Fixed Asset Accounting

Readers' questions are answered by NK Your Tax Representative LLC

Telephones in Yekaterinburg: 213-59-34, 378-33-29, 213-59-35

Organization on the general taxation system, content of activity - wholesale trade and services for the repair of large road technology. How to reflect in accounting and tax accounting and correctly document the following events of economic activity:

1. Equipment for exhaust hood in the workshop was purchased, requiring installation, costing over 80 thousand rubles. Installation is carried out in-house. How to properly arrange the acquisition, installation and commissioning of this fixed asset?

2. Rolled metal was purchased in the amount of 10 thousand rubles. for the manufacture of shelving in the workshop on our own. The question is the same.

3. A used unit (machine) was purchased for further resale (capitalized to 41 accounts). Subsequently, the unit was repaired on its own using spare parts, also recorded on account 41. How to correctly write off spare parts in this case and take into account the cost of repair work?

1.

In accordance with

the Chart of Accounts for accounting the financial and economic activities of organizations and the Instructions for its application

, approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n,

the receipt of equipment for exhaust hood in the workshop by the organization

is reflected in the accounting records

as the debit of account 07

“Equipment for installation" in correspondence

with the credit of account 60

"Settlements with suppliers and contractors" at the actual cost of purchase excluding VAT.

The amount of VAT on purchased equipment is reflected in the debit of account 19

“Value added tax on acquired assets” in correspondence

with account credit 60

.

Non-cash payment for equipment to the supplier is reflected in the accounting records as a debit entry to account 60

in correspondence

with the credit of account 51

“Current accounts”.

The cost of equipment transferred for installation (assembly) is reflected in the credit of account 07

and

the debit of account 08

“Investments in non-current assets”.

In this case, installation of equipment is carried out on our own

.

To summarize information about the costs incurred when installing equipment on our own, accounting account 08

“Investments in non-current assets” is used.

By debit of account 08

expenses related directly to the installation of equipment are reflected

in correspondence with the accounts for inventory

(materials), settlements with employees for wages, etc., and then written off from the credit of account 08 to the debit of account 01.

According to the Federal Tax Service of the Russian Federation, the organization has the right to deduct the amounts of VAT paid to the supplier of the equipment, as well as on the materials used for its installation, after registering this equipment as an item of fixed assets from the moment specified in paragraph 2 of clause 2 of Art. 259 Tax Code of the Russian Federation

, that is, in the month following the month in which this facility was put into operation (

clause 1, clause 2, clause 6, article 171, clauses 1, 5, article 172 of the Tax Code of the Russian Federation

;

clause 44.2 of the Methodological Recommendations on the application of Chapter 21 “Value Added Tax” of the Tax Code of the Russian Federation

, approved by order of the Ministry of Taxes of the Russian Federation dated December 20, 2000 No. BG-3-03/447.

Presidium of the Supreme Arbitration Court of the Russian Federation by resolution of February 24, 2004 No. 10865/03

recognized the organization’s right to claim VAT deduction on equipment requiring installation

immediately after this equipment is registered in account 07

“Equipment for installation”, and not after its installation is completed.

Despite this, the Federal Tax Service of the Russian Federation continues to insist that VAT deductions should be applied only after the commissioning of such equipment.

The tax authorities explain their position by the fact that the resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation was adopted based on a complaint from a specific taxpayer, taking into account the specific circumstances of the case, and cannot be applied by all taxpayers

.

In this situation, the taxpayer will have to decide for himself at what point to claim a VAT deduction, because if the deduction is claimed after the equipment has been accepted into account 07, the taxpayer will most likely have to defend his opinion in court.

Carrying out installation work for one’s own consumption is recognized as an object of VAT taxation ( clause 3, clause 1, article 146 of the Tax Code of the Russian Federation

).

In this case, the tax base is determined

as the cost of work performed, calculated on the basis of all actual expenses of the taxpayer for their implementation (

clause 2 of Article 159 of the Tax Code of the Russian Federation

).

Thus, the tax base is the amount of expenses for performing equipment installation work using one’s own resources.

For the purposes of Chapter 21 of the Tax Code of the Russian Federation

the date of completion of construction and installation work for own consumption is defined as the day of registration of the corresponding object completed by capital construction (

clause 10 of article 167 of the Tax Code of the Russian Federation

).

At the same time, in accordance with paragraph 47 of the Methodological Recommendations

for VAT tax purposes, the date of registration of an object completed by capital construction is determined taking into account the provisions of

paragraph 2, clause 2 of Art.

259 of the Tax Code of the Russian Federation , that is, the organization must charge VAT on the amount of expenses for installation work performed for its own consumption and on its own in the month following the month of commissioning of the installed fixed asset facility.

The accrued VAT amount is reflected in the debit of account 19

in correspondence

with account 68

“Calculations for taxes and fees”.

The deduction of the amount of VAT calculated when performing construction and installation work for one’s own consumption is made as the VAT calculated by the taxpayer when performing construction and installation work for one’s own consumption is paid to the budget (paragraph 2, paragraph 6, Article 171, paragraph 2, paragraph 5, Art. 172 Tax Code of the Russian Federation

).

In accordance with the explanations contained in paragraph 5 of clause 47 of the Methodological Recommendations

, the amount of VAT accrued on installation work performed for one’s own consumption is accepted for deduction after payment of this amount of VAT to the budget as part of the total amount of the declaration.

The deduction of VAT amounts is reflected in accounting as the debit of account 68 in correspondence with the credit of account 19.

The equipment is intended for production needs, has a useful life of over 12 months, therefore it is accepted for accounting as an item of fixed assets

(

clause 4 of PBU 6/01 “Accounting for fixed assets”

, approved by order of the Ministry of Finance of the Russian Federation dated March 30, 2001 No. 26n).

The initial cost of an item of fixed assets is recognized

the amount of the organization's actual costs for its acquisition, production and bringing it into a state suitable for use, excluding VAT and other refundable taxes (except for cases provided for by the legislation of the Russian Federation) (

clauses 8, 12 of PBU 6/01

).

In this case, the actual costs that form the initial cost of the fixed asset item are the amount (excluding VAT) paid to the equipment supplier, as well as the amount of costs for performing the installation of this equipment using one’s own resources.

The commissioning of equipment and its registration as part of fixed assets is reflected in the debit of account 01

“Fixed assets”

and credit account 08

, subaccount 08-3.

In accordance with paragraph 1 of Art.

257 of the Tax Code of the Russian Federation, the initial cost of an item of fixed assets is defined

as the amount of expenses for its acquisition, construction, production, delivery and bringing it to a state in which it is suitable for use, with the exception of amounts of taxes that are subject to deduction or taken into account as part of expenses in accordance with the Tax Code of the Russian Federation .

The initial cost of equipment for tax accounting purposes in the case under consideration includes the costs of its acquisition and installation at the site of operation and corresponds to the initial cost of the equipment in accounting.

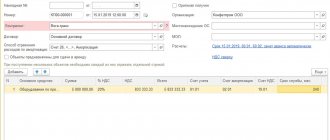

You can register the purchase, installation and commissioning of equipment using the following accounting entries:

:

| Contents of operation | Debit | Credit |

| Equipment requiring installation (installation) has been registered | 07 | 60 |

| The amount of VAT presented by the equipment supplier is reflected | 19 | 60 |

| Paid the cost of the equipment to the supplier | 60 | 51 |

| The equipment was transferred for installation (assembly) at the site of operation | 08-3 | 07 |

| Reflects the transfer of materials for equipment installation | 08-3 | 10 |

| VAT accepted for deduction when purchasing materials has been restored | 19 | 68 |

| The costs of performing equipment installation work are reflected | 08-3 | 02, 69, 70 |

| The equipment was put into operation and registered as part of fixed assets | 01-1 | 08-3 |

| VAT amounts paid on equipment and materials used for its installation are accepted for deduction | 68 | 19 |

| VAT is charged on the cost of construction and installation work performed for own consumption | 19 | 68 |

| Accepted for deduction of VAT paid to the budget | 68 | 19 |

2.

Since the manufactured racks meet the conditions listed in

clause 4 of PBU 6/01 “Accounting for fixed assets”

, approved by order of the Ministry of Finance of the Russian Federation dated March 30, 2001 No. 26n, they are subject to reflection in accounting as part of the organization’s fixed assets.

According to paragraphs 7, 8 of PBU 6/01

fixed assets are accepted for accounting

at historical cost

, which, in the case of production on its own, recognizes the amount of the organization's actual costs for construction and production, with the exception of value added tax and other refundable taxes (except for cases provided for by the legislation of the Russian Federation).

In this case, the initial cost of manufactured racks consists of the cost of materials, employee wages and payroll deductions.

According to clause 17 of PBU 6/01

the cost of fixed assets is repaid

through depreciation

, unless otherwise established by PBU 6/01.

At the same time, fixed assets worth no more than 10,000 rubles. per unit or other limit established in the accounting policy based on technological features, it is allowed to be written off as production costs (selling expenses) as they are released into production or operation.

In order to ensure the safety of these objects in production or during operation, the organization must organize proper control over their movement ( clause 18 of PBU 6/01

).

In accordance with paragraph 1 of Art. 156 of the Tax Code of the Russian Federation is recognized as depreciable property

property that is owned by the taxpayer, is used by him to generate income and the cost of which is repaid by depreciation.

Depreciable property is property with a useful life of more than 12 months and an original cost of more than 10,000 rubles.

According to paragraphs 3 p. 1 art. 254 Tax Code of the Russian Federation

The organization's expenses for the purchase of tools, fixtures, equipment, instruments, laboratory equipment, work clothes and other property that

are not depreciable property

are included in

material expenses

in full as they are put into operation.

Moreover, in accordance with paragraph 4 of Art. 254 Tax Code of the Russian Federation

if the taxpayer includes in its material expenses

products of its own production

, results of work or services of its own production, the assessment of these products, results of work or services of its own production is made based on the assessment of the finished product (work, services) in accordance with

Art.

319 of the Tax Code of the Russian Federation , that is,

based on the amount of direct expenses

.

If the manufactured racks have an initial cost of more than 10,000 rubles.

(taking into account the cost of the material, employee salaries, etc., most likely this will be the case), then these racks will be

depreciable property

.

As stated above, the cost of fixed assets is repaid through depreciation.

Moreover, in accordance with clause 18 of PBU 6/01

Depreciation is calculated using one of the following methods:

– linear method;

– reducing balance method;

– method of writing off value by the sum of the numbers of years of useful life;

– a method of writing off cost in proportion to the volume of products (works).

Calculation of depreciation charges

for an item of fixed assets begins on the first day of the month following the month of acceptance of this item for accounting, and ends on the first day of the month following the month of full repayment of the cost of this item or write-off of this item from accounting (

clauses 21, 22 of PBU 6 /01

).

In accordance with the Instructions for using the Chart of Accounts

the accrued amount of depreciation of fixed assets is reflected in accounting under the credit of account 02 “Depreciation of fixed assets” in correspondence with the production cost accounts.

The taxpayer will need to determine based on the Classification of fixed assets included in depreciation groups

, approved by Decree of the Government of the Russian Federation dated January 1, 2002 No. 1, which depreciation group the manufactured racks belong to, and based on this, for tax accounting purposes, determine its useful life.

In accordance with paragraph 1 of Art. 257 Tax Code of the Russian Federation

the initial cost of an item of fixed assets (racks) is determined as the amount of expenses for its acquisition, construction, production, delivery and bringing it to a state in which it is suitable for use, with the exception of amounts of taxes that are subject to deduction or taken into account as part of expenses in accordance with the Tax Code of the Russian Federation .

The initial cost of racks for tax accounting purposes in the case under consideration includes the costs of purchasing rolled metal and installation costs, but does not correspond to the initial cost in accounting, since the unified social tax, contributions for compulsory pension insurance and insurance contributions from accidents accrued to the salaries of production personnel.

The fact is that all these contributions according to paragraphs. 1 clause 1 art. 264 Tax Code of the Russian Federation

included in other expenses.

For income tax purposes, depreciation is calculated

begins on the 1st day of the month following the month in which this object was put into operation, and ends on the 1st day of the month following the month when the cost of such an object was completely written off or when this object was removed from depreciable property taxpayer for any reason (

clause 2 of article 259 of the Tax Code of the Russian Federation

).

Thus, for racks, depreciation in tax accounting should be accrued from the same moment as in accounting

.

When calculating depreciation in accounting and tax accounting, it is necessary to keep in mind that in the event of a discrepancy between the useful life or the initial cost of an item of fixed assets for accounting purposes and for tax accounting purposes, deductible temporary differences may arise in accounting, leading to the formation of deferred tax asset, namely deferred income tax, which should reduce the amount of income tax payable to the budget in the following reporting period or in subsequent reporting periods ( clauses 8-11, 14 PBU 18/02 “Accounting for income tax calculations”

, approved by order of the Ministry of Finance of the Russian Federation dated November 19, 2002 No. 114n).

VAT is calculated for the manufacture and installation of shelving according to the procedure outlined above.

3.

used equipment

is purchased for sale and repaired, then such pre-sale preparation (improving the technical characteristics of the equipment) is essentially a

production activity

.

Expenses associated with the acquisition and repair of equipment in accounting form the actual cost of finished products in accordance with clause 203 of the Guidelines for accounting of inventories

, approved by order of the Ministry of Finance of the Russian Federation dated December 28, 2001 No. 119n.

In tax accounting, these are expenses associated with production and sales, which for taxpayers who determine income and expenses on an accrual basis are distributed into direct and indirect in the manner established by Art. 318 Tax Code of the Russian Federation

.

| Contents of operations | Debit | Credit |

| The unit was purchased for further resale | 41 | 60 |

| Spare parts were purchased for further resale | 41 | 60 |

| Spare parts have been received for use during repairs. | 10-1, 10-5 | 41 |

| A unit requiring repair and restoration work has been registered | 102 | 41 |

| The transfer of the unit for repair and restoration work is reflected | 20 (23) | 10-2 |

| The wages of workers performing repair and restoration work are reflected, as well as the unified social tax and insurance contributions for compulsory social insurance accrued on it | 20 (23) | 70, 69 |

| The cost of spare parts and materials used to repair the unit is reflected | 20 (23) | 10-1, 10-5 |

| The unit was registered after carrying out a complex of repair and restoration work | 43 | 20 (23) |

Tax consultant at LLC NK Your Tax Representative

M.V. Grebenkin

© LLC “NK Your Tax Representative”

Account 07 “Equipment for installation”: accounting and postings

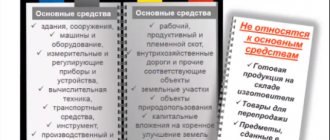

Equipment to be used by an organization for specific purposes is divided into two categories:

- to be installed;

- not subject to installation.

The first category includes various machines and devices, pilot plants, mechanisms and electrical appliances. The main criterion for inclusion in the first category is the installation features of these objects, namely installation in walls or connection to the foundation.

The second category includes various mobile machines and devices, tools that cannot be installed by the above installation, as well as vehicles.

The first category is accounted for on account 07. For the second, accounting is carried out on account 08.

Specialized account 07 interacts with many other accounts, including:

- by debit from 08, 76, 91, etc.;

- on a loan from 15, 60, 76, 91, etc.

This account is intended for accounting of installed fixed assets by persons whose activities are related to construction and reconstruction. They take into account various machines and other objects intended for installation in newly created and converted buildings and structures.

Disposal of equipment for installation

Disposal of purchased but not installed equipment listed on account 07 is possible as a result of:

- Write-offs due to unsuitability;

- Sales to another person;

- Free transfer, etc.

Unusable equipment that did not have time to be transferred for installation is subject to write-off from credit 07 to debit 94. If no specific person is to blame for the cause of the write-off, then the losses are included in other expenses, otherwise - to the accounts of specific guilty employees.

If it is decided to sell the object without installation or transfer it as a gratuitous gift, then this procedure should be completed through 91 invoices. If there is a tax obligation to pay VAT, it must be calculated on the basis of the value (sale value upon sale or market value upon donation) for subsequent transfer to the budget.