How to create a new entry in the purchase book in the 1C 8.3 accounting program?

The processes of creating entries in the purchase ledger can be defined as:

- generated by register entries from document postings

- generated by document 1C 8.3 “Creating purchase ledger entries”

This sequence of actions is similar for the purchase book in 1C 8.2.

1) In the purchase book in accordance with clause 2 of Appendix 4 of Rules No. 1137, entries are recorded based on the results of documents, for example such as:

- invoices (including adjustment ones) received

- adjustment invoices compiled and issued by the seller when the value of the goods decreases

- invoices registered by sellers upon receipt of advance payment

- invoices registered when the terms of the contract are changed or terminated

To get an idea of the process of creating entries in the purchase ledger, consider an example:

The organization purchased goods worth RUB 344,399.52, including VAT 18% RUB 52,535.52. Costs for delivery of goods - 5,000 rubles, including VAT 18% - rubles.

Transport costs are included in selling costs.

Procedure for completing documents:

- receipt (act, invoice)

- invoice received

Receipt of goods

The receipt document is located:

Purchases -> Purchases -> Receipt (act, invoice)

To reflect the receipt of the product range, fill out the “Products” tabular section:

In addition to the product range, we also received delivery services. To reflect transportation costs, use the “Services” tab, and select our service from the “Nomenclature” directory:

Now the document needs to be processed, the result is:

Issuing an invoice

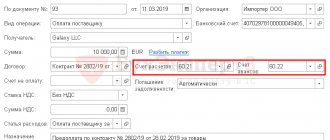

After posting the document, you need to register the invoice - assign it a number, date and click “Register”:

Let's open the created invoice:

By register

- VAT on purchases (an entry is created in the purchase book)

- VAT presented (the fact of receipt of the invoice forms the expense part)

The invoice generates the following entries:

The following entry is recorded in the invoice journal:

2) Reflection in the purchase book of such transactions as:

- VAT is accepted for deduction on fixed assets

- VAT is accepted for deduction upon adjustment of receipts

in the program is carried out using the document “Creating purchase ledger entries”

For clarity, consider the following situations:

- The organization purchased fixed assets in the amount of RUB 52,000.00. including VAT - RUB 7,932.20.

- The supplier issued and submitted to our organization an adjustment invoice in the amount of RUB 33,967.95. including VAT - RUB 5,181.55 (according to which, the cost of previously received goods increased)

Filling out the purchase book for advance invoices

Zinaida, hello!

You have everything reflected correctly. Let's look at the situation using one example. For example, Volgodonskvodstroy LLC transferred an advance in July 01.07, in August 20.08 this advance was credited in full. What will happen to the wiring in the control unit ? Precisely in accounting, because there are no postings in accounting, for VAT. 07/01/18 D 51 K 62.02 received an advance, 118 rubles (received an advance - are required to calculate VAT and write out the SF for the advance within 5 days - clause 1, clause 3 of Article 168 of the Tax Code of the Russian Federation) 07/01/18 D 76.AV K 68.02 VAT was calculated on advances and the SF was issued for the advance received, an entry was made in the Sales Book, 18r 08/20/18 D 62.02 By 62.01 the advance received in July was credited, sales documents were drawn up, 118r (I do not consider postings for accrual of revenue and VAT on sales here) .k. I want to focus specifically on advances and VAT on advances) 09.30.18 D 68.2 K 76.AB reflects the deduction of VAT on advances accrued in the Purchase Book, 118 rubles (the advance was sold, you have the right to deduct VAT on advances in the 3rd quarter , clause 8 of article 171 of the Tax Code of the Russian Federation).

Those. You see how according to the dates everything goes to BU, when D and when K according to 76.AB. Postings in 1C generate documents. We are required to close the month for editing in the program every time we have entered all the documents. Document date Formation of purchase book entries 09.30.18 and this is the date that will be the posting D 68.02 K 76.AB for the advance payment that was offset in August. A document dated September 30 will not be able to post on July 31 or August 31, because in our accounting July-August should already be “closed” for data entry. This is not your mistake. Movements on account 76.AB do not always coincide in date with postings on 62.02 and should not coincide. Therefore, we analyze all VAT calculations not by month, but by quarter . VAT is a quarterly tax.

Of course, you can create the document Formation of purchase ledger entries, Formation of sales ledger entries, etc. every month. But this option is recommended only for large companies that have complex accounting, including VAT. Then the postings on 76.AB will be month after month, as you want to see. But this additional work must be very thorough and accurate. Therefore, before you start using this method, you need to think carefully, evaluate your accounting situation, how documents arrive at the company - everything is 100% clear and without delay or there are difficulties, weigh all the pros and cons of such a solution.

And if you look at the Purchase Book , then there is the date and number of the SF for the advance payment and there are no other dates. The purchase book is formed per QUARTER . Those. there is no need to make an entry in the Purchase Book on the same date on which the advance was credited and received the right to deduction. You can “technically” make all entries in the Purchase Book, as in our example, on the last day of the quarter, 09/30/18, and everything will be correct.

Entries in the purchase book upon receipt of OS

The procedure for creating documents upon receipt of a fixed asset:

- document “Receipt (act, invoice)”

- registration invoice received

- the document “Acceptance for accounting of fixed assets” is drawn up

- document “Creating purchase ledger entries”

OS and intangible assets -> Receipt of fixed assets -> Receipt of equipment

The document generates movement by registers:

After posting the receipt document, we register an invoice, similar to the receipt discussed earlier:

An entry was made in the invoice journal:

We accept fixed assets for accounting (more details about accepting fixed assets for accounting can be found in a separate article):

An expense record is generated using the “VAT on purchased valuables” register:

Document “Creating purchase book entries” in the 1C program: Enterprise Accounting 8 - VIDEO

Published 03/01/2016 13:38 Why is the document “Creating Purchase Ledger Entries” needed and which organizations are required to fill it out? Why can the absence of this document lead to incorrect completion of the VAT return in 1C: Enterprise Accounting 8 edition 3.0? How can it be useful and how can it be used to transfer VAT deductions to other reporting periods, thereby regulating the amount of tax payable? You will learn the answers to all these questions by watching a short video tutorial.

Video author: Olga Shulova

Let's be friends on Facebook

Did you like the video tutorial? Subscribe to the newsletter for new materials

Add a comment

Comments

0 Atakanavratarya 12/01/2018 01:39 VAT amounts on lots attributed to the sales document at a VAT rate of 0%, if confirmed in the current period, are accepted for deduction in the main section of the purchase book. If the VAT rate is not confirmed, the VAT amounts will also be deducted, but in an additional sheet for the sales period.

Quote

0 Olga Shulova 08/19/2016 08:39 I quote Natalya:

Hello, 1S KA 8.3. The situation with the purchase book has not changed - so advances for April, May, June end up in the July book, although they were already included in the April, May, June purchase book and according to SALT on account 76 AB the amounts are doubled (expended) and the negative - incorrect balance due to this. Help!

Hello, Natalia!

Unfortunately, your situation cannot be resolved in absentia, because... This is not typical behavior of the program, and if information is entered correctly, it is not reproduced (we cannot repeat the same error on our databases). According to the algorithms embedded in the program, the same documents cannot be included in the Formation of purchase ledger entries several times. But at what stage your errors occur is very difficult to say in absentia, because There are many possible options. You need to very carefully check all VAT accounting registers and track those moments when something went wrong (problems could be in the settings, in entering primary documents, in violation of the order of performing routine operations, etc.). Therefore, to solve the problem, I can only offer you a personal consultation with a connection to your database. Quote 0 Natalya 08/19/2016 03:00 Hello, 1S KA 8.3. The situation with the purchase book has not changed - so advances for April, May, June end up in the July book, although they were already included in the April, May, June purchase book and in SALT on account 76 AB the amounts are doubled (expended) and the negative -never balance because of this. Help!

Quote

0 Natalya 07/18/2016 15:33 Hello! And if you look at the SALT account 76.AB, what is the situation there after the June document? Are the amounts really doubled (overspent) and a balance appears that should not exist? Yes, and according to SALT everything is doubled (overspent), the balance is incorrect

Quote

0 Olga Shulova 07/14/2016 14:58 I quote Natalya:

Good afternoon, 1s KA 8.3 The following problem has arisen: I am creating a purchase book for April, I fill out the second tab - the advances are credited, I post them, when creating the purchase book for May, I fill out the second tab, April advances that are already taken into account in April go there again, the same thing happens and in June, April, May and June advances also fall there. I've reposted the documents several times, nothing changes. What else can be done to solve this problem? help me please

Hello!

And if you look at the SALT account 76.AB, what is the situation there after the June document? Are the amounts really doubled (overspent) and a balance appears that should not exist? Quote 0 Natalya 07/13/2016 15:22 Good afternoon, 1s KA 8.3 The following problem has arisen: I create a purchase book for April, fill out the second tab - the advances are credited, I spend, when creating a purchase book for May, I fill out the second tab, April advances go there again, which are already taken into account in April, the same thing happens in June - April, May and June advances also fall there. I've reposted the documents several times, nothing changes. What else can be done to solve this problem? help me please

Quote

Update list of comments

JComments

Adjustment of goods receipt

Based on a previously created goods receipt, it is possible to create an adjustment document. To do this, open the previously created document No. 789 dated June 15, 2016

Purchases -> Purchases -> Receipt (act, invoice)

and using the “Create based on” button

Let's create an adjustment document:

The nomenclature now has two lines:

- before change - price and quantity of the original document

- after a change, a new price or quantity is set

Also, the supplier costs us 100 rubles. increased the cost of transport):

Register entries are created for the changed amount:

After completing the adjustment document, we will register the adjustment invoice:

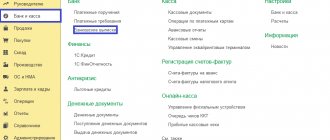

Generating purchase ledger entries in 1C 8.3

Reflection of transactions

- VAT is accepted for deduction on fixed assets

- VAT is accepted for deduction upon adjustment of receipts

becomes a document

Operations -> Closing a period -> Regular VAT operations -> Create -> Generating purchase ledger entries

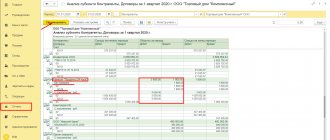

By clicking the “Fill” button, we see the records of the documents we created earlier in this section. After posting the document, we receive entries in the accumulation registers:

And in the “Purchase Book” report:

Purchase book in 1s 8.3

Subscribe to our YouTube channel!

We continue our series of mini lessons on compiling accounting and tax registers in an accounting program.

In the previous article I described the process of compiling a Sales Book in 1C 8.3

Now we will talk about the purchase ledger, a report that collects all “incoming” invoices and shows the total amount of VAT that can be deducted from the total accrued tax payable for the reporting quarter.

*

Find out what mistakes should not be made in invoices

Do you want to become a PRO in 1C 8.3?

Now let's apply our theoretical knowledge to business activities. We will independently compile a purchase book in 1C 8.3 . Typical situation:

« 06/12/2019

Receipt from the supplier Megastek LLC Glass 8 mm Bronze (bronze) quantity 15,636 m2 for a total amount of 50,000 rubles.

(including VAT 20% RUB 8,333.33).TORG-12 and invoice number 3162. 06/19/2019. Our organization paid the advance payment stipulated by the contract in the amount of 460,000 rubles (including VAT 20% 76,666.67) for the manufacture of glass structures. TRAVYCH LLC issued us an advance invoice No. 12AB dated June 19, 2019.”

Our task is to compile a purchase book for the 2nd quarter of 2021. using available data.

Let's get started:

1. Registration of an invoice from the supplier upon receipt of goods

As you most likely understood, initially we must reflect the admission document in the 1C program.

To do this, we will perform the following manipulations:

We sequentially write down all the necessary details of the document:

So, we have the first document for creating a purchase book ready.

2. Registration of advance invoice from supplier

Let's move on to the next operation according to the conditions of the problem.

We will create an advance invoice from the supplier.

You need to go to the bank statement for that day and find the required document.

All you have to do is enter the number and date, and the document is ready!

3. Creating a purchase book

If you studied our previous lesson, then you probably already know that these reports in the program are generated automatically after correct entry of invoices into the database. And since we have already done the most basic things, now all we have to do is analyze the correctness of the accounting.

And this is the picture that opened up to us!

As you can see, work in the 1C 8.3 program. easier than it seems! And, you will agree that with a practical example it is much more convenient to learn the material!

This is exactly how we structured the workshop course “Working in the 1C program: Accounting 8.3. Accounting for business transactions,” which includes all areas of accounting and tax accounting. These include cash transactions, salary accounting, advance reports, receipts, sales, and fixed asset accounting. In addition, the course includes practical lessons in the formation of regulatory operations and reporting.

Interested?

Then you will receive

And see for yourself the usefulness of the course!!!

| Author of the article: Tatyana Valerievna Matasova - expert on tax and accounting issues |

How to unload a purchase book from 1C 8.3

To download the purchase book, you can use the functionality built into the program. In order to save it in Excel format, you need to focus on any field of the report and in the main program select “File - Save As”:

Select the path to save, the file name and its type (for example, Excel):

Based on materials from: programmist1s.ru

Tax accounting in 1C 8.3 Accounting 3.0

Program 1C 8.3 Accounting - training. Part 3

17.10.2016 13:20