Author: Ivan Ivanov

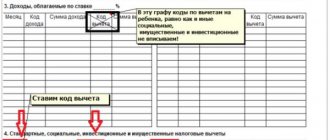

Two years ago, it was decided to change the form for the 2-NDFL certificate. As a result, different codes began to be used in different columns.

Sometimes putting the correct code is not a big problem, especially if we are talking, for example, about the Federal Tax Service. Accountants know that this is a four-digit tax code where the agent is registered and where, in fact, the tax documentation needs to be submitted. Moreover, the first pair of digits is the region number, and another pair is the tax code, where all reports are submitted.

However, there are more complex codes that you need to know about and be able to apply in practice. These include the document code that is responsible for the identity card. You can count 14 different codes corresponding to documents. By the way, code 07 is a military ID, and 21 is, directly, a passport.

The form must indicate the citizenship of the individual, for which, in fact, the certificate will be issued. And this information is also encoded. And if we are talking about citizenship, and in practice - the country code, it is worth determining it using OKSM. So, the code of Russia is number 643.

However, the most interesting, of course, are the deduction and income codes. Most often, it is these codes that cause the greatest difficulties for accountants.

What does deduction code 508 mean?

Employers have the right to pay their employees financial assistance. It may be provided for in a collective or employment agreement, or provided simply upon the employee’s application. In most cases, financial assistance is paid in cash, but sometimes it is in kind (property).

The main reasons for providing financial assistance are:

- birth of a child;

- wedding, anniversary, retirement, other special events;

- funeral of close relatives;

- health problems;

- difficult financial situation (including due to unforeseen circumstances: car theft, flooding or fire in the apartment, robbery, etc.).

Some types of financial assistance are exempt from taxation. This also applies to payments on the occasion of the birth of a child. Tax deductions from such amounts are indicated in the 2-NDFL certificate, as well as in the accounting registers where the income and expenses of citizens are kept, using code 508.

Deduction code 501 where to put in 3 personal income taxes for 2021

- For students aged 18-24 - confirmation of full-time education (certificate copy)

- Children's metrics (copy)

- Documents confirming family ties and (or) guardianship (copies)

- Licenses of service providers for educational (medical) activities

- Pension insurance policy and agreement (copies)

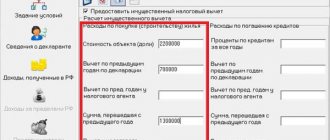

New declaration for personal income tax compensation when purchasing an apartment

This is a benefit provided to employees based on their income from the employer . If you need to receive a deduction for a child or another standard one, you should fill out this section. Typically, deductions are provided by the employer when calculating wages, but there are situations when personal income tax is withheld from the entire amount of income without taking into account benefits.

This is a benefit provided to employees based on their income from the employer . If you need to receive a deduction for a child or another standard one, you should fill out this section. Typically, deductions are provided by the employer when calculating wages, but there are situations when personal income tax is withheld from the entire amount of income without taking into account benefits.

Tax deduction amount by code 508

This deduction is an income tax benefit. Its essence lies in the fact that a certain amount of income representing material assistance is not subject to taxation - this is provided for in Article 217 of the Tax Code.

According to this document, financial assistance that an employer pays to an employee on the occasion of the birth (adoption) of a child in the amount of up to 50,000 rubles is not subject to income tax.

Accordingly, the maximum amount of income tax benefit will be 6,500 rubles (50,000 x 13% = 6,500).

Calculation example

Let’s assume that the company paid an employee financial assistance on the occasion of the birth of a child in the amount of 80,000 rubles. In this situation, the income tax calculation will look like this:

80,000 – 50,000 = 30,000 rubles

30,000 rubles x 13% = 3,900 rubles

Income tax is withheld from the amount of 30,000 rubles, since 50,000 rubles should be deducted from financial assistance in the amount of 80,000 rubles, which in this case are not subject to taxation according to Art. 217 Tax Code of the Russian Federation.

This example assumes that the employee who received financial assistance is not entitled to other income tax benefits (deductions).

Legal issues

Now almost all accounting departments are automated, so problems with incorrect assignment are rare. In addition to income codes, the Tax Code provides codes for tax deductions related to personal income tax.

What is deduction code 501: features of reflection in certificate 2 - personal income tax

The named value is considered, however, to be quite acceptable. Non-residents are forced to share a huge part of their own income with the state - as much as 30%! To make it clearer, we will give you an example.

- receive wages at the place of employment;

- receive royalties for the literary work they publish;

- sell an apartment, house or other housing, or maybe just a share in it;

- receive bonuses from their superiors;

- rent out their own living space;

- accept the provision of financial assistance;

- sell a car and other property belonging to them;

- in many other situations.

You can submit documents to receive a deduction any day after the end of the year in which the money was spent. The deduction can be received within three years. When selling an apartment or car that has been owned for less than 3 years, fill out the title page, sheet A, sheet D2 and sections 1 and 2 of the 3-NDFL declaration.

How to put deduction code 501 in the 3 personal income tax declaration for 2021

To pay tax on renting out an apartment, you only need to fill out the title page, sheet A and sections 1 and 2. When purchasing an apartment, you can get a tax deduction - fill out the title page, sheet A, sheet D1 and sections 1 and 2. Fill out the same pages for personal income tax refund when paying a mortgage loan.

In certain cases, a tax deduction refers to a partial refund of funds that were previously paid in the form of taxes on the income of an individual. For example, purchasing an apartment, medical expenses or training. In principle, tax should not be withdrawn from the amounts you spent on the above actions.

When filling out this form, tax authorities must indicate such a parameter as the income code. It plays an important role because it reflects the most important transactions and assists in carrying out basic accounting calculations.

What does code 503 mean in the 2-NDFL certificate?

28 Art. 217 of the Tax Code of the Russian Federation, the amount of financial assistance up to 4,000 rubles is not subject to taxation. That is, a deduction under code 503 is provided only when receiving financial assistance and for no more than 4,000 rubles per year.

Payment source - click on the first green +. In the window that appears, fill in the name of the organization you work for, INN, KPP, OKTMO. You can take the information to fill out this window from section No. 1 of the 2-NDFL certificate (get the certificate from the accounting department at your place of work).

Documents for granting the right to deduction 508

The decision to pay an employee financial assistance is formalized by a corresponding order from the head of the enterprise. This order can be issued on the basis of the following documents:

- employee's personal statement;

- a child’s birth certificate or an act of adoption;

- provisions of the contract or collective agreement (if any);

- an internal document of the enterprise regulating the procedure for allocating financial assistance to employees (if any).

If an employee was paid financial assistance on the occasion of the birth of a child, then if the above documents are available, an amount of up to 50,000 rubles is automatically discounted.

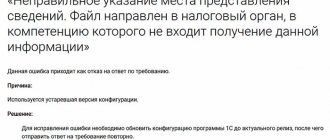

Step-by-step instructions for fixing error 508

So, if there is an error 508, the calculation is returned for revision. The procedure for further actions is the same for all obligated persons. (click to expand)

| Step-by-step actions of the obligated person to correct error 508 | Explanations |

| Read the FSS instructions regarding the existing error (508) and, according to them, make adjustments to the calculation | To make adjustments, you should update the program that generates the reports, check the completeness of the previously downloaded data, and perform other actions if necessary; all instructions sent by the fund along with the returned payment are binding |

| Check the adjusted calculation yourself on the official website of the Social Insurance Fund automatically | Sequence of actions for automatic checking: 1. Prepare calculations in an accounting program. 2. On the FSS website, find “Form 4-FSS”. 3. Upload the completed adjusted calculation form. 4. Check the downloaded calculation (click “check”). In this way, you can check any version of the 4-FSS before submitting it to the FSS |

| Submit an adjusted FSS calculation | When resubmitting the document, you must comply with the established deadlines for submitting reports. The payment must successfully pass all stages of verification: receipt, file decryption, digital signature verification, format and logical control, receipt generation. Only after this will it be considered accepted Date of submission of 4-FSS - the day the form was accepted after the verification was carried out |

If the errors were corrected, the calculation successfully passed control and was accepted, the Social Insurance Fund authorities notify the obligated person about this. He is sent confirmation of acceptance of 4-FSS (

What does income code 2762 mean in personal income tax certificate 2?

When drawing up a certificate, you must be guided by the following rules:

- All income is displayed in the form of codes;

- A list of income codes can be obtained by using a specialized directory;

- If you use software, it needs to be updated systematically to ensure all calculations are done correctly;

- Code 2762 reflects exclusively data on the income that an individual receives as financial assistance. Such assistance is awarded exclusively by the employer.

Insurance premiums

Insurance contributions are levied on payments and other remuneration that are made in accordance with labor legislation in favor of individuals who are subject to compulsory insurance (Article 20.1 125-FZ and Article 420 Tax Code). Financial assistance for the birth of a child in 2018, from the point of view of insurance premiums, is considered in the same way as when determining the personal income tax base. The targeted nature of such material support allows it to be excluded from the amount for calculating contributions, but also within the limit of 50,000 rubles for each child during the year (clause 3 of article 20.2 125-FZ and clause 3 of article 422 of the Tax Code of the Russian Federation).

Financial assistance in connection with the birth of a child

The birth of children in a family is a joyful event in the life of every person. Even if it is associated with serious material costs: both before its appearance and after. Any help to parents, guardians and adoptive parents in such a situation will not be superfluous. Moreover, both parents can receive it.

Such material assistance does not relate to wages, because it is neither stimulating nor compensatory in nature, but is aimed at targeted support for the employee in a special life situation. Let's look at how financial assistance for the birth of a child is obtained from an employer.

One-time financial assistance is provided to employees when:

- birth;

- adoption, adoption;

- establishment of guardianship.

The opinion of legislators on determining the personal income tax base and insurance premiums on such income has its own peculiarity.

Features of formatting help with codes

The legislation of our country establishes that a certificate that displays the income of citizens must necessarily indicate information about all types of income. Moreover, this information is indicated exclusively in an encoded format.

The thing is that in the program you must indicate only the income code, as well as the amount of income. Next comes the process of automatically calculating taxes that must be withheld from the employee. Each income is subject to its own personal income tax rate. You must understand that in order to correctly calculate all necessary deductions, you need to correctly indicate the income code.

New form of declaration 3-NDFL from 2021

It is also worth paying attention to the change of surname. This is especially true for women. If the birth certificate contains the maiden name, and now the employee has other data, then it is also worth bringing a document confirming this. In this case, it will be a marriage certificate.

Deduction code 126 in personal income tax declaration 3 2021 how to fill out

Different windows are designed to reflect standard, social and property deductions; by default, the “Standard Tax Deductions” . It is not necessary, but we do not uncheck the box next to “Provide standard deductions”, otherwise one of the pages will not print and the tax office may be sent to redo the declaration.

What category of deductions does code 312 belong to?

In Russia, there are several types of tax deductions, which are provided depending on the taxpayer’s occupation, marital status and other factors.

For example.

The standard deduction is available to most people to provide tax relief for child support expenses. In addition, standard deductions are provided to citizens with a special status (Heroes of the USSR and the Russian Federation, holders of the Order of Glory, etc.). With the help of social deductions, amounts spent on full-time education in educational institutions of the taxpayer or his children under 24 years of age are subsidized. Investment deductions can be used by citizens who have received income from activities in the securities market.

As for the deduction under code 312, it belongs to the category of property deductions. They are used to reduce the tax base of persons who have purchased an apartment or other real estate.

How much income can be reduced?

You can reduce your tax base using deduction code 312 for any categories of income subject to taxation. The main ones are:

- salary - not only basic, but also additional;

- royalties received under copyright agreements;

- income from civil contracts;

- interest on deposits, dividends from other investments;

- income from transactions with currency and securities;

- material assistance paid in cash or in property (in kind) form;

- winnings from participation in casinos and sweepstakes, drawings and lotteries received in monetary or property form;

- income from rental activities.

A new form 3-NDFL has been approved for individual entrepreneurs on special income tax and individuals

- Filling out for the past 3 years is allowed.

- It is possible to submit it in an electronic version, through a special program “Declaration 2021” or in your own hand, but without blots, corrections and in blue (black) ink.

- A separate declaration form is filled out for each year.

- Registration without indicating the date, signature, TIN is unacceptable, the document will be returned as invalid.

- Each form must be completed in duplicate.

- When printing, double-sided design is not allowed.

Such income is reflected in 3-NDFL in sheet B “Income from sources outside the Russian Federation, taxed at the rate of __%”. The code for the type of income data must be indicated in line 031 of sheet B. This code can take two meanings:

Since sheets A and B are intended to reflect any income taxable to personal income tax, except for income from business, advocacy and private practice, therefore, these sheets and, in particular, the codes of types of income, are filled out only by ordinary individuals (not individual entrepreneurs/lawyers/ notaries).

The codes for types of income given in sheets A and B are fundamentally different. For sheet A, they are listed in Appendix No. 4 to the Procedure for filling out 3-NDFL, contained in the order of the Federal Tax Service of Russia dated December 24, 2021 No. MMV-7-11/, which approved the declaration form. And for sheet B, these codes are given directly in the text of the Procedure for filling out 3-NDFL (clause 7.2) broken down into only 2 types:

When filling out a tax return in Form 3-NDFL in 2021, you should keep in mind that the law gives regional authorities the right to reduce the cadastral valuation coefficient for calculating tax. Therefore, before filling out the document, you need to consult the local tax office and clarify the percentage of reduction in the cadastral value to calculate the tax on income from the sale.

To enter the income type code 020 correctly in Appendix 1 of the 3-NDFL declaration, you need to be guided by the approved list (income from Russian sources). It contains only 10 positions. They are enlarged and divided only into main types to make it easier for the user to choose. Let's take a closer look at what is included in this or that line of the list.

“05” - the code is set by landlords who have received rental income. Here there is no need to subdivide from what property the funds were received - everything is combined into one position. This includes renting an apartment and renting any other property - for example, a car or computer.

Form 3-NDFL has many sheets, but a citizen is not required to fill out all of them. He is required to fill out those sheets that reflect his individual situation. Thus, Appendix 1 (in declarations filled out before 2021 - this is sheet A) is filled out by citizens submitting documents for deductions.

- fill out a declaration in the operating room of the Federal Tax Service - there are stands with reference information and, as a rule, there are printed collections with various codes and numbers; if you get into the declaration campaign, which is held annually from February to April inclusive, then consultants will help you correctly indicate the information in all columns;

- use codes posted on the website of the Federal Tax Service of Russia.