Each business entity has the right to dispose of its own property at its own discretion. It can be used in activities, sold, exchanged... But it cannot be given as a gift: the Civil Code of the Russian Federation does not allow it (clause 4 of Article 575). True, there is no prohibition on the transfer of property free of charge. However, that’s not what we’re talking about. It is known that the tax consequences of each option for using property can be different, depending not only on the option itself, but also on the type of property. Let's talk about the transfer (free of charge and not only) of property from one entity to another and the imposition of VAT on such transactions.

First of all, what is meant by the term “property” for the purposes of applying tax legislation? As stated in paragraph 2 of Art. 38 of the Tax Code of the Russian Federation, it means all types of objects of civil rights named in the Civil Code of the Russian Federation (more precisely, in Article 128 of the Civil Code of the Russian Federation) relating to property, with the exception of property rights. That is, property includes goods, cash, securities and finished products - in general, any thing that has a monetary value. In general, the transfer of ownership of property (even if this occurs free of charge) is subject to VAT (clause 1 of Article 146 of the Tax Code of the Russian Federation).

In what situations would the management of an organization, being in its right mind, order to transfer something of its own to someone? In fact, there are few options. Let's exclude charity right away - this is a separate topic. What remains, by and large, is the transfer of property to the authorized capital of another organization or transfer as a contribution to the property of the specified organization. And if the first operation is regulated by the norms of the Tax Code of the Russian Federation, and the mechanism for its implementation is described in some detail, then the second is not directly mentioned in the Tax Code of the Russian Federation, and its implementation, as a consequence, is a reason for questions and interpretations.

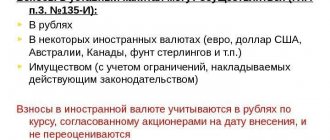

Non-monetary contributions to the authorized capital

Sometimes it is not money that is invested in the authorized capital, but property or intangible assets.

Restoration of VAT on non-cash deposits

If a VAT payer participant makes a contribution in the form of property, property rights or intangible assets (IMA), then in the general case he must restore the VAT previously accepted for deduction (clause 1, clause 3, article 170 of the Tax Code of the Russian Federation). For fixed assets and intangible assets, the tax must be restored in proportion to the residual value of the object, without taking into account revaluation. For other types of property, as well as for property rights, VAT must be restored in full.

VAT on a non-monetary contribution to the management company must be restored if two conditions are simultaneously met.

- For an object that is invested in the authorized capital, VAT was deducted upon purchase. Or during construction, modernization and other types of capital investments, if we are talking about fixed assets and intangible assets.

- At the time of transfer of the deposit to the management company, the participant was a VAT payer.

There is no need to restore VAT if:

- The participant did not deduct VAT on purchases (construction, modernization, etc.). For example, if the seller (contractor) or the participant himself used special tax regimes at the time of the transaction.

- The participant is not a VAT payer at the time of transfer of the deposit to the management company.

- The residual value of the fixed asset or intangible asset at the time of transfer of the deposit is zero.

How to determine the amount of VAT for recovery

VAT must be restored based on the amount in which it was actually deducted, regardless of subsequent changes in the tax rate.

If at the time of transfer of property to the management company the input invoices have not been preserved, then the VAT for restoration must be determined by calculation. To do this, multiply the residual value of the property by the VAT rate that was in effect during the period of its acquisition or construction (letter of the Ministry of Finance of the Russian Federation dated January 22, 2020 No. 03-07-11/3137).

If the value of a fixed asset item has been increased due to reconstruction or modernization, then:

- to recover, it is necessary to take into account the entire “input” VAT: both from purchase (construction) costs and from modernization costs;

- To calculate the VAT share for restoration, you need to use the residual value of the object, taking into account all the improvements made.

In all situations, you need to use the cost according to accounting data . The assessment of the market value of the property when it is transferred to the management company does not in any way affect the amount of restored VAT.

Example 1.

Rassvet LLC is a VAT payer and a participant in Zarya LLC. The owner contributes the following assets to the capital of the subsidiary company.

- Garage building purchased in 2010 for 2,360 thousand rubles, incl. VAT - 360 thousand rubles. In 2021, the building was reconstructed; reconstruction costs amounted to 240 thousand rubles, incl. VAT - 40 thousand rubles. The residual value of the garage without VAT at the time of transfer is 1,500 thousand rubles.

- A car purchased in 2021 for 600 thousand rubles, incl. VAT - 100 thousand rubles. The residual value of the car without VAT at the time of transfer is 400 thousand rubles.

- Spare parts purchased in 2021 for 120 thousand rubles, incl. VAT - 20 thousand rubles.

To determine the amount of VAT for restoration on the garage building and car, you need to divide the input tax for each object by the original cost without VAT and multiply by the residual value.

For the garage:

VAT = (360 40) / 2000 X 1500 = 300 thousand rubles.

For auto:

VAT = 100 / 500 X 400 = 80 thousand rubles.

It’s easier with spare parts - the company must restore the entire amount of tax deducted upon their purchase, i.e. 20 thousand rubles.

The total amount of VAT that Rassvet LLC must recover when transferring property to Zarya Management Company LLC will be:

VAT = 300 80 20 = 400 thousand rubles.

How will VAT restoration affect the subsidiary?

A subsidiary company can deduct VAT when receiving a non-monetary contribution to the Criminal Code (Clause 11, Article 171 of the Tax Code of the Russian Federation). But for this to happen, the following conditions must be simultaneously met.

- The transferring party restored the VAT.

- VAT is highlighted in the invoice, acceptance certificate, or in other accompanying documents for the transferred values or rights. In this case, an invoice is not required, since the transfer of property to the management company is not a sale and there is no charge of VAT.

- The subsidiary pays VAT and plans to use the received values for VAT-taxable transactions.

If the transferor fully owns the subsidiary, or a majority of it, then the two entities can be considered a single entity. Then, if the above conditions are met, there will be no losses for the business as a whole. The participant will restore VAT to the budget, and the subsidiary will simultaneously deduct the same amount.

An unfavorable situation for a businessman will be when the participant pays VAT, and the subsidiary uses one of the special tax regimes. Then the amount of VAT recovered when transferring the deposit to the management company will be lost for the business.

How it should have been done

If the founder, when transferring the property, did not allocate VAT as a separate line, you need to require him to re-issue the documents. And only after receiving the correct papers (with the allocated tax amount), the receiving party will be able to accept the tax as a deduction.

Example 2

Let's use the conditions of the previous example.

But let’s assume that the accompanying documents were completed correctly (with the tax amount allocated).

The postings will be like this:

DEBIT 75 CREDIT 80

— 500,000 rub. – the founder’s debt for transferring property to the authorized capital is reflected;

DEBIT 08 CREDIT 75

— 500,000 – reflects the cost of equipment received as a contribution to the authorized capital;

DEBIT 19 CREDIT 75

— 90,000 rub. – VAT on the received equipment is taken into account;

DEBIT 01 CREDIT 08

— 500,000 rub. – the equipment has been put into operation;

DEBIT 68 subaccount “VAT calculations” CREDIT 19

— 90,000 rub. – accepted for deduction of VAT on the equipment received.

Transfer of property to LLC participants to reduce the capital capital

When reducing the authorized capital, the law of 02/08/1998 No. 14-FZ “On Limited Liability Companies” does not oblige the company to pay the difference in the value of the shares to the participants. But there is no prohibition on this, so the LLC has the right to make such payments.

The transfer of property to participants is exempt from VAT in the following cases.

- When a participant leaves the society.

- When distributing the property of a liquidated company.

These transactions are not recognized as subject to VAT in accordance with paragraphs. 1 item 2 art. 146 of the Tax Code of the Russian Federation, taking into account clause 3 of Art. 39 Tax Code of the Russian Federation.

But if an LLC gives a participant the difference to reduce the capital in the form of property, there will be no VAT exemption. In this case, the company is not liquidated, and the participant remains in the company, albeit with a smaller share. Such a transfer of property is recognized as a sale and the company must charge VAT on a general basis (Letter of the Ministry of Finance of the Russian Federation dated April 12, 2019 No. 03-07-11/26069). How to determine the tax base in this case, i.e. The Ministry of Finance did not explain the cost of the transferred property without VAT. Here, by analogy, we can apply the approach that is established for property contributions when forming the authorized capital (Article 15 of Law No. 14-FZ).

- If the value of the property does not exceed 20 thousand rubles, then its monetary value must be unanimously approved by the general meeting of LLC participants.

- If the property costs more than 20 thousand rubles. — it is necessary to involve an independent appraiser.

The value of transferred valuables without VAT must be subject to tax at a direct rate of 20% (or 10% if the property belongs to one of the preferential categories). A member of the company who receives property will not be able to reimburse VAT on it, even if he is a VAT payer: this type of deduction is not provided for in Art. 171 Tax Code of the Russian Federation.

Example 2.

The owners of Zarya LLC decided to reduce the authorized capital. As compensation for the reduction in its share, Rassvet LLC received a car. According to an independent appraiser, its market value excluding VAT at the time of transfer was 300 thousand rubles.

Therefore, when transferring a car, Zarya LLC must charge tax in the amount of:

VAT = 300 X 20% = 60 thousand rubles.

GLAVBUKH-INFO

In payment for the share in the authorized capital of the LLC, an asset (movable property) was transferred. According to accounting and tax accounting data, the initial cost of the object is 400,000 rubles, the amount of depreciation accumulated at the time of transfer is 220,000 rubles, and the residual value of the object as of the date of transfer is 180,000 rubles. The value of the transferred property, as assessed by an independent appraiser, approved by the general meeting of LLC participants, is 200,000 rubles. The transfer of property was carried out after the registration of the LLC. The costs of paying for the appraiser's services are borne by the LLC.Account correspondence:

Civil relations

The authorized capital of the company is made up of the nominal value of the shares of its participants (clause 1 of article 90 of the Civil Code of the Russian Federation, clause 1 of article 14 of the Federal Law of 02/08/1998 N 14-FZ “On Limited Liability Companies”). Payment for shares in the authorized capital of a company can be made in money, securities, other things or property rights or other rights with a monetary value (Clause 1, Article 15 of Federal Law No. 14-FZ).

The monetary value of the property contributed to pay for shares in the authorized capital of the company is approved by a decision of the general meeting of company participants, adopted by all company participants unanimously (Clause 2, Article 15 of Federal Law No. 14-FZ).

In the case under consideration, the share in the authorized capital is paid for in kind by transfer of property (OS).

From September 1, 2014, a monetary valuation of a non-monetary contribution to the authorized capital of a company must be carried out only by an independent appraiser. Members of the company do not have the right to determine the monetary valuation of a non-monetary contribution in an amount exceeding the valuation amount determined by an independent appraiser (clause 2 of article 66.2 of the Civil Code of the Russian Federation, subparagraph “d”, clause 24 of article 1, part 1 of article 3 of the Federal Law dated 05.05.2014 N 99-FZ “On amendments to Chapter 4 of Part 1 of the Civil Code of the Russian Federation and on the recognition as invalid of certain provisions of legislative acts of the Russian Federation”).

Let us note that before this date, in order to determine the nominal value of a participant’s share in the authorized capital of the company, paid in kind, the obligation to engage an independent appraiser arose only if this nominal value was more than twenty thousand rubles (paragraph 2, paragraph 2, article 15 Federal Law N 14-FZ).

Value added tax (VAT)

The transfer of fixed assets as a contribution to the authorized capital of an LLC is not recognized as an object of VAT taxation (clause 1, clause 2, article 146, clause 4, clause 3, article 39 of the Tax Code of the Russian Federation).

At the same time, according to paragraphs. 1 clause 3 art. 170 of the Tax Code of the Russian Federation, the transferring party has the obligation to restore the VAT previously accepted for deduction when purchasing this property. When transferring a share of fixed assets, VAT is restored in an amount proportional to its residual (book) value (excluding revaluations). In the situation under consideration, the restored VAT amount is RUB 32,400. (RUB 180,000 x 18%).

The restored VAT amount is indicated as a separate line in the documents used to formalize the transfer of the deposit, while an invoice is not issued (paragraph 3, paragraph 1, paragraph 3, Article 170 of the Tax Code of the Russian Federation). VAT is restored in the tax period in which the date of transfer of fixed assets falls (i.e., the date of signing the act of acceptance and transfer of fixed assets).

For detailed information on the procedure for recovering VAT when transferring property as a contribution to the authorized capital, see the Practical Guide on VAT.

Accounting

The disposal of assets as a contribution to the authorized capital of another organization is not recognized as expenses of the organization (clause 3 of the Accounting Regulations “Expenses of the Organization” PBU 10/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 33n).

The cost of an asset that is disposed of, including in connection with its transfer to the authorized capital of another organization, is subject to write-off from accounting (clause 29 of the Accounting Regulations “Accounting for Fixed Assets” PBU 6/01, approved by Order of the Ministry of Finance of Russia dated March 30, 2001 N 26n).

To reflect the disposal of fixed assets to account 01 “Fixed assets”, an analytical account 01-c “Disposal of fixed assets” can be opened, the debit of which reflects the initial cost of the disposed object, and the credit - the amount of accumulated depreciation (Instructions for using the Chart of Accounts and financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n).

Accounting entries for recording transactions related to the disposal of fixed assets are made in the manner established by the Instructions for the Application of the Chart of Accounts and are shown below in the posting table.

A contribution to the authorized capital of another organization is a financial investment and is reflected in the debit of account 58 “Financial investments”, subaccount 58-1 “Shares and shares”, in correspondence with the credit of account 76 “Settlements with various debtors and creditors” (clause 2 , 3 Accounting Regulations “Accounting for Financial Investments” PBU 19/02, approved by Order of the Ministry of Finance of Russia dated December 10, 2002 N 126n, Instructions for the application of the Chart of Accounts).

Financial investments paid for in kind are accepted for accounting at their original cost (clause 8 of PBU 19/02), which is determined in the manner established by paragraph. 1 clause 14 PBU 19/02, as the cost of an asset transferred as payment for the acquired financial investments. When making an asset as a non-monetary contribution to the authorized capital, the value of such an object is determined on the basis of the existing conclusion of an independent appraiser. Such clarifications are given in clause 8 of Interpretation R101 “Initial assessment of financial investments received under agreements providing for the fulfillment of obligations (payment) in non-monetary means” (adopted by the Interpretations Committee on 02/25/2010, approved in the final version on 05/11/2010).

Clause 10 of the Interpretation R101 also explains that a financial investment received under agreements providing for the fulfillment of obligations (payment) in non-monetary means is initially assessed at the value of the transferred property, determined in accordance with clause 8 of the Interpretation R101, increased by the costs incurred by the organization related to with the transaction, and adjusted for monetary compensation provided by the parties to each other. The difference between the value of the transferred property, used for the initial assessment of the financial investment, and its book value (cost) is included in the financial results as part of income or expenses, respectively.

The amount of VAT to be recovered from the residual value of fixed assets is also included in the initial cost of financial investments, which is reflected by an entry in the debit of account 58, subaccount 58-1, and the credit of account 19 “Value added tax on acquired assets” (on this issue, see Letter of the Ministry of Finance of Russia dated December 19, 2006 N 07-05-06/302 “Recommendations for conducting an audit of the annual financial statements of organizations for 2006”). Accordingly, the initial cost of the financial investment will be 232,400 rubles. (RUB 200,000 + RUB 32,400).

In the situation under consideration, the value of the transferred asset determined by an independent appraiser exceeds its book (residual) value by 20,000 rubles. (200,000 rubles - 180,000 rubles). The specified difference is recognized as other income of the organization and is reflected in the debit of account 76 and the credit of account 91 “Other income and expenses”, subaccount 91-1 “Other income” (clause 7 of the Accounting Regulations “Income of the organization” PBU 9/99, approved by the Order Ministry of Finance of Russia dated May 6, 1999 N 32n, Instructions for the use of the Chart of Accounts).

Corporate income tax

Expenses in the form of a contribution to the authorized capital are not taken into account when taxing profits (clause 3 of Article 270 of the Tax Code of the Russian Federation).

When transferring property as payment for the acquired share, the participant does not incur profit (loss). The value of the share acquired by the participant is recognized as equal to the value (residual value) of the contributed property, determined according to tax accounting data on the date of transfer of ownership, taking into account additional expenses that are recognized by the participant for tax purposes upon such contribution (clause 2, paragraph 1, article 277 of the Tax Code RF).

Regarding the amount of restored VAT, we note that according to the official position, amounts of restored VAT are not recognized as an expense when taxing profits. For a selection of letters from the Ministry of Finance of Russia, the Federal Tax Service of Russia and the Federal Tax Service of Russia in Moscow on this issue, see the Encyclopedia of Disputed Situations on Income Tax.

Application of PBU 18/02

Since other income recognized in accounting in the amount of the excess of the value of the transferred fixed asset, as assessed by an independent appraiser, over the residual value of this fixed asset is not taken into account when determining the tax base for income tax, a permanent difference and a corresponding permanent tax asset (PTA) arise in accounting clauses 4, 7 of the Accounting Regulations “Accounting for calculations of corporate income tax” PBU 18/02, approved by Order of the Ministry of Finance of Russia dated November 19, 2002 N 114n). The accounting entry for the reflection of PNA is made in the manner established by the Instructions for the use of the Chart of Accounts and is shown in the posting table

Analytical account symbols used in the posting table

To balance account 01:

01-e “Fixed assets in operation”;

01-c “Disposal of fixed assets”.

To balance sheet account 68 “Calculations for taxes and fees”:

68-VAT “Calculations for VAT”;

68-pr “Calculations for income tax.”

| Credit | Amount, rub. | Primary document | ||

| A financial investment in the form of a contribution to the authorized capital was accepted for accounting at the value of the property established by an independent appraiser | 58-1 | 76 | 200 000 | Certificate of state registration of the LLC, Decision of the participants on the assessment of non-monetary contribution, Agreement on the establishment of the LLC |

| The initial cost of fixed assets transferred as a contribution to the authorized capital has been written off | 01-v | 01-e | 400 000 | Certificate of acceptance and transfer of fixed assets |

| The amount of accrued depreciation on the retiring fixed asset was written off | 02 | 01-v | 220 000 | Certificate of acceptance and transfer of fixed assets |

| The residual value of the disposed fixed assets has been written off | 76 | 01-v | 180 000 | Certificate of acceptance and transfer of fixed assets |

| VAT has been restored in an amount proportional to the residual value of the transferred fixed assets | 19 | 68-VAT | 32 400 | Accounting certificate-calculation |

| Recovered VAT is charged to the increase in the initial cost of the financial investment | 58-1 | 19 | 32 400 | Accounting information |

| Other income is recognized in the form of the difference between the value of the transferred fixed assets, established by an independent appraiser, and the residual value of this fixed assets | 76 | 91-1 | 20 000 | Accounting certificate-calculation |

| PNA reflected (20,000 x 20%) | 68-pr | 99 | 4000 | Accounting certificate-calculation |

———————————

Note: from para. 2 clause 85 of the Methodological guidelines for accounting of fixed assets, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 N 91n, it follows that the initial cost of a financial investment in the form of a share in the authorized capital of an LLC, paid for by the transfer of an asset, is determined as the residual value of this asset (see also Letter of the Ministry of Finance of Russia dated October 18, 2007 N 07-05-06/259). At the same time, since accounting for financial investments is regulated by PBU 19/02 and the norms of PBU 19/02 take precedence over the norms of the Methodological Instructions, in the situation under consideration we proceed from the condition that the organization, when determining the initial cost of financial investments paid in kind, is guided by the procedure , established by clause 14 of PBU 19/02.

M. S. Radkova Consulting and Analytical Center for Accounting and Taxation

| < Previous | Next > |

Conclusion

If a VAT payer makes a non-monetary contribution to the authorized capital of another organization, it is necessary to restore the amount of VAT that was deducted upon the purchase or creation of the transferred assets.

If a subsidiary also pays VAT, then it can deduct the tax that was restored by the founder when transferring the contribution to the management company.

To compensate for the restored VAT, or not to restore it at all, it is advisable to make non-monetary contributions to the management company only if:

- both the participant and the subsidiary pay VAT;

- the participant does not pay VAT;

- when purchasing or creating an object, the participant did not deduct VAT;

- fixed assets or intangible assets are transferred, the residual value of which is zero.

When reducing the authorized capital, the company can compensate the participant for the difference in the value of his share. If this compensation is issued in the form of property, the subsidiary will have to pay VAT. In this case, the participant will not be able to deduct the amount of VAT accrued by the subsidiary.

In order not to pay extra VAT , it is better to issue compensation to company participants in money rather than property.

General procedure for VAT recovery on real estate

In some situations, VAT accepted for deduction must be restored, that is, additionally charged for payment to the budget.

Read in the berator “Practical Encyclopedia of an Accountant”

VAT recovery: when needed

Restoration of VAT on real estate occurs in the manner prescribed by Article 171.1 of the Tax Code of the Russian Federation.

This order is special. VAT is restored at the end of each calendar year for 10 years. The countdown of this period begins on the first day of the month following the month in which this facility was put into operation.

For 10 years, at the end of each calendar year, it is necessary to restore 1/10 of the amount of VAT previously accepted for deduction. To do this, at the end of each year, the share of shipped goods (work, services) that are not subject to VAT in the total cost of shipped goods (work, services) for the year is determined.

This procedure is used by companies that purchased real estate, accepted VAT on it for deduction, and then began to use this property for tax-free transactions (clause 3 of Article 171.1 of the Tax Code of the Russian Federation). This is the main condition for the gradual restoration of the deduction.