The concept of targeted financing

Definition 1

Targeted financing is the funds that an enterprise receives from the state budget to achieve certain goals in the activities of such an enterprise.

In essence, targeted financing is government assistance for the development of certain areas of the organization’s activities.

An important condition that an organization that has received such funding must fulfill is to use the funds strictly for their intended purpose. The compliance of the costs incurred by the enterprise is compared with the approved estimates for the implementation of various activities that are financed by the state.

Note 1

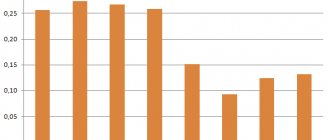

Based on practice, the largest share of targeted funding is received by enterprises in the agro-industrial sector, which is associated with government programs to support public agriculture.

Finished works on a similar topic

- Coursework Targeted funding 420 RUR.

- Abstract Targeted financing 280 rub.

- Test work Targeted financing 200 rub.

Receive completed work or specialist advice on your educational project Find out the cost

Explanation of balance sheet asset lines

10 “Materials”, 11 “Animals for growing and fattening”, 14 “Reserves for reducing the cost of material assets”, 15 “Procurement and acquisition of material assets”, 16 “Deviation in the cost of material assets”, 20 “Main production”, 21 “Semi-finished products own production”, 23 “Auxiliary production”, 28 “Defects in production”, 29 “Service production and facilities”, 41 “Goods”, 42 “Trade margin”, 43 “Finished products”, 44 “Sales expenses”, 45 “Goods shipped”, 97

50-3 “Money documents”, 94 “Shortages and losses from damage to valuables”

Targeted financing as an object of tax and accounting

Targeted financing is mentioned in the main regulatory legal act of the state for the purposes of taxation of enterprises - in the Tax Code of the Russian Federation.

Thus, the funds that are recognized in tax accounting as targeted financing are the following:

- Subsidies and appropriations for budgetary organizations.

- Free and non-repayable grants provided for benefits such as education, scientific development, cultural events, health or environmental activities.

- Investment financing that an organization receives upon completion of competitions.

- Funding of scientific or innovative projects.

In the sphere of regulating the income and expenses of an enterprise, taxation control authorities pay attention to the amount of funds received and to the expenses of the enterprise, which must correspond to the intended purpose of the funding received.

In terms of accounting, targeted financing is regulated by PBU 13/2000 “Accounting for state aid.” This regulatory document regulates the following types of targeted financing:

Do you need to select scientific articles for your academic work? Specify a topic and receive a response in 15 minutes get help

- Subventions, that is, funds from the state budget that the financed enterprise receives free of charge and irrevocably.

- Subsidies, that is, state budget funds that cover a certain share of the costs of targeted financing.

- Budget loans, that is, resources received by an enterprise, both in the form of cash and in the form of other resources (land, natural resources, etc.).

It is worth noting that budget loans exclude the receipt of a tax credit.

NPO balance sheet and report on the use of funds

Let's consider reporting simultaneously both for socially oriented non-profit organizations and for those non-profit organizations that will fill out the general balance sheet.

For socially oriented non-profit organizations, the balance sheet and report on the use of funds is simplified with aggregated indicators. The peculiarity of this reporting: the line code of the financial statements is indicated by the indicator that has the largest share in the composition of the large indicator - this is the requirement of paragraph 5 of Order 66n. Program 1C: Enterprise for NPOs accurately enters these codes.

Let's look at an ordinary balance sheet, which will be filled out by non-profit organizations that do not fall under the concept of socially oriented or have exceeded the parameters for cash and property receipts - over 3 million - and decided to fill out an ordinary balance sheet.

In Order 66n there is a setting according to which the passive changes. That is, “authorized capital” on line 1310 is replaced by “mutual fund”, the section “own shares purchased from shareholders” is replaced by “target capital”, “revaluation of non-current assets” is removed, “additional capital (without revaluation)” is replaced by “ target funds”, “reserve capital” is replaced by “real estate and especially valuable movable property fund”, “retained earnings (uncovered loss)” - by “reserve and other target funds”. There should be no retained earnings on the balance sheet of a non-profit organization. All profits from business activities for the year must be closed in accounting to account 86, that is, an accounting entry is made for debit 84 credit 86.

Any misuse of funds received by a non-profit organization is punishable. Therefore, try not to incur losses from business activities.

The balance sheet – both enlarged and ordinary – always shows fixed assets. That is, in the balance sheet for socially oriented non-profit organizations this is an aggregated indicator called tangible non-current assets, including fixed assets, unfinished capital investments, fixed assets.

Fixed assets in any balance sheet are shown at their original cost. Fixed assets are not depreciated in the accounting records of a non-profit organization. Fixed assets are not depreciated, regardless of the source from which they were acquired - through entrepreneurial activity or through targeted funds. For fixed assets, depreciation is calculated off-balance sheet. Depreciation accrued off the balance sheet does not reduce the initial cost of fixed assets, which we show in the financial statements. Therefore, the line “fixed assets” indicates the initial cost. At the same time, when we have formed non-current assets on account 08, all costs for the acquisition of fixed assets, including installation, delivery, consulting services (collected all costs), we make an accounting entry for debit 01 “Fixed assets” and credit 08. On the same date in We must make an accounting entry for the same amount as debit 86 and credit 83 of account. This suggests that we have reduced, i.e. spent our targeted funds and created a fund of real estate and especially valuable movable property. Account 83 sounds like “Additional capital”. When a fixed asset is retired, you do not write it off through 91 accounts, but reduce the fund of real estate and especially valuable movable property; in accounting, you will have an accounting entry for the debit of account 83 and the credit of account 01. That is, the initial cost is written off to account 83 and reduces the fund of real estate and especially valuable movable property.

Depreciation is accrued once a year, based on PBU 601, program 1C: An enterprise for non-profit organizations accrues it monthly in the correct amount. You must give information about accrued depreciation in an explanatory note, in the explanations in the tabular section - “presence of movements of fixed assets” in the column “accumulated contributions” you must give all the information on accrued depreciation for the fixed assets that you have and use.

Intangible assets are accounted for in accounting similarly to fixed assets. Intangible assets are also not amortized under any circumstances, and when you put intangible assets on 04, an entry is made in the accounting records to the debit of account 86 “Targeted financing” and the credit of account 83 “Additional capital”. We again show a decrease in earmarked funds and the formation of a fund of real estate and especially valuable movable property. This is done when fixed assets are purchased from earmarked proceeds.

Income investments are purchased objects that you intend to rent out in the future. Income investments are not depreciated.

Financial investments and intangible assets are indicated according to the aggregated indicator “Intangible, financial and other non-current assets”.

The line “Inventories” can reflect materials that remained at the end of the year in account 10 “Materials” and are expected to be used in further statutory activities. At the same time, the letter of the Ministry of Finance No. PZ-1/2011 dated January 17, 2012 states that in the absence of significant balances of insignificant material value, they are recognized as an expense, respectively, according to the groups of expense items for the maintenance of the management apparatus and expenses for targeted activities directly in the report on the target use of the funds received. That is, in accounting, we must write off insignificant balances of material assets to the conduct of statutory activities. Remember that accounting confirms financial statements, and financial statements are made on the basis of accounting data.

The request line can show costs for unfinished work and unfinished provision of services in accordance with the subject and goals of the activity. Typically, such costs are reflected as work in progress on account 20 “Main production”. Costs that have been incurred but not yet written off to account 86 in debit 86 are shown in the balance sheet on line 1210 Inventories.

Accounts receivable. Consumer cooperatives, including housing and construction cooperatives, dacha cooperatives, and garage cooperatives, reflect the debt of the cooperative members in terms of savings. The composition of financial investments takes into account, respectively, investments that meet the requirements of PBU 1902; separately, the Ministry of Finance in its letter PZ-1/2011 additionally indicated that the credit consumer cooperative of citizens reflects the amount of loans provided to its members.

Cash is a separate line, not mixed with anything, in a simplified balance sheet for socially oriented commercial organizations. In the “cash” line, we collect all the money and count the cash register plus the current account (ruble, foreign currency - in ruble valuation at the rate in effect at the end of the reporting period), plus the money in special bank accounts, money in account 57, and indicate on the line 1250 “cash” balance sheet.

I would like to draw the attention of non-profit organizations that place their funds in management companies and form endowment capital: if you transferred funds to a management company, you still reflect your funds on your balance sheet. The management company that took your property or money must provide a balance sheet, because all your property must be accounted for on a separate balance sheet, and you merge it all line by line with your balance sheet. Those. the property that is owned by the management company should be taken into account on your balance sheet. The regulatory document on the basis of which trust management operations are taken into account is Order of the Ministry of Finance of the Russian Federation dated November 28, 2001 No. 97n.

Personal savings of citizens transferred on the basis of agreements in favor of a credit consumer cooperative are taken into account and reflected in the balance sheet separately from other funds of the mutual financial assistance fund of the credit consumer cooperative.

Balance sheet liability for non-profit organizations

A separate line in the balance sheet will be a mutual fund - intended for consumer cooperatives, this article reflects information on share contributions of shareholders of consumer cooperatives, on contributions of members of credit consumer cooperatives - all this is reflected in correspondence with accounts receivable, i.e. As soon as your members pay their shares, the accounts receivable decreases. Until the members have paid all the outstanding shares, this line will appear in the balance sheet. Share contributions are reflected in the balance sheet separately from entrance fees and other earmarked funds.

Article “Target capital” - in this line we indicate the funds that form the target capital. This article discloses information about the amount of the target capital of a non-profit organization formed as of the reporting date. Letter PZ-1/2011 states: from the date of transfer of funds into trust management of the management company, the target capital is considered formed and is reflected as an increase in the item “endowment capital” and as a decrease in the group of items “accounts payable”. The first entry: debit 51, credit 76 - money has been received for the formation of the target capital, as soon as you have collected enough of it to transfer to the management company, a posting is made: debit 79, credit 51 - funds of the management company are transferred. And on the same date, as soon as you made an entry for debit 79 and credit 51, the target capital appears in the balance sheet - debit 76, credit 86. 79 account should not exist. The item “earmarked funds” reflects the earmarked funds that have not been used as of the reporting date, which are intended to provide the non-profit organization with the statutory activities for which it was created. This line includes the net profit (loss) from the business activities of a non-profit organization, formed based on the results of its activities for the reporting year. Letter PZ-1/2011 provides clarification: when a non-profit organization makes a decision to disclose information about debt on membership fees or other expected revenues, the amount of accrued debt is reflected in the group of items “accounts receivable”.

You may also be interested in:

- Accounting statements of non-profit organizations

- Socially oriented NPOs

- Financial results of NPOs

Additional products for NPOs:

- Accounting program for non-profit organizations 1C-Rarus: Accounting for a non-profit organization 5

- Creation of the Official Website of the NPO

- Accounting program for JSC 1C-Rarus: Accounting for legal entities

- Creation of a website for legal entities

- Mobile application for managers Uconto: Manager reports