In accordance with Accounting Regulations 6/01, the cost of fixed assets is repaid by calculating depreciation.

Depreciation is a process that characterizes the wear and tear of equipment or other equipment during operation. Depreciation cannot be calculated for a category of property whose properties do not change over time (for example, land plots).

In accordance with Russian legislation, depreciation should be calculated monthly, starting from the month following the commissioning of the facility. Control over depreciation is important not only for accounting, but also for tax accounting. Depreciation in reporting for accounting purposes is used in preparing the balance sheet. Line 1150 should reflect the residual value of the objects, which is calculated taking into account accumulated depreciation. In order to determine the residual value of a non-current asset, it is enough to subtract the credit balance of account 02 “Depreciation of fixed assets” from the debit balance of account 01 “Fixed Assets”.

For tax accounting, depreciation is no less important, since it allows you to reduce the calculated base for income tax. At the same time, to control the write-off of the value of an object as it wears out, organizations can use a depreciation sheet.

The role of depreciation of fixed assets in the activities of an enterprise

As is known, depreciation of fixed assets represents the cost of fixed assets, gradually distributed among the cost of production, manufactured goods and services provided. This implies the gradual accumulation in a specialized fund of funds received as a result of the sale of goods produced or services provided. These funds can be used as investments and, as a rule, they are: depreciation charges in many companies range from 70 to 80% of all investment funds, since their use is more profitable than third-party investment.

This investment can be used for the following needs:

- Purchasing new equipment instead of worn-out and retired equipment;

- Carrying out major repairs of equipment;

- Modernization of production;

- Reconstruction of structures;

- Technical re-equipment.

Accounting for depreciation of fixed assets

Accounting for depreciation of fixed assets is carried out in accordance with Accounting Rules 6/01. Maintaining such records is necessary so that at any time you can find out the level of depreciation of a fixed asset or its residual value. The calculation and distribution of depreciation payments is carried out by the organization's employees and is carried out in the manner established by the accounting policy of the enterprise. Various forms can be used for this, both recommended by legislative bodies and those developed independently.

Results

A statement of depreciation and fixed assets accounting is necessary for a company to correctly reflect the results of the movement of such objects, as well as the final values of accrued depreciation.

The formation of the statement in question does not require the use of complex and complex accounting mechanisms. The main thing for responsible specialists is to know the basic rules for filling out the main 2 subsections of the statement: on accounting for fixed assets and on the amount of accrued depreciation. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Fixed Asset Accounting Form

Most often, to account for depreciation of fixed assets, various types of enterprises use documents such as statements of depreciation of fixed assets in form No. B-1.

Important ! According to Article 314 of the Tax Code of the Russian Federation, employees of the accounting service of an enterprise can also develop their own form of accounting depreciation sheet . However, in this case, you should follow the recommendations of the Ministry of Finance on the approximate composition of the details of each section.

In this article, we will consider the most commonly used form of statement - form No. B-1 , developed for small enterprises. Despite the fact that the form is intended for small organizations, it can also be adapted for use in manufacturing companies with a large production volume.

conclusions

If you follow all the rules for filling out Form B-1 or sample statements developed by yourself, the enterprise will be able to see and evaluate the existing fixed assets, their total capitalization and analyze the process of depreciation (depreciation) of fixed assets, adjusting the company’s behavior towards increasing fixed assets or getting rid of surpluses, and also a correct reflection of the tax base.

Accounting statement indicators have a direct impact on the final cost of fixed assets, which, if calculated incorrectly, leads to a large number of difficulties, both in the field of tax and accounting, and can lead to direct losses for the organization.

Purpose of depreciation sheet B-1

Statement B-1 is used to document the decrease in the tax base for the reporting period. It also reflects the cost of fixed assets per month or per year. Form B-1 allows you to track changes in the cost of structures, buildings or some equipment over a certain period.

Thus, the depreciation sheet for fixed assets performs the following tasks assigned to it:

- Reflection of the disposal of fixed assets from circulation;

- Reflection of the modernization of means of production;

- Reflection of costs incurred for modernization;

- Reflection of the movement of OS used in production;

- Reflection of depreciation accrual over a certain period.

What is it used for?

The depreciation sheet for fixed assets is used to reduce the tax base for the reporting period, reflect the value of fixed assets for the period (month, year), as well as changes in the cost of equipment for the period.

In general, it is possible to divide the tasks regarding the OS for which the list is used into:

- disposal of fixed assets from the production process and turnover;

- modernization of means of production and costs incurred in connection with this;

- movement of the operating system during the production process;

- accrual of depreciation of funds over a period of time.

The indicators reflected in the statement must be of a cost and quantitative nature.

These parameters allow the company to have an idea of the amount of depreciation, the movement of fixed assets and allow them to adequately respond to changes.

The procedure for filling out the OS accounting sheet

The document in Form B-1 must be completed monthly . In this case, every month a new clean sheet is used, and the total for the previous month is entered into it.

In order to correctly draw up a depreciation statement in Form No. B-1, the following points should be taken into account:

- This document is divided into two parts: information on account 01, where fixed assets are recorded, and information on account 02, where depreciation is reflected.

- OS is reflected in groups, information for which is indicated separately.

The following information is reflected in the fixed assets account:

- OS name;

- Its inventory number;

- Cost of the OS object;

- Object status;

- Its location.

Important! It should be taken into account that fixed assets subject to transfer for use to other production companies, as well as depreciation on them, must be taken into account in a separate statement.

Account section 02 requires indicating the facts of calculation and calculation of depreciation of fixed assets. In this case, the following indicators are important:

- The amount of deductions per unit of time (for 1 month, since this is the frequency of updating this document);

- Category of operation of the fixed asset. This value should determine the period for calculating depreciation of the equipment, that is, over what period the wear and tear of this OS will occur.

- The total amount of depreciation. Indicated in monetary terms.

- The volume and amount of accrued depreciation for the specified period. This value directly affects the residual value of the depreciation item.

- The cost of the fixed asset. The remaining value of the object is indicated after deduction of depreciation charges from the original cost.

Based on the calculation results, under each column of the table, the total value is displayed for each group of fixed assets. The information obtained allows us to objectively assess the state of the fixed assets fund.

The completed form is the basis for reflecting data on fixed assets in the organization’s cost accounting sheets.

Important! The use of this form of statement allows you to enter information about the purchased equipment in the month following its acquisition or manufacture.

In what form?

According to Art.

314 of the Tax Code of the Russian Federation, an enterprise can develop its own accounting form; this is not an imperative form. However, in accordance with the order of the Ministry of Finance of Russia dated December 21, 1998 No. 64n, recommendations are given for reflecting relevant information for each section.

The most popular form of statement is the OKUD form No. B-1, which is designed for small businesses, but can be used in larger-volume industries.

This form is advisory in nature; the enterprise has the right to develop its own regulatory document.

The form is filled out monthly. The total for the previous month is carried over to the next month until the reporting form for the year is completed.

Maintaining a special form allows you to streamline the accounting of fixed assets and reflect objective data about fixed assets.

How to fill in when calculating depreciation charges for fixed assets?

Filling out the statement on a monthly basis allows the management of the enterprise and its financial departments to receive up-to-date information about the state of fixed assets, the degree of wear and tear of equipment and the cost taking into account depreciation.

For correct registration you need to remember:

- The depreciation sheet is divided into two main sections - account 01, in which fixed assets are recorded, and account 02, in which depreciation charges are reflected.

- Groups of fixed assets are reflected separately in each line without general mixing. Otherwise, it may provide misleading information about accrued depreciation.

In account 01 the following is reflected:

- Name, inventory number of the object. Each OS in the enterprise is given an individual number when such funds arrive at the enterprise.

- Price. The cost of an object is based on the method of its receipt - acquisition or production on site and must be reflected in the invoice.

- Status of the object and its location. The OS can be moved, which is fixed by regulatory documents - this information is also subject to mandatory reflection. A movement or change can also include the calculation of depreciation on an object.

At the same time, assets that the enterprise intends to give for use to other industries must be calculated in a separate statement and separate depreciation records are kept in relation to them.

Account 02 indicates the facts about the calculation and calculation of depreciation of the object and the grounds for this procedure:

- The amount of depreciation per unit of time. Since the form is filled out monthly as deductions are calculated, the unit of time is usually considered to be 1 month.

- The category to which the fixed asset belongs. The value of this category determines the rate at which depreciation (wear and tear) of equipment is calculated.

- The amount in total monetary terms of depreciation accrued on a separate fixed asset item.

- Volume and amount of depreciation per unit of time (month). It should be understood that subsequent accruals will directly affect the residual value of the asset.

- The value of a fixed asset after depreciation has been calculated at the end of the month (including the deduction of deductions).

After calculating all the values under each item, a separate total is summed up for each group of fixed assets, which ultimately provides objective information about the state of fixed assets.

Upon completion of filling out the form, data on fixed assets, their cost and condition are transferred to the organization’s cost accounting sheet.

The inclusion of such a list of data can be applied to both small and medium-sized businesses. New equipment is entered into the list in the month following its acquisition (manufacturing).

and sample filling

Download a standard form for the calculation and calculation of depreciation of fixed assets form according to OKUD V-1 – excel.

in free form – word.

filling out the statement of fixed assets – word.

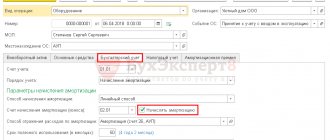

Instructions for creating a depreciation sheet for fixed assets in 1C: Accounting 3.0

As mentioned earlier, the depreciation sheet for fixed assets allows you to analyze data on these same assets. This is possible both in the context of accounting and in the context of tax accounting. The statement allows you to view the amounts of depreciation, amounts spent on modernization, facts of disposal of fixed assets. Such a document most fully reflects information about OS objects. With its help, you can create a list of fixed assets, group them by divisions or depreciation groups. Therefore, it is quite often used in accounting programs, such as the most common 1C: Accounting 3.0., in the form of a report. Therefore, within the framework of this article, we will consider the procedure for generating this report in this program.

So, to generate a statement that will reflect information about the depreciation of fixed assets, you must perform the following steps:

- Login to 1C: Enterprise 8;

- Select the required information base containing the configuration of the accounting accounting program;

- Select fixed assets and intangible assets from the menu—Reports—Statement of depreciation of fixed assets.

- Select the month in the window that opens and click the “Generate” button.

Also in this program it is possible to obtain extended information on each OS object. To do this, click the “Settings” button and specify the selection conditions. Also in the “Grouping” tab you can group statement data by additional fields. In this case, after clicking the “Generate” button, the report will be generated according to the specified settings and groupings.

This form also allows you to obtain information on one fixed asset object or on several objects selectively. The selection can also be made according to MOL, etc. To do this, in the “Selection” tab, select the required fixed asset and other information of interest, and then click the “Generate” button. You can reflect in the report both indicators for accounting and tax accounting. To do this, in the “Indicators” tab, check the box next to the corresponding indicator.

What points should compilers remember when creating a statement?

Filling out the statement in question is not a difficult task for professionals. However, a number of rules must be followed.

First of all, compilers should remember that for each individual fixed asset (or for a group of similar fixed assets), information on accrued depreciation must be reflected line by line. That is, each new line must contain a new object or OS group.

The statement itself consists of 2 subsections: account 01 “OS” and account 02 “Depreciation on assets”.

In the 1st subsection of the statement, the compilers reflect the following information:

- Object name;

- its original cost;

- the fact of movement of the object (and a document confirming this fact), for example, commissioning, sale or the fact of depreciation on the object.

In the 2nd subsection, devoted to the reflection of information on depreciation, you should indicate:

- depreciation rate for a specific object;

- monthly depreciation amount;

- the amount of accrued depreciation for a given object for a certain month;

- the residual value of the object minus the depreciation specified above.

After entering all the necessary information into the statement in question, the turnover for the period is calculated, after which the final values are displayed as the last line.

For more information about existing depreciation methods, see the article “Which depreciation method to choose in tax accounting?”

IMPORTANT! In addition, compilers should remember that the company statement must separately reflect information on fixed assets that the company requires for subsequent rental or for the purpose of making investments.