Individual entrepreneurs and organizations that are employers are required to transfer monthly insurance contributions for pension, medical and social insurance to the Federal Tax Service of the Russian Federation

. Contributions for injuries are still paid to the Social Insurance Fund.

Note

: from 2021, the procedure for paying and reporting on insurance premiums has changed, this is due to the transfer of control over insurance premiums to the Federal Tax Service of the Russian Federation and the entry into force of the new Chapter 34 of the Tax Code of the Russian Federation “Insurance Premiums”.

From payments to individuals under civil law contracts, it is necessary to transfer contributions only to pension and health insurance (contributions for accidents are not transferred in any case, and contributions for temporary disability are transferred only if such a clause is specified in the contract).

Payments to employees who are legally exempt from paying insurance premiums are listed in Art. 422 of the Tax Code of the Russian Federation.

note

that individual entrepreneurs, in addition to paying insurance premiums for employees, must additionally transfer insurance premiums to individual entrepreneurs “for themselves.”

Free tax consultation

What it is

Each employer must calculate and transfer contributions for workers to the Pension Fund on a monthly basis. In addition to the Pension Fund, it is also worth making contributions to the Social Insurance Fund and the Federal Compulsory Medical Insurance Fund.

The meaning of these payments is that the employer makes certain payments and, in the event of insured events, the fund to which payments are made makes a reverse withdrawal of funds in favor of the employee.

For example, when a person takes sick leave, the Social Insurance Fund pays benefits that should be transferred in case of temporary disability. The Russian Pension Fund does the same thing when it is necessary to pay a pension upon reaching a certain age.

It is worth remembering here that the employer must make pension and other types of contributions from his own funds, and he does not have the right to deduct these amounts from the employee’s salary. As for pension contributions, they are divided into two categories: insurance pension and funded pension.

It is worth noting that since 2014, payments have not been made in favor of the formation of the funded part, since all funds are used to replenish the insurance part.

Insurance premium rates in 2021 and 2021

Simple and convenient calculation of insurance premiums in the online service Kontur.Accounting! Get free access for 14 days

Let's look at the main rates of insurance premiums for employees in 2020 and 2021. They remain unchanged:

- For compulsory pension insurance - 22%.

- For compulsory health insurance - 5.1%.

- In case of temporary disability and maternity - 2.9%;

- For injuries - from 0.2% to 8.5%, depending on the occupational risk class assigned to the main type of activity performed.

The table shows special reduced contribution rates for certain categories of payers established in 2021 and 2021.

| Insured category | on OPS, % | on compulsory medical insurance, % | at VNiM, % | General tariff, % | Pension Fund from amounts above the base, % |

| Basic tariff, no benefits | 22 | 5,1 | 2,9 | 30 | 10 |

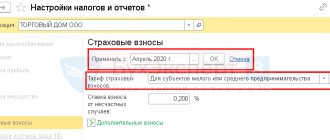

| Tariff for SMEs with payments above the minimum wage | 10 | 5 | 0 | 15 | 10 |

| IT organizations of the Russian Federation that develop and sell computer programs and databases, as well as install, test and maintain them (from 2021) | 6 | 0,1 | 1,5 | 7,6 | — |

| Residents of a technology-innovation or tourist-recreational special economic zone | 8 | 4 | 2 | 14 | — |

| Participants of the Skolkovo project | 14 | 0 | 0 | 14 | — |

| Employers who pay wages and benefits to crew members of Russian ships. Only in relation to payments to ship crew members | 0 | 0 | 0 | 0 | — |

| Non-profit organizations on the simplified tax system in the field of social services, science, education, healthcare, culture, art or mass sports | 20 | 0 | 0 | 20 | — |

| Charitable organizations on the simplified tax system | 20 | 0 | 0 | 20 | — |

| Participants in the free economic zone of Crimea and Sevastopol | 6 | 0,1 | 1,5 | 7,6 | — |

| Residents of the territory of rapid socio-economic development | 6 | 0,1 | 1,5 | 7,6 | — |

| Residents of the special economic zone in the Kaliningrad region | 6 | 0,1 | 1,5 | 7,6 | — |

| Residents of the free port of Vladivostok | 6 | 0,1 | 1,5 | 7,6 | — |

| Creators of cartoons, video and audio productions | 8 | 2 | 4 | 14 | — |

In 2021, most employers on the simplified tax system will pay contributions at a general rate of 30%, as the transition period has come to an end. Until 2024, charitable and non-profit organizations using the simplified tax system will be able to use a preferential rate of 20%.

Since 2021, several more categories of policyholders have switched to basic tariffs:

- business companies and partnerships that apply or implement the results of intellectual activity, the rights to which belong to their participants or founders - budgetary or autonomous scientific institutions or educational institutions of higher education;

- organizations and entrepreneurs that carry out technology-innovation activities and pay employees working in technology-innovation or industrial-production special economic zones;

- organizations and individual entrepreneurs who have entered into an agreement on the conduct of tourism and recreational activities, which pay employees conducting these activities in special economic zones.

From 2021, these categories pay contributions at the general rate - 30%, and if the maximum base for calculating contributions to compulsory pension insurance is exceeded, the payment is not canceled, but the percentage of contributions to the Pension Fund is reduced to 10%.

When is it produced?

Payments that should go to replenish each person's pension savings must be made on the 15th of each month. At this time, the employer pays contributions for the previous month.

In other words, if the employer makes contributions on October 15, then these contributions are made for the month worked in September.

It is definitely worth remembering the timing of deductions, so that subsequently employees at the enterprise do not have disagreements with employees of the Pension Fund.

Who pays insurance premiums

Contributions to the Pension Fund of the Russian Federation are required to be made by the following categories of persons and enterprises:

- Organizations making payments under any agreements in favor of individuals.

- Individual entrepreneur: for persons in whose favor payments were made for work or services under contracts of any kind, as well as for themselves.

- Notaries, lawyers and other categories of self-employed citizens.

- Individuals, in situations where they make payments under any agreements, and in situations where they do not act as individual entrepreneurs.

Insurance premiums for individual entrepreneurs without employees: changes for 2021

Until 01/01/2021, the amount of insurance premiums paid by individual entrepreneurs without employees “for themselves” was strictly “tied” to the established minimum wage (minimum wage). The amount of contributions was calculated in direct proportion to the minimum wage using the following formula:

Minimum wage * StStrVzn / 12 months. * PeriodDay,

where the minimum wage is an indicator of the minimum wage valid in the reporting period; StStrVzn – fixed rate of insurance premiums for individual entrepreneurs working independently – 26%; Activity Period – the period of actual activity, determined from the moment of registration to the moment of deregistration as an individual entrepreneur (in months).

From 01/01/2021, legislators made changes to Art. 430 of the Tax Code of the Russian Federation, according to which contributions of individual entrepreneurs without employees “for themselves” no longer depend on the minimum wage, but are fixed. The Tax Code establishes the values of contributions that individual entrepreneurs without employees will have to pay in 2021, 2021, 2021.

Tariffs in 2021

Despite the fact that changes are constantly being made to the legislative framework in the pension sector, the general tariff for contributions to the Pension Fund does not change. For 2021, it is the same 22% of wages, provided that payments cannot exceed the annual limit.

If it is exceeded, then deductions amount to 10% of earnings.

Those individuals who pay contributions on their own will also pay fixed contributions to the Pension Fund, which amount to 26% of the minimum wage. In this case, this amount is multiplied by 12 months.

It turns out that based on the actual minimum wage, which is 7,500 rubles, the total amount of the fixed contribution for the year will be 23,400 rubles.

Additional tariffs for OPS

Additional tariffs for contributions to the Pension Fund are introduced for those employers who have jobs in hazardous industries. In other words, if they make contributions in favor of those persons who are entitled to receive a preferential pension.

The tariff must be determined in accordance with the given assessment of working conditions, as well as the assigned class.

See when pension payments stop and how to restore them. Will there be an additional payment to the pension after 80 years of age in 2021? Find out in this article.

Limit base for calculating insurance premiums

Simple and convenient calculation of insurance premiums in the online service Kontur.Accounting! Get free access for 14 days

Contributions to the Pension Fund and the Social Insurance Fund are limited by the maximum bases for calculating contributions, which are annually indexed based on the growth of average wages:

The maximum base for contributions to the Pension Fund in 2021 is 1,292,000 rubles.

The maximum base for contributions to the Pension Fund in 2021 is 1,465,000 rubles.

The maximum base is calculated based on the employee’s income on an accrual basis. As soon as his income for the year reaches the maximum base, future contributions must be paid according to new rules. When paying contributions at the basic tariff, if this base is exceeded, contributions are paid at a reduced rate - 10%. If the organization is on a reduced tariff, then if it is exceeded, contributions are not paid.

The maximum base for contributions to the Social Insurance Fund in 2021 is 912,000 rubles.

The maximum base for contributions to the Social Insurance Fund in 2021 is 966,000 rubles.

If the base is exceeded, then there is no need to pay contributions.

For contributions to compulsory medical insurance and injuries, a maximum base is not established, therefore all income received by the employee is subject to contributions.

Amounts not subject to taxation

It is worth remembering that, unlike the personal income tax, which is taken into account in accordance with bonuses, salaries and the employee’s regional coefficient, the amount according to insurance premiums is not included in the salary. In other words, an employee at an enterprise receives a salary minus personal income tax.

As for the situation with the payment of funds to the Pension Fund, the payer must transfer a certain amount based on income, but not withhold this amount from the salary.

Where and when are insurance premiums paid for individual entrepreneurs without employees?

Since January 1, 2017, the functions of monitoring the completeness and timeliness of payment of insurance premiums have been assigned to the Federal Tax Service. In 2021, individual entrepreneurs without employees will pay insurance premiums for mandatory health insurance and compulsory medical insurance to the accounts of the Federal Tax Service. This procedure applies both in case of payment of contributions at the basic rate and in relation to additional payments.

Individual entrepreneurs without employees must pay insurance premiums for 2021 by December 31, 2021. An entrepreneur can pay the amount of contributions in installments throughout the year (in the form of advance payments) or repay the debt in one payment. In each case, the deadline for the last payment (debt repayment) should not be later than December 31, 2021.

When paying an additional compulsory pension contribution, calculated based on the amount of income exceeding the limit of 300,000 rubles, for individual entrepreneurs without employees, the deadline is set until 07/01/2021.

How can you find out the amount of contributions to the Pension Fund from your salary?

The amount of deductions should depend on the status of the payer. For those enterprises that operate under the general tax regime, it is 22% of earnings. 10% may also be added in situations where the amount of income is more than 800,000 rubles.

This amount should be calculated based on the total amount of wages for each employee.

Organizations that use the simplified system must pay 20%. Individual entrepreneurs pay the same rate for their employees.

Payment details

It is important to understand that for fruitful cooperation with the Russian Pension Fund, it is necessary to have the details according to which all contributions must be paid. If an employer or self-employed citizen makes a payment using incorrect details, then in this case it will be very difficult to prove that the payment was made on time.

And these deductions will not be easy to credit to the required account.

That is why we provide a list of details for paying various categories of insurance premiums:

- To pay for the formation of the insurance part of the labor pension.

- For payment towards the formation of the funded part of the pension.

- Contributions for compulsory medical insurance, which are credited to the FFOMS budget.

- Contributions for compulsory medical insurance, which are credited to the TFOMS budget.

Budget classification codes

The following list contains budget classification codes for various types of insurance contributions paid by employers and self-employed citizens:

- For payments for the formation of the insurance part of the pension - 39210202010061000160.

- For payments to form the funded part of the pension – 39210202020061000160.

- Contributions for compulsory health insurance, which are credited to the FFOMS budget - 39210202100081000160.

- Contributions for compulsory medical insurance, which are credited to the TFOMS budget - 39210202110091000160.

Procedure for transferring funds

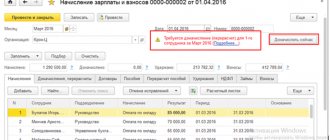

All contributions are calculated by the accounting department employees, thus, all payments in favor of the employee are multiplied by the amount at the insurance rate. This formula is the same for each enterprise - it cannot depend on the taxation regime.

Accounting for the reporting period accrues 22% of the earnings of workers in the Pension Fund. If the salary reaches a level of more than 624,000 rubles, then the tariff should be 10%. For example, if an employee receives 20,000 rubles every month, the accounting department accrues 4,400 rubles every month.

For some enterprises, preferential rates for insurance premiums are provided. For example, for the field of information technology it should be 8%. As for employee income, employers pay contributions at an increased rate - 6% more.

This applies to those citizens who are employed in heavy production.

Insurance premium rates for employee benefits

Insurance premiums in 2021 include four types of contributions:

- in case of maternity and illness;

- medical;

- pension;

- for injuries.

The general contribution rate in 2021 is 30% plus the rate of accident insurance premiums (the amount is variable and depends on the danger of production). Tariffs in 2021 directly depend on the maximum value of the base for calculating insurance premiums. The tariff rates for the majority of payers (Article 425 of the Tax Code of the Russian Federation) are shown in the table.

Table

| Contributions to compulsory pension insurance, % | Contributions for insurance in case of temporary disability and maternity, % | Contributions for compulsory health insurance, % | ||

| If the amount of payments to an individual employee does not exceed 1,495,000 rubles | If the amount of payments to an individual employee exceeds 1,495,000 rubles | If the amount of payments to an individual employee does not exceed 966,000 rubles | If the amount of payments to an individual employee exceeds 966,000 rubles | 5,1 |

| 22 | 10 | 2,9 | 0 | |

SMEs, as in 2021, will be able to pay contributions at a reduced rate on the portion of payments exceeding the minimum wage. Each month you need to allocate from the amount of payments that part that exceeds the minimum wage established at the beginning of the billing period, and apply a reduced tariff to it. The part within the minimum wage is subject to insurance premiums according to the standard rules that we described above. Preferential rate of 15% - of which 0% for VNiM, 5% for medical and 10% for pension insurance (including when the base limit is exceeded 1,465,000 rubles).

To avoid penalties, you must send insurance premiums by the 15th of each month. This procedure applies to all contributions. For example, contributions from the May salary must be transferred before June 15 inclusive.

Find out your rate for accident insurance.

3 months free use all the features of Kontur.Externa

Try it

How to check using SNILS

Contributions to the Pension Fund must be reflected in the individual account of each citizen. In other words, on a personal personal account. It is important to remember that in a situation where a person decides to use his funded pension, he can find out the amount of pension savings by using his SNILS number.

In order to do this, you must contact the Pension Fund employees and provide all the necessary contact information to formulate a request.

Through the Internet

Do not forget that pension contributions that were formed on each person’s personal account can also be checked through the specialized information portal “Gosuslugi”. In addition, it is possible to order the necessary certificate on the official website of the Pension Fund.

In order to find out the amount of your pension contributions, you must have your passport and SNILS at hand. It is worth remembering that another person can find out all the necessary information about the status of the personal account only if they have a power of attorney.

It turns out that every Russian citizen who is officially employed has his own personal account in the Pension Fund of Russia, into which contributions from the employer are received. Every person has every right to find out the status of their personal account at any time.

Read what freezing pension savings means. Category of the insured person in the pension fund in 2021. It is here.

What benefits are there for pensioners regarding personal property tax?

Find out further. It is worth noting that this can be done in any convenient way, and people will not have any difficulties in obtaining a certificate of account status.