Reporting to statistics for trading organizations

In addition to accounting and tax reporting, all organizations and individual entrepreneurs are required to report to Rosstat authorities. Respondents submit some reports subject to being included in the statistical sample once every few years, and some are annual. For business entities engaged in wholesale and retail trade, such an annual report is Form 1-TORG. The current form, electronic format and instructions for filling out form 1-TORG in statistics in 2021 were approved by Rosstat Order No. 418 dated July 22, 2019.

To report to Rosstat on time, use the free statistical reporting calendar for 2021 and instructions from ConsultantPlus experts.

Who reports on Form 1-TORG

Respondents to form 1-TORG are all legal entities, except representatives of small businesses. Individual entrepreneurs do not submit this report to Rosstat. If an organization has separate divisions, and it is a respondent to a statistical report, all branches and divisions are required to fill out and send to the statistical authorities at their location a separate form 1-TORG. The parent organization is accountable for itself and for all divisions as a whole.

But even legal entities do not have this obligation for everyone. The order of Rosstat indicates who submits 1-TORG to statistics:

- organizations engaged in wholesale trade;

- companies engaged in retail trade;

- legal entities that sell and repair motor vehicles and motorcycles.

For the latter organizations, a separate requirement has been established for types of activities according to OKVED - if the main type of activity is not trade, but repair work and service (45.2 “maintenance and repair of motor vehicles” or 45.40.5 “maintenance and repair of motorcycles”), it is necessary to report only with parallel sales of vehicles.

Legislative framework of the Russian Federation

not valid Edition from 06.06.2007

detailed information

| Name of document | DECREE of Rosstat dated 06.06.2007 N 45 “ON APPROVAL OF STATISTICAL INSTRUMENTS FOR ORGANIZING STATISTICAL OBSERVATION OF DOMESTIC AND FOREIGN TRADE FOR 2008” |

| Document type | decree, order |

| Receiving authority | Rosstat |

| Document Number | 45 |

| Acceptance date | 01.01.1970 |

| Revision date | 06.06.2007 |

| Date of registration with the Ministry of Justice | 01.01.1970 |

| Status | It does not work |

| Publication |

|

| Navigator | Notes |

DECREE of Rosstat dated 06.06.2007 N 45 “ON APPROVAL OF STATISTICAL INSTRUMENTS FOR ORGANIZING STATISTICAL OBSERVATION OF DOMESTIC AND FOREIGN TRADE FOR 2008”

The procedure for filling out and submitting form N 1-TORG

1. Form N 1-TORG is submitted by all legal entities whose main activity is wholesale or retail trade (except for small businesses) of all forms of ownership, and their separate divisions. Organizations whose main activity is the maintenance and repair of motor vehicles and motorcycles (OKVED codes 50.2, 50.40.4), as well as the repair of household products and personal items (OKVED code 52.7) in form N 1-TORG “Information on sales and inventories of goods in wholesale and retail trade organizations” are not reported.

The address part of the form indicates the full name of the reporting organization in accordance with the constituent documents registered in the prescribed manner, and then the short name in brackets.

The line “Postal address” indicates the name of the subject of the Russian Federation, legal address with postal code.

In the code part, the code of the All-Russian Classifier of Enterprises and Organizations (OKPO) must be entered on the basis of the Notification of assignment of the OKPO code sent (issued) to organizations by state statistics bodies.

2. In Form N 1-TORG, information is provided by a legal entity in total for all its divisions (including branches), except for territorially separate divisions located on the territory of other constituent entities of the Russian Federation (republics, territories, regions). Geographically separate divisions located on the territory of other constituent entities of the Russian Federation submit data to the statistical authorities at their location. If separate divisions (branches, representative offices) do not have information to fill out the form, then information for each such separate division is filled out on a separate form by the parent organization and sent to these separate divisions (branches, representative offices) for subsequent submission to the state statistics authorities. their location within the established time limits.

Legal entities submit Form N 1-TORG, as a rule, at the place of their state registration. An exception to this rule are cases when a legal entity registered on the territory of a constituent entity of the Russian Federation does not carry out activities on the territory of this constituent entity of the Russian Federation. In this case, the specified form is submitted at the place of actual trading activities.

3. In the case of carrying out activities on the basis of a simple partnership agreement (joint activity agreement), the cost of goods sold by the partners as a result of their joint activities, when each partner fills out form N 1-TORG, is distributed among the partners in proportion to the value of their contributions to the common cause, unless otherwise provided by the simple partnership agreement or other agreement of the partners. If the cost of these goods cannot be distributed among partners, then information on them is shown on a separate form of state statistical observation by the partner who is entrusted with keeping records of common property.

4. Wholesale trade organizations (committors, principals, principals) selling goods under a commission agreement, commission or agency agreement, i.e. transferring goods to another organization or individual entrepreneur (commission agent, attorney or agent) for resale to legal entities and individual entrepreneurs, reflect the sales volumes and balances of these goods in Section 1 “Sales to inventories of goods (products) by type” in columns 6, 7 and 8 and in section 2 “Turnover of wholesale and retail trade by months of the reporting year” on line 155. Commission agents (attorneys, agents) carrying out transactions in wholesale trade fill out only section 2, where lines 155 and 156 reflect the amount of remuneration (in this case p. 155 = p. 156).

Organizations carrying out transactions in retail trade in the interests of another person on the basis of commission agreements, commissions or agency agreements, fill out sections 1 and 2. The cost of goods sold to the public by commission agents (attorneys, agents) is reflected in section 1, columns 9 and 10 and in section 2 lines 157 - 162; The principals (principals, principals) who are the owners of these goods do not reflect the proceeds from their sale (retail trade turnover) in form N 1-TORG, since this information is filled in by the organization (usually a commission agent) that directly sells goods to the public.

5. Section 1 “Sales and inventories of goods (products) by type” in terms of wholesale trade (columns 6 - also filled in by retail trade organizations if they carried out wholesale sales of goods in the reporting year. Similarly, wholesale trade organizations that carried out sales in the reporting year goods to the population, fill out columns 9 - 10.

also filled in by retail trade organizations if they carried out wholesale sales of goods in the reporting year. Similarly, wholesale trade organizations that carried out sales in the reporting year goods to the population, fill out columns 9 - 10.

6. Line 01, column 7 shows wholesale trade turnover, which represents revenue from the sale of goods previously purchased externally for the purpose of resale to legal entities and individual entrepreneurs for professional use (for processing or further sale). Wholesale trade turnover also includes the amount of remuneration of wholesale trade intermediaries, i.e. commission agents (attorneys, agents) carrying out transactions for the purchase and sale of goods on behalf of or at the expense of other persons or firms (principals, principals, principals) under commission (assignment) agreements or agency agreements, but this amount is not reflected on line 1 of section 1 , but is shown on line 156 of section 2 and is included in the data on line 155 of section 2.

Wholesale trade turnover is indicated in actual sales prices, including trade margins, value added tax, excise duty, export duty, customs duties and similar mandatory payments. A mandatory feature of an operation classified as wholesale trade is the presence of an invoice for the shipment of goods.

Data on sales and inventories of own-produced products in columns 6, 7 and 8 are not shown.

7. Columns 6 and 7 provide information on wholesale sales by product groups and individual types of goods, respectively, in physical and value terms.

The data in column 7, line 01 must be equal to the sum of lines 02 and 59 in this column.

The data in column 7, line 02 must be equal to the sum of lines 03, 08 - 10, 12 - 17, 19, 20, 24, 27, 30 - 45, 52, 53.

The data in column 7, line 59 should be equal to the sum of lines 60 - 88, 92 - 98, 100 - 105, 107, 108, 110 - 113, 116 - 120, 125 - 127, 129 - 143, 145, 148, 149.

Please note that the data on line 106 “Window glass (sheet)” in columns 6 and 8 is given in thousand m2, and on line 146 “Cement” in columns 6 and 8 - in tons.

Data expressed in pieces, deciliters, kilograms, conventional boxes, cubic meters, dense cubic meters are given in whole numbers.

Data expressed in thousands of rubles, tons, thousands of tons, thousands of pieces, thousands of standard cans, thousands of decalitres, thousands of linear meters, thousands of pairs, thousands of square meters, millions of cubic meters are given with one decimal place.

8. Column 8 shows data on inventories of goods at the end of the year purchased externally and intended for resale to legal entities or individual entrepreneurs. Information on inventories in wholesale trade is given in the units of measurement indicated in column 4. For lines with the unit of measurement in thousands of rubles, inventories are reflected at purchase prices (excluding VAT and excise tax). Data on inventories of goods are provided for all storage locations (warehouses, cold storage warehouses, warehouses, etc.), including rented ones. This column also reflects inventories of goods transferred by the reporting organization for safekeeping. Goods accepted for safekeeping or located in leased areas and owned by other organizations are not shown in column 8. Data on inventories of goods of own production in column 8 is also not shown.

9. Line 01, Column 9 shows retail trade turnover (excluding public catering turnover), which represents revenue from the sale of goods to the public for personal consumption or household use in cash or paid by credit cards, bank checks, transfers from depositors' accounts via payment cards, which is also counted as cash sales. The cost of goods sold to the population at a discount (fuel, etc.), on credit, by mail and by sample, as well as the cost of medicines dispensed to certain categories of citizens free of charge or with preferential prescriptions, is included in retail trade turnover at the full cost.

The cost of goods sold through the retail trade network to legal entities (including social organizations, special consumers, etc.) and individual entrepreneurs is not included in retail trade turnover.

A mandatory feature of a transaction classified as retail trade is the presence of a cash receipt (invoice) or other document replacing the receipt.

The cost of goods sold to the population is given in retail prices - actual selling prices, including trade margins, value added tax and similar mandatory payments.

10. Column 9 provides information on retail sales by product groups (goods) in value terms.

The data in column 9, line 01 must be equal to the sum of lines 02 and 59 in this column.

The data in column 9, line 02 must be equal to the sum of lines 03, 08 - 10, 12 - 17, 19, 20, 24, 27, 30 - 45, 52, 53.

The data in column 9, line 59 must be equal to the sum of lines 60 - 88, 92 - 98, 100 - 105, 107, 108, 110 - 113, 116, 125 - 127, 129, 132, 133, 136, 145, 148, 149 .

11. Column 10 shows information about inventories of goods in retail trade at the end of the year. Inventories are reflected at sales prices, including trade margins and VAT. Data on inventories of goods by retail trade organizations are provided for all places where goods are stored (warehouses, refrigerated warehouses, stores), including rented ones. Wholesale trade organizations engaged in retail trade, in column 10, show inventories of goods intended for sale to the public directly by this organization. Goods accepted from the public on commission are not included in the volume of inventory in retail trade.

12. Information on the sale and inventory of goods not listed in column 1, but occupying more than 10% of the total sales volume, is reflected on free lines. Lines 54 - 58 show information about goods that occupy the largest share in other food products (line 53), and lines 150 - 154 - respectively, in non-food products (line 149).

13. Section 2 “Wholesale and retail trade turnover by month of the reporting year” provides information on wholesale trade turnover on line 155 and on retail trade turnover on line 157, broken down by month of the reporting year.

The data on line 155 minus the data on line 156, column 3 of section 2 “Wholesale and retail trade turnover by month of the reporting year” should be equal to the data on line 01, column 7 of section 1 “Sales and inventories of goods (products) by type.”

The data on line 157, column 3 of section 2 “Wholesale and retail trade turnover by month of the reporting year” must be equal to the data on line 01, column 9 of section 1 “Sales and inventories of goods (products) by type.”

14. Line 158 in Section 2 provides data on the cost of goods sold on credit (at the time the goods are released to the buyer), in the amount of the full cost of the goods.

15. Line 159 provides data on the volume of sales of goods by order of the population by mail, through television and online stores, as well as in kiosks, tents, through auto stores, auto shops, etc.

16. Line 162 indicates the cost of goods sold in rural areas (revenue from the sale of goods in rural stores, tents, kiosks, as well as revenue from outbound trade in rural areas, through auto stores, vans, auto shops).

17. In the “For reference” section, line 163 shows revenue from the sale of products and goods, receipts associated with the performance of work and provision of services, business transactions, which are income from ordinary activities. The data on line 163 must correspond to the indicator “Revenue (net) from the sale of goods, products, works, services (minus value added tax, excise taxes and similar mandatory payments)” of Form No. 2 “Profit and Loss Statement” and a similar indicator of the form Federal State Statistical Observation No. P-3 “Information on the financial condition of the organization.” Columns 4, 5 and 6 on line 163 provide data on revenue received as a result of wholesale trade, retail trade and other activities, respectively. On line 163, the data in column 3 must be equal to the sum of the data in columns 4, 5 and 6.

Organizations (commission agents, attorneys, agents) carrying out trading activities in the interests of another person under commission, commission or agency agreements indicate the cost of services in the amount of remuneration.

Line 164 from line 163 shows the amount of remuneration for the provision of intermediary services for the sale of goods accepted on commission to the public.

Line 165 reflects the recorded costs for the production of goods, products, works, services in the share related to the goods, products, works, services sold. When carrying out trading activities, line 165 reflects the purchase price of goods, the proceeds from the sale of which are reflected in line 163.

The data on line 165 must correspond to the indicator “Cost of goods sold, products, works, services” of form N 2 “Profit and Loss Statement” and a similar indicator of the federal state statistical observation form N P-3 “Information on the financial condition of the organization”. On line 165, the data in column 3 must be equal to the sum of the data in columns 4, 5 and 6.

Zero reporting

If the organization is included in the statistical sample, but:

- is in bankruptcy;

- did not conduct activities during the reporting period;

- temporarily not working, -

she still has to report; instructions for filling out form 1-TORG stipulate that respondents who are temporarily not conducting business fill out a report indicating the organization’s downtime. The bankruptcy stage does not have any special conditions for filling out the form. If no activity was carried out at all during the reporting period, a zero report is submitted. It consists of one title page with signatures of authorized persons. No other sheets with dashes and zeros are required.

Deadlines and method for submitting the 1-TORG report

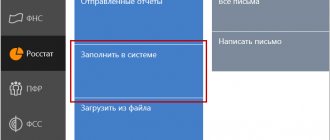

From 01/01/2021, the obligation of organizations and individual entrepreneurs to send reports to Rosstat in electronic form has been established by law. But given the lack of necessary technical support not only among some business entities, but also among statistical bodies, Rosstat met the respondents halfway and allowed them to submit reports on paper until further notice.

The deadline for submitting 1-TORG in 2021 has not changed due to the transition to an electronic reporting format - information must be sent to statistics no later than 02/17/2021, this is a normal working environment, no transfers are provided.

The Moscow Exchange began trading in Moscow green bonds

On May 27, 2021, the placement of the first issue of Moscow green bonds began on the Moscow Exchange.

The official ceremony dedicated to the start of trading in Moscow bonds was attended by Deputy Chief of Staff of the Mayor and Government of Moscow Maria Bagreeva and Managing Director for Relations with Issuers and Authorities of the Moscow Exchange Vladimir Gusakov.

Investors were offered the 74th issue of the city bonded (domestic) loan of Moscow in the amount of 70 billion rubles with a circulation period of seven years. The coupon rate is 7.38% per annum. Security code – RU000A1033Z8.

The Moscow Exchange included the 74th issue of Moscow bonds in the first-level quotation list, as well as in the Sustainable Development Sector. The issue complies with the Green Bond Principles 2018 of the International Capital Market Association (ICMA) based on an independent examination conducted by the Expert RA rating agency and the Methodological Recommendations for the development of investment activities in the field of green finance in the Russian Federation, developed by VEB.RF.

Maria Bagreeva, Deputy Chief of Staff of the Mayor and Government of Moscow:

“Today, there is a huge demand in international markets for sustainable financing instruments, and green bonds are one of such instruments. Moscow is implementing a huge number of projects in the “green” sphere - we want the ecology of Moscow to be at a high level, and Muscovites to live here comfortably. We follow the goals of sustainable development, so issuing green bonds is not accidental for us. The funds raised will be used for the construction of the Great Circle Line of the metro and for the purchase of electric buses. Both of these projects have a significant impact on the environment and will help improve the environmental situation in the city. In addition, Moscow green bonds are the first sub-federal green issue. We hope that this placement will give a new impetus to the development of the sustainable development sector in Russia and will attract new issuers to it, primarily the constituent entities of the Russian Federation.”

Vladimir Gusakov, Managing Director for Relations with Issuers and Authorities of the Moscow Exchange:

“I am pleased to welcome Moscow to the Moscow Exchange, the first issuer of green bonds among the constituent entities of the Russian Federation. This is indeed an important event, emphasizing the increasing importance of the principles of sustainable development for the country’s economy. Today, 15 bond issues of seven issuers with a total volume of more than 50 billion rubles are circulating in the Sustainable Development Sector of the Moscow Exchange. Based on the results of the placement of Moscow green bonds, the volume of securities traded in the Sector may increase by almost 2.5 times. I hope that the successful experience of Moscow will serve as a guide and example not only for other subjects of the Federation, but also for Russian corporations and banks. We, for our part, are ready to further improve listing rules and trading regimes and actively promote the dissemination of best practices in sustainable development.”

The funds raised through the placement of bonds are planned to be used for projects to develop urban transport infrastructure in order to reduce air pollution from motor vehicles. The Analytical Credit Rating Agency (ACRA) assigned the 74th issue of Moscow bonds a credit rating of AAA(RU).

On May 21, a new edition of the Moscow Exchange Listing Rules came into force, allowing subfederal and municipal bonds to be included in the Sustainable Development Sector. The sustainable development sector was created at the Moscow Exchange in 2021 to finance projects in the field of ecology, environmental protection and socially significant initiatives.

On April 27, 2021, Moscow successfully placed the 72nd issue of three-year bonds worth 35 billion rubles on the Moscow Exchange. The total volume of purchase orders exceeded the supply volume by 2.3 times.

Media contact information +7 (495) 363-3232 [email protected]

Contact information for clients +7 (495) 232-3363 Feedback form

How to fill out the statistical report 1-TORG

The reporting form consists of a title page and five sections. It is not necessary to fill them all out - each section is intended for information about specific transactions. You need to start with the title page, which is filled out by all respondents, without exception.

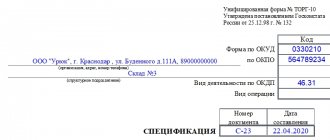

Title page 1-TORG

On the title page we indicate the name and address of the respondent organization and OKPO number. No other data is provided here, as well as signatures of authorized persons. Next are the information sections.

Section 1 (wholesale trade)

This large section contains groups and names of goods sold in bulk. OKVED codes for wholesale trade of these goods are indicated. There are many of them, but the procedure for filling out 1-TORG in statistics does not provide for filling out all the fields. If there is no data and such goods are not traded, you should not even put a dash or zero, leave the field empty. In the fields next to the appropriate names and OKVED, the sales amounts in the reporting period in thousands of rubles are entered. The total value is indicated at the beginning of the section.

Section 2 (retail)

Section 2, devoted to retail trade, is completed in the same way. At the top we indicate the total sales volumes in thousands of rubles, then we decipher them by name and OKVED.

Section 2.1 (number of gas stations)

From the title of the section it is clear that it has a narrow focus. It is filled out only by those organizations that have gas stations on their balance sheet.

Section 3 (turnover by month)

In this part of the TORG-1 form we indicate the annual turnover from the sale of goods monthly in the context of wholesale and retail. Separately at the bottom of the table we indicate (if such transactions occurred in the reporting period) sales turnover:

- goods sold on credit;

- goods sold by mail;

- goods sold outside shops, stalls and markets;

- goods sold via e-commerce.

Please note how to fill out form 1-TORG in statistics for 2020 in section 3 - in thousands of rubles. All numbers must agree with sections 1 and 2.

Section 5 (warehouses)

The last section of the reporting form is devoted to information about the organization’s warehouse premises. Indicate the data in terms of the number of premises and their volume. Vegetable storage facilities are indicated separately. Data are provided as of the end of the reporting period.

At the end, the form is signed by the authorized person who compiled it and is responsible for the accuracy of the information provided. Most often, this is the chief accountant of the organization.

How to fill it out correctly

The procedure for filling out 1-TORG in statistics in force in 2021 provides for the phased generation of reporting information. Respondents complete the title page and 5 sections.

Step-by-step instructions on how to fill out form 1-TORG in statistics for 2020 (submitted by 02/17/2021):

Step 1. Design the title page. Required filling:

- reporting year;

- name and postal address;

- OKPO.

Step 2. Fill out section 1. Enter the volumes of wholesale sales (in thousands of rubles) broken down by OKPD2:

- motor vehicles and motorcycles, parts, components and accessories (45.11.19.001.AG);

- agricultural raw materials, animals (46.2);

- food products, drinks, tobacco (46.3);

- non-food products for consumers (46.4);

- information and communications equipment (46.5);

- other machines, equipment, tools (46.6);

- specialized wholesale trade (46.7);

- non-specialized wholesale trade (46.90.10.000).

Step 3. We indicate retail trade volumes in section 2. We break down the sales information according to OKPD2:

- food products, drinks, tobacco (47.2);

- non-food products (45.47.30.001.AG).

We fill out section 2.1. It is intended for respondents who own or lease gas stations.

Step 3. We describe the trade turnover for the year by month.

Step 4. We indicate the municipality in which the respondent trades and the trade turnover recorded for this OKTMO.

Step 5. We note the availability of warehouses and a warehouse network.

We sign the statistical report with the responsible person, enter the date of completion, email address and contact information for contacting the contractor.