In the 2-NDFL certificate, the tax agent must reflect the income that he pays to employees. This includes salary and other payments. Salary is reflected in the 2-NDFL certificate in the usual manner. At the same time, when paying some other income, there are features of filling out the certificate. For example, if you pay an employee income that is taxed at different rates, then in 2-NDFL you need to fill out section. 1, 2, 3 (if necessary) and Appendix to the certificate separately for each rate. Let's look at how to correctly fill out a 2-NDFL certificate in various situations.

What income codes are taken into account when calculating vacation?

On the day of the employee’s dismissal, a final settlement must be made with him (Part 1, Article 140 of the Labor Code of the Russian Federation). In this case, the employer is obliged to pay the employee (in addition to the salary due to him) compensation for unused vacation, see Part 1 of Art. 127 Labor Code of the Russian Federation. The specified payment is subject to personal income tax in the generally established manner (paragraph 7, clause 3, article 217 of the Tax Code of the Russian Federation), that is, the organization must withhold tax from the employee’s income in the form of compensation for unused vacation at a rate of 13 percent (clause 1, art.

By order of the Federal Tax Service of Russia dated November 22, 2021 No. ММВ-7-11/, additions and changes were made to the list of income codes. In particular, code 2791, which denoted income received in kind from agricultural producers, was excluded; the content of code 3010 has changed. If previously this code denoted income from winnings paid by the organizers of lotteries, sweepstakes and other risk-based games (including using slot machines), then from December 26, 2021, code 3010 denotes income in the form of winnings received in a bookmaker's office and betting shop. In addition, the list of income codes was supplemented with codes to reflect income from transactions with securities, derivative financial instruments, interest on transactions recorded on an individual personal account. For more information about liability for incorrectly filling out the 2-NDFL certificate, see

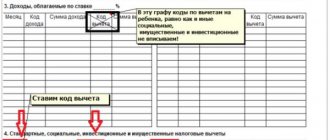

Section 3

Fill out the table in section 3 monthly.

In the heading, indicate the tax rate at which the income reflected in this section is taxed. If during the year the same person received income taxed at different personal income tax rates, fill out section 3 separately for each tax rate. When filling out the table in Section 3, use Appendix 1 “Income Codes” and 2 “Deduction Codes” to the order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/387. Individual codes are assigned to each type of income and each type of tax deduction. For example, income in the form of wages corresponds to code 2000. For income from the rental of vehicles, code 2400 is applied, for income from rental of other property - code 1400. When paying remuneration under other civil contracts (except for royalties) use code 2010; when paying temporary disability benefits, use code 2300.

The list of deductions that reduce the tax base for personal income tax is given in the table.

In section 3, show professional tax deductions (Article 221 of the Tax Code of the Russian Federation), deductions in the amounts provided for in Article 217 of the Tax Code of the Russian Federation, as well as amounts that reduce the tax base in accordance with Articles 213.1, 214, 214.1 of the Tax Code of the Russian Federation. Record this information next to the income for which deductions should be applied.

Situation: how to reflect the amount of vacation pay in a certificate on Form 2-NDFL if the vacation starts in one month and ends in another?

In the certificate on form 2-NDFL, reflect the amount of vacation pay in the month in which they were paid to the employee. And here's the explanation.

In section 3 of the certificate, income is reflected on the date of its actual receipt. When determining this date, you must be guided by the provisions of Article 223 of the Tax Code of the Russian Federation.

During vacation, the employee is free from performing work duties; therefore, the amount of vacation pay does not apply to income in the form of wages. For calculating personal income tax, the date of actual receipt of income in the form of vacation pay is the day of their payment (the day of transfer to the employee’s bank account) (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation). Therefore, in the certificate on form 2-NDFL, reflect the amount of vacation pay in the month in which they were paid to the employee. This should also be done in cases where an employee’s vacation begins in one month (year) and ends in another. For example, the entire amount of vacation pay paid in December 2015 for a vacation that ends in January 2021 must be reflected in the certificate in Form 2-NDFL for 2015.

Similar clarifications are contained in letters of the Ministry of Finance of Russia dated March 6, 2008 No. 03-04-06-01/49 and the Federal Tax Service of Russia dated April 9, 2012 No. ED-4-3/5888.

An example of how vacation pay is reflected in a certificate using Form 2-NDFL. An employee's vacation begins in one month and ends in another.

Organization economist A.S. Kondratyev was granted basic paid leave from December 26, 2015 to January 15, 2021. The amount of accrued vacation pay is 10,000 rubles. Kondratiev has no children.

The amount of personal income tax on vacation pay was 1,300 rubles. (RUB 10,000 × 13%).

On December 19, 2015, Kondratyev received vacation pay in the amount of 10,000 rubles from the organization’s cash desk. – 1300 rub. = 8700 rub.

Despite the fact that the employee’s vacation ends in 2021, the organization’s accountant included the amount of accrued vacation pay in his taxable income for 2015.

In section 3 of the certificate in form 2-NDFL for 2015, the accountant indicated:

- in the “Month” column – 12 (serial number of the month);

- in the column “Income code” - 2012 (based on Appendix 1 to the order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/387);

- in the column “Amount of income” – 10,000 rubles.

Situation: what code should be indicated in the “Income Code” field of the 2-NDFL certificate for a bonus paid for a conscientious attitude to work, high-quality performance of job duties and high discipline? The award was timed to coincide with the industry professional holiday.

In this case, you should indicate income code 2000 “Remuneration received by the taxpayer for performing labor or other duties.”

The “Income code” field of the certificate in form 2-NDFL is filled out on the basis of Appendix 1 to the order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/387. To reflect remuneration for the performance of job duties, a code has been set - 2000. With this code, you can also include in the rate the amount of bonuses for a conscientious attitude to work, high-quality performance of job duties and high discipline. The fact that the payment of the bonus is timed to coincide with a professional holiday does not matter.

Situation: what code should be indicated in the “Income Code” field of the 2-NDFL certificate for compensation paid for unused vacation?

In this case, you must indicate code 4800 “Other income”.

The “Income code” field in the certificate in form 2-NDFL is filled out on the basis of Appendix 1 to the order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/387. This application does not have a special code for income in the form of compensation for unused vacation. According to the tax department, when reflecting compensation for unused vacation in a certificate, you must indicate code 4800 “Other income” (letter of the Federal Tax Service of Russia dated August 8, 2008 No. 3-5-04/380).

Situation: how to reflect in the 2-NDFL certificate income that is not taxed within the established standards (for example, financial assistance, severance pay, etc.)?

Reflect your income in full, and indicate the tax-free portion in the “Deduction Amount” column.

The procedure for filling out the 2-NDFL certificate, approved by order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11/485, does not oblige you to indicate in the certificate income that is not taxed. The absence of such requirements allows us to conclude that it is enough to reflect in the certificate only the amount of income that exceeds the standard. For example, an organization paid an employee financial assistance in the amount of 5,000 rubles. Of this amount, 4,000 rubles. not taxed (clause 28, article 217 of the Tax Code of the Russian Federation). In such a situation, in section 3 of form 2-NDFL in the “Amount of Income” column, you can reflect only 1000 rubles, and not indicate anything in the “Deduction Amount” column. Formally, a certificate completed in this way does not distort the tax base for personal income tax, and the tax agent will not face sanctions in this case. However, this approach is still undesirable, and here's why.

In addition to the tax inspectorate, a 2-NDFL certificate is issued to the employee for whom it was filled out, upon his request (clause 3 of Article 230 of the Tax Code of the Russian Federation). And he can use it for various purposes. For example, based on the information from the certificate, a declaration in form 3-NDFL is filled out. A certificate may be needed to confirm income when obtaining a bank loan or a visa when traveling abroad. From this point of view, indicating only taxable payments in the 2-NDFL certificate will not reflect the real amount of income received by the employee. Moreover, it is quite likely that during the course of a year a person will receive financial assistance first from one employer (for example, 5,000 rubles), and then from another. Upon dismissal, he will be given a 2-NDFL certificate, which will indicate financial assistance in the amount of 1000 rubles. (5000 rub. – 4000 rub.). Having found another job, he can receive financial assistance again. Let's assume, again in the amount of 5,000 rubles. According to the law, in such a situation, the employee must pay personal income tax on an income of 6,000 rubles. (5000 rub. + 5000 rub. – 4000 rub.). However, due to the lack of complete information in the 2-NDFL certificate from the previous employer, the accountant at the employee’s new place of work will again not include 4,000 rubles in the calculation of income. and will withhold personal income tax only from 1000 rubles. As a result, the tax base for personal income tax will be underestimated, and if this fact is revealed during an on-site audit, the organization faces not only additional tax assessment, but also penalties and a fine under Article 123 of the Tax Code of the Russian Federation.

To avoid possible conflicts, it is better to indicate information about the payment of standardized income in the 2-NDFL certificate in two columns:

- in the “Amount of Income” column – the total amount of payment, including the non-taxable amount;

- – in the column “Deduction amount” – the amount of non-taxable income.

In addition, if an organization pays standardized income to an employee who joined the organization in the middle of the year, it is worth taking an application from him. In it, the employee must indicate that he has not received such income anywhere this year. And if you received it, then in what amount. If you have such an application, preferential payments up to 4,000 rubles may not be subject to personal income tax. The employee himself will be responsible for the accuracy of the income information specified in this application.

An example of how income that is exempt from taxation within the established standards is reflected in a certificate in Form 2-NDFL

A.S. In March, Kondratyev received financial assistance from his organization in the amount of 10,000 rubles. Such income is not subject to personal income tax up to 4,000 rubles. (clause 28 of article 217 of the Tax Code of the Russian Federation). In July, Kondratiev resigned, receiving compensation in the amount of 8,000 rubles. Since the amount of compensation does not exceed three times the average monthly earnings of Kondratyev, such payment is also not subject to personal income tax (paragraph 8, paragraph 3, article 217 of the Tax Code of the Russian Federation). Kondratyev received a 2-NDFL certificate, in section 3 of which the accountant indicated:

– by line with month code “03” (March):

| Revenue code | Amount of income | Deduction code | The amount of the deduction |

| 2760 | 10 000 | 503 | 4000 |

– by line with month code “07” (July):

| Revenue code | Amount of income | Deduction code | The amount of the deduction |

| 4800 | 8000 | 620 | 8000 |

Situation: how to reflect in the 2-NDFL certificate the income paid to the founder upon the redemption of his share in the authorized capital in connection with the exit from the company?

Reflect your income in full, indicating code 1540 for it. You must fill out the certificate even if the organization cannot withhold personal income tax from payments to the former founder.

In general, when filling out section 3 of form 2-NDFL, income should always be indicated in full. Even if a person is entitled to one or another deduction. This is stated in the Procedure for filling out a certificate, approved by order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11/485.

Income from the redemption of a share in the authorized capital can be paid in kind. However, this is not a reason not to indicate such income in section 3 of form 2-NDFL. For example, if a participant is paid with a car, tax can be withheld only if there are other cash payments. If they are not there, then the tax agent is obliged to notify the tax office within the established time frame of the impossibility of withholding and paying personal income tax. For income received in 2015, the impossibility of withholding must be reported before March 1, 2016 (Law No. 113-FZ dated May 2, 2015, letter of the Federal Tax Service of Russia dated October 19, 2015 No. BS-4-11/18217). At the same time, at the end of the year, Form 2-NDFL for this person will need to be submitted again.

The code of income received from the sale of shares in authorized capital is 1540 (Appendix 1 to the order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/387). The same code must be used to indicate the income received by the founder upon leaving the company.

What income codes are taken into account when calculating vacation?

On the day of the employee’s dismissal, a final settlement must be made with him (Part 1, Article 140 of the Labor Code of the Russian Federation). In this case, the employer is obliged to pay the employee (in addition to the salary due to him) compensation for unused vacation, see Part 1 of Art. 127 Labor Code of the Russian Federation. The specified payment is subject to personal income tax in the generally established manner (paragraph 7, paragraph 3, article 217 of the Tax Code of the Russian Federation), that is, the organization must withhold tax from the employee’s income in the form of compensation for unused vacation at a rate of 13 percent (paragraph 1, article 224 of the Tax Code of the Russian Federation)

Is it possible to pay compensation to the heirs - wife, children, etc.? In accordance with Art. 141 of the Labor Code of the Russian Federation, wages not received by the day of the employee’s death are issued to members of his family or to a person who was dependent on the deceased on the day of death.

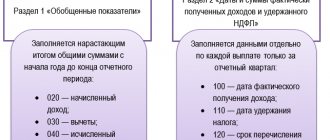

How to reflect in 2-NDFL income that is taxed at different rates

If during the year an individual was paid income taxed with personal income tax at different rates, for each of them it is necessary to fill out a separate page of the certificate, as well as the Appendix to it (clauses 1.19 and 4.2 of the Procedure for filling out the 2-NDFL certificate).

On the second and subsequent pages of the help you need to fill out:

- fields “TIN”, “KPP”, “Page number”, “Certificate number”, “Reporting year”, “Characteristic”, “Adjustment number” and “Submitted to the tax authority (code)”;

- section 1;

- section 2;

- section 3 – when reflecting standard, social and property deductions, by which income taxed at a rate of 13% was reduced.

In empty fields you need to put a dash.

| See also: How to fill out a 2-NDFL certificate |

Are vacation pay included in the calculation of average earnings for vacation pay in 2021?

- wages calculated based on the salary or tariff rate of the worker;

- remuneration at piece rates;

- Commission remuneration;

- remuneration in non-monetary form;

- monetary allowances for civil servants and employees of municipal bodies;

- royalties;

- additional salary, which is paid at the end of the year;

- compensation and incentive payments;

- other payments that are approved by the employer’s remuneration system.

We recommend reading: Is the installation session paid?

They are taken into account only to the extent that the employee actually performed the labor function. In March, Ivanov worked 10 days: In August - 20 days: In total, he worked 9 full months. Average earnings per day will be calculated as follows: Finally, we calculate vacation pay:

What is included in average earnings

- for time worked at tariff rates, salaries;

- for work performed at piece rates;

- for work performed as a percentage of revenue from product sales or in the form of a commission.

- allowances and additional payments to tariff rates and salaries - for length of service, length of service, combination of professions, team management, etc.;

- payments related to working conditions. For example, increased wages for heavy work, for night work, etc.;

- bonuses and rewards in accordance with the remuneration system.

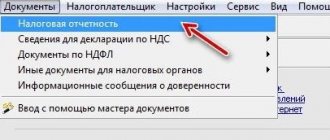

Instructions for filling

The certificate is filled out by a tax agent, namely, an employer represented by an accountant of a company or organization. It is filled out in three cases:

- When submitting a report to the tax service for the past year, which contains information on the amount of tax accrued for the entire reporting period.

- When it is impossible to withhold personal income tax, for example, in the event of dismissal of an employee.

- At the request of an employee of the organization to provide a certificate.

Heading

| Count | Content |

| Year | The year for which the certificate is provided is indicated. |

| Number | The number assigned by the person filling out the certificate. *They are assigned in each reporting period. Next year the numbering will be new. *If a certificate is drawn up to correct or cancel a previous one, the number of the original certificate is indicated. |

| date | Date in the format HH.MM.YYYY *If a certificate is drawn up for correction or cancellation, then their date is indicated, not the date of the original certificate. |

| Sign | Number 1, if the certificate indicates personal income tax, which was withheld from the employee’s earnings throughout the reporting period. Number 2, if the certificate is issued to notify the tax service of the impossibility of withholding tax. |

| Correction number | 00 – this number is indicated when drawing up a reporting document for the first time; 01, 02, 03, 04, etc. – with each adjustment; 99 – indicated when filling out a certificate to cancel information already submitted. |

| Federal Tax Service code | Code of the organization in which the enterprise is registered for tax purposes. Consists of four digits. The first two are the regional code, the second two are the tax service department code. |

Tax agent information

| Count | Content |

| 1 | Code of the territory in which the organization is directly located. Determined according to OKTMO. *If during the reporting year an employee worked in several organizations that have different OKTMO codes, then it is necessary to draw up different certificates from each place of work and indicate the corresponding codes. *You can enter 11 numbers. If the code consists of fewer characters, then empty fields are left blank. *Individual entrepreneurs and other persons carrying out work activities indicate the code at the place of registration. *Organizations using other taxation systems indicate a code reflecting the address of the company. |

| 2 | The mobile and landline (if any) telephone number of the organization represented by the tax agent is indicated. |

| 3 | The tax number of the organization or private entrepreneur is indicated. |

| 4 | This column can only be filled in by organizations. *If during the last reporting period an employee worked in several places, then you need to prepare as many certificates as the number of places the employee changed during the year, indicating for each organization its own checkpoint. |

| 5 | The abbreviated name of the organization is indicated (if it is not there, then the full name is indicated). *Entrepreneurs enter their full name according to their passport. No abbreviations can be used here. |

Information about the person who receives the income

| Count | Content |

| 6 | A number that confirms registration with the Federal Tax Service. If the TIN is missing, then the column is not filled in. |

| 7 | Tax number of the payer who is a citizen of another country. |

| 8 | The information is filled in according to the passport. *If the payer is a citizen of another country, then it is possible to write down this data in Latin letters. If there is no middle name, the column remains blank. |

| 9 | 1 – for a person who is a resident of the Russian Federation. 2 – for a person who is not a resident. 3 – for a person who is not a resident, but is recognized as a highly qualified specialist. 4 – for persons participating in the program for the resettlement of compatriots to our country who live abroad and are not residents. 5 – for persons who are refugees or have received asylum in the territory of the Russian Federation and are not residents. 6 – for citizens of other countries who work in the Russian Federation under an employment contract. |

| 10 | The payer's date of birth is indicated in the format HH.MM.YYYY |

| 11 | The code of the country of which the payer is a resident is indicated. *Registered in OKSM. *If a person does not have citizenship, then the code of the country that issued the passport is indicated. |

| 12 | The numerical code of the document is entered in the column, which confirms the identity of the payer. *You can find it out in the directory with document codes that establish identity. |

| 13 | The series and number of the identity document are filled in. *Only numbers are entered, other characters are not allowed. |

| 14 | The payer's residential address is indicated, the entry is made on the basis of a document that serves as proof of identity. *For a citizen of another country, enter the address at the place of residence or immediate stay. |

| The postal code of the branch to which the payer's residential address belongs is recorded. | |

| The code of the region in which the individual is registered is indicated. *The entry is made in accordance with the directory with codes of regions of Russia. | |

| Information about the area of registration of the taxpayer is entered. | |

| The city in which the individual is registered. | |

| For example, for the village of Vasilkovo, “Vasilkovo village” is indicated. | |

| Full information about the place of registration. | |

| 15 | The code of the country in which the person directly lives is indicated. *Can be left blank if the “Residence address in Russia” column is filled in. |

| 16 | The address at the place of residence in the country in which he directly resides is recorded. *Can be left blank if the column “Residence address in Russia” is filled in |

Income that is taxed at the rate

The name of the subsection indicates the rate at which a certificate is submitted to the supervisory authority. If during the reporting tax period the employee’s earnings were taxed at different rates, then for each of them it will be necessary to fill out this section.

| Count | Content |

| 17 | The serial number of the month in which payments were made to the employee is recorded. |

| 18 | The required code is indicated, which is indicated in the directory. |

| 19 | The full amount of earnings is deposited, from which no deductions were made. *If any deduction was made from income, its code is placed opposite this amount. *When filling out the document, income from which personal income tax was not withheld is recorded. |

| 20 | To be completed only if various types of deductions have been made from income. *The meanings of each code are taken from the corresponding reference book. |

| 21 | Indicated only when a tax deduction has taken place. |

Standard, social, investment and property tax deductions

In the event that a certificate for cancellation is completed, this subsection is not completed.

| Count | Content |

| 22 | Indicated based on the corresponding reference book. |

| 23 | The amount of deduction for each code is recorded. |

| 24 | The date of issue and the serial number of the notification and tax code that issued it are recorded. |

| 25 | The date and number of the notification, as well as the code of the tax office that issued it, are indicated. |

Total tax and income amounts

| Count | Content |

| 26 | The full amount is indicated without all possible deductions and personal income tax withholding. |

| 27 | The tax base from which personal income tax was calculated and withheld. |

| 28 | The total amount of the assessed duty. |

| 29 | The amount by which the assessed duty is reduced. |

| 30 | The total amount of the withheld duty. |

| 31 | The amount of the transferred fee. |

| 32 | The amount of duty that was excessively withheld and not returned to the payer. |

| 33 | The amount of duty that was not withheld in the reporting period. |

| 34 | To be completed if the payer has a corresponding notification. |

Conclusion

| Count | Content |

| 35 | If the certificate is issued by an agent – 1. If issued by an authorized person – 2. |

| 36 | Details of the person issuing the certificate. |

| 37 | Signature of the person issuing the certificate. |

| 38 | It is indicated when the certificate is issued by the agent's representative. |

Documents for download (free)

- New form 2-NDFL in Excel

- Sample of filling out 2-NDFL

What income code should be indicated for vacation pay in the 2-NDFL certificate?

Clause 2 Art. 230 of the Tax Code of the Russian Federation defines the employer’s obligation to provide tax authorities with 2-NDFL certificates every year. They must be compiled reflecting payments received from the enterprise by month of accrual, codes of types of income and separate divisions, as well as indicating tax deductions that the recipient of payments uses.

As you know, vacation is paid according to the average earnings for the entire vacation period at once. If in a situation where the vacation period falls within the framework of one month, everything is clear, then what to do with “rolling” vacations, the end date of which does not fall in the month when they were paid?

How to reflect vacation pay in 2-NDFL

The amount of vacation pay is reflected in the Appendix to the 2-NDFL certificate.

Vacation pay is reflected on the date of their actual receipt, that is, in the month in which they were paid to the employee (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation, clause 6.1 of the Procedure for filling out the 2-NDFL certificate).

The income code that must be indicated when recording vacation pay is “2012”.

Information about paid vacation pay and personal income tax on it is included in the total amounts of income and tax reflected in section. 2 certificates 2-NDFL.

How to reflect rolling leave in 2-NDFL

Rolling leave usually means an employee's leave that begins in one month and ends in another. The vacation pay amounts accrued in such a situation are reflected in the Appendix to the 2-NDFL certificate, indicating the month in which they were actually paid to the employee (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation, clause 6.1 of the Procedure for filling out the 2-NDFL certificate).

An example of filling out a 2-NDFL certificate when paying for rolling leave

Employee of the organization V.V. Fedorov paid leave was provided from March 27 to April 9, 2021. The amount of accrued vacation pay was 21,000 rubles. No deductions are provided to the employee. On March 21, 2021, vacation pay was transferred to the employee.

When filling out the Appendix to the 2-NDFL certificate, the organization reflected the amount of vacation pay paid as follows (clauses 1.11, 1.16, Chapter VI of the Procedure for filling out the 2-NDFL certificate):

- in the “Month” field – 03 (the serial number of the month);

- in the “Income code” field – 2012;

- in the “Income amount” field – 21,000 rubles;

- in the “Deduction code” field – a dash;

- in the “Deduction amount” field – 0.

Are vacation pay taken into account when calculating benefits under the BiR?

Hello dear forum users! We urgently need your help! Are vacation pay taken into account when calculating BIR benefits? The situation is this: I am now leaving for 2021, so to speak, “from maternity leave to maternity leave.” respectively, the default calculation years are 2021 and 2021. because during these years I was on maternity leave. Then, after thinking and thinking, I replaced 2021 with 2021.

The accountant deducted all vacation pay from my income for 2021 and calculated my BIR allowance from that amount. Is she right? I think I heard that vacation pay counts. But she insists on saying no. you don't understand. you see the income code “2021”..that means don’t take it into account. like, you only need to take into account what is with the income code “2021”. I don't understand what this income code is.

What income codes are taken into account when calculating vacation?

Note The payroll period is considered fully worked if during this time the employee did not have vacation, business trip, sick leave or other periods excluded from the payroll period. If there were such periods, then the billing period was not fully worked out;

We recommend reading: Sample characteristics for the mother of a kindergarten student

Vacation pay that the employer is obliged to pay to all employees (including when accounting for working hours is summarized) during the annual paid leave provided in calendar days is calculated using the formula:

Is the 2021 code taken into account when calculating vacation and maternity pay?

remuneration based on the results of work for the year, a one-time remuneration for length of service (work experience), other remunerations based on the results of work for the year, accrued for the calendar year preceding the event - regardless of the time the remuneration was accrued.

The most common income codes: - 1010 - dividends; — 2021 — wages; — 2021 — award; — 2021 — remuneration under a civil contract for the performance of work (provision of services); — 2021 — vacation pay; — 2300 — temporary disability benefit; — 2610 — material benefit from savings on interest for the use of borrowed funds; — 2760 — financial assistance to employees (except for financial assistance issued in connection with the death of a family member, the birth of a child, a natural disaster or other emergency circumstances); — 4800 — income for which there are no codes. For example, excess daily allowance, compensation for unused vacation upon dismissal

What payments for the billing period should be taken into account when calculating vacation pay?

An example of determining earnings when calculating vacation pay for an employee who, during pregnancy, was transferred to another job that excludes the influence of unfavorable production factors

- payments based on average earnings in accordance with current legislation. For example, during a business trip (Article 167 of the Labor Code of the Russian Federation) or paid vacation (Article 114 of the Labor Code of the Russian Federation). An exception to this rule is accrual for breaks for feeding a child (Article 258 of the Labor Code of the Russian Federation);

- sick leave or maternity benefits;

- payment for days off to care for disabled children and people with disabilities since childhood;

- payments due to downtime when an employee did not work due to the fault of the organization or for reasons beyond the control of the employer and the person himself. For example, due to a power outage.

What income codes are taken into account when calculating vacation?

To determine the number of vacation days subject to compensation, we correlate the number of days of annual paid leave earned by the employee with the number of vacation days that the employee took. actual work; when the employee did not actually work, but he retained his place of work (position); forced absenteeism due to illegal dismissal or suspension from work and subsequent reinstatement to the previous job; removal from work of a specialist who has not passed a mandatory medical examination (examination) through no fault of his own; unpaid leave provided at the request of the employee, not exceeding 14 calendar days during the working year.

On the day of the employee’s dismissal, a final settlement must be made with him (Part 1, Article 140 of the Labor Code of the Russian Federation). In this case, the employer is obliged to pay the employee (in addition to the salary due to him) compensation for unused vacation, see.

Main sections

- Information about the employer, which includes its name and details.

- Information about the employee.

- Salary by month, which is taxed at a rate of 13%.

- Different types of deductions (standard, social and property) and their codes.

- The sum of all deductions, income and taxes.

The employee can obtain the certificate from the company’s accounting department upon prior request. The registration period, according to the Labor Code of the Russian Federation, should not exceed three days. The certificate must bear the seal and signature of the head of the enterprise.

When filling out an employee’s salary certificate, the amount of vacation pay must be indicated in the column of the month in which it was issued to the employee. Such procedures were established by the tax service.

The filling procedure states that in the subsection of the certificate, which reflects data on the income of a particular employee, the amounts are indicated in the corresponding tax period. These must be the months in which the funds were issued. In other words, the date of receipt of vacation pay can be considered the day on which they were issued to the cashier or transferred to the employee’s personal bank account.

There are options when the vacation begins in one month and ends in one of the next. In this case, vacation pay in the certificate is taken into account in the month in which it was issued to the employee. For example, if an employee’s vacation fell in May-June, and they were issued to him in May, then they should be reflected in this month.

The same must be done if the vacation began in one year and ended in another. For example, the vacation began in mid-December 2021 and should end at the end of January 2021. In this case, it will be reflected in the certificate in December, since the employee’s vacation pay was issued in December on payday.

What income codes are taken into account when calculating vacation?

- awards for inventions and rationalization proposals, for promoting the implementation of inventions and rationalization proposals, for the introduction of new equipment and technology for the collection and delivery of scrap ferrous, non-ferrous and precious metals, collection and delivery of used machine parts, car tires for restoration, commissioning production facilities and construction projects (bonuses to employees of construction organizations are paid as part of bonuses based on the results of economic activities)

A one-time remuneration based on the results of work for the year and for length of service is included in the average earnings by adding to the earnings of each month of the billing period 1/12 of the remuneration accrued in the surrounding year for the previous calendar year.

We recommend reading: Is the management organization obligated to install a ramp at the expense of residents’ fees?

Calculation of compensation for unused vacation income code

Consultation on all accounting issues is available to users 24 hours a day, 7 days a week. Order No. ММВ-7-11 dated October 24, 2021/ came into force. New codes are valid when indicated in 2-NDFL certificates for 2021 and beyond.

An employee may ask to be paid part of his vacation pay without actually going on vacation and without being fired. The employer has the right (but is not obligated) to satisfy such a request. But compensation for vacation days is allowed only when we are talking about days in excess of 28 standard vacation days.

Income codes in 2-NDFL

- code 2002 - in the 2-NDFL certificate it is used for bonuses paid for production results and other similar indicators provided for by the norms of the legislation of the Russian Federation, employment agreements (contracts) and/or a collective agreement (paid not at the expense of the organization’s profit, not at the expense of special funds appointments or targeted revenues);

- code 2003 - for remunerations not related to the performance of job duties, paid from the organization’s profits, special-purpose funds or targeted revenues.

This code 2760 is used when an employer pays financial assistance to an employee or former employee who has retired due to disability or age. Please note that since amounts of financial assistance are not subject to personal income tax up to 4,000 rubles. per year (clause 28 of Article 217 of the Tax Code of the Russian Federation), then code 2760 in the 2-NDFL certificate is used together with deduction code 503.

Revenue code 4800: decryption

When accounting for wages, benefits and compensation is carried out in special programs, such as 1C:Enterprise, it is enough to make appropriate additions to the program once at the time the next change in the list is put into effect. When calculating salaries manually, the accountant will need to carefully distribute the income of individuals. According to Article 126.1 of the Tax Code of the Russian Federation, for the provision by a tax agent of certificates containing false information, a fine of five hundred rubles per document is threatened. If there are many employees, the amount of the fine in case of an incorrectly chosen income code will be sensitive.

Various types of deductions are subtracted from the tax base when calculating personal income tax. This is an amount determined by law that is not subject to taxation. Deductions are provided to citizens with children, representatives of certain professions, veterans, persons affected by man-made disasters, and others listed in the Tax Code of the Russian Federation.

Vacation income and vacation pay code in 2-NDFL

An employed person can request Form 2-NDFL from the accounting department by submitting a corresponding written application. The period for providing the employee with the document in question, based on the provisions of the Labor Code of the Russian Federation, should not be more than three days. Also, form 2-NDFL must be endorsed by the signature of the company manager and the seal of the enterprise, if any.

In accordance with the requirements of tax legislation, the amount of vacation pay must be entered in a separate column, separately from the rest of the subject’s earnings. In the line of the document where information about the employee’s income is reflected, the funds must be recorded for the period in which they were actually provided. That is, it is appropriate to consider the day of receipt of vacation money to be the date when the money was transferred for issue to the cashier, or transferred to the employee’s bank card.

We recommend reading: What age is considered working in Russia?

What income codes are taken into account when calculating maternity benefits?

Income for the previous 2 years does not include payments for sick leave, prior maternity leave, as well as payments made for any other periods during which statutory insurance premiums were not charged on income received.

The period of sick leave (it is sick leave, not vacation) for pregnancy and childbirth (in common parlance “maternity leave”) is always included in the pension period, as well as any period of incapacity (clause 2, clause 1, article 11 of the Federal Law of December 17, 2021 N 173-FZ “On labor pensions in the Russian Federation”).

Income codes in the 2-NDFL certificate - what does it mean?

This certificate reflects the tax deductions used, if any. On the other hand, in some cases the very fact of their provision is based on a 2-NDFL certificate. One example could be a deduction related to a child’s education at a paid university. There are also many other situations when this document cannot be avoided. It will be needed when:

Why is such detailed accounting needed? Paying taxes is an important responsibility of every citizen. In order to control the correctness and timeliness of their payments, the state must keep detailed records. In particular, each enterprise submits a certificate for each employee in Form 2-NDFL, which indicates a complete list of income received and the corresponding payments of personal income tax (NDFL).

Vacation in 2-NDFL (examples, difficult situations)

Holiday pay is subject to income tax as usual. This means that they should be included in the 2-NDFL certificate:

- in section 2 - as part of general information about income and tax;

- in the appendix to the certificate - here with details: in relation to the month and indicating the income code.

The income code for vacation pay is 2012, and for compensation for unused vacation is 2013.

We talked about this code in more detail in our article.

See also the full list of income in certificate 2-NDFL.

When you draw up vacation certificates, consider the following nuances.

Payment month

Vacation pay in 2-NDFL must be shown in the month in which they were paid. This is important for vacations that move from month to month or are paid in one month and started in the next. Most often there are doubts regarding January holidays paid in December. So, there is no need to doubt it. If you paid out the money in December 2020, and the employee was on vacation in January 2021, the vacation pay should be included in the certificate for 2021.

You can see an example of filling out a 2-NDFL certificate when paying for rolling leave in ConsultantPlus. Trial access to the system is provided free of charge.

Cancellation, recall from vacation

If the vacation is canceled or the employee is recalled from it, vacation pay and personal income tax from them are recalculated and reversed, and he receives a salary for the days worked. In this case, in 2-NDFL, vacation pay is either not reflected at all (if vacation is cancelled) or is partially reflected (for those days that the employee managed to take time off). The reversal itself in 2-NDFL with minuses does not need to be shown.

An example of recalculating vacation pay if the month of accrual is closed, from ConsultantPlus The employee went on vacation for 28 days from 11/09/2021 to 12/06/2021. Salary - 55,000 rubles, average daily earnings - 1,700 rubles, vacation pay - 47,600 rubles. (RUB 1,700 x 28 days). On 12/06/2021 he was recalled from vacation. You can view the entire example in K+ by getting free trial access.

Deduction for unworked vacation upon dismissal

A difficult situation arises when an employee used his vacation in advance and then quit. In this case, filling out 2-NDFL will depend on whether it was possible to retain or receive excess vacation pay from the employee upon dismissal.

Option 1. The amount of salary upon dismissal was enough to withhold or the employee returned it voluntarily.

Vacation pay with code 2012 is shown in the month of their payment minus the amounts reversed.

In the month of dismissal, reflect the salary (code 2000) in the accrued amount without deducting deductions for vacation.

Option 2. The amount of dismissal pay was not enough to withhold; the employee refused to return the extra vacation pay.

In the month of vacation pay:

- with code 2012, show vacation pay taking into account recalculation;

- with code 4800 - vacation pay that the employee still owes.

In the month of dismissal, reflect the salary (code 2000) without deducting deductions for vacation.

Should I indicate maternity benefits?

No. Since the benefit is not taxed, there is no need to indicate it in the 2-NDFL certificate for 2021. The Ministry of Finance made the same conclusion in letter dated 04/02/2019 No. 03-04-05/22860.

The procedure for filling out a certificate upon dismissal

When dismissing an employee, reflect all his income from the beginning of the year in the 2-NDFL certificate. Be sure to pay attention to the income codes:

- 2000 - for wages;

- 2012 - for vacation pay;

- 2013 - for compensation for unused vacation;

- 2014 - for severance pay.

How to fill out a certificate when a salary is delayed?

In this case, in section 1, reflect the income by the month for which it was accrued. And in section 2:

- Show accrued but unpaid wages in the “Total tax amount” and “Tax base” fields;

- indicate the accrued tax amount in the “Calculated tax amount” field;

- Do not include personal income tax from unpaid wages in the fields “Amount of tax withheld” and “Amount of tax transferred”.

There is no need to show compensation for late payment of wages in the 2-NDFL certificate, because it is not taxed.

For an example of filling out a 2-NDFL certificate when a salary is delayed, see K+. This can be done for free by getting demo access to the system.

Find more explanations on filling out 2-NDFL in this section of our website.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.