#4 14.11.2013 11:32:08

they total amounts must match

who told you this? The bases for personal income tax and insurance contributions are completely different. Don’t be like the tax authorities who once charged organizations additional personal income tax from the insurance premium base.

Pregnant employees of organizations can take maternity leave.

It is paid based on the average salary.

Many expectant mothers are concerned about the question: is the benefit income or not?

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call. It's fast and free!

Entering maternity benefits into 2 personal income taxes

Maternity benefits are not defined by the Tax Code as payments subject to income tax and are not included in the 2nd personal income tax.

The employee loses the right to receive them if she does not stop performing her official duties after the sick leave is issued to her.

The legislation provides for one type of profit for a pregnant working woman. She decides for herself what she needs more: a salary or an allowance.

If an enterprise pays only maternity benefits to an employee in the reporting year, the accounting department does not include this information in the tax department.

When applying for a maternity leave, it is advisable not to delay sending a certificate from a gynecologist and other necessary documents to the accounting department.

Procedure for paying maternity benefits

State benefits for BiR are paid to all women who give birth (adopt) a child. The benefit is payable to both working and unemployed women, full-time students in educational institutions, as well as military personnel. The place where benefits are calculated will depend on the status of the expectant mother. If we consider working women, the benefit is paid to them by the employer at their main place of work. Unemployed women turn to social services for benefits.

A woman must apply for B&R benefits no later than 6 months from the date of birth of the child. After she provides the necessary documents to the accounting department at her place of work, she is required to accrue benefits. The period for accrual should not exceed 10 days.

Important! Benefits are paid on the next day after the salary payment established in the organization. The assignment and payment occurs in one amount, it cannot be divided by month.

To apply for the benefit you will need:

- Application requesting payment;

- Certificate of incapacity for work;

- Information on average earnings for the working period that precedes the event (certificate for 2 years).

It is allowed to send documents as an attachment. If the mother decides to do this, then the letter should include copies of documents and a free-form statement (

Reflection of benefits in 6 personal income tax

A woman provides a sick leave certificate to the accounting department upon reaching 30 weeks of gestation.

If after this he goes on maternity leave and does not work even part-time, then the benefit received is not included in the declaration.

Calculation 6 personal income tax will be filled out in accordance with order MMV 7-11-450. There are, however, no specifics about birth payments.

Profit in the form of maternity benefits is completely reduced by the benefit amount. It is impossible to show in the calculation that this income is exempt from taxation.

The head of the enterprise is fined for deliberately concealing information about the exemption of maternity payments from tax.

A woman who continues to work before giving birth, when filling out personal income tax declaration 6, is required to indicate the amount of salary received during this period.

According to the letter of the Ministry of Finance 03-04-06-02-47, in the second part of the 6 personal income tax report, all bonuses and other additional payments paid to the employee in excess of maternity leave are also indicated.

In accordance with BS 4-11-13984, additional payments are reflected as follows:

- 100 - date of receipt of additional remuneration;

- 110 - the same information is written here as in the previous field;

- 120 is the next number after the specified number in the 100 field.

So, in accordance with the norms of the Tax Code of the Russian Federation, maternity benefits are considered preferential income - exempt from income tax. A pregnant woman's sick leave is not included in personal income tax certificates 2 and 6. Only rewards are entered there.

Share a link to the article or save it

Have you found the answer to your question? Find out how to solve exactly your problem - call right now:

Calculation of the amount of maternity benefits

The amount payable to a pregnant employee is calculated based on her average daily earnings for the previous 2 years. In this case, 2 calendar years are taken that preceded the year of maternity leave, but not the month the vacation began. In other words, if a woman goes on maternity leave in June 2021, then income for 2021 and 2021 will be taken into account to calculate the benefit. Months that fall in 2021 will not be taken into account.

Important! If there is no information about a woman’s salary during previous periods, then a certificate of income from previous places of work will be required. If the employee cannot provide such a certificate, then all days will be taken into account, but in some periods of time there will be no income. Due to this, the benefit amount will be underestimated.

If a woman provides a certificate of income, but after the calculation, the employer will need to recalculate and pay the difference. After the benefit is paid to the employee, the employer has the right to reduce its liability for insurance premiums by this amount.

When calculating benefits, it is necessary to take into account some features:

- It is necessary to compare the average daily income with the established minimum and maximum limits. They are established for the years that are used in the calculation.

- The basis for the calculation is earnings that do not exceed the income limit for which insurance premiums are calculated in the calendar year taken into account.

- If the calculation results in a significant difference between the average monthly benefit and the average earnings for the last calendar year and this difference is not in favor of the employee, then the employer can add additional payments. In this case, the source of financing will be the Social Insurance Fund, and the employer will make the additional payment at his own expense.

What is personal income tax certificate 2?

In principle, this is a specialized declaration that reflects the income received by an individual. It should be noted right away that in our country there is a law that indicates the need to deduct tax contributions from almost all types of income of individuals. It is for this reason that the tax agent, played by the employer, must provide detailed data on all types of employee income precisely through certificate 2 of the personal income tax.

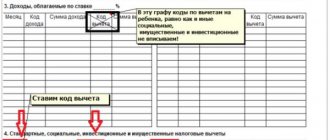

The certificate is drawn up on the basis of clearly established rules. In principle, there is a form in which the following data is indicated:

- Information about the employee and employer;

- Data on income received and deductions;

- Data on deductions;

- Total income;

- The total amount of calculated, withheld and remitted taxes.

There are certain features of document design with different characteristics. You can read about this in specialized instructions that are created for accountants as an ideal assistant in the preparation of certificate 2 of personal income tax. You also need to draw your attention to the existence of software, the use of which allows you to get the benefits of quickly calculating the necessary tax deductions.

Regional Chamber of Lawyers

Contents of the article: what is the income code in certificate 2 personal income tax sick leave for pregnancy and childbirth and what is the deduction code for the amount of this sick leave? thank you The question relates to the city of Meleuz Bashkortostan In accordance with paragraph.

1 tbsp. 217 of the Tax Code of the Russian Federation, state benefits are not subject to personal income tax, with the exception of temporary disability benefits, as well as other payments and compensation paid in accordance with current legislation.

At the same time, benefits that are not subject to taxation include unemployment benefits, maternity benefits. Therefore, for such types of income (such as maternity benefits, one-time benefits for the birth of a child), an income code is not provided.

Letter of the Ministry of Finance of the Russian Federation dated April 18, 2012 N 03-04-06/8-118 The Department of Tax and Customs Tariff Policy reviewed the letter on the issue of providing a standard tax deduction and filling out certificates of income for individuals and in accordance with Art. 34.2 of the Tax Code of the Russian Federation (hereinafter referred to as the Code) explains the following.

1. Established paragraphs. 4 paragraphs 1 art. 218 of the Code, standard tax deductions are provided to the taxpayer for each month of the tax period by reducing the tax base in each month of the tax period by the corresponding established deduction amount.

The tax base is reduced from the month of birth of the child (children) or from the month in which the adoption took place, guardianship (trusteeship) was established, or from the month of entry into force of the agreement on the transfer of the child (children) to be raised in a family until the end of that year, in in which the child (children) has reached the age specified in paragraph. 12 of the specified subparagraph, or the agreement on the transfer of the child (children) to be raised in a family has expired or been terminated early, or the death of the child (children). Clause 3 of Art. 218 of the Code provides that standard tax deductions are provided to the taxpayer by one of the tax agents who are the source of payment of income, at the taxpayer’s choice based on his written application and documents confirming the right to such tax deductions.

If the taxpayer has the right to receive a standard tax deduction, in particular, has been working for a tax agent since the beginning of the year and has a child in his care, then the tax agent has the right to provide a tax deduction from the beginning of the year, regardless of the month in which the taxpayer filed an application for the deduction, with the necessary documents attached. 2. The list of income not subject to personal income tax is established by Art. 217 of the Code. Since the income referred to in Art.

217 of the Code are exempt from personal income tax, then there are no grounds for reflecting the specified income in the certificate in Form N 2-NDFL. By Order of the Federal Tax Service dated November 17, 2010 N MMV-7-3/

“On approval of the form of information on the income of individuals and recommendations for filling it out, the format of information on the income of individuals in electronic form, reference books”

(taking into account the changes made by Order of the Federal Tax Service of Russia dated December 6, 2011 N ММВ-7-3/) deduction codes are not provided for these types of income.

How to find out the maternity income code in personal income tax certificate 2?

Maternity and pregnancy benefits are not subject to taxation - clause 1 of Art. 217 Tax Code of the Russian Federation. It also needs to be said that there are specialized codes that allow you to determine the type of income. All codes are in specialized reference books. There is no corresponding code for this type of income, such as pregnancy benefit or childbirth benefit. According to the letter of the Ministry of Finance dated 04.04.2007 N 03-04-06-01/109, if the income includes types of income that are exempt from personal income tax, they must be displayed in the certificate with sign 2.

Many accountants, when filling out certificates, put code 2300 in cases of child benefit, which is displayed in the certificate with attribute 2. Thus, income is indicated and at the same time it is indicated that taxes are not deducted from this income.

Sick leave income code in personal income tax certificate 2 The sick leave income code in personal income tax certificate 2 is 2300. Thus, when filling out personal income tax certificate 2, the accountant must reflect this amount under a certain code. The certificate is being issued. Salary income code in personal income tax certificate 2 Salary income code in personal income tax certificate 2 – 2000. Personal income tax certificate format 2 is a very important element in the formation of reporting documentation on income and deducted taxes. Quite. Income code 2300 in personal income tax certificate 2 Income code 2300 in personal income tax certificate 2 reflects benefit data. This refers to temporary disability benefits. Almost all types of income in our country are taxed123 Income code for 2nd personal income tax salary Income code for 2nd personal income tax on salary - 2000. As you know, certificate 2nd personal income tax is based on indicating all the income of an individual, which is displayed in a code format. Reference.

Are maternity payments considered income?

From the beginning of 2021, the payment of maternity contributions is regulated under Chapter 34 of the Tax Code of the Russian Federation.

For an employee going on maternity leave, maternity benefit (M&B) is a type of income, but no tax is charged on it.

Only those who are working or those who were laid off due to the closure of the enterprise can go on maternity leave. The amounts of accruals are determined by the average salary .

A one-time benefit is also provided to unemployed residents of Russia if they register with a gynecologist before the 12th week of pregnancy.

There is also a lump sum payment for the birth of a baby. This benefit is issued before the baby “celebrates” six months.