2-NDFL

This sample salary certificate from the place of work of the previous employer will allow the new employer to determine the principle of calculating insurance premiums from the salary of the hired employee. This is due to the determination of the maximum value of the base for calculating insurance premiums. Let us remind you that this limit in 2021 is set at 755,000 rubles per year for contributions to the Social Insurance Fund and 876,000 rubles for contributions to the Pension Fund. As soon as the employee’s salary, starting in January, cumulatively exceeds these thresholds, the employer will begin to calculate contributions from the excess amounts according to different rules. Pension contributions, instead of the usual 22% interest, will be paid at a rate of 10%, and social security contributions at a rate of 2.9% will not be charged at all. These limits do not apply to medical contributions and contributions for injuries, however, for the above-mentioned contributions, the new employer will have to calculate taking into account the amounts of salary and contributions for it that were paid to the new employee by his previous employer.

Help for the employment center

Another type of salary certificate is a certificate of average earnings for the last three months at the last place of work. Upon presentation of this document, the citizen is registered as unemployed at the labor exchange. The certificate itself contains data on the basis of which the amount and duration of unemployment benefits are calculated and determined.

An employer can issue such a free-form salary certificate to a dismissed employee. You can use the sample presented in the letter of the Ministry of Labor dated August 15, 2021 No. 16-5/B-421. Both options are united by a common principle: the calculation of average earnings in such certificates must be presented in accordance with the requirements of Resolution of the Ministry of Labor of the Russian Federation of August 12, 2003 No. 62.

Certificate of absence of COVID-19 when hiring Russian citizens

As a general rule, when concluding an employment contract, an employee must present to the employer:

- passport or other identity document;

- work book or information about work activity in accordance with Article 66.1 of the Labor Code (except for cases where the employment contract is concluded for the first time);

- a document (SNILS) confirming registration in the personalized accounting system, including in the form of an electronic document (ILS);

- a document on education or qualifications or the presence of special knowledge - when applying for a job that requires special knowledge or special training;

- military registration documents - for those liable for military service and persons subject to conscription for military service.

In some cases, taking into account the specifics of work, the Labor Code, other federal laws, decrees of the President of the Russian Federation and decrees of the Government of the Russian Federation may provide for the need to present additional documents when concluding an employment contract (Part 2 of Article 65 of the Labor Code).

The need to submit a medical document that confirms the employee’s negative test result for COVID-19 is not established by law.

At the same time, it is prohibited to require from a person applying for a job other documents other than those provided for by the Labor Code, federal laws, decrees of the President of the Russian Federation and decrees of the Government of the Russian Federation (Part 3 of Article 65 of the Labor Code of the Russian Federation).

Thus, when registering a person applying for a job, it is not allowed to require him to provide a certificate of absence of COVID-19.

More on the topic:

Employees need to have their coronavirus proof certificates checked

A foreign worker will not receive a permit if he has COVID-19

Employment and dismissal during coronavirus: unexpected problems

Sample salary certificate in free form

Finally, we cannot fail to mention the income certificate issued in free form. An employee can request such a certificate from the employer, for example, to obtain a visa and confirm solvency during a trip abroad. More rare, but nevertheless quite acceptable situations, when such a certificate is asked to be submitted to the bank. In this case, when filling out the document, the employer must focus on the amount of actual income paid to the employee. A sample salary certificate must contain the details of the company, as well as the full name and signature of its manager, a seal, if any, and the text itself may look like this:

REFERENCE

This certificate was issued to P.N. Ivanov. that, starting from 03/01/2016 to the present, he actually holds the position of leading engineer at Alpha LLC with an official salary of 70,000 rubles per month (before tax).

Certificate of arrears of wages - a sample of this may be needed by both the employee and the employer. We will talk about when it is required, how it is drawn up, what it looks like and what documents can replace it.

Salary certificate - features of preparation

The form is intended solely for reporting the absence or incorrect information on the website of the Federal Tax Service of Russia and does not imply feedback. The information is sent to the editor of the website of the Federal Tax Service of Russia for information. The Labor Code establishes that an employee has the right to request from the employer any information related to his work, and the organization, in turn, must provide it to him. The request is best made in writing in the form of a statement.

There is no single, unified, mandatory sample of a certificate of employment. Enterprises and organizations have the right to write it in free form or use a template developed within the company (however, such templates must be registered in its accounting policies). Regardless of which option the company chooses, the certificate must contain a number of necessary data:

- Name of the organization,

- date of compilation,

- information that needs to be confirmed

- signature of the company director.

The certificate is issued on plain A4 paper, in portrait orientation. There is no legally established uniform form for such a document. But, usually, a company stamp containing its details is applied in the upper left corner.

When may a certificate of absence or presence of wage arrears be required?

There are many such situations, and in some cases the certificate is needed by the employee, and in others by the employer himself. Here are just a few of them:

- The employer company is bankrupt. In order for an employee to be included in the register of creditors and receive the salary unpaid to him by the company, he will need to provide a certificate of salary debts to the arbitration manager.

- The employer operates, but delays or does not pay wages. To protect their rights, the employee will need to confirm the amount of debt with the State Labor Inspectorate (GTI) or in court.

- And again - bankruptcy. Only now the bankrupt company itself will need a certificate in order to be recognized as such. After all, the amount of salary arrears is included in the total amount of the creditor, and it, in turn, is taken into account in the total value of the property used to cover the creditors’ claims.

- At the request of the State Technical Inspectorate during scheduled inspections. A certificate of absence of salary debts will show that the employer regularly fulfills its obligations to employees, which means there should be no claims against it from government agencies.

- Inability to make loan payments due to late wages. A certificate of debt provided to the bank will confirm the fact of non-receipt of wages and will help to postpone or temporarily reduce payments.

- Protecting the rights of a citizen in court, for example when collecting alimony. A certificate of salary arrears will confirm that this citizen was not able to pay alimony because he did not receive remuneration for his work from the employer.

Thus, a certificate of arrears of wages is an important supporting document, and therefore it must be drawn up carefully and taking into account the circumstances in connection with which it is required.

IMPORTANT! This document should not be confused with certificates confirming the employee’s income. They are needed in other cases and are designed differently.

Letter about the absence of employees in the organization

Organizations are always required to submit personalized reports to the Pension Fund (not zero). They must do this even in the case where the head of the organization is at the same time its sole founder and an employment contract has not been concluded with him, and there are no employees in the company (PFR Letter No. LCH-08-24/5721 dated March 29, 2018, Determination of the Supreme Arbitration Court dated June 5. 2009 No. 6362/09). After all, the founding director is still recognized as the insured person. It is important to note that it is necessary to pass SZV-M and SZV-STAZH in such a situation, even if the company does not conduct business.

Taking into account the above, organizations cannot submit either zero reports or a letter about the absence of employees to the Pension Fund.

Certificate of absence of wage arrears to confirm the total amount of debt

Such a certificate is suitable in cases where there is no need to indicate a debt to a specific employee, but only the fact of the absence (presence) of a debt needs to be certified, for example, at the request of the State Tax Inspectorate, another government agency or bank.

There is no strict form of the certificate, however, based on established business practice, it reflects:

- employer name;

- outgoing number and date of document preparation;

- wording about the absence or presence of debt (if there is a debt, give its amount - total or broken down);

- FULL NAME. the compiler, to whom you can contact for clarification, his telephone number.

The certificate is endorsed by the general director (possibly together with the chief accountant), and if available, a stamp is placed.

For a sample certificate of arrears of wages drawn up in the form discussed above, please see the link below:

Certificate (calculation) of salary arrears: confirmation of debt to a specific employee

The employee himself may need this document to submit to the authority that needs to confirm the fact of non-receipt of wages. Its form is also not regulated by law.

The certificate is drawn up in the same way as the case discussed above, with the only exception that the wording changes: in the “individual” certificate it is necessary to indicate to whom and in what amount there is a “salary” debt. Various variations are possible:

- indicate the generalized amount of debt to the employee as of a certain date;

- provide a calculation of wage arrears with a monthly breakdown of debt by type of income.

One or another version of a salary arrears certificate is selected depending on where and why it is required.

A sample certificate of arrears of wages, including a breakdown by type of income, can be found at the link below:

A 2-NDFL certificate with zeros entered in the appropriate lines may be suitable as confirmation of the lack of income. He talks about how to arrange it.

Certificate of employment from an individual entrepreneur at the place of request - sample

Let's look at how to correctly issue a certificate for a visa. Unlike a simple certificate, it must indicate two more parameters - the employee’s salary and a guarantee of a job after returning from travel.

That is, in this case, it is important to have evidence confirming income from this particular activity, while it is desirable that there are no other activities whose income exceeds that indicated.

Typically, there are probably several options here. An employee of an enterprise has the right to request such a certificate for independent reconciliation of accrued and paid amounts or upon dismissal. Note that in such circumstances, this document is duplicated by another form - personal income tax-2. You can also request information from the Pension Fund and the Social Insurance Fund about the contributions made for employees. These organizations must tell you that you are not making contributions.

Results

A certificate of arrears of wages (or, conversely, of the absence of debt) is a document that can substantiate your claims or confirm insolvency. The legislation does not impose any specific requirements for this document. However, such a certificate must be drawn up taking into account the circumstances in connection with which it was needed, and include information that will help solve the problems of its bearer.

Bringing a certificate of income from your place of work is a common requirement when applying to both public and private institutions.

At the same time, not only the purpose of such a certificate may be different, but also its execution: drawn up in free form or according to the 2-NDFL form, about income for the last 3, 6 or 12 months.

Where is this document provided?

Such a certificate may be needed for two organizations - the Department of Social Protection of the Population and the Employment Center.

Certificates of income of family members for 3 months are provided to social security for family recognition. Such families are entitled to various monthly child benefits, travel benefits and others. Exactly what types of income are taken into account in this certificate are regulated by Federal Law No. 44 of 04/05/2003. “On the procedure for recording income and calculating the average per capita income of a family and the income of a citizen living alone in order to recognize them as low-income and provide them with state social assistance.”

A family is considered low-income if its average total income for the three months preceding the application for social security, divided by the number of family members, is below . When making your own calculations to determine whether you are included in this category of citizens, keep in mind the following: what is taken into account is not the amount that each working family member actually received in person, but the amount of wages before taxes and fees are deducted.

Included in family income are additional payments to the salary - bonuses, compensation, financial assistance from the enterprise. If these payments were assigned based on the results of work for the month, and this month is included in the billing period, then the amount of payments will be taken into account in full in the income certificate. If the payment is assigned for a different period (for example, a quarterly bonus), then the amount is divided by the number of months in the period for which it was accrued and taken into account for each of the three calculated months. A single person living without a family can be recognized as low-income according to the same criteria.

Undergraduate and graduate students receiving income must contact their dean's office

.

Pensioners will receive a similar certificate at the regional branch of the Pension Fund of the Russian Federation

.

Certificate of employment for individual entrepreneurs at the place of requirement

To recognize a family as low-income, social security requires a certificate from all officially established family members with income for the last 3 months. This will allow you to receive additional benefits and benefits for housing and communal services.

Typically, workers apply for documentary evidence of employment due to the need to provide it to certain organizations.

Legal portal Ruka Zakon - up-to-date information, news, document database and free consultation.

As already noted, there is no form of such a document approved by the Laws of the Russian Federation. Therefore, a handwritten or printed version is equivalent. But a certificate form prepared in advance on a computer will make it easier to issue in the future.

Of course, you shouldn’t give away the original book. If necessary, copies can be made from it and certified. At the same time, in case of very difficult situations, it is worth remembering that according to the law, the amount of income received by an entrepreneur is confirmed by primary documents - payment documents: “receipts”, bank statements reflecting the movement of accounts, contracts, etc.

An explanation of the suspension of the company's work is provided to the Federal Tax Service, the Social Insurance Fund and the Pension Fund of the Russian Federation and to the employment center. This document may be required by other organizations. For example, Rosprirodnadzor will need a sample letter about the absence of licensed activities when conducting scheduled inspections.

A certificate can be issued by an individual entrepreneur not only on the basis of a written application from an employee, but also at the request of various structures.

The form contains the following information:

- Full name of the individual entrepreneur for whom the employee works, his TIN, address, contact details;

- Full name of the employee;

- Position and name of the unit;

- Salary;

- Period of work for the individual entrepreneur;

- IP signature;

- Stamp, if any;

- Information about the person who compiled this document.

The explanation in the Social Insurance Fund must contain an indication of the suspension of operation, the absence of movements on the account, accruals and payments of wages. The explanation is signed by the head of the company and the chief accountant (if available).

Individual entrepreneur, can I get a certificate of income from the tax office for a mortgage? 02 December 2021, 19:57, question No. 1460997 3 answers

- How to get a certificate of income for a pregnant woman who has never worked? 07 December 2021, 17:43, question No. 1466157 2 answers

- How can I get a certificate of income if I work in an organization in which I am not officially registered? December 08, 2021, 22:52, question No. 1839678 1 answer

- How to obtain a certificate of income to apply for benefits for a third child? December 02, 2021, 11:24, question No. 1832099 1 answer

A certificate stating that a person is not an individual entrepreneur is provided in electronic form free of charge.

Filling rules

To register at the labor exchange, the income certificate must reflect the average earnings at the last place of work for the last 3 months. The certificate indicates the amount of income, the number of working days in each month and the number of days actually worked. The document must be drawn up in the form determined by the Employment Center.

There is no single unified form of income certificate for social security.

That is, this document is drawn up, essentially, in free form,

but it must contain certain elements:

Often such a certificate is issued on the company’s letterhead (all details are already entered into it), but this is not necessary. The text of the certificate itself may look something like this: “Issued to Sergei Viktorovich Ivanov that he actually works at Teremok LLC in the position of “security guard” from July 15, 2021 to the present, and his salary for the period from June 2021 to August 2021 amounted to 30,600 rubles, including for June 10,000 rubles, for July 10,400 rubles, for August 10,200 rubles. The certificate was issued on the basis of a personal account for presentation at the place of request.”

A certificate for a young mother on maternity leave may be slightly different and contain something like the following: “Given to Olga Petrovna Sidorova that she actually works at MDOU No. 1 in the position of “educator” since 01.08. 2010 to present. Since April 3, 2014, she has been on leave to care for a child up to 1.5 years old. Her income for the period from January 2021 to March 2021 amounted to 23,820 rubles, including 7,940 rubles for January, 7,940 rubles for February, and 7,940 rubles for March.”

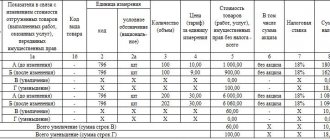

Often the income in the certificate is presented in the form of a table, for example:

The received certificate must be submitted to social security before the end of the current month.

Be careful: for the subsidies department

The Social Security Administration's income certificate must be issued differently - for the last 6 months in form 2-NDFL.

For information on the rules and procedure for applying for subsidies for low-income citizens, see the following video:

Salary certificate is a document that contains information about the amounts of accrued wages to an employee of an enterprise (organization), as well as deductions for a certain period of time. The issuance of a certificate is not mandatory and is carried out solely at the request of the employee, which must be confirmed by his written application. In the application, the employee must indicate the purpose of obtaining the certificate, and the organization, in turn, must provide it within three working days from the date of submission of the application.

The information presented in the certificate will also be useful to social security authorities. Even upon dismissal or retirement, citizens need officially certified data regarding income for a certain period.

A certificate of income is needed in the following cases: when applying for a loan, to receive assistance from a defense authority, in the process of dismissal, traveling abroad. And each excluded case may have its own unmentioned nuances and design features. Many people need to have an idea about filling out and receiving such a certificate: an entrepreneur, an employee, a civil servant. And in each case there will be a different type of filling.

A certificate is issued by an organization (state-owned enterprise, institution, individual entrepreneur, etc.) to confirm the person’s place of work, position, length of service and salary.

This document will be needed for registration:

- maternity leave;

- pensions;

- visas for traveling abroad;

- subsidies;

- bank loan;

- unemployed status (Employment Center);

- documents to court and other institutions.

Each organization has a prescribed document form, but a free one is also allowed.

According to the new legislation, an employee does not have to wait or ask to receive a document.

Upon the first written request, within three days (Article 62 of the Labor Code of the Russian Federation), the organization’s management must submit the document to the applicant.

This information is confidential and protected by the Personal Data Law, so the certificate is handed over to the employee personally. When picking it up, you need to write a receipt for receipt, and the responsible employee writes it down in a special journal.

The originating number on the certificate and the date of issue must correspond to the number and date recorded in the journal.

To an employee who resigns, the management of the enterprise is obliged to issue a document on the day of dismissal. A former employee also has the right to apply for such a certificate by submitting an application.

When calculating average earnings, remunerations and bonuses are taken into account.

Application example:

Letter of no activity

Answer: The legislation does not stipulate the fact that certificates should be issued only to working employees. If an application is received, you must provide the former employee with the necessary document within 3 days.

The actual profit received for an entrepreneur working using the UTII or PSN regimes often does not coincide with the expected profit (imputed or receivable). In such circumstances, the following documents can serve as confirmation of the income of an individual entrepreneur for a company operating on PSN:

- a patent directly indicating the amount of income potentially available for receipt;

- a book for accounting income of individual entrepreneurs in the patent mode, since it is in it that you can find information about the income received in fact.

If an employee works for an individual entrepreneur under an employment contract, then he has the right to contact the individual entrepreneur with a request to issue a certificate confirming the employee’s employment and level of income.

To obtain Schengen, it is preferable to submit a certificate in English to the embassy or official visa center of the country.

The certificate must contain

Each document has its own details. The salary certificate is no exception.

It should contain the following information:

- main state registration number (OGRN);

- taxpayer identification number (TIN);

- full details of the enterprise;

- address;

- Contact phone numbers;

- surname, name, patronymic of the employee;

- the document is certified by the seal of the organization.

Nuances: information is provided only for one calendar year.

The manager and chief accountant are required to sign the document.

The certificate is valid for up to 30 days.

Appearance of salary certificate

There is no single clear form for drawing up a salary certificate. It is drawn up in any form by employees of the HR department.

The main thing is to indicate the correct amount of salary received by the employee:

- for all years of work in the organization;

- in a year;

- a few months.

Each organization sets the form of the document independently, taking as a basis an existing form - for example, a bank or other organization.

Only the head of the enterprise, the head of the personnel department, and the chief accountant have the right to certify the document. The document must bear the company's seal.

Salary certificate (sample):

Samples download:

In what cases is this certificate needed?

The salary document will be required to be submitted to the Pension Fund for pension calculation.

It should contain complete information about annual payments, and not averaged over several months.

When calculating, all official payments are taken into account:

- for working on weekends;

- for part-time work;

- overtime.

Payments issued upon dismissal and payment for unused vacation are not taken into account for the calculation.

To apply for a pension, you must present other documents:

- passport;

- certificate of average earnings;

- original work book;

- if you have a disability, then a certificate.

When an organization (firm) is liquidated

The document can be issued by a higher organization or one that has become a legal successor after reorganization or renaming, indicating orders to change the details.

Are there no legal successors? All documentation must be stored in an archive. Its employees will issue a certificate by making an extract from the accounting documents.

If it is not possible to issue a document in the approved form, they have the right to draw it up themselves, based on the information that the archive has.

Rules and nuances of issuing a certificate of income for individual entrepreneurs

The destination of the information is determined depending on the requirements of the organization requesting this document. If the employee does not indicate where he needs to provide such paper, then this is indicated. A standard certificate form from the place of work, as a sample individual entrepreneur at the place of requirement, can be downloaded online as a sample.

In this case, it all depends on the prevailing practice in your area. It is useless to appeal such a refusal. In some cases, where inspectorates issue such certificates, it will be necessary to attach a independently compiled certificate to the application. Such a certificate is drawn up on behalf of the Federal Tax Service; the tax officer will only need to verify the data and affix a signature and seal.

Existing applications are recorded in a separate item. When an individual entrepreneur draws up a document for himself, it is necessary to attach information from the Unified State Register of Individual Entrepreneurs or, if the individual entrepreneur was registered before January 1, 2021, a copy of the registration certificate.

The status of an individual entrepreneur implies that, on the one hand, he participates in legal relations as an ordinary citizen, in others, he is actually equated to a legal entity - an organization. The situation is further complicated by the fact that an individual entrepreneur is almost always a self-employed person.

Certificate to the embassy

Have you decided to go abroad on vacation or on business? The embassy of the country where you are going will also require a certificate confirming your income, in Russian and English.

In addition to the certificate, you need to provide other evidence of your solvency:

- bank account statement;

- document for an expensive car;

- document for a cottage, a prestigious apartment.

Advice: when preparing a document to submit to the consulate, ask there about its form, because there may be nuances in the requirements for registration.

There is no way to contact the consulate - a travel agency will help. After all, incorrectly completed paperwork can jeopardize the trip abroad itself.

For maternity leave

Russian legislation guarantees 140 days of state-paid leave to every woman expecting the birth of a baby.

After giving birth, she has the right to extend it until the child is one and a half or three years old. Will also receive government assistance. To process it, you also need a salary document.

To receive financial assistance before the child is one and a half years old, you must submit:

- statement;

- baby's birth certificate;

- salary certificate.

The benefit is calculated as follows:

- The average salary for the last two years is divided by calendar days for the same period (minus maternity leave, parental leave, time off while maintaining salary, sick leave).

- The average daily earnings are equal to the maximum amount divided by 730. Multiplied by 30.4 and 40 percent. This results in a monthly allowance.

Subtleties of design

Until 2013, there was no clearly established form of salary certificate that was submitted to obtain childcare assistance for children under three years of age. It was compiled in free form.

Now when filling out you need to use the established form. Since the formats were not approved in a timely manner, please pay attention to their validity periods.

The document is filled out by hand with a ballpoint pen. Ink – blue or black. It cannot be cleaned up or corrected. You can change the font and add lines.

Example:

A woman, while on maternity leave, worked part-time - this period is considered maternity leave. When calculating monthly benefits, parental leave is excluded. The amounts earned during this time are included in the average earnings.

Help snippet:

For the Employment Center

Unemployment benefits for dismissed citizens during vocational training or retraining, if they were sent there by the employment service, depend on the salary at the last place of work. And you can’t do without a salary certificate.

For example, a dismissed employee needed a salary certificate to present to the Employment Center.

Calculation scheme:

- 01.03.2015-31.10.2015 – period worked;

- working days – 63 (19+21+23);

- during this period, salaries were increased; salary: 35,200 rub. (RUB 10,000+RUB 12,600+RUB 12,600).

- coefficient=12600/10000=1.26

- salary in the billing period = 10000*1.26+12600+12600=37800 rub.

- average daily earnings = 37800/63 = 600 rubles.

- average monthly number of working days in the billing period = 63 days/3 months = 21 days

- average earnings = 600 rubles * 21 days = 12,600 rubles.

For social security subsidies

Subsidies for housing and communal services and other social payments are relevant for many.

The following are eligible for the subsidy:

- owners of apartments and houses;

- apartment renters;

- relatives who live with the tenant.

To receive a subsidy, you must provide a salary certificate.

Example:

For what purposes is a salary certificate required for 3 months and 6 months?

In order to acquire the official status of a citizen who does not have a job and is looking for one, it is necessary to submit a list of papers to the employment center, one of which must be a certificate of average earnings for the 3 months preceding dismissal. This thesis is enshrined in paragraph 2 of Art. 3 Laws of April 19, 1991 No. 1032-1.

Employment authorities, as a rule, do not have special requirements for the data format, so the certificate can be created in any form. But it also happens that regional authorities approve a sample certificate of average wages in their region, and if you do not follow it, the citizen may be refused to accept the documents. Although, according to the letter of the Federal Labor Service dated November 8, 2010 No. 3281-6-2, the submission of a certificate in an unspecified form should not be a reason for refusing to grant benefits due to job loss.

The procedure for calculating average earnings is carried out on the basis of Resolution of the Ministry of Labor of the Russian Federation dated August 12, 2003 No. 62.

In order to assess future risks and determine the threshold for issuing funds, credit organizations require salary data for 6 months preceding the date of the borrower’s application. Although there is also no fixed form for this document, there is an established list of details that must be included in it:

- name and location of the company, contact information;

- the employee's length of service and the name of the position held by him;

- the amount of accrued earnings for each month.

A certificate of average monthly earnings for six months will also be needed when applying to social security, for example, to receive “children’s” benefits or apply for a subsidy for utility bills. In addition, obtaining a visa to enter some countries will also require the submission of a certificate for six months (although other periods may be indicated).

In both of the latter cases, the details when drawing up the certificate will be similar to those required in the “bank certificate”.

The time period that should be taken into account when drawing up a certificate of average earnings depends on the purpose of its use. The most common intervals in practice are:

- 6 months - to obtain permission to enter a foreign country (information for 12 months may be required);

- 3 months - for employment authorities;

- 2 years - for the purpose of calculating sick leave, to confirm the amount of earnings;

- 5 years - for calculating pension payments.

2-NDFL and others

The most common form of salary certificate, a sample form was approved by the Federal Tax Service (FTS) in 2015.

It states:

- Date of completion.

- Full name, INN, OKTMO code of the employer.

- Employee information. Last name, first name, patronymic, passport and contact details, TIN, registration address.

- Income for the past period, with a monthly breakdown.

- Deductions that have been received.

- Paid taxes.

However, form 2-NDFL is not always needed

, departments and companies come up with their own forms, and then a sample salary certificate is issued at the place of request, the employer is only required to fill it out and certify it.

In some cases, a document written in free form is sufficient.

In this case, the sample looks like this:

- Document header. Template form indicating the full details of the organization.

- Document name: “Help”.

- Issued to. The surname, first name and patronymic of the recipient are written.

- Text. It describes when and in what position the citizen worked, and what salary he received.

- Signature and seal. Signed by the director and chief accountant, certified by the round seal of the enterprise.

Letter about the absence of employees (sample)

In some cases, the individual entrepreneur himself also requires a certificate from his place of employment. In this case, you need to write it out yourself.

A certificate of employment is an information document containing certain details, which is submitted to government services, financial organizations, courts of various jurisdictions, and so on.

For more information about other types of employer certificates and examples of their execution, read the article “Salary certificate - sample and form in 2018-2019.”

The question immediately arises: where can I get a certificate of income if I don’t work? The certificate form has the index 2-NDFL. Most likely, you are working and simply receiving a “gray” salary - that is, unofficial. In this case, you can discuss all this with your boss.

A sample letter about the absence of economic activity is given below. This clarification will inform you about the time when the company was not functioning, and will allow you to be exempt from taxes and mandatory payments during this period, eliminate fines and facilitate reporting.

The certificate for obtaining a visa may contain an indication that the citizen has been granted leave from work during the tour. The standard set of information that must be contained in the certificate can be adjusted by the organization that requested it. Therefore, when preparing such a certificate, it is advisable to find out from the person who requests it what exactly needs to be reflected in it.

Documented information about work activity is provided upon written application from an individual no later than three days from the date of application.

Samples of writing certificates

Modern office work considers the form of writing “certificate given” obsolete. Nowadays it is customary to describe the situation immediately after the word “help”. It's easier to understand this with an example.

Example 1

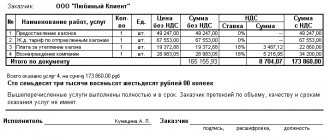

Ivan Petrovich Sidorov worked at Open Your Business LLC for three years as a furniture purchasing manager. After his dismissal, he needed a certificate for a new place of work to accrue sick leave. If you write it in free form, then a sample free form certificate of salary from your place of work for 6 months will look like this:

Limited Liability Company “Open your business” Address: Kommercheskiy, st. Entrepreneurs House 86 445047 Tel. 898-54-33, 344-54-32 OKPO 859548990, INN 68065980, KPP 48808677, OGRN 489687686 Ref. No. 433 dated May 32, 2021

Ivan Petrovich Sidorov has worked at Open Your Business LLC since May 1, 2014 as a furniture purchasing manager. Over the last 6 (six) months, wages were:

- __month__ 2021 – 10,000 rub.

- __________2017 – 10,000 rub.

- __________2017 – 10,000 rub.

- __________2017 – 10,000 rub.

- __________2017 – 10,000 rub.

- __________2017 – 10,000 rub.

Total income for 6 months amounted to 60,000 rubles.

The certificate was issued for submission to Close Your Business LLC. Director of Open Your Business LLC ___________ Sidorenko E.L. Chief accountant _________ Petrenko N.D.

Sidorov I. P.

Since Ivan Petrovich worked in a Limited Liability Company, the document must be certified with a round seal and the originating number must be indicated on the certificate.

Example 2

Maria Sergeevna Kommercheskaya works for individual entrepreneur Sidor Egorovich Prikhodko as an air seller. She needed a certificate from the social security authorities. Here is a sample of how to write a salary certificate for an individual entrepreneur.

Since Sidor Egorovich does not follow the latest fashion trends in office work, he draws up the document in a classic form:

IP Prikhodko I.S. TIN 45646537

Given to Commercial Maria Sergeevna that she was actually hired by individual entrepreneur Sidor Egorovich Prikhodko for the position of air seller on January 15, 2021 with a salary of 50,000 rubles.

Prikhodko I.S Date.

In this case, the document is certified only by the signature of the entrepreneur. The position of chief accountant for an entrepreneur is not required.

Individual entrepreneur what to write in a visa application form

——————————————————— >>><<< ———————————————————— Checked, no viruses! ——————————————————— wife is an individual entrepreneur (trade). So, can you help me decide what to write in job applications? and position if you are a private entrepreneur, US visa for individual entrepreneurs, how to write an application form. Certificate from the place of employment for individual entrepreneurs for submission to the CC - In the usual one. There is no need to write certificates to yourself. As I understand it, in the application form he needs to indicate a lawyer, office number, and provide copies of registration. How to fill out an application for a Schengen visa with examples and detailed explanations. Download. Why do you need to write your first and last name (points 1.3) as in your passport? We attach an extract from your individual entrepreneur account, if you have one, to the questionnaire. The form must be filled out exclusively in Latin letters (including German umlauts: ä=ae, ü=ue, ö=oe). no need to write). Region. for individual entrepreneurs, manager, specialist, economist, accountant. 08-manager secretary, etc. Applying for any visa always raises a lot of questions. If you are an individual entrepreneur or work for an individual entrepreneur, you need to attach a copy of the OGRN and TIN of the employer. Typically, forms cannot be filled out in Russian (but there are also. 2) In an adult’s form, write the legal address of the employer or the actual one??? 3) If the employer is an individual entrepreneur. Can. With these instructions, the Poland visa application form can be completed in 5 minutes. Write the name of the locality in the passport in the “Place of Birth” column. Do not indicate an individual entrepreneur, otherwise they may require a tax certificate. Marina and I received our one-year US visas last Monday and... information on filling out the form, write a comment and I will. If you are an individual entrepreneur, then in the column about work. At what point, what to write, what boxes to check, where to sign, and so on. Application forms for a Schengen visa for all Schengen countries. Do you know if a person is a freelancer without an individual entrepreneur (essentially. Instructions for filling out an application form for a visa to Cyprus, sample forms. If I am a student, an individual entrepreneur, unemployed?. In any case, if you don’t know how to write correctly . We specifically chose the questionnaire in English (although the Poles offer and. You need to write the last name, first name and citizenship of the person who has. Students put student, private entrepreneurs - self. Very often Ukrainian tourists think that they can get a visa in. In the Enter a field password reminder word you need to write any word that. part-time, self-employed - private entrepreneur. Application form for a Schengen visa for most countries. Individual entrepreneurs will need it. Click on Continue and start filling out the Questionnaire. Full Name in Native Alphabet write your last name, first name and patronymic in your native language. Visa to the USA in a new way. At the same time, he is an Individual Entrepreneur. Registered as an individual entrepreneur 4 years ago. Sample form DS-160, visa application form, US visa application form. in the DS-160 form, there is also a whole article on the topic “How to correctly write an address in the USA.” But I just can’t figure out what to write about my job as an individual entrepreneur. Filling out the DS-160 application for a US visa is an integral part. Can you write in a little more detail about what you do as an individual entrepreneur? Subtleties of filling out the application form How to write individual entrepreneur in the visa application form? Everyone who has read the document form and decided is faced with this question. Sample of filling out an application form for a visa to Thailand (date of publication: 02/27/2017). for individual entrepreneurs · for students over 18 years old · for. The following can apply for a visa: - the applicant personally; If fingerprints. Dear clients, when you register on the website, there will be a questionnaire. the employer is an individual entrepreneur, for reference p. Sample of filling out a UK visa application form. If you have any persons in your pay, write here the specific amount in pounds. And about the time spent in this position - indicate the date of opening of the individual entrepreneur.