General rules for filling out 6-NDFL

Let's look at how to reflect the recalculation of personal income tax in form 6-NDFL. The procedure for entering data into the calculation of 6-NDFL is established by Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/450.

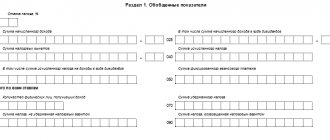

We will present the calculation structure in the diagram (we will show only those lines that will be involved in answering the question):

The date of actual receipt of salary is the last day of the month (Clause 2 of Article 223 of the Tax Code of the Russian Federation). Thus, accrued wages should be reflected on line 020 of Section 1 of the period to which the month of their accrual relates. The place of personal income tax calculated from this amount of wages is line 040 of Section 1. The salary for December is reflected in Section 1 of the personal income tax calculation for 2021.

Let's consider a situation where the December salary was calculated incorrectly. In February 2021, the error was corrected, so the recalculation should be reflected in 6-NDFL. How to reflect will depend on several factors.

Reflection of wage recalculation in form 6-NDFL

October 29, 2021: Webinar “Solving current issues related to personnel in times of crisis”

(Question from a listener of the webinar “Salaries in 2021” to the presenter - Yulia Khachaturyan, General Director of Nika, risk plan)

Question: how to reflect the recalculation of wages for the previous period (August) in the calculation of 6-NDFL for the fourth quarter of 2018?

Presenter's response:

Unfortunately, the author of the question did not specify whether the question was about overpayment in the corresponding month or about the fact that the employee was not paid extra. When indicating specific lines of the report, I will proceed from the fact that we are still talking about an underpayment of a certain amount.

There are two completely different points of view on this matter. The first is based on Letter of the Federal Tax Service dated January 27, 2017 N BS-4-11 / [email protected] (in clause 2, under clause 1 there is information on a different topic, you should skip it when reading the document) and involves making changes to section 1 forms for the previous period. Those. additionally accrued wages should be included in line 020, and additionally accrued personal income tax in line 040. The payment itself must be displayed in section 2 of form 6-NDFL in the present period when the additional payment was made.

Those. in calculations for 12 months in section 2 - you should indicate the date of receipt of income (line 100) - 08/31/2018 (i.e. the last day of the month for which wages were accrued); tax withholding date - the day you actually paid wages in the fourth quarter (line 110); the tax payment deadline is the day following the payment of income (line 120); on line 130 (amount of income received) - the amount of the additional payment; on line 140 – the amount of additionally accrued personal income tax from the surcharge.

However, guided by this approach, it will be necessary to make changes to the calculation of insurance premiums for the corresponding period, otherwise the control ratios may be violated (Letter of the Federal Tax Service dated April 20, 2021 No. BS-4-11 / [ email protected] , for example, discusses the situation when wages for the previous year are recalculated).

There is another, more practical approach to solving this issue, which is not based on letters from the Federal Tax Service, but is expressed in professional literature, let’s say, under the slogan “How to make the work of an accountant easier.” I will not advise its use, nor, on the contrary, criticize it - because, perhaps, there is a practical meaning in it, but to support the main theses of this approach with documents issued by the Federal Tax Service? impossible. The point of the approach is not to edit form 6-NDFL for the period in which the error occurred, but to show the amount of the surcharge in section 1 of this period, including the surcharge in line 020, and showing the personal income tax from the surcharge in lines 040 and 070. In section 2 of the report in lines 130 and 140 show, respectively, the amount of additional payment and personal income tax on it, but in line 100 (date of payment of income) - show not the last day of the month for which wages were accrued, but the day when the payment was actually made, the same day will be the day of tax withholding (line 110), and the next day (line 120) is the date of its transfer. Those. the difference in the design of section 2 of the 6-personal income tax form of this period lies only in line 2 (date of payment of income).

You can find out when the next seminar or webinar by Yulia Khachaturyan on wages is scheduled from the seminar schedule:

Seminars on taxes, tax planning (for accountants, financial directors, managers and company owners)

We fill out 6-NDFL for the 1st quarter of 2021 when recalculating

Payments that were actually made in the 1st quarter of 2021 will fall into Section 2 of the 6-NDFL calculation for the 1st quarter of 2021. You can read more about the procedure for filling out line 120 in 6-NDFL in this article.

Section 2 of the report for the 1st quarter of 2021 will include incorrectly calculated December salaries paid in January. How the recalculation will be reflected in Section 2 and whether it will be reflected there at all depends on several factors:

- in which direction the error was made - the employee was paid more or less than expected;

- when money is paid to employees if the erroneous amount of wages is less than the amount that actually needs to be paid;

- when a refund of over-withheld personal income tax is made, if an arithmetic error only crept into tax calculations, etc.

Features of reflecting an advance in form 6-NDFL

Before considering the nuances of reflecting wage advances in the report on Form 6-NDFL, it is necessary to define this term.

Determination of salary advance

So, a salary advance is part of the employee’s earnings, which he receives from his employer as a stipend for his work. There are three factors that characterize a salary advance:

- mandatory payment;

- legislative support for the mandatory requirement;

- urgency of payment, that is, the organization itself has the right to set the terms for payment of the advance, taking into account the requirements of the Labor Code of the Russian Federation.

Important point. According to Article 136 of the Labor Code of the Russian Federation, the organization is obliged to pay wages to employees every 1/2 month in order to avoid penalties for violation of labor laws that arise in accordance with Article 5.27 of the Code of Administrative Offenses, and financial liability in percentage calculation for delay in payment, according to Article 236 of the Labor Code of the Russian Federation.

Simply put, an advance on wages is part of the employee’s income, and, therefore, it is subject to personal income tax (NDFL) and is included in personal income tax reporting, in particular in form 6-NDFL.

Reflection of recalculation in 2-NDFL

2-NDFL certificates should be sent to the tax office before March 2, 2020. From 2021, the deadlines for submitting 2-NDFL and 6-NDFL are the same. So again there are two options:

- 2-NDFL certificates for 2021 have not been submitted.

In this case, it is necessary to fill them in with correct data on December wages, taking into account recalculation. If by the time the certificate is drawn up, all problems associated with the erroneous calculation have been resolved (for example, the overly withheld tax has been returned to the taxpayer), then the certificate lines “Calculated Tax,” “Tax Withheld,” and “Tax Remitted” will be equal.

If at the time of drawing up the certificate any debts still remain, it is necessary to fill out the certificate with the data that was current at the date of its preparation. Later, when the issue is resolved, it is necessary to submit a corrective form 2-NDFL.

- 2-NDFL certificates for 2021 have already been submitted.

It is necessary to submit clarifying certificates for 2021. Certificates for 2020 will not be affected by the recalculation.

The conclusions expressed in the article are also contained in the Letter of the Federal Tax Service of Russia dated July 21, 2017 No. BS-4-11/14329.

Reflection and payment of personal income tax

Income tax (NDFL) from wages must be withheld on the day the salary is issued (transferred to the card account). The tax must be paid to the treasury no later than the next working day. This norm is enshrined in the Tax Code of the Russian Federation (Article 226, paragraphs 4 and 6). In this context, the wording “no later” plays a key role. This means that income can be transferred earlier, this will not be a violation.

In this case, one should take into account the rules for postponing tax payment deadlines established by the Tax Code of the Russian Federation (clause 7, article 6.1).

Article 6.1 was amended by law 102-FZ. In the new version of the normative act, it is accepted that if the last day of the period falls on a non-working day, the end date of the period must be considered the first working day following it (clause 7 of article 6.1). In other words, deadlines are postponed in the same way as weekends/holidays.

Therefore, if non-working days are not extended, income from wages paid on March 27 can be transferred no later than May 6 of the current year .

Let's sum it up

- If an arithmetic error was made when calculating wages in December 2021, you should submit the calculation with clarifications in Section 1 for the 4th quarter of 2021.

- If, due to an error in calculating wages, an incorrect amount was paid in December 2019 and personal income tax was withheld incorrectly in January 2020, then the settlement of the error will be reflected in 6-personal income tax for the 1st quarter of 2021.

- Whether or not it is necessary to clarify the 2-NDFL if an arithmetic error is detected in the salary for December 2021 depends on the situation: If the 2-NDFL have not yet been submitted, you should immediately generate the certificates correctly. In this case, you need to remember to comply with the control ratios between 2-NDFL and 6-NDFL (it is recommended to submit the updated calculation of 6-NDFL for the 4th quarter of 2019 before submitting 2-NDFL or together with certificates).

- If the 2-personal income tax forms have already been submitted with an error, you should submit updated certificates in any case.

Features of salary transfer

The days from March 30 to April 31 were declared non-working days with retention of employee salaries (Decrees of March 25 No. 206 and April 2 No. 239).

According to the law, enterprises are required to transfer wages to employees twice a month. In addition, employees must receive earned funds no later than 15 calendar days after the end of the accrual period. If the payment date falls on a weekend/holiday, the transfer of income is postponed to the next business day. These norms are regulated by the Labor Code of the Russian Federation (Article 136, paragraphs 6 and 8).

Since the above-mentioned period has been declared a non-working period with continued pay, employees must receive full wages during this time. A legal entity is obliged to transfer wages on the days established by the internal documents of the enterprise. These recommendations were given by the Ministry of Labor and Rostrud. Since comments were received only in April, transferring salaries for March is not a violation.

How to reflect wages if they are paid next month?

The Federal Tax Service provided clarification on the question of how to fill out the first section of the 6-NDFL report if wages were paid next month, which was published in a letter from the Federal Tax Service of the Russian Federation dated May 16, 2021. No. BS-4-11/8609.

According to this letter, the first section states that the calculation of 6-NDFL is filled out with an accrual total for the 1st quarter, for the 2nd quarter (half year), for the 3rd quarter (9 months) and for the 4th quarter (for the year). In the first section, line “070” indicates the “Amount of withheld tax” as of the reporting date, which is calculated on an accrual basis from the beginning of the tax period. In line “080” of the same section, the “Amount of tax not withheld by the tax agent” is indicated, in accordance with the provisions of paragraph 5 of Article 226 of the Tax Code of the Russian Federation and paragraph 14 of Article 226.1 of the Tax Code of the Russian Federation.

Thus, when a situation arises where wages, for example, for June, are paid in July, personal income tax is withheld in July. The tax on the June salary is reflected in line “040” of the first section “Amount of calculated tax”, and in lines “070” and “080” 0 (zero) is entered.

In a similar way, these lines are filled in in other quarters in case of a recurring situation. Regarding the second section, it is important to clarify that the transaction is reflected in the “completion period”.