How the tax office checks the correctness of VAT

Before explaining what the VAT gap means, we will tell you how tax authorities check the correctness of VAT calculations.

Russian tax authorities are equipped with modern software, which is being improved from year to year.

In 2021, they work using the automated information system “Tax-3” (AIS “Tax-3”). Our immediate plans include the development of the concept of the next generation of this Tax-4 system.

The sensational ASK VAT (now “VAT Control”) is a software package that is part of the AIS “Tax-3”.

Now we’ll tell you how VAT gaps are checked. The VAT gap is identified using the VAT ASK.

To understand that this is a break in the VAT chain, let's look at the VAT tax return.

In addition to the general figures, the VAT return includes sections 8–12, which are essentially books of sales, purchases and invoice journals. That is, the tax authorities have data from invoices that were issued and for which the tax was accepted for deduction.

It turns out that the VAT tax gap is a discrepancy in the data reflected in the books of purchases and sales from counterparties. We will consider below what inconsistencies are meant.

On the procedure for calculating VAT in 2021, we have made a selection of articles “Procedure for calculating VAT in 2020–2021” .

Capitalist feudalism

It is difficult to keep track of the entire chain, although there are programs for reconciling VAT partners for this purpose. But you don’t have to do this: if the tax office is interested in you, then the problem has arisen between you and your direct partner. And it can be solved.

In part, this is reminiscent of the medieval feudal principle “my vassal’s vassal is not my vassal”: if you produce furniture from plywood, and the timber supplier is at fault, selling raw materials to a sawmill and incorrectly indicating the parameters of the transaction (not indicating the fact of the sale or understating its monetary value), then you has nothing to do with it.

Let us explain with a simplified example: during the reporting period, yours produced and sold wardrobes worth 430,000 rubles. The amount of VAT at a rate of 20% on the sale of these cabinets is RUB 71,667. But to make cabinets, “Graf” first purchased plywood from a wholesale and retail company for the full amount of 30,000 rubles, which theoretically already includes VAT at the same rate of 20% in the amount of 5,000 rubles.

But the transaction for the sale of this plywood to you may not be reflected in the tax reporting of Baron LLC or may be reflected with different parameters than yours. Then, as soon as you decide to apply for a VAT deduction (71,667 - 5,000 = 66,667 rubles), the problem of Baron LLC automatically becomes your problem. If everything is in order between you and Baron LLC, then Baron LLC itself has problems of the same kind with the sawmill IP M.U. Zhikov, then these are only their problems, not yours: your deduction will be offset.

What are the VAT gaps?

VAT gaps can be divided into direct VAT gaps and complex VAT gaps.

Let's look at the VAT return again. So, tax authorities use software to compare data from purchase books and sales books. Any invoice reflected in the purchase book of one business entity must be reflected in the sales book of another business entity. If this does not happen, then we can talk about a direct gap in VAT.

We wrote about how to apply VAT deductions in the article “Procedure for applying VAT tax deductions: conditions” .

However, not everything is so simple, and the matter does not end with direct comparison. ASK VAT compares data not only in the seller/buyer pair, the program tracks the entire chain by supplier, analyzing the declared deductions and the actual payment of VAT to the budget. Such in-depth analysis and identification of inconsistencies at the second, third, and so on levels is usually called a complex VAT gap.

What kind of discrepancies relate to gaps:

- absence of a counterparty in the Unified State Register of Legal Entities;

- lack of reporting from the counterparty or zero reporting;

- non-payment of taxes to the budget.

Gaps can also be characterized as technical and schematic gaps.

A technical gap may be caused by a technical error. For example, significant details of invoices are indicated incorrectly, invoices are accidentally not reflected in the sales book.

Scheme gaps in VAT are the unlawful use of deductions by the taxpayer and the use of illegal tax optimization schemes. However, a conscientious taxpayer can also be caught in a VAT gap.

Find out how a desk audit for VAT is carried out in the article “Desk tax audit for VAT: deadlines and changes in 2021” .

Problems can be prevented

The most unpleasant thing about a VAT gap is when it turns out that the supplier is involved in long chains. In order not to worry about gaps, I advise you to check your counterparties.

This can be done using services and verification services from counterparties - banks and online accounting services have them. It also helps to record the first purchase: photograph or videotape a warehouse, a car with goods.

White business for risk control. We check the reliability of partners, the volume of transfers and the amount of taxes, and give recommendations on how to protect yourself from tax issues.

→ rko.modulbank.ru/wb

Advertising, we love this

Gap discovered: actions of tax authorities

A VAT gap is discovered - the consequences for the company are almost always the same. Tax officials will do everything to close the VAT gap. Or rather, closing VAT gaps will, of course, be handled by the company itself.

If the gap is technical and direct, then the question of how to eliminate the VAT gap in this case is not urgent. In response to the tax company's request, the company simply corrects its mistake by filing an updated return.

What is being done to eliminate VAT gaps of a more complex nature?

When a gap in the VAT scheme is detected, controllers begin to take actions in accordance with the internal instructions of the tax authorities on VAT gaps. These rules are not reflected in legislative acts; they are presented in the tax manual, so taxpayers do not need to rely on them, but it is useful to know what is being discussed there.

When a gap is identified, tax authorities begin to thoroughly check the entire chain of suppliers/buyers. The tax must be paid to the budget in any case. Once a gap is detected, it means that the tax has not been paid. Tax officials see this as a tax evasion scheme and are looking for a beneficiary. If there is a VAT gap, how can you find out the beneficiary?

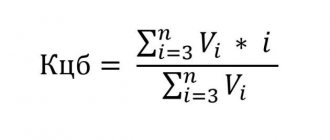

Tax officials do this by calculating points by checking data for the two years preceding the audit:

The following parameters are analyzed:

From the above diagram it is clear that almost any actively functioning company can be designated as a beneficiary of the gap in the VAT tax return.

The conclusion also suggests itself that they will “dig” for someone who can pay. An accepted VAT gap is, in simple terms, the determination of the beneficiary of such a gap.

Then they begin to work with the beneficiary.

Aspects

When checking a legal entity, tax authorities pay attention to the following:

- Date of registration of the legal entity.

- The company has a warehouse and office. For a transaction that was carried out by a certain company, documents will be requested by the regulatory authority. From them, all addresses that are associated with the organization’s partner will be visible. To check the latter, just open any maps online and see the street where the legal entity is located. If a company sign or other identifying sign is visible on the street, this means that the company address is real. The need for such a thorough investigation regarding legal entities is due to the fact that sometimes non-existent locations or premises are indicated that cannot be used as a warehouse or office.

- Information about the company in open sources. In particular, they are interested in answers to questions about whether the legal entity has an official website and whether the organization takes part in conferences. What are the reviews about the company, is the legal entity active in advertising?

- Director, founders of the company. This aspect focuses on these individuals. For example, if the director of an organization is “hung” by several companies, it is necessary to check their connections with each other: this will be quite enough. In addition, the final beneficiary is monitored and identified based on the massive number of payment documents passing through the organization, on the accounts of legal entities that are opened in the same bank, and on the simultaneous submission of reports to the Federal Tax Service.

Gap detected: taxpayer actions

What to do in the event of a VAT gap depends on how the tax authorities act.

They may send a request to provide explanations on the VAT tax gap or make corrections to the declaration.

How to respond to a VAT break requirement depends on what error is identified. Let us repeat, if the error is of a technical nature, then you must submit an updated declaration or provide explanations to the tax office.

the article how to check the correctness of a VAT return using control ratios .

If the problem is on the part of the counterparty (the required invoice is not specified, the tax has not been paid to the budget, etc.), then the further actions of the taxpayer depend on how confident he is in his correctness and ability to defend his rights.

As we can see, claims from tax authorities regarding VAT gaps can arrive not only after the camera’s own VAT return, but also after checking the declarations of contractors not even of the first level.

How to fight off the VAT gap from the tax authorities? The easiest way is to comply with the tax authorities’ requirement, remove the controversial deduction and pay additional tax. This can be done even if the transaction is real and the taxpayer is not to blame for anything. Many people do just this, fearing deeper checks.

But if the cost of the issue is high and the taxpayer has not committed any violations, then, of course, we must fight for our rights in the form of a deduction.

The response to the request may include the following:

A well-written response to a request for an explanation of the gaps will help prevent the situation from developing further. Sign up for a free trial access to ConsultantPlus - there you will find an example answer compiled by experts.

This may be followed by a call to the tax office for a VAT gap if the tax authorities’ demands for additional tax payment have not been satisfied.

Basic advice for those who are called to the tax commission regarding the VAT gap. Please note that a commission and an interrogation are different concepts, and they are carried out on different grounds. The commission is more of a conversation than a clear interrogation algorithm. The result of the commission is an offer to you to voluntarily pay additional VAT.

Additional inspection by the Federal Tax Service

Associated with actions:

- Does the company have a profile on sites that are related to the search for employees? The criterion shows the labor reserves, resources, and capacity of the legal entity.

- Business data is requested: history of work with a certain counterparty, under what circumstances the interaction took place.

- The presence of judicial enforcement proceedings that are related to the company.

- Having controlled access to reports submitted by the counterparty.

The entire presented set of measures allows you to check a legal entity.

Tags: Financial statements of organizations, Accounting, Accounting, Value added tax, VAT, Tax audit, Risks

Let's sum it up

Requirements for breaks in the VAT chain can come to the taxpayer not only after a desk audit of his own declaration, but also after checking the declarations of counterparties of the second, third, and so on levels. When a gap is identified—inconsistencies in VAT returns—the tax authorities look for the beneficiary. As a rule, such a company is able to pay additional taxes to the budget. The taxpayer can pay additional tax even if he does not agree with the claims. But he can also seek the right to a deduction if he has ironclad evidence that he is right and the resources to argue with the tax office.

Sources: order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Shell companies

It often happens that the chain also contains fictitious operations, or, as they are called, technical ones. They are carried out with shell companies, whose main task is the transit of funds for subsequent cashing. As a rule, such companies have formal, low-quality accounting services or are not serviced at all and last 1-2 quarters, after which the company is simply abandoned.

Most of the gaps are formed in relationships with such companies. There are certain criteria for classifying companies as one-day companies - mass manager, mass registration address, lack of number of employees, transit movement of funds through a current account, etc.

And relationships with shell companies are a reason to conduct a thorough check of any of the counterparties in the chain. After all, if someone from the chain is connected with a shell company, it is possible that the entire chain is connected, or the chain was generally built for the purpose of cashing out funds.

Expanding the powers of inspectors

In recent years, a number of legislative changes have been adopted that have given Federal Tax Service specialists more powers during desk audits. In particular, in order to determine the company that ultimately received an unjustified financial benefit under VAT, they can apply an expanded list of control measures. Law No. 348-FZ gave inspectors the authority to request additional documents and data relating to the work of the organization being inspected. In addition, Federal Tax Service employees can now gain access to the company’s territory and conduct an inspection.