Dividends - what is it?

Dividends are the profits of privately owned enterprises that remain after mandatory deductions: taxes, contributions, loan payments, wages, bonuses. It consists of the income received by the company for a specific period of time. By decision of the meeting of founders, profits are distributed among the persons who invested their money in its development.

People who invest money in a company are called investors. In a Limited Liability Company, these are the founders, participants, and shareholders. In a joint stock company, there are shareholders. Cash profits (dividends) are distributed among partners, stockholders, bondholders according to the share contributed by each of them to the enterprise. — Dividends are not subject to insurance premiums, since the profit distributed among investors reflects the property, and not the labor, form of the relationship.

Features of calculation and payment

Profit is distributed not only from the current year, but also across previous reporting periods. For example, if previously income was not distributed in different directions. The general meeting of shareholders or members must make a final decision as to whether the matter is worth pursuing at this time.

The decision must be formalized using a protocol form. Otherwise, the accounting department will not be able to draw up documents and record the business transaction at all.

Dividends are also not included in the 4-FSS report.

You need to know exactly how much profit you're making in order to make decisions about how it's distributed. It is much easier to look at the financial statements; in other cases, it is difficult to find answers.

Section 3 of the accounting report should describe such phenomena in detail. The presence of a bracket indicates an undistributed loss. All amounts must be indicated for a specific date. If the amount was not distributed in previous periods, then information about it is also displayed in full.

Important! Determining net profit for a specific period is the most important issue. The income statement should contain a detailed description of the required figures.

Are insurance premiums charged?

The Tax Code provides comprehensive information on the types of income from which mandatory contributions are made to extra-budgetary funds. To answer the question “Are dividends subject to insurance contributions or not?”, you need to study the list of types of earnings from which interest is taken in the Social Insurance Fund, the Pension Fund of the Russian Federation, the Unified Social Tax is subject to:

- salaries;

- bonuses;

- payment under the contract;

- fees.

Contributions to the Social Insurance Fund, Pension Fund and other non-budgetary organizations are levied on all types of cash payments received under an employment agreement. From this list you can see what income is not eligible for insurance premiums. For the reason that they are issued not for labor, but for monetary capital invested in the enterprise. If an employee or manager turns out to be its investor, contributions to the Social Insurance Fund and the Pension Fund of the Russian Federation are made from his salary, bonuses and other payments required by the state. Insurance premiums are not collected from the founder's dividends.

Errors and other nuances

When calculating profits, one cannot do without the human factor. For example, some areas of activity are not taken into account at all. Net profit is distorted even with the slightest errors and problems.

To ensure that the numbers correspond to reality, the founder and chief accountant make adjustments.

After eliminating the errors, two situations arise:

- Understatement of net profit. The recalculation was carried out, but an additional amount of income appeared. There are no problems; the income received is simply distributed for specific needs.

- Dividends are overpaid, results are overstated. Net profit of the next period is reduced due to overpayment in the current one. Owners receive smaller amounts for redistribution.

Net assets in this case are the difference between the company's current assets and debts. According to the final line of the third section, this information is displayed in the balance sheet.

Retained earnings influence such phenomena. You need to find out in advance what requirements for net profit are established at the legislative level. Usually this is equal to the authorized capital, or net profit must be greater than it. Sometimes there are problems with this, because many companies have an authorized capital of no more than 10 thousand rubles.

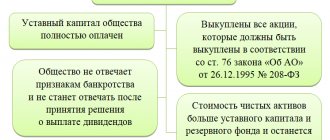

Only when problem situations are prolonged do negative consequences arise, such as liquidation of the company and other serious punishments. Until the authorized capital is paid, dividends are also not transferred to anyone, this is the basic rule. Therefore, the value of net assets requires additional control.

Corporate legislation and the charter of a legal entity must fully describe the procedure for paying dividends. The state cares little about how exactly the money is distributed. That is why it is so important to gather meetings of the founders, for which official documents are then drawn up.

An oral decision is acceptable, but it also causes problems. There is a high probability that one of the participants will go to court to restore their rights. You cannot refer in court to a decision that is not recorded in writing. And business transactions are recorded on the basis of primary documents. At the same time, the accountant himself is deprived of the right to distribute and pay dividends. This still requires a decision from the general meeting.

At the same time, the organization itself can not only pay dividends, but also receive them. Therefore plays the role of tax payer or agent depending on the circumstances. 6% is the maximum rate if the profit is related to Russian sources, 15% if it is from foreign sources. A 30% rate is imposed on the income of those persons who are not recognized as official residents of the state.

It is also useful to read: Contributions of individual entrepreneurs to the Pension Fund of Russia

Dividends in RSV

Calculation of insurance contributions - a consolidated, individual report on mandatory monetary contributions of the company, employee to the Social Insurance Fund, Pension Fund, Compulsory Medical Insurance.

Are dividends reflected in the calculation of insurance premiums in 2019? The articles of the Tax Code and the letter from the Social Insurance Fund show that the DAM must include information about deductions from those types of earnings that are subject to insurance contributions. Dividends are not reflected in the DAM, because their payments are not regulated by labor relations. Information about the amounts paid to shareholders is not reflected in the calculation of insurance premiums.

conclusions

So, are dividends subject to insurance premiums in 2019?

- Cash income received by investors, depositors, and shareholders as profit is not subject to contributions to the Unified Social Tax, because it is accrued not for work, but for investments.

- The amount of payments depends on the amount of funds invested in the company by each participant. The contribution may be expressed in value, number of shares, denomination of bonds or other securities held by these persons.

The rule is valid for deductions to the Pension Fund and other public funds.

Dividends are not subject to insurance premiums in 2021 on the basis of: clause 1 of Art. 236, paragraph 4 of Article 420 of the Tax Code of the Russian Federation, as well as Letter of the Federal Tax Service No. 015-03-11/08-13985. The only tax paid is personal income tax for individuals and income tax for legal entities.

Become an author

Become an expert

Deadline for transferring income tax withheld from dividends

When paying dividends from profits of previous years, organizations have to face problems of taxation of such payments.

As noted above, paragraph 3 of Art. 284 of the Tax Code of the Russian Federation determines that the following rates should be applied to dividends:

- 9% - on income received in the form of dividends from Russian and foreign organizations by Russian organizations;

- 0% - for income received by Russian organizations in the form of dividends, provided that on the day the decision is made to pay them, the company has continuously owned, for at least 365 calendar days, at least a 50% contribution to the capital of the organization that is the source of the dividends or depositary receipts giving the right to receive dividends in an amount corresponding to at least 50% of the total amount of dividends paid by the organization;

- 15% - on income received in the form of dividends from Russian organizations by foreign companies.

For the purpose of calculating income tax on income in the form of dividends received by Russian organizations from other (Russian or foreign) companies, a tax rate of 0% may be applied. To do this, on the day the decision to pay dividends is made, the organization receiving dividends must:

- for at least 365 calendar days, continuously own by right of ownership a contribution (share) in the authorized (share) capital (fund) of an organization paying dividends or depository receipts giving the right to receive dividends;

- the share of such participation must be at least 50 percent contribution (shares) in the authorized (share) capital (fund) of the organization paying dividends, and depository receipts must give the right to receive dividends in an amount corresponding to at least 50% of the total amount paid by the organization dividends;

- when dividends are paid by a foreign organization, a zero rate is applied if the state of permanent residence of the foreign company is not included in the List of offshore zones approved by Order of the Ministry of Finance of Russia dated November 13, 2007 N 108n.

The law does not provide for any additional conditions for the application of this income tax benefit, including the payment of dividends from last year’s profits.

Basis - pp. 1 clause 3 art. 284 of the Tax Code of the Russian Federation as amended by Federal Law No. 368-FZ of December 27, 2009, in force since January 1, 2011 and extending to legal relations regarding the taxation of income tax on income in the form of dividends accrued based on the results of organizations’ activities for 2010 and subsequent periods ( see Letters of the Ministry of Finance of Russia dated 09/08/2011 N 03-03-06/1/541, dated 06/21/2011 N 03-03-06/1/368).

Profit based on the results of activities for 2011, directed on the basis of the decision of the company's participants to pay dividends, is determined according to accounting data in the manner established by clause 79 of the Regulations on maintaining accounting and financial reporting in the Russian Federation, approved by Order of the Ministry of Finance of Russia dated July 29.

1998 N 34n, and clause 21 of the Accounting Regulations “Accounting Statements of an Organization” (PBU 4/99), approved by Order of the Ministry of Finance of Russia dated 07/06/1999 N 43n, and is reflected in the profit and loss statement for 2011 (form according to OKUD 0710002, approved in Appendix No. 1 to Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n).

In this regard, retained earnings for 2009 and 2010 according to paragraph 3 of Art. 284 of the Tax Code of the Russian Federation cannot be attributed to profit accrued based on the results of the organization’s activities in 2011.

Taxation of dividends paid by a taxpayer on the basis of a decision made in 2011, but relating to profits received based on the results of 2009 and 2010, is carried out in accordance with the generally established procedure using a tax rate of 9%. It is this conclusion that meets the norms of the legislation on taxes and fees (see Letters of the Ministry of Finance of Russia dated 09/08/2011 N 03-03-06/1/541, dated 06/21/2011 N 03-03-06/1/368, dated 04/06/2010 N 03-03-06/1/235).

Let's see whether the organization has the right to apply reduced income tax rates if the founders decided to distribute dividends disproportionately to contributions to the authorized capital.

It is safer to withhold income tax at the rates established for dividends only from that part of them that is proportional to the participant’s share. After all, according to the Tax Code of the Russian Federation, precisely such income is considered a dividend (clause 1 of Article 43 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated June 24, 2008 N 03-03-06/1/366).

A different position will most likely have to be defended in arbitration court. Judicial practice is not in favor of organizations (see Resolution of the Federal Antimonopoly Service of the Moscow District dated May 25, 2009 N KA-A41/4239-09 in case N A41-20203/08).

Starting from January 1, 2011, the income tax withheld from dividends must be transferred to the budget no later than the day following the day of payment of dividends. Basis - clause 2, 4 art. 287 Tax Code of the Russian Federation, clause 32 art. 2 of the Federal Law of July 27, 2010 N 229-FZ “On amendments to part one and part two of the Tax Code of the Russian Federation and some other legislative acts of the Russian Federation, as well as on the recognition as invalid of certain legislative acts (provisions of legislative acts) of the Russian Federation in connection with the settlement of debts on taxes, fees, penalties and fines and some other issues of tax administration.”

According to paragraphs 1 and 2 of Art. 28 of the Law on Limited Liability Companies, a company has the right to make a decision quarterly, once every six months or once a year on the distribution of its net profit among the participants of the company. The decision to determine the part of the company's profit distributed among the company's participants is made by the general meeting of the company's participants.

The term and procedure for payment of distributed profit are determined by the company's charter or a decision of the general meeting of company participants. The period for payment of part of the distributed profit of the company should not exceed 60 days from the date of the decision on the distribution of profit between the participants of the company (clause 3 of Article 28 of the Law on Limited Liability Companies).

Each member of the company is obliged to promptly inform the company about changes in their data. If a company participant fails to provide information about changes in information about himself, the company is not liable for losses caused in connection with this (Clause 3, Article 31.1 of the Law on Limited Liability Companies).

From January 1, 2011 Art. 28 of the Law on Limited Liability Companies has been supplemented with clause 4, according to which, if dividends are not paid to a company participant within the period established by the company’s charter and he has not applied for their payment within the next three years (unless a longer period is established charter of the company), the part of the profit distributed and not claimed by the participant is restored as part of the retained profit of the company (Part 2 of Art.

Let us note that the provisions of paragraph 4 of Art. 28 of the Law on Limited Liability Companies (as amended on December 28, 2010 N 409-FZ) apply to claims the deadline for submission of which has not expired before the date of entry into force of the Federal Law dated December 28, 2010 N 409-FZ - December 31, 2010. (Part 3 of Article 4 of the Federal Law of December 28.

The amount of profit restored as part of retained earnings is not taken into account as income (clause 3.4, clause 1, article 251 of the Tax Code of the Russian Federation).

At the same time, according to clause 18 of Art. 250 of the Tax Code of the Russian Federation for profit tax purposes, non-operating income includes income in the form of amounts of accounts payable (liabilities to creditors) written off due to the expiration of the statute of limitations or for other reasons, except for the cases provided for in paragraphs. 21 clause 1 art. 251 Tax Code of the Russian Federation.

The limitation period is the period for protecting the right under the claim of a person whose right has been violated. In accordance with Art. 196 of the Civil Code of the Russian Federation (Civil Code of the Russian Federation), the general limitation period is established at three years.

The legislation of the Russian Federation does not provide for a special limitation period for claims for the company to pay dividends to its participants.

Thus, in relation to the company’s obligations to pay declared dividends, the general limitation period is set at three years. Once the statute of limitations has expired, the right to receive dividends cannot be protected in court.

Consequently, the amounts of dividends not claimed by the company's participants after the expiration of the limitation period calculated in accordance with the Civil Code of the Russian Federation are subject to inclusion in non-operating income.

Considering that the company acts as a tax agent for income tax on income in the form of dividends only when they are paid (clause 2 of article 275, clause 4 of article 287 of the Tax Code of the Russian Federation), double taxation in the case of taking into account amounts accrued, but not dividends paid within a three-year period do not appear as part of non-operating income (see Letters of the Ministry of Finance of Russia dated 02/14/2006 N 03-03-04/1/110, Federal Tax Service of Russia for Moscow dated 06/15/2010 N 16-15/).

In practice, a situation may arise in which an organization paid interim dividends during the year, but based on the results of work for the financial year, no profit was received. In such a situation, it is necessary to recalculate the amount of personal income tax from 9% to 13%. After all, in this case it will not be possible to take advantage of the preferential rate established for dividends. In this regard, the accountant usually has the following questions:

- what is the correct thing to do - add an additional 4% and transfer it to the budget and write a letter to the tax office about offset of personal income tax from 9% to 13%, or transfer 13% to the budget and return 9%;

- Is it necessary to submit a tax return in Form N 3-NDFL to founders - individuals who are not employees of the organization, if the tax agent does not have the opportunity to withhold personal income tax from them?