art.

The concept of retained earnings

Retained (another name is accumulated) profit is the part of profit remaining at the disposal of the enterprise after paying taxes, dividends, fines and other obligatory payments.

This concept closely intersects with net profit. If a company has no deferred tax liabilities and no dividends were accrued during the year, then these indicators in the annual reporting coincide. However, retained earnings represent the resulting indicator for the reporting year and for the entire period of the company’s existence, and net profit - only for the reporting period.

This term is interpreted differently in accounting and economic understanding. For an accountant, this is the final result of work, reflected in the reporting on account 84. But it has not yet actually been distributed, since the decision on where to send retained earnings is made by the owners (shareholders) in the period from March 1 to June 30 of the following year. Therefore, in an economic sense, they consider profits for the past year after this date, that is, when the accountant makes all deductions according to the decision of the owners of the enterprise.

Availability - Retained Earnings

Page 1

The presence of retained earnings does not indicate the presence of free cash. The fact that a firm has significant retained earnings does not necessarily mean that it has sufficient cash available for capital investment.

The presence of retained earnings in the amount necessary to finance the investment also indicates the availability of sufficient cash for this purpose.

If there is retained earnings of the reporting period, reflected in the balance sheet on line 480, but in the absence of funds from retained earnings of previous years (balance sheet line 470) and free balances of special-purpose funds, current costs at the expense of profits are also reflected in the debit of account 88 subaccount Costs at expense profits not covered by sources of financing and on line 330 of the third asset section of the balance sheet.

The dividend yield is usually lower than the total yield due to the presence of retained earnings.

Within the framework of such large territorial-production complexes as feasibility studies, it is advisable to create an insurance fund at the expense of the undistributed part of the profit remaining at the disposal of industrial energy associations and enterprises, of course, in the presence of undistributed profit.

In the letter of the State Tax Service of the Russian Federation dated October 27, 1998 No. ШС-6-02 / 768 Methodological recommendations on certain issues of profit taxation, paragraph 2 emphasizes that the change in the procedure for accounting for the use of profit of the reporting period, introduced by the Order of the Ministry of Finance of the Russian Federation dated November 21, 1997, if there is undistributed profit of the reporting year, it cannot serve as a basis for not providing benefits.

Increasing the share of own funds from any of the listed sources helps to strengthen the financial stability of the enterprise. At the same time, the presence of retained earnings can be considered as a source of replenishing the enterprise’s working capital and reducing the level of short-term accounts payable.

All profit remaining at the disposal of the enterprise is divided into profit that increases the value of the property, i.e. participating in the process of accumulation, and profit directed to consumption, which does not increase the value of property. If the profit is not spent on consumption, then it remains in the enterprise as retained earnings from previous years and increases the size of the enterprise's equity capital. The presence of retained earnings increases the financial stability of the enterprise and indicates the presence of a source for subsequent development.

A study of the structure of the balance sheet liability allows us to establish one of the possible reasons for the financial instability (sustainability) of the organization. For example, increasing the share of own funds from any source helps to strengthen the financial stability of the organization. At the same time, the presence of retained earnings can be considered as a source of replenishment of working capital and reduction of the level of short-term accounts payable.

A study of the structure of the balance sheet liability allows us to establish one of the possible reasons for the financial instability (sustainability) of an enterprise. For example, increasing the share of own funds from any source helps to strengthen the financial stability of the enterprise. At the same time, the presence of retained earnings can be considered as a source of replenishment of working capital and reduction of the level of short-term accounts payable.

How is it formed and what does it include?

A positive or negative result from the sale of products or the provision of services is reflected in the active-passive account 90 “Sales.” The debit of the account shows the full cost, VAT and other costs. The loan reflects revenue. The final balance is transferred to account 99 “Profits and losses”.

The following entries are made in the accounting book:

- Dt90Kt99 – profit made;

- Dt99Kt90 – loss received.

The operations of the enterprise, which are classified as operating and non-operating, are shown on account 91 “Other income and expenses”.

These include:

- Sale and rental of assets owned by the company;

- Depreciation and revaluation of non-current assets;

- Transactions with foreign currency;

- Investments in business shares of other companies;

- Liquidation and donation of property;

- Income and expenses from transactions with securities.

The postings are as follows:

- Dt91Kt99 – profit made;

- Dt99Kt91 – loss received.

This procedure for writing off the totals for accounts 90 and 91 is called balance sheet reformation. Many economists understand this term as the direct distribution of accumulated profit from account 84.

Similarly, the balance from accounts 76 “Extraordinary income and expenses” (for example, insurance compensation or losses from natural disasters) and 10 “Materials” (the cost of accepted inventory items that are unsuitable for production) is transferred to account 99.

Retained earnings increase when accounting errors are discovered that resulted in overstated expenses. And also in case of unclaimed dividends by shareholders, if more than three years have passed since they were accrued. Accordingly, errors that create an overstatement of income will reduce the accumulated profit.

The components of retained earnings are not always cash in the form of cash or in a checking account (a writedown of fixed assets increases earnings, but does not add cash). This must be taken into account when conducting economic analysis.

In the last days of the reporting year, the chief accountant writes off the final balance (profit or loss) from account 99 to account 84 “Retained earnings”.

Postings are made:

- Dt99Kt84 – upon receipt of profit;

- Dt84Kt99 – upon receipt of a loss.

After this, account 99 is reset to zero and no transactions are carried out on it until the beginning of the next year. Count 84 is active-passive. Before entering the total amount of accumulated profit into the financial statements, the amount of income tax is subtracted from it (later it can be adjusted).

Retained earnings of an organization: 3 options for where to write it off

The amount of the reserve fund for the reporting year increased by 79.5 million rubles. and amounted to 251 million rubles. Growth rate 146.44%. On the one hand, this deserves a positive assessment, because may be caused by an increase in the number of loans issued. On the other hand, the reason for this increase could be an increase in reserve standards.

The smallest share in the structure of equity is revaluation at fair value of securities available for sale. Their share is 0.20%. The revaluation amount increased by 365 million rubles. and amounted to 23 million rubles. This increase cannot indicate the bank’s efforts to increase capital, since capital growth due to revaluation does not provide real money for business development.

Conclusion : the main changes in the structure of equity capital were:

1) Reduction in the share of shareholders' funds and share premium by 5.76 and 6.84 percentage points, respectively.

2) An increase in the share of retained earnings from previous years by 8.67 percentage points and the revaluation of securities by 4.05 percentage points.

At the same time, the reduction in the share of shareholders' funds and share premium is caused by an increase in the share of retained earnings from previous years. An increase in retained earnings indicates that the profit of the previous period was not used to improve the technological development of the bank, increase the authorized capital or create funds.

In general, the analysis showed that the main reason for the growth of bank liabilities is the growth of equity capital. The share of own funds in the currency of the bank's balance sheet increased. This deserves a positive assessment, because... indicates an increase in the level of bank reliability. The bank's own funds are formed mainly from profits, and attracted funds from the funds of clients who are not credit institutions.

Date added: 2015-07-30; ;

Retained earnings and uncovered losses: commonalities and differences

These terms are absolute indicators of the enterprise's performance. There are no significant differences in accounting, except for the difference in debit and credit entries. As a rule (although not always), the loss is covered by the remainder of the profits of previous years, a reserve fund, authorized or additional capital. Profit in the reporting year, by decision of the owners, is distributed in a number of areas.

Retained earnings, which is part of the liability side of the balance sheet, actually increases the equity capital of the business entity. This states the effectiveness of invested assets in production. A detailed analysis will show which factors were responsible for achieving profit.

In the Balance Sheet (Form No. 1), the amount of loss is reflected with a “-” sign and is taken in parentheses. If it is present, it is necessary to carefully analyze the reasons. This can be either a negative sales result and a drop in the competitiveness of products, or a temporary phenomenon with large investments in production that slowly pay off.

Retained earnings - where can it be used and who makes the decision?

An increase in accounts receivable is a negative factor, indicating that the company provides its customers with deferred payment in amounts exceeding the amount of funds received in the form of deferred payments from commercial creditors.

In analyzing the structure of the balance sheet liabilities, we pay attention to the amount of equity capital (authorized capital and accumulated profit). An increase in the share of funds and retained earnings indicates the effective operation of the enterprise.

In the structure of an enterprise's borrowed funds, we pay attention to the share of long-term loans and credits, as they increase the financial stability of the enterprise. An increase in short-term debt means a decrease in turnover.

According to the degree of liquidity, Assets are divided into:

- quickly implemented,

- averagely marketable,

- slow to implement

- difficult to implement.

According to the degree of urgency, Liabilities are divided into:

- short-term,

- mid-term,

- long-term

- permanent.

An enterprise must conduct its financial activities in such a way that the amounts of assets and liabilities of one group coincide. Which in reality is extremely rare.

Therefore, a financial condition in which:

- short-term financial investments, cash and short-term receivables are covered by short-term loans and accounts payable;

- inventories, long-term receivables and non-current assets are covered by the authorized capital, reserves and funds and retained earnings.

To correctly understand the structure of the balance sheet, it is necessary to understand that in different industries the same indicator can mean different results.

It is considered normal for trading enterprises if part of the inventory (goods for resale) is financed through accounts payable or short-term loans.

If such a situation arises at a manufacturing enterprise, this may mean that there is a threat to the solvency of the enterprise due to overstocking and lack of sales of products.

Financiers use the balance sheet to calculate the liquidity ratios, solvency and financial stability of the enterprise, as well as to calculate the net assets of the enterprise.

These ratios are especially important if the company intends to obtain borrowed funds from a credit institution (bank loan).

Balance sheet indicators allow you to create a reliable picture of the financial condition of the enterprise.

Calculation procedure and formula

To calculate retained earnings, you need to know its value at the beginning of the year, net profit (or loss) for the year and the amounts paid to owners.

For JSCs (joint stock companies) these are dividends to shareholders, and for LLCs (Limited Liability Companies) these are payments to the founders.

This data is taken from lines 1370 of the Balance Sheet and 2400 of the Income Statement. Interim payments during the year from future profits must be reflected in the order for the enterprise.

If a profit is made in the current year, then the calculation formula will be as follows:

NPoch.year = NPat the beginning of the year + Pnet. – Double, where NPat beg. year - retained earnings at the beginning of the year, Pchist. – net profit, Dvypl. – dividends paid to shareholders.

If there is a loss this year, the formula will change slightly:

NPoch.year = NPat the beginning of the year – Dec. – Dw., where Dec. – loss for the current year.

The value of NPotch.year may be negative if the loss for the current year is greater than the accumulated profit at the beginning of the year. Then this indicator will be called uncovered loss.

For enterprises of different forms of ownership, the formula may change, but the calculation principle is the same.

Operations on account 99 “Profits and losses”

During the reporting period, financial results of operations for ordinary activities are displayed on account 99 (from subaccount 90-9 “Profit/loss from sales”) and financial results from other income and expenses (from subaccount 91-9 “Balance of other income and expenses” ):

DEBIT 99 CREDIT 90-9 (91-9)

— the profit of the reporting period is revealed.

In the income statement, this figure is referred to as “earnings before taxes.”

The frequency of such procedures is determined by the company’s accounting policy, but most companies perform them monthly - in accordance with the rules in force before January 1, 2013 (the date the new Federal Law “On Accounting” came into force).

Let’s assume that the company does not apply PBU 18/02 “Accounting for corporate income tax calculations.” Then profit before tax should be reduced by the amount of income tax reflected in the tax return (clause 22 of PBU 18/02):

DEBIT 99 CREDIT 68 Sub-account “income tax”

— current income tax is accrued in the amount of calculated income tax.

In the same order, penalties for income tax are reflected, as well as fines related specifically to this tax and only to it (for non-payment or incomplete payment of this tax, for failure to submit a tax return, etc.).

After recognizing the debt to the budget for income tax, net profit remains in account 99.

note

Profit as an object of accounting refers to the sources of financing the activities of an economic entity (clause 4, article 5 of the Federal Law of November 6, 2011 No. 402-FZ “On Accounting”).

Note that under the conditions of application of PBU 18/02, the amount of current income tax is formed not only in account 99, but also with the involvement of accounts 09 “Deferred tax assets” and 77 “Deferred tax liabilities”. In this regard, the balance on account 99 will be different. But we will not go into such details.

Attention!

Mandatory payments similar to income tax should be considered a single tax on imputed income, a single agricultural tax, and a tax paid in connection with the use of a simplified taxation system.

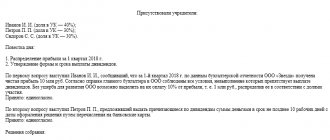

These taxes, as well as penalties and the amount of tax sanctions on them are reflected in the debit of account 99 in the same order as income tax (attachment to the letter of the Ministry of Finance of Russia dated December 28, 2016 No. 07-04-09/78875). The remaining tax sanctions, as well as penalties for other taxes, should be taken into account as part of other expenses. EXAMPLE 1. REFLECTING TAX SANCTIONS

Based on the results of an on-site audit of a company, an additional property tax was assessed in the amount of 30,000 rubles and, in this regard, penalties for arrears were accrued in the amount of 500 rubles, and a fine was imposed for non-payment of tax in the amount of 6,000 rubles (clause 1 of Art. 122 of the Tax Code of the Russian Federation). In addition, a fine was imposed for gross violation of the rules for accounting for income and expenses and taxable items in the amount of 10,000 rubles (clause 1 of Article 120 of the Tax Code of the Russian Federation). The accountant will reflect all these amounts as a debit to subaccount 91-2 “Other expenses” in correspondence with the corresponding subaccounts opened to synthetic account 68.

Previous reporting years

There are two possible ways to account for accumulated profits:

- cumulative,

- weather

With the first method, the division of profit for the reporting year and previous years by opening separate sub-accounts to account 84 is not carried out. It accumulates on a cumulative basis from the beginning of the operation of the enterprise. If a loss occurs, it is automatically covered by the existing profit of previous years. This is typical for small businesses.

The annual accounting method is distinguished by the presence of separate sub-accounts for synthetic accounting of accumulated profits in different periods.

Options for second-order accounts can be different, for example:

- account 84.1 – Retained earnings of the reporting year;

- account 84.3 – Retained earnings from previous years.

In both cases, the amount received in previous years is included in the calculation of the results for the reporting year.

To obtain detailed information, data from the following sources is required:

- explanatory note - can be attached to the balance sheet (except for small enterprises);

- accounting entries for account 84;

- reporting of previous years.

If errors are detected in the calculation of profit or loss for previous years, they will be taken into account in the financial result for the reporting year.

Bank's own funds

The structure of the bank's own funds is shown in Table 2.7.

Table 2.7 - Bank's own funds

| Liabilities | As of 01/01/2012 | As of 01/01/2013 | Changes, | ||

| million rubles | % | million rubles | % | million rubles | percent paragraph |

| Funds of shareholders (participants) | 23,92 | 18,15 | -5,76 | ||

| Own shares (shares) purchased from shareholders (participants) | 0,00 | 0,00 | 0,00 | ||

| Share premium | 28,40 | 21,55 | -6,84 | ||

| Reserve Fund | 1,92 | 2,14 | 0,22 | ||

| Revaluation at fair value of securities available for sale | -342 | -3,85 | 0,20 | 4,05 | |

| Revaluation of fixed assets | 14,03 | 10,60 | -5 | -3,42 | |

| Retained earnings (uncovered losses) of previous years | 17,71 | 26,37 | 8,67 | ||

| Unused profit (loss) for the reporting period | 17,89 | 20,98 | 3,10 | ||

| Total sources of own funds | — |

The share of own funds during the reporting period increased by 1.05 percentage points and amounted to 9.07%. The volume of own funds for the reporting year increased by RUB 2,821 million. and amounted to 11,705 million rubles. This deserves a positive assessment and indicates the stable and developing activities of the bank.

The largest share in the value of equity is occupied by unused profit (loss) of previous years. The share of unused profit for the reporting period increased by 8.67 percentage points and amounted to 26.37%. The profit volume increased by 1514 million rubles. and amounted to 3087 million rubles. Growth rate 196.28%.

The share of share premiums during the reporting period decreased by 6.84 percentage points and amounted to 21.55%. The volume of share premium for the reporting period did not change and amounted to 2523 million rubles.

The share of retained earnings for the reporting period increased by 3.10 percentage points and amounted to 20.98%. At the same time, the amount of retained earnings increased by 867 million rubles. and amounted to 2456 million rubles. The growth rate was 154.56%. The increase in profit from sales deserves a positive assessment, because indicates the stable and profitable operation of the bank.

The share of shareholders' funds during the reporting year decreased by 5.76 percentage points and amounted to 18.15%. Their value did not change during the reporting year and amounted to 2125 million rubles. This indicates stability in the bank's activities.

The volume of revaluation of equity during the reporting period decreased by 5 million rubles. and amounted to 1241 million rubles. Their share during the reporting year decreased by 3.42 percentage points and amounted to 10.68%. This decrease cannot indicate the bank’s efforts to reduce capital, since capital reduction due to the revaluation of fixed assets does not deprive of real money for business development.

A small share in the structure of own funds is occupied by the size of the reserve fund. The share of the reserve fund increased by 0.21 percentage points and amounted to 2.14%.

Directions for spending

After the balance sheet reformation, the chief accountant distributes the accumulated profit according to the decision of the owners of the enterprise. He has no right to do this on his own.

Compared to other items, it can be disposed of more freely, but within the framework of the company’s charter and the law. Typical entries for various areas of spending profit will be as follows:

- Dt84Kt84 – covering losses from past years. Also, this posting in the context of individual subaccounts of account 84 (for example, 84.2/84.3) can display investment in production through the acquisition of non-current assets;

- Dt84Kt82 – contributions to the reserve fund (creation or replenishment);

- Dt84Kt75 (80) – increase in the authorized capital (for an LLC on a loan account 75, and for a JSC – account 80);

- Dt84Kt83 – increase in additional capital.

It is not allowed to distribute profits if there is a debt on investment in the authorized capital (debit to account 75) of at least one of the owners. The same rule applies if the net assets of the enterprise are less (or will become less after the planned distribution of profits) of its authorized capital and reserve fund, as well as in the event of bankruptcy of the company. The same restrictions apply to the payment of dividends on shares.

For an LLC, the creation of a reserve fund is not necessary, but for a JSC its size must be specified in the charter (minimum 5% of the authorized capital). Enterprises in the LLC form can create various funds for spending profits (development, bonuses for employees, social sphere, charity). To reflect them in accounting, it is possible to open any subaccounts to the necessary accounts.

For JSCs, the law provides for the possibility of creating a fund to corporatize the company's employees. Cash from it is spent only on the purchase of securities from shareholders. In the future, employees of the company can buy out free shares.

Directing retained earnings into production (both assets and liabilities) is essentially open self-financing. This is also called reinvestment or hoarding.

The peculiarity of investing profits in the development of production is that the acquisition of property does not reduce the liabilities of the balance sheet. At the same time, the asset increases. In fact, the profit will be spent, but this will not reduce the amount of equity capital. The amounts of funds spent will be reflected in the subaccount of account 84. When the amount of accumulated profit ends (the balance of account 84 becomes a debit), then it will become clear that further investments in production are made with the help of working capital.

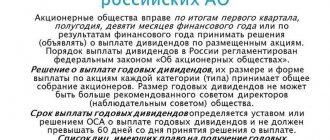

Payment of dividends in shares for the past year

In addition to the standard distribution of profits, the JSC has the right to issue dividends in shares. This option is possible if management wants to settle accounts with shareholders, but does not want to spend money on it.

For example, if the Board of Directors approves a 30% stock dividend, then each shareholder will receive 3 shares for every 10 shares held.

As a result of the transaction, neither the shareholder's share nor the total value of his shares changes, but the price of each share decreases.

Increase in additional capital

You can increase additional capital by revaluing fixed assets or intangible assets (IMA).

According to clause 15 of PBU 6/01 “Accounting for fixed assets,” a commercial organization can revalue groups of similar fixed assets at current (replacement) cost no more than once a year (at the beginning of the reporting year). The amount of revaluation of an object of fixed assets as a result of revaluation is credited to the additional capital of the organization. Similar standards for the revaluation of intangible assets are given in clauses 17 and 21 of PBU 14/2007 “Accounting for intangible assets”.

When making this decision, the following must be considered:

— subsequently, fixed assets and intangible assets are revalued regularly. The application of the right to revaluate assets, the procedure and frequency of its implementation are fixed in the accounting policies of the organization;

— on overvalued fixed assets you will have to pay more corporate property tax. According to paragraph 1 of Art. 374 of the Tax Code of the Russian Federation, the object of taxation for Russian organizations is movable and immovable property recorded on the balance sheet as fixed assets in the manner established for accounting. The very amount of tax can be accepted as expenses for the purposes of calculating income tax (clause 1, clause 1, article 264 of the Tax Code of the Russian Federation).

Taking this into account, the tax overspending will be:

- 1.76% of the amount of increase in additional capital by the amount of revaluation of fixed assets = 2.2% (the maximum rate of tax on property of organizations established by clause 1 of Article 380 of the Tax Code of the Russian Federation) x (1 - 0.2) (including tax profit rates of 20%);

— to carry out the revaluation of fixed assets or intangible assets, an appraiser’s report will be required.

It is possible to increase the additional capital of an LLC by making contributions to the property of the company by participants on the basis of Art. 27 of the LLC Law.

So, according to paragraphs 1, 3, 4 of Art. 27 of the Law, the participants of the company are obliged, if provided for by the charter, by decision of the general meeting of participants to make contributions to the property of the company. Such an obligation of participants may be provided for by the charter of the company upon its establishment or by introducing amendments to the charter by decision of the general meeting of the company’s participants, adopted unanimously by all participants. Contributions to the company's property are made in money, unless otherwise provided by the company's charter or a decision of the general meeting of participants. Contributions to the company's property do not change the size and nominal value of the participants' shares in the authorized capital of the company.

Contributions made to the property of the LLC are subject to reflection in the additional capital of the company. The procedure for reflecting contributions to the company's property in the financial statements under Art. 27 of the LLC Law is not regulated by law. However, since the list of transactions that form additional capital is open and there are corresponding explanations from the financial department (Letter of the Ministry of Finance of Russia dated April 13, 2005 N 07-05-06/107), it is advisable to include these amounts specifically in additional capital.

Betting, odds, formula

The reinvestment process is associated with the following key concepts:

- Reinvestment rate. Shows the percentage value that will be applied to the amount of invested funds when calculating income. The higher the rate, the greater the investor's profit.

- Reinvestment rate. Reflects the share of net profit that was allocated to a new investment round after receiving dividends. The indicator is calculated by dividing the value of reinvested funds by the amount of net profit.

When reinvesting interest, the term compound interest is used. Such interest rates are calculated using the formula:

SUM = X * (1 + %)n , where:

- SUM – total sum of calculations;

- X – initial investment amount;

- % - the value of the interest rate for the selected deposit program, calculated in annual percentages;

- n – number of years in the period (or months, quarters, weeks, years).

The formula for determining the rate on interest deposits with capitalization looks like this:

Rate = p * d / y , where:

- p – deposit interest rate, calculated as annual percentage/100;

- d – the period following which the capitalization of funds begins, expressed in days;

- y – calendar year, presented in days (365 or 366 days).

Increase in retained earnings (reduction of uncovered loss)

You can increase retained earnings or reduce losses by providing gratuitous assistance to participants (shareholders). However, this option may entail significant tax costs in the form of a 20% profit tax on the entire amount of gratuitous injections (clause 8 of Article 250 of the Tax Code of the Russian Federation).

It is possible to avoid significant tax losses only in the cases provided for in paragraphs. 11 clause 1 art. 251 Tax Code of the Russian Federation. In particular, income not taken into account when determining the tax base includes property received by a Russian organization free of charge:

- from an organization, if the authorized capital of the receiving party consists of more than 50% of the contribution (share) of the transferring organization;

- from an organization, if the authorized capital of the transferring party consists of more than 50% of the contribution (share) of the receiving organization;

- from an individual, if the authorized capital of the receiving party consists of more than 50% of the contribution (share) of this individual.

The only limitation is that the received property (except for funds) is not transferred to third parties within one year from the date of its receipt. In addition, it is necessary to take into account paragraphs. 4 paragraphs 1 art. 575 of the Civil Code of the Russian Federation, according to which donation is not allowed, with the exception of ordinary gifts, the value of which does not exceed 500 rubles, in relations between commercial organizations.

You should pay attention to ways to improve such an indicator as retained earnings (uncovered loss), reflected on line 470 of the balance sheet. This indicator characterizes the success of the company over a number of years. The resulting losses can be covered not only by injections from outside, but also by redistributing the structure of equity capital and reserves. Moreover, this will not affect the final value of net assets.

The main ways to cover losses are as follows:

1. Authorized capital. If the value of net assets becomes less than the authorized capital of the company, the difference is used to cover its losses (clause 4 of Article 90, clause 4 of Article 99 of the Civil Code of the Russian Federation, clauses 4, 5 of Article 35 of the Law on OJSC, clause 3 Article 20 of the LLC Law). An entry is made in the accounting records: D-t 80 “Authorized capital”, K-t 84 “Retained earnings (uncovered loss)”.

2. Reserve fund. According to paragraph 1 of Art. 35 of the Law on JSC, a reserve fund is created in the amount of at least 5% of its authorized capital through annual contributions of at least 5% of net profit until the amount established by the company’s charter is reached. One of the purposes of the reserve fund is to cover society's losses. The Law on LLC does not stipulate a detailed procedure for the creation and use of the reserve fund of an LLC, however, in practice, such companies, as a rule, enshrine in the charter and apply the procedure established by the Law on JSC.

3. Additional capital. An organization through reorganization can reclassify additional capital and reserves as retained earnings. When merging, joining, dividing, spinning off and transforming an organization, if the value of the net assets of the successor turns out to be greater than the amount of the authorized capital, then the difference is subject to settlement in the opening balance sheet in the section “Capital and reserves” with the numerical indicator “Retained earnings (uncovered loss)”. In case of conversion of shares, the difference that arises is attributed to additional capital (Order of the Ministry of Finance of Russia dated May 20, 2003 N 44n).

If there is a lot of retained earnings, then where is the money?

67.1 of the Civil Code of the Russian Federation, paragraphs. 11 clause 1 art. 48 of the Law of December 26, 1995 N 208-FZ “On Joint-Stock Companies” (hereinafter referred to as the Law on JSC), paragraphs. 7 paragraph 2 art. 33 of the Law of 02/08/1998 N 14-FZ “On Limited Liability Companies” (hereinafter referred to as the LLC Law)).

Accordingly, the accounting of the decisions of the participants (shareholders) will depend on the instructions that they record in the minutes of the general meeting and give to the management of the organization.

However, when making this decision, many, unfortunately, make mistakes. It is an accountant who can suggest the right decision to shareholders and participants. And our task is to help him with this.

What can and what should you spend retained earnings on?

The procedure for distribution of profits is regulated by the Laws on JSC and LLC. As for accounting, what you can spend retained earnings on is stated only in the annotation to account 84 in the Chart of Accounts. There are no further references to how retained earnings can be spent in accounting regulations.

So, let's see what the profits are spent on.

Reserve Fund

For joint-stock companies, the Law provides for the obligation to form a reserve fund from net profit. Its size must be at least 5% of the authorized capital of the company (Clause 1, Article 35 of the Law on JSC). The fund is “spent” to cover losses (in most cases), as well as to repurchase its own shares and redeem its own bonds (paragraph 3, paragraph 1, article 35 of the Law on JSC).

Limited liability companies, unlike joint stock companies, can create a reserve fund on a voluntary basis (Clause 1, Article 30 of the LLC Law). The size of the reserve, the amount of annual contributions to it and the purposes for which the fund can be spent (LLCs usually also use it to cover losses) are prescribed in the company's charter.

The reserve fund is created by posting:

Debit 84 “Retained earnings (uncovered loss)” Credit 82 “Reserve capital”.

In the balance sheet, just like retained earnings, it is reflected in section. III “Capital and reserves” on line 1360. Thus, part of the net profit is actually transferred to another item of capital. But at the same time, the structure of the balance sheet improves, since the owners are actually prohibited from withdrawing funds from the company’s turnover (for example, paying dividends) using the amount of the formed fund. We can say that the reserve fund is a kind of financial safety net for organizations.

Dividends

The owners can use the profit remaining after the formation of the reserve fund to pay dividends. It should be noted that this is the most common way to use profits. The accrual of dividends reduces retained earnings, and their payment leads to a decrease in the organization's assets (money or property).

In accounting, the accrual of dividends will be reflected in the following entry:

Debit 84 “Retained earnings (uncovered loss)” Credit 75 “Settlements with founders.”

Payment of dividends in cash should be reflected by the following entry:

Debit 75 “Settlements with founders” Credit 51 “Current accounts”.

If the money was previously withdrawn from the current account in order to issue it in cash, then the posting will be as follows:

Debit 75 “Settlements with founders” Credit 50 “Cash”.

Dividends can be paid not only in money, but also in property, because current legislation does not prohibit this. According to the Federal Tax Service of Russia, when transferring property to pay dividends, VAT must be charged (Letter of the Federal Tax Service of Russia dated May 15, 2014 N ГД-4-3/ [email protected] , agreed with the Ministry of Finance of Russia).

It should be noted that there are separate court decisions in which the arbitrators agree that the transfer of property for the payment of dividends is not a sale and is not recognized as subject to VAT (Resolution of the Federal Antimonopoly Service of the Ural District dated May 23, 2011 in case No. A07-14871/2010) . Therefore, if an organization does not include in the VAT base the value of property transferred to pay dividends, then it will most likely have to defend its position in court. But is it worth doing this? After all, if an organization decides to pay dividends in money, but it does not have any, then first it sells the property, calculates VAT on its sale, and only then transfers the funds to shareholders (participants). In other words, in any case, if there is no money, you will first have to pay VAT and only then settle accounts with the owners.

If goods or fixed assets, the sale of which is not subject to VAT (for example, land plots), are transferred as dividends, then VAT is not required.

The transfer of property to pay off debt on dividend payments is reflected in accounting as follows:

1) upon transfer of goods or finished products:

| Account correspondence | Contents of the fact of economic life | |

| Debit | Credit | |

| 90 (sub-account “Revenue”) | Revenue from the sale of goods is recognized | |

| 90-1 (sub-account “VAT”) | VAT reflected | |

| 90-2 (sub-account “Cost of sales”) | 41 “Goods” or 40 “Finished products” | The cost of goods or finished products is written off |

| 75 (sub-account “Settlements with founders for payment of dividends”) | 76 (sub-account “Settlements with various debtors and creditors”) | The debt to the participant for the payment of dividends is offset |

2) when transferring a fixed asset:

| Account correspondence | Contents of the fact of economic life | |

| Debit | Credit | |

| 75 (sub-account “Settlements with founders for payment of dividends”) | 91-1 (sub-account “Other income”) | The transfer of fixed assets for the payment of dividends is reflected |

| 91-2 (sub-account “Other expenses”) | VAT reflected | |

| 01 (sub-account “Disposal of fixed assets”) | 01 (sub-account “Fixed asset in operation”) | The initial cost of the fixed asset (FA) is reflected |

| 01 (sub-account “Disposal of fixed assets”) | The amount of accrued depreciation is written off | |

| 91-2 (sub-account “Other expenses”) | 01 (sub-account “Disposal of fixed assets”) | The residual value of fixed assets is recognized as expenses |

Is it legal to use profits differently?

Sometimes the owners of an organization make decisions to pay bonuses to employees, financial assistance, and the acquisition of fixed assets at the expense of profits. Some decide to create so-called consumption and accumulation funds. Is it correct?

First, let's look at expenses at the expense of profits. Firstly, the Laws on JSC and LLC do not provide for any payments from profits to anyone other than the owners. As we have already mentioned, this is the account of the owners; accordingly, only they have the right to receive dividends.

Secondly, the Russian Ministry of Finance has already repeatedly expressed the opinion that account 84 is not intended to reflect all kinds of social and charitable expenses, payments of material assistance and bonuses (Letters of the Russian Ministry of Finance dated June 19, 2008 N 07-05-06/138, dated December 19. 2008 N 07-05-06/260, etc.).

From the point of view of the financial department, the organization’s expenses for sporting events, recreation, entertainment, cultural and educational events and other similar events, as well as the organization’s transfer of funds (contributions, payments, etc.) related to charitable activities are other expenses and should be accounted for in account 91 “Other income and expenses”. Only the payment of dividends is not an expense of the organization; any other disposal of assets is an expense of the current period (clause 2 of the Accounting Regulations “Expenses of the Organization” PBU 10/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 33n).

Therefore, all kinds of bonuses, financial assistance and charity expenses will also affect the organization’s net profit, but only during the period of these expenses. They have nothing to do with last year's net profit.

Thus, all kinds of payments from net profit, with the exception of dividends, are illegal .

As for the formation of the consumption fund at the expense of net profit, this is simply an echo of Soviet accounting. Then real money was transferred to the production development funds, which were kept in the bank separately from the organization’s funds, and it was with this money that fixed assets were purchased (commentary to account 87 of the no longer valid Instructions for the application of the Chart of Accounts for accounting of production and economic activities of associations, enterprises and organizations, approved by Order of the USSR Ministry of Finance dated March 28, 1985 N 40). Today, no one transfers money intended for the development of production anywhere.

When purchasing fixed assets, organizations simply spend funds from the current account and one asset (money) is exchanged for another (fixed asset). Account 84 is not used at all in postings. Therefore, if the owners of the organization decide to direct profit to the development of production, and the accountant makes an entry in the accounts Debit 84, subaccount “Profit for distribution”, Credit 84 “Reserved profit”, this does not affect the final balance on the credit of account 84.

This posting, by and large, only indicates that the owners refused to receive dividends this year and decided not to withdraw funds from the company’s turnover. But such a decision will allow the organization to improve the structure of its balance sheet and make its financial position more stable. But since the final balance on the credit of account 84 will not change, nothing prevents the owners of the organization from distributing in the future the profit reflected in the balance sheet as undistributed.

Is it possible to distribute profits from previous years?

Another question that worries both owners and accountants: is it possible to distribute profits from previous years as dividends? The answer is yes. Can. After all, neither tax nor civil legislation contains restrictions on the payment of dividends from the profits of previous years. Therefore, if an organization has “accumulated” profits from previous years, the general meeting of shareholders (participants) can use it to pay dividends.

Neither the regulatory authorities object to this (clause 1 of the Letter of the Federal Tax Service of Russia dated 05.10.2011 N ED-4-3/ [email protected] , Letter of the Ministry of Finance of Russia dated 20.03.2012 N 03-03-06/1/133), nor courts (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 25, 2013 N 18087/12, Decision of the Supreme Arbitration Court of the Russian Federation dated November 29, 2012 N VAS-13840/12). The Supreme Arbitration Court of the Russian Federation came to the conclusion that, by their economic nature, net profit and retained earnings are identical, therefore nothing prevents the owners from deciding to pay dividends not only from the net profit of the reporting year, but also from the retained earnings of previous years.

If you do not find the information you need on this page, try using the site search:

A balance sheet is a final document that allows you to understand the financial condition of an enterprise. It is an analysis of the company's assets, the sources of these assets, as well as the company's liabilities.

Assets are the resources of an enterprise; they are capable of generating economic benefits. Balance sheet items are arranged from less liquid to more liquid:

- fixed assets and unfinished capital construction,

- stocks and goods,

- cash.

Liabilities are the sources of formation of assets:

- accumulated profit of the enterprise,

- loans and credits,

- accounts payable.

Balance sheet items are arranged according to the degree of urgency of return.

All articles have data for 3 reporting periods (3 calendar years). It is the availability of data for several periods that makes balance sheet analysis possible.

It is customary to carry out horizontal analysis (analysis of balance sheet items) and vertical analysis (analysis of changes over time in the share of each balance sheet item).

The following is a general description of the balance.

The correctness of the document is visually checked, all required details, signatures and seals are filled out.

There is a change in the balance sheet currency (if the balance sheet currency has decreased, this is an alarming sign).

Balance sheet structure. Analysis of the structure of Assets. The ratio of current and non-current assets.

Studying the composition of non-current assets, determining the share of fixed assets. If the share of fixed assets in the composition of non-current assets is large, then in order to maintain financial stability the enterprise must have a high share of equity capital as the main source of financing. Studying the composition of current assets, determining the status of settlements with consumers.

Increase in deferred income

Deferred income includes:

1) income received in the reporting period, but relating to future reporting periods: rent or apartment payments, utility bills, revenue for freight transportation, for passenger transportation on monthly and quarterly tickets, subscription fees for the use of communications equipment, etc.;

2) the value of assets received by the organization free of charge;

3) receipts of debt for shortfalls identified in previous years, the movement of upcoming receipts of debt for shortfalls identified in the reporting period for previous years is taken into account;

4) the difference between the amount recovered from the guilty persons for missing material and other assets and the cost listed in the organization’s accounting records.

When leasing, deferred income arises in the lessor's balance sheet when the leased asset is transferred to the lessee's balance sheet in the amount of the difference between the total amount of lease payments according to the leasing agreement and the cost of the leased property (clause 4 of Order of the Ministry of Finance of Russia dated February 17, 1997 N 15 “On reflection in accounting operations under a leasing agreement").

In practice, sometimes deferred income is classified as accounts payable or other liabilities, thereby unlawfully reducing the value of the company's net assets. Thus, if an organization does not have enough net assets, it is necessary to reconsider accounts payable and other liabilities for their qualification as deferred income.

Dynamics of decrease or increase in retained earnings

3. Dynamics of decrease or increase in the volume of retained earnings.

In 2005, compared to 2003, the volume of retained earnings decreased by 71%, and compared to 2004, decreased by 31%. A decrease in profit indicates a deterioration in the ability to replenish working and fixed assets for the organization’s sustainable economic activities.

Table 3

Balance sheet structure analysis

| Indicators from the balance sheet form No. 1 | Previous years | Reporting year | Changes compared to the reporting year (+,-) | |||||

| thousand roubles. 2003 | % to balance | thousand roubles. 2004 | % to balance | thousand roubles. 2005 year | % to balance | 7-3 | 7-5 | |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| Assets | ||||||||

| I. Non-current assets | 23451 | 72 | 24952 | 71 | 26651 | 69,31 | -2,69 | -1,69 |

| including: — fixed assets; | 23267 | 71 | 24399 | 70 | 26166 | 68,05 | -2,95 | -1,95 |

| - long-term financial investments | — | — | — | — | — | — | — | |

| 2. Current assets | 9200 | 28,18 | 9875 | 28,35 | 11803 | 30,69 | 2,51 | 2,34 |

| including: - reserves; | 8399 | 25,72 | 9034 | 25,94 | 10476 | 27,24 | 1,52 | 1,3 |

| — accounts receivable up to a year; | 645 | 1,98 | 832 | 2,39 | 1089 | 2,83 | 0,85 | 0,44 |

| — short-term financial investments; | — | — | — | — | — | — | — | — |

| - cash | 68 | 0,21 | 9 | 0,03 | 238 | 0,62 | 0,41 | 0,59 |

| Balance (I + II) | 32651 | 32651 | 34827 | 34827 | 38454 | 38454 | — | — |

| III. Capital and reserves | 20202 | 61,9 | 23536 | 67,6 | 22933 | 59,64 | -2,26 | -7,96 |

| including: — authorized capital; | 5573 | 17,06 | 5573 | 16 | 5573 | 14,5 | -2,56 | -1,5 |

| - Extra capital; | 22306 | 68,32 | 21193 | 60,85 | 19596 | 51 | -17,32 | -9,85 |

| - Reserve capital; | 2 | 0,006 | 2 | 0,006 | — | — | — | — |

| — retained earnings (uncovered loss] | (7679) | -23,52 | (3232) | -9,28 | (2236) | -5,8 | -29,32 | -15,08 |

| IV Long-term liabilities | 535 | 1,64 | 4871 | 14 | 7014 | 18,24 | 16,6 | 4,24 |

| V. Current liabilities | 11914 | 36,5 | 6420 | 18,43 | 8507 | 22,12 | -14,38 | 3,69 |

| including: - loans and credits; | — | — | 350 | 1,005 | 350 | 0,91 | — | -0,095 |

| - accounts payable | 11914 | 36,5 | 6070 | 17,43 | 8157 | 21,21 | -15,29 | 3,78 |

| Balance (III + IV + V) | 32651 | 32651 | 34827 | 34827 | 38454 | 38454 | — | — |

| Table 4 Analysis of the structure of indicators of form No. 2 | ||||||||

| Indicators of form No. 2 | Previous years | Reporting year | Changes in relation to the reporting year (+; -) | |||||

| thousand roubles. 2003 | % of revenue | thousand roubles. 2004 | % of revenue | thousand roubles. 2005 year | % of revenue | 7-3 | 7-5 | |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| Sales revenue | 13803 | 100 | 17983 | 100 | 18954 | 100 | ||

| Product cost | 14690 | 106,43 | 17954 | 99,84 | 19439 | 102,56 | -3,87 | 2,72 |

| Gross profit | — | — | 28 | 0,16 | 485 | 2,56 | — | 2,4 |

| Expenses (commercial and administrative) | — | — | — | — | — | — | — | — |

| Profit (loss) from sales | (887) | -6,43 | 28 | 0,16 | 485 | 2,56 | 8,99 | 2,4 |

The table shows that the share of fixed assets has decreased, the share of working capital has increased. At the same time, the share of receivables and inventories increased while the cost of products decreased, which indicates the immobilization of working capital. Considering the liabilities of the balance sheet, it should be noted the low share of capital and reserves. The negative point is the increase in the share of accounts payable.

4. The ratio of items that make up non-current assets.

Table 3 shows a decrease in the volume of fixed assets, which indicates the disposal of fixed assets or the absence of a policy for the purchase of modern equipment.

5. Change in the structure of total assets.

An increase in the share of current assets in total assets indicates an increase in the mobility of the organization's property.

6. Change in the structure of current assets.

An increase in the share of receivables indicates problems associated with consumer payments for products and services. An increase in the share of cash also indicates an increase in own working capital.

7. Rate of change in inventories.

Tables 1 and 2 show a faster growth in the rate of inventory value compared to the growth rate of revenue and profit, which indicates a decrease in the rate of inventory turnover, which is a negative sign for the organization.

8. Change in debt balance.

According to Table 1, there is a passive balance (accounts payable exceed receivables). It can be argued that this indicates negative trends in the development of the organization.

9. Change in equity capital and reserves.

A decrease in the share of equity capital and reserves indicates a deterioration in the financial stability of the organization.

10. Change in the share of short-term borrowed funds.

An increase in the share of short-term borrowed funds compared to the increase in the share of profit in revenue by 2005 indicates an increase in the financial instability of the organization.

Conclusion: after conducting a horizontal and vertical analysis, we can conclude that the enterprise is solvent for this period, because assets are greater than external liabilities. Accordingly, the share of risk is not significant, however, for some items there is a decrease, which in the future can lead to financial instability of the enterprise. But at the same time, there is also an increase in cash and current assets, which indicates the potential of the enterprise, as well as increased stability.

Information about the work “Anti-crisis management” Section: Management Number of characters with spaces: 43438 Number of tables: 25 Number of images: 0

Similar works

249674 0 0

... out of crisis. In the fight against the threat of bankruptcy, an enterprise must rely exclusively on internal financial capabilities. The above principles are the basis for organizing anti-crisis management of an enterprise. Now let's touch on the question of what role financial management plays in crisis management. Almost all of the above authors agree that...

175282 0 0

... management mechanism, anti-crisis managers and auditors pursue the goal of establishing compliance between the system of anti-crisis measures and the chosen financial development strategy. Chapter 3 Crisis management in Russia: support mechanisms 3.1 Institutional support mechanisms Many organizations have encountered one or another crisis situation as a result of their activities. ...

136479 3 0

... the function is strategic, i.e. ensuring timely effective transformation of the economy for the purpose of sustainable growth not only in the current period, but also in the future. This function is especially significant in the transitive economy of Russia, since the transition to a market intensifies crisis processes and aggravates conflicting interests of business entities. In addition, market conditions are changing rapidly and these...

172011 4 0

... the activity of the enterprise (turnover ratio) in the financial aspect; return on capital in search of reserves.” 2.2 Development of a marketing strategy and a controlling system in anti-crisis management of an enterprise It has been noted more than once that in the context of the transformation of the Russian economy in the activities of business entities, the uncertainty factor has significantly increased, increased ...

Retained earnings: problems of accounting and use

Studying the structure of the balance sheet liability allows us to establish one of the possible reasons for the financial instability of an enterprise, which can lead to its insolvency. This reason may be the high share of borrowed funds (over 50%) in the structure of sources of financing economic activities. At the same time, an increase in the share of own sources in the liability currency of the balance sheet indicates increased financial stability and independence of the enterprise from borrowed and raised funds. At the same time, the presence of retained earnings can be considered as a source of replenishment of working capital.

Studying the structure of the balance sheet liability allows us to establish one of the possible reasons for the financial instability of the enterprise, which led to its insolvency. This reason may be the high share of borrowed funds (over 50%) in the structure of sources of financing economic activities. At the same time, an increase in the share of own sources in the liability currency of the balance sheet indicates increased financial stability and independence of the enterprise from borrowed and raised funds. At the same time, the presence of retained earnings can be considered as a source of replenishment of working capital. The assets of the enterprise and their structure are studied both from the point of view of their participation in the production process and from the point of view of assessing their liquidity. The most easily realizable assets include cash and short-term securities; The most difficult to sell assets include fixed assets and other non-current assets.

Pages: 1