Currently, companies have the right to independently decide whether to use printing in their work or not. If companies do not refuse to use the seal, then when filling out the 2-NDFL certificate they have the following question: is a stamp required on the 2-NDFL certificate. The issue is related to the fact that on the certificate form itself there is no such detail as “M.P.” (place of printing). In this article we will figure out whether it is necessary to put a stamp on the 2-NDFL certificate, as well as what an accountant should do if the employee has not provided his TIN and residential address.

Do I need a stamp on the 2-NDFL certificate?

Important! According to Law 82-FZ, companies currently have the right to operate without a seal. The 2-NDFL certificate form itself also now does not contain such details as “M.P.” (place of printing). This field is no longer provided.

If the company decides not to refuse to use the seal, then it must, as before, put it in the completed 2-NDFL certificate. That is, if the company has retained the seal and applies it, then it puts the seal on the certificate and no fine will be charged for this. However, even without a stamp, the certificate will be considered valid.

How to properly stamp a new form

A new sample certificate is certified only by the signature of the tax agent, as well as his legal representative by power of attorney.

At your own request, you can add a round seal to the document. If an organization uses a print in its activities, then it must be used in reporting in accordance with established standards.

Since there is no space for a stamp on the 2-NDFL certificate in the updated format, the stamp is placed in different ways.

It will be considered correct to use it in the following places in the document:

- On the signature of the responsible person;

- The signatures below.

Putting a stamp in this way is an unspoken generally accepted norm. It is used by analogy with the previous sample certificate, in which the letters “M. P." pointed to the place of printing.

When is a 2-NDFL stamp required?

If an employee submits a corresponding application addressed to his manager, then in accordance with Art. 230 of the Tax Code of the Russian Federation, he must be provided with a 2-NDFL certificate. Since the employer withholding personal income tax from his employees acts as a tax agent. All documents directly related to work must be issued to employees within three days from the date of application, as well as on the day of dismissal.

Often an employee asks to provide him with a 2-NDFL certificate to apply for a loan from a bank. However, this does not mean that the company is obliged to put a stamp on this certificate. The law does not oblige companies to do this. Only the signature of the manager will be sufficient. But, the presence of a seal in such a document will serve as additional confirmation that the certificate is genuine. Therefore, if there is such a possibility, then it would be useful to put a stamp (

In what situations is printing needed?

If your company uses a seal in its activities, then in 2021 you can affix it to the 2-NDFL certificate at your own request. The tax authorities will definitely not issue a fine for its presence or absence, since this process is not regulated by law.

This certificate can be used for various purposes. One of your employees may, for example, go to the bank to apply for a loan. In this case, no stamp is required. But in order for the employees of the credit institution to have no doubts about issuing money, it is better to leave an imprint on the document.

If the organization’s seal is not affixed, then the bank, in its own interests, can make calls to the employer to clarify the information and confirm its accuracy. To avoid such inconveniences and not do unnecessary work, you should immediately issue a 2-NDFL certificate with a stamp. This simple action will help you avoid unnecessary questions and intrusive calls.

The absence of a seal is not a violation, but for your own peace of mind you can affix it. The imprint will make your life much easier, as it increases the confidence of third parties in the authenticity of the document.

Availability of TIN in certificate 2-NDFL

Sometimes employees, after getting a job, do not provide their TIN to the accounting department. But indicating it in the 2-NDFL certificate is not mandatory today. In 2021, a 2-NDFL certificate can be submitted to the tax office without the employee’s TIN. This explanation can be found in the letter of the Federal Tax Service No. BS-4-11/1-68 dated January 27, 2016, which states that the TIN is not a mandatory detail. If the employee has not provided his TIN, then this field in Section 2 of the certificate is simply not filled in and there are no penalties for this.

When a company sends 2-NDFL electronically, the tax office responds by sending a protocol with the following content: “Warning. The TIN for a citizen of the Russian Federation has not been filled in.” Even if such a protocol is received, this does not mean that the certificate was not accepted by the tax authorities. 2-NDFL will be accepted as usual.

Important! Companies should be very careful about providing the correct TIN. If a fictitious TIN number is indicated on the certificate, this will be regarded as providing deliberately false information, for which the organization faces a fine of 500 rubles.

Previously, it was impossible to provide a 2-NDFL tax certificate that did not contain an INN. Therefore, employers independently found out the TIN number through the tax website - nalog.ru. If there was no TIN number in the tax database, then employees had to be sent to obtain this certificate.

New form 2-NDFL

According to Tax legislation, all legal entities that have hired employees on their staff are required to provide the Fiscal Service with a certificate in form 2-NDFL separately for each of their employees who received income. Sent to the Federal Tax Service according to one of two proposed options:

2-NDFL without TIN

Compiled by a tax agent in three cases:

- Every year. Sent to the Tax Office based on the results of the past reporting period. The amounts of income received by an individual, as well as the amounts of personal income tax withheld and paid to the Treasury are indicated.

- If inconsistencies are found. If a discrepancy is detected in the amounts of calculated and withheld personal income tax.

- At the request of full-time employees. An employee can request a 2-NDFL certificate when applying for a loan, subsidy, or upon dismissal.

We have looked at the cases in which the form is drawn up, now we will determine whether a stamp is needed for 2-NDFL when submitting it in 2021.

How to indicate the TIN in 2-NDFL

If a company makes payments to individuals, then they are required to submit 2-NDFL tax certificates annually (230 Tax Code of the Russian Federation). This document indicates the certificate attribute: “1” or “2”. A certificate with attribute “1” is submitted for individuals to whom payments were made throughout the year. A certificate with attribute “2” is submitted if tax was not withheld from any income by the tax agent. The deadlines for submitting certificates vary depending on what feature it contains.

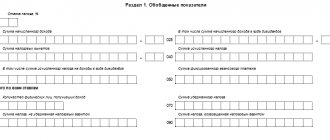

The second section of the 2-NDFL certificate contains the following fields:

- “TIN in the Russian Federation”;

- "TIN in the country of citizenship."

If the certificate is drawn up for a citizen of the Russian Federation, then the TIN in the Russian Federation is written in the field. If a foreigner is employed in an organization, then the employer should find out information about the availability of a number that is similar to the TIN. If this number is available, then it is entered in the “TIN in the country of citizenship” field.

If an employee has a TIN but does not know it, the employer can determine it himself. To do this, you can use the special “Find out TIN” service on the website nalog.ru . The service will request the following data: full name of the individual, date of birth and passport details. If this person really has a TIN, it will be indicated on the computer. Otherwise, the employer will have only one option - to submit a certificate without this number. And we repeat once again, this will not be a violation.

Important! If a company submits 2-NDFL certificates electronically, it has the right to submit it without a TIN. If the taxpayer does not have this number, then the “TIN in the Russian Federation” field simply remains blank.

Certificate 2-NDFL without address

The second section of the 2-NDFL certificate also indicates the address of the individual’s place of residence, as indicated in his passport or other document. Thus, the 2-NDFL certificate records the permanent registration of an individual or his temporary registration.

The field “Residence address of the Russian Federation” does not have to be filled in only if

if the indicators “Country code of residence” and “Address” are filled in. That is, to submit a certificate, you need the employee’s address under any circumstances. Even if the address is not indicated in the employee’s passport, it can be found in another document, for example, in a lease agreement, or in the employee’s application, which he wrote when hiring.

If the employee refuses to provide his address, then it is better to submit the certificate in paper form. In this case, you will need to attach to it:

- a copy of the passport (2-5 pages), as proof that there is no registration stamp;

- explanatory note.

In the note, you can indicate that it is not possible to submit a 2-NDFL certificate, since the employee (full name) does not have permanent or temporary registration in the Russian Federation. If the tax office refuses to accept such a certificate, then it should be sent by mail as a valuable letter with a list of the contents and a receipt.

Where to put the stamp?

In situations where a full-time employee has requested information about his income received and personal income tax withheld, he can indicate that the certificate bears the company’s seal. Then the question arises, where to put a stamp on the 2-NDFL certificate if there is no space for it in the new form? Let's turn to the old form - the seal is placed below the name of the manager and his signature put on the certificate.

Similar articles

- Deadline for submitting 2-NDFL (with sign 2) for 2021

- Submitting 2-NDFL on paper

- Correct decoding of the 2-NDFL certificate using an example

- Who signs the 2-NDFL certificate?

- Basic rules for filling out a certificate in form 2-NDFL

conclusions

The 2-NDFL form contains quite a few details that require filling out, each of which is important. However, an accountant may not always have information about them, or doubt whether they need to be entered. For convenience, we will summarize the details discussed above in a table and determine the need to indicate them in 2-NDFL:

| Details of the 2-NDFL certificate | Do I need a certificate? |

| Employee TIN | If the employee does not have a Taxpayer Identification Number (TIN), and it is not possible to find it out, then the certificate can be obtained without this detail. |

| Company's stamp | A stamp on the certificate is not required, but if the company has not refused to use the seal, then it can put it on the certificate and this will not be considered a violation. |

| Employee address | Without the employee’s address, 2-NDFL cannot be submitted electronically. The employee should be required to provide any document confirming his address (for example, an application). If it was not possible to obtain registration information from the employee, it is better to send the certificate by mail. |

Do you need a seal or not?

The rules for filling out the form are established by Federal Tax Service Order No. ММВ-7-11/19В dated January 17, 2018, where there are no instructions regarding affixing a stamp. Also on the form itself there is no line M.P. Therefore, the question of where to put a stamp on 2-NDFL becomes relevant for those companies that have a stamp.

For many enterprises that have the form of LLC and JSC, from April 7, 2015, in accordance with the legislation of the Russian Federation (Federal Law No. 82-FZ of April 6, 2015), the presence of a seal has become an optional condition for conducting business. Such companies have the right to independently decide whether to use a seal or not, and the decision made is confirmed by the constituent documents of the organization:

- If the decision was made not to have a seal, then it is not required in any of the documentation.

- If an enterprise decides to use a seal, it is affixed only in certain documents (power of attorney for the company’s authorized representative, on business papers when issuing securities, and other legally approved seals).

But do such organizations need to put a stamp on the new 2-NDFL certificate? The Fiscal Service refers to Federal Law No. 82-FZ, which states that there is no designated part for affixing a seal in the certificate, so a seal is not required. However, this does not mean that companies are prohibited from putting it on 2-NDFL. There are no statements regarding this fact in any regulatory act.

The position regarding the cancellation of the stamp is confirmed by the Federal Tax Service of the Russian Federation in letter No. BS-4-11/2577, therefore in 2021 a new certificate 2-NDFL will be submitted, whether it needs to be stamped can be seen from all of the above, the answer is no. The form is approved by the signature of the head of the organization or the signature of his deputy.