In order to reduce the tax burden on Russian citizens, the state uses a number of mechanisms that make it possible to legally reduce the tax base and, accordingly, the amount of tax.

One such mechanism is the provision of tax deductions. These are statutory amounts that are deducted from taxable income. These benefits may concern not only earnings, but also other payments received in cash or property (in kind) form - for example, material assistance.

In the 2-NDFL certificate, as well as in the tax and accounting registers reflecting the income and expenses of individuals, these deductions are indicated using the corresponding numeric codes.

Code 115 in certificate 2-NDFL in 2021

Regular payment of taxes and high rates can become a serious financial problem for an ordinary Russian.

The state provides support programs. With their help, you can return part of the money in a variety of circumstances: purchasing housing, medicines, paying for education. The most common type of deduction in 2021 is code 114 and 115 in certificate 2 - personal income tax, which is regularly applied until the child reaches 18 years of age or completes his studies. The restriction comes into force after the 24th birthday. The code may be specified incorrectly, in which case the applicant will be refused, or an erroneous calculation will be made. In the second option, the taxpayer can receive a larger or smaller amount

Therefore, it is very important to carefully enter codes 114 and 115 in the 2-NDFL certificate

Deduction codes 501 and 503 in the 2-NDFL certificate: how to fill out

- receive wages at the place of employment;

- receive bonuses from their superiors;

- accept the provision of financial assistance;

- sell an apartment, house or other housing, or maybe just a share in it;

- rent out their own living space;

- sell a car and other property belonging to them;

- receive royalties for the literary work they publish;

- in many other situations.

If a company is not an employer, it is not required to make payroll payments and transfer income tax contributions to the state budget. This means that the organization is also not obliged to prepare, fill out and submit a tax return for verification.

Let's sum it up

The use of codes when filling out documentation for verification in government systems is a frequent and necessary practice, primarily due to the fact that this method of providing information seriously reduces the time spent on carrying out this procedure; in addition, labor costs are also reduced. It is very important to have knowledge regarding encodings, or to constantly keep a list with their decoding at hand in order to avoid mistakes and not receive various types of penalties from the tax office.

What is deduction code 503?

We often hear about such concepts as “tax deduction”, “value added tax”, etc. The deduction code also relates to the topic of tax regulation of the activities of the population, namely to the standard 2-NDFL certificate.

In 2021, no significant amendments were made to the tax code of the Russian Federation. Therefore, an explanation of what deduction code 503 means in the 2-NDFL certificate is still given in Art. 217 Tax Code of the Russian Federation. According to this provision, a certain amount from any income of tax residents and non-residents in Russia must “go” to the country’s tax budget.

Even the abbreviation itself, personal income tax, means “personal income tax.” For residents, i.e. For citizens of the country permanently residing in Russia and foreign citizens with a residence permit, the rate is set at 13%, for non-residents - 30%.

According to the legislation of the Russian Federation, all citizens are required not only to consistently pay taxes, but also to fill out the appropriate documentation: for example, a document in form 2-NDFL or a tax return in form 3-NDFL. The first is most often required to obtain services: a bank loan, various subsidies from the state, grants, etc. The 2-NDFL certificate is filled out only by the employer with the document certified by authorized persons - the chief accountant and the head of the enterprise.

Declaration 3-NDFL is filled out by an individual completely independently; the document is required when nominating oneself for the post of deputy or other civil servant, as well as when paying taxes on property (or other taxes) annually to the Federal Tax Service. Deduction code 503 is indicated both in the 2-NDFL certificate and in the 3-NDFL tax return. The only difference is that the first document is completely filled out by the employer, and the second - by the individual himself.

In addition to 503, there is also deduction code 501 in the 2-NDFL certificate or in the declaration, codes 129, etc. In accordance with the Order of the Federal Tax Service dated September 10, 2015 N ММВ-7-11/ [email protected] , the value 503 means a deduction from the amount of financial assistance provided by employers to their employees, as well as to former employees who quit due to retirement, according to age or disability. Details of regulating the procedure for issuing mat. assistance are reflected in clause 28 of Art. 217 Tax Code of the Russian Federation.

Help: Code 503 is always closely related to code 2760, which denotes that same financial assistance in the form of additional income of an individual.

In simple terms, code 503 means that the amount indicated in the corresponding column is not taken into account when calculating the tax fee, because it falls within the taxable amount. That is, the employer, up to a certain limit, can provide financial assistance to its employees, and the amount issued will not be taxed.

In this way, a compromise is reached between the state, citizens and commercial companies: a tax is present if it is permissible to impose it, but if the collection of a tax becomes similar to robbery, special conditions are introduced with the possibility of obtaining preferential taxation.

Usage example

According to Art. 217 of the Tax Code of the Russian Federation, the maximum tax deduction for financial assistance is 4,000 rubles per financial year. This means that if you pay an employee exactly 4,000 rubles or less, the income will not be taxed. But if you exceed the limit, the entire excess amount will be subject to the standard 13% tax for tax residents.

Example: Ivan was paid mate. assistance in the amount of 9,000 rubles. Accordingly, only an amount of 5,000 rubles will be taxed (9,000 is the maximum deduction amount of 4,000 rubles = 5,000 rubles). Next, from these 5000 the amount of tax is calculated at a rate of 13%: 5000 x 0.13 = 650 rubles. It is this amount that the employer must send to the tax authorities, taking into account the deduction made.

Where is the code indicated?

In the tax return and certificate 2-NDFL, the code is indicated in the column called “Deduction Code”. Remember that code 503 can only appear on the line that contains the income code “2760”. In the rightmost cell of the same row, in the “deduction amount” column, you can find out exactly how much of the amount of financial assistance was taken into account in the deduction.

For example, the income amount 2760 may indicate 10,000 rubles, and the deduction amount may indicate 4000 rubles. This means that only the remaining 6,000 rubles of financial assistance will be taxed.

The essence of code 501

A 501 deduction is an amount that is deductible from the value of a prize, incentive received from an employer or a private organization gift.

Deduction code 501 has the following properties:

- The deduction amount encrypted with its help cannot exceed 4,000 rubles. annually;

- If the amount of the gift is more than 4,000 rubles, the difference is subject to taxation at the rate of 13%;

- Individual entrepreneurs using the simplified tax system and other simplified taxation systems that do not provide for the payment of a 13 percent personal income tax, as well as officially unemployed individuals, cannot count on deductions;

- Used exclusively for those taxpayers whose list is determined by Article 218 of the Tax Code.

If the amount of the gift does not exceed 4,000 rubles, then no deductions will be made from such a gift to the state treasury. This condition also applies to winnings - if this condition is met, they will not be subject to tax. If the winnings exceed the specified limit of 4,000 rubles, then the tax amount is calculated. In the 2-NDFL certificate, the cost of a gift that is not subject to taxation will be encrypted under code 501 as a deduction.

Now the majority of residents of the Russian Federation use the standard tax deduction. Such a deduction is a means by which it is possible to reduce the tax base formed from the financial income of a citizen.

It can only be applied to certain types of income, which, in accordance with Decree of the Government of the Russian Federation of March 30, 2021 N 357, are forcibly subject to personal income tax (exclusively at a rate of 13%).

The tax agent has the privilege of calculating tax deductions for basic income and wages and providing this information to the taxpayer.

The right to receive a tax deduction is confirmed after submitting the appropriate package of documents and a tax return.

The documents must include a specialized written application from the taxpayer requesting a deduction. It is also recommended to demonstrate documents that confirm the possibility of receiving them. After this, recalculation occurs without fail. In this way, you can return the amounts paid in the form of personal income tax or reduce its amount.

Examples of calculating deductions using code 501

- At the enterprise, in order to encourage employees, bonuses were issued. You should know the features of the correct presentation of incentives. The 2-NDFL certificate indicates code 2000 if the award was given for exceptional work, exceeding production standards and high quality of manufactured products. Code 4800 is indicated if gifts are presented for anniversaries, weddings and other celebrations.

- The citizen received a present worth 10 thousand rubles. In this case, the 2-NDFL certificate must contain the amount of income and the income code, as well as a three-digit deduction code. The standard deduction amount is 4,000 rubles, which will not be taxed, therefore, taxes will be calculated on an amount of 6,000 rubles.

- An employee of the enterprise received an incentive of 3,000 rubles. After some time, the employee received a gift worth 6,000 rubles from the company. Although the incentive was not taxed, since its amount did not exceed the legal limit, the total value of the gifts exceeded it, so tax must be withheld.

Thus, deduction under code 501 makes it possible to reduce the tax burden falling on individuals, in particular, in paying personal income tax.

What does deduction code 501 mean?

The 501 deduction is applied when an employee receives a gift or prize. For such income, a certain tax calculation scheme is used. When the gift amount is less than 4,000 rubles, it is not included in the tax base. But if the value of the prize exceeds this limit, it is subject to tax. It will be calculated on income minus benefits.

The features of this benefit are as follows:

- The amount of the deduction cannot be higher than 4,000 rubles.

- If the value of the prize is more than four thousand rubles, the difference between the price and the deduction will be taxed at 13%.

Suppose a person received a gift worth 8,000 rubles. This amount will be indicated on the certificate; below, the deduction will be indicated with code 501 in the amount of 4,000 rubles. Thus, the tax will be calculated on the amount of 8000 – 4000 = 4000 rubles. And it will be 4000 * 13% = 520 rubles.

Only residents with official income are entitled to claim this benefit.

Deduction codes in the 2-NDFL certificate in 2021

- statement from an employee;

- child's birth certificate;

- child’s passport, if available;

- documents confirming adoption, if necessary;

- a certificate from an educational institution for a child over 18 years of age;

- divorce certificate or other document confirming single parent status, if necessary.

To determine which deduction is provided, the total number of children is considered, regardless of whether they are alive, whether they live with their parents, or whether there are other nuances. If the first child died, then the second one is still given a deduction of 127, not 126. The same applies to subsequent children.

What does the barcode on 2-NDFL mean?

Of course, in some companies the accounting program puts the required barcode on 2-NDFL. But, of course, not everyone keeps up with the times. If a company uses the program, then it makes sense to update it to the latest version. Perhaps the latest changes have already been taken into account.

For example, when receiving a loan from a bank, you will definitely need proof of your income. In this case, 2-NDFL will need to be provided. If it is filled out incorrectly, it may cause problems.

Therefore, it is important how to correctly draw up this document so that it complies with legal requirements.

Table of tax deduction codes for personal income tax

Starting this year, social deductions for personal income tax related to the payment of education (up to the age of 24) and treatment (if for children, then until the 18th birthday) can also be taken into account by the tax agent without waiting for the end of the year in which they were received. It is enough to present documents confirming these expenses to the tax office for verification, and after a positive response from the tax authorities in the form of a notification, the deduction can be used at the place of work.

It is a guide for taxpayers and tax agents to correctly select the digital code assigned to a particular benefit provided for by tax legislation when filling out 2-NDFL certificates on income received by individuals for the period from November 29, 2020.

What types of income can be deducted?

Certificate 2-NDFL indicates all types of income that the taxpayer received in a specific reporting period, including:

- salary at the main and additional places of work;

- interest on deposits, income from transactions with securities;

- material assistance in cash or property (in kind);

- income from foreign currency transactions;

- winnings from bookmakers, casinos, from participation in lotteries and drawings, received in cash or property (for example, prizes);

- income from rental of vehicles and real estate;

- royalties, dividends, etc.

Tax deductions can be provided for different types of income. To avoid confusion when preparing a 2-NDFL certificate, as well as tax and accounting registers reflecting the income and expenses of individuals, an individual code is assigned to each type of income and tax deduction.

What is personal income tax

To understand why the 2-NDFL certificate is used, you must first understand the meaning of the required abbreviation that appears in its name after the number 2.

What is the certificate in question?

So, personal income tax is a tax levy withdrawn from income received by individuals. The list of these incomes is determined by law. Not all money a citizen can receive is subject to this tax. For example, funds donated by a close relative are not subject to partial deduction to the state treasury.

Most often, the state expects to receive funds for personal income tax from citizens when they:

- receive wages at the place of employment;

- receive bonuses from their superiors;

- accept the provision of financial assistance;

- sell an apartment, house or other housing, or maybe just a share in it;

- rent out their own living space;

- sell a car and other property belonging to them;

- receive royalties for the literary work they publish;

- in many other situations.

This fee is otherwise called income tax. The rates on it are fixed. There are two of them in total. One is relevant for so-called tax residents of the Russian Federation, the other for non-residents.

Possession of this status implies staying on the territory of Russia for a certain period of time - at least 183 days a year. If a citizen has been within the Russian borders for at least a day less, he is not assigned resident status.

At the same time, depending on the number of days “on the account” of each citizen, the tax rate will also change. Thus, residents have the opportunity to transfer funds to the treasury at the standard rate for the country: they give only 13% of the funds received. The named value is considered, however, to be quite acceptable. Non-residents are forced to share a huge part of their own income with the state - as much as 30%!

As a rule, Russians pay the most income tax in their own lives from the wages they receive at their place of employment. It is issued every month in a certain amount. On the day the salary is issued, a specific part (usually 13%) is deducted from it and transferred to the state treasury on behalf of the taxpayer from whom the money was calculated. The tax agent is involved in this procedure. This, as we have already found out, is the employer organization. In addition to the transfer of wages and tax deductions, the company also provides so-called deductions to citizens by decision of the tax service.

A tax deduction is a certain amount of money by which it is possible to reduce the monetary base taxed in favor of the treasury. In other words, the tax is always calculated from a certain value. Funds deducted from wages are calculated based on its original amount. So, if an employee is promised to be paid a salary of 20 thousand rubles, it means receiving 2 thousand 600 rubles less, that is, only 17 thousand 400 rubles. The difference not received is the part that is due to the state. Its value can be reduced by reducing the wage itself, however, not by demoting the employee or applying any sanctions to him.

It is possible to carry out the procedure using a tax deduction. It is provided to citizens as a result of relevant situations arising in their lives. Most often, deductions are provided through the employer:

- social, for treatment or training of an employee or his family members;

- property, issued when purchasing housing;

- standard, for child support and other types of compensation.

By the amount of the deductions provided, it is possible to reduce the monthly deduction of personal income tax in favor of the state budget, taken directly from the employee’s salary. This reduction will be made until all funds due have been provided in full to the employee.

Deduction code 503 in the 2-NDFL certificate and other deduction codes

| Code | Meaning |

| 503 | Deduction from the amount of financial assistance provided by employers to their employees or former employees who quit due to retirement due to age or disability |

| 504 | Deduction from the amount of payment/reimbursement by employers to their employees, their spouses, children, parents, former employees who have retired due to age, as well as to disabled people, the cost of medicines purchased for them or by them, which were prescribed to them by their attending physician |

| 505 | Deduction from the amount of winnings/prizes received at games/competitions, other events held for the purpose of advertising goods/works/services |

| 506 | Deduction from the amount of financial assistance provided to disabled people by public organizations of disabled people |

| 507 | Deduction from the amount of assistance in cash/in-kind, as well as the value of gifts received by participants/disabled people of the Second World War, widows of military personnel who died during the war with Finland, Japan, World War II, widows of deceased disabled people of the Second World War, as well as former prisoners of Nazi prisons/camps /ghettos, and former juvenile prisoners of ghettos/concentration camps and other places of forced detention that were created by the Nazis or their allies during the Second World War |

| 508 | Deduction from the amount of one-time financial assistance provided by employers to their employees (parents/guardians/adoptive parents) upon the birth/adoption of a child |

| 509 | A deduction from the amount of income received by employees in kind as wages from organizations of agricultural producers, determined by clause 2 of Art. 346.2 of the Tax Code of the Russian Federation, peasant farms in the form of agricultural products of their own production and/or work/services performed by such organizations and farms in the interests of the employee, property rights that are transferred to the employee by these farms and organizations |

| 510 | Deduction from the amounts paid by the employer for the taxpayer of additional savings contributions to the Pension Fund of the Russian Federation |

Approved Revenue Codes

For convenience and uniform reflection of income in accounting and tax accounting, certain codes are used. In certificate 2 - personal income tax, separate cells indicate codes by which you can determine the name of the earnings received. The classifier approved by law includes codes consisting of four digits. All income is distributed by codes from 1010 to 4800.

Income classification

Quite often, when assigning a code, an accountant may doubt the correctness of the chosen cipher. Then they assign it to code 4800. There are no penalties in the law for incorrectly assigning income in certificate 2 - personal income tax. However, this does not mean that codes do not need to be given attention. Different types of income have their own individual code. Incorrect classification may lead to a distortion of the tax base. Accordingly, the tax will be calculated incorrectly.

There are several basic income codes that are used by employers:

- 2000 – salary

- 2012 – vacation pay

- 2300 – disability benefits

- 2400 – rental profit

- 2760 – financial assistance from the enterprise

- 2720 – gifts

- 2730 – prizes

- 4800 – other income

If the directory does not contain the required code for attributing income, it should be designated as code 4800.

Income subject to personal income tax in full

The most popular code is 2000 . This is the employee's salary. This also includes allowances for hazardous conditions and night work.

The remuneration of members of the Board of Directors is included in a special code. The role of the council may be performed by another management body. Indicate the remuneration of its participants using code 2001 in the 2-NDFL certificate.

A separate code was allocated for bonuses for results achieved in work. It is designated by number 2002 .

Employees can receive money from the company's net profit. Usually these are owners and top managers. Such income is marked with the code 2003 . This also includes targeted revenues and special-purpose equipment.

The company may employ persons engaged under a GPC agreement. Their income is accompanied by the code 2010 . Copyright agreements do not fall into this category.

Indicate income in the form of vacation pay with the code 2012 . But compensation for missed vacation is carried out according to code 2013 . Severance pay - 2014 .

Sick leave is also subject to income tax. Therefore, in the certificate there is a code for them 2300 . But maternity and child benefits are not subject to personal income tax, which means they are not included in the certificate.

An employee can give an interest-bearing loan. The amount earned from receiving interest is his income. Accompanied by number 2610 in 2-NDFL.

An individual who owns property can rent it out. For example, renting out a garage or an apartment. For such income the code is 1400 . This does not include revenue from the rental of vehicles, communications equipment and computer networks. code 2400 is allocated for them in 2-NDFL.

An employee can have their debt forgiven. Then personal income tax is withheld from him, since in essence this is already his income. The code in the help is 2611 .

For interest income on bonds of domestic firms there is code 3021 .

Indicate dividend income with number 1010 .

Rarely, but there are situations when income does not have an established number. These are accrued additional payments in excess of taxable daily allowances or additional payments for sick leave. This income is subject to personal income tax, and the certificate contains a universal code - 4800 .

There are other codes, but they are less common. For example, cash prizes are number 2750 . If you have earnings from foreign currency transactions, indicate it together with the code 2900 . There is an income code even for betting winnings - 3010 . Check out the full list of income and deductions on the 2-NDFL certificate.

Income and deduction codes in the 2-NDFL certificate

The requirements for filling out the certificate are the same regardless of who the recipient of the document is: the Federal Tax Service or the bank. However, in the first case, an accountant’s mistake is fraught with penalties for the compiling agent or a refusal to provide a deduction to a citizen.

To fill out the document, the accountant must select the appropriate values from the reference book given in the Order of the Federal Tax Service MMV-7-11 / [email protected] , dated 2015. The list is frequently updated, so to correctly fill out the certificates, the accountant needs to monitor changes in legislation and make the appropriate settings in the accounting program (for example, 1C).

Deduction code 501 where to put in 3 personal income taxes for 2021

For information on how to fill out the 3-NDFL return, read the article “Sample for filling out the 3-NDFL tax return.” Is it always necessary to fill out 3-NDFL for property deduction? You can do without filling out 3-NDFL for property deductions when using deductions for the costs of purchasing (or building) housing and mortgage interest. This is acceptable in situations where, in the year of collecting the full package of documents required for such a deduction, a person applies to the Federal Tax Service for a notification of the right to deduction and, on the basis of this notification and a similar document received annually in subsequent years, returns the tax at work. If he uses only this algorithm of actions to return personal income tax on this basis, then he may not need a 3-NDFL declaration to receive a property deduction in connection with the purchase of a home.

Home / Taxes / Personal Income Tax / How to fill out codes in the 3-NDFL declaration 01/08/2020, Sashka Bukashka When filling out the 3-NDFL declaration, code designations are used. This help article contains all the necessary codes that you may need when filing your tax return yourself. Adjustment number The adjustment code for the 3-NDFL declaration means which declaration is submitted to the tax office for the reporting period.

Documents to confirm the right to deduct

The decision to provide an employee with financial assistance is formalized by order of the head of the enterprise. The grounds for issuing an order may be:

- employee's personal statement;

- relevant provisions of the employment or collective agreement;

- internal regulatory document regulating the procedure for providing financial assistance to employees of the enterprise.

No additional documentary evidence is required to receive a deduction under code 503. This benefit is provided for at the legislative level and is set out in paragraph 28 of Art. 217 of the Russian Tax Code.

-Accordingly, if an employee received financial assistance, then a deduction in the amount of 4,000 rubles per year is provided automatically.

Deduction codes 130-139

This group is also intended to reflect information on deductions for children.

| Deduction codes | Decoding |

| 130 | A deduction that is provided to a guardian, adoptive parent, trustee, spouse of an adoptive parent, for the first child under the age of 18, as well as for each full-time student, resident, student, intern, graduate student, cadet under the age of 24 |

| 131 | A deduction that is provided to a guardian, adoptive parent, trustee, spouse of an adoptive parent, for a second child under the age of 18, as well as for each full-time student, resident, student, intern, graduate student, cadet under the age of 24 |

| 132 | A deduction that is provided to a guardian, adoptive parent, trustee, spouse of an adoptive parent, for the third and each subsequent child under the age of 18, as well as for each full-time student, resident, student, intern, graduate student, cadet under the age of 24 years old |

| 133 | A deduction that is provided to a guardian, adoptive parent, trustee, spouse of an adoptive parent, for a disabled child under the age of 18 or a full-time student, resident, graduate student, intern, student who is a disabled person of group I or II. |

| 134 | A double deduction, which is provided to a single parent or adoptive parent, for the first child under the age of 18, as well as for each full-time student, intern, student, resident, graduate student, cadet under the age of 24 |

| 135 | Double deduction provided to the sole guardian, trustee, adoptive parent, for the first child under the age of 18, also for each full-time student, resident, intern, graduate student, cadet, student under the age of 24 |

| 136 | Double deduction, which is provided to the only adoptive parent, parent, for a second child under the age of 18, also for each full-time student, resident, intern, graduate student, cadet, student under the age of 24 |

| 137 | Double deduction, which is provided to the sole guardian, trustee, adoptive parent, for a second child under the age of 18, also for each full-time student, resident, intern, graduate student, cadet, student under the age of 24 |

| 138 | Double deduction provided to the only adoptive parent, adoptive parent, for the third and each subsequent child under the age of 18, also for each full-time student, resident, intern, graduate student, cadet, student under the age of 24 |

| 139 | Double deduction, which is provided to the sole caregiver, guardian, adoptive parent, for the third and each subsequent child under the age of 18, as well as for each full-time student, resident, intern, graduate student, cadet, student under the age of 24 |

How to fill out deduction codes 501 503 in 3 personal income tax

In addition, you can use a service that will help you determine not only the BCC, but also the numbers of your inspection of the Federal Tax Service and the All-Russian Classifier of Municipal Territories (OKTMO). OKTMO code - what is it in 3-NDFL? Using OKTMO, the declaration indicates the code of the municipality at the place of residence (or registration) of the person (or individual entrepreneur).

Financial assistance can be issued to current and former employees. Tax legislation directly links the non-taxable limit to the reason for payments. Not subject to taxation: Confused about how to fill out documents? Don’t worry, we will do the 3-NDFL declaration or zero reporting for you.

Help 2-NDFL

When issuing a certificate, fill in the following fields:

- Sign. If the certificate is in the usual form, then it is given 1. If it is not possible to withhold personal income tax, then it is given 2.

- Correction number. If you submit the first version of the certificate, then 00 is entered. For subsequent adjustments, 01, 02, and so on are entered. If this is a cancellation certificate, then 99 is entered.

- OKTMO code. Depends on citizenship. It can also be found on the Federal Tax Service website.

- KPP, TIN and tax agent. In the “Tax Agent” column, enter the name of the organization - for example, Kristall LLC. If we are talking about an organization, then the checkpoint and TIN are entered, but if the certificate is filled out by an individual entrepreneur, then only the TIN is entered.

- Full name of the employee. If the employee’s last name has changed, then its new version should be indicated on the certificate. It should be remembered that the tax office may not have the employee’s new name - to do this, prepare a photocopy of his passport. In the case of foreign employees, FIs are entered in Latin letters.

- Taxpayer status. If the employee stayed in Russia for 12 months, then the number is 1; if less than 183 days, then the number is 2. In the case of a highly qualified employee, the number is 3.

- Citizenship. If the employee is a citizen of the Russian Federation, they enter code 643. The series in the passport means citizenship.

- Code of the document that proves identity. As mentioned earlier, each document in the certificate has its own number, the passport code is the number 21.

- Residence address. The employee's registered address is written here. As for the place of residence, this address is not recorded.

- Taxable income. Codes are set corresponding to the employee’s income.

- Tax deductions. Codes are set corresponding to the employee’s deductions.

- Total tax and income amounts. The results of tax deductions and income are summed up.

Usage example

Income code 503 appears on the income tax certificate if the amount of support itself is greater than the amount of the deduction.

For example, over the course of a year, the company helped an employee with a difficult financial situation several times: first it paid him 4,000, then another 4,000, and at the end of the year – 5,000. In total, the employer helped him in the amount of 13,000 rubles.

In the certificate for the year, personal income tax on these payments will be: (13,000 – 4,000) × 13% = 1,170 rubles.

The income code will be 2760 - 13,000. The deduction code will be 503, in the amount of 4,000.

Note! If a person works for an individual entrepreneur, then the general rules apply. Individual entrepreneurs are the same employers and tax agents as organizations: they are required to calculate taxes on salaries and other income for personnel and submit reports.

Moreover, it does not matter what mode the individual entrepreneur operates in: simplified tax system, “imputation” or the general system. Even if the entrepreneur himself does not pay income tax, he is obliged to pay it instead of his employees in accordance with Article 226 of the Tax Code of the Russian Federation.

Features of tax deductions

A tax deduction is an amount of money that allows you to reduce the amount of income, which in turn is subject to taxes. In certain cases, a tax deduction refers to a partial refund of funds that were previously paid in the form of taxes on the income of an individual. For example, purchasing an apartment, medical expenses or training. In principle, tax should not be withdrawn from the amounts you spent on the above actions. Therefore, all necessary documents are completed, and funds previously withdrawn from your wages are returned.

It must also be remembered that not the entire amount of expenses incurred is subject to refund, but only the amount of tax that was calculated and withheld from these funds.

Types of deductions:

- Standard deductions;

- Social deductions;

- Property deductions;

- Professional deductions.

How to correctly determine the amount of deduction? Everything is quite simple. For example, you receive a salary of 50,000 rubles. Naturally, your salary is taxed at 13%. During the month you spent 10,000 rubles on training. Accordingly, the refund involves the amount of taxes on the amount of 10,000 rubles. This turns out to be 1300 rubles.

How to take a 503 deduction to later claim the standard deduction

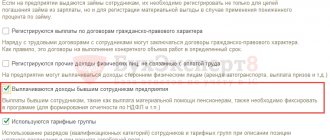

Information about income from your previous job should be entered into the program. This can be done from the employee’s card using the link Income tax - Income from previous place of work:

This data is used to track your standard deduction limit year-to-date. Since material assistance is taken into account to determine the limit only in the taxable part, then in the table it is necessary to indicate only the taxable part: the difference between the amount of material assistance and the deduction for it.

How to put deduction code 508 in the 3-NDFL declaration

This code marks a deduction for a specific type of mat. assistance - on the occasion of the birth or adoption of a child by an employee:

It applies if the employee was provided with financial assistance in accordance with clause 8 of Article 217 of the Tax Code. The maximum amount on which tax is not paid is RUB 50,000. The income itself is in the form of mat. assistance is marked in the 2-NDFL certificate with code 2762.

Code 508 is displayed in the “Declaration” program on the “Income” tab:

In Appendix 4, the non-taxable amount is indicated in line 010:

Example

In 2021, on March 8, Svetlana received a gift worth 7,000 rubles from her employer company. In July, she was given a curse word at work. help 10,000 rub. In October, Svetlana went on maternity leave. In December, on the occasion of the birth of her child, she received a mat. assistance 55,000 rub.

The entire personal income tax for Svetlana was transferred by the employer. There is no need to report or submit a declaration for the assistance provided. If Svetlana wants to return personal income tax in 2021 for other deductions (property, social, etc.), she needs to correctly reflect the income received in 2021.

On the “Income” tab in the program:

Deductions in Appendix 4:

Total amount of non-taxable income in Section 2:

A sample declaration based on the above example is available for download here.

How to record a 503 deduction so that it is not provided repeatedly in our organization

The Tax Code does not oblige organizations to monitor the use of other tax agents for any deductions other than standard ones. So there is no need to reflect the deduction itself anywhere. Financial assistance to this employee can be provided in the usual manner, using a deduction.

However, if an organization wants to take into account a deduction applied from another tax agent and not re-provide it at home, then in the ZUP you can do the following: create a fictitious separate division and record the applied deduction for this division.

To do this, you must perform the following sequence of actions:

- Install in settings Organizations (Setup - Organizations) tab Main checkbox The organization has branches (separate divisions):

- Create in directory Organizations a new element in which to set the checkbox This is a branch (separate division) and select your organization in the field Head office of the branch:

- Enter document Personal income tax accounting operation (Taxes and contributions - Personal Income Tax Accounting Operations), which should be filled out as follows: In the header of the document:

- Select the created separate division in the Organization ;

- In the Date and Transaction Date , you can specify any date of the calendar year for which we are registering the deduction, but before the date of admission to our organization. This may be the date of the month in which financial assistance was provided by another employer or simply January 1.

On the Income :

- In the Income receipt date , indicate the same date that you selected in the header;

- Select Income code - 2760 , the Deduction code will be filled in automatically with code 503 .

- In the Income Amount and Deduction Amount , indicate the amount of the deduction provided (cannot exceed RUB 4,000).

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Did the article help? Rate it

Loading…

question What deduction is indicated in the 2-NDFL certificate under code 503?

An employee of an enterprise has reached retirement age and is about to retire. Is the employer required by law to provide him with a financial lump sum payment upon retirement? How is this payment reflected in the certificate in Form 2-NDFL and how is it calculated. Is this payment taxable? Is the income received by an employee really reflected under code 503 or is a tax deduction indicated there?

In accordance with current legislation, all income received by citizens of the Russian Federation must be strictly reflected in the financial statements and a tax must be imposed on them, which must be reflected in the form 2-NDFL. This certificate is issued for the reporting period and covers one year. To fill out the certificate, state regulations are used. For the convenience of reflecting in the certificate the items of income and taxes deducted from them, a special coding approved by the Federal Tax Service of the Russian Federation is provided. Such codes are reflected in section 3 of the certificate next to direct income or tax.

Under code 503, reporting reflects income taxed at 13%. This code corresponds to the item of deductions from the amount of financial assistance allocated by the employer for its current or former employees dismissed upon reaching retirement age and officially retiring. Another case for paying a lump sum benefit may be retirement due to disability.

It is worth noting that the law does not regulate the employer’s obligation to pay such compensation (assistance). It appears on a voluntary basis.

The 2-NDFL certificate simultaneously reflects the income received by the employee (material assistance) under code 2760, and the tax deduction from the assistance provided under code 503.

According to the tax code, the financial assistance in question has a fixed amount, which is not taxed. It is maximum 4 thousand rubles. Consequently, if the assigned assistance exceeds the specified amount, then that part of the assistance that exceeds the amount not subject to taxation will be taxed at a rate of 13%.

Consequently, if financial assistance is less than the tax-free minimum, then this amount may not be reflected in the certificate at all. However, if assistance is assigned in a larger amount, then it is necessary to reflect both the assigned amount and make tax deductions from the assistance allocated by the employer.

The procedure for taxing the income of citizens of the Russian Federation, as well as the rules for reflecting them in the 2-NDFL certificate, are regulated by Article 217 of the Tax Code of the Russian Federation.

The amount of fixed financial assistance, established by code 503, which is not subject to taxation, is determined by paragraphs 8 and 28 of Article 217 of the Tax Code.

The need to indicate income in the form of financial assistance

As stated earlier, the use of code 2760 is due to the presence of payments by the head of the enterprise in favor of current or former employees in the form of financial assistance. From a legal point of view, not all types of income paid to citizens are subject to mandatory taxation. However, almost all of them must be displayed in the reporting documentation.

| No. | Display conditions | Duty to display |

| 1. | Income paid to employees of an enterprise is subject to taxation, that is, it involves contributions to specialized state funds. | In this case, an indication of this type of income must be present in all reporting documentation. |

| 2. | Income paid to employees of an enterprise is not subject to mandatory taxation. | It is not necessary to indicate this type of income in the declaration. |

It is also worth noting that different types of income paid to employees of a business are subject to tax at different income tax percentages. Therefore, when drawing up a 2-NDFL certificate, an accountant should carefully indicate the required income code.

Features of deductions

Today the following tax deductions have appeared:

- Social – deductions that are issued exclusively to low-income families;

- Property deduction is a deduction that is formed in the process of selling real estate on which tax was paid, as well as the subsequent acquisition of real estate, which provides for the return of a certain amount of tax paid;

- Professional deductions are directly related to professional activities and certain professional risks;

- Investment deductions are based on the formation of the amount of risk for investment projects;

- Standard deductions for children (upbringing and maintenance), amounts spent on education and treatment, which should not be taxed.

In principle, almost anyone can apply for standard deductions. As for other deduction options, in this case you need to collect a package of documents in order to complete them.

A deduction initially helps reduce the amount of income that is subsequently taxed. But, there are situations when the deduction is provided in the form of a refund of funds from previously paid taxes.

How else can you use the deduction?

When calculating the deduction, state support funds are not taken into account. For example, maternity capital, military mortgage or housing certificates from the regional administration. Such government assistance is not reflected in the tax base. And funds spent on home decoration can be included in the limit amount up to 2 million rubles. But for this, certain nuances must be observed:

- if the housing was purchased from the developer, and the text of the purchase and sale agreement indicates that unfinished living space has been sold;

- The text of the purchase agreement states that the living space being sold is sold without finishing.

If the text of the contract specifies that the apartment has no repairs, not finishing, then the deduction may be denied. For the tax service, repair and decoration are not synonymous. Therefore, it is important to comply with this wording.

The buyer of an apartment can include the following finishing costs in the property deduction:

- materials for repairs;

- payment for the work of the construction team;

- payment for drawing up estimates and design of finishing works.

There is no clear list in the legislation, but the expenses incurred must be appropriate in meaning. Costs that are not directly related to finishing work may not be included in the property deduction amount. Expenses will be approved for:

- installation and dismantling of windows and doors;

- installation of flooring, tiles, kitchens, ceilings, bathrooms;

- painting or wallpapering walls and ceilings;

- laying communication systems - water supply, heating systems, electrical wiring.

To confirm expenses, checks, acts, receipts, payment orders are suitable, which clearly indicate what the payment was made for. You can include materials in expenses, even if you carried out all the repair and installation work yourself. You can specify any materials - doors, windows, primer, wallpaper. But a drill, an air conditioner or the price of a kitchen set cannot be included in the deduction.

You can include the amount of finishing not in the deduction for the decoration of the apartment, but in another period. If this year the accrued tax amount is less than the deduction, then the balance can be carried over to the next year and so on until the entire allowable amount is returned.

Deduction codes

Many accountants are puzzled over which code to put in the document. Deduction codes can be divided into several groups:

- 114 to 125 are codes that relate to standard child deductions;

- from 311 to 312 are property deductions;

- from 320 to 324 – social deductions;

- from 403 to 405 – professional deductions.

However, there are other codes for deductions that are not taxable within certain amounts. These are codes from 501 to 508:

- Code 501 – deduction from gifts made by an individual entrepreneur or organization;

- Code 503 – deduction from financial assistance provided to retired employees;

- code 505 – deduction from prizes and winnings made as a result of a competition conducted as advertising;

- Code 508 is a deduction from financial assistance provided at the birth of a child.

Standard children's

Standard child deductions include the following codes:

- 114 – deduction made for the first child;

- 115 – for the second child;

- 116 – for the third and subsequent children;

- 117 – for a child who has a disability of the first or second group;

- 118 – double deduction for one child;

- 119 – double for two children;

- 120 – double for three and subsequent children;

- 121 – double for disabled children of the first or second group.

If one of the parents refuses double deduction, then the following codes apply:

- 122 – deduction for the first child;

- 123 – for the second child;

- 124 – for the third and subsequent children;

- 125 – for disabled children (only the first and second groups are taken into account).

Property

When it comes to property deductions, the following codes are used:

- Code 311 - refers to deductions in relation to housing purchased or under construction;

- Code 312 – the percentage of targeted loans that were taken for the purchase or construction of housing is taken into account.

Social

Social deductions:

- expenses that the taxpayer incurred in connection with his studies;

- amounts that were spent by the taxpayer on the education of children;

- expenses incurred for medical services or drugs that were purchased for the taxpayer himself, his spouse or children.

Professional

There are several codes at work here:

- 403 – expenses that arose during the performance of work and have documentary grounds;

- 404 - deductions that arose due to the receipt of royalties and have a documentary basis;

- 405 - the amount that was spent on royalties.

For income without personal income tax within certain amounts

There are other codes for deductions that are non-taxable within certain amounts. These are codes from 501 to 508:

- 501 code – deduction from gifts made by an individual entrepreneur or organization;

- code 503 – deduction from financial assistance provided to retired employees;

- 505 code – deduction from prizes and winnings made as a result of competitions held as advertising;

- Code 508 is a deduction that is made when paying parents at the birth of a child.

Types of tax deductions

- standard. They are provided to specific categories of employees for each month they pay taxes; a parent can also receive a deduction for a child;

- property Citizens who officially pay taxes when purchasing housing or building their home, as well as on the amount of repaid mortgage interest, have the right to such deductions;

- social. These deductions can be received by employees for the amounts of money that they spent on their studies during full-time education or on children studying under 24 years of age. You can also receive social benefits for treatment of yourself or your family members, but for this you will need to provide medical reports. In general, the annual deduction does not exceed 120 thousand rubles. But the treatment is very expensive - a deduction can be given for the entire amount spent. This also applies to expensive training;

- professional. These deductions are provided for individual entrepreneurs and are given for the amount spent exclusively on conducting their business activities. If such expenses cannot be confirmed with documents, then a deduction is taken of 20% of the amount of all income that the entrepreneur received during the reporting period.