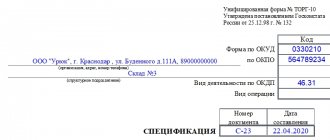

Source/official document: Decree of the State Statistics Committee No. 132 of December 25, 1998

Document name: KM Unified Form No. 3 “On the return of funds to customers on unused cash receipts” Format: .xls Size: 33 kb

Print Preview Bookmark

Save to yourself:

According to the current legislation, namely the Law of the Russian Federation “On the Protection of Consumer Rights” dated 02/07/92 No. 2300-1, the consumer can exercise the right to return purchased products. At the same time, based on the current legislation, the right depends on whether the payment was made in cash or he paid with a bank card. The time frame for returning products is also taken into account (on the day of purchase or later). If the consumer paid for and returned the product on the day of purchase, the fact of the refund must be confirmed by the availability of documentation. To do this, we use the unified form KM-3, with the title “Act on the return of funds to consumers...” On the check, the administrator of a retail or wholesale establishment is required to certify the act with his signature as the basis for the return of money. The check is pasted separately along with the KM-3 form and sent to the accounting department.

When is a certificate of return of funds to the buyer drawn up?

Situations when a buyer wants to return a purchased product arise quite often.

The possibility of such a return is provided for by the Law “On the Protection of Consumer Rights” dated 02/07/92 No. 2300-1. Before the transition to online cash registers, the procedure for the cashier and company management depended on whether the buyer paid at the cash register in cash or by card, as well as on the moment of return (on the day of purchase or later).

For more information about what requirements must be observed when working with cash, see the material “Cash discipline and responsibility for its violation .

If the buyer paid in cash and returned the goods on the day of purchase, the fact of the buyer’s return of money to the seller was formalized using the unified form KM-3, called “Act on the return of money to buyers (clients) for unused cash register receipts (including erroneously punched cash register receipts). checks)". On the check, a representative of the store administration had to put his authorization signature as the basis for issuing cash from the cash register. The check was pasted on a separate sheet and, together with the KM-3 act, was transferred to the accounting department.

ConsultantPlus experts explained in detail how to correctly process the return of goods from the buyer and return the money from the cash register. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

Let's take a closer look at filling out the KM-3 form.

When is an act in form No. KM-3 needed?

When tax authorities check the work of organizations and entrepreneurs with cash and their conduct of cash transactions, then when they discover an act on the return of money to buyers (clients) for unused cash receipts in the unified form N KM-3 <1> (hereinafter referred to as the KM-3 act) They study it and the documents attached to it especially carefully. After all, they must make sure that cash proceeds are recorded correctly. Therefore, we will consider when it is necessary to draw up this primary document and how to draw up the papers attached to it.

When to draw up an act

Act KM-3 must be drawn up if:

<or> the cashier made a mistake and entered an incorrect cash receipt (for example, a check for a larger amount that was not cleared during the shift);

<or> the buyer returns the goods on the day of purchase and the money is returned to him from the operating cash desk;

<or> the check has been knocked out, but the buyer has changed his mind about purchasing it (for example, when the check is first knocked out at the general cash register, and then the goods are released in the department).

We are writing an act

This act is drawn up in one copy at the end of the working day (shift) when submitting revenue for the day (when making a Z-report). That is, on the same day that the erroneous or unnecessary check is issued. The act is signed by a commission, which consists of <2>:

- from the head of the organization (entrepreneur);

— head of department (section);

- senior cashier;

- cashier-operator.

The cashier reflects the total amount of the act for all checks canceled during the day in column 15 of the cashier-operator’s journal in Form N KM-4 <1>.

What to attach to the act

The KM-3 act must be accompanied by an incorrect check pasted on a piece of paper (this is more convenient so as not to lose it). The check must be signed by the head of the organization (head of department or section) or the entrepreneur himself and must be stamped “Canceled” <3>.

However, the check that must be attached to the act is not always available. And then tax authorities may interpret this as non-compliance with the requirements for processing refunds to customers or erroneously entered amounts on cash registers. And accordingly, equate part of the proceeds to non-receipt <4>. This means you need to insure yourself, but how depends on the situation.

SITUATION 1. The buyer returning the goods did not return the check.

As is known, according to the Law on the Protection of Consumer Rights, the seller is obliged to return money to the buyer, even if the latter does not have the original cash receipt <5>. Therefore, if the buyer was able to prove to you that he purchased the goods from you, and you returned the money to him, then the buyer’s application for a refund can be attached to the KM-3 act, indicating that the cash receipt was lost. On this application, the head of the organization (entrepreneur) must put a mark that he agrees with the return of money to the buyer. Moreover, if the cash register program allows you to print out information about the purchase, then it can also be attached to the act.

SITUATION 2. The cashier does not have the erroneously punched check.

This is possible, for example, when:

<or> the check was mistakenly issued for a larger amount, but the buyer took it, although the money for the goods was received in the required amount;

<or> the cashier lost the incorrect receipt.

At first glance, there is a shortage of money in the cash register, for which the cashier is responsible <6>.

However, if the documents show that money is available for all the goods sold and the head of the organization (entrepreneur) considers it possible not to punish the cashier, then an explanatory note can be taken from him. And then this note and a commodity report can be attached to the KM-3 act (for example, according to form N TORG-29 <7>).

Please note that in this situation, tax authorities, of course, may try to fine you for not posting revenue, but the courts will most likely support you <8>.

* * *

So, correct execution of the KM-3 act will allow you to avoid fines for failure to receive revenue. And they are rather big <9>.

And keep an eye on the deadlines: if more than 2 months have passed since the incorrect execution of the act, then they will no longer be able to punish you - the statute of limitations for bringing to justice will have passed <10>.

——————————-

<1> approved Resolution of the State Statistics Committee of Russia dated December 25, 1998 N 132

<2> Instructions for the use and completion of forms of primary accounting documentation for recording cash settlements with the population when carrying out trade operations using cash registers, approved. Resolution of the State Statistics Committee of Russia dated December 25, 1998 N 132 (hereinafter referred to as the Instructions for filling out)

<3> Instructions for filling; pp. 4.2, 4.3, 4.5 Standard rules for the operation of cash registers when making cash payments to the population, approved. Ministry of Finance of Russia 08.30.93 N 104

<4> Letter of the Federal Tax Service of Russia for Moscow dated July 30, 2007 N 34-25/072141

<5> clause 5 art. 18, paragraph 1, art. 25 Law of the Russian Federation dated 02/07/92 N 2300-1 “On the protection of consumer rights”

<6> Art. 244 Labor Code of the Russian Federation; List of positions and work replaced or performed by employees with whom the employer can enter into written agreements on full individual financial responsibility for shortages of entrusted property, approved. Resolution of the Ministry of Labor of Russia dated December 31, 2002 N 85

<7> approved Resolution of the State Statistics Committee of Russia dated December 25, 1998 N 132

<8> Resolution of the Federal Antimonopoly Service of the Moscow Region dated 04/09/2008 N KA-A40/2670-08; Federal Antimonopoly Service NWO dated December 1, 2005 N A56-7930/2005, dated September 29, 2004 N A52/1052/2004/2

<9> art. 15.1 Code of Administrative Offenses of the Russian Federation; Letters of the Federal Tax Service of Russia for Moscow dated December 18, 2008 N 22-12/118181, dated November 3, 2006 N 22-12/97729

<10> part 1 tbsp. 4.5 Code of Administrative Offenses of the Russian Federation

Read the full text of the article in the journal “Glavnaya Ledger” N17, 2011

We fill out the act form KM-3

Act KM-3 was drawn up in 1 copy by a commission consisting of the head of the department, senior cashier and cashier and approved by the head. It was necessary to fill out information for all canceled checks, as well as for checks returned by customers in cases where they returned goods. Cash proceeds for that day were reduced by the amount returned to customers, and an entry was made about this in the journal of the cashier-operator KM-4.

It was not necessary to draw up a KM-3 act in all cases of returning goods. If the buyer paid with a bank card, it was impossible to give him money from the cash register when returning the goods, since this direction of spending cash proceeds was not provided for by regulatory documents (clause 2 of Bank of Russia Directive No. 3073-U dated October 7, 2013 on spending cash from the cash register) . An act was not drawn up in the KM-3 form even if the goods were returned not on the day of purchase. In this case, at the request of the buyer, the return of the goods, paid for in cash, was carried out on the basis of his application from the main cash register using a cash receipt order.

What to attach to the act

The receipt received along with the returned goods becomes the reason for starting this procedure.

Naturally, this is the main document, which plays the role of an appendix to the main document. Due to its small size, the receipt is often lost. And without it it is simply impossible to complete the return procedure. To avoid this problem, you can glue it to a large sheet of paper. He adapts to the main act. In general, the following documents most often serve as applications:

- Sales receipt . It is usually issued to the buyer in situations where the organization’s activities do not involve the use of cash registers.

- Cashier's check. When the buyer receives the goods, he is also given a receipt, which he must try to keep for as long as possible. In the absence of this document, it is unlikely that you will be able to return the product and get your money back.

- Explanatory letter . The human factor cannot be ruled out. The cashier can make a simple mistake, for example, punch a check with incorrect information. There is no standard template for a note. The cashier has the right to use free form here.

- Refund check . This document is usually used when there are errors in the original check.

- Statement from the buyer . Of course, in most cases the parties do without this document. But if it is drawn up, it must be adjusted to the act. Usually the buyer writes this statement at the request of the seller. In this document, the buyer provides an explanation of why the decision was made to return the goods. Although often the buyer himself wants to draw up this statement. It is written in a free style.

Filling out KM-3 when using an online cash register

From July 2017-2019, all sellers, with rare exceptions, are required to use online cash registers.

Read about the use of online cash registers by UTII payers in the article “Use of online cash registers for UTII (nuances).”

When using an online cash register, it is not necessary to use KM-3 when returning money to the buyer. Fiscal data that comes to the tax office from online cash desks completely replaces information from forms KM-1, KM-2, KM-3, KM-4, KM-5, KM-6, KM-7, KM-8, KM-9 (see letter of the Ministry of Finance dated September 16, 2016 No. 03-01-15/54413 (notified to the tax inspectorates by letter of the Federal Tax Service dated September 26, 2016 No. ED-4-20/18059).

When the buyer returns the goods, the seller using the online cash register, based on the buyer’s application, must issue a check with the “return of receipt” sign (see letter of the Ministry of Finance of the Russian Federation dated July 4, 2017 No. 03-01-15/42312, 03-01-15/42315 ). In addition to the check with the sign “return of receipt”, it is also necessary to issue a cash receipt order for the amount of the refund (Article 1.1, Clause 1, Article 1.2, Clause 1, Article 4.7 of the Law of May 22, 2003 No. 54-FZ, Clause 6.2 of the Bank’s instructions Russia dated March 11, 2014 No. 3210-U).

If you trade retail and use OSNO, when returning goods from a buyer, it is important to correctly reflect the transaction for calculating VAT.

The Ministry of Finance explained in detail how to do this. To do everything right, get trial access to the ConsultantPlus system and find out the opinion of officials. It's free.

For more information on issuing refund checks, read the following materials:

- “How to make a refund check in KKM online?”;

- “How to make a refund for a purchase at an online checkout?”;

What to do if there is not enough money in the online cash register is discussed in the material “[LIFE HACK] If there is not enough money in the cash register for a refund, make a “cash deposit””.

And you can learn about processing a refund for non-cash payments from the material “[LIFEHACK] We issue a refund if the buyer pays by bank transfer.”

In what programs can the KM-3 act be formed?

The following programs can be used:

| Software for generating the KM-3 act | |||

| p/p | Program | Maybe | Impossible |

| Paid programs | |||

| 1 | 1c accounting | Yes | |

| 2 | Circuit | Yes | |

| 3 | Class365 | Yes | |

| 4 | SAP | Yes | |

| Free programs | |||

| 5 | Taxpayer legal entity | No | |

| 6 | Business Pack | No |

Results

If the seller has not yet switched to the online checkout and the buyer purchased the goods for cash, and then changed his mind and decided to return it, then the seller needs to fill out the KM-3 act.

In the case of using an online cash register, when returning money, a form in the KM-3 form may not be issued, but issuing a check with the sign “return of receipt” and cash settlement is required. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

When to draw up the KM-3 act

Since this document is completed only in certain cases, the form does not need to be submitted daily. However, if several returns occurred during the day, then only one KM-3 is issued. This happens at the end of the shift after the Z-report is taken. Data from KM-3 is used for forms KM-4 and KM-7.

The limitation period for a document is 2 calendar months . After this time, the inspection cannot make a claim against the incorrectly executed act. KM-3 is stored in the accounting archive .