Such a certificate is submitted to the tax office by each enterprise. But it also has other areas of application.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

For example, when receiving a loan from a bank, you will definitely need proof of your income. In this case, 2-NDFL will need to be provided. If it is filled out incorrectly, this may cause problems. Therefore, it is important how to correctly draw up this document so that it complies with legal requirements.

Barcode on 2-NDFL certificates: special details

The barcode for 2-NDFL appeared as part of this program.

Previously, two-dimensional codes were assigned to other documents.

It is also on the 3-NDFL form. The advantage of documents with a barcode applied to them is the speed of their processing. All information from the reporting automatically enters the system.

Federal Tax Service specialists do not have to enter data manually.

The system automatically does this for him.

As a result, the program issues already completed certificates with barcodes. Also see.

"".If the system you are using does not put down barcodes, then you need to do it depending on the average list

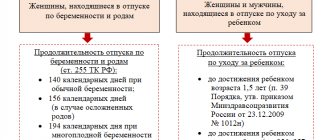

These changes are as follows: The “Adjustment number” field has been added. To put it simply, it is written here at what time the person is trying to submit this certificate.

That is, when a citizen takes it for the first time, for example, to the bank, in this field he writes “00”, and if the second time, then “01” and so on by analogy. More codes have been added. In addition to the usual codes for residents, non-residents and highly qualified specialists, codes have now been added for immigrants living outside the Russian Federation (code 4), refugees (5) and foreigners who came to Russia with their patent and work here.

A line has appeared for social deductions. In this line, the employer will have to write when the notice for deduction arrived, the number of this document and the code of the institution that issued it. Foreigners who work on the basis of a patent will need to indicate advances. For this, there is a field “Fixed

It is better for those who have an official salary to choose loan products that require proof of income and, of course, carefully check the document issued by the accounting department to avoid misunderstandings. Conclusion: We strongly do not recommend using fake 2-nfdl certificates. The bank will happily accept a document in free form with the signature of the responsible person and the seal of the organization, and in some cases (especially when a small amount is required or collateral is used), income will not have to be documented at all.

Pay attention to the offers of banks and microfinance organizations on our website. We will help you get the coveted loan.

If not provided

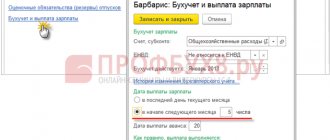

It often happens that tax agents use the latest versions of specialized accounting programs, with the help of which the tax agent completely gets rid of putting 2-NDFL barcodes on his documentation, since instead this procedure will be completely automatically carried out by the program used. Ultimately, this utility will issue certificates already filled out in the appropriate form, which will immediately contain all the necessary barcodes.

If, for one reason or another, the utility you are using does not provide barcodes during its operation, then in this case you can act depending on how many employees the company submits reports for to government agencies.

To avoid any misunderstandings associated with the use of new forms, from which some equipment cannot read information or does not carry out this procedure correctly, then in this case you can adhere to certain recommendations.

First of all, it is best to avoid joining multiple papers using staples or paper clips, as they can damage the barcodes being used.

If any adjustments need to be made to the already completed certificate in the future, the responsible person will have to re-format the documents used, as well as print them out, if such a need really arises.

Form 2-NDFL is required to submit information about income paid to individuals to the tax authority.

In this article you will find a sample of filling out financial assistance in the 2-NDFL report.

A sample of filling out form 2-NDFL can be downloaded.

The personal income tax stamp may not be affixed, but there is a barcode on it, without which the document will be considered invalid. You cannot create a certificate yourself. It is issued by an accountant who fills out the form in a special program and is based on information from personal accounts. In addition to the bank, you may be required to provide a certificate from:

- When calculating alimony.

- When drawing up form 3-NDFL for tax deduction crediting to the Federal Tax Service.

- When adopting a child from an orphanage or baby home, as well as establishing guardianship.

- To the Pension Fund for recalculation of pension payments.

- To consider labor disputes in court.

Online magazine for accountants

The correctness of the calculated amounts.

- Correct entry of deduction and deduction codes.

- If any of them are found in the document, then the document must be returned to its owner and replaced with a new one, without violations. To provide a small loan amount for a short period, a visual check of the certificate is sufficient. The banker can check the data of the company listed in the certificate with the general register of legal entities in the Federal Tax Service of the Russian Federation and compare the TIN data and other details. A detailed study of information about the borrower. A visual check of 2-NDFL is followed by a more detailed one. The following steps are performed here:

- Telephone verification of the organization in which the person works.

The basis for rejecting certificates without a barcode will be that the version of the updated 2-NDFL is a form approved by law. Why is it needed For several years in a row, tax specialists have been coding reporting forms.

Attention

This develops the field of electronic document management, which means it simplifies the work of not only tax agents, but also specialists of the Federal Tax Service. The barcode for 2-NDFL appeared as part of this program.

Previously, two-dimensional codes were assigned to other documents. It is also on the 3-NDFL form. The advantage of documents with a barcode applied to them is the speed of their processing.

All information from the reporting automatically enters the system. Federal Tax Service specialists do not have to enter data manually.

Info

All of them are machine recognized. The introduction of such technologies can significantly reduce the likelihood of making mistakes. From the tax service point of view, they are practically zero.

Also see

Bank employees also call close relatives to study personal information about the borrower.

- A request can be created at the place of work to confirm the data from the 2-NDFL certificate.

- The salary level is compared with the salary in the region of the profession that the employee occupies at the workplace.

- Data is exchanged with other banks regarding debt or regular late payments.

- Situations often occur when the current employer does not provide the bank with the requested details of real income, in which case the bank has the right to refuse to issue a loan to the person. Security Service Service employees carry out a more thorough and in-depth check. As a rule, the bank's security service gets involved when a person wants a large amount of money.

Paper Features

The need to print such documents with specialized barcodes has been fixed for more than two years, and a strict place on the document is provided for the placement of this element - they must be placed in the upper left corner of the generated document. This marking is mandatory today, since it significantly simplifies reporting processing.

By using this marking, the data from the certificate will be taken into account and recorded directly in the INFS database, thanks to which tax officers will be able to save a huge amount of time.

In this regard, if you need to issue a certificate in form 2-NDFL, it must have a unique barcode, and if reporting is submitted in a multi-sheet version, then in this case it is highly not recommended to combine pages with a stapler, so how this can lead to damage to two-dimensional elements that help optimize electronic document management.

If the certificates used do not have barcodes, then tax officials have every right to refuse to accept this documentation, since their execution differs significantly from the form accepted by law.

Of course, if you order the appropriate forms in advance, then in this case you will receive papers drawn up in the correct order, but in any case, it is better to check the barcodes in this situation.

You can download the application for a 2-NDFL certificate on the website. Is it possible to submit 2-NDFL without a TIN - read the details here.

As mentioned above, the only solution to the situation when there is no marking on a document is to file reports in paper form, if the company has an average number of employees of 25 people, since accountants of such organizations are given the opportunity to submit reports filled out by hand, and that is quite enough obtain ready-made forms. For everyone else, the only option left is to use the “Legal Taxpayer” program, located on the official website of the tax service.

Example of a barcode on a 2-NDFL certificate

For 2 personal income tax, set the barcode

What are the personal income tax benefits? The advantages of technology are:

- saving money and time for tax inspectors;

- a simple and convenient way to record enterprises and information on their economic activities;

- increasing data processing speed.

Printing reports also has certain standards.

The state obliges the use of high-quality paper, modern printers for printing and one-sided submission of information (on one side of the landscape sheet). The basis for rejecting certificates without a barcode will be that the version of the updated 2-NDFL is a form approved by law.

The data with the declaration completed by the tax agent is sent to an electronic file, which collects the most necessary information. The electronic format file is processed using a single printing module, the system sends the received data to a specific tax authority template.

After this, from the database system, tax inspectors can print out any data that is necessary for control and accounting of enterprises and organizations. After completing the necessary activities, the tax agent sends a report to the place of registration and accounting.

Methods of data processing and comparison Using machine methods and data center technologies, the tax office compares the information received. After this, the data verification procedure takes place, deviations, errors and shortcomings are identified.

general information

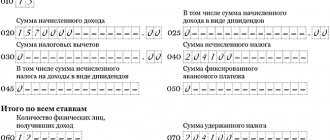

Filling out and submitting the 2-NDFL report is necessary so that the tax office receives information about what income this individual had and how much income tax he paid on it.

Reports are submitted for the calendar year and must be received by the tax authorities no later than April 1 of the following reporting year.

Such a certificate is submitted by a tax agent, that is, the one who is responsible by law for the transfer of this tax.

It also provides the opportunity to submit corrections to an already submitted document. The code for the type of certificate is entered in the appropriate column.

It is also possible to submit a cancellation document. There they indicate the lines that need to be removed from the original document.

As you can see, there are several options for this type of report.

In addition, when a report is submitted to the tax office, there are not only certificates for each employee, but also a register of 2-NDFL certificates is compiled.

How do banks check the authenticity of a 2-personal income tax certificate?

Important

How does the bank check the 2-NDFL certificate? An income certificate in 2-NDFL format is one of the most important documents for a bank when granting a loan. It is in 2-NDFL that information about the client’s average monthly income is displayed, which determines the level of solvency. Personal Income Tax stands for “Personal Income Tax” - the income tax that you and I pay to the state from each official salary.

In our country this is as much as 13%. A 2-personal income tax certificate is issued in the accounting department of the organization where you are officially employed. But it’s no secret that employees of some companies, especially small ones, receive a share of their salary “in an envelope”, and the official income according to documents is very low. Some citizens even work unofficially, and obtaining a certificate of income in this case is problematic.

Security Service Service employees carry out a more thorough and in-depth check. As a rule, the bank's security service gets involved when a person wants a large amount of money. Today, many companies provide services specifically for those who are engaged in forgery and partial falsification of 2-NDFL certificates.

The essence of the service is that this kind of organization answers the bank's calls.

And when an employee asks whether a potential borrower works for the company, he is given a positive answer at the other end of the line.

But the bank has a completely legal way to check the 2-NDFL certificate for falsification. To do this, you just need to visit the official website of the Federal Tax Service.

Criminal Code of the Russian Federation (forgery of forms and seals);

- the potential borrower himself will be included in the bank’s stop list;

- the loan will be denied.

The most unpleasant outcome for a client who decides to forge a certificate is the fact that the bank contacts the police or immediately goes to court. There are often cases in judicial practice when, under this article, citizens who in any way participated in the falsification of 2-NDFL certificates or who were directly involved in their production received real prison sentences.

Attention

The main job of the security service of any commercial and state bank is:

- Preventive measures to protect financial assets.

- Processing various types of information about clients and potential clients.

- Protection of commercial and confidential information relating to the activities of the bank and its clients.

It is SEB that in most cases verifies the authenticity of the provided certificates of form 2-NDFL.

As well as all other documents submitted to the bank. Most often, units of this type are staffed by qualified lawyers, former employees of the Ministry of Internal Affairs. That is why you should not provide fake documents to the bank - the likelihood that the fraudster will be exposed is very high. And forgery of documents and official forgery faces criminal liability.

Attention

It is better for those who have an official salary to choose loan products that require proof of income and, of course, carefully check the document issued by the accounting department to avoid misunderstandings. Conclusion: We strongly do not recommend using fake 2-nfdl certificates.

The bank will happily accept a document in free form with the signature of the responsible person and the seal of the organization, and in some cases (especially when a small amount is required or collateral is used), income will not have to be documented at all. Pay attention to the offers of banks and microfinance organizations on our website.

We will help you get the coveted loan.

Nowadays, not all companies have begun to use electronic means for submitting accounting and tax reports. At the same time, any beginning entrepreneur may be faced with the need to issue his employees a 2-NDFL certificate, which must have a barcode on it. The Tax Service developed a specialized method for recording and processing information reflected on various paper media, and it was decided to introduce the use of specialized barcodes, with the help of which civil servants will be able to solve a huge number of problems associated with accounting and reporting.

Many people do not know why a barcode is needed on a 2-NDFL certificate and how its use is regulated by current legislation in 2021.

Attention

On the main page of this site you can very easily and quickly get all the reliable information about a legal entity, knowing:

This data is usually quite enough to get acquainted with all the necessary information about the representative of the income certificate. The information received will have a reliability close to 100%. The same applies to individual entrepreneurs and KFC.

Tips and tricks

Here are some recommendations:

- When submitting such certificates, it is recommended to use high-quality paper, the density of which is no less than 80 grams per cubic centimeter.

- It is recommended not to use a stapler to avoid damaging the barcode.

- It is recommended to print the certificate only on one side of the sheet.

In order to submit reports without problems, you need to keep track of changes in legislation on time and provide accounting departments with the appropriate forms on time.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Personal income tax (personal income tax)

What does the barcode on 2-personal income tax mean?

In accordance with these regulations, it is approved:

- form of providing information about the income of certain individuals;

- the procedure for completing the form of information on the profits of individuals;

- the format in which information on the profits of individuals should be submitted electronically;

- the form in which a notice of impossibility of withholding taxes must be submitted, as well as the amount of income of the individual from whom it was not possible to withhold tax, and the total amount not withheld.

In addition, in accordance with this order, Tax Service Order No. ММВ-7-3/611 was completely neutralized, in accordance with which the previously existing form for submitting data on the income of individuals was adopted.

Important

They can make a request to the tax service, but it is simply impossible to check all the certificates in this way. Large reputable banks in some cases request reports from the organization where the borrower works, from the pension fund or copies of payroll papers.

If there is a difference between the client’s real income and that stated in the certificate, everything will become obvious. In this situation, the bank's security service has the right to call the head of the company and the borrower's relatives to verify the authenticity of the data provided when applying for a loan.

In doubtful cases, a bank employee also finds out the average salary in the area in which the company operates. And with a significant gap in the direction of overestimation, the deception will be exposed.

Banks are more willing to give loans to those who are salary card holders, because it is very easy to check the receipt of funds.

Serious deception, when the borrower provided a fake certificate without planning to repay the loan, is fraught with a fine of 120 thousand rubles or a year of correctional labor. Sometimes the court issues a verdict: 2 years probation, or 4 months in a general regime colony. Simple falsification of a document without further malicious intent (Article 327.3) is punishable by a fine of up to 80 thousand rubles or forced labor for a total duration of 480 hours.

But this is by law. In most cases, the police simply talk to the unscrupulous borrower and let him go. Here whoever is lucky. And of course, you will ruin your credit history for a long time. The bank will definitely share this information with the Credit Bureau. How to fill out the 2-NDFL certificate correctly? When submitting documents for a loan, a bank employee draws attention to every detail, including the 2-NDFL certificate.

In 2015, a document form was approved, in which there is a barcode in the upper right corner. Now the 2-NDFL report is submitted on exactly these forms.

Order of the Federal Tax Service of Russia dated October 30, 2015 N ММВ-7-11/

Since the tax office processes a fairly large number of documents, the use of computer processing and document accounting capabilities is relevant.

At the legislative level, it was decided that:

- enterprises with more than 25 employees are required to submit reports electronically;

- if there are 25 or fewer, it is allowed to submit them on paper.

In the first case, all processing can be carried out using computer technology. In the second case, we are talking about manual processing, which is many times slower.

In order to facilitate the work, a form was created containing a barcode, which can be considered a special device.

This innovation is intended to make the work of tax officials easier when accepting such reports.

The information contained in the code does not contain specific numbers of the report, but information about the form of the document.

Do I need to provide 2-NDFL for a new place of work?

How is a 2-NDFL certificate issued for a foreigner? Find out .

Should there be or not

The main purpose of barcodes is to provide automation of reporting for the tax service.

Each tax and other forms have certain markings, and all this as a whole represents a separate element of the development of electronic document management in our country. If reporting is submitted in paper rather than electronic form, tax officials need to independently transfer all the necessary information into their programs.

A barcode, which is read using special equipment, makes it possible to completely eliminate the need for manual data entry, which also eliminates inevitable errors. To prevent this field from being damaged, it is highly not recommended to staple several sheets of paper with a standard stapler during the documentation process.

It must be included on the 2-NDFL certificate, that is, with a barcode already placed, and therefore a certain form of the certificate has been approved. If it is missing, then the tax authorities will simply not accept the information on profit, and will indicate as a basis for refusal that the submitted certificates do not comply with accepted standards.

If profit certificates are filled out using specialized accounting utilities, then in this case there should not be any difficulties with affixing barcodes to 2-NDFL, since the program automatically downloads current forms.

If for some reason this format is not used, then you can manually fill out all the necessary documents and submit reports in paper form, but this is only allowed if the average number of employees in the organization is less than 25 people.

If the average number of employees of the company is larger, then in this case you can use a special program posted on the official website of the tax service, which helps prepare data on Form 2-NDFL for any number of employees for the purpose of their further submission in the form of tax reporting.

New certificate form 2NDFL

Personal income tax manually, but recently specialized PDF417 technologies have also gradually begun to be introduced, which make it possible to get rid of this need. If we talk about the advantages of using such a system, thanks to which it has become so necessary today, then it is worth noting several main ones:

- saving money and time that tax inspectors need to spend processing all the information received;

- the ability to maintain convenient and simple accounting for modern companies, which means that much less resources are spent collecting all the necessary information on core economic activities;

- a significant increase in the speed of processing all necessary information.

In addition, certain standards also apply to the printing format of all required reports.

PDF417 technology is used in the following areas of activity:

- digital personal identification;

- accounting of commercial products;

- accounting of documentation and information.

Purposes of using PDF417 in the field of taxation In the field of accounting and taxes, the barcode for 2 personal income tax is used to achieve the following goals:

- simplification of the procedure for entering data on the activities of enterprises;

- increasing the level of database performance;

- reduction of errors when entering and processing information about taxpayers.

Accounting is carried out using standardized rules for placing codes on the pages of reports and declarations. Each document and its page corresponds to a specific two-dimensional code.

An established classification helps to get rid of unnecessary difficulties and errors during accounting and audits. Compensation for unused vacation: ten and a half months go in a year When an employee who has worked in the organization for 11 months is dismissed, compensation for unused vacation must be paid to him as for full time year (clause 28 of the Rules, approved by the NKT of the USSR on April 30, 1930 No. 169). But sometimes these 11 months are not so spent. {amp}lt; ...

Income tax: the list of expenses has been expanded. A law has been signed that has amended the list of expenses related to wages. Thus, employers will be able to take into account in the “profitable” base the costs of paying for services for organizing tourism, sanatorium-resort treatment and recreation in Russia for employees and members of their families (parents, spouses and children).

What does the document indicate?

There is a special form and the data and details that must be included in the document are defined. Data is provided not only for the employee, but also for the employer:

- Name of company. In this case, all registration codes in the tax register, as well as other details, are indicated;

- Employee’s passport data (taken from the first two pages);

- The amount of total income for a clearly defined period of time is indicated;

- The sum of all deductions;

- Data on standard, social and property deductions may be indicated, indicating their codes (if the employee is entitled to receive them).

Receipt for payment of insurance premiums to the Pension Fund in 2021: instructions and form

Insurance contributions to the Pension Fund are one of the mandatory payments that must be paid regardless of whether business activity is being conducted or not. In this article we will tell you how to generate a receipt for payment of insurance contributions to the Pension Fund for an individual entrepreneur in 2019 and provide instructions on how to pay a receipt of contributions to the Pension Fund for an individual entrepreneur in 2021 online on the tax office website.

Mandatory payments for entrepreneurs include contributions to social funds - the Pension Fund, the Compulsory Medical Insurance Fund and the Social Insurance Fund. The last type of contributions is paid if there are employees in case of temporary disability, injury and maternity. When it comes to individual entrepreneurs’ contributions for themselves, the main requirement is payment of mandatory contributions to the Pension Fund.

Late payment of mandatory contributions may result in fines and sanctions from the tax authorities. If you are afraid of missing deadlines or filling out the payment form incorrectly, entrust the work of paying insurance premiums to experienced specialists. For example, using this service.