How to decipher the term “consolidated invoice”

There is no official definition of this concept.

In general, any document compiled on the basis of several primary documents can be considered consolidated. Accordingly, an invoice that combines information from several invoices can be considered consolidated. Consolidated invoice information can be obtained from various sources:

- Art. 158 of the Tax Code of the Russian Federation - this norm provides for the preparation of a consolidated invoice for the sale of the enterprise as a whole as a property complex. It identifies types of property, the amount of receivables, the value of securities and other components of balance sheet assets as separate items.

- Rules for filling out invoices approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137 - they provide for the possibility of issuing consolidated invoices in certain situations and contain general requirements for invoices.

- Explanations from the Ministry of Finance and the Federal Tax Service - officials, in responses to private inquiries, deciphered the procedure for filling out consolidated financial statements in different situations: in shared construction, for commission and agency transactions, in other cases.

Find out how to issue a consolidated invoice if the principal sells the goods through an agent in this material.

We will talk further about the features of the design of consolidated financial statements in certain situations from the position of the Federal Tax Service and the Ministry of Finance.

Regulatory regulation

Under a commission agreement, one party (the commission agent) undertakes, on behalf of the other party (the principal), for a fee, to carry out one or more transactions on its own behalf, but at the expense of the principal (Clause 1, Article 990 of the Civil Code of the Russian Federation).

According to the agreement, the commission agent:

- has the right to demand: remuneration for services (clause 1 of Article 991 of the Civil Code of the Russian Federation);

- reimbursement of expenses for the execution of a commission order (Article 1001 of the Civil Code of the Russian Federation);

The report is drawn up in any form, taking into account the requirements of Part 2 of Art. 9 of Federal Law 402-FZ “On Accounting”.

In the annex to the commission agreement the following should be established:

- report form,

- its contents,

- list of attached documents,

- deadline for submitting the report and documents.

To avoid tax risks, we recommend including in your report:

- a list of completed transactions indicating the date of completion of each of them and the counterparties;

- information about sold/acquired property indicating its price;

- the amount of funds received in payment for goods sold or as advances received from buyers at the time of drawing up the report;

- calculation of the commission agent's remuneration and its amount;

- information about deviations from the instructions of the principal and the reasons for such deviations;

- information on the commission agent's expenses for transactions.

You can draw up several documents (acts, reports) containing all the necessary data.

The report is considered accepted if the committent has not submitted objections within the deadline:

- 30 days or

- established by the contract.

Regular long-term supplies: the Ministry of Finance has allowed to optimize VAT document flow

The Ministry of Finance does not object to the execution of consolidated financial statements if a long-term agreement for the continuous supply of products is concluded between the customer and the contractor (letter dated September 13, 2018 No. 03-07-11/65642).

Officials considered a situation where bakery products are supplied monthly on a continuous basis to the same buyer. In this case, you don’t have to draw up an invoice for each supply of bread, but issue a consolidated invoice at least once a month: no later than the 5th day of the month following the end.

Find out how to account for costs in a bakery enterprise from this material.

The Ministry of Finance recommends that this procedure for issuing invoices be fixed in the accounting policy for tax accounting purposes. The supplier must agree on its desire to arrange shipments with a consolidated s/f with the buyer. It is better to do this in writing by including in the contract or additional agreement a description of the document flow scheme.

The following materials will tell you how to organize and improve document flow:

- “Personnel document flow is ordered to be transferred to electronic form”;

- “Maintaining document flow for warehouse accounting of materials.”

Intermediary with several buyers

If an intermediary sells the principal's goods, he usually has several buyers. This time the invoice is prepared by the principal. He uses the invoice data that the intermediary issues to customers. At the moment, the principal must issue a separate invoice for each buyer.

Since 2015, the situation has changed in the same way as for an intermediary with several sellers. That is, the principal received the right to draw up a single invoice for several customers. The main thing is that the original invoices issued by the intermediary are dated on the same day. Buyers' details must also be indicated separated by a semicolon: names, addresses, tax identification number, checkpoint, payment details. And in the columns you need to highlight each sale separately. Column 1 also makes sense to reflect specific buyers.

Consolidated invoices for freight forwarders

Can forwarders issue consolidated s/f? To answer this question, we will use tax regulations and explanations from officials:

- The Ministry of Finance equates forwarders to intermediaries acting on their own behalf (letters dated January 10, 2013 No. 03-07-09/01, dated December 29, 2012 No. 03-07-15/161);

- The rules for filling out invoices, approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137, provide for the possibility for the parties to an intermediary agreement to issue consolidated invoices in certain cases.

We talk about the possibility of drawing up summary documents by participants in mediation agreements in this publication.

When preparing a consolidated financial statement, you must take into account the following (letter of the Ministry of Finance of Russia dated March 16, 2015 No. 03-07-09/13799):

- numbering is carried out in accordance with the chronology of the preparation of invoices of the forwarder;

- each service (product, work) purchased from third parties is reflected in a separate line;

- copies of the performers' invoices are attached to the consolidated financial statement;

- There is no need to register it in the sales book.

Registration of a consolidated tax return in accordance with all the rules does not exclude increased attention from tax authorities and does not guarantee the unconditionality of receiving a deduction (see below).

The commission agent purchases goods for the principal

The essence of the deal is as follows. The principal instructs the commission agent to find a suitable supplier and negotiate with him to ship the goods for the principal. Thus, there are three participants in the transaction. The first is a third-party supplier, the second is the principal (aka the buyer), the third is the commission agent, who is an intermediary between the supplier and the principal.

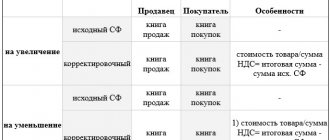

Document flow of the commission agent

When purchasing goods, the intermediary acts in the interests of the principal. However, according to the agreement concluded between the supplier and the commission agent, all rights and obligations fall on the commission agent (clause 1 of Article 990 of the Civil Code of the Russian Federation). Consequently, in all primary documents, including the invoice, the commission agent is listed as the buyer.

Having received such an invoice from the seller, the intermediary must register it in part 2 of the log of received and issued invoices (clause 11 of the journal rules). There is no need to make an entry in the purchase book, since the goods belong to the consignor, and the commission agent has no right to deduct.

Then the commission agent needs to re-issue the invoice in the name of the principal. The new rules for filling out an invoice describe in detail how to fill out lines 1, 2, 2a, 2b and 5 (see table below). As for the columns of the reissued invoice, they should duplicate the data from the columns of the invoice issued by the supplier in the name of the commission agent.

The reissued invoice must be registered in part 1 of the journal of received and issued invoices (clause 7 of the journal rules). No entry is made in the sales book because the commission agent has no obligation to charge VAT.

What information should be included in the invoice reissued to the principal-buyer?

| Invoice field | What to indicate |

| Line 1 (number and date) | Serial number in accordance with the individual chronology of the commission agent Date of the invoice issued by the seller in the name of the commission agent |

| Line 2 (seller) | Information about the third-party supplier: full or abbreviated name of the organization, or full name of the entrepreneur |

| Line 2a (seller's address) | Location of the third-party supplier: legal address of the organization, or place of residence of the entrepreneur |

| Line 2b (TIN and KPP of the seller) | TIN and PPC of a third-party seller |

| Line 5 (details of the payment document) | Numbers and dates of payment and settlement documents for the transfer of money from the commission agent to a third-party supplier and from the principal to the commission agent |

In addition, the intermediary is obliged to draw up a commission agent’s report (Article 999 of the Civil Code of the Russian Federation). The report must describe what goods and at what price were purchased for the principal, when the payment took place, and what the intermediary’s remuneration is.

Document flow of the principal

The principal receives the invoice re-issued by the commission agent and registers it in part 2 of the journal for recording received and issued invoices (clause 11 of the journal rules).

Then the principal registers the re-issued invoice in the purchase book, and receives the right to accept VAT for deduction.

The principal must keep a copy of the original invoice issued by the supplier in the name of the commission agent for four years. If this document is drawn up in paper form, the intermediary must certify it, and the committent must file it in a folder. If the invoice is issued in electronic form (for example, using the Diadoc system), the commission agent must simply transfer it to the principal via electronic communication channels (subparagraph “a”, paragraph 15 of the journal rules; for the transfer of electronic invoices, see “How will the exchange of electronic invoices take place?”

Please note that the committing party does not need to record a copy of the original invoice in either the journal, purchase ledger, or sales ledger.

If there was an advance payment

When transferring an advance, the supplier issues an invoice in the name of the commission agent. He registers the document in part 2 of the journal, but does not register it in the purchase book.

Then the commission agent reissues the “advance” invoice in the name of the principal, registers it in part 1 of the journal, but does not register it in the sales book.

The principal registers the re-issued invoice for the advance payment in part 2 of the journal, makes an entry in the purchase book and receives the right to deduct VAT from the advance payment. Subsequently, when the products are shipped, the principal will restore the deduction in the usual manner.

Plus, the principal is obliged to file a copy of the “paper” invoice for the advance payment, issued by the supplier in the name of the commission agent and certified by the latter. If the advance invoice is issued in electronic form, the principal must receive it from the commission agent via electronic communication channels. In both cases, the document must be kept for four years.

Commission remuneration

Having completed the transaction, the intermediary receives a reward from the principal. This amount is the commission agent's revenue.

The commission agent issues an invoice for the amount of the remuneration and registers it in part 1 of the log of received and issued invoices. After which the intermediary makes the appropriate entry in the sales book (clause 20 of the rules for maintaining the sales book) and charges VAT for payment to the budget.

The principal registers the same invoice in part 2 of the journal and makes an entry in the purchase book (clause 11 of the rules for maintaining the purchase book). As a result, the principal receives the right to deduct “input” VAT on the services of the commission agent.

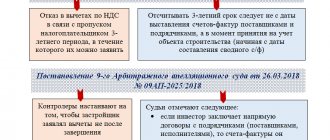

Deductions on consolidated invoices: claims of tax authorities and arguments of judges

Taxpayers often have to defend their right to receive a VAT deduction under a consolidated tax return in court. Particularly indicative are the legal proceedings regarding the illegality of denial of deductions to taxpayer-investors.

What most often becomes the subject of litigation regarding consolidated invoices, see the figure:

A well-drafted agreement, as well as the ability of the taxpayer to prove its legality in court after the end of the three-year period, helps to defend VAT deductions under the consolidated s/f.

Results

An invoice that combines information from several invoices can be considered a consolidated invoice.

Such a combined document is drawn up during the sale of an enterprise as a single property complex, in shared construction, during intermediary transactions, in conditions of long-term contractual deliveries and in other cases. Consolidated invoices attract increased attention from tax authorities, which often results in taxpayers facing legal proceedings regarding the legality of applying VAT deductions. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.