Based on the invoice, the company has the opportunity to receive VAT deductions. In this case, several conditions must be met under which receiving a tax deduction is considered legal. There are three such conditions:

- The acquisition of goods (services) is carried out for the purpose of production or subsequent resale.

- All purchased goods must be reflected on the balance sheet of the enterprise.

- The invoice is properly executed and is available at the enterprise (electronic or paper format).

Despite the fact that the 1C program greatly simplifies working with taxes, the user must follow certain procedures.

Accounting for incoming VAT in the 1C program is possible in two ways:

- In the process of processing the receipt of goods;

- Through the document “Creating purchase ledger entries”.

What to do if for some reason the invoice does not end up in the purchase book.

How to correctly account for VAT in a purchase ledger

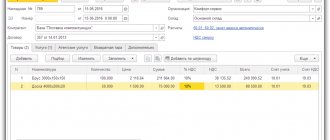

Figure 1 and Figure 2 show an example of the execution of a receipt document and the invoice received from it. An invoice issued in this way will be included in the purchase book.

Fig.1

Fig.2

Pay attention to the registration of the invoice directly from the receipt document (Fig. 1). An invoice is created automatically directly from the “Receipt of goods, services” document if its date and number are filled in (the required fields are located at the bottom of the “Receipt ..." document). What would seem simpler?

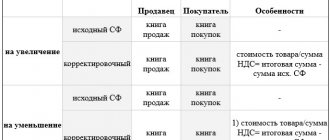

Features of registering an adjustment invoice in the book of purchases and sales

Registration of an adjustment invoice by the seller when reducing the cost of shipped goods

If the cost of goods decreases, the seller registers an adjustment invoice in the purchase book in the tax period in which the right to deduct VAT arose (paragraph 1, paragraph 13, article 171, paragraph 10, article 172 of the Tax Code of the Russian Federation).

A deduction is possible on the basis of an adjustment invoice if there is a contract, agreement or other primary document confirming the consent (fact of notification) of the buyer to change the cost of shipped goods. In Letter dated September 28, 2011 N ED-4-3/ [email protected] the Federal Tax Service of Russia draws attention to the following features of registering an adjustment invoice in the purchase book:

- Column 2 of the purchase book indicates the date and number of the adjustment invoice;

- the indicators from column 9b (difference to be reduced) of the line “Total on adjustment invoice” of the adjustment invoice are transferred to column 7 of the purchase book;

- data from column 5b (difference to be reduced) of the line “Total on adjustment invoice” of the adjustment invoice is transferred to column 8a (9a) of the purchase book;

- indicators from column 8b (difference to be reduced) of the line “Total on adjustment invoice” of the adjustment invoice are transferred to column 8b (9b) of the purchase book.

Registration of an adjustment invoice by the seller when the cost of shipped goods increases

The increase in the cost of shipped goods is taken into account when determining the tax base for the period in which they were shipped (clause 10 of Article 154 of the Tax Code of the Russian Federation).

Therefore, if the value of goods has increased after the expiration of the tax period in which they were shipped, the seller must record an adjustment invoice on an additional sheet in the sales ledger. The Federal Tax Service of Russia draws attention to the following:

- in column 1 of the additional sheet of the sales book, the date and number of the adjustment invoice are indicated;

- data from column 9c (difference to additional payment) of the line “Total on adjustment invoice” of the adjustment invoice is transferred to column 4 of the additional sheet of the sales book;

- indicators from column 5c (difference to additional payment) of the line “Total on adjustment invoice” of the adjustment invoice are transferred to column 5a (6a) of the additional sheet of the sales book;

- data from column 8c (difference to additional payment) of the line “Total on adjustment invoice” of the adjustment invoice is transferred to column 5b (6b) of the additional sheet of the sales book.

If the increase in the cost of goods occurred in the same tax period as the shipment of goods, the adjustment invoice should be recorded in the sales ledger for the same period.

In other words, if the initial transaction price increases, the seller must pay an additional amount of tax to the budget. Moreover, such additional accrual is made not in the adjustment period, but in the quarter when the sale was reflected (clause 13 of Article 171 of the Tax Code of the Russian Federation). Accordingly, the adjustment invoice in this case is registered in the sales book of the tax period in which the shipment was made (fulfillment, provision, transfer). Moreover, if the adjustment is made in another tax period (not in the quarter of shipment), the obligation arises to compile an additional sheet of the sales book.

Moreover, in the event of an increase in the initial transaction price, the seller is obliged to submit an updated VAT return to the tax authority.

Registration of an adjustment invoice by the buyer when the cost of purchased goods decreases

The buyer is obliged to restore the VAT corresponding to the difference between the amount of tax calculated from the cost of shipped goods and the amount of tax calculated after reducing this value (subclause 4, clause 3, article 170 of the Tax Code of the Russian Federation). The restoration must be made in the tax period in which either the adjustment invoice or the primary document on the reduction in the value of shipped goods was received (depending on which of these documents was received first).

To recover the tax, the buyer must register an adjustment invoice or source document in the sales ledger. At the same time, according to the Federal Tax Service of Russia, it is necessary to pay attention to the following:

- Column 1 of the sales book indicates the date and number of the adjustment invoice or primary document for reducing the cost of goods;

- indicators from column 9b (difference to be reduced) of the line “Total on adjustment invoice” of the adjustment invoice are transferred to column 4 of the sales book;

- data from column 5b (difference to be reduced) of the line “Total on adjustment invoice” of the adjustment invoice is transferred to column 5a (6a) of the sales book;

- indicators from column 8b (difference to be reduced) of the line “Total on adjustment invoice” of the adjustment invoice are transferred to column 5b (6b) of the sales book.

Registration of an adjustment invoice by the buyer when the cost of purchased goods increases

The buyer registers an adjustment invoice in the purchase book in the tax period in which the right to deduct VAT arose (paragraph 2, paragraph 13, article 171, paragraph 10, article 172 of the Tax Code of the Russian Federation). In this case, the features of the procedure for registering an adjustment invoice in the purchase book are as follows:

- Column 2 of the purchase book indicates the date and number of the adjustment invoice;

- data from column 9c (difference to additional payment) of the line “Total on adjustment invoice” of the adjustment invoice is transferred to column 7 of the purchase book;

- indicators from column 5c (difference to additional payment) of the line “Total on adjustment invoice” of the adjustment invoice are transferred to column 8a (9a) of the purchase book;

- data from column 8c (difference to additional payment) of the line “Total on adjustment invoice” of the adjustment invoice is transferred to column 8b (9b) of the purchase book.

In the event of an increase in the initial transaction price, the buyer has the right to deduct the additional amount of VAT presented. The right to deduct the difference in VAT arises after receiving an adjustment invoice in the presence of an agreement (agreement, other primary document confirming the consent (fact of notification) of the buyer) to change the value, but no later than three years from the date of drawing up the adjustment invoice (clause 10, Article 172 of the Tax Code of the Russian Federation).

Errors when accounting for incoming VAT in 1C

However, errors also occur here. For example, documents are often entered backdated, and the dates of the receipt document and the invoice may not match. Inconsistent dates may result in errors in the purchase ledger. If the “Reflect VAT deduction in the purchase book by the date of receipt” checkbox is checked, then the invoice should appear in the purchase book in the period to which its date belongs. Accordingly, if by mistake the dates differ, then we may not see the invoice in the purchase book.

There are times when the dates really don't match. For example, when goods and documents for them arrive at different times; or when the equipment arrives. Let us recall the second point of the three necessary conditions: “Purchased goods must be capitalized, i.e. stand on the company's balance sheet."

It often happens that the receipt of fixed assets or equipment and the acceptance of these objects for accounting refer to different reporting periods. In this case, the document “Creating purchase ledger entries” is drawn up (Fig. 8). The checkbox “Reflect the VAT deduction in the purchase book by the date of receipt” should be unchecked (see Fig. 3, Fig. 4, Fig. 5). VAT will be deducted only after the equipment is accepted for registration (Fig. 6, Fig. 7). If there is no posting Dt01 - Kt08, then there is no invoice in the purchase book.

Fig.3

Fig.4

Fig.5

Fig.6

Fig.7

Fig.8

Another error is related to the “VAT included in price” checkbox (Fig. 9). This checkbox is used for separate VAT accounting, when materials will obviously be used in the production of products sold without VAT. To accept VAT for deduction on received materials, you must turn off this checkbox.

Fig.9

“Forgotten” invoices. The procedure for registering in the purchase book and sales book

About the procedure for making changes to the purchase book and sales book

Letter of the Federal Tax Service of the Russian Federation dated September 6, 2006 No. MM-6-03/ [email protected]

In No. 20 "A-E"

for 2006, on page 15, we talked about the changes made to the Rules for maintaining logs of received and issued invoices, purchase books and sales books, approved by Decree of the Government of the Russian Federation of December 2, 2000 No. 914.

The most important of them, perhaps, was the introduction of a new obligation for VAT taxpayers to fill out additional sheets

purchase books and sales books, if necessary, make changes to these books.

Almost six months later, the Federal Tax Service of the Russian Federation decided to explain to taxpayers the intricacies of using additional sheets if the taxpayer discovers in the current tax period that he has not registered an invoice

in the purchase book or sales book for past tax periods.

Changes to the purchase book

In accordance with paragraph 1 of Art. 171 Tax Code of the Russian Federation

the taxpayer has the right to reduce the total amount of VAT calculated in accordance with

Art.

166 of the Tax Code of the Russian Federation , for tax deductions.

According to paragraph 1 of Art. 172 Tax Code of the Russian Federation

tax deductions provided for

in Art.

171 of the Tax Code of the Russian Federation , are made

on the basis of invoices

issued by sellers when the taxpayer purchases goods (work, services), property rights, after the said goods (work, services), property rights are registered and in the presence of relevant primary documents.

Thus, tax deductions are made by the taxpayer if they have documentary evidence, namely: an invoice

and relevant primary documents confirming the fact of acquisition and registration of goods (works, services), property rights.

Art. 81 Tax Code of the Russian Federation

It has been established that a taxpayer who has discovered facts of incomplete reflection of information in a tax return previously submitted by him (including information on tax deductions) has the right to make the necessary

additions and changes

to the tax return of the tax period to which the relevant transactions relate.

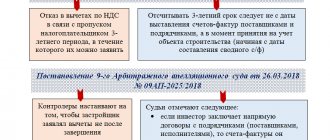

Consequently, if a taxpayer-buyer in the current tax period discovered in his previously submitted VAT tax return that he did not fully reflect the amounts of VAT subject to deduction, then he must submit an adjusting tax return

for those tax periods in which tax deductions are not reflected in full.

In order to compare the amounts of tax deductions declared in the corrective return with the amounts of VAT indicated in the final columns of the purchase ledger

make appropriate changes

to the purchase book of the tax period for which the specified declaration is submitted .

Tax authorities recommend reflecting these changes in an additional sheet of the purchase book.

for the tax period in which such invoices should have been registered.

In this regard, in an additional sheet of the purchase book, records should be made of those invoices that were not previously registered

in this shopping book.

, the indicators of the invoices registered in it should be added to the totals of the additional sheet of the purchase book

.

Please note that the Rules for maintaining journals of received and issued invoices, purchase books and sales books when calculating value added tax provide for entering into an additional sheet of the purchase book only entries on invoices subject to

cancellation

.

Addition order

are not established

by the Rules .

However, the tax authorities apparently decided to make an exception for invoices, the deduction for which should have been made in previous tax periods, but was not made for some reason.

And here is the opinion of the Federal Tax Service regarding the registration in the purchase book of invoices drawn up with violations

, does not contradict the Rules..., but is completely unprofitable for taxpayers.

Tax officials reminded that if the buyer, before the seller made corrections to the invoice, registered it in the purchase book, then the entry on the cancellation of the invoice

is made in an additional sheet of the purchase book for the tax period in which the invoice was registered before corrections were made to it, and

the registration of the corrected invoice

- in the tax period in which the corrected invoice was received.

Sales book changes

As in the case of registering “forgotten” invoices in the purchase book, if the taxpayer-seller discovers in the current tax period that invoices have not been registered

in the sales book

for past tax periods, tax officials recommend

in an additional sheet of

the sales book for the expired tax period this invoice and

add the indicators of the registered invoice

.

a corrective tax return to the tax authority at the place of registration

, for the tax period in which they made changes to the sales book.