Deduction code 601 in personal income tax certificate 2

Deduction code 601 in personal income tax certificate 2 reflects the amount that can reduce the tax base exclusively for this type of income such as dividends. We need to draw your attention to the fact that this code operates in accordance with Article 214 of the tax...

What is a deduction? In principle, this is a certain element of reducing the tax base. Tax base is the total amount of taxes, which is subject to clear deduction of funds in the amount of 13% personal income tax. That is, out of 10,000 rubles of salary, the employee is obliged to transfer 1,300 rubles to the tax fund, the net salary in this case will be 8,700 rubles.

Every income is taxed. At the same time, there are deductions that help reduce the amount of income from which a tax of 13% is calculated.

Deduction codes in the 2-NDFL certificate

However, if you are eligible for a deduction, your overall tax base will be reduced. For example, you use a standard type tax on children, which provides for a reduction in the tax base by an amount of 3,000 rubles. In this case, the calculations will be as follows: from the total income of 10,000 rubles, an amount of 3,000 rubles is subtracted, which is not taxed. It turns out that the amount of income is 7,000 rubles. Accordingly, the amount of taxes in this case will be 910 rubles. The difference is quite significant.

Deductions can be processed by providing a package of documents and an application. Tax authorities clearly define all ways to formalize this option of reducing the overall tax base for an individual.

What does deduction code 601 mean in personal income tax certificate 2?

First of all, let's talk about the features of filling out personal income tax certificate 2:

- The certificate is filled out on a specialized form;

- All income is indicated in the form of codes;

- All deductions are indicated in the form of codes;

- If a person is not a resident of the country, then he does not have the right to receive tax deductions;

- If an individual entrepreneur pays tax according to a special system, he is not entitled to receive deductions;

- The certificate is filled out only for officially employed citizens;

- In the absence of personal income tax payments, it is impossible to issue tax deductions.

Deduction code 601 allows you to reduce the level of dividend income to a certain extent. In our country, every type of income must be taxed. If the tax is not calculated, then no deductions are provided. As for dividends, this type of income is necessarily included in 2 personal income taxes as income taxed under a special personal income tax system. You can reduce the amount of deductions using code 601. However, only categories of persons clearly defined by law can claim this deduction.

Personal income tax on dividends. examples of calculation and reporting

Rules for calculating personal income tax on dividends in cases where the company receives dividends and if it does not. How to reflect dividends in forms 2-NDFL and 6-NDFL - read the article.

Advanced training courses for accountants and chief accountants on OSNO and USN. All requirements of the professional standard “Accountant” are taken into account. Systematize or update your knowledge, gain practical skills and find answers to your questions.

Calculation of personal income tax on dividends

When calculating personal income tax on dividends, standard, social and property tax deductions are not applied; this procedure is confirmed in clause 3 of Art. 210 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service dated June 23, 2016 No. OA-3-17 / [email protected] ).

Even if dividends are paid several times during the year, the tax is calculated for each payment separately, that is, not on an accrual basis (clause 3 of Article 214 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance dated 12.04.

2016 № 03-04-06/20834).

How dividend taxes are calculated depends on whether your company receives dividends from other organizations.

Situation 1. Your company does not receive dividends

In this case, the tax is calculated according to the formula (clause 2 of article 210, clause 5 of article 275 of the Tax Code of the Russian Federation):

Example. Calculation of personal income tax on dividends by an organization that does not itself receive dividends

Alpha LLC paid its participant A.A. Ivanov. dividends in the amount of RUB 4,000,000.

When paying them, personal income tax is withheld in the amount of 520,000 rubles. (RUB 4,000,000 x 13%), RUB 3,480,000 was transferred to the participant. (RUB 4,000,000 – RUB 520,000).

Situation 2. Your company itself receives dividends

If you only receive dividends subject to income tax at a rate of 0%, personal income tax can be calculated in the same way as in Situation 1.

In other cases, to calculate the tax you will need the following indicators (clause 2 of article 210, clause 5 of article 275 of the Tax Code of the Russian Federation , Letter of the Ministry of Finance dated October 14, 2016 No. 03-04-06/60108):

- the amount of dividends accrued to all participants is the value “D1”;

- the amount of dividends received by your . It includes dividends that:

- were not subject to income tax at a rate of 0%;

- were not previously taken into account when calculating taxes on dividends you paid.

To calculate personal income tax, proceed as follows:

Calculate your personal income tax deduction using the formula:

Calculate the tax on dividends accrued to the participant using the formula:

Example. Calculation of personal income tax on dividends by an organization that itself receives dividends

Alpha LLC owns shares in the authorized capitals of:

- Gamma LLC - 100% (Alpha LLC has owned this share for five years);

- LLC "Delta" - 30%.

Alpha LLC received dividends from Gamma LLC in the amount of RUB 1,000,000. and from Delta LLC - in the amount of RUB 1,500,000. These dividends were not previously taken into account when calculating personal income tax on dividends paid by Alpha LLC to its participants.

Alpha LLC distributed profits in the amount of RUB 4,000,000 among the participants, including:

- Ivanov A.A. – RUB 1,600,000;

- Beta LLC - RUB 2,400,000.

Personal income tax on dividends paid to A.A. Ivanov is calculated as follows:

- The personal income tax deduction on dividends is RUB 600,000. (RUB 1,600,000 / RUB 4,000,000 x RUB 1,500,000). Dividends received from Gamma LLC are not taken into account when calculating the deduction, since they are subject to income tax at a rate of 0% (clause 1, clause 3, article 284 of the Tax Code of the Russian Federation);

- Personal income tax on dividends will be 130,000 rubles. ((RUB 1,600,000 – RUB 600,000) x 13%). The participant receives 1,470,000 rubles. (RUB 1,600,000 – RUB 130,000).

Personal income tax on dividends is paid to the usual BCC for personal income tax - 182 1 0100 110.

The tax withheld by the LLC from dividends paid to participants must be paid no later than the day following the day of transfer of dividends (clause 6 of Article 226 of the Tax Code of the Russian Federation).

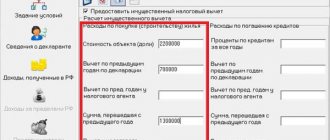

Reflection of dividends in certificate 2-NDFL

Organizations that pay dividends to individuals must submit 2-NDFL certificates for them (clause 2 of Article 230 of the Tax Code of the Russian Federation).

The amount of dividends paid must be reflected in section. 3 certificates indicating the tax rate - 13%. The amount of dividends is indicated in full, without reduction by the amount of withheld tax. The income code for dividends is “1010”.

If, when calculating personal income tax, you took into account dividends received from other organizations, in the same line of section. 3, where you indicated the amount of dividends, indicate the deduction amount with code “601”. If the deduction was not provided, then put “0” in the “Deduction Amount” column (Section I of the Procedure for filling out Form 2-NDFL).

Indicate the personal income tax deduction from dividends in section. 4 is not necessary (section VI of the Procedure for filling out form 2-NDFL).

If, in addition to dividends, you paid the participant other income taxed at a rate of 13%, incl. salary, indicate dividends along with other income. Fill out separate sections for dividends. 3 and 5 are not necessary (section I of the Procedure for filling out form 2-NDFL, Letter of the Federal Tax Service dated March 15, 2016 No. BS-4-11 / [email protected] ).

Reflection of dividends in 6-NDFL

Dividends must be reflected in 6-NDFL for the period in which they were paid (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation). Accrued but unpaid dividends are not reflected in 6-NDFL.

In Sect. 1 specify:

- in lines 020 and 025 - the entire amount of dividends paid in the reporting period, together with personal income tax;

- in line 030 - deduction from dividends, if applied;

- in lines 040, 045 and 070 - personal income tax on dividends.

In Sect. 2 in a separate block of lines 100 - 140 show all dividends paid on one day, indicating:

- in lines 100 and 110 - the date of payment;

- in line 120 - the next business day after payment;

- in lines 130 and 140 - dividends along with personal income tax and withholding tax.

Peculiarity. Dividends paid on the last working day of the reporting period, in Sec. 2 don't show. Reflect them in section. 2 for the next quarter (Letters of the Federal Tax Service dated November 2, 2016 No. BS-4-11/ [email protected] , dated October 24, 2016 No. BS-4-11/ [email protected] ).

Deduction code 601 in personal income tax certificate 2

Deduction code 601 in personal income tax certificate 2 reflects the amount that can reduce the tax base exclusively for this type of income such as dividends. We need to draw your attention to the fact that this code operates in accordance with Article 214 of the tax...

What is a deduction? In principle, this is a certain element of reducing the tax base. Tax base is the total amount of taxes, which is subject to clear deduction of funds in the amount of 13% personal income tax. That is, out of 10,000 rubles of salary, the employee is obliged to transfer 1,300 rubles to the tax fund, the net salary in this case will be 8,700 rubles.

Every income is taxed. At the same time, there are deductions that help reduce the amount of income from which a tax of 13% is calculated.

Features of deductions

For example, you receive 10,000 rubles, of which you must pay tax in the amount of 1,300 rubles. However, if you are eligible for a deduction, your overall tax base will be reduced. For example, you use a standard type tax on children, which provides for a reduction in the tax base by an amount of 3,000 rubles. In this case, the calculations will be as follows: from the total income of 10,000 rubles, an amount of 3,000 rubles is subtracted, which is not taxed. It turns out that the amount of income is 7,000 rubles. Accordingly, the amount of taxes in this case will be 910 rubles.

What does deduction code 601 mean in personal income tax certificate 2?

First of all, let's talk about the features of filling out personal income tax certificate 2:

- The certificate is filled out on a specialized form;

- All income is indicated in the form of codes;

- All deductions are indicated in the form of codes;

- If a person is not a resident of the country, then he does not have the right to receive tax deductions;

- If an individual entrepreneur pays tax according to a special system, he is not entitled to receive deductions;

- The certificate is filled out only for officially employed citizens;

- In the absence of personal income tax payments, it is impossible to issue tax deductions.

Deduction code 601 allows you to reduce the level of dividend income to a certain extent. In our country, every type of income must be taxed.

Codes for different types of income

In particular, code 2002 has appeared for bonuses paid for production results and other similar indicators provided for by the laws of the Russian Federation, labor or collective agreements (applies to bonuses paid not at the expense of the organization’s net profit, not at the expense of special-purpose funds or targeted revenues) .

Amounts of remuneration paid from the organization’s profits, special-purpose funds or targeted income will need to be reflected using code 2003.

In addition, new income codes for transactions with securities and derivative financial instruments have been added to the list (codes 1544 - 1549, 1551 - 1554).

Deduction code 601

If the tax is not calculated, then no deductions are provided. As for dividends, this type of income is necessarily included in 2 personal income taxes as income taxed under a special personal income tax system. You can reduce the amount of deductions using code 601. However, only categories of persons clearly defined by law can claim this deduction.

In addition to income codes, the 2-NDFL certificate contains many deduction codes for personal income tax. The explanations of these codes are given in the table.

How to indicate income code 1010 in the Declaration program

This code corresponds to the “Dividends” income. Because To register dividends from Russian companies, the program provides a separate tab; in this case, the code is not entered anywhere. It's another matter if you need to declare income from foreign sources.

Example 4

Vasily invests money in foreign companies and receives dividends. In 2021, an American investment fund paid him 4 times $340. He withheld 10% tax from each payment. In 2021, Vasily needs to file a declaration and calculate the personal income tax due.

How to work in the program:

- We set basic conditions: we indicate that the income was received in foreign currency.

- We fill out information about the taxpayer as standard.

- Go to the “Income outside the Russian Federation” tab. Add a new source (using the “+” button). The company name may be written in Latin letters. We select country codes from the available list.

- In the lower field we indicate the payment currency and the date of the transaction. The program allows you to automatically determine the course. If the company withheld tax immediately, the date of receipt of income and payment of tax will be the same. If the tax was not paid, do not touch the “date of tax payment” field.

- In the income code, select 1010. Indicate the amount of income in foreign currency and the amount of tax withheld.

- We repeat operations according to paragraphs 3-5 for each payment case separately. In the example under consideration, there are 4 receipts of $340.

- The declaration is completed. All that remains is to check it and print it ().

Deduction code in certificate 2-NDFL

Companies submit a 2-NDFL certificate annually to confirm the amount of income that a person received for a particular period. With the help of such certificates, tax inspectors check whether the organization has correctly applied deductions and calculated the amount of tax payable to the budget. Special codes are used to indicate deductions.

All codes are given in Appendix 2 of the order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/387 (as amended by the orders of the Federal Tax Service of Russia dated November 22, 2021 No. ММВ-7-11/633 and dated October 24, 2021 No. ММВ-7-11 /820).

Deduction codes are indicated in the table of section 3 of form 2-NDFL. Each deduction has its own code.

How to fill out dividends in 3-NDFL

Since this is income, it is reflected on sheets A and B of 3-NDFL (depending on the source).

Let's look at it in order. Example 1

Semyon is one of the founders of the company. The organization closed 2021 with a profit and in 2021 paid him 50,000 rubles. with a deduction of 6,500 rubles. Personal income tax. In addition, Semyon received dividends from a foreign investment company twice for 230 US dollars, i.e. only 460 $. Upon payment, the foreign company withheld 10% tax. Semyon is obliged to pay personal income tax on foreign currency earnings himself. He plans to declare Russian dividends in his declaration, although the tax on them has already been transferred.

How to reflect “domestic” income:

- On sheet A, indicate the name and details of the tax agent.

- Enter the amounts paid and tax withheld. All this data on dividends for 3-NDFL is in the certificate that the organization is required to provide at the end of the reporting year (in form 2-NDFL).

- Specify code (08) and tax rate (13%).

How to report on foreign sources:

- On sheet B indicate the tax rate (13%).

- On page 020, write down the name of the foreign company that paid the income (you can use the Latin alphabet). Next to it, indicate the country code in which this company is located.

- Below, put the code designation of the payment currency, the income code (1 - only for profits from controlled foreign companies, in other cases - 2).

- On page 040, enter the date of receipt of income.

- Based on the Central Bank exchange rate in effect on that day, calculate the amount of income in rubles.

Important! Foreign countries also levy taxes on income earned abroad. If a special agreement on the avoidance of double taxation has been concluded between the Russian Federation and this country, the personal income tax payable can be reduced by the amount of this expense. This is stated in paragraph 2 of Article 214 of the Tax Code.

- Complete pages 080-130. The date of tax payment will coincide with the date of transfer of money, when the foreign company automatically writes off the required amount upon payment.

- Repeat steps 1-6 for each payment transaction.

Important!

Clause 3 of Article 214 of the Tax Code states that tax on dividends must be calculated for each payment separately!

After filling out sheets A and B, the overall result is reflected in Section 2:

- all income received is summed up;

- calculate the resulting amount of tax payable.

A sample of a completed 3-NDFL declaration based on the data from Example 1 is available for download.