Financial payments of individual entrepreneurs in most cases are carried out in non-cash form.

Their choice is due to the practicality and simplicity of the method, which does not require registration of cash register entries.

However, it will be difficult for a businessman to cash out funds from a current account, since there are a number of restrictions that do not allow the owner of a banking product to freely withdraw funds for any purpose.

Withdrawing cash from an individual entrepreneur's account

An additional problem may be the limits set by banking institutions, if exceeded, you will have to pay a commission. How to withdraw money from the current account of an individual entrepreneur so as not to come under the close attention of the Tax Service and not overpay the bank?

How can an LLC withdraw money from its current account?

Legally, an LLC has the right to cash out money from its current account:

- salary payments;

- social benefits;

- payment of profits to the founders;

- borrowed funds;

- travel, representative and household allowances. needs;

- management expenses.

To avoid problems with the tax authorities, all these options for cashing out funds must have a documentary basis.

We recommend reading: Where to open a current account for individual entrepreneurs and LLCs: comparison of tariffs and reviews.

How to withdraw money from an LLC current account for salary

You can withdraw money for salary in cash from the LLC current account or withdraw it to a personal card. faces. The director fills out a bank check, gives it to the operator and, after checking the check, receives cash at the cash desk.

Personal income tax of 13%, insurance (30%) and social contributions are withheld from the salary paid. The rate of the latter depends on the type of activity.

Payment of dividends from the LLC current account

The Articles of Association must reflect how often the founder can withdraw net profits. If there is no profit, then dividends cannot be accrued. As a rule, dividends are paid no more often than once a quarter, minus a tax of 13%. If there are several founders, dividends are distributed in proportion to the shares of the authorized capital.

How to withdraw money from a current account under a loan agreement

The founder can take out a loan from his organization. To do this, you need to draw up an agreement and state in it whether the loan will be interest-bearing or not. Subsequent taxes depend on this. If the loan is forgiven, then it is regarded as receipt of income from the LLC with the accrual of 13% personal income tax.

Under the loan agreement, funds are withdrawn by bank check, then credited to the cash desk and issued to the founder using an expense order.

Issuance of money on account

Money from a bank account can be withdrawn for reporting to employees: for business trips, representative and other household expenses. goals. They can be quickly cashed using a checkbook. The reporting employee must provide a documented report of the expenses incurred.

How to cash out money from an LLC current account through an individual entrepreneur

The founder, as an individual entrepreneur, can exercise external management of the LLC under an agreement. This service will be paid separately and credited to the entrepreneur’s account monthly. The founder, as an individual, can withdraw money from this account at his own discretion.

This cash-out scheme gives rise to many tax disputes, and the manager of an individual entrepreneur is often considered as a full-time director. If you use it, you need to be prepared to answer all sorts of questions from tax officials. An advantage in this situation can be a well-drafted agreement with the LLC and monthly execution of the necessary documents - acts and reports on the work done.

What is the best way to cash out money from an LLC current account?

Let's calculate which of the above methods will be the most profitable and correct when withdrawing money from a legal account. faces. In order to simplify the calculations, we will accept the following conditions:

- The salary, net profit, and income of the IP manager are the same - 75 thousand per month.

- The billing period is quarter.

- LLC uses OSNO.

- Contributions for injuries are not taken into account.

The founder works as the director of the LLC.

- 75,000 x 3 = 225 thousand rubles. - salary for 3 months.

- 225 thousand x 0.13 = 29,250 rubles. - income tax.

- 225 thousand x 30% = 67,500 rubles. - insurance premiums.

- (225,000 + 67,500) x 20% = 58,500 - income tax savings.

- 225,000 - 29,250 - 67,500 + 58,500 = 186,750 - the founder’s income for the quarter.

The founder is not an employee. He receives dividends from the LLC.

- 75 thousand x 3 = 225,000 rubles. — net profit for the quarter.

- 225 thousand x 13% = 29,250 rubles. — tax on dividends.

- 225,000 - 29,250 = 195,750 rubles. — the founder’s income for the quarter.

The founder is the manager of the individual entrepreneur.

Let's add a few more conditions here:

- Individual entrepreneurs apply the simplified tax system “Income”.

- The individual entrepreneur does not have hired employees.

- We will calculate the income of an individual entrepreneur per year.

Calculation:

- 75,000 x 12 = 900,000 rub. — annual management fee.

- 900,000 x 0.06 = 54 thousand rubles. - simplified tax.

- 36,238 + 1% x (900 thousand - 300 thousand) = 42,238 rubles. - personal fear. entrepreneur contributions and 1% pension. contributions from excess income. The individual entrepreneur can fully deduct this amount from the accrued tax.

- 900,000 - 54,000 - 42,238 = 888,838 rubles. - net annual income.

- 888,838: 4 = 222,059 rub. — quarterly income of the founder.

The founder took out a loan from the LLC.

If the agreement states that the loan is interest-free or its rate is extremely low, you will have to pay 35% personal income tax. This tax rate will be applied if the loan has interest rates below 2/3 of the Central Bank rate at the time of issue.

For example, until mid-summer the rate will be 7.5%. In order not to pay increased taxes, the loan must be issued at 5% per annum (7.5 x 2: 3).

If the LLC forgives the founder a loan, then he will have to pay personal income tax (13%) from this amount to the budget.

Accountable funds.

An LLC can issue money on account only to its employees. Money is issued for a certain time, you will need to account for it - provide documentary evidence of expenses incurred. If there are no documents, the money will be recognized as income and subject to personal income tax (13%).

You can withdraw money for entertainment expenses without charging additional taxes only within 4% of the LLC payroll.

Conclusion from the calculations:

According to calculations, external management of individual entrepreneurs turned out to be the most profitable. However, we emphasize once again that this method of cashing out is quite risky, and the benefits may turn out to be imaginary. The safest option is considered to be a combination of salary and dividends. On the one hand, this method is more expensive, but on the other hand, it is completely legal and not subject to tax risks.

Withdrawing money for reporting purposes and for issuing a loan should not be considered as a method of cashing out money, since these expenses are regulated and must be documented. Otherwise, they may be considered illegal operations.

We recommend reading: Banks with the cheapest opening and maintenance of a current account for individual entrepreneurs and LLCs.

Purpose of withdrawal

A small business representative with the status of an individual entrepreneur has the right to withdraw funds from a business account for personal needs, to ensure the functioning of the business and to fulfill the obligations formed as a result.

Several areas for spending funds have been identified, which are indicated in the comments section of the payment documentation. Some positions will have to be confirmed with additional documents.

An entrepreneur can withdraw funds from a current account to ensure:

- payment of wages to employees;

- payment of mandatory payments to authorized bodies;

- carrying out business transactions;

- rental fees for premises and equipment;

- conducting settlements with counterparties;

- own needs.

The fact of conducting a financial cash transaction is documented. For each transaction, the bank issues a receipt to the person who initiated the procedure with the signature of the responsible employee performing the transaction and the seal of the institution.

Legislative regulation

The Civil Code of the Russian Federation regulates the ability of an individual entrepreneur to use funds received as a result of the functioning of a business to meet personal needs.

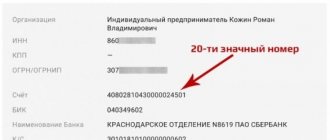

Legal acts define the need to separate the direction of spending money. To implement this task, individual entrepreneurs are recommended to have two plastic cards. At the same time, one of them must be opened from an individual, and the second from a business representative.

In this perspective, money for different purposes is transferred to different cards. The law does not provide for a restriction on the withdrawal of personal funds, however, when making payments for business needs, the limit of 100,000 rubles applied for one agreement is relevant.

Nuances of withdrawing funds from individual entrepreneurs to support entrepreneurial activities

Withdrawal through a personal card

Withdrawal of money from an individual entrepreneur's current account is carried out in accordance with certain regulations. All transactions of the entrepreneur, the subject of which are cash, must be carried out in compliance with cash discipline. The provisions of legal acts do not oblige individual entrepreneurs to maintain cash documentation. However, in practice, the simplified procedure can lead to disputes and disagreements with tax authorities when determining the tax base. Therefore, it is better not to neglect the documentation of such procedures.

If a small business representative often withdraws money from a current account in an amount exceeding 100,000 rubles, then it is within the competence of the banking institution to require documentary evidence in the form of prepared statements reflecting the direction of further spending of the cash. The check is carried out as part of the implementation of the law on combating legalization of proceeds from crime.

The expenditure of cashed funds for business purposes must be documented.

To do this, it is necessary to draw up agreements with counterparties and payment documentation, as well as ensure their proper storage.

When responding to a request from authorized bodies, an entrepreneur will probably have to refer to invoices, delivery notes, as well as cash and sales receipts.

How to find out loan debts by last name for free

If the money was withdrawn to pay wages to hired employees, then it is necessary to prepare a statement in the T-53 form. An individual entrepreneur is not required to prepare transaction entries, since the law does not determine the need to use such an accounting tool in accounting for its activities.

The difference between an entrepreneur and an LLC founder is his ability to spend the money he earns for personal purposes. Withdrawn money is not subject to additional taxes. They can be spent in unlimited quantities. A small business representative does not need to prepare advance statements for the amount of cash spent by him.

For comparison, the founder of a company can cash out funds only by ordering the payment of dividends, which is provided within the time limits provided for by the charter.

For funds received classified as his income category, the LLC participant will have to pay an additional 13 percent.

Receiving cash from an entrepreneur's current account for any personal needs is possible in several ways:

- at the cash desk of a banking institution where individual entrepreneurs are served by payment order or by check;

- transfer to a bank card of an individual;

- transfer to a savings or deposit account with subsequent withdrawal according to a simplified scheme.

Receipt through the cashier

When receiving money through a cash register, in the purpose of payment in the payment order, it is necessary to indicate that the funds are issued for personal needs.

Some entrepreneurs strive to minimize the cost of bank commissions and indicate in the purpose of payment that the money belongs to the category of the individual entrepreneur’s salary.

This interpretation is incorrect, and the bank has the right to refuse to carry out the transaction, citing an incorrectly executed order, since the provisions of the legal act regulate that the entrepreneur does not have the right to charge and pay himself wages.

Transfer to card

Withdrawal on a paid order

When making a transfer to a plastic card, it is important that it is issued to the entrepreneur. If the banking product belongs to another person, then the funds received on the card are subject to taxation on the income received by the individual. In such a situation, the entrepreneur, when making a transaction, must withhold and transfer the amount of personal income tax to the budget.

When using card and current accounts opened in different banks for a transaction, the entrepreneur must expect to pay an additional commission.

When making a transfer to your card, the bank does not charge a cash withdrawal fee, since in fact the individual entrepreneur does not withdraw money as a result of such an operation. He receives funds in his hands by withdrawing them through an ATM. The commission is withdrawn in accordance with the procedure relevant for servicing the banking product. For some types of cards it is not provided.

Transfer to savings account

An entrepreneur can have not only a current account, but also a savings account. The transfer transaction is processed according to the standard scheme that is relevant for card transactions. Depending on the procedure for servicing the account, money must be withdrawn immediately after it is received or within a certain period of time.

Banking nuances

A banking operation to withdraw funds from a current account is only possible with a commission. Its value is determined by the purpose of further spending of money.

If it is planned to pay wages to employees in cash, then its size is not very large, and rarely reaches one percent.

When withdrawing for any other purpose, which may be personal or business in nature, the commission reaches 2 percent. Its value is also influenced by the withdrawal amount.

What's the best way to cash out?

Assessing the algorithm for carrying out all types of withdrawal operations, it should be noted that the most profitable and convenient method of cashing out is making transfer transactions between settlement and card accounts. To implement the procedure, it is not necessary to visit a bank branch. Modern opportunities allow you to solve the problem through Internet banking or by phone.

It is better not to use cash payments with employees and contractors in terms of financial activities of a business. To eliminate the complexity of processing cash transactions and the need to pay commission interest, it is easier to work with all business participants by bank transfer.

Before concluding a service agreement with a bank, it is recommended that you familiarize yourself with the terms of cooperation and analyze them in order to identify pitfalls. Some financial organizations, when making a transfer, instead of a fee for cash withdrawal, charge the client a transfer fee, the amount of which may exceed the same values current for cash withdrawal.

When security intervenes in a transaction

Each financial institution has its own service parameters. They will determine transfer limits and the time of day at which they are relevant for entrepreneurs.

Any amount received into the account must be documented by an agreement or checks.

Their absence may be grounds for the security service to suspect the dishonest nature of the transactions, which they are obliged to report to the authorized bodies for further proceedings.

How much cash can you withdraw from an LLC current account?

A legal entity has the right to withdraw cash from a current account without violating the established limits. If money is taken to pay salaries, then the amount must correspond to the total in the payroll. You can spend up to 100,000 rubles on household needs. under contract. To pay dividends, money is withdrawn according to the amount specified in the protocol for their distribution.

If legal a person systematically withdraws large amounts, and this is from 600,000 rubles. per month, it may come under close attention first from the banking security service, and then from Rosfinmonitoring and tax authorities. Operations on the current account will be suspended during the investigation. If facts of illegal cash withdrawal are revealed, the persons responsible will be brought to administrative or criminal liability, which depends on the severity of the offenses.

What the law says

Since an individual entrepreneur has the status of an individual, and not a separate organization, all funds are his personal property, which he can use as he pleases. In accordance with the Civil Code of the Russian Federation (Article 209), the owner has the rights to own, use and dispose of property, which includes the money of an individual entrepreneur.

It is worth considering that there is Law No. 115-FZ “On combating the legalization of proceeds from crime,” according to which banks must identify suspicious transactions and verify them. Withdrawing large amounts from an individual entrepreneur's account may arouse the interest of a credit institution, especially if you often withdraw cash in large amounts - from 600 thousand rubles. In this case, the bank may ask what you spend the money on, so it is useful to have documents confirming the expenses.

An entrepreneur who has paid the budget on time and in full can freely use the remaining funds for personal needs.

Interest on cash withdrawals from the current account of a legal entity

A certain commission is charged for withdrawing funds from a current account. Its size depends on the amount and purposes for which the money is withdrawn. If there are several expense items in the check, then a single commission will be charged for the operation, with a maximum amount. The smallest percentage - from 0.1 to 3 - is charged for cash withdrawal for salary.

The bank may set a monthly limit on cash withdrawals at a reduced interest rate. If it is exceeded, the highest rate will apply.

We recommend reading: Rating of banks for small businesses with profitable cash settlement services for individual entrepreneurs and LLCs.

Is it worth opening a bank account for an individual entrepreneur?

Considering that cash flow may raise questions for a credit institution, entrepreneurs often decide to work without a current account. This is convenient because you don’t have to wait for the bank to transfer the money. In addition, some contractors offer a discount when paying in cash.

The law does not oblige individual entrepreneurs to open a bank account, but this is a convenient tool for entrepreneurs who run a legal business. In addition, large payments (from 100 thousand rubles) to counterparties can only be made in cashless form. This rule does not apply to cash payments with clients and customers in smaller amounts.

In general, a bank account is reliable and convenient. Funds in the account can be used to pay for goods and services, rent, employee salaries, interest on loans, taxes, etc. This makes it easier for an entrepreneur to control the receipt and expenditure of funds, and in a credit institution money is safer than, say, in the cash register of an enterprise. Of course, it happens that banks close, so it’s worth choosing a credit institution to open a current account not only based on the size of the commission, but also on reliability.

Bank account for individual entrepreneurs - a convenient financial management tool

How much money should I keep in my current account?

It is worth remembering that individual entrepreneurs’ funds in banks are insured for up to 1.4 million rubles. True, entrepreneurs will receive compensation only after all obligations to individuals have been covered. Therefore, experts recommend storing available funds not in the individual entrepreneur’s account, but in the personal account of the individual.

Banks with high cash withdrawal limits for LLCs

We have already written 2 articles where we selected and compared the conditions of more than 20 banks for receiving cash in 2 ways: withdrawal from an ATM and transfer to an individual’s card. These are the articles:

Banks with a large limit for withdrawing cash from a current account for individual entrepreneurs and LLCs;

Banks with favorable limits on transfers from individual entrepreneurs and LLCs to individual cards. faces.

How to report for money withdrawn from the LLC's current account

Funds withdrawn from the LLC's current account are immediately credited to the cash desk. Then they are issued for the needs specified in the check according to expense orders. All transactions must be documented. How to report for money, see the table:

| What was the money used for? | Accounting documents |

| Salary | Payment statement |

| Business trips | Flight/transfer tickets, hotel check |

| Household needs | Checks, Comrade invoices |

| Representative | Checks, acts, contracts |

| Dividends | Protocol for distribution |

| Loan | Loan agreement |

For the issuance of salaries, dividends and loans, reporting documents are attached to the expense order, for other purposes - to the advance report.