What is it and who rents it?

Until 2021, individual entrepreneurs had to submit a declaration in form 4-NDFL on the general taxation system after receiving their first income in the year (from the moment the application of the OSN began or the transition to it).

In 4-NDFL, the entrepreneur indicated the estimated income for the year that he planned to receive (minus expenses). Based on this information, the Federal Tax Service calculated and sent payment slips to individual entrepreneurs for the payment of quarterly advance payments for personal income tax.

It was necessary to resubmit 4-NDFL if the income received during the year differed significantly (by more than 50%) from that indicated in the previously submitted declaration. This was necessary for accurate calculation (adjustment) of advances payable.

At the end of the year, entrepreneurs on OSNO must submit a 3-NDFL declaration.

Entrust reporting to specialists

Calculation of estimated income

To complete the report in question, you must calculate your estimated annual income. The calculation principles for individual entrepreneurs who have been doing business for more than a year and for newly registered individual entrepreneurs may differ:

1. Newly registered individual entrepreneurs are calculated based on the amount of income received in the first month after registration.

2. If an individual entrepreneur has been engaged in entrepreneurial activity for more than a year , then the amount of income recorded in the 3-NDFL report for the previous year can be used as the estimated income.

In each case there are nuances.

Newly registered individual entrepreneurs

In this case, the report includes information about the income received during the first month. The calculation is quite simple.

Example. A.I. Ivanov registered as an individual entrepreneur on January 15, 2018. The entrepreneur received his first income on March 25, 2018. The amount of his income for this month (minus expenses) amounted to 100,000 rubles. To get the amount of estimated annual income, you need to multiply 100,000 rubles by the number of months remaining in the year:

100,000 rubles X 10 months = 1,000,000 rubles.

Individual entrepreneurs who have been operating for several years

If a person has been engaged in entrepreneurial activity for more than a year, then the amount recorded in the 3-NDFL report for the previous year can be taken as the estimated annual income.

If, in the opinion of the individual entrepreneur, his income this year will be less than last year, he has the right to indicate the amount he considers necessary.

At the same time, according to the letter of the Ministry of Finance of the Russian Federation dated 01.04.08 No. 03-04-07-01/47, if the amount of expected income in 4-NDFL differs from the amount in 3-NDFL by less than 50%, the Federal Tax Service will calculate advance payments based on 3-NDFL for last year.

Declaration form 4-NDFL

Note

: the reporting form, procedure for filling out and submission format are approved by Order of the Federal Tax Service of Russia dated December 27, 2010 No. MMV-7-3/ [email protected] The latest changes were made to it by Order dated January 9, 2019 No. MMV-7-11/ [email protected] , and in 2021 the updated form 4-NDFL was in effect.

Download the latest 4-NDFL declaration form, current for 2019: PDF format.

4-NDFL declaration, relevant in 2021: WORD format, PDF format.

This might also be useful:

- Tax calendar for 2021 for individual entrepreneurs

- Production calendar for 2021

- Increasing the minimum wage in 2021

- Act of joint reconciliation of taxes and fees with the Federal Tax Service

- What taxes does the individual entrepreneur pay?

- Tax system: what to choose?

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Deadline for submitting the 4-NDFL declaration in 2021

In 2021, there is no need to submit a 4-NDFL declaration

, since it has been cancelled.

Previously, the 4-NDFL declaration had to be submitted within 5 working days after the month

from the date of receipt of the first income of the year.

For example

, the individual entrepreneur began to apply the OSN from 01/01/2019, and he received his first income on January 18; in this case, he must submit the 4-NDFL declaration no later than February 25 (01/18-02/18 – a month from the date of receipt of income + 5 working days).

Deadline for submitting the updated declaration

(in case of a significant change in the income indicated in a previously submitted declaration) is not established by law, and therefore the inspector has no right to be fined for failure to provide “clarification.”

Declaration 4-NDFL was submitted in the case when the actual income received is less than declared. This is to reduce the advances payable.

Fines

for late submission of the declaration:

- For failure to submit the initial 4-NDFL declaration (after receiving profit) – 200

rubles. (Article 126 of the Tax Code of the Russian Federation); - There is no penalty for failure to submit an updated declaration (if income changes by more than 50%).

Fined for failure to submit 4-NDFL under Art. 119 of the Tax Code of the Russian Federation, the inspector does not have the right, since this declaration does not contain the amount of income actually received, and charging a fine on the estimated income is unlawful.

Therefore, if an inspector suddenly assesses a fine based on estimated income, this fact must be appealed through a pre-trial audit (by filing a complaint first with the Federal Tax Service and then with the Federal Tax Service).

Note

: also, the tax authority does not have the right to collect a fine for non-payment of advance payments and charge penalties for late payment of advances.

Thus, if an individual entrepreneur has not submitted 4-NDFL at all (for periods before 2020), the only fine may be 200 rubles for failure to submit a declaration. Sanctions such as freezing accounts (suspension of transactions on them) are also unlawful.

Sanctions for failure to submit a declaration

Federal legislation of Russia obliges individual entrepreneurs to generate a 4-NDFL report and submit it within the established time frame to local regulatory authorities (business entities must submit this report at least once). But it is worth noting that the Tax Code does not provide for any liability for violators of the regime in the form of penalties, which are calculated as a percentage of underpaid taxes to the budget.

This is due to the fact that in this reporting form, business entities do not need to indicate data on income received and accrued tax liabilities. Since estimated figures are included in the declaration, the maximum punishment for an entrepreneur can be in the form of a fine, the amount of which will not exceed 200 rubles.

Methods for submitting the 4-NDFL declaration

The declaration of expected income is submitted to the Federal Tax Service at the place of residence of the individual entrepreneur.

4-NDFL was presented in 3 ways:

- In paper form (in 2 copies) in person or through a representative. The first copy is sent to the Federal Tax Service, the second (with a mark of acceptance) remains with the individual entrepreneur;

- By mail as a registered item with a description of the contents. In this case, there should be an inventory of the attachment (indicating the declaration to be sent) and a receipt, the number in which will be considered the date of submission of the declaration;

- In electronic form via telecommunication channels (through EDI operators, as well as using the service on the Federal Tax Service website).

Note

: if the declaration is submitted by a representative, a notarized power of attorney must be issued for him.

note

, when submitting any declaration on paper, some Federal Tax Service Inspectors may require:

- Attach the reporting file in electronic form (on a flash drive or floppy disk);

- Print a special barcode on the declaration that duplicates the information contained in it.

These requirements are not reflected directly in the Tax Code of the Russian Federation, but some inspectorates may refuse to accept a declaration without fulfilling these conditions. If this happens, the fact of refusal of admission can be appealed to a higher tax authority.

Note

: in accordance with the Letter of the Ministry of Finance of the Russian Federation dated April 18, 2014. No. PA-4-6/7440, an error in OKTMO and (or) the absence of a two-dimensional bar code cannot become a reason for refusing to accept a tax return (if the declaration itself is drawn up in the approved form).

What if you don’t submit it?

Oddly enough, a 4-NDFL certificate not sent on time threatens more trouble than failure to pay an advance tax payment. Articles 52-55 of the Tax Code define the tax base as real income received by an entrepreneur in a certain time period. But the advance payment for personal income tax is based on estimated data or last year’s indicators. That is why in disputes between entrepreneurs and the tax inspectorate, the court takes the side of the business and removes penalties from the commercial structure. Moreover, it is impossible to recover an unpaid advance from an entrepreneur in the current legal framework.

The situation is different if you have not submitted the document (4-NDFL) to the inspectorate. Responsibility for such behavior is provided for by two articles of the Tax Code of the Russian Federation - 119 and 126. According to the first, the fine for failure to provide is 1000 rubles, and the second norm says 200 rubles. Practice shows that tax inspectors make a more severe decision and punish individual entrepreneurs with a fine specified in Article 119. However, it happens that tax officials change their anger to mercy and issue a bill for 200 rubles.

How to fill out the 4-NDFL declaration

Basic rules for filling out the 4-NDFL declaration

- The declaration can be filled out by hand or printed on a computer;

- Acceptable ink colors: black and blue;

- Information in the declaration is entered from left to right, starting from the first cell. When filled out on a computer, numbers are aligned to the right;

- In unfilled cells you must put a dash;

- When filling out by hand, information is entered in large block letters, when filling out on a computer - in large letters using Courier New font 16-18 points high;

- The use of putty, making corrections and fastening sheets with a stapler is not allowed;

- When submitting (filling out) a declaration by a representative, a power of attorney must be attached to the reporting.

Instructions for filling out the 4-NDFL declaration form

Field "TIN". Individual entrepreneurs indicate the TIN reflected in the certificate of registration with the tax authority.

Field "Adjustment number". If the declaration is submitted for the first time, then “0—” is indicated, if updated (if income changes during the year by more than 50%), its number is indicated: “1—”, “2—”, etc.

Field "Tax period". The year in which the declaration is submitted (the first income was received) is indicated.

Field “Submitted to the tax authority (code)”. Indicate the code of the Federal Tax Service on which the individual entrepreneur is registered. You can find out your Federal Tax Service code using this service.

Field "Taxpayer category code". Individual entrepreneurs indicate the code “720”, notaries and other persons engaged in private practice – “730”, lawyers – “740”, individual entrepreneurs heads of peasant farms – “770”.

Field "OKTMO Code". The code of the municipality of the individual entrepreneur’s place of residence is indicated. You can find out OKTMO using this service.

Fields “Last name”, “First name”, “Patronymic”. Data on last name, first name and patronymic are entered line by line in accordance with the Russian passport.

Field "Contact phone number". The telephone number is indicated in the format “+7 (code)xxxxxxxx”.

Field “Amount of estimated income (RUB)”. The amount of income that the individual entrepreneur plans to receive for the year (including expenses) is indicated. The amount is indicated in full rubles and is aligned to the right.

Field “on 1 page with supporting documents or copies thereof attached.” If the individual entrepreneur wants to attach documents confirming the expected income (this is optional) or a power of attorney for the representative to the declaration, it is necessary to indicate the number of sheets in the format “001”, “010”, etc.

Field “I confirm the accuracy and completeness of the information specified in this declaration.” If the declaration is submitted by the individual entrepreneur himself, “1” is indicated, the lower lines are not filled in. If you represent an individual entrepreneur, indicate “2” and fill in the following lines:

“Last name, first name, patronymic in full” - full name of the individual entrepreneur’s representative. If the representative is an individual, only this field is filled in. If a legal entity, indicate the full name of the representative and the name of the organization in which he works.

"Signature" field. The declaration of the individual entrepreneur is signed personally or by his representative.

Then the individual entrepreneur or his representative must indicate the date of filling out the declaration and the name of the document confirming the authority of the representative.

Report structure

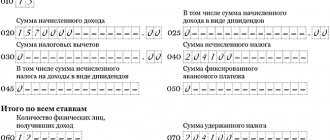

Declaration 4-NDFL contains only one sheet with a simple structure.

At the top of the document there is a field for entering the TIN.

In the “correction number” item the following is entered:

- the number “0” if the individual entrepreneur submits a report for the first time this year;

- the number “1” or more if the individual entrepreneur submits a report clarifying the expected income. In this case, the number means the number of the clarification being submitted.

The “tax period” section indicates the year for which the report is submitted.

The paragraph “submitted to the tax authority” indicates the code of the Federal Tax Service to which the declaration is submitted.

In the item “taxpayer category code” you should enter the numbers “720”, indicating that the document is being submitted by an individual entrepreneur.

For other categories of individual entrepreneurs the following codes are established:

- 730 Notary engaged in private practice and other similar persons;

- 740 Lawyer who opened a law office;

- 770 An individual is an individual entrepreneur who is the head of a peasant (farm) enterprise.

In the item “OKTMO code” the code of the territory where the person is registered as an individual entrepreneur is entered.

Item “F.I.O. and telephone" is used to indicate this data. They must be written in full without abbreviations.

The “amount of estimated income” item is used to indicate the expected income. Data must be entered in whole monetary units without dashes, brackets or any punctuation marks.

Procedure for calculating estimated income

There is no official methodology for calculating the estimated income indicated in the 4-NDFL declaration. However, regulatory authorities explained how to calculate such income. An entrepreneur can reduce the first income received during a month by expenses incurred during the same period. The resulting difference should then be multiplied by the number of months remaining until the end of the calendar year.

How is it different from 3-NDFL?

Participants in economic relations have to fill out and submit quite a lot of declaration papers. In some situations, people get confused between forms that contain similar data. Thus, some individual entrepreneurs consider the third and fourth personal income tax reports to be identical. This is wrong.

comparison table

| Distinctive features | Four personal income taxes | Three personal income taxes |

| The essence of the information | Forecast | Data on income received during the reporting period (actual) |

| Subjects | Individual entrepreneurs working for OSNO | Participants in economic relations and citizens who received any income during the reporting period |

| Purpose of provision | Calculation of advance payment by taxes | Calculation of the amount of deductions due to the taxpayer |

Where are the reports submitted?

The declaration must be sent to the tax authority, which is located at the place of registration of the entrepreneur.

If an individual entrepreneur has difficulties determining the correct code of the Federal Tax Service, to which he should send the completed form, then a special service from the tax service portal will come to his aid. There you need to indicate your registration address, after which the required code will be displayed.

If an individual entrepreneur operates in a region other than his registered registration, then he must still submit the form to the inspectorate where he was registered.