Article 87 of the Tax Code of the Russian Federation defines two types of tax audits: in-house and on-site. The procedure for conducting desk tax audits is regulated by Article 88 of the Tax Code of the Russian Federation. It also defines the term “desk tax audit” - this is an audit carried out at the location of the relevant Federal Tax Service body, on the basis of tax returns and documents submitted by the taxpayer, as well as other data available to the tax authority. This type of tax audit is carried out and does not require a decision from the head of the tax authority. As for on-site tax audits, the procedure for conducting them is established by 89 of the Tax Code of the Russian Federation.

To conduct an on-site tax audit, the tax inspector must obtain special permission from the head (his deputy) of the tax inspectorate. An on-site tax audit is carried out on the territory of the taxpayer. Federal Law of July 18, 2017 No. 163-FZ, Article 82 of the Tax Code of the Russian Federation was supplemented, which defines the rules for conducting tax audits and tax monitoring. This will be discussed in this article.

New rules for tax audits from August 2021

From 2021, the Federal Tax Service will cease to apply the rules of the Plenum of the Supreme Arbitration Court of the Russian Federation 10/12/2006 N 53 “On the assessment by arbitration courts of the validity of a taxpayer receiving a tax benefit”?

Tax lawyer Gordon A.E.

Moscow

When conducting tax audits in 2021 of tax deductions and expenses declared in declarations, Russian tax authorities should not apply the criteria of “justified/unjustified tax benefit” and other rules established by the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated October 12, 2006. No. 53.

According to the rules of the new Article 54.1 of the Tax Code of the Russian Federation, as part of tax audits in 2021, the validity of the use of deductions and expenses will be assessed by tax authorities according to the criteria of “ abuse of rights” introduced by this article .

To be precise, that is, from mid-August 2021. Tax authorities, in addition to the existing rules of parts 1 and 2 of the Tax Code of the Russian Federation, have at their disposal two new grounds for withdrawing deductions and expenses, and taxpayers have a new obligation: for each declaration, and in each field trip, the business will have to prove the right to apply deductions and expenses .

New rules for conducting tax audits in 2021 apply when conducting desk tax audits of VAT returns - starting from the date of entry into force of this article (from August 19, 2017), and for on-site audits - starting from the year of appointment of the on-site audit in which Article 54.1 came into force Tax Code of the Russian Federation. That is, on-site inspections scheduled after 08/19/2017 will be carried out by tax authorities taking into account the rules of Article 54.1 of the Tax Code of the Russian Federation. Accordingly, tax authorities will not take into account the rules of Resolution No. 53, even for transactions completed before August 2021.

The rules for conducting tax audits under Article 54.1 of the Tax Code are set out in the letter of the Federal Tax Service of the Russian Federation dated October 31, 2021 N ED-4-9 / [email protected] and are formally advisory in nature, but reading the full text leaves no doubt: from August 2021 tax authorities are required to apply the new tax audit rules.

At the same time, the letter also contains carrots for taxpayers:

1) From August 2021, when drawing up tax audit reports, conclusions about tax violations must be motivated by references to the rules of Article 54.1 of the Tax Code of the Russian Federation, as well as be “generally” motivated. This means that inspectors cannot use the terms of Resolution No. 53, for example, “unjustified tax benefit” and “due diligence” to motivate decisions of inspectors.

2) Now the following cannot independently serve as a basis for filing tax claims: signing of primary accounting documents by an unidentified or unauthorized person; violation of tax laws by the counterparty; the possibility of the taxpayer obtaining the same result of economic activity when performing other transactions (operations) not prohibited by law.

The requirements of Article 54.1 of the Tax Code were brought to the attention of the territorial tax inspectorates of the Russian Federation in order to exclude the possibility of tax authorities making formal claims against taxpayers during tax audits.

An unambiguous conclusion follows from the letter from the Federal Tax Service: inspectors should file tax claims in a motivated and systematic manner, based on the totality of evidence . For example, if “toxic” invoices are discovered, the tax audit report will not just be motivated by this fact alone, but in addition several other circumstances will be included for consistency and motivation.

Is an on-site tax audit carried out on the basis of an oral order or a written decision?

The procedure for conducting on-site inspections is quite fully reflected in the Letter of the Federal Tax Service of Russia “On Recommendations...” dated July 25, 2013 No. AS-4-2/13622 (hereinafter referred to as the Recommendations).

Before the inspection, a program of measures must be drawn up, which is guided by officials of the Federal Tax Service. It reflects a complete list of actions that will allow monitoring of possible violations and collecting a sufficient amount of evidence to confirm them.

An on-site inspection cannot be carried out on the basis of an oral order; without a decision to carry out inspection activities, it will be considered illegal. The decision in accordance with clause 1.2 of the Recommendations is made by the Federal Tax Service at the place of registration of the inspected company. The document must be signed either by the head or deputy head of the Federal Tax Service.

The form of the decision is approved in Appendix No. 3 to the Order of the Federal Tax Service of Russia “On approval...” dated 05/08/2015 No. ММВ-7-2/ [email protected]

The document contains the following information:

- Name of the legal entity being inspected.

- Subject of verification actions.

- Tax periods audited as part of audit activities.

- Information about the person conducting the inspection, indicating the full name. and positions.

A copy of the decision must be handed to the head or representative of the organization being inspected, and a note is made in its copy, which remains with the Federal Tax Service.

Identification and assessment of distortions in accounting as part of a tax audit 2021

Rules clause 1 of Article 54.1 of the Tax Code of the Russian Federation

Clause 1 of Article 54.1 of the Tax Code of the Russian Federation establishes a prohibition for a taxpayer to reduce the tax base and (or) the amount of tax payable as a result of distortion of information about the facts of economic life (the totality of such facts), about objects of taxation that are subject to reflection in tax and (or) accounting or tax reporting of the taxpayer.

The clause is aimed at combating tax evasion through distortion.... .

The Federal Tax Service explains: The provisions of clause 1 of Article 54.1 of the Tax Code presuppose deliberate actions of the taxpayer himself to introduce distortions. This circumstance must be established by the tax audit 2021. How will it be established.

When conducting a tax audit in 2021, the tax authority must prove: conscious distortion by the taxpayer of information about the facts of economic life (the totality of such facts), about objects of taxation that are subject to reflection in tax and (or) accounting or tax reporting of the taxpayer and the purpose of such actions is to reduction by the taxpayer of the tax base and (or) the amount of tax payable, incorrect application of the tax rate, tax benefit, tax regime, manipulation of the status of the taxpayer, deliberate actions of the tax agent for non-withholding (incomplete withholding) of tax amounts subject to withholding by the tax agent.

If there is no evidence of such intent on the part of the taxpayer in the materials of the 2018 tax audit, a methodological (legal) error in itself cannot be recognized as a distortion for the purposes of applying paragraph 1 of Article 54.1 of the Tax Code of the Russian Federation.

What actions will the Federal Tax Service consider as intentional distortions for paragraph 1 of Art. 54.1 Tax Code of the Russian Federation:

The text of the letter from the Federal Tax Service sets out specific signs of intentional distortion , although the list is open and obviously evaluative, which puts those being audited in a deliberately high-risk position.

In tax audits 2021 inspectors must consider distortions intentional and consider them as elements of a tax scheme if at least one of the following signs occurs:

1) creation of a “business fragmentation” scheme aimed at the unlawful use of special tax regimes;

2) taking actions aimed at artificially creating conditions for the use of reduced tax rates, tax benefits, tax exemptions;

3) creation of a scheme aimed at the unlawful application of the norms of international agreements on the avoidance of double taxation;

4) unreality of execution of the transaction (operation) by the parties (lack of fact of its completion).

The Federal Tax Service considers (in particular) the following methods of distortion of information about objects of taxation, which, during an audit, may be qualified under paragraph 1 of Article 54.1 of the Tax Code of the Russian Federation: failure by the taxpayer to reflect income (revenue) from the sale of goods (work, services, property rights), including in connection with with the involvement of controlled persons in business activities, as well as the reflection by the taxpayer in the accounting and tax registers of obviously unreliable information about the objects of taxation.

At the same time, controllability can be viewed in different ways - from “legal” interdependence to the use of fly-by-night accounts. Accordingly, the identification of fly-by-night companies in the supply chain, in itself, should not be considered as a basis for removing deductions and expenses. At the same time, taking into account the clarifications of the Federal Tax Service under consideration and the data provided by the tax service earlier, one should not expect any simplification of tax audits. Now the withdrawal will be proved by circumstantial evidence and the totality of evidence.

On-site inspection of the tax office: what is checked?

Documents containing information that the Federal Tax Service can obtain from other government bodies are most often not examined during the audit. Clause 5.3 of the Recommendations reveals a huge list of information bases that officials have the right to study. These include information from the registers of the Unified State Register of Legal Entities, the Unified State Register of Legal Entities, the Unified State Register of Individual Entrepreneurs, data from the Unified State Automated Information System, FSS, Customs F, the CCP Register, and many other databases.

The main focus of on-site inspection activities is the verification of documents held by the taxpayer. An approximate list of them is contained in paragraph 5.1 of the Recommendations.

Have a question? We'll answer by phone! The call is free!

Moscow: +7 (499) 938-49-02

St. Petersburg: +7 (812) 467-39-58

Free call within Russia, ext. 453

Can be studied:

- Licenses.

- Waybills.

- Accounting data.

- Accounting data.

- Orders issued by the organization.

- Constituent documents.

- Agreements with counterparties.

- Agreements with clients.

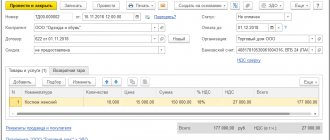

- Invoices.

- Primary accounting documents.

- Other documents.

Thus, there are no restrictions on the list of possible documents that Federal Tax Service employees have the right to check. By virtue of clause 12 of Art. 89 of the Tax Code of the Russian Federation, officials have access to all documentation that is in one way or another related to the payment of taxes.

If an organization interferes with verification activities, including by failing to provide the necessary documents, thereby depriving Federal Tax Service employees of the opportunity to analyze them, the company may be held administratively liable under Art. 19.4.1 Code of Administrative Offenses of the Russian Federation. Fine – from 5 to 10 thousand rubles. If, due to the creation of obstacles, the inspection was not completed, the fine may increase and range from 20 to 50 thousand rubles.

Like in 2021 Tax authorities will prove violations of clause 1 of Article 54.1 of the Tax Code of the Russian Federation

The elements of the composition (Circumstances under the above-mentioned points 1, 2 and 4) are identified in documents, and therefore the methodology for their establishment by inspectors when conducting a tax audit in 2021. obviously will not differ from that used previously.

The intent of the person being audited is to reduce the tax base, etc. precisely due to distortions - it is much more difficult to prove, and as a rule, inspectors approach this issue formally. Traditionally, in tax audit reports, inspectors replace evidence by listing certain circumstances. Pointing to this, the Federal Tax Service in a letter simultaneously explains the inadmissibility of such an approach.

How will they prove the taxpayer’s intent to apply the tax scheme in 2021:

The Federal Tax Service instructs inspectors as part of a tax audit in 2018. prove intent to apply a tax scheme by identifying the simultaneous presence of circumstances indicating that:

1) the person was aware of the illegal nature of his actions (inaction) - the use of an illegal scheme, as a result of which the tax is reduced

2) wanted or consciously allowed the occurrence of harmful consequences of such actions (inaction) - a reduction in the amount of tax.

Thus, according to the Federal Tax Service, one of the signs of unlawful intentional actions of a taxpayer to illegally reduce taxes is the facts of legal, economic and other control of the participants involved in the tax scheme. Therefore, tax audits in 2021 of any taxpayers will contain a mandatory element - checking the interdependence and controllability of participants in transactions.

Now, when submitting reports electronically, this is not difficult to do. At the first stage, the detection of the listed signs is established automatically - by a robot program. Back in 2015, the automated control system “AIS Tax-3” was developed and fully put into operation in 2021 ( Order of the Federal Tax Service of February 10, 2021 N ММВ-7-15 / [email protected] ).

How can an on-site tax audit be carried out and how are its results documented?

According to the Tax Code of the Russian Federation, an on-site tax audit generally lasts 2 months. However, this period can be extended to 4, and sometimes 6 months (in the presence of exceptional circumstances).

The procedure for conducting verification activities is contained both in the already mentioned Recommendations and in the Federal Law “On the Protection of the Rights of Legal Entities...” dated December 26, 2008 No. 294.

At the beginning of the inspection, officials of the Federal Tax Service present their official ID and inform the management of the organization or its representative with the decision to conduct the inspection (Clause 4 of Article 12 of Federal Law No. 294). In the absence of a company representative on site, inspection actions are prohibited. However, the absence of guidance risks the possibility of subsequent inspection without prior notice.

The list of actions that can be performed by inspectors is disclosed in paragraph 5.4 of the Recommendations.

Federal Tax Service employees have the right to:

- Send requests to foreign government agencies if information about the registration of a foreign counterparty that entered into transactions with the inspected company was not confirmed in the database of a foreign state, or if there is reason to believe that the inspected company is evading tax payments by concluding transactions with foreign counterparties.

- Request information about bank accounts and movements on them.

- Conduct an inventory of assets.

- Conduct interviews with witnesses.

- Inspect both documents and territories and objects.

- Request documents.

- Excavate.

- Conduct an examination.

- Engage a specialist.

- Engage a translator.

- Attract witnesses.

At the end of the inspection, a certificate is drawn up which reflects the main points that took place during the inspection activities. These include the inspection period, information about its extension and suspension, etc. Within 2 months after drawing up the certificate, an inspection report is drawn up, which reflects the violations identified during the inspection.

What must a taxpayer prove in every tax audit starting from 2021?

The burden of proof for the taxpayer is actually established in Part 2 of Article 54.1 of the Tax Code

From August 2021, after the introduction of Article 54.1 of the Tax Code, taxpayers will always have to additionally prove two circumstances when submitting tax reports:

1) the main purpose of the transaction (operation) is not non-payment (incomplete payment) and (or) offset (refund) of the tax amount;

2) the obligation under the transaction (operation) was fulfilled by a person who is a party to the agreement concluded with the taxpayer, and (or) a person to whom the obligation to perform the transaction (operation) was transferred under the agreement or law.

A more correct statement: the tax authorities in 2021. two new grounds established by law (Tax Code of the Russian Federation) for withdrawing deductions and expenses have appeared . According to the Federal Tax Service, according to the new rules of Part 2 of Article 54.1 of the Tax Code, expenses can be withdrawn during an inspection if:

1) the tax authority has evidence that the taxpayer has the main purpose of completing the transaction (operation) - non-payment (incomplete payment) and (or) offset (refund) of the tax (fee) (clause 1, part 2, article 54.1 of the Tax Code);

2) if the inspection materials indicate that the goods (work, service) come from another person and not from the declared counterparty (clause 2, part 2, article 54.1 of the Tax Code).

The listed characteristics are evaluative, and one can assume how inspectors will apply them. For example, in its letter, the Federal Tax Service evaluates the information (evidence) obtained during inspections not as direct, but as indirect.

In what cases can a repeat on-site tax audit of a taxpayer be carried out?

According to clause 1.3.3 of the Recommendations, the maximum number of inspections per year is limited to two. However, there is an exception to this rule. If the head of the Federal Tax Service of Russia decides that it is necessary to conduct a larger number of inspections, then the territorial Federal Tax Service has the right to do this. The decision is made based on a request from the territorial tax authority.

As for restrictions on repeated inspections, they are established in paragraph 3.1 of the Recommendations. According to this paragraph, repeated inspections are generally impossible, but there are the following exceptions when repeated inspections are allowed:

- When the inspection is carried out by a higher-ranking Federal Tax Service.

- When the taxpayer has submitted an amended return with a reduced tax amount.

- When a taxpayer is liquidated or reorganized.

***

Thus, the procedure for conducting on-site inspection activities is reflected in detail in the various regulations mentioned in the article. The audited organization, having studied the publication, can prepare for all possible verification actions of Federal Tax Service employees.

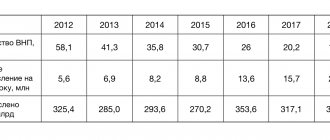

New in tax control 2021

The new year 2021 has arrived and the state is once again demonstrating how control over business can be improved. And in fairness, it must be said that it is doing this more and more effectively, which Western experts also admit, sometimes visiting Russia to exchange experiences. The leader among controllers, as always, is the Federal Tax Service, which has learned to very effectively use the capabilities of information technology for fiscal purposes. The Federal Tax Service often uses IT technologies much more efficiently than business, which, however, is not surprising, given the funds the state “pumps” in this direction.

We all remember the government’s promises that businesses, especially small ones, will be inspected infrequently, without unnecessary nit-picking. A separate law No. 294-FZ of December 26, 2008 “On the protection of the rights of legal entities and individual entrepreneurs in the exercise of state control (supervision) and municipal control” was even issued, according to which scheduled inspections are carried out no more than once every 3 years. But this law does not apply to tax audits. It’s understandable, the budget needs to be replenished. The Tax Code is constantly being updated. In August 2021, amendments were made that seriously changed the state’s position regarding unjustified tax benefits, and the latest addition (dated November 27, 2021, came into force on January 1, 2021) seriously changed the wording of two parts of the Tax Code, including parts of tax control.

What you need to pay close attention to if the tax authorities are showing increased interest in your business:

1. In the first place it is worth putting the implemented software package ASK VAT-3. Let us remind you that so far the ASK NDS-2 has been very successfully tested on us. With its help, tax authorities automatically find all VAT gaps in chains of transactions - and, accordingly, identify who in these very “chains” evaded paying taxes.

ASK VAT-3 is inherently much more advanced than its predecessor. The new complex allows you to fully automate control over the movement of money not only through the accounts of legal entities, but also individuals. An intelligent search mechanism has been introduced that allows you to very quickly identify interconnected companies and individuals associated with them - which means you can see who, where, how they optimized taxes and who to make claims against. To help controllers, starting from 2021, the civil registry office database will be transferred, which will make it possible to identify related persons based on signs of kinship. Fiscal officials will be able to see the actual sales of goods in retail when analyzing data received from online cash registers. And although the deadline for their implementation for those who use the unified income tax or the patent system was postponed for another year, by and large, this fact will have little effect. It’s just that full control for these companies will begin a little later.

I would also like to note that in some industries a labeling system is being actively implemented. So far this has affected fur products, tobacco and medicines. That is, those industries in which, according to the state, there is a serious shadow turnover of goods. The trend is obvious - to collect all possible information relating to the taxpayer into an electronic database. And now, after all the data on the movement of goods, the movement of money and the ultimate beneficiaries of the business are collected, any company may find itself at risk.

The main danger of ASK VAT-3 is that it will automatically begin to generate a report, which in itself may be the basis for initiating a criminal case if the amount of violations exceeds the amount established by law. And if previously the Investigative Committee had to conduct a pre-investigation check, request documents from counterparties, conduct surveys and interrogations of employees of the taxpayer and its counterparties, analyze the data received and draw conclusions, then with the help of the new software package to collect a sufficiently large part of the evidence it will be enough to “press one buttons."

You can recommend what was proposed earlier, but now you need to do it with great diligence, without formalism, and not just “for show.” We must actively check our counterparties, the heads of these companies and their powers. View databases of bailiffs, court cases and any other similar sources. Check the organization's accounting data and assets for accuracy and consistency. And only after that make a decision on cooperation with the counterparty.

2. Next, it’s worth talking about counter audits, which are very popular among tax authorities, the improvement of which has no end in sight. According to the Ministry of Finance and the Federal Tax Service, many unscrupulous companies live for less than three years, and after that they are re-registered in other regions or liquidated in various “gray” ways (by joining or through a change of participants and moving the company to another region where it is liquidated). Therefore, tax authorities often (especially in the Moscow region) by hook or by crook prevent the movement of legal entities between inspectorates and regions. Tax control measures may also interfere with such movement.

Counter checks are carried out especially actively, because one of the favorite and effective techniques of inspectors is to request documents from counterparties. And very often such events end in serious additional charges, sometimes with the initiation of criminal cases. Recommendations for taxpayers include the following:

— If your counterparty has not reflected on the disputed transactions or denies the very fact of their completion, when challenging the conclusions of the tax inspectorate, it is necessary to emphasize the fact that the counterparty may be interested in concealing information on the transactions and it is impossible to draw conclusions only on his testimony. After all, the fact that the work was performed or the goods were posted has not been refuted. And besides this, the tax office did not provide, for example, a handwriting examination.

The taxpayer himself can request such an examination, and if it confirms the signing of documents by the counterparty, this will be a significant reinforcement of your testimony. Many arbitration courts adhere to this position.

— Tax control procedures are quite highly regulated at the level of both law and departmental instructions. Therefore, it is necessary to thoroughly record all mistakes made by tax officials during tax control activities in order to refer to them when challenging acts of tax authorities.

Let’s say the tax office inspects warehouse premises and concludes that your counterparty or you yourself could not store goods there, for example, due to the unsuitability of this premises. But in violation of Article 92 of the Tax Code, inspectors forget to notify the owner of the premises or invite witnesses. This means that the results of such an inspection cannot be taken into account.

The same applies to police activities. A fairly common example. The tax office (often together with the police) interrogated the managers and employees of your counterparties. But they were not notified of liability for giving knowingly false testimony, that is, there is a violation of Article 90 of the Tax Code. This means that these testimonies cannot subsequently be taken into account, since they were obtained in violation of the law.

During interrogations, it often happens that the tax or police pay too much attention to witness statements obtained after a significant period of time, often more than two or three years. The memory of the witness is imperfect and the witnesses could simply forget about the controversial operations, which must also be taken into account and this circumstance must be pointed out when forming the defense position.

In one of the court cases, the contractor’s employees did not confirm the fact that work was being performed on the territory of the company being inspected. The tax authorities did not recognize this work. But the taxpayer was able to present both the employee ID badges and the signed sheet of their safety instructions, and this helped the company prove in court the reality of the relationship and the fact that the work was being performed.

— Sometimes tax authorities refer to the absence of your counterparty at his address. But this only indicates that he was not there at the time of the inspection. And during the period of cooperation with you, the counterparty could well have been there. There is an obvious error in the “conclusions” of the controllers.

3. An important event in August last year was the new article NK 54.1. If previously the standards for substantiating the correctness of tax officials and taxpayers were contained in the Resolution of the Plenum No. 53 (on unjustified tax benefits) of the now abolished Supreme Arbitration Court, today we must directly refer to the new article of the Tax Code. According to this article, the taxpayer now needs to prove the following:

- information about the facts of economic life and objects of taxation was not distorted;

- the main purpose of the transaction was not tax evasion;

- the obligation under the transaction was fulfilled by the party to the contract, who was obliged to fulfill it on the basis of the contract or law.

Here it is necessary to recall that previously the argument was quite suitable that if there are doubts about the counterparty, then controllers still need to take into account that someone executed the transaction (the goods were supplied by someone or the building was built by someone) and it is impossible to arbitrarily remove 100% taxpayer costs. But the current wording allows such a withdrawal to be made and additionally charge huge taxes and fines (contrary to the norm of the law, unrealistic transactions have been taken into account), and the inspectorate now does not have to determine real tax obligations by calculation. According to tax specialists, Article 54.1 of the Tax Code is a new approach to establishing and proving the taxpayer’s abuse of his rights.

4. The next innovation in the field of tax control is the introduction at the end of 2021 of changes to the Tax Code regarding the fulfillment by the Russian Federation of its obligations under the Convention on Mutual Administrative Assistance in Tax Matters. We note that the fiscal world is becoming more and more transparent and the international exchange of information has begun to work. It has been determined how tax authorities of different countries will interact when exchanging information, tax monitoring and conducting joint tax audits. We see that tax authorities are consistently moving towards identifying the actual, beneficial owners of a business and transparent taxation of cross-border companies.

5. And in addition to the previous paragraph, special attention should be paid to the desire of the tax authorities to determine the circle of persons who actually manage the business. This is a continuation of the trend in bringing persons controlling the debtor to subsidiary liability. The Supreme Court summarized the practice in this area and indicated that now it is not enough for the nominal manager to simply point out the persons controlling the debtor; it is also necessary to determine the degree of involvement of each of the real owners in the management of the business and their connection with the consequences that have occurred.

6. Speaking about tax control, we cannot ignore the strengthening of state control over personal correspondence and negotiations in 2021. Today, tax and law enforcement authorities are very actively using his email correspondence and the results of dry negotiations as evidence of taxpayer abuse. And the final entry into force of the “Yarovaya package” in 2021 (in order for it to work to its fullest, a Government resolution must still be adopted, but apparently this will not be the case) will make the work of inspectors even more efficient. Let us remind you that from July 1 of this year, organizers of the dissemination of information on the Internet (providers, telecom operators, WhatsApp, Viber and others) will have to store all information about text and voice messages for six months.

What can we say in conclusion? Apparently, with the rapid growth of information technology, the world has become completely different. Both tax control and the work of law enforcement agencies are no exception here. Businesses use IT to their advantage. Tax and law enforcement agencies are in their own hands. We must accept that the previous models of tax planning and tax security simply no longer work. And we need to adapt to the new reality, where tax planning methods, information security techniques, and legal structures that take into account all of the above will be combined.

Mikhail Zholudev, CEO

of the consulting company Read our publications on the website https://www.kpfm.ru/

Plan of on-site inspections of the Federal Tax Service: criteria for drawing up

The schedule of on-site tax audits for 2021 is compiled by employees of the Federal Tax Service based on an assessment of a number of criteria characterizing each specific enterprise. The list of such criteria is determined by the provisions of the Concept of the planning system for on-site tax audits, approved by Order of the Federal Tax Service dated May 30, 2007 No. MM-3-06/ [email protected]

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

Based on the information provided in Appendix No. 2 of this Concept, tax authorities can pay attention to an organization or individual entrepreneur if:

- The amount of tax payments made by the taxpayer to the budget differs significantly from the average level of tax burden on entrepreneurs that has developed in the industry as a whole. The values of this indicator for different types of economic activity are given in Appendix No. 3 of the Concept.

- For two or more reporting periods, the organization operates at a loss.

- During the reporting period, the taxpayer received one or more tax deductions in a significant amount. In this case, a deduction is recognized as significant if the share of VAT deductions is equal to or exceeds 89% of the total tax amount calculated for the same reporting period, the duration of which is 1 calendar year.

- The growth rate of expenses exceeds the growth rate of income.

- The results of the financial and economic activities of the enterprise have repeatedly approached the values established as a limitation for the use of any taxation regime.

- The amount of expenses incurred during the year of entrepreneurial activity is as close as possible to the amount of income received for the same year (this criterion is used when assessing the performance of individual entrepreneurs).