Who must provide information on the number of employees

The report was approved back in 2007. The paper form is by order of the Federal Tax Service No. MM-3-25/ [email protected] dated 03/29/2007, and information in electronic form is by order of the Federal Tax Service No. MM-3-13/ [email protected] dated 07/10/2007. Information is presented on one sheet.

It would seem that it is already clear who should submit this form to the regulatory authority, however, there are some nuances here too.

Naturally, the form must be generated and submitted by all employers , which include:

- Companies that employ employees

- Individual entrepreneurs who use hired labor

Despite these obvious cases, there is a letter from the Ministry of Finance No. 03-02-07/1/4390 dated 02/04/2014, which clearly states that organizations that do not have hired employees also submit information to the tax office. The same fact is confirmed by paragraph 3 of Article 80 of the Tax Code of the Russian Federation.

If the organization does not have employees, then the information is submitted in the same form, filled out in the same way as a full-fledged report, only in the appropriate column where it is necessary to indicate the number of personnel there will be 0. Such a report is considered zero.

Deadlines for submitting information to the tax office

The report is annual, in most cases it is submitted once a year, but there are other cases.

Let's look at the deadlines for submitting the report form in the table.

| Conditions for submitting a report | Submission deadlines |

| Generating a year-end report | Once a year, until January 20 |

| If the organization has just registered or has been reorganized | For new (reorganized) companies, the first submission of information is provided within 20 days after the month of registration . At the end of the year, such an organization will submit information on a general basis, before January 20 |

| In case of liquidation of the organization or termination of the entrepreneur’s activities | Information is submitted no later than the date of liquidation of the organization or entrepreneur |

As you can see, there are several deadlines for submission; the main thing is not to forget the dates for submitting the report in different situations.

Of course, most organizations rent once a year, but there are exceptions.

Expert opinion

Entrepreneurs who operated and had employees, but ceased their activities, are required to submit information about the number of employees to the tax office.

Deputy Director of the Department

Tax and customs tariff policy,

R, A, Sahakyan

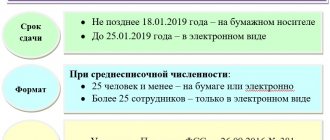

Deadlines for submitting a report on the average headcount in 2021

The day by which a business entity is obliged to provide regulatory authorities with a report on the average headcount depends on the functioning of the entity itself:

- Individual entrepreneurs and companies that have been operating for a long time are required to submit a report by January 20 of the year that follows the year of the report. If such a day falls on a weekend or holiday, then the deadline is moved forward to the first working day. In 2021, January 20 is a Sunday, so the report will need to be submitted by January 21, 2019.

- The average headcount for newly created organizations must be submitted by the 20th day of the month following the month the company was created. The second time you open an LLC, you will need to send a report on schedule, at the end of the calendar year. Thus, for a newly created LLC, two dates have been determined on which a report will need to be filed in the first year of its existence.

- If an individual entrepreneur or company is closed, then the final report must be submitted on the day the business entity is removed from the state register.

How to calculate the number of employees to fill out the form

Information is provided only for employees who are employed under employment contracts.

Detailed instructions for calculating the number are given in the Rosstat Instructions, approved by Order No. 772 of November 22, 2017.

The main categories of workers that are not taken into account when calculating the number are the following:

- Everyone who works externally

- Employees working under civil contracts

- Women who are on maternity leave or on maternity leave with children

- Entrepreneurs themselves

- Founders who do not receive compensation from the company

|

In order to calculate the average number of employees per month, you need to calculate the number of employees for each day of the month, add these indicators and divide by the number of calendar days in the month.

Here are the formulas for calculating the average number of employees:

- The number per day consists of the number of workers who went to work and those who did not go to work for some reason

- Per month ,

where Ch1 is the number for the 1st day of the month,

n – number of days in a month

- In a year ,

where is the average number for each month of the year

As you can see, the formulas are simple. The only difficulty may arise when deciding whether to include a specific employee in the calculation or not.

If for a given period there are employees who did not work all the time taken into account, then for ease of calculation it is necessary to first determine those who worked the entire period. After this, you need to add data for those who did not work full time.

Calculation example

The company has 10 employees. Of these, 8 work full time and 2 work half-time (4 hours a day, 5 days a week). Let's calculate the average headcount for a month in which there were 23 working days.

First, let's calculate the number of part-time workers: 23 days * 4 hours a day / 8 hours / 23 days * 2 people = 1, that is, the average number of part-time workers is 1. The average number of employees for the billing month: 8 + 1 = 9 people.

To calculate the average number for a year, you need to similarly determine the average number for each month, then add them up and divide by 12.

Now let's look at how to fill out the form according to KND 1110018, according to which this information is presented.

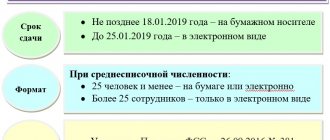

Methods for submitting reports to regulatory authorities

Like many other reports, headcount information can be sent to the tax office in different ways:

| Submission form | What we do |

| Personally | For those who do not like electronic document management and do not want to waste time and money at the post office, all that remains is to print the report and go to the tax authority in person. After communicating with a specialist, the taxpayer will become the proud owner of his copy with a mark of delivery. The specialist will accept a report on paper only if the number of employees does not exceed 25 people |

| Electronic | The most convenient way is to transmit the report via the Internet. It is fast, convenient and reliable, and in addition there is no need to keep track of the current report form. All companies with more than 25 employees must submit information electronically. |

| By mail | Well, as a last resort, there is the option of sending the report by mail. By the way, it’s not so bad if the accountant suddenly remembered to submit the report on the evening of January 20th. After all, the date of mailing will be the date the report is submitted. This opportunity applies only to taxpayers whose number of employees is less than 25 people |

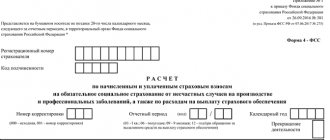

General principles for filling out information

Filling out the information form is no different from other reports that are submitted to the tax office. The general requirements for all reports, which also apply to this form, are as follows:

- The form can be filled out either on a computer or manually

- On the computer, the information is filled out in a special program, or the data is entered into a form downloaded from the Internet. When filling out using software, you can immediately check the report for errors and make sure that everything is filled out correctly

- If the report will be submitted on paper, then fill out the form fields with a pen, the paste should be black or blue

- You cannot make corrections or blots, or use a stroke

- Each character has its own field

- Empty cells and fields are filled with dashes

- Don’t forget that the report must have the manager’s signature and seal. Otherwise, the information will be considered not provided.

As you can see, the main points are standard and apply to all reports for the tax office

Filling out the report form line by line

The report is extremely easy to fill out and consists of only 1 sheet . Let's consider row-by-row filling in the table.

| Report field | How to fill |

| INN/KPP | This information can be found in the constituent documents |

| Where is the information submitted? | In this line we write the name of the tax authority where the report is submitted. Here we indicate the digital code (4 characters) |

| Company or entrepreneur name | The line must include the full name of the organization or individual entrepreneur. Abbreviations are not allowed |

| As of what date the information is provided | This field can be filled in 3 options: 1. In general, the date is set to January 1 of the new year in which the report is compiled 2. During liquidation, indicate the date of closure of the organization or entrepreneur 3. If a company or entrepreneur has just passed state registration, then set the 1st day of the month that follows registration In order to know exactly what date to put in a particular case, there is a hint on the information form |

| Number of persons | The average number of employees is indicated according to the methodology given above |

That, in fact, is the entire report. At the bottom of the information we indicate who is submitting the form. The signature of the manager or entrepreneur, the date of provision and the seal of the organization or entrepreneur, if any, must be affixed.

The field to be filled out by the tax office employee is left blank.

Questions and answers

Question No. 1. Our current account has been blocked. Can they do this because we have not submitted the KND form 1110018?

Answer: No, failure to provide KND form 1110018 is not grounds for seizure of a current account.

Question No. 2. In the period from June to August, the number of employees in our organization exceeded 100 people. Could this somehow affect the change in the tax regime?

Answer: If the average headcount for a calendar year exceeds 100 people, this will be a reason to change the tax regime. Otherwise, you retain the right to apply special tax regimes.

Responsibility according to the form KND1110018

Since the report is as simple as possible and contains a minimum of information, draconian measures are not applied to taxpayers.

| Violation | Responsibility |

| If an error is made in indicating the number of employees | There is no liability for this violation. The information is not specified. They will need to be submitted again, since adjustments to the report are not provided. |

| If the report is not submitted or submitted late | 200 rubles per organization |

| Liability for officials (according to Article 15.6 of the Administrative Code) | 300-500 rubles |

Despite the fact that liability for violations under this form is insignificant, information will still have to be submitted. The fact is that the tax office uses the report data in its work. Sometimes the average headcount is used when calculating a particular tax, and its value is important to the tax authority. In addition, the number of employees in the company determines whether reporting can be provided on paper or only electronically. Therefore, simply taking the form and not turning it in won’t work.

Where should I submit the KND form 1110018

Form KND 1110018 “Average number of employees” is submitted by a legal entity to the Federal Tax Service at its location, and for individual entrepreneurs at its place of registration.

The method of submitting the document will depend on how many employees work in the organization:

- if there are more than 100 employees, the form is filled out and sent to the tax office electronically;

- if there are 100 or fewer employees, the report can be submitted on paper by personally appearing at the tax office.

Organizations with 100 or fewer employees may submit the report via a certified mailing. A description of the investment must be attached to it.