2-NDFL certificates are filled out for all employees who received income subject to income tax in a calendar year in accordance with Chapter. Tax Code of the Russian Federation. In the certificate form approved by Order of the Federal Tax Service dated October 2, 2018 No. ММВ-7-11/ [email protected], the accrued amounts are reflected along with the codes. The type of income is determined by the encrypted indicator. Sometimes doubts arise about which bonus code to choose in 2-NDFL in 2020 in one case or another. In the current directory there are several values that can include the amount of accrued remuneration.

Deadline for submitting personal income tax declaration 2

Certificate 2 of personal income tax for the Federal Tax Service is generated annually after the expiration of the reporting period. They submit it to the fiscal authorities no later than 01.04; for the report for 2021, this deadline has been postponed to April 2 due to the weekend.

In addition, if a legal entity did not withhold personal income tax from the profits of individuals for the reporting period, it is necessary to notify the Federal Tax Service and the employee no later than March 1. Please note that in the second case, 2 personal income tax certificates are submitted for March 1, 2019 and April 2, 2019.

It is important to remember that report 2 of personal income tax includes all types of employee income: earnings, bonuses, valuable gifts, rental of real estate or its sale. The entire list of taxable remuneration is listed in more detail in Art. 217.

About transactions with securities

Code 3023 is allocated for income in the form of interest (coupon) received by a taxpayer on traded bonds of Russian organizations denominated in rubles and issued after 01/01/2017. From paragraph 7 of Art. 214.1 of the Tax Code of the Russian Federation it follows that income from transactions with securities includes income in the form of interest (coupon, discount) received in the tax period on securities. But Federal Law No. 58-FZ dated 04/03/2017 clarified that from 01/01/2018, income in the form of interest (coupon) received by a taxpayer on circulating bonds of Russian organizations denominated in rubles and issued after 01/01/2017 does not apply to transaction income with securities. The tax base for such bonds is determined in accordance with paragraph 1 of Art. 214.2 Tax Code of the Russian Federation.

Therefore, the tax authorities considered it necessary to establish a separate code for this income. Accordingly, code 1011 has also been clarified.

Where can I find out the Federal Tax Service code of section 1 of the personal income tax certificate 2

In the first part of the report, the accountant is confused by the Federal Tax Service code, what this set of numbers means, and also where it can be found. It is a four-digit number, the first two digits are the code of the Russian legal entity, the last two are the code of the inspection to which the company is assigned. You can clarify or check if necessary in three ways.

1 way

The official website of the Federal Tax Service provides background information, including the Federal Tax Service code. To do this, in the electronic services tab, go to the “All services” menu and select the cell with inspection addresses.

In the menu that opens, you don’t need to enter anything, just follow the “Next” command, enter the city to search and the street on which the fiscal service is located. Information about the tax authority and its details will appear on the screen.

Method 2

You can find out the Federal Tax Service data by the company’s Taxpayer Identification Number, which is assigned to any legal entity or individual. The first 4 digits will be the agent’s federal inspection code. But this option is only suitable for the Federal Tax Service code to which the business entity is attached. If you need to find out the code of another tax authority, this method will not work.

3 way

You can find out the code of the Federal Tax Service Inspectorate from the reference book; to do this, you need to download the SOUN database onto your computer - a list of designations of tax authorities and other information useful for generating reports. The database contains the codes of all Federal Tax Service Inspectors, their full name, address, contact phone numbers and information about reorganization.

The easiest and most effective way to find out the Federal Tax Service code is to simply call the inspectorate or hotline. Consultants will provide all the information in detail.

An example of filling out 2 personal income taxes from 2021 using the new form:

OFFICIAL CONGRATULATIONS ON LAWYER'S DAY

Dear Elena Leonidovna!

On behalf of the staff of the Office of the Ministry of Justice of the Russian Federation for the Chuvash Republic and on my own behalf, I congratulate you and your team on your professional holiday - Lawyer's Day - a holiday of people who dedicated their lives to serving the Law, Truth and Justice!

Being a lawyer is a great honor and a huge responsibility. It is the activities of lawyers that allow the legal component of the state to function effectively. And regardless of the field in which a particular lawyer works, his work contributes to the accomplishment of this task. Your activities are aimed at ensuring justice and legality in society, protecting the rights and legitimate interests of citizens.

I wish you good health, prosperity and further professional success in your work for the benefit of the Fatherland and dedication to the great cause of serving the Law!

Head of the Department of the Ministry of Justice of the Russian Federation for the Chuvash Republic O.N. Nikonova

Dear Elena Leonidovna!

On behalf of the State Council of the Chuvash Republic, I congratulate you and all employees of your department on Lawyer’s Day!

The activities of representatives of the legal community are multifaceted - protecting the rights and freedoms of citizens, ensuring law and order in society, developing and strengthening the legal foundations of the state. The high professionalism of lawyers, their integrity, commitment to the spirit and letter of the Law are an important condition for improving the legal culture of citizens and maintaining stability in society.

Please accept our sincere thanks for your joint work and wishes for success in all your endeavors, good health and prosperity!

Chairman of the State Council of the Chuvash Republic A.E. Egorova

Dear Elena Leonidovna!

Please accept my sincere congratulations on Lawyer's Day!

Lawyer's Day is a holiday for everyone who sacredly values the history of their country, who fulfills their civic duty with honor, who dedicated their lives to serving the law, truth and justice. I sincerely wish that your professional activity brings you satisfaction, serves the interests of the state and our citizens, and that the efforts expended are always returned with the consciousness of a fulfilled duty. May your life always be filled with respect and support from colleagues, warmth and love from family and friends, good health, peace, goodness and prosperity!

Head of the State Service of the Chuvash Republic for Justice Affairs Sergeantov D.M.

Dear Elena Leonidovna!

On behalf of the Supreme Court of the Chuvash Republic, I congratulate you and your team on your professional holiday - Lawyer's Day, as well as on the upcoming Constitution Day of the Russian Federation!

These holidays unite everyone who dedicated their lives to serving the letter of the Law, who ensures the protection of the rights and interests of citizens. After all, the Constitution is the main law of the state, the guarantee of national harmony and social stability in Russia.

Thanks to the activities of the entire legal community of the country, a high legal culture of society is being formed and the Russian state as a whole is strengthening.

With all my heart I wish you and your employees good health, happiness, prosperity, as well as further professional success!

Chairman of the Supreme Court of the Chuvash Republic A.P. Petrov

Features of filling out general information in declaration 2 about the organization

In the first part of the personal income tax report 2, it is necessary to correctly reflect information about the organization. The name is filled out in accordance with the statutory documents, but to generate information regarding an individual, his last name, first name and patronymic are indicated in full without abbreviations.

For individual entrepreneurs, information is generated in accordance with registration documents and with the definition of the abbreviated affiliation of the individual entrepreneur. For them, both the indication of a surname with initials and a complete decryption of the data are allowed.

In addition, for physical persons, it is important to correctly indicate the identification document code. For Russian citizens, this is a passport of the Russian Federation, in this case, sign 21.

For other documents, you can use the following table:

When filling out the field about the citizenship of the employee, indicate the code of the country of which the employee is a resident. For Russia, this is code 643. You can find out all the codes on the Federal Tax Service website. If the list does not include a state of physical persons, indicate the details of the country that issued the passport.

Filling out income code 2762

Specialists responsible for payroll in a company are required to fill out the appropriate reporting forms in accordance with the law. Financial assistance is paid upon the occurrence of special cases confirmed by documents.

Benefits accrued to employees may be partially subject to personal income tax or not included in the tax base. Those payments that are not subject to calculation at the tax rate are not indicated in certificate 2 of the personal income tax.

According to the Tax Code of the Russian Federation, Article 217, paragraph 8, this type of remuneration is not subject to personal income tax if it is less than 50 thousand rubles for each child.

In this case, in certificate 2 of personal income tax, the entire amount of financial assistance is entered, but the non-taxable part must be indicated in the form of a deduction with code 508. That is. When filling out, you must enter the amount of the payment with the appropriate code - 2762, and indicate the deduction amount not exceeding 50 tr.

When entering information, the general principles of filling out a certificate must be observed:

- In general information, the data of the tax agent is indicated in accordance with the details of the constituent documents (TIN, KPP, etc.).

- Document number – the corresponding serial number within the reporting period.

- The basis for submitting the certificate form (characterized by the sign established by regulatory legal acts).

- The employee’s data is entered according to the information in the documents available to the employer.

- The personal income tax rate is fixed: for residents – 13%, non-residents – 30%.

- Income codes 2762 and deduction 508 are entered into the application in accordance with the month when the remuneration was accrued.

Financial assistance is considered a one-time payment if it is paid on the basis of one order of the company (social security authorities). If several reasons for transferring benefits are issued in relation to one employee, then all amounts, with the exception of the first administrative document, will be subject to personal income tax and insurance contributions.

Codes for different types of income in personal income tax certificate 2

When filling out the third section of the personal income tax declaration 2 for the Federal Tax Service, it becomes difficult which code to use to reflect information about the income of individuals.

In 2021, the MMV regulatory act 7-11-820 has supplemented the general list of codes for different types of remuneration for the following positions:

- Cash compensation for unused vacation, now applies to code 2013;

- code 2014 is used to reflect severance pay, compensation to the director, his deputies and the chief accountant in an amount exceeding 3 times the average monthly salary. For the Far North this limit is 6 times the size;

- under code 2301 you need to fill out the penalties listed by court decisions for non-compliance with consumer rights;

- debts written off from the company's balance sheet are reflected under code 2611;

- 3023 – interest in the form of interest on bonds issued after January 1, 2019.

To fill out Form 2 in relation to earnings and equivalent remuneration in the form of production bonuses, allowances, indicate the code 2000. All payments, the source of which are the company’s own funds, for example, additional payment for sick leave, maternity benefits, travel allowances in excess of the norms, approved by law, code 4800 is used.

About writing off bad debt

In accordance with Federal Law dated 02.05.2015 N 113-FZ, from 01.01.2016, in the case of writing off a bad debt from the organization’s balance sheet in accordance with the established procedure, the day of write-off is determined for an individual as the date of actual receipt of income (clause 5, clause 1, article 223 of the Tax Code RF).

Now, in connection with this, a special code has been established for this type of income - 2611. But it must be borne in mind that in relation to income received in tax periods starting from 01/01/2017, this norm applies only if the individual is interdependent in relation to organizations (Based on Federal Law dated November 27, 2017 N 335-FZ). However, such income in any case will need to be reported using code 2611.

Features of filling out section 4 of section 2 of personal income tax

When filling out part 4 of the report regarding deductions, individuals. the person brings the relevant documents to the accounting department for the right to use them. Most often, they provide a standard benefit in the presence of children; the following can also be issued: disability, participation in hostilities, liquidation of emergency situations.

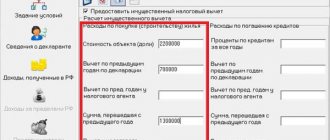

Next in popularity are property benefits coded 311, 312 - this is reimbursement of funds spent on the construction or purchase of housing under a mortgage agreement or on credit.

After the amounts of tax benefits are determined, the amount of income and tax for the reporting period is calculated. In the declaration, all remunerations and deductions are indicated with an accuracy of two decimal places, and the income tax calculated, withheld by the tax agent and transferred to the treasury is rounded to whole numbers according to the rounding rules.

After adding up the deductions, it is important that the estimated tax amount does not exceed the income of the specified person.