Normative base

The main regulatory framework is the laws “On Joint Stock Companies” and “On Limited Liability Companies”, as well as part of the Tax Code. This also includes Law No. 402-FZ, because it determines the documents regulating accounting, on the basis of which profit is calculated.

It is interesting that the laws on companies do not directly define the concept of “dividends”. It is disclosed only in the first part of the Tax Code.

A dividend is any income received by a shareholder/participant from an organization when distributing profits remaining after taxation (including in the form of interest on preferred shares) on shares/shares owned by the shareholder/participant in proportion to their shares/shares in the authorized/share capital.

Dividend payment procedure

As a rule, dividends are paid in cash, since payment in property (which is allowed by law) is equated to sale and turns out to be unfavorable for taxation.

The issuance of money should be carried out within the time frame counted in a joint-stock company from the day on which the list of shareholders was formed, and in an LLC - from the date of the decision on payment. For an LLC, this period will be 60 calendar days, and for a JSC there will be 2 options, estimated in working days:

- 10 days - for payments to nominee holders and trustees;

- 25 - for payment to other shareholders.

A shareholder (participant) who has not received his share of dividends within the specified period has the right to claim it within 3 (or 5, if specified in the charter) years, determined from the date:

- payment resolution adopted by shareholders;

- corresponding to the end of the 60-day period allotted for the payment of income to LLC participants.

After the expiration of 3 (or 5) years, unpaid dividend amounts are credited back to the company’s net profit.

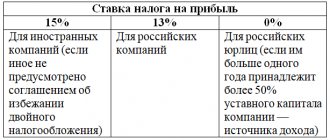

When paying, personal income tax (for an individual recipient) or income tax (for a legal entity recipient) will be withheld from the amounts of income issued. The rate of both taxes will be 13% for resident recipients and 15% for non-residents, as well as for the payment of dividends in the amount of 5 million rubles. and higher. If the payment is made to a legal entity that has been the owner of more than half of the share in the authorized capital of the company paying the dividends for at least 1 year, then a 0% rate may be applied to the payment.

Is the payment of dividends in the 1st quarter reflected in sheet 03 of the semi-annual income tax return? The answer to this question is in ConsultantPlus. Learn the material by getting trial access to the system for free.

Read more about the nuances of calculating taxes on dividends in the publication “How to correctly calculate the tax on dividends?”

What dividends can there be?

For convenience, we have collected all the information in a table:

| By payment method | By payment amount | By payment frequency | By type of shares | |||

| Cash bonuses | Enterprise property | Full | Partial | Quarterly, semi-annual, annual | Regular | Privileged |

| Payments are made in cash equivalent | The organization puts into circulation additional shares through transfer to shareholders | One-time payments | Paid in installments throughout the year | Dividends are distributed by the board of directors | Shares are enshrined in the charter of the enterprise, their profitability is higher and there are advantages in the order in which they are received | |

In what cases can a company not pay dividends?

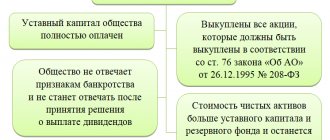

According to the Law “On Joint Stock Companies”, declared dividends on shares cannot be paid in the following cases:

- the company has signs of bankruptcy;

- the company will go bankrupt when paying these dividends;

- the value of the company's net assets is less than the sum of its authorized capital and reserve fund;

- the value of the company's net assets will become less than the above amount as a result of the payment of dividends.

In fact, all this can be boiled down to one thing - dividends are not paid in the case where the payment will lead to serious consequences for the organization or an increase in the risks of such consequences.

Legal restrictions

There are no direct legal restrictions on payments in different reporting periods. Those. Interim dividends can be paid several times a year, but subject to certain rules.

However, other cases may arise when interim or annual dividends cannot be paid for other reasons, which I will discuss in detail below.

Taxation of dividends and other payments

Interim dividends and other payments are taxed at a rate of 13%. For foreign participants this rate is 15%.

When divas are paid, the tax agent immediately transfers the necessary funds to the Federal Tax Service, so the individual receives payments already “cleared” of taxes.

Let me give you a simple example. There is a share X, it costs 100 rubles. The dividend is paid 2 times a year. Accrual periods: 1st quarter (interim dividend for the reporting 3 months) and payment for the year (accruals for 12 months). The first dividend is 5 rubles, for the second period 5 rubles are also paid. The final nominal amount of dividend payments for the year will be equal to 10 rubles.

Those. The nominal return for the year will be (10/100) * 100% = 10%.

But the real return, taking into account taxes paid, will be (10/100) * 100% * 0.87 = 8.7 rubles or 8.7% per year.

Interim dividends and insurance premiums

Insurance premiums will not be charged either when interim dividends are paid or when annual dividends are paid.

Insurance premiums are recognized exclusively in cases of labor relations or civil agreements, the meaning of which is to perform work or services for a certain fee and within a specified time frame.

When an investor buys a security or the right to own part of a joint stock company, which is equivalent in meaning, the civil law relations described above do not arise.

In very simple words, insurance premiums are paid from wages, but are not subject to deduction from dividends.

Frequency of dividend payments

In accordance with the legislation on joint stock companies, the issuer may pay interim dividends for the following periods:

- quarter;

- half year;

- nine month;

- year.

How to calculate dividend payments

The amount of accruals can be assumed relative to the dividend policy set by the issuers themselves. This is an optional measure, but many people use it to improve the attractiveness of their securities.

Everything is simple here. For example, an organization has established a standard for div. policy of 50%. Those. when you earn 100 rubles. the total amount of payments will be 50 rubles, and if the company has 100 shares in circulation, then 50/100 = 0.5 rubles will be paid for each security.

Now for a real and slightly more complex example, in which I will show how interim and annual dividends were paid in the mining industry for 2021.

Let me make a reservation right away that the issuer adheres to the procedure for calculating semi-annual dividends, which are formally paid not from profits, but are tied to EBITDA for the reporting period. However, the legal basis for payments is still recognized as the profit of the company.

As a result, in 2021, 1 interim dividend and 1 annual dividend were paid. They are shown in the table below:

| Accrual period | Total amount of dividends, billion rubles. | Dividend per share, rub. | Company profit (PE) for the period, billion rubles. | % of emergency | EBITDA for the period, billion rubles. | % of EBITDA |

| For 2021 | 125, 45 | 792,52 | 98,0 | 128% | 182,6 | 68,7% |

| In 6 months 2021 | 122, 8 | 776,02 | 91,5 | 134,2% | 206,5 | 59,5% |

The issuer has 158,245,476 ordinary shares in circulation. As a result, 248.25 billion rubles were paid for the current year, which is 1568.54 rubles. per one ordinary share.

Risks associated with the payment of interim dividends

There are cases when a company pays interim dividends to shareholders for a quarter, half a year or 9 months, but after that an annual loss is recorded. In this case, there is a risk that this accounting entry will lead to an increase in accrued tax costs.

This problem can be solved quite simply. When interim dividends are paid, an organization may indicate that the calculation base is not current income, but “retained earnings.” Then the question disappears, no additional taxes or contributions have to be paid.

From an accounting perspective, this process is described below.

Is it possible to pay dividends for previous years?

Yes, and this is an absolutely normal practice that occurs in many organizations. Dividend accruals can be paid not only from current profits, but also from income from previous years.

And even more, there are special securities for which, in cases of losses in the current period, according to the company’s inability to pay the dividends specified in div. policy, obligations to distribute profits for this period are preserved and transferred to the income of future years or reserve funds previously formed for these purposes.

For example, such securities are cumulative preferred shares.

Is it possible to pay dividends from the profits of previous years?

Yes, you can. The fact is that Article 43 of the Tax Code establishes the deadlines for making a decision on the payment of dividends, but we are talking only about the profit of the reporting year - participants can make decisions on payments only based on the results of a quarter, half a year, 9 months or based on the results of the calendar year. At the same time, the distribution of profits from previous years as dividends is not regulated or limited in any way. Accordingly, participants are free to distribute such profits at any time and with any frequency.

Still, it is worth making one caveat. If the net profit was used to form funds provided for by the organization’s charter, then payments from it are not recognized as dividends. Only if the accumulated profit has not been directed anywhere, the meeting of participants or shareholders can distribute it in this capacity.

Results

Payment of dividends based on the results of the half-year is possible if such a decision is made by the general meeting of shareholders (participants) and the company at the time of making this decision meets a number of conditions (availability of net profit, fully paid-up authorized capital, absence of signs of bankruptcy, net assets exceed the established value). The amount allocated for payment is distributed among the recipients in proportion to their share of participation in the authorized capital or according to another algorithm specified in the charter. When paying, tax (profit or personal income tax) is withheld from income.

Sources:

- Law “On JSC” dated December 26, 1995 No. 208-FZ

- Law “On LLC” dated 02/08/1998 No. 14-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Accounting for profits that can be used for dividends

The final financial result of the organization’s economic activity in the reporting year is formed and summarized in account 99 “Profits and losses”. When reporting, this account is closed, and the net profit is written off to the credit of account 84 “Retained earnings”, and it also reflects income payments to the founders in correspondence with account 75 “Settlements with founders”.

There are 2 main ways to calculate profits:

- Yearly. In this option, both loss and profit are reflected separately in account 84. Those. several subaccounts are created - retained earnings of the reporting year, uncovered loss of the reporting year, retained earnings of previous years, uncovered loss of previous years.

- Cumulative. No subaccounts are created, and profits are not distributed among special funds. In this case, it is as simple as possible to distribute both current dividends and dividends from the profits of previous years.

How are dividend payments processed?

The decision to pay dividends is made by the general meeting of shareholders, the meeting of LLC participants or the sole participant of the organization. Accordingly, depending on the form of organization and composition of participants, you may need the following documents:

- Minutes of the general meeting of LLC participants.

- Minutes of the general meeting of shareholders.

- The decision of the sole founder to pay dividends.

- Order on accrual and payment of dividends.

The payment period should not exceed 60 days from the date of the decision on the distribution of profits (of course, if the exact period is not predetermined by the charter).

Rules for payment of interim dividends

The procedure for paying interim dividends can be divided into 3 main stages:

- The accounting policy must indicate how to pay the founders. This document contains the frequency according to which dividends are paid (quarterly, half-yearly, yearly), terms, and distribution of profits according to shares.

- At the end of the period in which the emergency is received, a meeting is held. A decision is made whether interim dividends will be paid. The minutes of the meeting record:

- size of the state of emergency;

- the amount of transfers to the founders;

- in what form are they paid?

- Direct distribution of interim profits according to the share/number of shares.

Normative base

The regulatory framework for LLCs is Law No. 14-FZ of February 28, 1998; Article 28 lists the procedure for distribution of profits and payment terms.

The activities of the JSC are regulated by Law No. 208-FZ of December 26, 1995. Article 42 says everything about settlements with shareholders.

How is cash issued

You can pay shareholders by bank transfer or by transfer via mail. To receive cash, the money must be received at the cash desk from the organization’s current account, since it is not paid from the proceeds, this is prohibited.

If a participant was entitled to interest on his share, but did not receive it due to some circumstances, he can contact the company within 3 years.

Accounting entries

Accounting uses the entry Dt84 Kt75-2 to calculate dividends. For employees of the organization Dt84 Kt70.

To pay the founders, the following transactions are made:

- Tax withheld: Dt75-2 (70) Kt68.

- The tax is transferred: Dt68 Kt51.

- Dividends are paid: Dt75-2 (70) Kt51 (50).

If there is a loss at the end of the year

The company found itself in a position where interim dividends were paid, but at the end of the year there was a loss. In order not to complicate their lives with disputes with the Federal Tax Service, organizations in their documents indicate the return of funds from recipients.

In fact, the funds are usually not returned, and the participants remain in debt to the company. Such debt is repaid, for example, using discounts on bills of exchange or retained earnings of the next period.

How to be a simplifier

The simplified company in which interim dividends were paid is a tax agent. Her responsibilities include calculating and withholding tax regardless of the taxation regime. Calculations and payments are made in the general manner.

Closing the registry

The closing date of the register can be determined by the date of the constituent meeting. To clarify the list of recipients of funds, 10 days are given before the meeting and 20 days after. The exact date for closing the register is fixed at a meeting by the board of directors.

Receive professional advice from accountants and lawyers

The best way to avoid making mistakes when making calculations and paperwork is to entrust the process to an accounting company with extensive experience. PROGRAMS 93 LLC has been providing professional advice to individual entrepreneurs and organizations for many years, tackling even the most complex issues.

Call the number listed on the website or fill out the feedback form so that we can:

- Tell us more about our services;

- Find out your needs and goals in order to offer the optimal solution;

- Orient by cost and timing;

- Explain how to start cooperation.

Remember that it is easier to keep your accounting records correctly right away than to correct mistakes later!